Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Difference between traditional and roth tsp: A Quick Federal Guide

The real difference between the Traditional and Roth TSP boils down to a single, critical question: Do you want to pay taxes now or later?

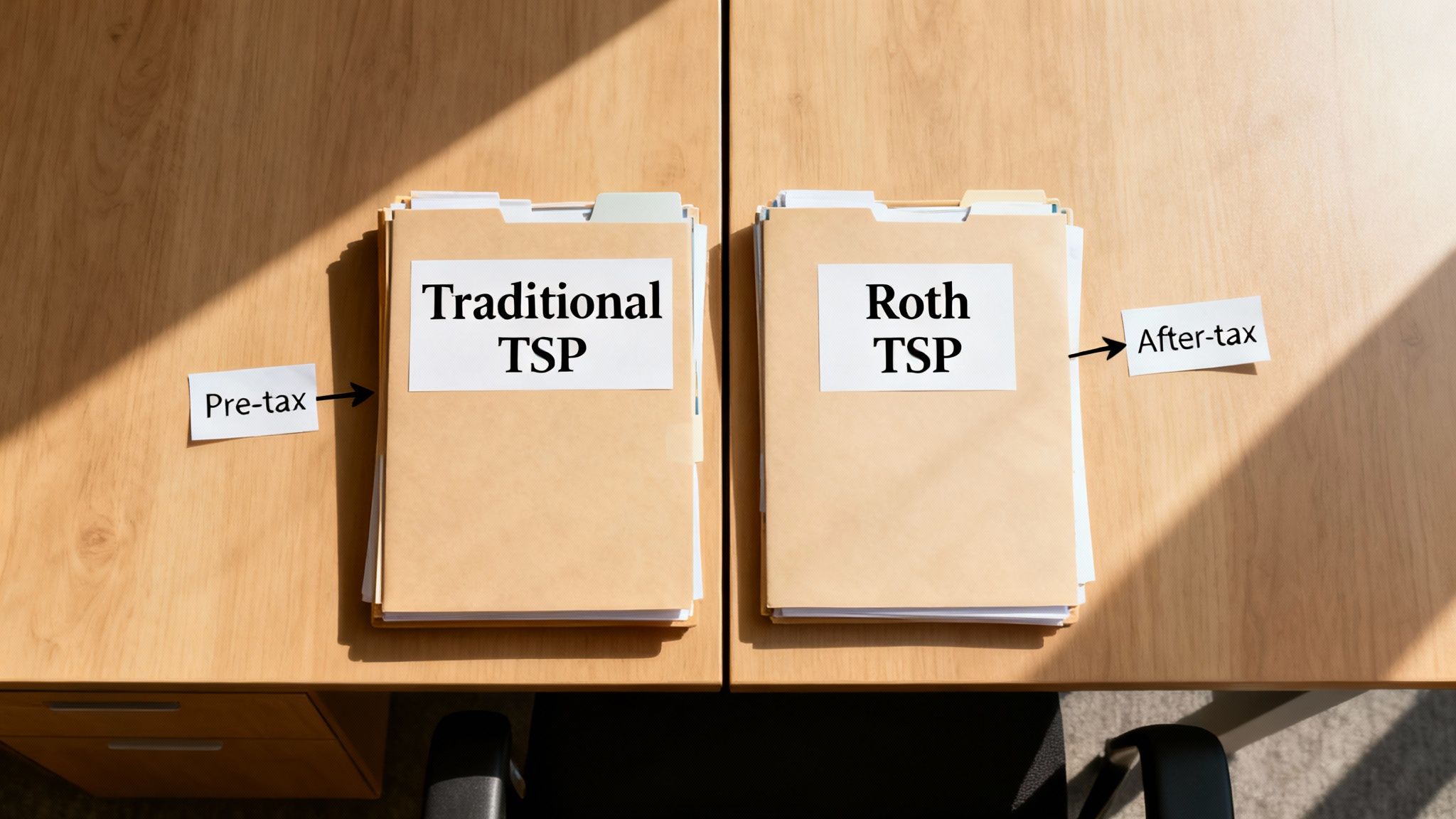

With a Traditional TSP, your contributions are made with pre-tax dollars. This gives you an immediate benefit by lowering your taxable income for the year, but you'll pay income tax on every dollar you withdraw in retirement. The Roth TSP, on the other hand, works in reverse. You contribute with after-tax dollars—getting no upfront tax break—but your qualified withdrawals in retirement are completely tax-free.

