Fers Retirement Eligibility Simplified

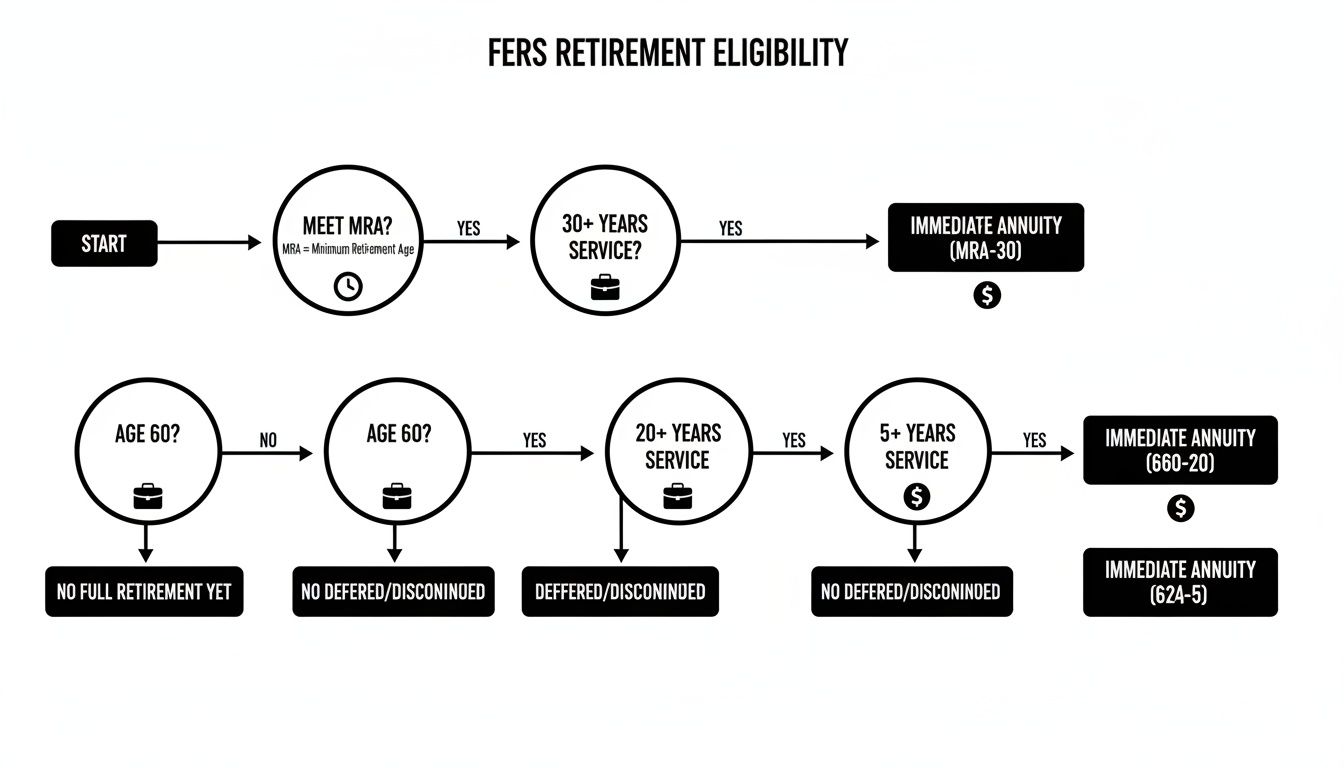

FERS retirement eligibility gives you three straightforward paths to an unreduced pension: reach age 62 with at least 5 years of service, hit age 60 after 20 years, or achieve your Minimum Retirement Age (MRA) plus 30 years on the job. Knowing these milestones up front lays the groundwork for everything that follows.

Unreduced FERS Retirement Eligibility Paths

Each option balances age and service against federal guidelines. Think of them as three doors—you only need to open one to claim your full annuity.

Here’s a quick snapshot of what each requires.

Quick FERS Eligibility Overview

Retirement OptionMinimum AgeMinimum ServiceAge 62 + 5 Years625 YearsAge 60 + 20 Years6020 YearsMRA + 30 YearsMRA (55–57)30 Years

Keep this table in mind as we unpack how your actual MRA shifts by birth year and when reductions kick in.

OPM’s official summary highlights those core age and service milestones at a glance.

Key Topics We’ll Cover

Immediate Retirement, MRA +10 and Early/Penalty options

Deferred, Discontinued and Disability retirements

Special rules: reduced annuities, CSRS offsets, high-risk categories

Real-world calculation examples

A step-by-step application checklist

For a deeper dive into federal retirement rules, check out our guide on federal retirement eligibility explained.

Minimum Retirement Age Schedule

Your MRA depends on birth year—generally between 55 and 57. Pinpoint your milestone below:

Born before 1948: MRA is 55

Born 1948–1952: MRA is 56

Born 1953–1964: MRA increases in two-month increments

Born 1965 and after: MRA is 57

With these basics in hand, you’re ready to explore how service credit, reductions, and special categories impact your final annuity.

Understanding Key Concepts Of FERS

To get a clear picture of your FERS retirement, start by focusing on three pillars: the Minimum Retirement Age (MRA), your “high-three” salary, and your total years of service. Together, these determine when you can retire and how big your pension check will be. Then there’s the Special Retirement Supplement, which fills the gap until Social Security kicks in.

Minimum Retirement Age And Your Timeline

Think of your MRA as the gate that swings open once you reach a certain age. That age depends on your birth year—much like leveling up in a game.

Born before 1948 – MRA is 55

Born 1948 to 1952 – MRA is 56

Born after 1964 – MRA is 57

Between 1953 and 1964, your exact MRA shifts by birth month. In practice, this means matching your birth date to the MRA chart before you calculate service requirements.

Years Of Service As Investment Term

Your federal service builds like a series of bond maturities. Each year you work adds credit to your retirement “investment.”

Every additional year boosts your payout percentage

At 30 years of service, retiring at MRA means no reduction to your annuity

Once you’ve mapped your service years, the next piece is to nail down your high-three salary—your personal annuity “share price.”

High-Three Salary As Annuity Share Price

Your high-three salary is simply the average of your highest three consecutive pay years. Picture it as a stock price: the higher it is, the stronger your retirement return.

Pinpoint your top three payroll years

Calculate the average salary over those years

Multiply that average by your service years and the FERS rate

Most retirees use 1% of their high-three per credit year—bumping to 1.1% if they’re 62 with 20+ years of service.

“Your high-three salary determines the financial strength of your federal pension, much like a stock’s share price shapes your investment return.”

Special Retirement Supplement Explained

This supplement bridges the gap between your FERS annuity and Social Security at 62. Imagine a temporary walkway guiding you from one benefit to the next.

In fiscal year 2025 the Office of Personnel Management recorded 112,679 civil service annuitants added to the annuity roll, up from 95,477 in FY2024 and 108,387 in FY2023, reflecting a notable increase in processed retirements. By the end of June 2025, OPM had already received 70,351 retirement applications—a 40% increase over the same period in 2024—driven by workforce shifts and incentives that concentrated retirements in spring and summer months, creating processing backlogs that highlight the importance of timing your application. Read more about FERS annuity roll changes on OPM’s retirement statistics page: Discover FERS retirement trends.

Key features of the supplement include:

A hypothetical Social Security benefit prorated to your FERS service

An annual earnings test that can reduce the supplement if you exceed income limits

Ineligibility for deferred, disability, and MRA+10 retirees

Key takeaway: The supplement can significantly enhance interim income but requires careful planning around earnings and application timing.

By now, you should feel comfortable with MRA, high-three salary, and the Special Retirement Supplement. These building blocks set the stage for exploring each FERS retirement path and the special rules that might affect your decision.

Exploring FERS Eligibility Types And Requirements

Navigating FERS retirement can feel like merging onto a busy highway. You’ve spent years building service credit, and now it’s all about picking the lane that gets you to an unreduced pension without detours.

Here’s a quick glance at the main paths:

Immediate Retirement Options: MRA + 30 years, Age 60 + 20 years, Age 62 + 5 years, or MRA + 10 (with reduction)

Early Retirement: Voluntary Early Retirement Authority (VERA) or MRA + 10 (with penalty)

Deferred Retirement: Leave federal service early, then claim benefits at a later age or service milestone

Discontinued Service Retirement: Involuntary separation due to a RIF or agency reorganization

Disability Retirement: Service-connected or non-service-connected medical paths

Immediate Retirement Options

When you hit your Minimum Retirement Age (MRA) plus 30 years of credit, the annuity kicks in without any penalty.

You can also retire at 60 with 20 years of service or at 62 with just 5 years, both offering full, unreduced benefits.

The chart below shows how your birth year determines an MRA between 55 and 57:

This schedule lets you pinpoint exactly when you hit that MRA milestone.

Other Retirement Types

Early retirement through VERA usually calls for age 50 + 20 years or 25 total years of service.

If you step away from federal service before reaching those thresholds, deferred retirement lets you claim benefits later—often at age 62 or when you reach 30 years.

Facing an involuntary separation? Discontinued Service Retirement follows similar age and service tests as VERA.

Check out our guide on discontinued service retirement for the nitty-gritty on eligibility and process.

Disability retirement hinges on medical proof and can be either service-connected or non-service-connected.

A clear retirement lane choice starts with understanding your age-service balance to avoid unnecessary annuity reductions.

FERS Retirement Options Comparison

Below is a side-by-side look at each FERS retirement path—so you can see minimum ages, service requirements, and any reductions at a glance.

TypeMinimum AgeService YearsAnnuity ReductionImmediate (MRA + 30)MRA (55–57)30NoneImmediate (Age 60 + 20)6020NoneImmediate (Age 62 + 5)625NoneEarly (MRA + 10)MRA (55–57)105% per year before 62DeferredVaries5+May applyDisabilityVaries18+Depends on medical evaluation

In this overview, you can spot that only the MRA + 10 and deferred routes carry possible reductions—while the standard lanes remain penalty-free.

Required Documentation Checklist

Gather these items before you file your retirement paperwork:

SF-50 Personnel Actions showing start dates, promotions, and any breaks in service

Form SF-3107 (FERS Annuity Estimate) to preview your benefit amount

TSP Statement with your current balance and contribution history

FEHB Enrollment Records proving 5 years of continuous coverage

Medical Certifications if you’re applying for disability retirement

Having everything on hand cuts down on back-and-forth with OPM.

Next Steps For Your Planning

Pull together your SF-50s and service records.

Match your age and service totals to the retirement lane that avoids reductions.

Double-check for special rules—like CSRS offsets or reduced-annuity scenarios.

When exceptions or tricky details come up, Federal Benefits Sherpa’s team can walk you through personalized strategies and ensure you choose the path that fits your goals.

Special Rules and Exceptions for FERS Retirement

Federal retirement plans can feel like a toolkit full of hidden levers. A few special rules might bump your benefit or let you delay the start of your annuity.

That said, these carve-outs don’t apply automatically. You only tap them when you elect a survivor option, mix CSRS and FERS service, work in a high-risk job, or choose to put off payments.

Knowing these exceptions up front keeps you from finding surprises on payday.

Survivor Annuity Elections reduce your pension today in exchange for lifetime support to a spouse or dependent.

CSRS Offset comes into play when you carry prior CSRS service into your FERS career.

High-Risk Occupations offer early retirement ages and shorter service requirements.

Postponed Retirement lets you separate from service but push back annuity payments to avoid early-claim penalties.

How Special Rules Function

Think of each exception as an optional add-on in a car—handy if it fits your journey. You dial it in only if your title or past election matches specific criteria.

Survivor Annuity Elections

Picking a survivor annuity means shading your monthly check so a loved one can collect after you’re gone.

If you choose a 50% survivor benefit, your own annuity drops by roughly 10% each month.

50% Benefit Election covers half your pension for the survivor, trimming yours by 10%.

25% Election sets aside a smaller safety net—just 5% off your base payment.

CSRS Offset Rules

When you have CSRS service before FERS, OPM subtracts that hypothetical CSRS annuity from your FERS payout—like peeling away an older layer of pension.

OPM calculates your FERS annuity then subtracts the CSRS component based on pre-FERS service.

Review your SF-50s to confirm exact CSRS dates before you file.

High Risk Occupation Exception

Jobs with extra stress or danger come with retirement perks. Law enforcement officers, air traffic controllers, and nuclear couriers all fall into this bucket.

Law Enforcement: Retire at 50 with 20 years.

Air Traffic Controllers: Eligible at 50 with 20 years, but no FERS supplement.

Nuclear Couriers: Can leave at 50 with 20 years; if you retire before 55, there’s a 5% age-reduction.

Postponed Retirement Option

Postponing retirement is like holding your purse strings until the market turns in your favor. You leave federal service but delay annuity start to avoid early-claim penalties.

File Form RI 92-19 specifying your desired start month.

Choose a date on or before your 62nd birthday to dodge reductions.

Reenroll in FEHB, FEGLI, and FEDVIP when payments kick in.

Document Checklist For Exceptions

Before you submit claims, gather:

SF-50s showing any law enforcement or air traffic controller designation

Proof of CSRS service (past retirement election forms)

Survivor option paperwork, including SF-3107 estimates

Completed RI 92-19 if you pursue postponed retirement

When To Seek Expert Advice

Every twist in these rules can change your benefit. If you’re juggling more than one exception, it makes sense to call in a specialist.

Federal Benefits Sherpa offers a free 15-minute review to walk you through tricky scenarios. Schedule your consultation to secure a clear retirement path.

Tips For Choosing Exceptions

Match your career timeline to each rule’s requirements early. Keep your selections documented, track all deadlines, and revisit your plan annually as your service credit grows.

Practical Calculation Examples And Next Steps

Planning your FERS retirement means turning your high-three salary, service years, and supplement into a clear annuity estimate. Below, we break down each piece so you see how gross income shifts with elections, taxes, and insurance.

High-Three Salary: The average of your top three consecutive pay years, which sets your annuity’s base.

Service Years: Each full year in federal service adds a percentage point in the basic formula.

Special Retirement Supplement: A temporary bridge payment that covers the gap until Social Security benefits begin at age 62.

Calculation Of Your Basic FERS Annuity

The core FERS formula is straightforward: 1% of your high-three salary multiplied by each year of service. If you retire at 62 or later with 20+ years, that percentage rises to 1.1% per year.

For example, a $105,000 high-three salary over 30 years yields:

FERS basic annuity = High-Three Salary × Years of Service × 1%

So, $105,000 × 30 × 1% = $31,500 gross annually before any supplements or deductions.

Including The Special Retirement Supplement

The supplement approximates your Social Security payment until age 62. In Government Executive’s 2025 illustration, a $30,000 basic annuity pairs with roughly $15,000 from the supplement, totaling $45,000 gross.

That figure doesn’t account for a 50% survivor annuity election, federal taxes, or health insurance premiums—items that trim your take-home pay.

DescriptionAmountBasic FERS Annuity$31,500Special Retirement Supplement$15,000Gross Total Before Reductions$46,500Survivor Election (10% of annuity)-$3,150Typical Deductions (Taxes & Insurance)-$11,350Estimated Net Income$32,000

Detailed Supplement Proration

OPM prorates your supplement based on covered service out of a 40-year maximum and your hypothetical SSA benefit at 62.

Supplement = (Years of FERS Service ÷ 40) × Estimated SSA Benefit

With 30 years of service, you get 30/40 = 75% of that SSA figure—about $15,000 annually before any earnings-test reductions.

Earnings limit $19,560 for 2025.

You lose $1 of supplement for every $2 earned above the limit.

Adjusting For Survivor Election Taxes And Insurance

Opting for a spouse or partner survivor annuity typically reduces your own benefit by around 10%. After that, federal taxes and health insurance premiums (FEHB, Medicare Part B) can shave off another 20–25% of what remains.

This layering of deductions can turn a $45,000 gross benefit into roughly $32,000 in your pocket each year.

Tip: Build a simple spreadsheet to layer elections and deductions step by step for an accurate net figure.

Common Pitfalls In Estimation

Overlooking overtime, locality pay, or step increases in your high-three average.

Assuming the supplement continues past age 62, leading to an unexpected income gap.

Forgetting FEHB premiums and Medicare Part B deductions.

Ignoring survivor election costs when calculating net income.

Skipping COLA factors that adjust your annuity annually.

Application Checklist And Timeline

Start early to avoid OPM backlogs, which jumped over 40% in 2025. Aim to file your retirement packet at least 120 days before your desired annuity start date.

Collect and review SF-50 records to confirm total service and pay history.

Calculate your high-three salary, including locality and overtime.

Decide on your retirement option (MRA+10, 60+20, 62+5) to minimize reductions.

Complete Form SF-3107 for an official FERS estimate and survivor election preview.

Schedule a free review with Federal Benefits Sherpa at least three months before separation.

Next Steps And Professional Support

When special rules apply or you’re weighing multiple survivor elections, a professional walkthrough can prevent costly missteps. Federal Benefits Sherpa offers a free 15-minute review to refine your numbers and map out any complexities.

Check out our guide on how to calculate FERS retirement like a pro for detailed tools and tips.

Planning Your Application Timeline

Break your retirement prep into three phases:

Phase One (Months 4–3 Before Separation): SF-50 collection and service verification.

Phase Two (Months 3–2 Before Separation): Benefit estimates, supplement checks, survivor election decisions.

Phase Three (Months 2–0 Before Separation): Finalize forms, submit to OPM, confirm FEHB status.

Allow at least 90 days for OPM to process an immediate retirement application. Deferred or discontinued cases often require a longer review.

When To Seek Expert Guidance

If your federal record has gaps, multiple pay adjustments, or mixed CSRS service, expert advice is invaluable. A 15-minute review with Federal Benefits Sherpa can spotlight overlooked items—FEHB retention, CSRS offsets, special category rules—and keep your retirement on track.

With precise figures and a clear timeline, you’ll choose the best FERS path to meet your post-federal career goals.

FAQ

How Do I Choose The Best Time To File For FERS Retirement Eligibility?

Set your retirement date about 4 months ahead. OPM’s backlog can stretch processing beyond 120 days, so give yourself breathing room. Gather all required forms early to avoid last-minute scrambles.

What Happens If I Retire Before Age 62 Under MRA+10?

Under MRA+10, your basic annuity drops by 5% for each year you retire before 62. Retire 5 years early, and you’re looking at a 25% cut. You’ll still get the Special Retirement Supplement until your Social Security kicks in.

Leaving at MRA+10? Expect a smaller initial payout and plan for supplement income.

Key Documents To Gather

SF-50 Personnel Action statements for every service period

SF-3107 FERS Annuity Estimate form to preview your benefit

FEHB enrollment records showing 5 years of continuous coverage

TSP statements with your balance and contribution history

How Can I Avoid Losing The Special Retirement Supplement?

You forfeit the supplement if you switch to deferred or discontinued service retirement. Working past 62 also ends the benefit. Double-check your retirement choice so you don’t accidentally lose eligibility.

When Does CSRS Offset Apply And What Does It Do?

If you have pre-FERS CSRS service, OPM subtracts that CSRS annuity from your FERS payment. Think of it as balancing old benefits against new ones to prevent a double pension.

Common Scenarios

A 55-year-old with 30 years of FERS service retires at MRA and receives an unreduced annuity

A 52-year-old at MRA+10 with 10 years of service takes a 5% annual penalty under age 62

A law enforcement officer retires at 50 with 20 years of service under special rules, with no supplement

Can I Keep My FEHB And FEDVIP Into Deferred Retirement?

Deferred retirement won’t let you carry over health or vision plans directly. You can use Temporary Continuation of Coverage (TCC) for 18 months at full premium rates. Alternatively, postponing retirement may allow FEHB reenrollment when your annuity begins.

What Should I Do If An RIF Affects My Eligibility?

In a Reduction in Force (RIF), you might qualify for Discontinued Service Retirement (DSR). The rules mirror VERA: age 50 with 20 years of service or any age with 25 years. Check OPM’s Retirement Center and use their worksheets to confirm your status.

RIF events trigger special deadlines—act fast and file the right election forms.

Resources And Takeaway

Visit OPM’s Retirement Center for official updates

Download our FERS Eligibility Worksheet to compare options side by side

Schedule a free 15-minute benefit review with Federal Benefits Sherpa for personalized advice

What Do I Need To Know About Minimum Retirement Age Calculation?

Your MRA depends on your birth year, ranging from 55 to 57. Refer to the OPM MRA table to identify your exact age. This clarity helps pinpoint your earliest, penalty-free window.

What Is The Best Way To Track FERS Policy Updates?

OPM’s website and the Federal Register publish official changes. Federal Benefits Sherpa offers email alerts and easily digestible blog posts. Bookmark these sources and subscribe for timely notices.

What If I Leave Federal Service With Under Five Years Credit?

You can request a refund of your contributions and interest. Plan on the process taking about 3–6 months.

Schedule your free 15-minute benefit review with Federal Benefits Sherpa to maximize your retirement benefits today and secure a stable future.