Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Windfall Elimination Provision Explained for Federal Employees

The Windfall Elimination Provision (WEP) can feel like a curveball in your retirement planning, especially if you've dedicated years to public service. In short, WEP is a rule that can reduce your Social Security retirement or disability benefits if you also receive a pension from a job where you didn't pay Social Security taxes.

It’s not a penalty. Think of it as a recalculation. The Social Security benefit formula is designed to give a higher percentage of pre-retirement earnings back to lower-income workers. WEP adjusts this formula for people who have pensions from non-covered employment to prevent them from unintentionally receiving this higher, weighted benefit.

Why Does WEP Even Exist?

Let's try a simple analogy. Imagine your working life created two separate income streams. One stream comes from a private-sector job where you paid Social Security taxes with every paycheck. The other, often larger, stream comes from your career as a public servant—maybe as a teacher, firefighter, or a federal employee under the old CSRS system—where you earned a government pension instead of paying into Social Security.

When the Social Security Administration (SSA) calculates your benefits, its system only sees the earnings from that first stream. It has no visibility into your government pension. Based on that limited information, you look like a low-wage worker, and the standard formula would give you a disproportionately large Social Security benefit—a "windfall."

The Windfall Elimination Provision was created back in 1983 to fix this. It modifies the math to account for your government pension, ensuring the benefit you receive from Social Security is more aligned with what you actually contributed over the years.

At its core, the WEP is a mechanism to prevent the overpayment of Social Security benefits to retirees who have pensions from non-covered employment. It aims to place these retirees on a more equal footing with workers who spent their entire careers paying into Social Security.

This isn't a niche rule affecting just a few people. As of today, approximately 2.1 million Social Security beneficiaries have their payments adjusted by WEP, which represents about 3% of everyone receiving benefits.

Who Is Primarily Affected by WEP?

The rule specifically targets anyone who worked in a job not covered by Social Security (meaning you didn't pay FICA taxes on that income) but also worked other jobs long enough to qualify for Social Security.

The most common groups impacted are:

State and Local Government Employees: This frequently includes teachers, firefighters, and police officers, depending on the state's retirement system.

Federal Employees: This is especially common for those hired before 1984 who are covered by the Civil Service Retirement System (CSRS).

Employees of Non-Profits or Overseas Employers: In some cases, these workers may not have paid into the U.S. Social Security system.

To make it even clearer, here's a quick breakdown of who typically falls under the WEP umbrella.

Who Is Typically Affected by WEP

Employee CategoryTypically Affected by WEP?ReasonCSRS Federal EmployeesYesCSRS is a non-covered pension; they did not pay Social Security taxes.FERS Federal EmployeesNoFERS employees pay Social Security taxes as part of their retirement plan.State/Local Gov. WorkersDepends on the StateMany states (like California, Texas, and Ohio) have their own pension plans for public employees that don't include Social Security.Private Sector WorkersNoPrivate-sector employment is almost always covered by Social Security.

This table provides a quick reference, but individual circumstances can vary. The key takeaway is simple: if you earned a pension from non-covered work and you qualify for Social Security from other employment, the WEP will likely be a factor in your retirement planning.

Before we get into the nitty-gritty of WEP calculations, it helps to have a solid grasp of the basics. Understanding how to apply for Social Security benefits gives you a good foundation for the entire process.

How WEP Adjusts Your Social Security Benefits

To get a real handle on the Windfall Elimination Provision, you first have to peek behind the curtain at how Social Security calculates benefits. It’s not just a straight percentage of what you earned. The system is intentionally tilted to give a bigger boost to lower-income workers, using a three-tiered formula with what they call "bend points."

For someone hitting retirement age in 2024, the standard calculation breaks down like this:

You get 90% of the first $1,174 of your average indexed monthly earnings (AIME).

You get 32% of your AIME between $1,174 and $7,078.

You get 15% of any AIME over $7,078.

That first tier is the key. The 90% factor is a powerful part of the formula designed to give a substantial leg up to workers with lower lifetime earnings. WEP’s entire purpose is to adjust this specific piece of the calculation.

The WEP Formula Change Explained

The Windfall Elimination Provision leaves the second and third tiers (the 32% and 15% parts) completely alone. Its only job is to dial back that generous first tier. For anyone subject to WEP, the 90% multiplier is knocked down, sometimes to as low as 40%.

That’s the whole mechanical change. It’s a simple switch in the math that stops the Social Security system from mistakenly treating a public servant—who is already getting a separate, non-covered pension—as a low-wage earner.

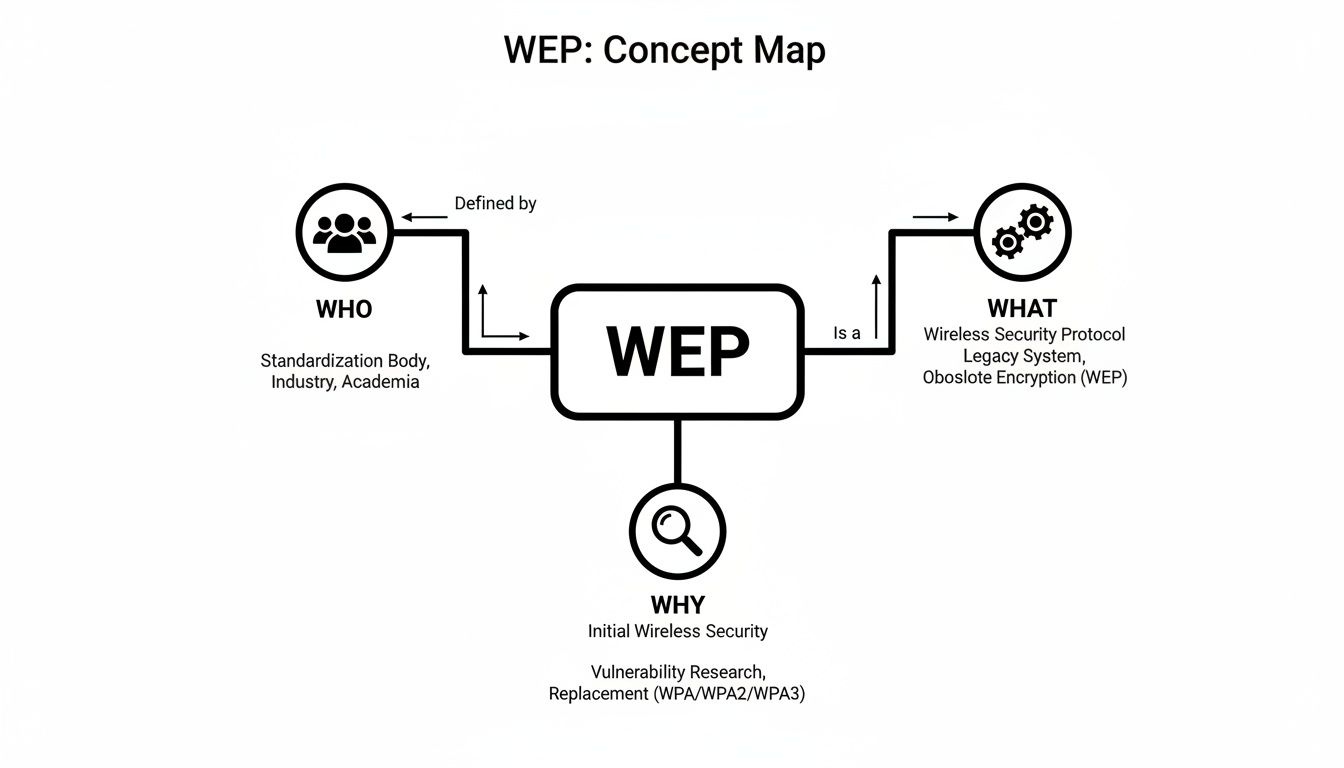

This concept map helps pull together the moving parts of the Windfall Elimination Provision we're covering.

As the map lays out, WEP is all about who is affected, what part of the calculation changes, and the original reason Congress created it.

Let's walk through a real-world example to see just how big of a difference this can make. Imagine two federal retirees, both with an identical AIME of $3,000 from their years in Social Security-covered jobs.

Worker A (Not Affected by WEP): This is a FERS employee who paid into Social Security throughout their entire career.

Worker B (Affected by WEP): This is a CSRS employee. They have a non-covered CSRS pension but also worked other jobs long enough to qualify for a Social Security benefit.

Here’s a side-by-side look at how their benefits would be calculated:

Calculation TierWorker A (No WEP)Worker B (Full WEP)First $1,174 of AIME$1,174 x 90% = $1,056.60$1,174 x 40% = $469.60Next $1,826 of AIME$1,826 x 32% = $584.32$1,826 x 32% = $584.32Initial Monthly Benefit$1,640.92$1,053.92

The result is striking. Just by changing that first multiplier from 90% to 40%, Worker B’s monthly benefit is $587 lower. Navigating these tricky rules is precisely why so many people look for clarity on their overall Social Security benefits for federal employees, so they can plan with confidence.

An Important Safeguard: The Pension Limit

Seeing that number might be a bit of a shock, but there’s a critical safeguard built into the WEP rule to soften the blow. The reduction to your Social Security benefit can never exceed a specific limit.

Your Social Security benefit can never be reduced by more than one-half of the amount of your monthly pension from non-covered employment.

Let's say your non-covered CSRS pension is $800 a month. The absolute most that WEP can reduce your Social Security check is $400 (half of your pension). Even if the formula we just ran shows a potential $587 reduction, the law caps it at $400.

This rule acts as a crucial ceiling, especially for public servants with more modest pensions. It ensures the adjustment doesn't become overly punitive, and understanding it is absolutely vital for getting an accurate picture of what your financial future really looks like.

You Can Soften the WEP’s Blow with Substantial Earnings

The Windfall Elimination Provision might seem like a permanent roadblock in your retirement plan, but it’s not as rigid as you think. The good news is that the Social Security Administration (SSA) has a built-in mechanism to reduce its impact—and even eliminate it entirely. The key is racking up what are called "years of substantial earnings."

Think of it this way: each year you work in a job where you pay into Social Security and earn above a certain amount, you get a "credit." These credits work directly against the WEP formula, systematically boosting your Social Security benefit back up.

So, what counts as "substantial earnings"? The SSA sets a specific income threshold for every year, which increases over time to keep pace with wage growth. For instance, back in 1990, you needed to earn $9,525 to get credit for the year. Fast forward to 2024, and that figure has jumped to $31,275. Accumulating enough of these years is hands-down the most powerful tool you have to fight back against the WEP.

How Substantial Earnings Adjust the WEP Calculation

Normally, the WEP slashes the first "bend point" in the Social Security benefit formula from 90% down to just 40%. It's a significant cut. But this is where your years of substantial earnings come into play. Once you have more than 20 years of these earnings, the math starts to shift back in your favor.

Beginning with your 21st year of substantial earnings, the multiplier begins to climb. For every additional year you add, the percentage goes up, slowly but surely erasing the WEP reduction.

The big takeaway here is that the WEP is not necessarily a life sentence. If you plan strategically and accumulate enough years paying into Social Security, you can wipe out the Windfall Elimination Provision completely.

This creates a clear path forward. That part-time job you're considering after retiring from your government career? Or that side hustle you’ve been thinking about? It's not just about extra spending money—it's a direct investment in a larger Social Security check for the rest of your life.

This chart from a Social Security publication shows you exactly how the multiplier climbs with each year of substantial earnings you get beyond the 20-year mark.

As you can see, the percentage moves steadily upward, starting at 45% with 21 years and eventually returning to the full 90% once you hit the 30-year milestone. At that point, the WEP is gone.

The Roadmap to Wiping Out the WEP

This sliding scale gives you a tangible goal to shoot for. Let’s break down how the multiplier for the first portion of your earnings improves as you collect more years:

20 Years or Less: You get hit with the maximum WEP reduction. Your benefit is calculated using the low 40% multiplier.

21 Years: Things start looking up. The multiplier gets a bump to 45%.

25 Years: You're halfway there! Your multiplier is now up to 65%.

30 Years or More: Congratulations, the WEP is no longer a factor for you. Your Social Security benefit will be calculated using the standard 90% multiplier, just like anyone else.

This turns the WEP from a frustrating problem into a challenge with a clear solution. It gives you a specific target to aim for, even after you've left your primary career. Every single year of substantial earnings you add to your record translates directly into more guaranteed income from Social Security in retirement.

Understanding the Government Pension Offset

Just when you think you've got the Windfall Elimination Provision figured out, another rule throws a wrench in the works. It's really important to know the difference between the WEP and its equally impactful cousin, the Government Pension Offset (GPO). While they both affect public servants and sound similar, they operate in completely different lanes.

Think of it this way: WEP deals with the Social Security benefits you earned for yourself through your own work history. The GPO, on the other hand, has nothing to do with your personal benefit. It specifically targets any spousal or survivor benefits you might be eligible to collect based on your spouse's Social Security record.

The GPO Formula in Action

Unlike the WEP's sliding scale calculation, the GPO formula is brutally straightforward. It reduces your potential spousal or survivor benefit by an amount equal to two-thirds of your government pension from non-covered employment. That's it. There are no "bend points" or adjustments based on your years of work.

This simple math often has a massive impact. In many cases, this two-thirds reduction completely wipes out the entire spousal or survivor benefit, leaving the person with zero dollars from that source.

The whole point of the GPO is to mirror the "dual-entitlement" rule that applies to everyone else. That rule stops someone from getting both their own full Social Security retirement benefit and a full spousal benefit at the same time.

Put into law back in 1977, the GPO works hand-in-hand with WEP to adjust benefits for people with government pensions. The effect is profound. Research shows that for nearly 70% of beneficiaries hit by the GPO, their spousal or widow(er) benefit was completely eliminated. You can find more details about these provisions on the official SSA press release page.

A Clear Example of the GPO Calculation

Let's walk through an example to see how this plays out in the real world.

Meet Maria: She’s a retired teacher who receives a $3,000 monthly pension from her state teaching job, where she never paid into Social Security.

Her Spouse: Her husband, who worked in the private sector his whole life, passes away. Based on his extensive work record, Maria is eligible for a $2,200 monthly Social Security survivor benefit.

Now, let's apply the GPO formula.

Calculate the GPO Reduction: First, we need to find two-thirds of Maria’s government pension.

$3,000 (Pension) x (2/3) = $2,000 (This is the GPO reduction amount)

Apply the Reduction to the Survivor Benefit: Next, we subtract that reduction from her potential survivor benefit.

$2,200 (Survivor Benefit) - $2,000 (GPO Reduction) = $200

Without the GPO, Maria would have collected the full $2,200 survivor benefit. But because of her non-covered pension, the Government Pension Offset slashes that payment down to just $200 a month. Seeing how both WEP and GPO can affect your household’s total income is a critical piece of the retirement puzzle.

How to Estimate Your Own WEP Reduction

Alright, let's move from theory to reality. Understanding the concept of the Windfall Elimination Provision is one thing, but seeing how it could actually affect your Social Security check is what really matters. The good news is, you don't need to be a math genius to get a solid estimate.

The best place to start is with the tool provided directly by the Social Security Administration (SSA). Their official WEP Online Calculator is designed specifically to give you a personalized estimate, taking the guesswork out of the equation.

Using the Official SSA WEP Calculator

To get the most out of the SSA's tool, you’ll want to have a few key pieces of information ready. Gathering these details beforehand will make the whole process go much smoother.

Here's what you'll need:

Your complete earnings history: The easiest way to get this is to log into your

my Social Securityaccount on the SSA website. You can download your official statement, which lists every year you've paid into the system.Your planned retirement date: The calculator needs to know when you plan to claim benefits, as your age plays a big role in the final calculation.

Your monthly pension amount: You'll need the estimated monthly payment from your "non-covered" pension—the one that didn't pay into Social Security. If you aren't sure, your HR department or pension administrator can provide this figure. A clear understanding of how to calculate pension benefits can be a big help here.

Once you plug in this information, the calculator handles all the complex math. It applies the WEP formula, factors in your years of "substantial earnings," and gives you an estimate of your adjusted Social Security benefit. This is the number you need for effective retirement planning.

Don't let the WEP be a big question mark in your financial future. Using the SSA's calculator turns it from a vague worry into a concrete number you can build a solid retirement strategy around.

A Simplified Manual Worksheet

If you're the kind of person who likes to see how the numbers work for yourself, you can run a simplified manual calculation. It won't be as exact as the official online tool, but it will give you a great ballpark estimate of the potential reduction and help you understand the mechanics behind it.

Here’s a simplified worksheet to walk you through the process. It's a great way to demystify the formula and see how each component influences the outcome.

Simplified WEP Calculation Worksheet

StepActionYour Calculation1. Find Your AIMELook at your Social Security statement to find your Average Indexed Monthly Earnings (AIME). If it’s not listed, you can use the SSA’s online AIME calculator to find it.Enter Your AIME Here2. Calculate Standard BenefitUse the standard "bend points" for your retirement year. For 2024, it's 90% of the first $1,174, 32% of the amount up to $7,078, and 15% of the rest.Standard Benefit = ______3. Calculate WEP BenefitRe-run the calculation, but change the first bend point from 90% down to 40% (or the higher percentage based on your years of substantial earnings).WEP Benefit = _________4. Find the Initial ReductionSubtract your estimated WEP benefit (Step 3) from your standard benefit (Step 2). This is your preliminary reduction amount.Initial Reduction = ______5. Apply the Pension LimitTake your monthly non-covered pension amount and divide it by two. This is a critical step—the WEP reduction cannot be more than this number.Max Reduction = ______6. Determine Final ReductionCompare the results from Step 4 and Step 5. Your actual WEP reduction will be the smaller of these two numbers.Final Reduction = ________

Going through this exercise is incredibly valuable. It strips away the mystery and really hammers home how the WEP calculation works, especially that all-important pension limit safeguard. Whether you use the online tool or a manual worksheet, taking this step is the first, most important part of planning for a WEP-adjusted retirement.

Take Control of Your Federal Retirement Plan

Getting a handle on the Windfall Elimination Provision and Government Pension Offset is the first big hurdle. But real financial security comes from taking what you've learned and putting it into action. You now have the core knowledge to start building a smarter retirement strategy.

You’ve seen how WEP and GPO work, why they exist, and how piling up those "substantial earnings" years is your best defense. These rules might seem complicated, but with the right guidance, they are absolutely predictable and manageable. It's time to shift from just knowing about these provisions to actively planning for them.

From Knowledge to a Confident Plan

Turning this understanding into a solid plan for your future is a personal journey. Cookie-cutter advice won’t cut it; your specific work history and life goals call for a strategy built just for you. Getting specialized help means you can navigate the precise math involved and weave it all into a single, comprehensive retirement plan that leaves no stone unturned.

Don't let WEP and GPO become a source of stress. Think of them as known variables in an equation. With the right help, you can solve for them and ensure there are no nasty surprises when that first retirement check arrives.

The next logical step is a deep dive into your unique situation. Our experts can help you create a guide to federal employee retirement planning that’s tailored specifically to your circumstances.

