Your Guide to Mastering the FERS Pension Calculation

Your FERS pension calculation really boils down to three key numbers: your High-3 average salary, your total years of creditable service, and a specific pension multiplier. Get these three right, and you're well on your way to a solid retirement projection. It's a simple formula on the surface, but mastering each component is what separates a rough guess from a reliable plan.

The Three Pillars of Your FERS Pension Calculation

Before you even think about plugging numbers into a calculator, it’s critical to understand the foundation of your FERS pension. I like to think of it as a stool with three legs—if one is off, the whole thing wobbles. Getting a firm grip on these components ensures the rest of your retirement planning is built on solid ground.

These aren't just abstract terms; they represent the culmination of your entire federal career. Each one has its own rules and quirks that directly impact your bottom line. For a broader overview of this benefit, our guide explaining how federal employees get a pension is a great place to start.

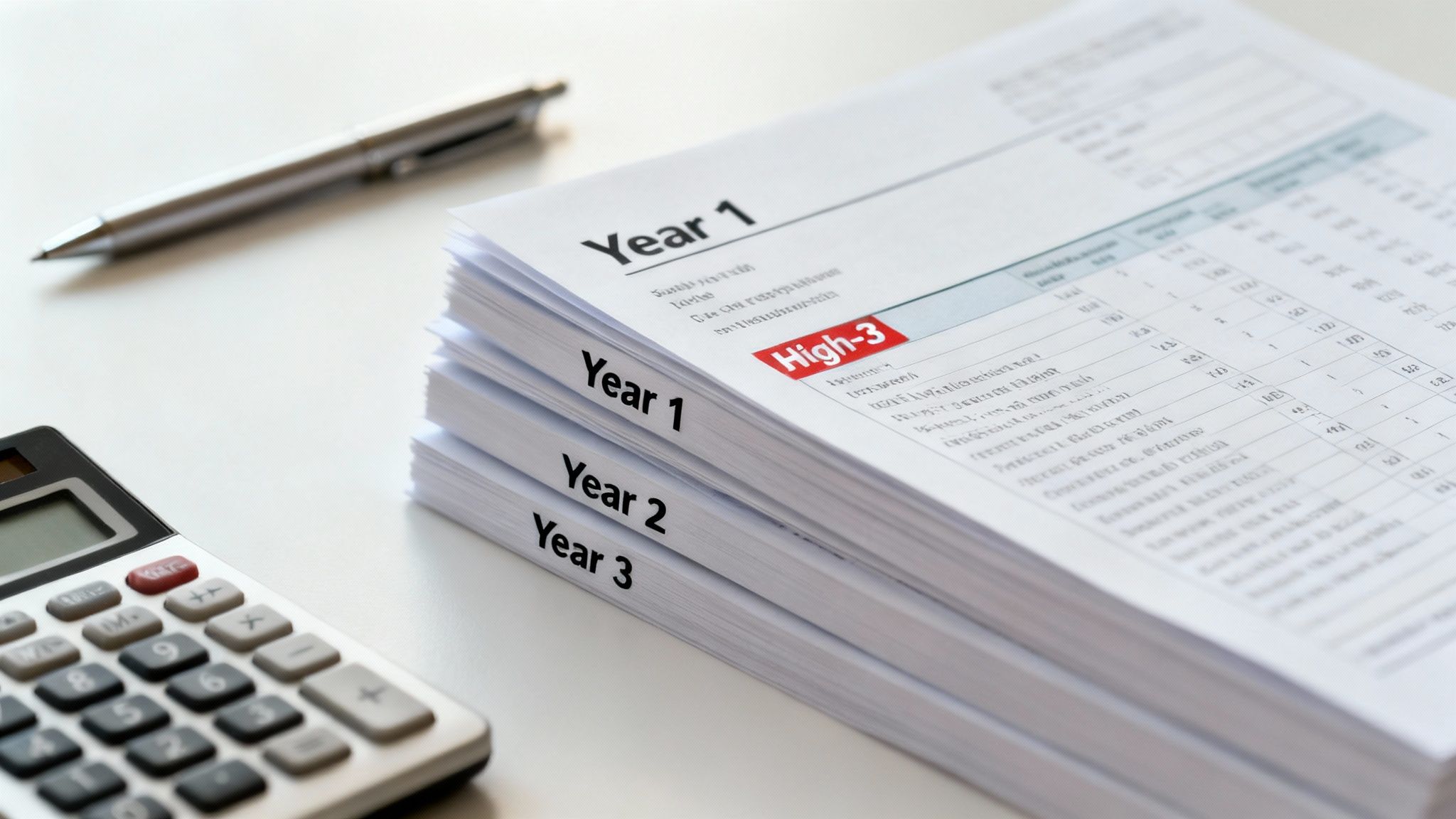

Your High-3 Average Salary

This is the bedrock of your pension. Your "High-3" is simply the average of your highest 36 consecutive months of basic pay. For most federal employees, this will naturally be their last three years on the job, when their salary is at its peak.

So, what exactly is "basic pay"?

- What's In: Your standard base salary plus any locality pay.

- What's Out: Overtime, performance bonuses, awards, and most allowances.

I see it all the time—people mistakenly include overtime or a one-time award, which throws off their entire estimate. Stick to your base and locality pay to keep your projection accurate.

Total Years of Creditable Service

The second pillar is straightforward: the total amount of time you’ve worked in a qualifying position, counted in years and full months. Every single month matters and adds to your final pension.

But it’s not always just your standard civilian service. Other types of service can often be counted, which is a huge advantage.

One of the most common and valuable strategies I see is when feds "buy back" their military time. By making a deposit to the retirement fund, those years of military service get added to their civilian time, giving their total creditable service—and their future pension—a significant boost.

And don't forget about your unused sick leave! At retirement, it gets converted into additional service credit, a fantastic perk that many people overlook until the very end.

The FERS Pension Multiplier

The last piece of the puzzle is the multiplier. This is the percentage that ties your salary and service time together. For the vast majority of FERS employees, this multiplier is 1%. Simple enough.

However, there’s a major exception that provides a 10% bump to your pension. If you retire at age 62 or older with at least 20 years of service, the multiplier increases to 1.1%. It might not sound like a huge difference, but believe me, that extra tenth of a percent compounded over decades of retirement adds up to a substantial amount of money. Many federal employees I work with plan their retirement date specifically to hit this milestone.

It's also worth noting that special category employees, like federal law enforcement officers and firefighters, operate under a different, more generous multiplier.

FERS Pension Formula Components at a Glance

To help you keep these moving parts straight, here’s a quick-reference table that breaks down the three core components of the FERS pension formula.

| Component | What It Means for You | Where to Find Your Information |

|---|---|---|

| High-3 Average Salary | The average of your highest 36 consecutive months of basic pay (base + locality). This sets the financial baseline for your entire pension. | Your SF-50s (Notification of Personnel Action) and Leave and Earnings Statements (LES). |

| Years of Service | The total time you’ve worked in a creditable position, including bought-back military time and converted sick leave. More time equals a bigger pension. | Your Official Personnel Folder (OPF), which can be accessed through your agency's HR portal. |

| Pension Multiplier | The percentage used in the final calculation. It's 1% for most, but bumps up to 1.1% if you retire at age 62+ with 20+ years of service. | Based on your age and years of service at retirement. |

Think of this table as your checklist. Once you have a firm handle on these three inputs, you're ready to start running the numbers and see what your FERS pension will actually look like.

How to Nail Down Your High-3 Salary

When it comes to your FERS pension, one number matters more than any other: your "High-3" average salary. This is the bedrock of the entire calculation. Getting it right is crucial, as even a small error here can ripple out into a significant difference in your monthly check for the rest of your life.

So, what is it? Your High-3 is the average of your highest 36 consecutive months of basic pay you earned during your entire federal career. For most people, this period naturally falls at the very end of their service, but that’s not a requirement. It's simply your peak three-year earning window, whenever that happened to be.

