A Guide to Federal Employee Retirement Planning

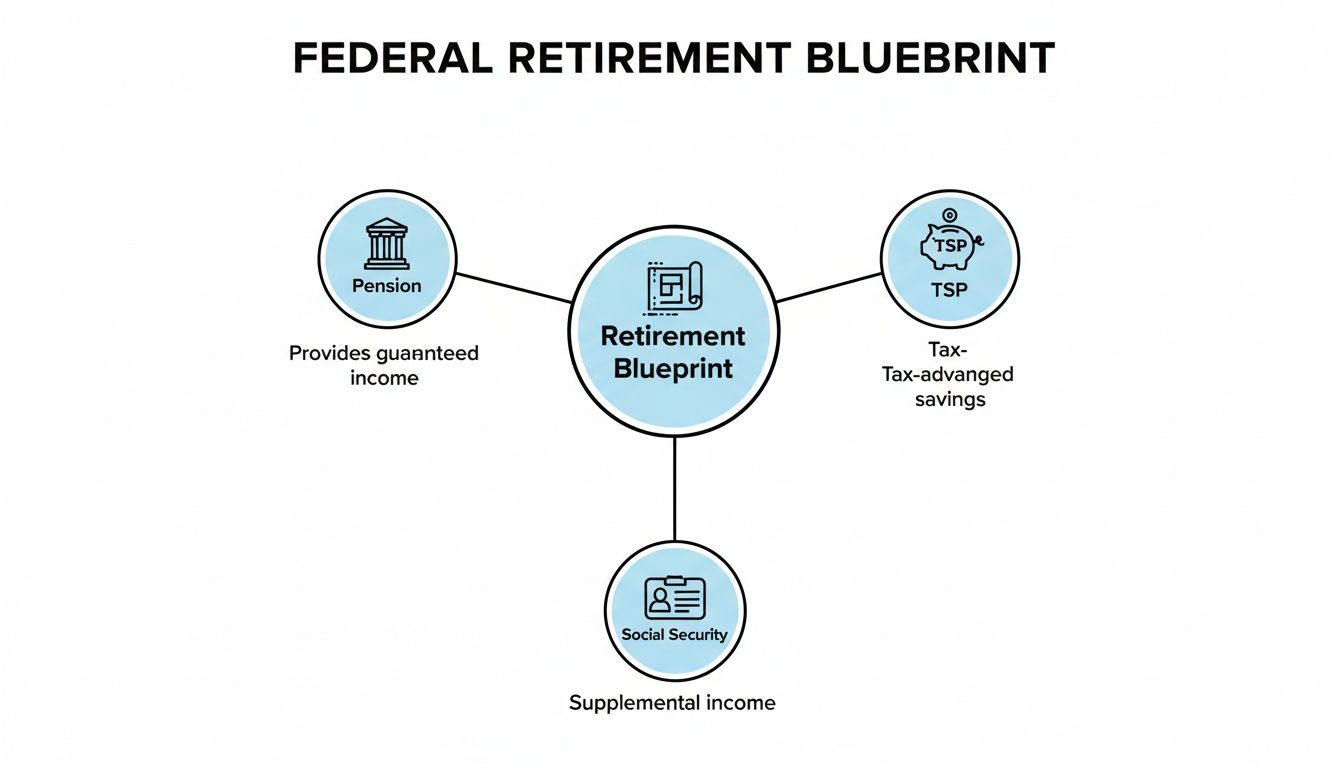

When you're a federal employee, planning for retirement isn't about guesswork. It’s about understanding the three core pillars that will support you financially after you hang up your hat: your pension, your Thrift Savings Plan (TSP), and Social Security.

Think of them as the legs of a sturdy stool. If one is weak, the whole thing gets wobbly. Getting to know how each one works—and how they work together—is the absolute first step toward a retirement you can feel good about.

Building Your Federal Retirement Blueprint

It’s easy to feel overwhelmed by all the acronyms and rules. FERS, CSRS, TSP, FEHB... it can feel like alphabet soup. But you don't need to get lost in the weeds right away. The trick is to start with a solid foundation.

Let's focus on that "three-legged stool" I mentioned. Each leg represents a different source of your future income, and they're all designed to work together. This blueprint gives you a high-level view of how it all connects.

As you can see, a successful retirement isn't about relying on just one thing. It's about building a balanced financial structure that leverages your pension, your personal TSP investments, and the Social Security benefits you've earned.

The Three Pillars Explained

To really grasp how your retirement will take shape, you need to understand the role each of these pillars plays. For federal employees under the Federal Employees Retirement System (FERS), these three components are designed to be a complete package.

- Your Pension (FERS or CSRS): This is the bedrock. It's a guaranteed, lifelong monthly payment you receive from the government. The amount is calculated based on a formula that uses your salary and how long you worked. It's predictable, and it's there for you no matter what the stock market is doing.

- Thrift Savings Plan (TSP): Think of this as your personal investment engine, much like a 401(k) in the private sector. You contribute to it, and the government helps you out with a generous 5% match. This is where you have the most control—your choices and contributions directly impact how much it grows over your career.

- Social Security: This is the safety net. As a FERS employee, you've been paying into Social Security your whole career. It provides another layer of income to supplement your pension and TSP, protecting your financial foundation.

To make this even clearer, let's break it down in a table.

The Three Pillars of Federal Retirement

Here’s a quick summary of the core components of your federal retirement, what they do, and where you should focus your planning efforts for each one.

| Component | What It Is | Key Planning Action |

|---|---|---|

| Pension (FERS/CSRS) | A defined-benefit plan providing a guaranteed monthly income for life based on your service history and salary. | Understand your eligibility dates and how your high-3 salary impacts your final pension amount. |

| Thrift Savings Plan (TSP) | A defined-contribution plan, similar to a 401(k), where your investments grow tax-deferred. | Maximize the 5% government match and choose an investment allocation that aligns with your risk tolerance and timeline. |

| Social Security | A federal insurance program providing retirement, disability, and survivor benefits. | Decide on the optimal age to begin claiming benefits to maximize your lifetime payout. |

Seeing these pieces laid out like this really helps clarify how they're all meant to support one another to create a comprehensive retirement income stream.

Why You Need a Blueprint Right Now

Having a clear plan has never been more important. In a recent fiscal year, the U.S. Office of Personnel Management (OPM) processed an incredible 112,679 federal retirements—the highest number in more than two decades.

This huge wave of retirements shows that federal employees are being strategic about when they leave, often timing their exits around workforce shifts or potential changes to benefits. This isn't a "wait and see" environment. You can dig into the numbers yourself on the official OPM retirement statistics page.

A successful retirement doesn't just happen by accident. It is the result of a deliberate, well-constructed plan that balances guaranteed income from your pension with the growth potential of your TSP investments, all supported by the safety net of Social Security.

Once you truly understand this framework, everything else starts to fall into place. You can start making smart, informed decisions about how much to save, where to invest, and when you can confidently step into the retirement you've earned.

Understanding Your Federal Pension: FERS and CSRS

Your federal pension is the bedrock of your retirement plan. It’s a defined-benefit plan, which is just a formal way of saying you’re guaranteed a specific, predictable monthly check for the rest of your life. Think of it as the solid foundation that holds up the other parts of your retirement house.

When we talk about federal retirement, we're really talking about two different systems: the Civil Service Retirement System (CSRS) and the Federal Employees Retirement System (FERS). They both provide a pension, but they couldn't be more different in how they work.

CSRS is the legacy system, and it was phased out for new hires after 1983. If you started your career before 1984 and never switched, you’re likely covered by CSRS.

FERS is the modern system designed to be part of a "three-legged stool" alongside Social Security and the Thrift Savings Plan. Today, the vast majority of federal employees fall under the FERS umbrella.

FERS vs. CSRS: A Simple Travel Analogy

To get a feel for the main difference between the two, let's think about planning a vacation.

The CSRS pension is like booking an all-inclusive resort. It's one big, generous package designed to cover almost everything you need. The pension payment is much larger because it was intended to be the main source of retirement income, as CSRS employees generally don't pay into Social Security.

The FERS system, on the other hand, is like putting together a custom travel package. You get a smaller, foundational pension (the hotel room), but it comes with two other powerful benefits: Social Security (your tour tickets) and the TSP (your spending money). Each piece is critical, and they all work together to create a complete and secure retirement.

How Your FERS Pension Is Calculated

For FERS employees, the math behind your pension is surprisingly straightforward. It isn't tied to the stock market's wild swings or complex investment returns. Instead, it comes down to a simple, three-part formula.

Here are the key ingredients:

- Your High-3 Average Salary: This is simply the average of your highest 36 consecutive months of basic pay—which, for most people, is their last three years on the job.

- Years of Creditable Service: This is all your time in federal service. Pro tip: unused sick leave can be converted to add more time to your service record!

- A Pension Multiplier: This is a fixed percentage set by the government. For most FERS employees, it’s 1%.

The basic formula is as clean as it gets:

High-3 Salary x Years of Service x 1% = Your Annual Pension

But wait, there’s a great little bonus. If you retire at age 62 or later with at least 20 years of service, that multiplier gets bumped up to 1.1%. That’s a permanent 10% raise on your pension, for life. To see more detailed examples of how this works, check out our in-depth guide on federal pensions.

The Stability You Can Count On

The real power of these pensions lies in their stability. This isn't just a promise; it’s a guarantee backed by massive, well-managed funds. In fact, government defined-benefit plans like FERS and CSRS recently held an incredible $9.3 trillion in assets, a significant piece of the total $45.8 trillion U.S. retirement market. This provides a rock-solid foundation for millions of public servants.

Let's see how the FERS formula plays out in the real world.

Imagine a federal employee, Alex, is retiring at age 62 after 30 years of dedicated service. Alex’s High-3 average salary is $90,000. Because Alex meets the age and service requirements, that enhanced 1.1% multiplier kicks in.

Here’s the math:

- $90,000 (High-3) x 30 (Years) x 1.1% (Multiplier) = $29,700 per year

This means Alex will receive a guaranteed pension of $29,700 every year, which comes out to $2,475 per month—for life. And remember, that predictable income stream is just one piece of the puzzle, sitting alongside Social Security and withdrawals from a well-funded TSP. It's how all three components come together that builds a truly strong financial future.

Getting the Most Out of Your Thrift Savings Plan

If your federal pension is the rock-solid foundation of your retirement, think of your Thrift Savings Plan (TSP) as the engine that really drives your wealth forward. This is your personal investment account, much like a 401(k) in the private sector, and it's where you have the most direct control over your financial future. Nailing your TSP strategy is a massive piece of the federal employee retirement planning puzzle.

Far too many feds take a “set it and forget it” approach, but that’s a surefire way to leave money on the table. To build the kind of wealth you’ll need for a truly comfortable retirement, you have to be proactive. That means having a real strategy, not just making contributions.

Finding Your Investment "Gear"

I like to think of the different TSP funds as gears in a car. Each one has a different combination of speed (potential return) and bumpiness (risk). Your job is to pick the right gear for where you are on your road trip to retirement.

- The G Fund (Government Securities): This is first gear. It’s incredibly safe and designed to never lose your principal investment. The trade-off? The growth is slow and steady. It’s a perfect choice for preserving your capital, especially as you get close to retirement.

- The F Fund (Fixed Income Index): Call this second gear. It follows a U.S. bond index, giving you a bit more return than the G Fund with just a smidge more risk. It’s a great way to add stability to your portfolio.

- The C, S, and I Funds (Common Stock, Small Cap, International): These are your highway gears, built for speed. The C Fund tracks the S&P 500, the S Fund focuses on small-to-mid-sized U.S. companies, and the I Fund invests in international stocks. They have the highest potential for long-term growth, but you have to be comfortable with the ups and downs of the market.

If you're younger and have decades to go, you can afford to spend more time in those faster lanes (C, S, and I Funds) to really let your money grow. As you get closer to your retirement date, you’ll likely want to downshift into the slower, safer gears (G and F Funds) to protect the nest egg you've worked so hard to build.

The L Funds: Your TSP on Autopilot

Don't want to worry about shifting gears yourself? The Lifecycle (L) Funds are designed to be your TSP's "automatic transmission." You just pick the L Fund with a target date closest to when you think you’ll retire, and it handles all the adjustments for you.

The L Funds are designed to get more conservative as you get older. They start out heavily invested in the stock funds (C, S, and I) for maximum growth and then gradually, automatically shift more money into the safer bond funds (G and F) as your retirement date gets closer.

This hands-off approach is a fantastic option, but it’s still smart to know what’s going on under the hood. To see how different allocation models work in practice, check out our guide on the top TSP investment strategies for federal employees.

Traditional vs. Roth TSP: A Crucial Tax Decision

One of the biggest choices you'll make is whether to contribute to the Traditional TSP or the Roth TSP. The only difference is when you pay the taxes. It's a simple concept with huge long-term implications.

| TSP Type | How It Works | Best For Employees Who... |

|---|---|---|

| Traditional TSP | Your contributions are pre-tax, which lowers your taxable income right now. You'll pay income tax on the money when you withdraw it in retirement. | ...think they'll be in a lower tax bracket when they retire. |

| Roth TSP | Your contributions are after-tax, so you don't get a tax break today. The huge benefit? All your qualified withdrawals in retirement are 100% tax-free. | ...think they'll be in the same or a higher tax bracket in retirement. |

And you don't have to choose just one! You can split your contributions between both, giving you a mix of taxable and tax-free income in retirement. This is a savvy move for creating tax flexibility down the road.

Don't Miss the Free Money: The Government Match

Beyond your own investing smarts, the single most powerful feature of the TSP is the government match. For FERS employees, your agency automatically contributes 1% of your basic pay into your TSP—even if you contribute nothing at all.

But the real magic starts when you contribute. The government will match your contributions dollar-for-dollar on the first 3% you put in, and then fifty cents on the dollar for the next 2%.

Let's break that down: If you contribute 5% of your salary, the government puts in another 5%. That's a 100% return on your money before it even has a chance to grow in the market. Failing to contribute at least 5% is literally walking away from free money, one of the costliest mistakes you can make in your federal career.

Weaving Your Health and Social Security Benefits into the Plan

A solid retirement plan is more than just a FERS pension and a healthy TSP balance. True financial security in retirement means anticipating and managing your biggest future expenses, with healthcare sitting right at the top of the list. It also involves understanding how all your benefits—federal and otherwise—fit together.

Think of it this way: your pension and TSP are your income engine. But programs like FEHB, Medicare, and Social Security are the shock absorbers, smoothing out the financial bumps in the road ahead.

Keeping Your Health Insurance in Retirement

One of the most valuable benefits you can carry with you into retirement is your Federal Employees Health Benefits (FEHB) coverage. It's a real game-changer. But it's not a given.

To keep this coverage, you have to meet the "5-year rule." It’s a simple but non-negotiable requirement: you must have been continuously enrolled in any FEHB plan for the 5 years immediately before you retire. The specific plan can change, but the coverage can't have any gaps. Missing this checkpoint is one of the costliest mistakes a federal employee can make.

If you don't meet the 5-year rule, you lose your eligibility for FEHB in retirement, period. You'd be pushed into the private insurance market, where finding comparable coverage at a similar price can be incredibly difficult, if not impossible.

Once you hit your 60s, Medicare also enters the picture. It's designed to work hand-in-hand with your FEHB, creating a powerful combination of coverage. Getting this coordination right is crucial, and you can learn more by reading our federal retiree's guide to FEHB and Medicare.

To help clarify how these two major health programs interact, here’s a quick breakdown:

FEHB vs. Medicare Key Considerations

| Feature | FEHB in Retirement | Medicare (Parts A & B) | How They Interact |

|---|---|---|---|

| Premiums | You pay monthly premiums, often pre-tax. | Part A is usually premium-free; Part B has a standard monthly premium. | Most retirees keep FEHB and enroll in Medicare. FEHB often acts as secondary coverage, potentially reducing your out-of-pocket costs. |

| Coverage | Comprehensive coverage for hospital, medical, and prescriptions. | Part A covers inpatient hospital care; Part B covers outpatient medical services. | Medicare becomes your primary payer for hospital and medical bills, and FEHB wraps around it, covering things Medicare doesn't. |

| Enrollment | Must meet the 5-year rule to continue into retirement. | You are typically eligible at age 65. Delaying enrollment can result in lifetime penalties. | The strategy is key. Enrolling in Medicare Parts A & B at 65 while keeping FEHB is the most common and often most effective approach. |

This table is just a starting point, but it highlights why you can't just think about one without considering the other.

Factoring in Social Security

For nearly all FERS employees, Social Security is the third leg of that retirement stool, right alongside your pension and TSP. You've paid into it your whole career, and it provides an inflation-adjusted income stream for life. The biggest decision you'll have is when to claim it—starting at 62, full retirement age, or waiting until 70 can dramatically change your monthly check.

Now, if you're a CSRS employee, the story is a bit different. Since you typically didn't pay Social Security taxes on your federal earnings, a couple of rules might come into play:

- Windfall Elimination Provision (WEP): This rule can reduce any Social Security benefit you earned from other private-sector jobs.

- Government Pension Offset (GPO): This can shrink or even wipe out any spousal or survivor benefits you might have qualified for from your spouse's Social Security record.

Adding Layers of Financial Protection

Finally, a complete plan includes a financial safety net for your loved ones and your assets. The government offers two key programs to help with this.

First is the Federal Employees' Group Life Insurance (FEGLI). Just like FEHB, you need to have been enrolled for 5 continuous years before retirement to keep it. FEGLI can be a great source of protection, but be warned: the premiums can get very expensive as you get older. You'll need to run the numbers to see if it makes sense for your situation.

Second is the Federal Long Term Care Insurance Program (FLTCIP). This insurance is designed to help pay for care if you can no longer handle daily activities on your own. It's an often-overlooked part of planning, but thinking about potential long-term care costs now can protect your hard-earned retirement savings down the road.

Timing Your Retirement and Navigating the Application

Crossing the finish line into federal retirement is about more than just hitting your age and service numbers. The exact date you choose and how well you put together your application can make a huge difference in your transition. To put it simply, smart timing and meticulous paperwork are your best friends for a smooth start to this next chapter.

Think of your retirement application as your final, and most important, project as a federal employee. You wouldn't rush a major work project at the last minute or turn in incomplete work, right? The same logic applies here—maybe even more so. Rushing can lead to costly delays and a ton of unnecessary stress.

Strategic Timing for a Bigger Payout

Picking your retirement date isn't just about what feels right; it's a financial move. For many feds, one of the smartest strategies is to retire at the very end of a month. Why? This small tweak ensures you’re on the payroll for the entire month, which means you’ll get your first pension payment the very next month without a long, unpaid gap.

Retiring at the end of the year is also a popular move, and for good reason. Here’s a quick breakdown of the perks:

- Lump-Sum Annual Leave: You get a cash payout for every hour of unused annual leave. If you retire in January, you get paid for last year's leave plus any you just earned in the new leave year.

- Final Paycheck Boost: That lump-sum payment gets tacked onto your final paycheck, giving you a nice cash cushion while you wait for your first full annuity check to arrive.

- Sick Leave Credit: While you can’t cash out your sick leave, it doesn't go to waste. It gets converted into additional creditable service, which nudges your lifetime pension just a little bit higher.

The Application Backlog and Why It Matters

Now more than ever, submitting a perfect retirement application is critical. The Office of Personnel Management (OPM) is often buried under a mountain of applications, which can seriously slow down the finalization of your benefits. Any mistake, no matter how small, can get your paperwork kicked to the back of the queue.

We've seen massive surges in retirements lately, putting incredible pressure on the system. In one recent year, OPM was flooded with over 70,000 applications by mid-year—that's a nearly 40% jump from the year before. This wave created a backlog of 48,396 cases by the end of November, showing just how real these delays can be. You can get more insights into how these backlogs impact federal workers on stwserve.com.

Submitting your retirement application 60 to 90 days before your planned retirement date isn't just a suggestion—it's essential for getting ahead of the logjam and ensuring your transition is as seamless as possible.

This buffer gives your agency’s HR folks enough time to review everything and get it over to OPM without any last-minute panic.

Mastering the Retirement Application

Your mission is to hand in a "decision-ready" application—one so clean and complete that an OPM specialist can process it without a single question. These days, most of this happens through the Online Retirement Application (ORA), which definitely helps guide you along.

To sidestep the common hiccups that cause those frustrating delays, laser-focus on these key areas:

- Verify Your Service History: Go through your Official Personnel Folder (OPF) with a fine-tooth comb. Make sure every single period of service, including any military buy-back time, is correctly documented.

- Make Survivor Benefit Elections: This is one of the biggest decisions you'll make. Be absolutely sure you understand the options for providing a survivor annuity for your spouse and have the required documents, like your marriage certificate, handy.

- Complete All Forms Accurately: Take your time with every section of the ORA. A simple typo or a missed signature is all it takes to get your application flagged for correction, which means—you guessed it—a delay.

Think of it like packing for a big trip. You wouldn't leave home without your passport, and you shouldn't submit your retirement package without every single required document. Treat it with that level of importance, and you'll be on the fast track to a stress-free retirement.

Common and Costly Retirement Planning Mistakes to Avoid

The road to federal retirement is full of twists and turns, and a few small missteps can have a surprisingly big impact on your financial future. Learning from the mistakes others have made is one of the smartest things you can do for your own federal employee retirement planning. Let's walk through some of the most common—and costly—pitfalls so you can sidestep them entirely.

Underestimating Your Future Healthcare Bills

One of the biggest financial shocks for new retirees is the true cost of healthcare. It’s easy to assume your FEHB premium will be your only major medical expense, but that's rarely the case. We often forget about the out-of-pocket costs that add up quickly, like copays for specialist visits, major dental work, or new glasses every year.

Here's a number that gets people's attention: a healthy 65-year-old couple retiring today might need over $300,000 set aside just for healthcare expenses throughout their retirement. That figure really underscores why you need a plan that goes far beyond your pension and TSP.

Misunderstanding Key Benefit Elections

Choosing your survivor benefits for the FERS or CSRS pension is another area where people stumble. This is a huge decision, and once you make it, it's pretty much set in stone. The most serious error is failing to elect a survivor annuity, which could leave your spouse without a reliable income for the rest of their life if you pass away first.

On the flip side, some people automatically choose the maximum survivor benefit without fully grasping the trade-off. Doing so permanently reduces your own monthly pension check. The right move is to look at your family's entire financial situation—including life insurance and other assets—to make a decision that provides security without unnecessarily shrinking your own income.

Playing It Too Safe with TSP Investments

I see this all the time, especially with employees who are decades away from retirement: being far too conservative with their Thrift Savings Plan. It feels safe to park all your money in the G Fund, and it is—it's guaranteed not to lose value. But it’s not guaranteed to beat inflation.

Think about it this way: by sticking only to the G Fund and avoiding the stock funds (C, S, and I) for 30 years, you're missing out on decades of potential compound growth. A young employee who plays it too safe could easily end up with a TSP balance that's hundreds of thousands of dollars smaller than a colleague who chose a balanced, age-appropriate strategy.

This isn't about being reckless. It's about matching your investment mix to your timeline. A well-diversified portfolio is your best tool for building the kind of wealth you'll need for a long and comfortable retirement.

Forgetting About Inflation

Finally, many federal employees simply don't plan for the slow, silent erosion of their spending power. Inflation is a force that can seriously undermine your retirement plan if you ignore it. Here are three major blind spots I often see:

- Fixed Income: Many assume their pension and Social Security COLAs will keep them whole. That’s a risky bet, as these adjustments don't always keep up with your personal inflation rate.

- Withdrawal Rates: Pulling too much money from your TSP early on is dangerous. When prices rise, you're forced to withdraw even more, which can drain your account much faster than you ever expected.

- Long-Term Care: The potential cost of long-term care is a massive financial risk. These expenses tend to rise much faster than general inflation and can wipe out a lifetime of savings if you haven't planned for them.

A truly solid retirement strategy is one that looks decades into the future and protects your purchasing power for the long haul.

Common Questions on the Road to Retirement

Even with the best-laid plans, a few tricky questions always seem to surface as you get closer to your federal retirement date. Getting these details straight is crucial for a smooth transition. Let's walk through some of the most common questions we hear from federal employees.

How Does OPM Figure Out the FERS Annuity Supplement?

The FERS Annuity Supplement is a real lifeline for FERS employees who retire before they can start collecting Social Security at age 62. Think of it as a temporary payment that stands in for the Social Security benefits you’ve earned as a federal employee.

OPM has a specific formula for this. They estimate what your Social Security benefit would be at age 62, but they only use your years of FERS civilian service in that calculation. One huge thing to remember is the earnings test. If you retire and then take another job, your supplement can be reduced or even wiped out if your new income goes over a certain yearly limit.

Can I Still Borrow from My TSP After I Retire?

This is a firm no. Once you separate from federal service, you can no longer take out a loan from your Thrift Savings Plan. The TSP loan program is a perk strictly for active federal employees.

After retirement, your relationship with your TSP account fundamentally changes. Instead of borrowing, you start thinking about withdrawing. You’ll have a few different ways to access your money:

- You can set up regular monthly payments.

- You can take out a partial or full lump-sum withdrawal.

- You can use your balance to purchase a life annuity.

- You can roll the funds over into another retirement account, like an IRA.

What Happens to My FEGLI Life Insurance in Retirement?

You might be able to keep your Federal Employees' Group Life Insurance (FEGLI) after you retire, but it's not a given. To qualify, you have to satisfy the "5-year rule"—the same one that applies to your health insurance. This means you must have been continuously enrolled in FEGLI for the five consecutive years right before you retire.

If you meet that requirement, you'll have to decide how much coverage you want to keep. But be prepared for a reality check on the premiums. The cost of FEGLI can jump dramatically in retirement, especially as you get older. It's really important to look at the numbers and decide if the expense still makes sense for your family and your budget.

Sorting through these complexities is exactly where expert guidance can make a world of difference. At Federal Benefits Sherpa, we specialize in helping federal employees make sense of every single benefit to build a rock-solid financial future.

Ready to make sure your plan is on track? Schedule your free 15-minute benefit review today at https://www.federalbenefitssherpa.com.