Broader Strategies for a Secure Future

While we've zeroed in on the rules that hit federal employees, it’s also crucial to pull back and incorporate broader general retirement planning strategies. Smart wealth management and tax-efficient investing can add another layer of strength to your financial foundation, working hand-in-hand with the steps you take to counter WEP and GPO.

The ultimate goal here is a complete, 360-degree view of your financial life. A personalized assessment makes sure every piece of your retirement puzzle—from your federal pension and Social Security to your TSP—fits together exactly as it should. Take that first step today and schedule a review of your unique financial picture.

Got Questions About WEP and GPO? We've Got Answers.

Even when you've got a handle on the basics of the Windfall Elimination Provision and Government Pension Offset, some specific questions almost always pop up. These rules are notorious for their tricky nuances, so I've put together some straight answers to the questions I hear most often from federal employees and public servants.

Think of this as the "what if" section—a chance to tackle those lingering concerns about your personal situation. Let's clear up some of the finer points.

Will WEP Affect My Medicare?

I get this question all the time, and thankfully, the answer is a simple one that brings a lot of relief: No, the Windfall Elimination Provision has zero impact on your eligibility for Medicare.

Your Medicare eligibility is a separate issue entirely. It's tied to your work history and age, not the dollar amount of your Social Security check.

As long as you've worked and paid Medicare taxes for at least 10 years (the 40 credits you always hear about) in a Social Security-covered job, you've earned your premium-free Medicare Part A at age 65. The WEP formula only tinkers with your cash benefit from Social Security; it doesn't touch your eligibility for health benefits.

What if My Government Pension Is Really Small?

This is a great question because it highlights a crucial safeguard the Social Security Administration built into the WEP. They wanted to make sure the provision didn't hit people with modest pensions too hard. It’s called the pension limit rule.

The rule is straightforward but powerful:

The WEP reduction to your Social Security benefit can never be more than half of your monthly non-covered pension amount.

Let's say your government pension is only $500 a month. In this case, the absolute most WEP could ever reduce your Social Security benefit is $250. Even if the standard formula spits out a higher number, this cap kicks in, ensuring the reduction is proportional. It’s a vital protection that keeps things fair for public servants with smaller pensions.

Can I Get Around WEP by Taking My Pension as a Lump Sum?

It's a clever thought, but the answer is almost always no. Cashing out your pension in a lump sum does not let you sidestep the Windfall Elimination Provision.

The Social Security Administration has seen this one before. They will simply calculate what your monthly pension payment would have been if you had taken it as an annuity and apply the WEP reduction based on that projected monthly number. So, trying to take a lump sum won't work as a loophole to avoid the WEP reduction.

Does My WEP Reduction Affect My Spouse's Benefits?

The impact of WEP is laser-focused on your own Social Security retirement or disability benefit. It does not directly spill over and reduce the benefit your spouse is entitled to based on their own work record. But—and this is a big but—we have to distinguish between different types of spousal benefits.

Here’s how it breaks down:

Your WEP vs. Your Spouse's Own Benefit: Your WEP reduction has no effect whatsoever on the Social Security benefit your spouse earned from their own career.

Your Pension vs. Your Spouse's Spousal or Survivor Benefit: This is where the other shoe drops. The Government Pension Offset (GPO) can slash—or completely wipe out—any spousal or survivor benefit your spouse might have been counting on from your work record if they also have a non-covered pension of their own.

It's easy to get them mixed up, but just remember: WEP hits your benefit. GPO hits your spouse's potential spousal/survivor benefit. They're two different rules that can seriously impact a household's retirement income.

Figuring out how all these federal benefit rules fit together can feel like a puzzle with missing pieces. You don't have to solve it alone. At Federal Benefits Sherpa, we specialize in giving federal employees a clear map to a secure retirement. We can show you exactly how WEP and GPO will factor into your plans and help you build a strategy to make the most of your hard-earned benefits.

Take the first step and schedule your free 15-minute benefit review to get some clarity.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved