Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

What is a fers supplement: A Clear Guide for Federal Retirement Bridges

Retiring from federal service often means a gap between your last paycheck and your first Social Security check. This is where the FERS Special Retirement Supplement comes in—it’s designed to be a crucial financial bridge, ensuring you have a steady income stream before you’re old enough to claim Social Security.

Think of it as a temporary stand-in, but only for the Social Security benefits you earned during your time as a federal employee.

What Is a FERS Supplement and How Does It Work?

Many federal employees choose to retire before reaching age 62. While your FERS pension starts right away, you can't tap into Social Security until you hit that magic number. This creates a potential income gap that can make early retirement feel financially risky.

The FERS supplement is designed to fill that very gap. It provides a monthly payment that approximates the Social Security benefit you accrued while under FERS, making it much more feasible to retire early without a major drop in income.

It's important to remember this isn't your full Social Security benefit. The calculation is an estimate based strictly on your years of FERS service, not any time you spent working in the private sector.

Key Features of the Supplement

So, what are the core rules you need to know? The FERS supplement has a few defining characteristics that set it apart from other retirement benefits.

- It's Temporary: This is the big one. The supplement payment automatically stops the month you turn 62. It doesn't matter if you decide to start taking your actual Social Security benefits then or wait a few more years—the supplement is gone.

- It's Based on FERS Service: The math behind your supplement amount only looks at your years of credible service under the FERS system. Any other work history is ignored for this specific calculation.

- It's Subject to an Earnings Test: If you decide to get another job after your federal retirement, be careful. Earning over a certain amount can reduce your supplement payment, sometimes all the way to zero.

This benefit is a critical bridge income strategy for federal employees. It functions as a replacement for estimated Social Security benefits until you become eligible for the real thing.

This isn't just a minor perk; for many, it's a significant financial tool. Recent estimates show the average annual supplement for eligible retirees reached about $18,000, which breaks down to around $1,500 per month in critical bridge income. You can learn more about how these benefits fit into a larger financial picture from expert federal benefits analysis.

To make things even clearer, here’s a quick summary table that lays out the essential details.

FERS Supplement at a Glance

| Feature | Description |

|---|---|

| Purpose | To provide a temporary income stream for early retirees before they can claim Social Security. |

| Eligibility Age | You must retire before age 62 and meet specific MRA and service requirements. |

| Payment Duration | The supplement begins at retirement and ends automatically when you reach age 62. |

| Earnings Impact | Payments are subject to the Social Security earnings test and can be reduced by post-retirement income. |

This table captures the most important things to remember as you start planning. The supplement is a powerful tool, but understanding its rules and limitations is the key to using it effectively.

Who Actually Qualifies for the FERS Supplement?

Let's be clear: the FERS supplement isn't handed out to every federal employee who retires before age 62. It’s a fantastic benefit, but the eligibility rules are strict. Think of it as a special bridge benefit, and you need to meet three non-negotiable conditions to cross it.

The whole point of the supplement is to support those who retire with a full, unreduced pension but aren't old enough yet to draw Social Security. This means you must be eligible for an immediate retirement—no deferred or postponed annuities allowed. You're going straight from your federal career into retirement.

The Three Pillars of Eligibility

To get the supplement, you have to check all three of these boxes at the time you separate from service. Miss even one, and you're out of luck.

You must meet the age and service requirements for a full, immediate retirement. This typically means retiring at your Minimum Retirement Age (MRA) with at least 30 years of service, or retiring at age 60 with at least 20 years of service. We cover these rules in-depth in our complete guide to FERS retirement eligibility.

You must retire before you turn 62. The supplement is specifically designed to fill the income gap until you can claim Social Security benefits, which starts at age 62. If you're already 62 when you retire, there's no gap to bridge.

You must be entitled to an immediate, unreduced annuity. This connects back to the first point. Early retirement options like MRA+10 (retiring at your MRA with 10-29 years of service) don't qualify because your pension is reduced if you start it right away. The supplement is for those who've put in the time for a full pension.

The logic is straightforward: the supplement is reserved for career federal employees who are old enough to retire with a full pension but too young to claim Social Security. It’s not a benefit for those who leave federal service early and wait to draw their pension later.

Finding Your Minimum Retirement Age (MRA)

Your MRA is a critical piece of this puzzle. It’s determined by the year you were born, and it’s the earliest age you can retire with a full pension, provided you have the required years of service.

You can find your MRA using this quick reference table:

| If You Were Born... | Your MRA Is... |

|---|---|

| Before 1948 | 55 |

| In 1953 - 1964 | 56 |

| In 1970 or later | 57 |

For birth years falling between those ranges, the MRA increases incrementally. For instance, if you were born between 1948 and 1952, it climbs by two months each year. It’s absolutely crucial to know your exact MRA when you start mapping out your retirement timeline. Getting this right is the first step in figuring out if the supplement can be part of your financial plan.

How Your FERS Supplement Payment Is Calculated

At first glance, the formula for the FERS supplement seems like something only an accountant could love. But once you break it down, it's actually quite logical. The Office of Personnel Management (OPM) isn't just pulling a number out of a hat; they're essentially estimating the Social Security benefit you’ve earned from your years as a federal employee.

Think of it like this: your entire working life is a timeline, but for this specific calculation, only the "FERS years" matter. Any private sector jobs you had before, during, or after your government career are set aside for this purpose. The whole point is to figure out what slice of your future Social Security check is attributable to your FERS service.

The Basic Calculation Formula

So, how do they do it? It all starts with the Social Security benefit you're projected to receive at age 62. OPM then takes that number and adjusts it based on how long you worked under FERS.

Here’s the general formula they use:

(Your Years of FERS Service / 40) x Your Estimated Social Security Benefit at Age 62

The "40" in the formula isn't random. It represents a standard "full" working career in the eyes of the Social Security Administration. So, this calculation determines the portion of a 40-year career you completed under FERS and gives you that same percentage of your estimated Social Security payment. Simple as that.

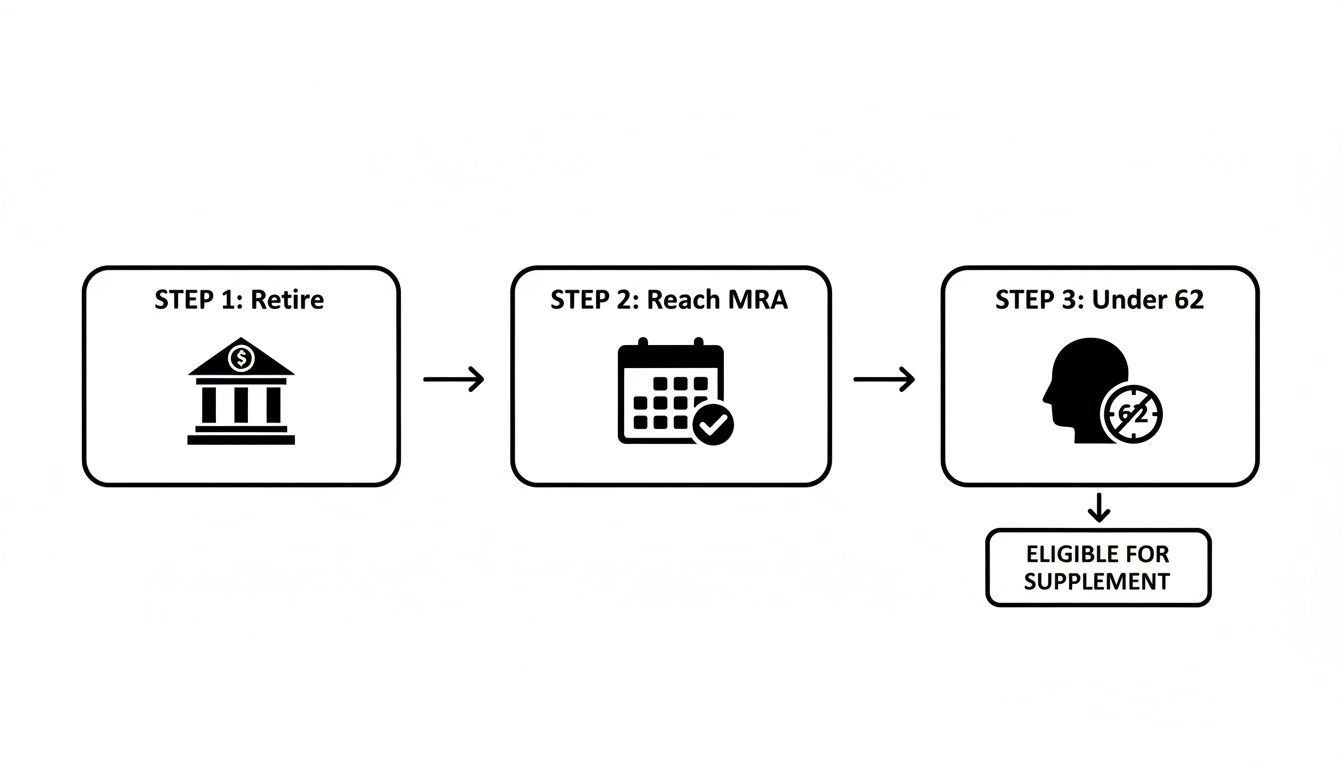

For a quick visual refresher on who qualifies in the first place, this flowchart maps out the key milestones.

As you can see, it boils down to three things: you have to be retired, have reached your Minimum Retirement Age (MRA), and be under age 62.

Putting the Numbers to Work

Let's make this real with a quick example.

Meet Alex, a federal employee who is retiring right at his MRA after 30 years of FERS service. He logs into his mySocialSecurity account and sees his estimated monthly benefit at age 62 is $2,000.

Here’s how OPM would calculate his supplement:

- (30 Years of FERS Service / 40) x $2,000

- 0.75 x $2,000 = $1,500

In this case, Alex would get a FERS supplement of $1,500 per month. That's a significant payment that bridges the gap until his Social Security kicks in at age 62, paid right alongside his regular FERS pension.

Of course, the supplement is just one part of your retirement income. To get the full picture, you'll also want to understand how your main pension is figured out. You can dive deeper in our guide to the FERS pension calculation to see how all the pieces fit together.

How Working After Retirement Affects Your Supplement

Retiring from your federal career doesn't necessarily mean you'll stop working altogether. Maybe you've got your eye on a part-time gig, some consulting work, or even launching a small business you've always dreamed of. But if you're collecting the FERS supplement, you need to be aware that this new income can throw a major wrench in your plans.

The reason? Your supplement is subject to an earnings test. This is the exact same test the Social Security Administration applies to people who start drawing their benefits before their full retirement age. If your earned income goes over a specific limit for the year, your supplement payments get cut.

Understanding the Earnings Test

At its core, the rule is pretty straightforward: for every $2 you earn over the annual limit, your FERS supplement gets docked by $1. This limit isn't static; it changes each year to keep pace with the Social Security threshold. For 2024, that magic number is $22,320.

Now, this reduction isn't something that happens in real-time as you get paid. Instead, the Office of Personnel Management (OPM) looks back at what you earned in the previous year and applies the reduction to your supplement payments for the current year. If you're not ready for it, this delay can cause a sudden and significant drop in your monthly income.

The earnings test is easily one of the most misunderstood parts of the FERS supplement. Getting this wrong can wipe out your supplement entirely, leaving a gaping hole in your budget during those crucial early years of retirement.

What Counts as Earned Income

A big source of confusion is what the government actually defines as "earned income" for the test. It's vital to get this right so you know what will impact your supplement and what won't.

What Counts Towards the Limit:

- Wages from a job: Think salaries, hourly pay, bonuses, and commissions from an employer.

- Net earnings from self-employment: If you become a contractor or start your own business, your net profit is counted.

What Does NOT Count Towards the Limit:

- Your FERS pension payments

- Withdrawals from your Thrift Savings Plan (TSP) or other retirement accounts

- Interest, dividends, and capital gains from your investments

- Rental income from real estate

This distinction is everything. Your retirement income streams—the ones you earned through federal service and personal investing—are safe. It's only the new income you generate from actively working that can trigger a reduction.

A Real-World Example

Let's walk through an example to see how this works. Meet Sarah, a recent federal retiree. She's receiving a FERS supplement of $1,200 a month, which works out to $14,400 a year. To stay busy, she takes on a part-time consulting project and earns $32,320 over the course of the year.

Here's the breakdown:

- Her earnings: $32,320

- Annual limit: $22,320

- Amount over the limit: $10,000

Since the formula is a $1 reduction for every $2 earned over the limit, Sarah’s supplement will be reduced by $5,000 for the year ($10,000 ÷ 2). This means her total annual supplement plummets from $14,400 down to $9,400.

Knowing these rules is absolutely essential when you're trying to understand what is a FERS supplement and how to make it work for you. It allows you to make smart choices about post-retirement work without accidentally torpedoing this valuable bridge benefit.

Should You Retire Early or Wait for a Bigger Pension?

The FERS Supplement is a game-changer, making early retirement a very real possibility for many federal employees. It puts a steady income in your pocket from your Minimum Retirement Age (MRA) until you turn 62.

But this brings up one of the biggest questions in federal retirement planning: should you take the supplement and retire as early as possible, or is it smarter to work a few more years to lock in a permanently larger pension? It's a classic dilemma—more time versus more money.

The Power of the 1.1 Percent Multiplier

Your standard FERS pension is calculated using a 1.0% multiplier. But OPM offers a pretty significant incentive for those who stick around a little longer.

If you work until at least age 62 and have 20 or more years of service, your pension calculation gets a permanent upgrade to a 1.1% multiplier.

That little 0.1% might not seem like much at first glance, but it’s a 10% raise on your pension payment. For life. Let that sink in.

Think about it this way: an employee with a High-3 salary of $100,000 and 30 years of service would get an annual pension of $30,000 with the standard 1.0% factor. By waiting until 62, that pension jumps to $33,000 every single year—a $3,000 annual boost that lasts for the rest of their life.

Retiring at MRA vs. Age 62: A Financial Comparison

To really understand the trade-off, you have to look beyond just the first few years. This decision impacts your finances for decades to come.

The table below breaks down the key differences between grabbing the supplement early and holding out for the bigger pension multiplier.

| Factor | Retire at MRA with Supplement | Retire at Age 62 with 1.1% Multiplier |

|---|---|---|

| Immediate Income | You get your FERS pension and the supplement from your MRA until age 62, creating a solid cash flow early on. | You keep earning your full salary until 62, which means more TSP contributions and a potentially higher High-3. |

| Lifetime Pension | Your pension is calculated with the standard 1.0% multiplier, resulting in a smaller base payment for life. | Your pension is permanently 10% larger, giving you much more financial stability in your later years. |

| Survivor Benefits | The survivor annuity for your spouse is based on this smaller pension amount. | A survivor annuity will also be 10% larger, providing better financial protection for your loved ones. |

| Cost-of-Living Adjustments (COLAs) | Future COLAs are applied to your smaller base pension, which means smaller dollar-amount increases over time. | COLAs are calculated on the higher pension, which magnifies their effect and helps your income keep pace with inflation. |

Looking at it this way, it's clear the decision isn't just about the money you'll have from, say, age 57 to 62. It's about setting the foundation for your income for the next 20, 30, or even 40 years.

The choice isn't just about the first few years of retirement. It's about weighing a few years of extra freedom against a lifetime of higher, inflation-protected income for both you and potentially your spouse.

So, what’s the right call? Honestly, there isn't one. The "best" path depends entirely on your personal situation—your health, your family, and your finances.

If your TSP is well-funded and you have other income sources, the freedom of retiring early might be well worth the trade-off. But if maximizing every dollar for long-term security is your top priority, working until 62 is often the more prudent financial decision. This is a core part of figuring out how to plan for early retirement as a federal employee.

Common Questions About the FERS Supplement

Once federal employees start digging into the details of the FERS supplement, a few questions almost always pop up. Let's tackle the most common ones so you can get a clearer picture of how this benefit really works.

Does the FERS Supplement Get a COLA?

In a word, no. This is a critical detail to remember for your financial planning. While your main FERS pension and eventual Social Security benefits are designed to increase with inflation through Cost-of-Living Adjustments (COLAs), the supplement is fixed.

The amount you're awarded on day one of retirement is the exact same amount you'll receive every month until it stops.

Will I Owe Taxes on the Supplement?

Yes, you can count on it. The FERS supplement is treated as taxable income by the federal government, just like the rest of your FERS annuity.

State taxes are a different story, though. Every state has its own rules for taxing retirement income. Some don't tax it at all, some offer partial breaks, and others tax it fully. You'll need to check the specific tax laws for your state to see how the supplement will be treated.

What Happens When I Hit Age 62?

This is one of the most important rules: the supplement stops cold the month you turn 62. There are no exceptions.

It doesn’t matter if you’ve started drawing your actual Social Security benefits or not. The supplement is a temporary bridge, and at 62, you've reached the other side. The payments end for good.

Is There a Separate Application for the Supplement?

Thankfully, no. If you're eligible for an immediate, unreduced retirement and you're under age 62, the Office of Personnel Management (OPM) automatically calculates and pays the supplement.

It's one less piece of paperwork to worry about. The supplement simply shows up as part of your monthly annuity payment, making the process a little bit smoother.

Planning your federal retirement involves a lot of moving parts. At Federal Benefits Sherpa, we specialize in helping you see how every piece—from your pension to your TSP—fits together. Get a free, personalized 15-minute benefits review to make sure you're on the right track. Secure your financial future by visiting us at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved