Your Guide to government pension calculation: Maximize FERS & CSRS Benefits

Figuring out your federal pension really comes down to one core formula: your High-3 average salary multiplied by your years of creditable service and a specific pension multiplier. While the nuances differ between the FERS and CSRS retirement systems, getting a handle on these three key inputs is where we need to start.

Understanding Your Federal Pension Calculation

Before you can run any numbers, you have to know which retirement system you're in. It's a critical distinction. Most federal employees hired after 1983 are covered by the Federal Employees Retirement System (FERS), which is a more modern, three-part plan. On the other hand, if your service started before 1984, you're likely in the legacy Civil Service Retirement System (CSRS).

This isn't just about a date on a calendar; it fundamentally changes the entire structure of your retirement income. CSRS is a powerful, standalone pension plan. It's known for its generous annuity calculations but comes with a major caveat: you don't earn Social Security benefits during your federal service.

FERS, in contrast, was designed from the ground up to work alongside other retirement benefits. You'll often hear it called a "three-legged stool" because it's built on three distinct income sources working together:

FERS Basic Annuity: This is your actual pension, calculated using that core formula we mentioned.

Social Security: As a FERS employee, you contribute to and earn Social Security benefits just like someone in the private sector.

Thrift Savings Plan (TSP): This is the government's version of a 401(k). You can save and invest your own money for retirement, and the government even provides matching contributions up to 5%.

Your total retirement income under FERS is a blend of these three sources. A successful government pension calculation requires looking at the annuity and forecasting your Social Security and TSP income together.

FERS vs CSRS a Quick Comparison

Getting these foundational differences straight is essential. The table below breaks it down, but the main takeaway is that one system relies on a single, powerful pension, while the other creates a diversified retirement portfolio by integrating multiple components. This is the baseline knowledge you need before we can dive into the specific formulas.

FeatureFERS (Federal Employees Retirement System)CSRS (Civil Service Retirement System)Primary ComponentsAnnuity, Social Security, Thrift Savings Plan (TSP)A single, standalone defined-benefit pensionSocial SecurityYes, employees pay Social Security taxes and earn benefits.No, CSRS employees do not contribute to or earn Social Security during their service.TSP ContributionAutomatic 1% agency contribution; up to 5% total matching.Employees can contribute, but there is no government matching.Annuity GenerosityGenerally a smaller percentage multiplier (1% or 1.1%).Higher percentage multipliers that increase with years of service.

Once you've confirmed which system applies to you, you're ready to start gathering the specific numbers needed for your calculation.

The 3 Key Numbers That Drive Your Pension Calculation

Before you can even think about plugging numbers into a formula, you have to get the raw ingredients right. Calculating your federal pension isn't about guesswork; it's about precision. Think of it as building a house—if the foundation is off, the whole structure will be shaky.

Let's walk through the three crucial numbers you need to pull from your career records. Getting these spot-on is the single most important part of the entire process.

Your High-3 Average Salary

First up is the big one: your High-3 Average Salary. This isn't just your final salary. It's the average of your highest basic pay over any 36-consecutive-month period of your federal career. For most people, this ends up being their last three years on the job, but it doesn't have to be.

The term "basic pay" is critical here. It’s your standard salary plus any locality pay. What it doesn't include is just as important:

Overtime pay

Bonuses or awards

Lump-sum payments for unused annual leave

I’ve seen folks accidentally include these extras, which only inflates their estimate and sets them up for a tough surprise down the road. The best place to find this information is by digging through your old SF-50s (Notification of Personnel Action) or your earnings and leave statements to identify that peak 36-month window.

Calculating Your Creditable Service

Next, you need to nail down your total Creditable Service—down to the years and months. This is more than just how long you've been in your current job. It's the sum of all your qualifying time in federal service.

Most of your civilian time under a federal retirement system will count, but a lot of feds have other periods of service that they forget to include.

Expert Tip: Every single day of creditable service counts. It might not seem like much, but adding in a few extra months by converting sick leave or buying back military time can mean thousands more in your pocket over the course of your retirement.

A common oversight is prior military service. If you were on active duty, you might be able to make a deposit to get that time counted towards your federal pension. We call this "buying back" your military time, and it can give your years of service a serious boost. For a detailed walkthrough, you can learn more about military buy-back for federal retirement in our comprehensive guide.

Don't forget about your unused sick leave, either. When you retire, your entire sick leave balance is converted into extra creditable service, which feeds directly into your pension calculation. It’s a powerful, and often overlooked, benefit.

Identifying the Correct Pension Multiplier

Finally, you need the pension multiplier. This isn't a single number for everyone; it's a percentage that depends on your retirement system (FERS vs. CSRS) and sometimes your age and service history when you retire.

For most FERS employees, the standard multiplier is 1%. But here’s a pro-tip: that multiplier gets a 10% bump to 1.1% if you meet two conditions:

You retire at age 62 or older.

You have at least 20 years of creditable service.

For my fellow CSRS folks, the system is tiered to reward a long career. The formula is a bit more complex, using 1.5% for your first 5 years of service, 1.75% for your next 5 years, and a generous 2.0% for every year after that.

Once you have these three pieces of the puzzle—your High-3 salary, your total creditable service, and the right multiplier—you're ready to put it all together. Now, we can move on to the actual formulas.

Putting the FERS and CSRS Pension Formulas to Work

Alright, you've done the legwork and gathered the three critical numbers for your pension calculation: your High-3 salary, your total creditable service, and the correct multiplier. Now it's time to plug them in and see what your future income looks like. This is where the numbers on paper turn into a real-world retirement estimate.

Because the FERS and CSRS systems operate so differently, we'll tackle them one at a time. This keeps things clear and ensures you’re using the exact formula that applies to you.

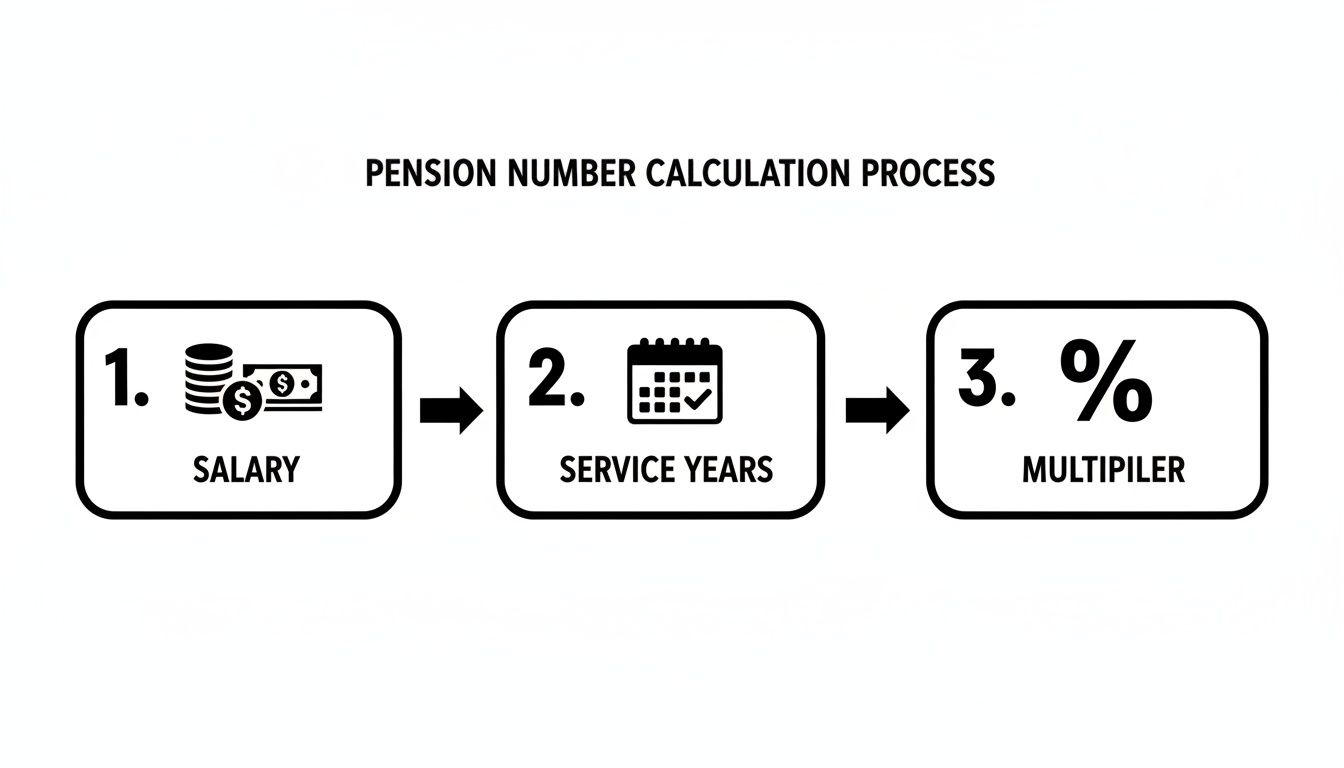

This simple flowchart breaks down how these three core components—salary, service, and multiplier—come together to produce your final pension amount.

Getting each piece of this puzzle right is absolutely essential for an accurate retirement projection.

The FERS Pension Calculation in Action

For most federal employees on the job today, the FERS formula is the one that counts. It’s a pretty straightforward calculation that gives you a solid baseline for your retirement annuity.

The standard FERS formula is:

High-3 Salary x 1% x Years of Creditable Service

But there’s a key enhancement you should know about. If you retire at age 62 or older with at least 20 years of service, the multiplier gets a nice bump from 1% to 1.1%. That 10% increase might not sound like much, but it adds up to a significant boost in your pension checks over a long retirement.

Let’s see how this plays out with a couple of practical examples.

To bring this to life, we've created a table showing how two different retirement choices can affect the final FERS pension. It's a great way to visualize the impact of age and service on your bottom line.

Sample FERS Pension Calculation Scenarios

Employee ProfileHigh-3 SalaryYears of ServiceRetirement AgeMultiplierAnnual PensionSarah (Retires at 60)$110,00030601.0%$33,000David (Retires at 62)$115,00032621.1%$40,480

As you can see, David's decision to work just two more years netted him a much higher lifetime income, thanks to more service years, a slightly higher High-3, and that all-important 1.1% multiplier. You can explore more scenarios with our guide to mastering the FERS pension calculator for your retirement.

Demystifying the Tiered CSRS Formula

If you're one of the veteran employees covered by the Civil Service Retirement System (CSRS), your calculation is a bit more involved. The formula is specifically designed to reward a long federal career, using tiered multipliers that grow with your years of service.

Here's how the CSRS formula breaks down:

1.5% x High-3 Salary x First 5 years of service

PLUS 1.75% x High-3 Salary x Next 5 years of service

PLUS 2.0% x High-3 Salary x All years of service over 10

Let’s run the numbers for a long-serving CSRS employee.

A Key Insight on CSRS: The real power of the CSRS system kicks in after your first decade. That 2% multiplier for every year over 10 is incredibly generous compared to the FERS formula, which explains why career CSRS employees often retire with very substantial pensions.

Example: A CSRS Employee with a 35-Year Career

Meet Robert, who is retiring under CSRS after a long and distinguished career.

High-3 Average Salary: $120,000

Years of Creditable Service: 35 years

We have to calculate his pension in three separate chunks based on the formula:

Part 1 (First 5 Years):

$120,000 x 0.015 x 5 = $9,000Part 2 (Next 5 Years):

$120,000 x 0.0175 x 5 = $10,500Part 3 (Remaining 25 Years):

$120,000 x 0.02 x 25 = $60,000

Finally, we add the three parts together to get his total annual pension:

$9,000 + $10,500 + $60,000 = $79,500 per year

That comes out to a gross monthly annuity of $6,625, a perfect illustration of how well the CSRS system rewards long-term service.

By working through these examples, you can start to see a clear picture of how your own career decisions directly shape your final pension. The next step is to understand the common adjustments—like survivor benefits or sick leave credit—that can modify this initial figure.

How Key Decisions Adjust Your Final Pension

The number you get from the basic FERS or CSRS formula is a great starting point, but it's almost never your final take-home pay. A handful of critical decisions and adjustments can, and will, change your monthly check in a big way. These aren't just minor details; they are strategic choices with real financial weight.

I like to think of the initial pension calculation as the sticker price on a new car. It’s the big, important number, but by the time you drive off the lot, other factors have changed the final cost. Your pension works the same way.

Getting a handle on these adjustments ahead of time is absolutely essential. It lets you plan with real numbers and avoid any nasty surprises when that first retirement payment from the Office of Personnel Management (OPM) hits your bank account.

The Survivor Annuity Election

One of the most significant choices you'll face is whether to provide a survivor annuity for your spouse. This is a powerful benefit, ensuring your spouse receives a portion of your pension for the rest of their life if you pass away first.

Of course, this protection isn't free. To fund this future benefit, your own pension is reduced during your lifetime. Here’s how it typically breaks down:

Full Survivor Annuity: Choosing the maximum benefit (usually 50% of your pension for your spouse under FERS) means your gross annuity will be reduced by 10%.

Partial Survivor Annuity: You can opt for a smaller benefit (25% of your pension under FERS), which comes with a smaller 5% reduction to your pension.

It’s a direct trade-off: maximize your income now or provide long-term security for your spouse later. This is a deeply personal decision with no single right answer, but it's one that will impact your monthly check from day one.

Unpaid Deposits and Redeposits

Your creditable service is the engine driving your pension, so making sure every last bit of it counts is vital. It’s not uncommon for federal employees to have periods of service where retirement contributions were either not made or were refunded. This is where a "deposit" or "redeposit" comes into play.

A classic example is prior military service. To get credit for that time in your FERS or CSRS pension, you have to make a deposit to essentially "buy back" that time. The same goes if you ever left federal service and cashed out your retirement contributions—you'll need to pay them back (a redeposit) for that service to be included in your pension formula.

Ignoring these can leave a real hole in your retirement income. For instance, failing to make a deposit for civilian service performed before 1989 could permanently reduce your annuity.

A crucial takeaway is that paying a deposit is often a fantastic investment. You are essentially purchasing a guaranteed, inflation-adjusted income stream for life at a relatively low cost, directly boosting your government pension calculation.

The Power of Unused Sick Leave

Here’s a benefit that many federal employees completely underestimate: your unused sick leave. When you retire, every single hour of sick leave you’ve saved up is converted into additional creditable service. This is a direct, dollar-for-dollar boost to your pension calculation.

It’s not a cash payout. Instead, those hours are tallied up and added to your service time, increasing the "Years of Service" part of the pension formula. For someone with a hefty sick leave balance, this can easily add several months—or even more than a year—to their service credit, bumping up their annuity for the rest of their life.

The world of pensions is massive, with global funds managing trillions. Just for context, the world's top 300 pension funds have hit an all-time high of US$24.4 trillion in assets. In the US, a giant like the California Public Employees' Retirement System (CalPERS) uses complex formulas and manages over US$541 billion, with its funded status around 70-75% highlighting market risks. For federal employees, seeing these numbers really underscores the value of optimizing every available benefit, like sick leave, to strengthen your own FERS annuity. You can see more about these global pension fund trends on the Thinking Ahead Institute's website.

CSRS Offset and Social Security

If you're under the CSRS Offset system—a hybrid plan for those who had a break in CSRS service and came back under FERS rules—there's a specific adjustment that happens later in retirement. Your CSRS pension gets "offset," or reduced, once you become eligible for Social Security, which is usually at age 62.

This reduction isn't random. It's calculated specifically to account for the Social Security benefit you earned while you were working under CSRS Offset service. The whole point is to prevent "double-dipping" from both systems for the same period of work. While OPM handles the math, it’s critical to factor this future reduction into your long-term financial plan to avoid an unexpected income drop down the road.

Strategies to Maximize Your Federal Pension

Knowing how your government pension is calculated is one thing. Actually shaping that number for the better is a whole different ballgame. Your goal shouldn’t be just to calculate your pension—it should be to maximize it.

A few strategic decisions can significantly increase the annuity you'll receive for the rest of your life. It’s about more than just working longer; it’s about timing, thoughtful planning, and making smart financial moves at just the right moments. Get this right, and you could be looking at tens of thousands of extra dollars over your retirement.

The Impact of Retirement Timing

One of the most powerful levers you can pull is simply deciding when to retire. For FERS employees, the difference between retiring at your Minimum Retirement Age (MRA) and waiting until age 62 can be huge. As we covered earlier, if you retire at age 62 with 20 or more years of service, your pension multiplier jumps from 1.0% to 1.1%.

That 10% boost is a permanent raise to your pension, a guaranteed return that isn't subject to market swings. Waiting also gives your High-3 salary more time to grow and increases your years of service, further amplifying the final payout.

Waiting isn't just about a bigger multiplier. Delaying retirement also means you are eligible for Cost-of-Living Adjustments (COLAs) sooner. Timing your exit strategically ensures your pension’s buying power is protected against inflation from the start.

The Three-Legged Stool: FERS, TSP, and Social Security

A truly maximized retirement isn't built on your pension alone. For FERS employees, a secure financial future rests on three pillars working in harmony: your FERS annuity, Social Security, and your Thrift Savings Plan (TSP). If you neglect one, the whole structure gets wobbly.

Your TSP is so much more than a savings account; it's a critical income stream. Maximizing your contributions to at least get the full 5% government match is absolutely non-negotiable. That’s free money that compounds over your entire career, building a substantial nest egg to supplement your pension.

Coordinating your FERS pension with Social Security is just as crucial. Understanding the optimal Social Security collection timing is a vital strategy to get the most out of your total retirement benefits. For a deeper look at how these benefits interact, check out our complete guide on Social Security for federal employees.

Other High-Impact Maximization Strategies

Beyond timing and benefit integration, a few other actions can directly pump up your pension calculation.

Make Your Military Deposit: If you have prior active-duty military service, making a deposit to "buy back" that time is often one of the best investments you can make. You are essentially purchasing a guaranteed, inflation-protected income stream for a relatively small, one-time cost.

Boost Your High-3 Salary: Your High-3 is based on your highest 36 consecutive months of basic pay. If you have the opportunity, seeking promotions or taking on higher-graded assignments in your final years can create a significant and permanent lift in your pension base.

Guard Your Sick Leave: Every single hour of unused sick leave converts directly into more creditable service time when you retire. Resisting the urge to use it for minor reasons can add months of service to your calculation, boosting your lifetime income.

The stability of the FERS system is a notable strength. Globally, pension systems are constantly evaluated for their health and effectiveness. The Mercer CFA Institute Global Pension Index, for example, ranks systems on adequacy and integrity. The Dutch system often tops this list with a score of 85.4. The FERS structure, which combines the annuity with up to a 5% TSP match, mirrors the adequacy goals of top-tier systems by aiming for a 70-80% income replacement for retirees. You can discover more insights about global pension rankings from Mercer.

Untangling the Finer Points of Your Pension Calculation

Even after you've seen the formulas, a few things can still feel a bit fuzzy. That's completely normal. The reality is that federal careers aren't always a straight line, and the little details can throw a wrench in your planning. I've spent years helping federal employees map out their retirement, and a few key questions always seem to come up.

Let's walk through them one by one. Getting these right can be the difference between a rough estimate and a number you can actually build your retirement around.

So, How Exactly Do They Calculate the High-3?

Think of your High-3 as the foundation of your entire pension—it has to be solid. This number is the average of your highest 36 consecutive months of "basic pay." Now, "basic pay" is a specific term. It’s your base salary plus any locality pay, but it pointedly does not include things like overtime, performance awards, or bonuses.

You can actually run a quick version of this calculation yourself. Just pull the basic pay numbers for your three peak earning years.

Let's imagine your salary history looked like this for your best three years:

Year 1: $105,000

Year 2: $108,000

Year 3: $111,000

A simple average gives you the answer: ($105,000 + $108,000 + $111,000) / 3 = $108,000. That’s the High-3 that plugs into the formula. When OPM does the official calculation, they'll use your actual monthly pay stubs for precision, but this method gets you incredibly close.

Does Part-Time Service Count Toward My Pension?

Yes, it absolutely does, but this is one of the most misunderstood parts of the calculation. The government accounts for part-time work with a proration adjustment.

Here’s the key distinction: every single day you work, whether full-time or part-time, counts toward your eligibility to retire. You’ll meet the age and service milestones just the same.

Where it changes is in the math for the annuity itself.

Let’s say you worked for 10 years at a 50% part-time schedule. For eligibility purposes, you have a full 10 years of service. But when calculating the pension for that decade, the service credit is prorated to 5 years (10 years x 0.50). That prorated figure is what gets used in the formula for that period of your career.

What Happens if I Left and Came Back to Federal Service?

A break in service definitely doesn't wipe out your hard-earned time. If you leave your federal job and later return, your prior service can almost always be combined with your current service to build toward a single, larger pension.

The big question is what you did with your retirement contributions when you left. If you left the money in your FERS or CSRS account, you’re all set—that time is still credited to you. If you took a refund of your contributions, you'll need to pay that money back (called a "redeposit") with interest to get that service time to count toward your pension calculation.

On the bright side, your High-3 will almost certainly be based on your most recent, higher-paying years, which is a huge benefit for anyone who returns to government work later in their career.

Will My Pension Keep Up With Inflation?

Yes, your pension is designed to grow over time through Cost-of-Living Adjustments, or COLAs. This helps protect your purchasing power from inflation. However, the COLA rules are different depending on whether you're under FERS or CSRS, and this is a critical detail for your long-term planning.

The adjustments are tied to the annual change in the Consumer Price Index (CPI), but they're applied differently:

CSRS COLAs: Are straightforward. They typically provide a full match to the CPI. If the CPI increases by 3%, your annuity gets a 3% COLA.

FERS COLAs: Have a built-in buffer. If the CPI is 2% or less, the FERS COLA will match it. If the CPI is between 2% and 3%, the COLA is a flat 2%. And if the CPI is over 3%, your COLA is the CPI increase minus 1 percentage point.

This means that during years with high inflation, a FERS pension won't keep pace as directly as a CSRS pension will. It’s a vital distinction to understand as you forecast your income needs decades into the future.

Working through these specific scenarios is essential for getting an accurate picture of your retirement. If you want to be sure your calculations are spot-on and your retirement strategy is sound, Federal Benefits Sherpa can help you find clarity. We offer a free 15-minute benefit review to get you on the right track.