Before you can run any numbers, though, you have to be crystal clear on what the government actually considers "basic pay." This is where many people stumble.

What's In and What's Out of Basic Pay

"Basic pay" is a specific term with a specific definition, and it’s not the same as your gross pay or take-home pay. It’s the fixed, recurring part of your salary.

Let's break down what typically counts and what doesn't:

Included in Basic Pay:

- Your standard salary listed on your SF-50

- Locality pay

- Within-grade increases (WGIs)

- Career ladder promotions

- Certain other consistent premium pay, like law enforcement availability pay (LEAP)

Excluded from Basic Pay:

- Overtime (this is a big one!)

- Bonuses and cash awards

- Travel allowances or uniform stipends

- The government's contribution to your health benefits

I've seen many feds mistakenly think that a year with a lot of overtime or a big performance award will boost their High-3. Unfortunately, OPM doesn't see it that way. You need to focus squarely on your official, basic rate of pay.

Digging Up Your Salary History

The only way to get this right is to use official records. Your definitive source is your collection of SF-50s (Notification of Personnel Action). These forms document every single pay change you've ever received. You should be able to find a complete history in your electronic Official Personnel Folder (eOPF).

Pull up the SF-50s from your highest-earning years. You're looking for the exact effective dates of every promotion, step increase, and annual cost-of-living adjustment.

Precision is your best friend here. Don't just grab three W-2s and average them out. You need to break down the 36-month window by each distinct pay rate and the exact number of days or months you earned it. It's tedious, but it's the only way to get a truly accurate figure.

A Real-World High-3 Calculation

Let's walk through a practical example. Imagine a federal employee, Sarah, is getting ready to retire. We’ve looked at her SF-50s and identified her highest 36-month earning period:

- For the first 12 months of that period, her annual salary was $95,000.

- Then, a step increase kicked in. For the next 18 months, her salary was $98,500.

- For the final 6 months, she received an annual pay adjustment, bringing her salary to $102,000.

You can't just average those three salary figures. You have to weight them based on how long she earned each one.

First, calculate the total earnings for each specific timeframe:

- 12 months @ $95,000/year = $95,000

- 18 months @ $98,500/year = $147,750

- 6 months @ $102,000/year = $51,000

Next, add it all up to get the total for the 36-month period:

- $95,000 + $147,750 + $51,000 = $293,750

Finally, divide by 3 to get the annual average:

- $293,750 / 3 = $97,916.67

So, Sarah's official High-3 average salary is $97,916.67. This is the number we'll plug into the FERS pension formula.

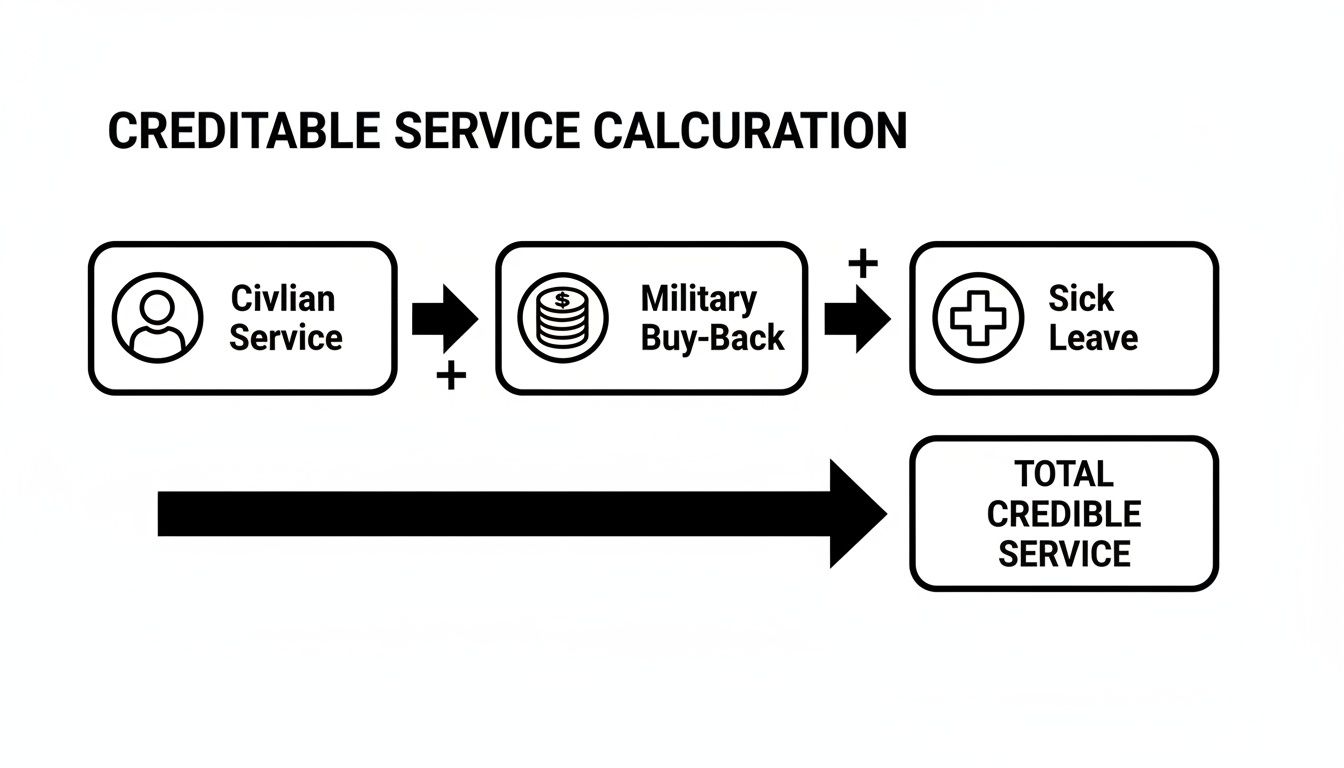

Tallying Up Your Years of Creditable Service

Once you’ve locked down your High-3 salary, the next big piece of the puzzle is your total creditable service. It’s a common mistake to think this is just the number of years you’ve been on the government payroll. The truth is, it's more nuanced than that, and getting the details right can mean a significant boost to your final pension payment.

Think of it this way: your standard federal civilian time is the foundation of your pension. But you can add other "bricks"—like unused sick leave and military time—to build that pension higher. Every single month you add directly increases your annuity for life.

What Actually Counts as Service?

For most feds, the lion's share of their service time is straightforward—it's the time they spent in a FERS-covered job. If you’ve worked full-time for 20 years, you start with a baseline of 20 years of service. Simple enough.

But overlooking the other types of service is like leaving money on the table. Here’s what else can potentially be added to your total:

- Standard Civilian Service: This is the most obvious one. It’s any period you worked for the federal government where FERS deductions were coming out of your paycheck.

- Unused Sick Leave: When you retire, every single hour of your unused sick leave gets converted into more service time. This is an incredibly valuable perk, and there’s no cap on how much you can convert.

- Military Service: Active duty military time can often be added to your civilian service. The catch? You have to make a deposit to "buy back" that time so it counts toward your FERS pension.

- Non-Deduction Service: This is less common, but if you had a government job in the past (maybe a temporary or intermittent position) where no retirement deductions were taken, you might be able to make a deposit to get credit for it now.

Making a deposit for military or non-deduction service is a serious financial decision. It means paying money now, but in return, you permanently increase your FERS pension. For many, the long-term payout over a 20- or 30-year retirement makes it a fantastic investment.

Heads Up: There's a critical rule here. To even be eligible for a FERS pension, you must have at least five years of creditable civilian service. You could buy back 10 years of military time, but without hitting that five-year civilian minimum, you won't get a FERS annuity.

How Your Sick Leave Becomes Extra Service Time

One of the most powerful—and frequently misunderstood—elements of the FERS calculation is sick leave. At retirement, OPM doesn't just throw those hours away. They take your total balance and convert it into additional years, months, and days of service using a special 2,087-hour work-year chart.

For instance, retiring with exactly 2,087 hours of sick leave adds one full year to your service credit. Have 1,044 hours banked? That’s an extra six months. This can be a complete game-changer, sometimes pushing you over the line for a key retirement milestone or simply beefing up your final pension amount.

The Way OPM Officially Calculates Your Service

When it comes to the final calculation, OPM gets precise—down to the very last day. They use a 360-day year, where every month has 30 days, to do the math.

Here’s a quick look at their process:

- First, they add up all your distinct periods of service (years, months, and days).

- Next, they convert your total unused sick leave balance into an equivalent service time.

- Then, they combine those two totals.

- Finally, they convert any groups of 30 days into full months. Any leftover days—and this is the important part—are dropped. OPM does not round up.

That last point is a big deal. If your final tally comes out to 29 years, 5 months, and 29 days, you only get credit for 29 years and 5 months. Those 29 days vanish. This is precisely why savvy federal employees often plan their retirement date carefully to make sure they cross that 30-day threshold and capture one final month of service credit.

What About Part-Time Service?

Did you spend part of your career working a part-time schedule? This introduces another wrinkle into your FERS calculation. The good news is that all of your part-time service counts toward your eligibility to retire. The calculation for your pension amount, however, gets prorated.

Basically, OPM will first calculate your pension as if all your service had been full-time. Then, they’ll apply a proration factor based on the ratio of the hours you actually worked compared to what a full-time employee would have worked over the same period. It's an extra step, but it ensures your pension accurately reflects your actual time on the job—a crucial detail for anyone with a mixed service history.

Putting the FERS Pension Formula into Practice

Alright, you've done the legwork to pin down your High-3 salary and total creditable service. Those are the essential building blocks. Now comes the satisfying part: putting them together with the official FERS formula to see what your actual pension looks like.

The math itself isn't complicated, but seeing it work with real numbers is what makes it click. Let's walk through a few common retirement scenarios to show you just how much different career decisions can impact your bottom line.

The Standard 1 Percent Calculation

For the vast majority of federal employees, the pension multiplier is a straightforward 1%. This is the default rate and the one that applies in most cases.

Let's look at an example. We'll call him David, a program analyst who’s ready to retire at age 60.

- High-3 Average Salary: $95,000

- Total Creditable Service: 28 years, 6 months (we'll use 28.5 for the math)

- Pension Multiplier: 1% (or 0.01)

The formula is pretty simple: High-3 Salary x Years of Service x Multiplier.

Plugging in David's numbers, we get: $95,000 x 28.5 x 0.01 = $27,075.

This means David's gross annual pension will be $27,075. That comes out to about $2,256 a month before any deductions for things like taxes or a survivor benefit.

The Enhanced 1.1 Percent Multiplier

Now, let's talk about a powerful way to boost that pension. If you can meet two specific conditions—retiring at age 62 or later with at least 20 years of service—your multiplier gets a permanent bump from 1% to 1.1%. It might not sound like much, but that extra tenth of a percent makes a huge difference over a lifetime.

Let's meet Maria, an IT specialist who decided to work a bit longer to hit that magic number.

- High-3 Average Salary: $110,000

- Total Creditable Service: 31 years

- Retirement Age: 62

- Pension Multiplier: 1.1% (or 0.011)

Since she's retiring at 62 with well over 20 years of service, she qualifies for the enhanced multiplier.

Here’s her calculation: $110,000 x 31 x 0.011 = $37,631.

Maria’s annual pension is $37,631. If she had retired just before her 62nd birthday with the exact same service and salary, her multiplier would have been the standard 1%, giving her a pension of only $34,100. By working until she turned 62, she increased her annual pension by $3,531—an increase she’ll receive every single year for the rest of her life.

This strategic decision to wait for the 1.1% multiplier is one of the most effective ways for eligible FERS employees to boost their retirement income. Think of it as a guaranteed, permanent 10% raise on your pension, just for timing your retirement right.

Special Calculation for LEOs, Firefighters, and ATCs

Some federal jobs are just plain tougher. To account for the physical demands and hazardous nature of their work, "Special Category Employees" like Law Enforcement Officers (LEOs), Firefighters, and Air Traffic Controllers get a more generous pension calculation. This is designed to support their mandatory earlier retirement ages.

For these employees, the first 20 years of service are calculated with a 1.7% multiplier. For any years of service beyond those first 20, the multiplier drops back to the standard 1%.

Let’s run the numbers for Michael, a federal LEO retiring with 25 years on the job.

- High-3 Average Salary: $120,000

- Total Creditable Service: 25 years

We have to break this calculation into two separate parts.

- First 20 Years: $120,000 x 20 years x 0.017 = $40,800

- Remaining 5 Years: $120,000 x 5 years x 0.01 = $6,000

Then, you just add them together: $40,800 + $6,000 = $46,800.

Michael's gross annual pension is a substantial $46,800. This specialized formula gives him a much higher income replacement rate, which is a direct reflection of the unique and demanding nature of his career.

To give you a clearer picture of how these multipliers affect the final number, here’s a quick comparison.

FERS Pension Calculation Scenarios

| Scenario | High-3 Salary | Creditable Service | Multiplier | Annual Pension |

|---|---|---|---|---|

| Standard Retirement (David) | $95,000 | 28.5 years | 1.0% | $27,075 |

| Enhanced Retirement (Maria) | $110,000 | 31 years | 1.1% | $37,631 |

| Special Category (Michael) | $120,000 | 25 years | 1.7% / 1.0% | $46,800 |

As you can see, the multiplier tied to your retirement age and service type is a critical lever in determining your final pension amount.

The flowchart below shows how your different buckets of service—civilian time, military buy-back, and unused sick leave—all flow together to form the "Total Creditable Service" number we use in these formulas.

It’s a great visual reminder that your total service is often a composite of different parts of your career, all of which count toward your final pension. If you want to play around with your own numbers, you might find it helpful to check out our guide on using the federal pension calculator for FERS to run some personalized estimates.

From Gross to Net: Factoring in Reductions and Supplements

Getting a handle on your gross annual pension is a great first step, but it’s not the number that will actually hit your bank account. That initial figure is just the starting point.

Now, we need to dig into the real-world adjustments that shape your final payment. Some of these are choices—like providing for a spouse—while others are penalties for retiring early. Understanding how they work is the key to creating a realistic retirement budget.

The MRA+10 Early Retirement Penalty

One of the steepest adjustments you might face is the age reduction. This only kicks in if you retire under the MRA+10 provision, which lets you leave federal service at your Minimum Retirement Age with as few as 10 years of service. It’s a flexible option, for sure, but that flexibility comes with a permanent price tag if you start your pension before age 62.

The math is straightforward but unforgiving: your pension is cut by 5% for every year you are under 62.

Let's walk through a quick example. Say you retire at your MRA of 57.

- You are five years shy of age 62.

- The reduction is 5 years x 5%, which equals a hefty 25% cut.

- This means your pension will be permanently slashed by one-quarter.

This isn't a temporary hit; it's a lifelong reduction. The good news is you have a choice. You can retire at 57 but postpone receiving your pension payments. If you wait until you're 62 to turn on the income stream, that 25% penalty vanishes completely.

The Survivor Benefit: Planning for Your Spouse

Another common adjustment is the reduction you take to provide a survivor benefit. This is a critical decision you make at retirement, ensuring your spouse receives a portion of your pension for the rest of their life if you pass away first. It's a fundamental part of securing your family's future, but it does reduce your own monthly payment.

You generally have two choices:

- Full Survivor Annuity (50%): To give your spouse 50% of your pension, your own annuity is reduced by a flat 10%.

- Partial Survivor Annuity (25%): To give your spouse 25% of your pension, the cost is a 5% reduction to your annuity.

While you can choose to provide no survivor benefit, this is a major decision that requires your spouse to formally sign off on it. Be very careful here, as this choice can also impact their ability to stay on your FEHB health insurance plan after your death.

The FERS Annuity Supplement: A Bridge to Social Security

It’s not all about reductions. One of the most valuable perks for early FERS retirees is the FERS Annuity Supplement, often called the Special Retirement Supplement or SRS. It’s designed to fill the income gap for people who retire before they can start collecting Social Security at age 62.

Think of it as a temporary stand-in for the Social Security benefits you earned while working for the government. It’s paid out with your regular pension, but it always stops the month you turn 62—no exceptions, even if you decide to delay taking your actual Social Security.

To qualify for the FERS Annuity Supplement, you have to meet a few key conditions:

- Have at least one calendar year of FERS service.

- Be retiring on an immediate, unreduced pension (e.g., at MRA with 30 years, or at age 60 with 20 years).

- Be younger than 62 when you retire.

Notice that MRA+10 retirees typically don't qualify because their pension is considered "reduced" due to the age penalty. To get a complete picture of this fantastic benefit, check out the Social Security supplement for federal employees in our detailed guide. It can make a huge difference in your cash flow during those first few years of retirement.

So, You Have Your Numbers. What's Next?

Okay, you've crunched the numbers and have a solid handle on what your FERS pension might look like. That’s a huge milestone. But remember, what you have right now is a powerful estimate. The next step—and it's a critical one—is to verify everything with official sources and start gathering your paperwork.

This isn't just busywork. It's about making sure the numbers you're banking on are the same numbers your agency and the Office of Personnel Management (OPM) will use. A little bit of diligence here can save you a world of headaches down the road. Catching a mistake now is far easier than trying to fix it after you've already retired.

Start Building Your Retirement "Case File"

Think of this as pulling together the official story of your career. Having these documents ready not only makes the verification process smoother but is absolutely essential for your actual retirement application. Don't put this off.

Here’s what you need to track down:

- SF-50s (Notification of Personnel Action): These are the single most important records of your federal career. They document every promotion, pay adjustment, and position change you've ever had. You should find a complete history in your electronic Official Personnel Folder (eOPF).

- Leave and Earnings Statements (LES): Your most recent statements are key. They provide the up-to-date sick leave balance that gets added to your creditable service.

- Military Service Records (DD-214): If you made a deposit to get credit for your military time, you'll need this document to prove it.

Get an Official Annuity Estimate from Your Agency

Once you’re within a few years of retiring, it's time to get a formal estimate from your agency's Human Resources or benefits department. This is the closest you can get to the real thing without actually submitting your retirement papers.

This official estimate is generated using the same data and systems OPM will use to calculate your final annuity. It will show your projected gross pension, any deductions for survivor benefits, and other costs. This is your chance to compare their numbers to yours.

If the numbers don't match, this is your moment to investigate. A small difference could be a simple typo, but a larger one might point to a missing period of service or an incorrect salary figure. Sorting this out with HR before you retire is infinitely easier than correcting the record later.

When to Call in a Professional

Figuring out your FERS pension is something many people can do on their own, but sometimes an expert eye can make all the difference. A financial advisor who specializes in federal benefits can provide an invaluable second opinion and help you see how your pension fits into your total financial picture.

It might be a good idea to talk to a pro if:

- Your service history is complicated—maybe you had part-time work, breaks in service, or temporary appointments.

- You're trying to nail down the perfect retirement date to maximize your High-3 or hit the 1.1% multiplier.

- You need a clear strategy for combining your FERS pension, TSP, and Social Security into a cohesive income stream for retirement.

An expert can help you sidestep common mistakes and turn that pension calculation from just a number into a cornerstone of a robust, long-term financial plan.

At Federal Benefits Sherpa, we help federal employees navigate these critical decisions every day. If you're ready to move from estimation to action, schedule a free 15-minute benefit review to ensure your retirement plan is built on a solid foundation. Learn more and book your session at https://www.federalbenefitssherpa.com.