Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Understanding the TSP Loan Interest Rate for Federal Employees

When you take out a loan from your Thrift Savings Plan (TSP), the interest rate isn't set by a bank or influenced by your credit score. Instead, it’s tied directly to the rate of return of the Government Securities Investment (G) Fund for the month your loan is processed.

This is a unique setup. You're essentially paying interest back to your own retirement account, making up for the growth your money would have earned if it had stayed invested.

Breaking Down the TSP Loan Interest Rate

Unlike a personal loan where rates can feel like a moving target, the TSP loan process is refreshingly simple. The interest rate is pegged to the G Fund's performance, which is made up of stable, non-marketable U.S. Treasury securities. This makes it a very predictable benchmark.

Here's the best part: once your loan is issued, that rate is locked in for the entire life of the loan. No surprises, no variable-rate headaches. Your payments will be consistent and predictable from start to finish.

To give you a quick overview, here are the essential characteristics of the TSP loan interest rate.

Key Features of the TSP Loan Interest Rate

| Feature | Explanation |

|---|---|

| Benchmark | The rate is set to the G Fund's rate of return for the month the loan is processed. |

| Payment Destination | Interest payments go directly back into your own TSP account, not to a bank. |

| Stability | Once set, the interest rate is fixed for the entire duration of the loan. |

| Credit Score | Your personal credit score has no impact on the loan's interest rate. |

This structure is designed to help you borrow from yourself without permanently damaging your retirement nest egg.

A Look at Recent G Fund Rates

The rate you lock in depends entirely on the G Fund's performance in the month your loan is finalized. For context, the G Fund rate as of January 2026 stands at 4.250%.

Rates do change month to month. For example, the rate was 4.125% in late 2025 and hit a high of 4.500% in June 2025. Keeping an eye on historical G Fund rates can help you get a feel for these trends before you apply.

Think of it this way: you're borrowing from your future self. The interest is the mechanism to pay that future self back, ensuring your retirement account is made whole over time.

Two Loan Types to Consider

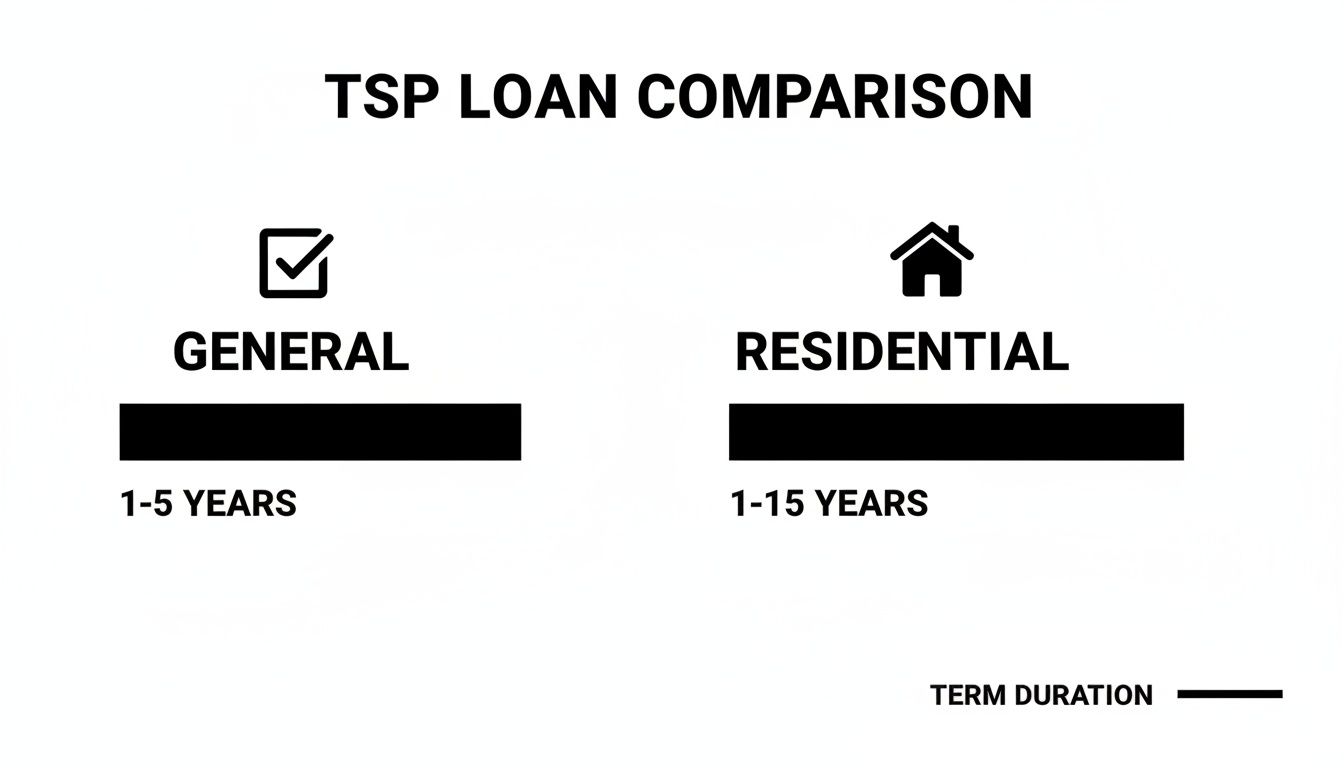

The TSP offers two kinds of loans, and while the interest rate calculation is the same for both, their terms and purposes are quite different.

- General Purpose Loan: This is your go-to for just about anything—consolidating debt, covering a medical bill, or handling an unexpected expense. The repayment term is between one and five years.

- Residential Loan: This loan is specifically for buying or building your primary home. Because it’s for such a major purchase, it comes with a much longer repayment period of one to fifteen years.

Getting a handle on how the interest rate works is the first crucial step. To learn more about managing your TSP for the long haul, take a look at our complete guide on how to use your TSP for smart federal savings.

How the G Fund Determines Your Interest Rate

When you go to a bank for a loan, the first thing they do is pull your credit report. Your score, your history—it all goes under the microscope. The TSP loan program tosses that entire process out the window. Your creditworthiness doesn't matter one bit. Instead, the TSP loan interest rate is pegged directly to the performance of a single investment: the G Fund.

It’s a simple and elegant system. The rate you pay is set to whatever the G Fund's rate of return was during the month your loan was finalized. This direct link makes the process transparent and equitable for every single federal employee.

Why Is the G Fund the Benchmark?

The Government Securities Investment (G) Fund isn't your average stock or bond fund. It's a unique beast, invested exclusively in special short-term U.S. Treasury securities that aren't available on the open market. This entire structure is built around one core principle: protecting your principal.

Think of the G Fund as the bedrock of your Thrift Savings Plan—the most conservative, stable option available. It's designed specifically to sidestep the market's wild swings. Because of this built-in stability, it makes for a perfect, low-risk benchmark for setting loan interest rates.

By tying the loan rate to the G Fund, the TSP has a clever way of making your account whole again. The interest you pay back is designed to replace the earnings your money would have made if it had been sitting in the plan's safest possible investment.

This means your rate isn't based on what a bank wants to charge for profit or what the stock market is doing. It’s tied to the interest paid on U.S. government debt. Better yet, once your loan is issued, that rate is locked in for the entire life of the loan. It won’t budge, no matter how the G Fund or the economy performs in the future.

Predictability in an Unpredictable World

This fixed-rate structure gives you a massive advantage over most commercial loans, especially things like credit cards or variable-rate personal loans where your payments can suddenly jump. With a TSP loan, you know exactly what you’ll be paying from the first month to the last. No surprises.

This predictability is one of the most powerful features of the program. For federal employees who need financial clarity, understanding the G Fund's central role is the key to seeing just how stable a TSP loan can be. As you think about your overall financial picture, you might also find our guide on the top TSP investment strategies for federal employees helpful.

Choosing Between General and Residential TSP loans

When you decide to tap into your Thrift Savings Plan for a loan, you'll come to a fork in the road. You have two distinct options: a general purpose loan or a residential loan. While the TSP loan interest rate is set the same way for both, everything else—from what you can use the money for to how long you have to pay it back—is quite different.

Think of the general purpose loan as your all-around financial multitool. It’s built for flexibility. You can use it for just about anything, whether that's wiping out high-interest credit card debt, handling a surprise medical expense, or finally tackling that kitchen remodel. It's designed for life's more immediate financial hurdles.

The residential loan, on the other hand, is a specialist. It has one job and one job only: to help you buy or build the home you plan to live in. It's not for refinancing a mortgage you already have, and you can't use it for a vacation house or an investment property. It’s strictly for your primary residence.

Key Differences in Loan Terms

The biggest difference between these two loans comes down to the repayment timeline. This single factor dramatically impacts your monthly payment and how you'll need to budget for the years ahead.

- General Purpose Loan: You’ll need to pay this one back within one to five years. That shorter window makes it perfect for getting out of debt quickly and moving on.

- Residential Loan: To account for the massive expense of a home, the TSP gives you a much longer runway—from one to fifteen years to repay the loan.

That extended term for residential loans can make the monthly payments feel much more manageable. But don't forget the trade-off: a longer loan term means your money is out of the market and not growing for a longer period.

The decision really boils down to this: A general loan gives you flexibility for all sorts of immediate needs with a quick repayment schedule. A residential loan is a targeted, long-term tool specifically for putting a roof over your head.

Documentation and Requirements

Getting the loan approved also looks very different for each type. A general purpose loan is incredibly straightforward. You just apply—no need to submit paperwork explaining why you need the money.

A residential loan is a different story. You have to provide detailed documentation proving the funds are being used to buy or build your home. Get ready to gather up documents like a signed sales contract, settlement statements, or builder agreements. The TSP is strict about this.

To make the choice crystal clear, let's break down the differences side-by-side.

Comparing General Purpose and Residential TSP Loans

Deciding which loan to take is a big deal. This table lays out the core features to help you figure out which path aligns with your financial situation and goals.

| Feature | General Purpose Loan | Residential Loan |

|---|---|---|

| Loan Purpose | Any valid expense (debt, repairs, etc.) | Purchase or construction of a primary home only |

| Repayment Term | 1 to 5 years | 1 to 15 years |

| Documentation | None required | Extensive proof of purchase/construction is mandatory |

| Flexibility | High | Low (restricted to primary residence) |

Ultimately, the right choice depends entirely on your specific circumstances. A general purpose loan offers speed and simplicity for a wide range of needs, while the residential loan provides the long-term support necessary for one of life's biggest purchases.

The Real Costs of Borrowing from Your TSP

At first glance, a TSP loan can seem like a fantastic deal. The interest rate is low and stable, and since you’re paying that interest back to yourself, it feels like you're just moving your own money around. What's not to love?

But the true cost isn't on the loan paperwork. It's an invisible cost—the lost potential of what your retirement account could have been. These opportunity costs are the biggest downside you need to weigh carefully.

The Unseen Cost of Lost Growth

The number one risk you take with a TSP loan is sacrificing tax-deferred compound growth. When you take out a loan, you're yanking that money out of the market. Those funds are no longer invested, no longer earning returns, and you can't get that lost time back. Over the life of a loan, this can put a serious dent in your future nest egg.

Think of your TSP as a snowball rolling downhill, picking up more snow and gaining momentum. Taking a loan is like stopping that snowball, carving out a chunk, and then trying to get it rolling again from a smaller size. You've lost critical momentum that’s incredibly difficult to recover.

This graphic shows the two loan types and highlights just how long your money could be sitting on the sidelines.

With a residential loan, your money could be out of the market and missing out on potential growth for a very long time.

The Problem of Double Taxation

Another easily overlooked trap is double taxation. Here's how it works: you repay your TSP loan with after-tax money directly from your paycheck. Years later, when you retire and start withdrawing that exact same money, it gets taxed again as income.

You’re essentially getting taxed twice on the same dollars—once when you earn your salary to pay back the loan, and a second time when you withdraw it in retirement. This financial double-dip quietly erodes your long-term returns.

It's no surprise that loan activity often mirrors the economy. By late 2023, for instance, general-purpose loans had jumped by 40% from the previous year, with nearly 480,000 loans active. This trend is a major red flag for financial planners because it means a huge number of federal employees have paused the growth engine of their retirement savings.

To really see what a loan would cost you, playing with an amortization schedule calculator can help you map out the payments and total interest. Understanding these hidden costs is vital, and our complete guide on https://federalbenefitssherpa.com/post/borrowing-from-tsp-a-guide-to-using-your-savings offers an even deeper look.

Finding the Current Rate and Applying for a Loan

So, you're thinking about moving forward with a TSP loan. The good news is that the process itself is pretty straightforward. Your first move should always be to check the current TSP loan interest rate to make sure you're working with the latest numbers.

Because the loan rate is pegged to the G Fund's performance, the official TSP website is your best and only source for this information. Head over to the "Fund Performance" section to see both the current rate and historical data.

Just remember, the rate that gets locked in for your loan is the one in effect for the month your loan is processed, which isn't always the same month you hit "submit" on your application.

How to Apply Step-by-Step

Once you’ve got the rate and you’re ready to go, the entire application happens right inside your TSP account online.

Log into 'My Account': First things first, head over to the official TSP website and log in. This is your command center for everything related to your TSP.

Find the Loans Section: After you're in, look for a link that says "Loans" or maybe "Withdrawals and Loans." It's usually pretty easy to spot in the main menu.

Start a New Loan Request: Click the option to begin a new loan application. The system will prompt you to choose between a general purpose loan or a residential loan.

Fill Out the Details: Here, you'll enter the amount you want to borrow and how long you want to take to pay it back. The system will show you an estimated monthly payment based on what you enter and the current interest rate.

Before you finalize anything, stop and read the Loan Agreement carefully. This is the fine print—it lays out all the terms, conditions, and what's expected of you. Make sure you understand it completely before committing.

The last step is to double-check that your personal info is correct and then provide your electronic signature. From there, the TSP will let your agency's payroll office know to start the automatic deductions from your paycheck once the loan is approved and the funds are sent.

Exploring Alternatives to a TSP Loan

It's tempting to see your TSP account as a ready source of cash when you need it. The process is straightforward, and the interest rate looks attractive. But before you pull the trigger on a TSP loan, it's crucial to pause and look at the bigger picture.

Taking money out of your retirement account, even as a loan, comes with a hidden cost: lost growth. That money is no longer invested and working for you. It’s always smart to weigh other options that can meet your immediate needs without putting a dent in your future retirement security.

Let's walk through some of the most common alternatives.

Common Financial Alternatives

Before you borrow from your future self, see if one of these more traditional tools makes better sense for your situation.

- Home Equity Line of Credit (HELOC): If you're a homeowner with some equity built up, a HELOC can be a great option. It lets you borrow against your home's value, often for big-ticket items like a major renovation or college tuition. The rates are usually variable, but it's a powerful and flexible financial tool.

- Personal Loans: Don't overlook your federal credit union. They often provide personal loans with very competitive fixed rates and predictable monthly payments. This makes them a solid choice for things like consolidating high-interest credit card debt.

- 0% APR Credit Cards: Need to cover a smaller, short-term expense? A credit card with a 0% APR introductory offer can be perfect. The catch is you absolutely have to pay it off before that promotional period ends. If you can, you've just gotten an interest-free loan.

It's also worth noting that if you're thinking about real estate investing, there are dedicated financing options for rental property that are structured specifically for that purpose, which might be a better fit than a general-purpose TSP loan.

Weighing the Pros and Cons

The low tsp loan interest rate, which is tied to the G Fund's return, is what catches everyone's eye. It feels like you're just paying yourself back. But other loan types have their own advantages that might be more valuable.

For example, the interest you pay on a HELOC can sometimes be tax-deductible, which is a benefit you won’t get with a TSP loan. More importantly, using a personal loan or HELOC leaves your retirement funds invested and compounding. You avoid that massive opportunity cost of pulling your money out of the market.

Ultimately, the decision comes down to a trade-off. A TSP loan is simple and self-contained, but it actively stunts your retirement growth. Other options might require dealing with a bank and a credit check, but they leave your most important long-term investment alone to do its job.

While the G Fund rate has been relatively low, hovering between 0.625% and 5.000% since 2016, a concerning trend emerged in 2023: a 40% jump in general-purpose TSP loans. This suggests many are tapping their retirement early, a habit that can seriously derail long-term financial goals if not handled carefully. You can read more about these TSP savings and loan trends at GovExec.com.

Your TSP Loan Questions, Answered

Taking a loan from your TSP is a big decision, and it’s natural to have questions about how it all works, especially when life throws a curveball. Let’s tackle some of the most common questions federal employees ask.

What Happens to My TSP Loan If I Leave Federal Service?

This is a huge one, and something you need to plan for carefully. If you leave your federal job or retire while you still have a loan balance, the clock starts ticking. You’ll have a grace period, usually 90 days, to pay back the entire loan in full.

If you can't pay it back within that window, the TSP will declare the outstanding amount a "taxable distribution." This is just a formal way of saying it’s treated as income. That means the entire remaining balance gets added to your income for the year, and you'll owe federal and state taxes on it.

But that's not all. If you're younger than 59½, you'll likely get hit with an additional 10% early withdrawal penalty on top of the taxes. This can turn into a serious financial blow, so it's critical to have a repayment strategy in place before you separate from service.

Can I Pay My TSP Loan Back Early?

Yes, and there are no strings attached. The TSP doesn't hit you with prepayment penalties, so you can pay off your loan ahead of schedule without any extra fees. You can easily make extra payments or pay off the whole thing at once through your online TSP account.

Paying it back early is usually a smart move. The quicker you clear the loan, the faster that money gets back to work for you, reinvested in your TSP funds and earning those all-important compound returns for your future.

How Many TSP Loans Can I Have at the Same Time?

The TSP has a clear-cut rule here: you can have two loans out at once, but they can't be the same kind.

- You can have one general purpose loan (for things like debt consolidation or a car).

- And you can have one residential loan (used only to buy your primary home).

You can't, for example, have two general purpose loans or two residential loans open simultaneously. There are also strict legal limits on the total amount you can borrow, which depends on your vested account balance and any loans you already have. This system is designed to keep you from borrowing too heavily against your own retirement savings.

Getting the most out of your federal benefits is the key to a comfortable retirement. At Federal Benefits Sherpa, we offer personalized retirement planning to help you navigate the details of your TSP, FERS, and other benefits. Start with a free 15-minute benefit review to get clear on your next steps. Learn more at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved