Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Your Guide to Federal Employee Retirement Eligibility

Understanding when you can retire from federal service is the first and most important question you need to answer. It's the bedrock of your entire financial plan. Your eligibility isn't a single date on a calendar; it's a set of rules based on your age and how many years you've put in, all dictated by your retirement system—FERS or CSRS.

Decoding Your Federal Retirement Eligibility

Think of your eligibility not as one big finish line, but as a series of different doors that open at various points in your career. Each door has a unique combination lock—a specific mix of age and service—that grants you access to your retirement benefits. The trick is knowing which door you're aiming for and what the combination is.

This guide will cut through the dense government-speak and give you a clear, straightforward map to your retirement qualifications. We'll start with the foundational concepts, so you can immediately get a handle on where you stand.

The Building Blocks of Eligibility

At its heart, federal retirement eligibility boils down to two things: your age and your years of “creditable service.” You can't have one without the other. It's like baking a cake—you need both the right ingredients and the right amounts to get the result you want.

Let's break down the essential concepts we'll be working with:

Minimum Retirement Age (MRA): This is the magic number set by your birth year. For most federal employees under the Federal Employees Retirement System (FERS), the MRA is somewhere between 55 and 57.

Creditable Service: This is the total amount of time you’ve worked that counts toward your pension calculation. It’s mostly your federal civilian time, but it can also include certain types of military service if you've made the required "buy back" deposits.

Retirement Systems (FERS vs. CSRS): The rules that apply to you depend entirely on which system you’re in. Most current employees are in FERS, but some long-time feds are still under the older Civil Service Retirement System (CSRS).

Getting these fundamentals right is absolutely critical. A simple miscalculation of your MRA or service time could mean a delayed retirement or a permanently smaller annuity check every month for the rest of your life.

Why This Matters for Your Planning

Figuring out your eligibility date is about so much more than circling a day on the calendar. It's the anchor point for your entire retirement strategy. It determines when your pension starts, how much you'll get, and whether you can keep your valuable Federal Employees Health Benefits (FEHB) coverage.

For instance, leaving your job even one day too early could be the difference between getting a full, immediate pension and having to wait years for a smaller, deferred benefit. My goal here is to arm you with the knowledge to make smart, confident decisions as we dive deeper into the specific rules that shape your career's final chapter.

FERS vs. CSRS: Understanding the Two Systems

Before we can even talk about retirement eligibility, we have to start with the most important question of all: are you a FERS or a CSRS employee? Think of them as two completely different roadmaps to retirement. The path you're on determines the rules, the math, and the milestones you'll need to hit.

Figuring this out is your first and most critical step. For most federal employees today, the answer is simple. If you were hired after December 31, 1983, you are almost certainly in the Federal Employees Retirement System (FERS). The older Civil Service Retirement System (CSRS) covers folks with service dates before 1984, making it much less common these days.

The Modern Three-Legged Stool: FERS

FERS is the modern retirement framework, built to be more flexible and portable. You'll often hear it called a "three-legged stool" because your retirement income is designed to come from three separate sources, all working together.

FERS Basic Benefit: This is your pension, the defined monthly payment you get for life. The amount is calculated based on how long you worked and your "high-3" average salary.

Social Security: Unlike their CSRS counterparts, FERS employees pay into Social Security throughout their careers. This means you'll receive those benefits, which are a foundational piece of your retirement income.

Thrift Savings Plan (TSP): This is your 401(k)-style investment account. Your final payout from this "leg" depends entirely on how much you contribute, the government's matching funds, and how well your investments perform over time.

This three-part structure gives you more direct control over your financial destiny, but it also means the responsibility is on you to be a diligent saver and investor, especially with your TSP. Getting these three components to work in harmony is the secret to a comfortable FERS retirement.

The Traditional Pension: CSRS

CSRS, on the other hand, is a throwback to a more traditional model. It’s a powerful, standalone pension system that was designed to be the one and only source of a retiree's income. The pension it pays is much more generous on its own, for a very specific reason: CSRS employees don't pay Social Security taxes on their federal earnings, and they generally won't receive Social Security benefits based on that service.

Because the CSRS pension is so robust, these employees don't get the automatic 1% agency contribution or matching funds for their TSP. They can still contribute, of course, but the TSP is treated more like an extra supplement rather than a core pillar of their retirement plan.

The bottom line is this: CSRS is a powerful, self-contained pension. FERS is a collaborative system where your pension, Social Security, and personal TSP savings work together to build your retirement income.

Some long-time feds, often called "trans-FERS" employees, have time under both systems because they switched from CSRS to FERS mid-career. Their retirement calculation gets a little more complex, with a special component that credits their CSRS years separately. To dive deeper into these calculations, check out our guide on how to maximize your government pension calculation.

The number of people navigating this process is huge. In fiscal year 2025, a staggering 112,679 federal employees retired, the highest number since at least 2000. With the average FERS employee retiring around age 62 with 20 years of service, planning ahead is more critical than ever. You can explore more about these trends and learn more from the latest OPM retirement statistics.

Navigating Your Key Eligibility Milestones

Figuring out when you can retire from federal service is a bit like learning the combination to a safe. It’s not just one number—it's a specific mix of your age and years of service. Get the combination right, and the door to your earned benefits swings open. Get it wrong, and you could face delays or even a permanent cut to your pension.

Let's walk through the official jargon and turn it into a clear roadmap. We'll start with the most important number in your federal retirement calculation: your Minimum Retirement Age.

What Is Your Minimum Retirement Age?

Your Minimum Retirement Age (MRA) is the absolute earliest age you can retire with an immediate, full pension, provided you have enough years of service. This isn't a one-size-fits-all number; it's tied directly to the year you were born. Think of it as your personal starting line for retirement.

The MRA only applies to those under the Federal Employees Retirement System (FERS). Here’s a quick guide to pinpoint your exact MRA.

Your FERS Minimum Retirement Age (MRA)

This chart shows how your birth year determines your specific Minimum Retirement Age under the FERS system.

If You Were BornYour MRA IsBefore 194855 yearsIn 194855 years and 2 monthsIn 194955 years and 4 monthsIn 195055 years and 6 monthsIn 195155 years and 8 monthsIn 195255 years and 10 monthsIn 1953 - 196456 yearsIn 196556 years and 2 monthsIn 196656 years and 4 monthsIn 196756 years and 6 monthsIn 196856 years and 8 monthsIn 196956 years and 10 monthsIn 1970 and after57 years

Once you know your MRA, you can pair it with your years of service to see which retirement path is open to you. It's the essential first piece of the puzzle.

Unlocking Your Immediate Retirement

An immediate retirement is the goal for most federal employees. It means your pension checks start arriving right after you separate from service, with no waiting period and no penalties. Under the FERS system, there are three main paths to an unreduced, immediate annuity.

MRA + 30 Years: This is the classic path for career federal employees. If you’ve reached your MRA and have at least 30 years of creditable service, you're eligible for your full pension.

Age 60 + 20 Years: Hit age 60 with at least 20 years of service under your belt? You also qualify for an immediate, unreduced annuity.

Age 62 + 5 Years: The requirements ease up significantly as you get older. At age 62, you only need a minimum of 5 years of service to retire with a full pension. This serves as a great backstop for many.

Let's put this into perspective. Imagine a federal employee, Susan, who was born in 1970. Her MRA is 57. If she started her government career at 27, she'll have exactly 30 years of service when she turns 57, qualifying her perfectly for the MRA+30 path.

The MRA+10 Provision: A Costly Trade-Off

So, what happens if you reach your MRA but you’re short of the 30-year service mark? This is where the MRA+10 provision comes into play. It gives you the option to retire with as few as 10 years of service once you hit your Minimum Retirement Age.

But there’s a serious trade-off. Your annuity will be permanently reduced if you start drawing it before age 62. The penalty is a steep 5% for every year you are under 62.

Let’s look at Susan again: If she decides to retire at her MRA of 57 but only has 15 years of service, she’s 5 years away from age 62. Her pension would be permanently slashed by 25% (5 years x 5% per year). Ouch.

You can choose to postpone receiving your annuity to a later date to reduce or even eliminate that penalty, but that means going without that income for several years—a tough choice for anyone.

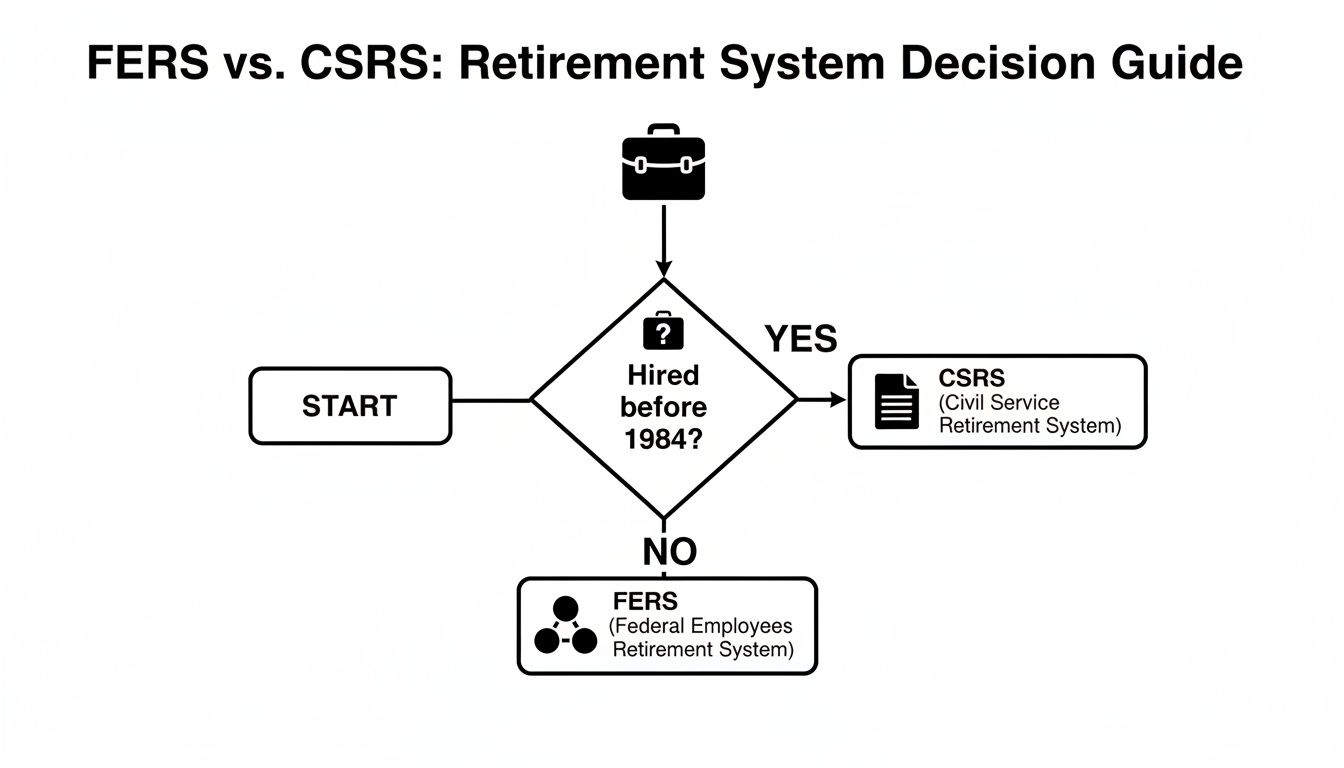

As the flowchart below shows, the first question to answer is which retirement system you fall under, which all comes down to when you were first hired.

This simple visual makes it clear: if you were hired before 1984, you're likely under the old CSRS system. Hired after that? You're in the modern FERS plan.

Early and Deferred Retirement Options

Life doesn't always go according to plan, and sometimes retirement happens on an unexpected timeline. The government has a couple of other options for these unique situations.

Early Retirement (VERA/VSIP): Occasionally, an agency undergoing a reorganization or downsizing may offer a Voluntary Early Retirement Authority (VERA), often paired with a Voluntary Separation Incentive Payment (VSIP), or "buyout." This allows employees to retire earlier than they normally could, usually at age 50 with 20 years of service, or at any age with 25 years.

Deferred Retirement: If you leave federal service with at least 5 years of service but before you're old enough for an immediate annuity, your pension doesn't just disappear. You can apply for a deferred retirement later on, typically once you reach age 62. However, this path comes with a huge downside: you almost always lose your eligibility to carry your Federal Employees Health Benefits (FEHB) and Federal Employees' Group Life Insurance (FEGLI) into retirement, making it a last-resort option for most people.

Maximizing Your Creditable Service

Your years of creditable service are the foundation of your federal retirement annuity. Think of each year like a brick you lay—the more bricks you have, the bigger and stronger your financial house will be in retirement. But I've seen it time and again: many federal employees leave valuable "bricks" on the table simply because they don't realize what actually counts.

This is where you need to put on your auditor's hat and make sure every ounce of your hard work is accounted for. Let's dig into the different types of service that can beef up your pension and the critical strategies you can't afford to miss.

What Counts as Creditable Service?

Creditable service is just the official term for the total time the government recognizes when calculating your pension. For most feds, this is your straightforward civilian service where retirement contributions came out of every paycheck. Simple enough. But the calculation can get more interesting when you start looking for other eligible time.

Here are the key areas to investigate in your own work history:

Standard Civilian Service: This is the obvious one—any time you spent in a federal job covered by FERS or CSRS.

Temporary or Part-Time Work: If you had any "non-deduction" or temp service before 1989, you can often get credit for it by making a deposit. It's worth looking into.

Unused Sick Leave: Under FERS, your leftover sick leave balance gets converted into additional service time when you retire. This can be a game-changer, sometimes pushing you over the line into another full year of service.

Military Service: Honorable active duty military time can be added to your civilian service, but it's not automatic. You have to take a specific, crucial step to make it count.

That last point about military service is hands-down one of the most powerful—and most frequently overlooked—opportunities available to federal employees with a military background.

The Power of Military Service Buybacks

If you served in the armed forces before becoming a federal civilian, that time won't count toward your federal pension unless you do something about it. The process is called making a "military deposit," but most people just call it a "buyback." You are essentially paying a deposit into the federal retirement fund to have your military years treated as if they were civilian years.

So, why is this a big deal? Buying back your military time can dramatically accelerate your federal employee retirement eligibility and pump up the size of your pension for life. Adding three, four, or even more years of service can mean retiring earlier or enjoying a permanently higher monthly check.

The financial impact is significant. A deposit of a few thousand dollars today could translate into tens of thousands of dollars in additional pension payments over the course of your retirement.

The process kicks off by getting your estimated military earnings and submitting a request to your agency. To see exactly how this works from start to finish, check out our complete guide to military buy back for federal retirement.

Understanding the Financials and Deadlines

The cost to buy back your time is typically 3% of your total military base pay if you're a FERS employee. But here’s the catch: interest. You get a two-year grace period from the start of your federal career to make the deposit interest-free. After that, interest starts piling up, and it compounds.

Waiting is a costly mistake. I've seen two employees with the exact same four years of military service end up in wildly different situations. One buys back his time within the first two years and pays a small, manageable amount. The other waits 20 years, and the accrued interest balloons the cost into something far more substantial. The lesson is clear: act fast.

Key Steps for Military Buyback:

Request Your Estimated Earnings: You'll start by filling out Form RI 20-97, Estimated Earnings During Military Service, and sending it to the right military finance center.

Submit Your Application: Once you get your earnings statement back, you'll complete Form SF 3108 (for FERS) and give it to your HR or payroll office.

Make the Deposit: Your agency will calculate the final amount you owe, including any interest. You can usually pay it all at once or set up convenient payroll deductions.

Don't leave this money on the table. Taking the time to audit your entire work history for every piece of creditable service is one of the most important things you can do to build a better retirement.

Special Provisions for Federal Careers

Not everyone in federal service punches the clock on the same retirement schedule. The government recognizes that certain jobs—the high-stakes, physically grueling ones—take a greater toll. For these roles, there's a different set of rules, a sort of "fast track" to retirement.

If you're a federal Law Enforcement Officer (LEO), Firefighter, or Air Traffic Controller (ATC), your path to federal employee retirement eligibility looks quite different. These special provisions are in place for a good reason: to acknowledge the unique demands of your career and allow you to retire with security while you're still young enough to enjoy it.

Enhanced Eligibility for High-Stress Roles

Forget the standard MRA charts for a moment. For these special provision careers, the timeline is kicked into high gear. You can hang up your hat much, much sooner than most other FERS employees.

Here’s the breakdown:

At Age 50 with 20 Years: Once you hit your 50th birthday with at least 20 years of covered service under your belt, you're eligible for an immediate, unreduced pension.

At Any Age with 25 Years: Got 25 years of covered service? You can retire with your full annuity, regardless of your age. It doesn't matter if you're 48 or 52—you've earned it.

Of course, this comes with a trade-off: a mandatory retirement age. For LEOs and Firefighters, you generally must retire by age 57. For Air Traffic Controllers, it's often age 56. This is to ensure that these critical public safety roles are always staffed by people at the top of their game.

A More Generous Pension Formula

It's not just about retiring earlier; it's also about retiring with more. Special provision employees get a significant boost in their pension calculation.

A regular FERS employee’s pension is calculated using a 1% multiplier (or 1.1% if they retire at 62 or older with 20+ years of service). But for your first 20 years of special provision service, your pension is calculated with a 1.7% multiplier. That’s a 70% increase. Any service you have beyond those first 20 years is then calculated at the standard 1% rate.

This isn't just a small bonus. The enhanced formula is a core part of the deal for taking on these demanding careers. It's a direct acknowledgment of the higher risks and intense pressures of the job, making sure your retirement benefit truly matches the service you've given.

Understanding Disability Retirement

Sometimes, a career is cut short not by choice, but by necessity. Disability Retirement is a critical safety net for federal employees who can no longer perform their duties because of an illness or injury.

Eligibility here isn't about age and service years in the traditional sense. Instead, it’s about whether your medical condition prevents you from providing "useful and efficient service." You'll generally need at least 18 months of creditable civilian service to qualify.

The process is demanding and requires thorough medical evidence to be approved by the Office of Personnel Management (OPM). It's a lifeline for those facing an unexpected end to their federal career.

It’s worth noting that this is a separate path from other types of early separation. If you're facing an involuntary separation like a RIF, you should read our guide on discontinued service retirement to see what other options might be on the table. For a disability claim, success really comes down to careful preparation and meeting OPM’s strict documentation standards.

Your Actionable Retirement Eligibility Checklist

Knowing the rules is one thing; putting them into practice is another. This is where we shift from theory to action. Think of the following steps as your personal project plan for retirement—a practical framework to confirm your own federal employee retirement eligibility and get everything in order for a smooth transition.

Let's turn that retirement anxiety into confident, decisive action. Following this checklist will give you a crystal-clear picture of where you stand and what you need to do next, making sure nothing falls through the cracks.

The Five-Year Countdown

When should you get serious about this? The sweet spot is 1 to 5 years before you plan to hand in your badge. This timeline gives you plenty of breathing room to hunt down documents, fix any errors you find in your service record, and make smart financial moves without a deadline breathing down your neck. Starting early is the best defense against last-minute panic.

The Core Document Audit

Your entire federal career is captured on paper (or, more likely, in a PDF). It’s on you to gather these records and make sure they tell the right story. Don't just assume everything is correct—trust, but verify.

Gather Your SF-50s: Your collection of Standard Form 50s ("Notification of Personnel Action") is the official biography of your career. Track down every single one, from the day you started to your latest update. They are the ultimate proof of your service history.

Request Your eOPF: Your electronic Official Personnel Folder (eOPF) is the digital vault holding all your SF-50s and other critical career documents. Get a complete copy from your agency's HR portal and review it carefully, page by page.

Confirm Your Service Computation Date (SCD): This is a big one. Find your SCD on your latest SF-50, as this date is what determines your total years of creditable service. If it looks off—maybe it’s not accounting for that military buyback or some temporary time—now is the time to get it fixed with HR.

A common mistake is assuming your HR department will catch discrepancies in your record. They are often managing hundreds of employees. It is up to you to be the auditor of your own career history. Proactive verification prevents last-minute delays.

The Official Verification Phase

Once you’ve done your homework, it’s time to get an official projection from the source. This is the step that makes your retirement plan feel real.

1. Request an Official Retirement Estimate

About 12-18 months out from your target date, formally request a retirement annuity estimate from your agency's HR office. This isn't just a generic calculation; it's a projection of your pension based on your high-3 salary and service records. It's the closest you'll get to a preview of your future retirement income.

2. Analyze the Estimate

When that estimate arrives, resist the temptation to just look at the bottom-line number. You need to put on your detective hat and scrutinize every detail:

Is your Service Computation Date (SCD) correct?

Does it include all your service, especially any you bought back?

Is the high-3 salary calculation what you expected?

Does it confirm you're eligible to keep your health and life insurance?

3. The Five-Year FEHB Rule

Speaking of health insurance, this is a make-or-break detail. To carry your Federal Employees Health Benefits (FEHB) into retirement, you absolutely must have been enrolled for the five years immediately before you retire. Your estimate should confirm your eligibility. If there's any question about this, you need to sort it out right away. For most feds, this rule is non-negotiable.

By working through this checklist, you’re not just planning—you’re building a solid, verifiable foundation for your retirement, ensuring you can step confidently into your next chapter.

Common Questions About Federal Retirement Eligibility

When you start digging into the details of federal retirement, you'll inevitably run into some very specific, "what-if" questions. Let's tackle some of the most common ones that come up for federal employees as they get closer to retirement.

How Is the MRA+10 Reduction Calculated?

Taking an MRA+10 retirement can give you an early out, but it comes with a permanent catch if you start taking payments before you turn 62. The math is simple but the impact is huge: your annuity gets a permanent haircut of 5% for every single year you are under age 62.

Let's make that real. Say your MRA is 57. You retire and start your annuity right away. That's a full five years before you hit 62. The math would be 5 years x 5% = a 25% reduction. That's not just a temporary ding; it's a permanent cut to your pension check for the rest of your life. You do have the option to postpone when you start receiving your annuity, which can reduce or even eliminate that penalty.

Can I Keep My Health and Life Insurance with a Deferred Retirement?

This is a huge one, and the answer is usually a hard "no." If you leave federal service and later claim a deferred retirement, you almost always forfeit your ability to keep your Federal Employees Health Benefits (FEHB) and Federal Employees' Group Life Insurance (FEGLI).

Why? To carry these incredibly valuable benefits into retirement, you need to have been enrolled for the five consecutive years right before an immediate retirement. Deferred retirement breaks that chain. This is a massive financial risk, especially for anyone depending on that federal health plan.

The loss of FEHB is probably the single biggest reason people avoid a deferred retirement. It can mean being forced to find private insurance, which is often far more expensive and might not offer the same level of coverage. For most feds, this makes an immediate or postponed retirement the only secure path.

Are There Restrictions on Working After I Retire?

For the vast majority of federal retirees, heading back to work in the private sector is no problem at all. You can start a second career, open a business, or do consulting work without it affecting your FERS annuity one bit.

The rules get tricky, though, if you decide to come back and work for the federal government again. In that scenario, you become what's known as a "reemployed annuitant." Typically, your annuity payments will be put on hold, and you’ll start paying back into the retirement system. When you eventually re-retire, your pension will be recalculated to include that extra service time.

What Are the Most Common Application Mistakes?

Nothing is more frustrating than having your retirement paperwork kicked back because of a simple error. Delays happen all the time, and they're usually caused by a few common and completely avoidable mistakes.

Here are the top culprits we see:

Incomplete or Incorrect Forms: A missed signature, an unchecked box, or using an old version of a form can bring the whole process to a screeching halt.

Service History Discrepancies: Not double-checking that your official service computation date is correct is a classic mistake. This is especially true if you have military buybacks or temporary service deposits that need to be accounted for.

FEHB Enrollment Gaps: Fumbling the five-year rule for health benefits or discovering a surprise gap in your coverage can cause a last-minute panic.

Your best defense is a good offense. Go over every single line of your application and get a copy of your service history from HR well before you plan to retire. It's the surest way to make your transition a smooth one.

Navigating these complexities is where having a guide can make all the difference. At Federal Benefits Sherpa, we help you build a clear and confident path to the retirement you've earned. Schedule your free 15-minute benefits review today to ensure your plan is on the right track.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved