Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

What Is a sf 50 form and Why It Matters for Federal Employees

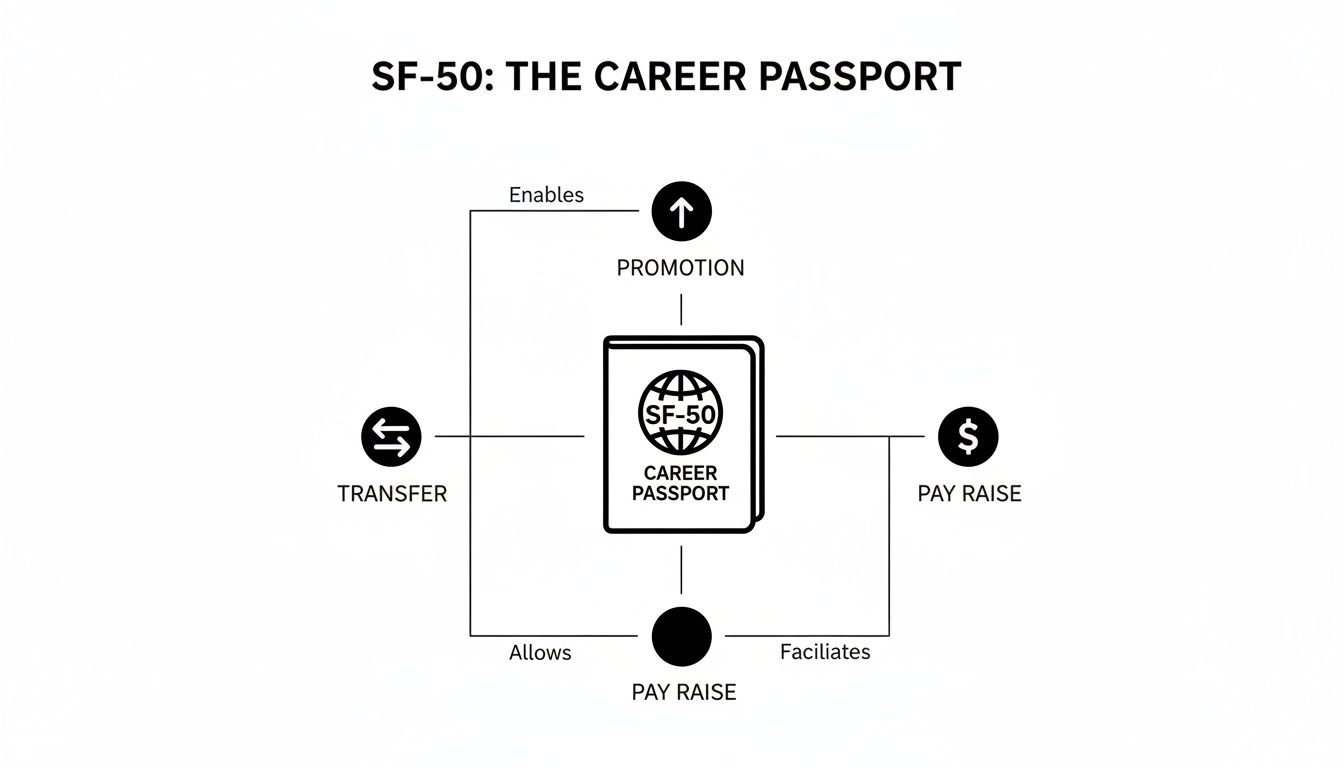

The SF-50, officially called the Notification of Personnel Action, is without a doubt the single most important document you’ll encounter in your federal career. I like to think of it as your career’s official passport—every major milestone, from your first day on the job to your last, gets a new “stamp” in the form of a new SF-50.

Your Career Passport: The Role of the SF-50 Form

Imagine trying to travel internationally without a passport. You wouldn’t get very far, right? In the world of federal service, the SF-50 plays that exact same role. It’s the definitive, official record that proves your entire employment history. This isn't just another piece of administrative paperwork; it's the bedrock document that validates your pay, your service time, and ultimately, your eligibility for benefits.

Just like a passport gets a new stamp for every country you visit, your official personnel file gets a new SF-50 for every significant personnel action. These actions are the key moments that shape your professional journey with the government.

Milestones That Trigger a New SF-50

So, what exactly counts as a major career event? Your HR department will issue a new SF-50 for quite a few reasons.

Here are some of the most common ones:

- Appointments: Your very first day as a federal employee is documented with an SF-50.

- Promotions: When you move up to a higher grade, a new form makes it official.

- Pay Adjustments: This covers everything from your standard within-grade increases (WGIs) to annual cost-of-living adjustments.

- Transfers: Moving to a different agency or even just a different position will be recorded.

- Separations: Your resignation or retirement is finalized with one last SF-50.

Over a long career, it’s not unusual to accumulate dozens of these forms. Each one is a critical piece of your professional puzzle, and having a complete set is essential for building an accurate service history. You can find more details on federal employment reporting on the official OPM site.

Think of it this way: this collection of forms tells the complete story of your service. Each document validates your position, pay rate, tenure, and benefit eligibility. Without a complete and accurate set of SF-50s, proving your service for retirement or other benefits can turn into a bureaucratic nightmare. It's a key part of understanding your federal benefits to ensure a secure future.

How to Read Your SF-50 Without an Interpreter

At first glance, the SF-50 can look like a cryptic jumble of codes, boxes, and government-speak. It’s easy to feel like you need a secret decoder ring just to make sense of it all. But don't worry—we're going to break down the most important parts into plain English, turning that intimidating document into a tool you can actually use.

Think of it like learning to read a map. Once you know what the symbols mean, you can navigate your entire federal career. The process is a bit like understanding what data parsing is—we’re just taking complex information and making it simple and useful. We’ll zero in on the key blocks that directly affect your job, your paycheck, and your retirement.

The Most Important Blocks to Check

While every block on the form has a purpose, a handful are absolutely critical to your financial future. These are the fields you need to review with a fine-tooth comb every single time a new SF-50 lands in your eOPF. Think of them as the vital signs of your federal career.

Here's a quick rundown of the big ones:

- Pay Plan, Grade, and Step (Blocks 19-21): These three blocks confirm your exact pay level. Any time you get a promotion or a standard step increase, this is the first place you should look to make sure it was processed correctly. An error here means an error on your paycheck.

- Tenure (Block 24): This little code is a big deal. A '1' means you're a career employee (permanent, with over three years of service). A '2' means you're career-conditional, and a '3' is for temporary appointments. Your tenure status directly impacts your job security and rights.

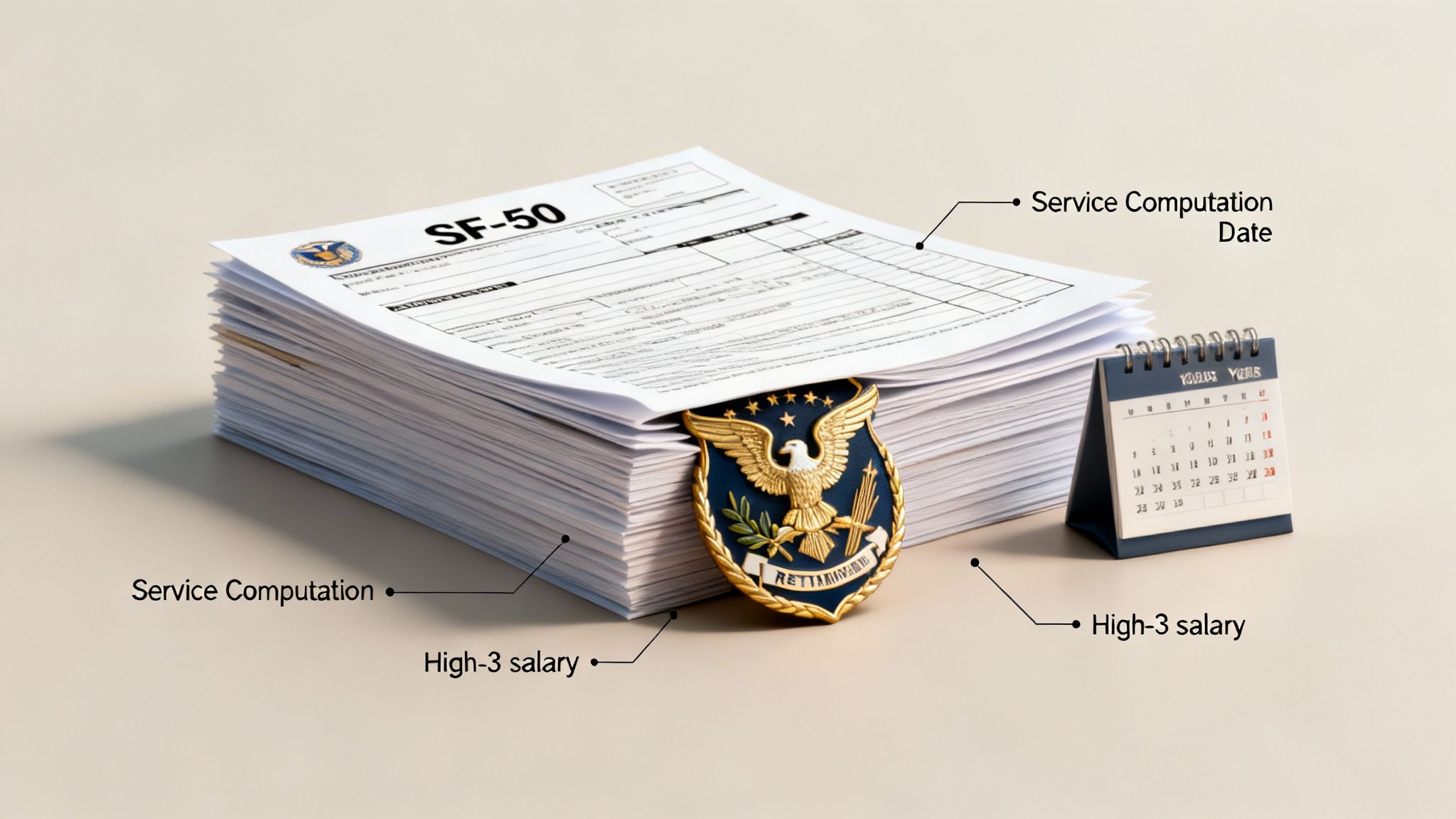

- Service Computation Date (SCD) (Block 31): This is the official start date for calculating your total creditable service—the time that counts toward your leave accrual and, most importantly, your retirement eligibility. An incorrect SCD can cost you dearly by delaying your retirement or shrinking your pension. Verifying it is non-negotiable.

This infographic does a great job of showing how each SF-50 acts as a "stamp" in your career passport, officially documenting promotions, transfers, and pay raises.

It's a perfect visual reminder that the SF-50 isn't just a piece of paper; it’s the official record that validates every single step you take in your federal journey.

Connecting the Dots to Your Retirement

These blocks aren't just abstract numbers; they have very real consequences for your retirement. The pay information in Blocks 19-21 is used to calculate your "high-3" average salary, which is the cornerstone of your FERS or CSRS pension.

A simple mistake, like being documented at the wrong grade for a few months, can have a ripple effect for years. Your Service Computation Date in Block 31 is the master key for tallying up all your creditable civilian and military service. Even your tenure code can determine eligibility for things like pay retention if your position changes.

To put it in perspective, having your pay plan misdocumented by just one grade could lower your final annuity by 2-4% every single year in retirement. That's a huge deal.

The table below breaks down these critical blocks even further.

Essential SF-50 Blocks and Their Impact

This table highlights the most important blocks on the SF-50 form, explaining what they mean and why they are critical for your federal career and benefits.

| Block Number | Block Name | What It Tells You | Why It Matters |

|---|---|---|---|

| 19-21 | Pay Plan, Grade, Step | Your exact position on the federal pay scale. | Directly determines your salary and is a key component of your "high-3" retirement calculation. |

| 24 | Tenure | Your employment status (e.g., career, career-conditional, temporary). | Affects your job security, reduction-in-force (RIF) rights, and eligibility for certain benefits. |

| 31 | Service Computation Date | The official start date for all your creditable service for leave and retirement. | The single most important date for determining when you are eligible to retire and your pension amount. |

| 34 | Position Occupied | Indicates whether your position is competitive or excepted service. | Impacts your appeal rights and the rules governing your employment. |

| 36 | Retirement Plan | Shows which retirement system you are under (e.g., FERS, CSRS, FERS-RAE). | Confirms your retirement coverage. An error here could have catastrophic financial consequences. |

By getting familiar with these fields, you're taking control. You can spot errors early, ask informed questions, and ensure every bit of your dedicated service is counted correctly. It's the best way to stop a small clerical mistake from becoming a major headache down the road.

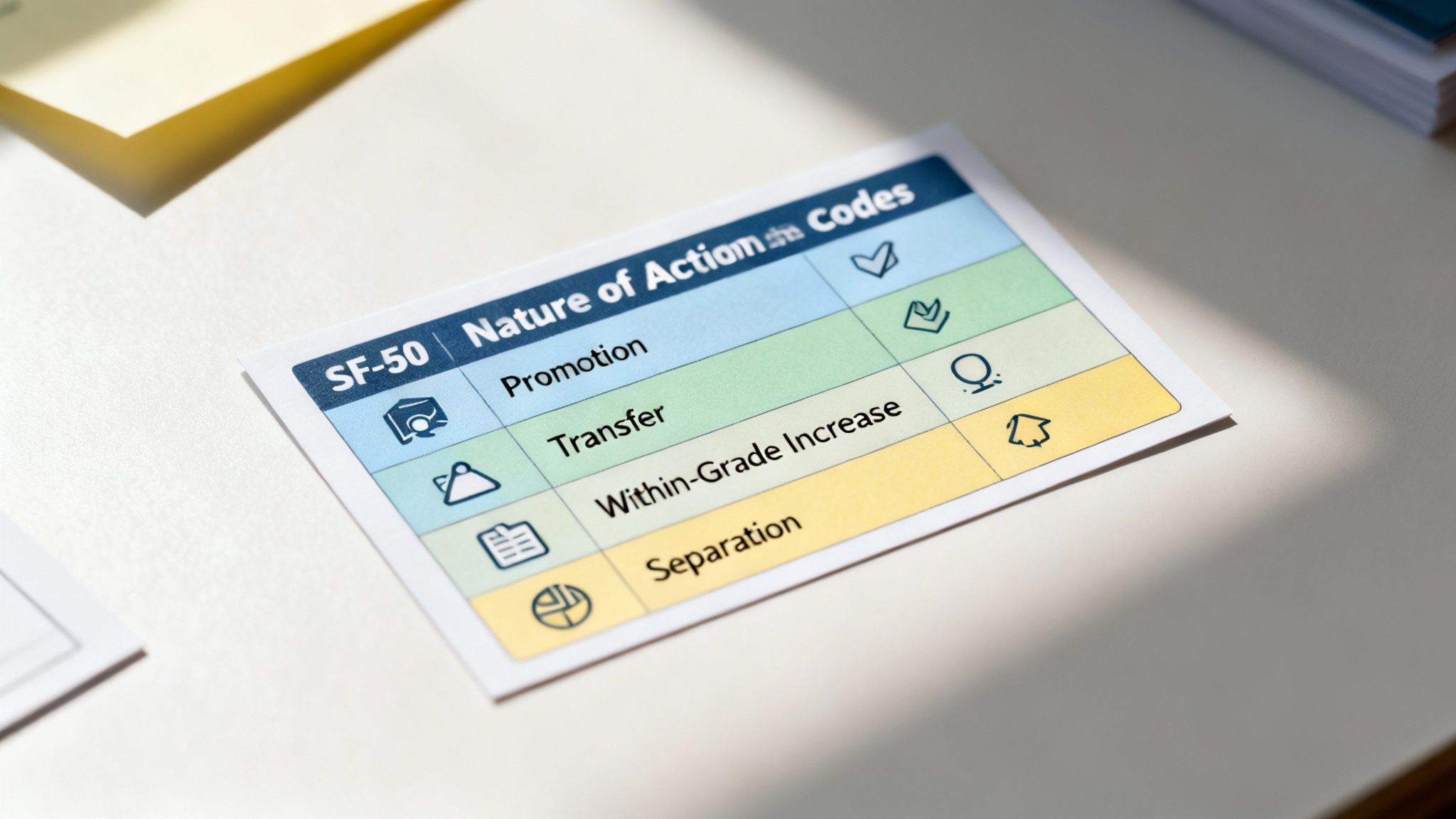

Translating Common SF-50 Action Codes

Every time a new SF-50 lands in your personnel file, it's triggered by a specific event. That event is captured by a three-digit "Nature of Action" (NOA) code in Block 5. At first glance, these codes can seem like some kind of secret government language, but they’re just shorthand for what just happened in your career.

Think of each NOA code as the headline for a new chapter in your federal service story. A code for "Promotion" tells a very different tale than one for "Separation." Learning to read these headlines is the fastest way to confirm your official record matches reality, which helps stop tiny clerical mistakes from becoming massive headaches down the road.

Key Action Codes You'll Actually See

While hundreds of codes exist, most of us will only ever encounter a handful of them on a regular basis. Let's break down the ones you're most likely to find on your own SF-50s.

- Appointment (Codes 100-199): This is the one that starts it all—your official entry into federal service. When you see a “101 - Career-Conditional Appointment,” you need to immediately check that your start date, grade, and retirement plan (like FERS) are all correct from day one.

- Promotion (Code 702): This is the action code you love to see. It means you’ve officially moved up to a higher grade. When this SF-50 arrives, your first priority is to confirm that the new, higher grade, step, and salary are all accurately recorded.

- Within-Grade Increase (WGI) (Code 893): Think of this as your standard, periodic pay raise for doing good work. When you get an SF-50 with this code, just do a quick check to make sure your step number went up and your salary was adjusted correctly.

- Separation (Codes 300-399): These codes mark the end of your federal service, whether you're resigning, retiring, or leaving for another reason. Your final SF-50 is absolutely critical for locking in your benefits, so triple-check that the effective date and reason for separation are right.

Verifying the details tied to each action code isn't just about being a stickler for details; it's about protecting your financial future. An incorrect salary on a promotion SF-50 could lower your high-3 average, which would directly reduce your pension payments for the rest of your life.

Beyond the Usual Suspects

Of course, you might see other codes pop up over the years. These could be for a reassignment (moving to a new position at the same grade), a transfer to a different agency, or even just a change to your benefits.

Each code is a cue, telling you exactly what to look for. A "Change in Data Element" (Code 925) might sound boring, but it could be documenting a crucial update to your service computation date. The bottom line is simple: always open the document, find the code, and confirm the change is what you expected. When you learn to translate these codes, you become the lead auditor of your own career.

Connecting Your SF-50 to Your Federal Retirement

When you look at your stack of SF-50s, don't just see a pile of old paperwork. You're looking at the official financial blueprint for your entire federal retirement. Every single number on those forms feeds directly into the calculations that determine your pension, your eligibility for benefits, and the security you'll have for the rest of your life.

Think of it this way: the Office of Personnel Management (OPM) will use your SF-50 file as the source material to write the final, most important chapter of your career story. It's the evidence they rely on.

When it comes to your pension—whether you're under FERS or CSRS—two figures are king: your total years of creditable service and your "high-3" average salary. And where do those numbers come from? You guessed it. Your SF-50s.

Calculating Your Pension With SF-50 Data

Your Service Computation Date (SCD), found in Block 31, is the official starting line. OPM will trace your career from that date forward, using each SF-50 to confirm every single period of employment and make sure there are no unaccounted-for gaps.

At the same time, they'll be scrutinizing the salary history documented on those forms. They are on a mission to find your 36 consecutive months of highest earnings to calculate that all-important high-3 average. This number is the bedrock of your annuity formula, and it’s a simple equation: a higher documented salary means a bigger monthly pension check.

A complete and accurate SF-50 file is non-negotiable. Missing forms or incorrect salary data can lead to a lower pension calculation, delayed retirement processing, and a significant amount of stress trying to prove your service history at the last minute.

More Than Just Your Pension

Your monthly annuity is just one piece of the puzzle. Your SF-50 is the official gatekeeper for other vital retirement benefits, serving as the definitive proof of your eligibility for your Thrift Savings Plan (TSP) and health insurance.

Thrift Savings Plan (TSP): Your SF-50s document your eligibility to contribute to the TSP and, crucially, to receive those valuable agency matching funds. They provide the official start and end dates that determine when you are vested.

Federal Employees Health Benefits (FEHB): To carry your FEHB coverage into retirement, you generally need to have been enrolled for the five years immediately before you separate from service. Your SF-50s provide the concrete proof of your employment and insurance eligibility during this critical window.

Ultimately, your SF-50s are the final word on your federal career. They provide the unassailable proof you need to lock in the benefits you’ve worked so hard to earn. As you map out your future, it's smart to think about all aspects of post-career life. If you plan on living internationally, don't forget the critical translations for living abroad after retirement you might need for official documents.

For a deeper dive into this topic, you can learn more by exploring our https://federalbenefitssherpa.com/post/your-guide-to-federal-employee-retirement-benefits.

How to Access and Correct Your SF 50 Records

It’s one thing to understand your SF-50, but it’s another thing entirely to have your records in hand and know they're accurate. Being proactive about managing your Official Personnel Folder (OPF) is one of the smartest moves you can make for your financial future. A clean, correct career history is your golden ticket to a smooth retirement process.

Getting your hands on your SF-50s works a little differently depending on whether you're still working for the government or have already left. The process for each is pretty simple, but you need to know which path to take.

Locating Your SF 50 Documents

If you're a current federal employee, you're in luck—your records are just a few clicks away. Most agencies now use an electronic Official Personnel Folder (eOPF). Think of it as a secure digital filing cabinet where you can see, download, and print every SF-50 from your entire career. You can typically find a link to the eOPF portal on your agency's internal HR website.

For former employees, the process is different. Once you separate from federal service, your OPF—containing all your SF-50s—is transferred to the National Personnel Records Center (NPRC) within 120 days. So, if you've been gone for more than a few months, you'll need to formally request your records from them. To start the process, you'll need to provide details like your full name, Social Security Number, and your dates of employment. You can get more specifics on how to request your SF-50 from the government directly from their resources.

Your Action Plan for Correcting Errors

Finding a mistake on your SF-50 can feel like a punch to the gut. Whether it’s a wrong service date, a pay grade that was never updated, or a missing promotion, it's a serious issue. The good news? It’s fixable. The key is to act quickly and be organized.

If you spot an error, here’s what you do:

- Gather Your Evidence: Before you pick up the phone, pull together any proof you have. This could be anything from old Leave and Earnings Statements (LES) and previous SF-50s to performance reviews or even emails from your supervisor confirming a promotion.

- Contact Your HR Office: Your agency's human resources department is your first stop. Get in touch with them, clearly explain the error you found, and be ready to share copies of the documents you gathered.

- Follow Up in Writing: After you talk to HR, always send a follow-up email. Briefly summarize the problem, what you discussed, and the next steps you agreed on. This creates a paper trail and makes sure there’s no confusion later on.

Do not wait until you are a year away from retirement to review your personnel file. Small errors are much easier to fix when the personnel action is recent. A proactive approach today can save you from major delays and financial headaches tomorrow.

Your Pre-Retirement SF-50 Checklist

As you get closer to retirement, that stack of SF-50s you've collected over the years becomes more than just a record of your career—it's the proof OPM will use to calculate the pension you've worked so hard for. Think of it as your financial life story in government terms.

Getting this story straight before you're ready to retire is crucial. Don't wait until you're filling out your retirement papers. You'll want to dig into your SF-50 history at least one to two years before your target retirement date. This gives you plenty of breathing room to track down and fix any errors without putting your plans on hold.

The Three-Point Inspection

Your main job here is to play detective and hunt for any mistakes or gaps in your record. A tiny error from a decade ago could have a surprisingly big impact on your final annuity calculation. A great starting point is to complete the ultimate federal employee retirement planning checklist for a full picture of your readiness.

When you're reviewing your SF-50s, focus on these three critical areas:

Confirm All Service Periods: Lay out your SF-50s in chronological order. Make sure every job you've had is accounted for, and that there are no weird, unexplained gaps in your employment timeline. Every single month of service counts toward your pension.

Verify Your High-3 Salary: Your annuity is calculated using your highest 36 consecutive months of basic pay. Follow the salary trail on your SF-50s for that specific period. Check that every promotion, within-grade increase, and cost-of-living adjustment shows up correctly.

Check Key Data Points: Take a close look at your most recent SF-50. Is your Service Computation Date (SCD) correct? Does it list the right retirement plan (like FERS)? Was your tenure status accurate throughout your career?

Think of this as your own personal career audit. By carefully checking your service time, salary history, and other key details, you're making sure the official story in your records matches the career you actually lived. This step is your best defense against last-minute delays and ensures you get every penny you've earned.

Your Top SF-50 Questions Answered

After working with federal employees for years, I've noticed a few questions about the SF-50 pop up time and time again. Let's clear up some of the most common points of confusion so you can feel confident navigating your own career documents.

How Often Should I Check My SF-50?

My advice is simple: look at your SF-50 every single time one is generated. Treat it like a receipt after a major purchase. Whether you get a promotion, a standard within-grade increase, a new job, or even just the annual pay adjustment, a new SF-50 is created. You need to verify it's correct right away.

Beyond that, I strongly recommend doing a full review of your entire electronic Official Personnel Folder (eOPF) at least once a year. Think of it as an annual check-up for your career. Catching an error five years after it happened is much, much easier than trying to fix it twenty-five years later when you're filing for retirement.

What’s the Difference Between an SF-50 and an SF-52?

This is a classic, and it’s easy to get them mixed up. The simplest way to think about it is that one is the request and the other is the result.

- SF-52 (Request for Personnel Action): This is the form your manager fills out to start something. If they want to hire you, promote you, or make another official change, they begin by submitting an SF-52.

- SF-50 (Notification of Personnel Action): This is the official document you receive after the request has been approved and processed by HR. It’s the final word that confirms the change is complete and has been added to your permanent record.

So, the SF-52 kicks things off, but the SF-50 makes it official.

Is the SF-50 the Same as My Leave and Earnings Statement?

Nope, they're two completely different documents with very different jobs. Your Leave and Earnings Statement (LES) is your bi-weekly pay stub. It’s a snapshot in time, showing what you earned and what leave you used for that specific pay period.

Your SF-50, however, is a historical document that records the major milestones of your federal career. It's what establishes your pay grade, your appointment type, and your service history for the long haul. Your LES shows the now; your collection of SF-50s tells the entire story of how you got here.

Here’s an analogy: Your LES is like a single bank statement showing recent transactions. Your eOPF, full of SF-50s, is like the official deed to your house—a permanent record of your career history and status.

Navigating your federal benefits can feel overwhelming, but you don't have to figure it all out on your own. Federal Benefits Sherpa offers personalized retirement planning and gap analysis to help you build a secure future. To get started, you can book your free 15-minute benefit review today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved