How to Reduce Taxes in Retirement: A Federal Employee's Practical Guide

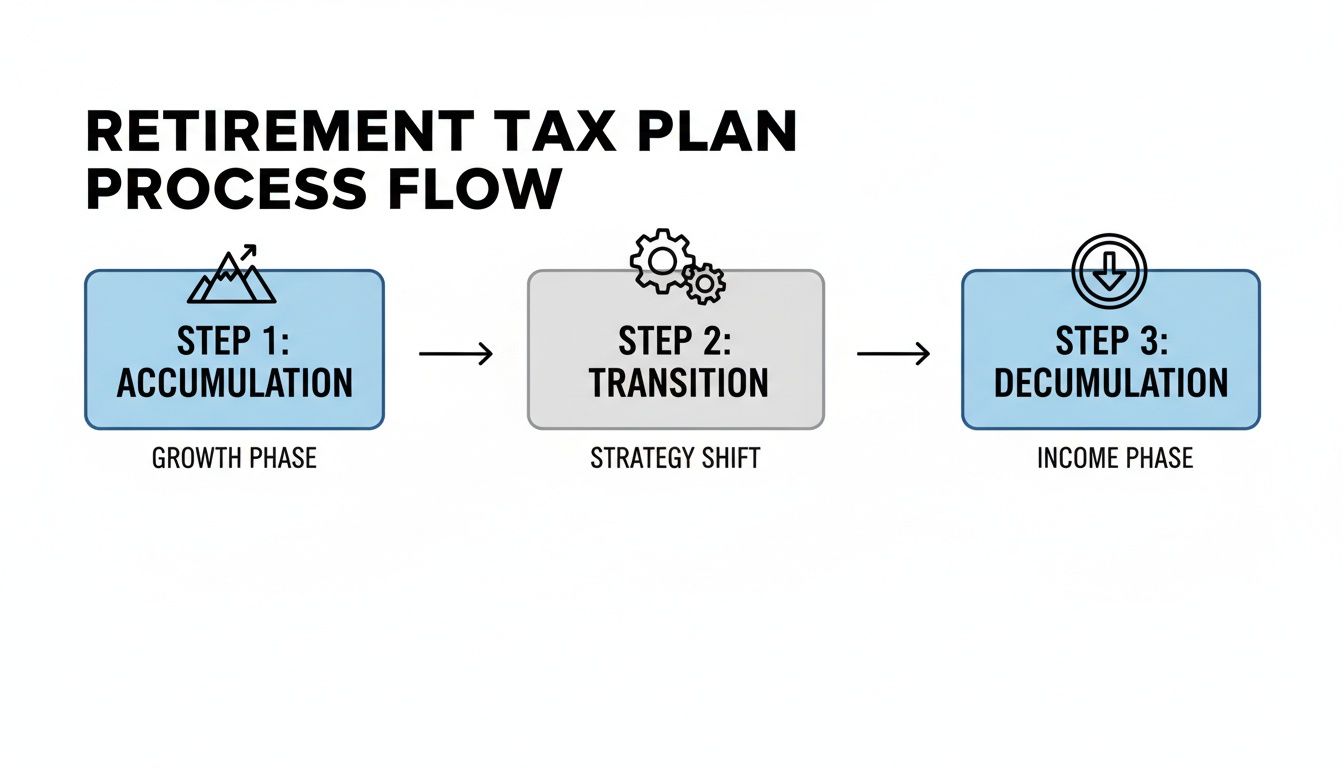

As a federal employee, you’ve spent your career focused on one thing: building your wealth. Now, the game changes. The key to lowering your taxes in retirement isn’t about earning more—it’s about strategically planning how you draw down your income.

It all comes down to when you take your money and which accounts you pull from. The most powerful levers you have are sequenced TSP withdrawals, well-timed Roth conversions, and a smart Social Security claiming strategy.

Your Blueprint for a Tax-Smart Retirement

After decades of dedicated service and disciplined saving into your Thrift Savings Plan (TSP), you've successfully built your nest egg. That was the hard part, right? Well, not exactly. The next challenge is making that money last while keeping the IRS's share as small as legally possible.

Many retirees make the costly mistake of simply withdrawing funds as they need them. This reactive approach can trigger surprisingly high tax bills and even impact your healthcare costs. A proactive retirement tax plan isn't about finding secret loopholes; it’s about understanding the rules and orchestrating your income sources—your FERS pension, Social Security, TSP, and other investments—to work in your favor.

The Decumulation Mindset Shift

During your working years, the goal was simple: max out your contributions. In retirement, things get more complex. The new goal is to maintain your lifestyle while minimizing the tax bite. This requires a "decumulation" strategy—a conscious plan for which accounts to tap first.

Why is this so important? Because it lets you control your Adjusted Gross Income (AGI). This one number is the linchpin of your retirement tax picture. It doesn't just determine your income tax bracket; it also dictates:

- How much of your Social Security benefits are taxed: Depending on your income, up to 85% of your benefits can become taxable.

- Your Medicare Part B and D premiums: Cross certain AGI thresholds, and you’ll get hit with the dreaded Income-Related Monthly Adjustment Amount (IRMAA)—a significant surcharge on your monthly premiums.

- Eligibility for other tax breaks: A lower AGI can keep you eligible for valuable credits and deductions you might otherwise lose.

Key Levers to Pull

By strategically sequencing your withdrawals, you can directly influence your AGI each year. This isn't just theory; it's a practical way to lower your tax and Medicare costs. Research from firms like SSGA highlights how thoughtful retirement planning can make a tangible difference. Even small shifts in timing can save you thousands of dollars annually.

The goal isn't just to have retirement income; it's to have tax-efficient retirement income. The difference between a planned and an unplanned withdrawal strategy can be tens or even hundreds of thousands of dollars over a 30-year retirement.

This guide is your blueprint. We're moving past generic advice to give you the specific, actionable steps federal employees can take to keep more of their hard-earned money.

Here's a quick overview of the primary tools at your disposal for crafting a tax-efficient retirement. Think of these as the main controls you can adjust each year to fine-tune your financial picture.

Key Levers to Reduce Your Retirement Tax Bill

| Strategy | Primary Tax Impacted | Best Time to Act |

|---|---|---|

| TSP & IRA Withdrawal Sequencing | Ordinary Income Tax, Capital Gains Tax | Annually, throughout retirement |

| Roth Conversions | Ordinary Income Tax (now for future savings) | "Gap years" (post-retirement, pre-RMDs) |

| Social Security Optimization | Ordinary Income Tax on benefits | Before claiming benefits (ages 62-70) |

| IRMAA Management | Medicare Premium Surcharges | Annually, by managing AGI |

| Charitable Giving (QCDs) | Ordinary Income Tax (reduces AGI) | After age 70.5 |

Each of these strategies plays a distinct role, and the real power comes from knowing how to combine them effectively. Now, let's dive into the specifics of how to put them to work for you.

Mastering Your TSP and IRA Withdrawal Strategy

Once you retire, the game changes. You’ve spent decades saving and accumulating, and now you have to flip the switch to spending. But how you spend that money—specifically, which accounts you pull from first—can make a huge difference in your lifetime tax bill. It's not just about what you take out, but when and from where.

This is what we call strategic sequencing, and it's a cornerstone of any solid retirement tax plan.

A popular and effective way to think about this is the "bucket" strategy. Picture your retirement savings sorted into three distinct buckets:

- Taxable Accounts: This is your standard brokerage account, where you pay capital gains tax on any growth.

- Tax-Deferred Accounts: Your traditional Thrift Savings Plan (TSP) and traditional IRAs fall into this category.

- Tax-Free Accounts: This is the goldmine—your Roth TSP and Roth IRAs.

The entire goal is to draw from these buckets in an order that keeps your taxable income as low as possible each year. This isn't just about saving for retirement; it's about thoughtfully spending it down.

As you can see, making the move from accumulation to decumulation isn't automatic. It requires a deliberate plan.

Start With Your Taxable Brokerage Account

This first move might feel a little backward. Spend your investment money first? Absolutely. There's a powerful tax reason for this.

When you sell investments in a taxable brokerage account that you've held for over a year, your profits are taxed at the much friendlier long-term capital gains rates. These rates are often significantly lower than the ordinary income tax rates that apply to your TSP withdrawals.

In fact, for 2024, a married couple filing jointly with a taxable income up to $94,050 pays exactly 0% in federal long-term capital gains tax. By drawing from this account first, you can potentially generate completely tax-free cash flow, especially in those early retirement years before Social Security and Required Minimum Distributions (RMDs) complicate things.

Tapping your brokerage account first lets your tax-deferred money in the TSP and traditional IRAs continue to grow without you having to pay taxes on it just yet. This strategy puts you in the driver's seat, giving you incredible control over your taxable income from one year to the next.

Next, Tap Your Tax-Deferred Accounts

Once your taxable brokerage account is used up, or if your spending needs are more than it can provide, it's time to turn to your tax-deferred bucket. This means your traditional TSP and any traditional IRAs.

Here’s the catch: every single dollar you withdraw from these accounts is taxed as ordinary income. This is where careful, year-by-year planning becomes absolutely critical. You want to withdraw only what you need to cover your expenses while staying within a specific tax bracket. Pulling out too much can easily bump you into a higher bracket, cause more of your Social Security benefits to be taxed, and even trigger those nasty Medicare IRMAA surcharges.

As a federal employee, getting familiar with all the ways you can access your TSP funds is a must. You can dive into the different Thrift Savings Plan withdrawal options in our complete guide to make sure your choices line up perfectly with your tax strategy.

Let Your Roth Accounts Grow Last

Your Roth TSP and Roth IRA are, without a doubt, your most valuable retirement dollars. Why? Because every qualified withdrawal is 100% tax-free. This is your ace in the hole for tax planning, and it's why you should almost always let this money grow untouched for as long as possible.

Think of your Roth accounts as a multi-purpose financial tool:

- A Tax-Free Emergency Fund: If you suddenly need cash for a new roof or an unexpected medical bill, a Roth withdrawal won't add a single dime to your taxable income for the year.

- A Bracket Management Tool: Let's say a planned withdrawal from your traditional TSP would push you into a higher tax bracket. You could take a smaller TSP distribution and fill the gap with tax-free money from your Roth.

- A Tax-Free Inheritance: Original owners of Roth IRAs have no RMDs. You can let that account grow for your entire life and pass it on to your kids or grandkids as a completely tax-free inheritance.

By following this simple withdrawal sequence—taxable first, then tax-deferred, and finally tax-free—you build a flexible and powerful framework for your retirement income. This approach gives you the control to actively manage your tax situation each year, helping you keep more of the money you worked so hard to save.

Unlocking the Power of Roth Conversions

When it comes to powerful tax-reduction strategies for retirement, the Roth conversion is in a league of its own. I like to think of it as paying your taxes on sale. You're intentionally moving money from your pre-tax accounts—like your traditional TSP or IRA—into a Roth IRA and paying the income tax now, so you never have to pay tax on that money again.

Sure, nobody loves writing a check to the IRS. But the real genius of a Roth conversion isn't just what you're doing, but when you do it. For federal retirees, there's a unique window of time where this strategy can save you an incredible amount of money down the road.

The Golden Opportunity of the "Gap Years"

This sweet spot is what many of us in the field call the "gap years." It's that period after you've retired but before you've started claiming Social Security or taking your Required Minimum Distributions (RMDs) from your retirement accounts (which now start at age 73 or 75).

During these few years, your taxable income is often the lowest it will ever be. Your federal salary is gone, and the big income sources that define retirement—Social Security and forced RMDs—haven't kicked in yet. This temporary dip in income creates a low-tax environment that's absolutely perfect for executing some strategic conversions.

Filling Up the Lower Tax Brackets

The name of the game is to convert just enough from your traditional TSP or IRA each year to "fill up" the lowest tax brackets without pushing yourself into a higher one.

For 2024, a married couple filing jointly is in the 12% federal tax bracket all the way up to $94,300 of taxable income. After that, the rate jumps to 22%. That 12% bracket is your playground.

By looking at your fixed income (like your FERS pension) and subtracting your standard deduction, you can see exactly how much "room" you have left. Then, you convert just enough to use up that room, locking in that low tax rate on the converted funds for good.

By methodically moving money from a tax-deferred to a tax-free account during your lowest-income years, you are essentially pre-paying taxes at a discount. This single action can prevent a massive tax headache when RMDs force you to take large, taxable withdrawals later.

A Practical Roth Conversion Example

Let’s walk through a common scenario. Imagine a retired federal employee, Sarah, who is 65. Her FERS pension gives her $50,000 a year. She and her husband will take the $29,200 standard deduction (for 2024).

- Taxable Income Before Conversion: $50,000 (pension) - $29,200 (deduction) = $20,800

Their $20,800 of taxable income sits squarely in the 12% tax bracket. Crucially, they have $73,500 of "space" left in that bracket before they hit the 22% threshold ($94,300 - $20,800).

This is Sarah's opportunity. She could convert $73,500 from her traditional TSP to a Roth IRA. That amount gets added to her income, bringing her taxable total right up to the $94,300 limit. She'll pay 12% in federal tax on that conversion, but now that $73,500 is in a Roth, where it can grow and be withdrawn completely tax-free forever.

Roth Conversion Scenario Analysis

To really see the long-term impact, let's compare paying a low tax rate now versus a potentially higher one later.

| Scenario | Conversion Amount | Tax Paid at Conversion (12%) | Future Tax on RMDs (22%) | Net Tax Savings |

|---|---|---|---|---|

| Roth Conversion | $73,500 | $8,820 | $0 | $7,350 |

| No Conversion | $0 | $0 | $16,170 | $0 |

This simple table shows that by converting $73,500 and paying the $8,820 in taxes now, you avoid a potential future tax bill of $16,170 on that same money. That's a net savings of $7,350 on just one year's conversion. Imagine the impact of doing this for several years in a row.

Strategic Considerations for Your Conversion Plan

While Roth conversions are incredibly effective, they aren't something to jump into blindly. A little bit of planning goes a long way.

- Pay Taxes from an Outside Account: This is a big one. If you can, pay the taxes on the conversion with money from a savings or brokerage account. If you use money from the conversion itself to pay the tax, you're shrinking the pot of money that gets to grow tax-free, which waters down the benefit.

- Watch for IRMAA Thresholds: A large conversion could bump your income high enough to trigger higher Medicare Part B and D premiums, known as IRMAA. Since these are based on your tax return from two years prior, you need to plan your conversion amounts carefully to stay under these income cliffs.

- The Five-Year Rule: Remember that any money you convert has to stay in the Roth IRA for five years before the principal can be withdrawn penalty-free. This rule makes conversions ideal for money you won't need in the near future.

For federal employees ready to make this move, knowing the nuts and bolts is key. Our guide on how to transfer your TSP to a Roth IRA provides a smart strategy guide to walk you through the process. Done right, a series of annual Roth conversions during your gap years can be one of the most powerful tax-saving moves you'll ever make.

Optimizing Social Security and Avoiding IRMAA Surcharges

Managing your income in retirement isn't just about trying to pay less to the IRS—it’s also about protecting the benefits you’ve worked so hard for. Two of the biggest financial hurdles for retirees are the taxation of Social Security benefits and the dreaded Medicare IRMAA surcharges. Both are tied directly to your income, which actually gives you a powerful incentive to keep it under control.

This isn’t some minor detail you can brush off. A single unplanned withdrawal from your TSP can create a ripple effect, increasing not only your tax bill but your healthcare costs at the same time.

How Your Income Impacts Social Security Taxes

It’s a surprise to many retirees, but yes, your Social Security benefits can be taxable. The IRS uses a specific formula based on what's called "provisional income" to figure out if you owe taxes on your benefits.

Here’s the simple math for it:

Your Adjusted Gross Income (AGI) + Nontaxable Interest + 50% of Your Social Security Benefits

Depending on where that number lands, up to 85% of your benefits could wind up being subject to federal income tax.

This is exactly where strategic withdrawals become so important. By pulling from a Roth account (which doesn't count toward your AGI) instead of your traditional TSP, you can keep that provisional income figure low. That simple move can mean the difference between paying tax on your benefits or keeping them entirely tax-free.

A lower provisional income doesn't just save you a few dollars; it fundamentally changes how much of your core retirement income you get to keep. Every dollar you avoid adding to your AGI from TSP withdrawals is a dollar that helps shield your Social Security.

For federal employees, when you claim is just as crucial as how you manage your income. To get the most out of your benefits, you have to understand the best claiming age for your specific situation. You can learn more by exploring our detailed guide on how to maximize Social Security.

Navigating the Medicare IRMAA Minefield

Beyond Social Security, your income has a direct—and often very expensive—impact on your Medicare premiums. If your Modified Adjusted Gross Income (MAGI) goes over certain thresholds, you'll get hit with an Income-Related Monthly Adjustment Amount (IRMAA).

This isn't a small fee. IRMAA is a significant monthly surcharge tacked onto your Part B (medical) and Part D (prescription drug) premiums. The Social Security Administration determines your IRMAA based on the tax return you filed two years ago. That means your 2024 income will set your 2026 premiums.

These income thresholds are like cliffs. Go over by just $1, and you can trigger hundreds or even thousands of dollars in extra premiums over the course of a year.

A Real-World IRMAA Scenario

Let's look at a retired couple, David and Maria, who are both on Medicare. In 2024, their main goal is to keep their MAGI under the $206,000 threshold for married couples filing jointly to avoid IRMAA. Their income breaks down like this:

- Pensions & Social Security: $160,000

- Planned TSP Withdrawals: $45,000

- Total Expected MAGI: $205,000

They are safely under the limit. But then, in December, they decide to pull an extra $2,000 from their TSP for a last-minute holiday trip. That small withdrawal pushes their MAGI to $207,000.

Because they crossed that line, their monthly Medicare Part B premiums in 2026 will each increase by $74.20.

- Monthly IRMAA Surcharge: $74.20 x 2 = $148.40

- Annual IRMAA Surcharge: $148.40 x 12 = $1,780.80

That seemingly innocent $2,000 withdrawal effectively cost them an extra $1,780.80 in healthcare premiums. Had they taken that money from a Roth IRA instead, their MAGI wouldn't have changed, and they would have completely avoided the surcharge.

This is a perfect example of why managing every single dollar of taxable income is so critical. Using Roth distributions, carefully timing capital gains, and making Qualified Charitable Distributions (QCDs) are all powerful tools to help you stay below those IRMAA cliffs and keep your hard-earned retirement savings in your own pocket.

Using State Tax and Charitable Strategies to Your Advantage

Federal tax planning is a massive piece of the retirement puzzle, but your strategy shouldn't stop there. Where you choose to live and how you give back can have a huge impact on your bottom line. These two levers—state tax planning and charitable giving—offer some powerful ways to keep more of your money.

Thinking about where you'll spend your retirement years? Your choice of state could save you thousands. The idea is simple: not all states treat retirement income the same way. The differences can be dramatic, with state income tax rates ranging from 0% to over 13%.

When you dig into state-specific retirement tax policies, you see how a smart move can significantly cut the tax bite on your pension and investments. Some states are particularly friendly to retirees. For example, while about a dozen states tax Social Security benefits, most don't, providing an immediate financial boost. You can discover more insights about global retirement tax regimes to see just how much location matters.

Leveraging Qualified Charitable Distributions

Once you hit age 70½, a fantastic tool opens up: the Qualified Charitable Distribution (QCD). This strategy lets you send money directly from your traditional IRA to a qualified charity. It's a simple move with profound tax implications.

So, why is this so effective? A QCD lets you satisfy all or part of your Required Minimum Distribution (RMD) for the year, up to $105,000 in 2024. The brilliant part is that the money travels straight from your IRA to the charity. It never touches your hands, so it never shows up as taxable income on your return.

This move directly lowers your Adjusted Gross Income (AGI), which can set off a chain reaction of other tax benefits.

A QCD is one of the few ways to meet your RMD obligation without increasing your taxable income. This single move can help you stay in a lower tax bracket, reduce the taxable portion of your Social Security benefits, and avoid costly Medicare IRMAA surcharges.

How a QCD Works in Practice

Let's look at a real-world example. Imagine Robert, a 75-year-old federal retiree. His RMD from his IRA this year is $20,000, and he also plans to donate $10,000 to his local animal shelter.

Here are his two options:

- Standard Withdrawal and Donation: Robert takes his $20,000 RMD, and that full amount gets added to his taxable income. He then writes a $10,000 check to the charity. He can try to claim it as an itemized deduction, but with today's high standard deduction, there's a good chance he won't get any tax benefit from it.

- Using a QCD: Robert simply instructs his IRA custodian to send $10,000 directly to the animal shelter. He then withdraws the remaining $10,000 of his RMD for his living expenses.

The result? By using the QCD, Robert’s taxable income for the year is $10,000 lower. He fulfilled his charitable goals and his RMD obligation in the smartest way possible.

Key Rules for Making a QCD

To make sure your gift qualifies for this fantastic tax treatment, you just need to follow a few simple rules.

- Age Requirement: You have to be at least 70½ years old on the day you make the distribution.

- Direct Transfer: The money must go straight from your IRA custodian to the charity. You can't take the money out first and then write a check.

- Eligible Accounts: QCDs can only come from traditional IRAs, inherited IRAs, SEP IRAs, and SIMPLE IRAs. They are not allowed from employer-sponsored plans like a 401(k) or the TSP.

- Qualified Charity: The organization receiving your gift must be a registered 501(c)(3). This means donor-advised funds and private foundations don't qualify.

By combining savvy state-level tax planning with strategic giving through QCDs, you can unlock significant savings and put more of your hard-earned money to work for you.

Got Questions About Your Retirement Taxes? We've Got Answers.

When it comes to retirement, taxes are one of the biggest puzzle pieces. It's only natural to have questions. In fact, after working with hundreds of federal employees, I've found that the same handful of concerns pop up time and time again.

Let's walk through some of the most common questions I hear. Getting these right can literally be the difference between a tax-efficient retirement and one filled with costly surprises.

When Is the Best Time to Do a Roth Conversion?

This is a big one. The sweet spot for most federal employees is what I call the "gap years"—that golden window after you've retired but before you've turned on Social Security and your TSP Required Minimum Distributions (RMDs) kick in.

Think about it: during this period, your taxable income is likely the lowest it will ever be. This gives you a unique opportunity to strategically convert pre-tax TSP or IRA funds into a Roth. You're essentially "filling up" the lower tax brackets, like the 10% and 12% brackets, with converted income. You pay a small amount of tax now to move that money into a tax-free bucket for life, avoiding a much bigger tax bite down the road.

How Can I Avoid That Nasty Medicare IRMAA Surcharge?

Ah, IRMAA. The Income-Related Monthly Adjustment Amount is a thorn in many retirees' sides. The trick to avoiding it is all about managing your Modified Adjusted Gross Income (MAGI) to stay below the government's annual thresholds.

Here's how you stay in the clear:

- Be smart about withdrawals. Instead of pulling big chunks from your traditional TSP, lean on your Roth accounts or cash savings first to cover expenses.

- Time your capital gains. If you're selling a highly appreciated stock or property, try to do it in a year when your other income is lower. A one-year income spike can trigger IRMAA for years to come.

- Use Qualified Charitable Distributions (QCDs). Once you're over 70.5, you can donate your RMD directly to charity. The money never touches your tax return, so it doesn't count toward your MAGI.

- Know how to appeal. If a one-time event like selling your home pushes you over the limit, don't just accept the higher premium. You can file Form SSA-44 to appeal based on a life-changing event.

Staying just under an IRMAA cliff is one of the most powerful moves you can make. A single unplanned withdrawal can cost you thousands of dollars a year in higher Medicare premiums. It’s that serious.

Do I Have to Take Withdrawals from My Roth TSP When I Retire?

Nope! And this is exactly what makes the Roth TSP so powerful.

Unlike your traditional TSP, Roth accounts are not subject to Required Minimum Distributions (RMDs) for you, the original owner. That money can just sit there, growing completely tax-free, for your entire life. You can let it compound for decades, using it as a tax-free emergency fund or leaving a tax-free inheritance for your kids. It’s the ultimate financial control.

Should I Take Money from My TSP or My Brokerage Account First?

For the vast majority of retirees, you'll want to tap into your taxable brokerage account first. It’s a fundamental part of a smart withdrawal strategy.

The math is pretty straightforward. Money coming out of a brokerage account is typically taxed at the much lower long-term capital gains rates—think 0%, 15%, or 20%. Every single dollar you pull from your traditional TSP, however, is taxed as ordinary income, which is almost always a higher rate. By drawing from your brokerage account first, you can often pay 0% tax on those gains if your overall income is low enough.

This tactic lets your tax-deferred TSP money continue to grow untouched and gives you precise control over your taxable income. And as we've seen, controlling your income is the key to managing your tax bracket, Social Security taxes, and those pesky IRMAA surcharges.

Getting a handle on these concepts is your first step toward building a truly tax-efficient retirement. At Federal Benefits Sherpa, we help federal employees put these strategies into a personalized plan that works for their specific situation. If you're ready to see what this could look like for you, schedule your free 15-minute benefits review today at https://www.federalbenefitssherpa.com.