Understanding the Key TSP Differences

Choosing between the Traditional and Roth TSP options is one of the most significant decisions you'll make in your federal retirement planning. This choice directly affects your take-home pay today and, more importantly, how much of your nest egg you actually get to keep in retirement.

While both accounts use the same excellent investment funds and have the same contribution limits, the way they handle taxes creates two fundamentally different paths to retirement security.

Ultimately, this isn’t just a matter of preference. It's a strategic financial bet on your future. You're forecasting whether your income tax rate will be higher now, during your working years, or later, when you're living off your savings.

Key Differences Traditional TSP vs Roth TSP

To make this clearer, let's put the core features of each account side-by-side. Seeing the distinctions laid out like this is the first step toward building a TSP strategy that truly fits your financial life.

For a more detailed explanation, check out our complete guide on what the Roth TSP is and how it works for federal employees.

| Feature | Traditional TSP | Roth TSP |

|---|---|---|

| Contribution Taxes | Contributions are pre-tax, which lowers your current taxable income. | Contributions are after-tax, so there's no immediate tax deduction. |

| Withdrawal Taxes | All withdrawals, including earnings, are taxed as ordinary income. | Qualified withdrawals of contributions and earnings are 100% tax-free. |

| Agency Matching | All matching funds are automatically deposited into your Traditional balance. | All matching funds are automatically deposited into your Traditional balance. |

| Best For You If... | You believe you'll be in a lower tax bracket when you retire. | You believe you'll be in a higher tax bracket when you retire. |

Looking at the numbers, it's clear many feds haven't yet embraced the Roth option, despite its powerful tax-free withdrawal benefit. As of December 2023, Roth balances accounted for just $55 billion of the TSP's massive $849 billion total.

Why the gap? It often comes down to simple human psychology. The instant gratification of a lower tax bill today with the Traditional TSP can feel more tangible than the delayed reward of tax-free income decades from now.

How Your TSP Choice Impacts Your Taxes Now and Later

The biggest difference between the Traditional and Roth TSP boils down to one simple question: do you want to pay taxes now or later? This single decision sends ripples through your financial life, affecting your paycheck today and your income decades from now. It's a strategic choice between immediate tax relief and long-term tax freedom.

Your choice has a direct, immediate impact on your take-home pay. When you contribute to a Traditional TSP, those contributions are pre-tax. This lowers your Adjusted Gross Income (AGI) for the year, giving you a tangible tax break you can see on every pay stub.

On the other hand, contributions to a Roth TSP are made with after-tax dollars. You pay your full income tax now and don't get that immediate break. The powerful tradeoff, however, is that all qualified withdrawals in retirement—including all the investment growth—are completely tax-free.

The Now-Versus-Later Tax Calculation

At its core, the decision hinges on a simple but crucial question: do you think your income tax rate will be higher now, during your working years, or later in retirement? Your best guess at the answer is what determines which account has the better mathematical edge for you.

Let's walk through an example. Imagine a federal employee contributing $10,000 a year who is currently in the 22% federal tax bracket.

With a Traditional TSP: That $10,000 contribution lowers their taxable income, creating an immediate tax savings of $2,200 for the year. The catch is that when they withdraw that money (plus its earnings) in retirement, it will all be taxed as ordinary income at whatever their tax rate is at that time.

With a Roth TSP: The contribution is made after taxes are already paid, so there are no upfront savings. But when they take a qualified withdrawal of that $10,000 and all its earnings in retirement, the entire amount is 100% tax-free.

This choice is really a calculated bet on where you think tax rates are headed and what your own financial future looks like. To get a broader perspective, you can learn more about how taxes will affect your savings as you plan for retirement.

Creating Tax Diversification for an Uncertain Future

The good news is you don't have to go all-in on one or the other. Many savvy federal employees hedge their bets by contributing to both the Traditional and Roth TSP, a strategy known as tax diversification.

By putting money into both pre-tax and after-tax accounts, you build critical flexibility into your retirement plan. This gives you the power to pull income from different tax "buckets" in retirement, offering you far more control over your annual taxable income.

This blended approach is especially smart because nobody knows for sure what tax rates will look like 20 or 30 years down the road. Having both taxable (Traditional TSP) and tax-free (Roth TSP) sources of income is a powerful tool for managing your tax bill once you stop working. Our guide on how to reduce taxes in retirement for federal employees explores these strategies in much more detail.

Ultimately, the right choice isn't just about the numbers. It's about building a resilient financial future that can adapt to whatever comes next.

A Closer Look at Contribution Limits and Agency Matching

Getting a handle on the difference between a Traditional and Roth TSP is step one. Step two—and where your retirement strategy really takes shape—is understanding how the contribution rules work. Each year, the IRS sets a ceiling on how much you can put away from your own paycheck, and these limits often get a bump for inflation.

Critically, this annual limit applies to the combined total you put into your Traditional and Roth TSP accounts. It's one big bucket.

For example, in 2025, a federal employee under the age of 50 can contribute up to $23,500. You have total control over how to split that money: all of it can go into your Traditional TSP, all into your Roth TSP, or any combination you choose.

If you're 50 or older, the IRS gives you a fantastic tool called "catch-up contributions." This allows you to sock away even more money on top of the standard limit, which is a huge advantage for those who are getting closer to their retirement date.

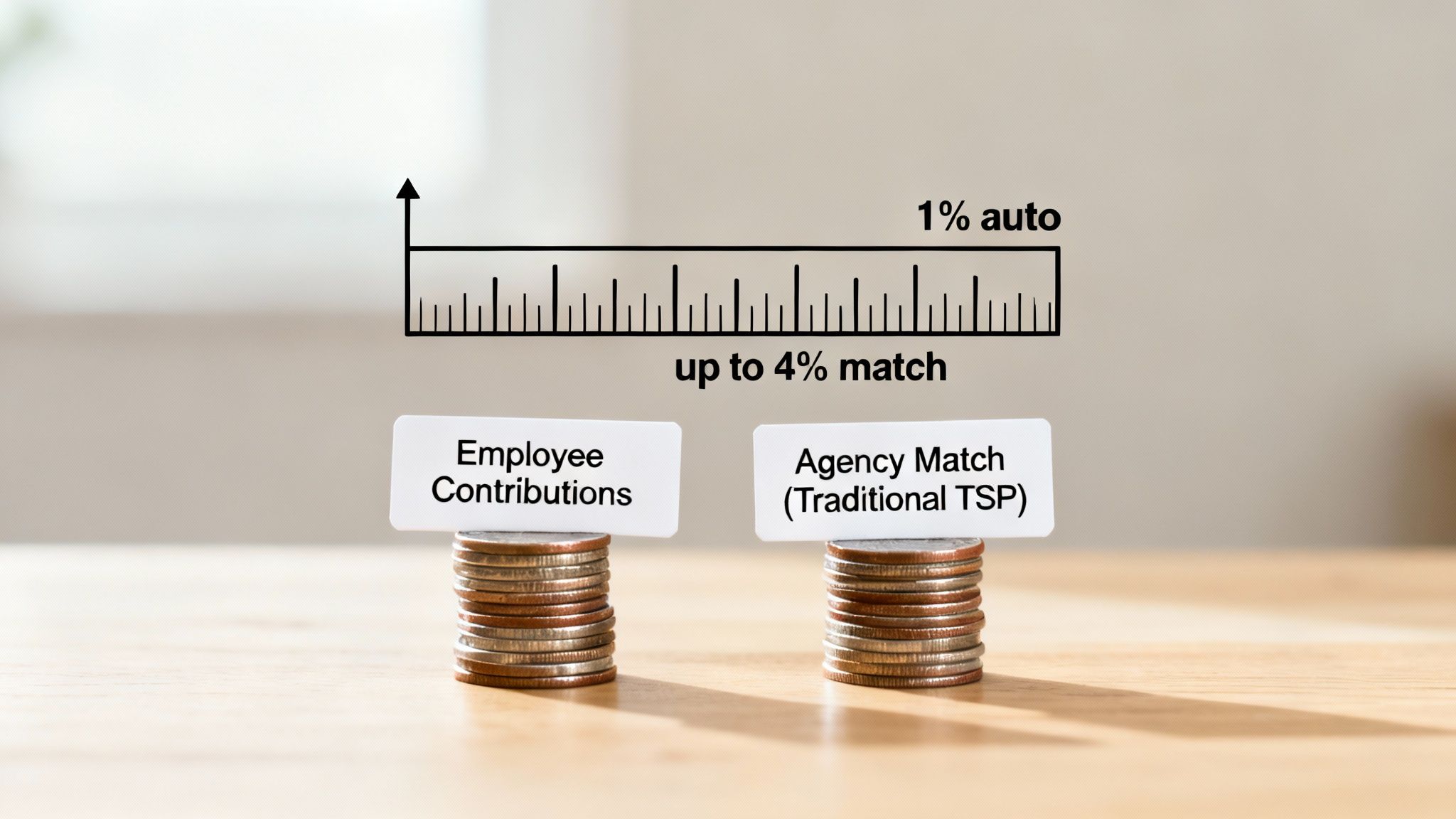

The Agency Match: Always Traditional, No Exceptions

This is one of the most common points of confusion for federal employees, but it's an absolutely vital rule to understand. Regardless of how you allocate your own contributions, your agency's matching funds will always be deposited into your Traditional TSP balance.

This is a hard-and-fast rule set by federal law, and there’s no way around it.

What does this mean in practice? Even if you decide to contribute 100% of your money to the Roth TSP to build up your tax-free retirement bucket, you will still accumulate a Traditional TSP balance from the government's contributions. This effectively creates a tax-diversified portfolio for you right from the start.

Key Insight: Your agency contributes up to 5% of your basic pay if you contribute at least 5% yourself. This match is broken down into a 1% automatic agency contribution and up to a 4% agency match. Every single penny of it goes into your Traditional TSP.

Understanding this structure is fundamental to your retirement planning. It guarantees that every participating employee will have a pre-tax source of funds in retirement, which can be a strategic asset. To really squeeze every drop of value from this benefit, it’s a good idea to learn about maximizing your government matching TSP contributions.

Keeping an Eye on Future Contribution Rules

The rules of the game aren't set in stone; new legislation can and does change them. A perfect example is a new law set to take effect by 2026. It will require high-earning employees (making over $145,000 in Social Security wages) who are 50 or older to make all their catch-up contributions on a Roth (after-tax) basis.

For 2025, those 50 and over can contribute up to $31,000 total, which includes their catch-up amount. You can dive deeper into how Roth TSP contribution rules compare to Roth IRAs on Farther.com.

This upcoming change signals a broader policy trend toward Roth savings and serves as a great reminder to stay on top of the regulations. By mastering both the annual limits and the unique way agency matching works, you can build a retirement strategy that's not just effective, but truly intentional.

Comparing Withdrawal Rules and RMDs

How you get your money out of the Thrift Savings Plan in retirement is every bit as important as how you put it in. The withdrawal rules for the Traditional and Roth TSP are fundamentally different, and understanding them is key to building a smart retirement income strategy—and keeping more of your hard-earned money.

With a Traditional TSP, the concept is simple. You got a tax break on the way in, so the government collects its share on the way out. Every dollar you withdraw is taxed as ordinary income—your contributions, your agency's match, and all the earnings.

The Roth TSP works in reverse, offering a much better deal at withdrawal time if you've played by the rules. As long as your withdrawal is a "qualified distribution," every penny you take out is 100% tax-free. That includes your after-tax contributions and all the growth.

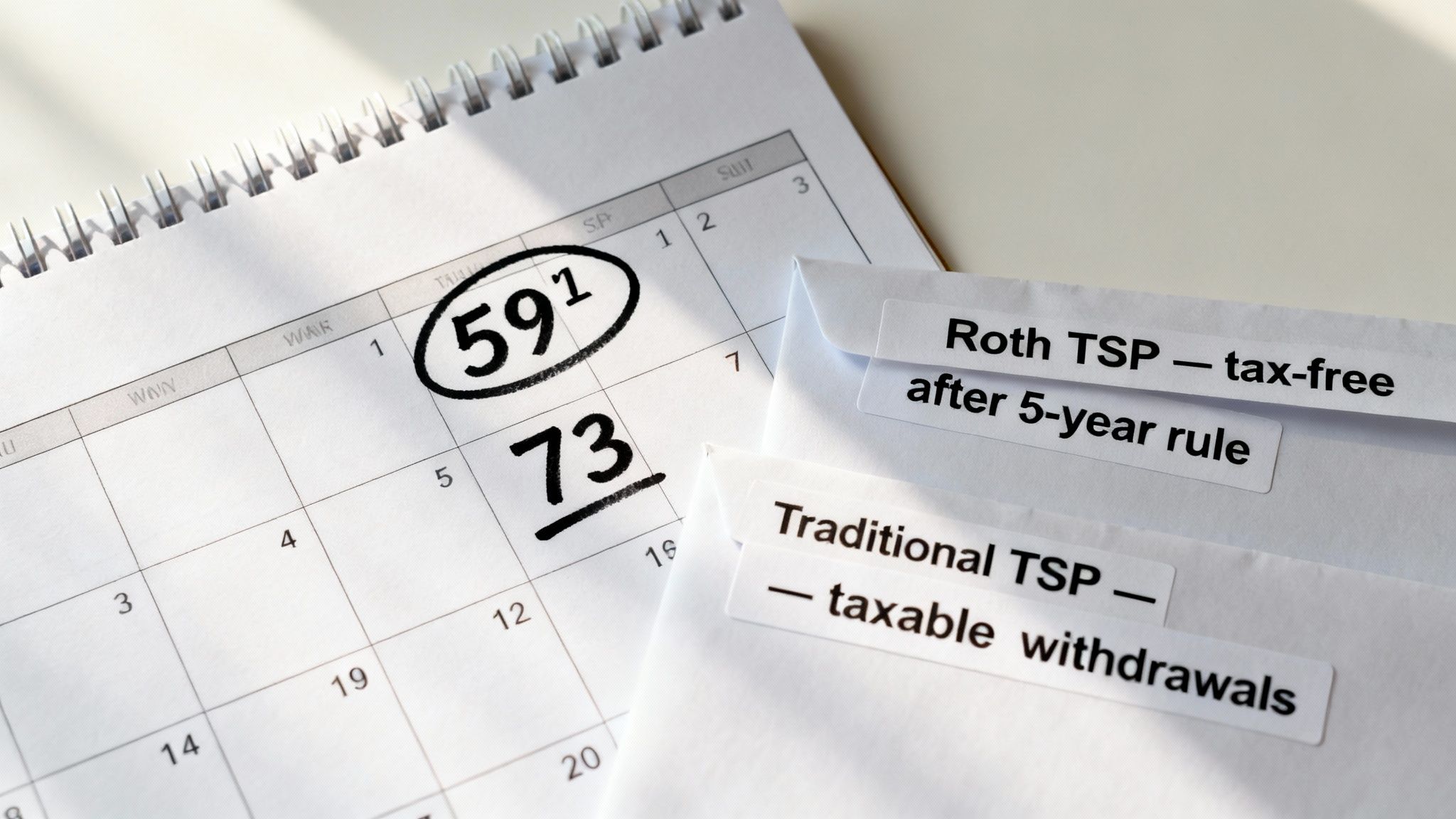

The Roth TSP Five-Year Rule Explained

Getting to that tax-free finish line with your Roth TSP earnings requires clearing two hurdles. This is the whole ballgame when it comes to making the Roth option work for you.

First, you generally have to be at least age 59½ (or meet other conditions like a permanent disability). Second, you need to satisfy the five-year rule. This rule is often misunderstood, but it simply means that five years must have passed since January 1st of the calendar year you made your very first Roth TSP contribution.

It's a one-and-done clock. If you make your first Roth contribution in 2024, that clock is satisfied on January 1, 2029.

Crucial Insight: The five-year clock doesn't care if you stop contributing or even if you leave federal service. Once that clock starts, it keeps ticking. After you hit age 59½ and the five years are up, your Roth earnings are unlocked for tax-free withdrawals for good.

This is exactly why it's so important for federal employees—even those nearing retirement—to open a Roth TSP and contribute something, anything, as soon as possible. That small initial deposit gets the five-year clock started, giving you maximum flexibility down the road.

Required Minimum Distributions: A Key TSP Detail

Here's a critical detail where the TSP differs from retirement accounts in the private sector. Required Minimum Distributions (RMDs) are the IRS-mandated withdrawals you must start taking from your retirement accounts once you reach age 73.

Now, if you have a Roth IRA, you're off the hook—the original owner never has to take RMDs. But the TSP is different.

- Both your Traditional TSP and your Roth TSP are subject to RMDs.

This is a massive detail that many federal employees miss. The TSP calculates your total RMD based on your entire account balance and then pulls the money proportionally from your Traditional and Roth buckets. This means you can be forced to withdraw from your tax-free Roth account, even if you don't want or need the money.

To see these rules side-by-side, it helps to break them down clearly.

Comparing Withdrawal and RMD Rules

| Rule | Traditional TSP | Roth TSP |

|---|---|---|

| Withdrawal Taxes | All withdrawals are fully taxed as ordinary income. | Qualified withdrawals are 100% tax-free. |

| RMDs (Age 73+) | Yes, RMDs are mandatory. | Yes, RMDs are mandatory, a key difference from Roth IRAs. |

| Strategic Benefit | Allows for spreading out a predictable taxable income stream over your retirement years. | Creates a bucket of tax-free money to help you manage your tax bracket in retirement. |

The fact that the Roth TSP has RMDs is a major planning consideration. To get around this, many savvy federal retirees execute a strategic rollover after separating from service. By moving your Roth TSP funds into a Roth IRA, you can completely eliminate the RMD requirement for that money for the rest of your life. This gives you ultimate control, letting those funds continue to grow tax-free for as long as you wish.

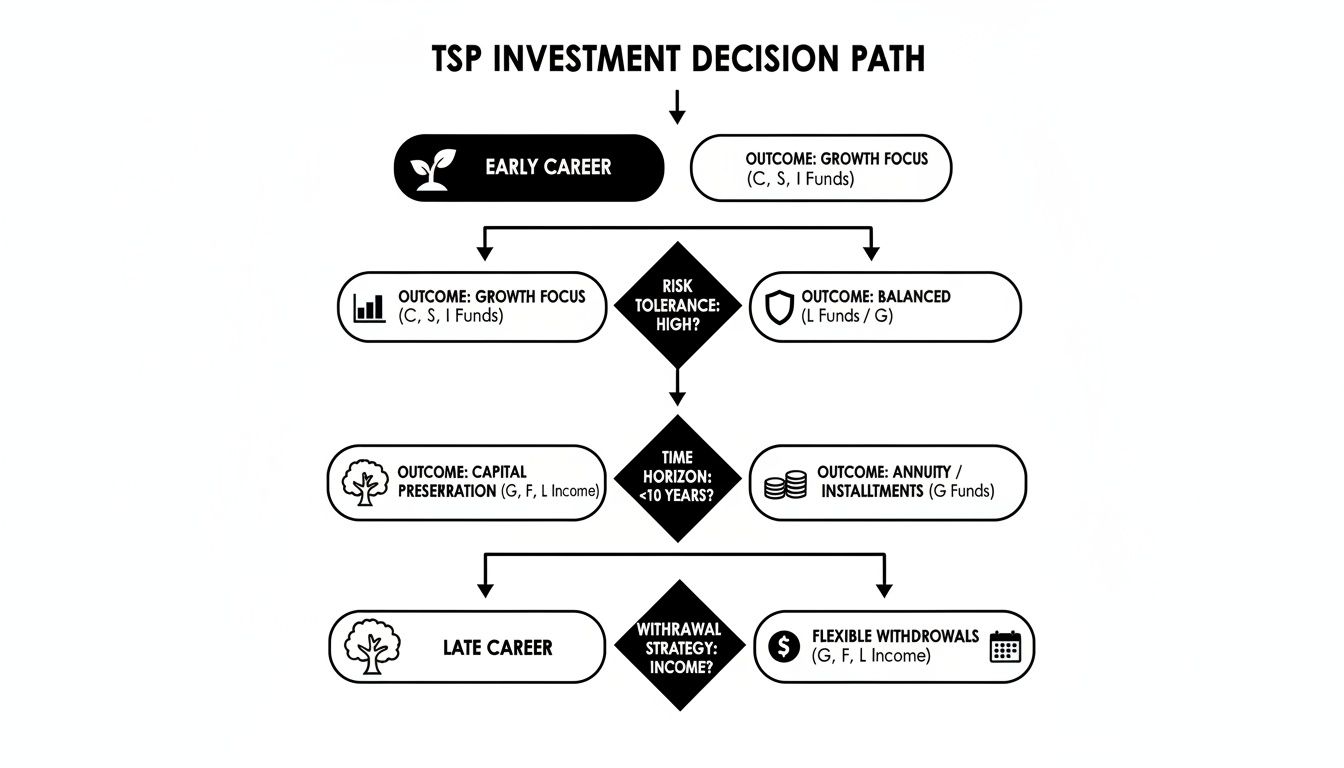

Which TSP Is Right for Your Career Stage?

Deciding between a Traditional and Roth TSP isn't a one-and-done choice. It's a strategic move that should really evolve right alongside your federal career. The best option for a brand-new GS-7 hire is almost certainly different from what a senior manager needs as they approach retirement.

Let's walk through how to think about this at each phase of your career. The whole decision really boils down to one simple question: Is your income tax rate likely to be higher now, or in retirement? Your answer will change over time, and your TSP strategy should, too.

New and Early-Career Employees: The Roth Advantage

For most feds just starting out, the Roth TSP is usually the powerhouse choice. In your early years, you're typically in a lower income tax bracket than you will be down the road, after you've climbed the ladder with promotions and step increases.

By contributing to the Roth TSP now, you're paying taxes on that money while your rate is relatively low. This locks in that lower tax hit forever. You get to watch decades of compound growth build up into a pool of money that is 100% tax-free in retirement. Think of it as paying a small, known tax bill today to completely avoid a much larger, unknown one tomorrow.

Since it was introduced back in 2012, the Roth TSP has become a go-to for younger employees who get the long-term math. The 2024 TSP Annual Report shows that while overall TSP balances are high, the median Roth balance is much smaller—a clear sign of newer accounts with massive growth potential ahead of them.

Mid-Career Professionals: Embracing Tax Diversification

Once you hit your mid-career stride, your financial picture gets a bit more complicated. You're likely earning more, you've probably jumped into a higher tax bracket, and the whole "pay taxes now or later" question isn't so black and white anymore. This is the perfect time to shift to a blended strategy.

By splitting your contributions between the Traditional and Roth TSP, you create tax diversification. This is just a smart way to hedge your bets against an uncertain future. No one has a crystal ball to know what tax rates will look like in 20 or 30 years, so having access to both pre-tax and after-tax money gives you incredible flexibility.

A common mid-career approach looks something like this:

- Contribute to the Traditional TSP: This move lowers your taxable income during your peak earning years, providing immediate tax relief when your bill is likely at its highest.

- Keep funding the Roth TSP: You continue building your tax-free bucket, ensuring you have a source of retirement income that won't push you into a higher tax bracket later on.

A Practical Takeaway: A 50/50 split is a solid starting point, but feel free to tweak that ratio based on your specific income and goals. The whole point is to avoid putting all your eggs in one tax basket.

This two-bucket approach gives you options. If you need to pull out a large sum in retirement for a new car or a home repair, you can take it from your Roth TSP without triggering a huge tax event. For your regular living expenses, you can draw from your Traditional TSP, managing the withdrawals to keep yourself in a comfortable tax bracket.

Late-Career Specialists and Pre-Retirees: Fine-Tuning the Plan

For federal employees in their final 10-15 years of service, the game changes. The focus shifts to maxing out contributions and getting your retirement income plan dialed in. You're likely at your peak earning potential, which makes the immediate tax deduction from the Traditional TSP especially appealing.

Pouring money into the Traditional TSP at this stage can seriously reduce your current taxable income. This strategy is particularly powerful for those who expect their income—and therefore their tax bracket—to drop significantly in retirement when their salary is replaced by their FERS pension and TSP withdrawals.

But don't ignore the Roth option. If you haven't already, starting a Roth TSP account now—even with a tiny contribution—is critical. It gets the five-year clock ticking, which is a requirement for withdrawing your earnings tax-free. This simple step ensures you have a tax-free emergency fund ready to go in your early retirement years.

Here's a simple framework for your late-career decision:

- If your retirement income will be lower than your current income: Prioritize the Traditional TSP to get the biggest tax break right now.

- If you expect a high retirement income (big pension, other investments): Stick with a blended or Roth-focused strategy to keep your future taxable income under control.

- No matter what: Make sure you've contributed something to a Roth account to start that five-year clock. It's all about preserving your future flexibility.

Integrating Your TSP With Other Federal Benefits

Your choice between a Traditional and Roth TSP doesn't happen in a vacuum. It's a crucial piece of a much larger retirement puzzle that includes your FERS pension and future Social Security benefits. To build a truly tax-smart and resilient retirement, you have to think about how these three income streams work together.

The core difference between the Traditional and Roth TSP—taxable versus tax-free withdrawals—takes on a whole new meaning when you look at the bigger picture. In retirement, your FERS pension and a good chunk of your Social Security benefits will be counted as taxable income.

Managing Your Retirement Tax Bracket

This is where the Roth TSP really shines. By building up a Roth balance, you’re creating a pool of tax-free money you can tap into later. Think of it as a lever you can pull in retirement to manage your overall taxable income.

Let's say a large, unexpected expense pops up. You can pull that money from your Roth TSP without adding a single dollar to your taxable income for the year. This control is huge for staying in a lower tax bracket and, critically, it can help reduce how much of your Social Security is subject to federal income tax.

A holistic approach is essential. An optimized retirement isn't built on isolated decisions about your TSP, pension, and Social Security. It’s built on integrating them into a single, cohesive strategy that gives you control over your future tax liability.

This flowchart offers a simple framework for matching your TSP choice to where you are in your career.

As you can see, the ideal strategy often shifts. It might start with a Roth focus early on and then move toward a more blended or Traditional-heavy approach as you get closer to retirement.

Aligning Your TSP for a Cohesive Plan

A well-designed plan understands how each income source affects the others. For instance, if you're on track for a solid FERS pension that will cover your essential living expenses, focusing on Roth TSP contributions can build a fantastic fund for discretionary spending that won't bump up your tax bill.

On the other hand, if your main goal is to lower your taxes during your peak earning years, maximizing Traditional TSP contributions provides that immediate relief. It’s a trade-off, but one you can plan for. As you map out your long-term finances, it's also wise to understand legal tools like a Power of Attorney, which can be vital for managing your assets if you're ever unable to.

The ultimate goal here is to orchestrate your benefits, not just collect them. By seeing how the Traditional vs. Roth TSP decision fits within your entire federal benefits package, you can shift from simply saving to truly strategic financial planning. You'll be building a retirement that's not only well-funded but also incredibly tax-efficient.

Common Questions About Traditional vs. Roth TSP

Even after you get the basic concepts down, the nitty-gritty details of the Traditional and Roth TSP can bring up some specific questions. Let's tackle a few of the most common ones that federal employees ask when they're trying to map out their financial future.

Getting these answers straight is crucial. Every decision, from how you allocate your contributions to understanding where your agency match goes, has real consequences for your retirement decades down the road.

Does My Agency Match Go into the Roth TSP if I Contribute to It?

No, and this is a point that trips a lot of people up. All agency automatic (1%) and matching contributions are legally required to go into your Traditional TSP balance.

This is a hard-and-fast rule. It doesn't matter if you put 100% of your own money into the Roth TSP; the government's contribution will always be pre-tax. On the bright side, this means most feds who use the Roth TSP automatically end up with a mix of pre-tax and after-tax money, which can be a huge advantage for managing taxes in retirement.

Can I Convert My Existing Traditional TSP Balance to Roth?

While you're still an active federal employee, you can't just flip a switch and convert your old Traditional TSP money to Roth. At least, not yet. But a big change is coming.

The TSP is working on an in-plan Roth conversion feature, which they are targeting for a January 2026 launch.

For now, the only way to get your Traditional TSP funds into a Roth account is to leave federal service first. After you separate, you can roll the money into a Roth IRA. Just remember, a rollover like that is a taxable event—you'll owe income tax on the entire amount you convert that year.

Once the new in-plan conversion is available, it will open up a world of new tax planning strategies for active employees, all without having to leave your job.

Which Option Is Better if I Think My Taxes Will Be Higher in Retirement?

This one's pretty straightforward. If you expect to be in a higher tax bracket when you retire, the Roth TSP is almost always the smarter play. This is a classic scenario for younger feds early in their careers who have a lot of promotions and salary growth ahead of them.

Think of it this way: you're choosing to pay taxes now, while you're in a lower tax bracket. In return, you get to take all of your withdrawals completely tax-free later on, when your income—and your tax rate—would have been much higher. You’re essentially locking in today's lower tax rate and shielding your retirement savings from any future tax increases. It’s a strategic move to pay a smaller, known tax bill now to sidestep a much bigger, unknown one later.

At Federal Benefits Sherpa, we specialize in helping you navigate these critical decisions to build a secure retirement. If you need clarity on your TSP, FERS pension, or other benefits, book your free 15-minute benefit review today at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved