Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Guide to Thrift Saving Plan Withdrawal Options

Deciding what to do with your Thrift Savings Plan (TSP) after you leave federal service is just as important as the decades you spent building it. This guide is here to cut through the complexity and lay out your options in plain English, helping you create a smart strategy for your retirement.

Your Guide to Smart TSP Withdrawal Decisions

Making the right call on your TSP withdrawals is a cornerstone of your broader financial planning for retirement. Think of your TSP as a reservoir you've painstakingly filled over your career—our goal is to show you how to open the tap just right, so it provides for you for the rest of your life without running dry too soon.

We’ll walk through every withdrawal option, diving into the critical details like taxes, timing, and how each choice aligns with your long-term goals. By the end, you'll have the clarity to move forward with confidence and secure the retirement you've worked so hard for.

Key Withdrawal Concepts

First things first, let's get familiar with the basic ways you can access your TSP funds. Each method is designed for a different need, whether you want a large chunk of cash right away or a steady, predictable income stream to last for years.

Your primary thrift saving plan withdrawal options fall into three main categories:

Lump-Sum Payments: Taking some or all of your account balance in one single payment.

Installment Payments: Setting up a regular, pension-like income paid monthly, quarterly, or annually.

Life Annuity: Trading a portion of your TSP balance for a guaranteed income stream for life, provided by an insurance company.

It’s interesting to see how retirees' preferences are shifting. More and more federal retirees are opting for flexible income streams instead of locking into fixed annuities. In fact, post-separation withdrawals have surged. Data from 2025 shows record activity, with total post-separation withdrawal transactions reaching nearly 4 million and distributions hitting about $15 billion so far this year. You can see the full breakdown in the FRTIB's April 2025 Participant Activity Report.

The core challenge of TSP withdrawals isn't just getting your money out; it's designing a sustainable, tax-efficient income plan that can support your lifestyle for the next 20, 30, or even 40 years.

This trend underscores just how critical it is to weigh the pros and cons. A lump sum gives you immediate access to your cash but can trigger a massive tax bill. Installments offer great flexibility but require you to manage your money carefully so it doesn't run out. An annuity provides peace of mind with guaranteed income, but you give up control and potential market growth. We'll explore these trade-offs every step of the way.

Exploring Your Post-Separation Withdrawal Options

Once you separate from federal service, your Thrift Savings Plan shifts its purpose. For decades, it was all about accumulation—building your nest egg. Now, it's time to turn it into a personal income engine for your retirement. This is a huge milestone, and figuring out your thrift saving plan withdrawal options is the first step toward creating a reliable retirement income.

Think of it this way: you've spent your entire career cultivating a field. Now, you have to decide on your harvesting strategy. Do you bring in the entire crop at once? Or do you plan for a steady, manageable supply that will last you for the rest of your life?

This section will walk you through the four main ways you can access your funds after you hang up your hat. We’ll look at how each one works in the real world so you can confidently match the right strategy to your financial goals.

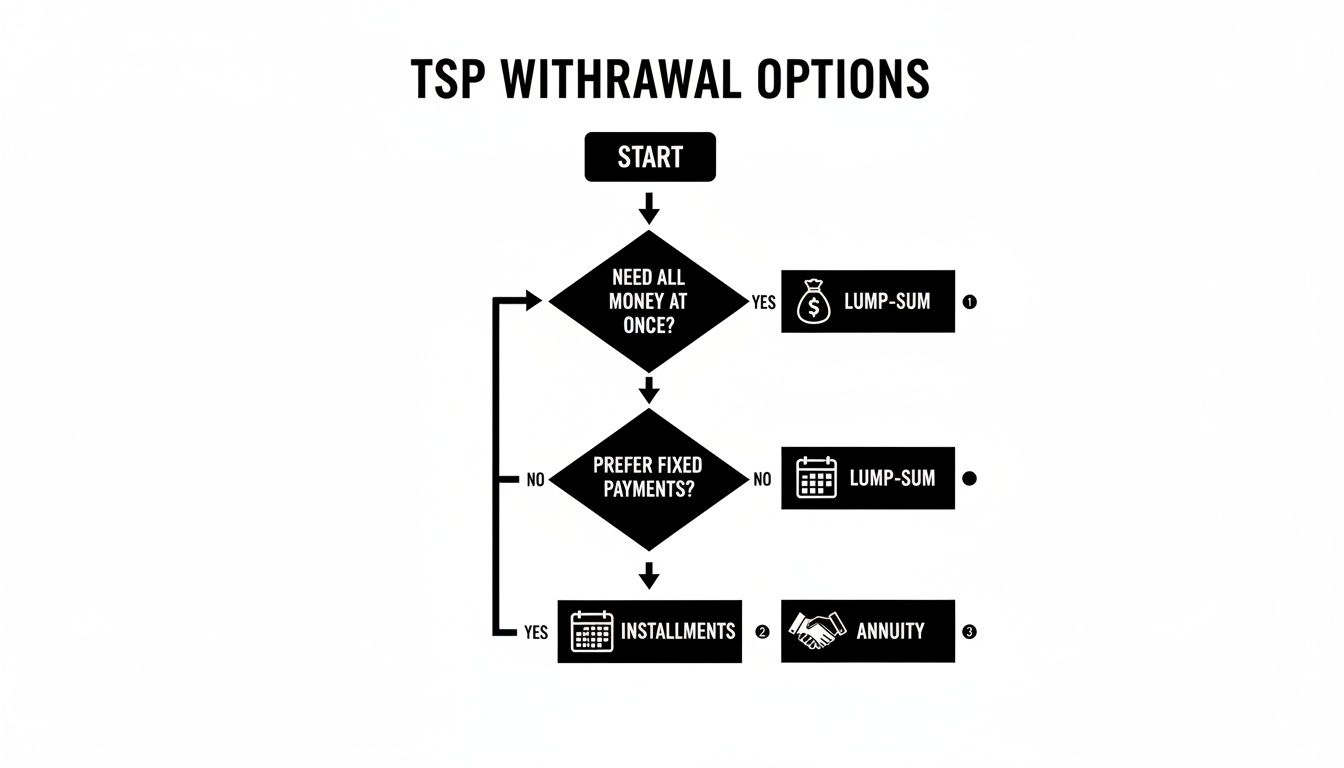

This flowchart gives you a great visual overview of your main choices, helping you see how each path leads to a different retirement reality.

As the chart shows, this isn't just about getting your money out. It's a strategic decision between immediate access, a flexible income stream, or lifetime financial security.

1. Full Lump-Sum Withdrawal

The most straightforward choice is taking a full lump-sum withdrawal. This means you cash out your entire TSP account balance in one single payment. It’s like harvesting your whole field in one day—you get all the proceeds at once, but you also have to deal with the immediate consequences, especially taxes.

This option can be mighty tempting if you have big plans, like paying off your mortgage or buying that dream RV. The downside? A massive, immediate tax bill. Taking a huge withdrawal from a Traditional TSP will almost certainly catapult you into a higher tax bracket for that year. A significant chunk of your hard-earned savings could end up going straight to the IRS.

2. Partial Lump-Sum Withdrawals

A far more flexible approach is to take one or more partial lump-sum withdrawals as you need them. Thankfully, the TSP Modernization Act did away with the old, restrictive rules. You’re no longer limited to a single partial withdrawal before being forced to choose a permanent option for the rest.

This is perfect for covering large, one-off expenses without draining your entire account. Maybe you need $50,000 for a new roof or want to help a grandchild with college tuition. You can take just what you need, and the rest of your TSP funds stay put, continuing to grow and compound. It’s a surgical approach that gives you cash on demand while preserving your long-term nest egg.

One important thing to know: You can't pick and choose which TSP funds (like the C, S, or I Fund) to sell from. All withdrawals are taken proportionally from every fund you're invested in. This can be a real drawback if you're forced to sell during a market downturn.

3. TSP Installment Payments

If you’re looking for a predictable, recurring income stream, TSP installment payments are a fantastic option. This feature lets you essentially create your own customized pension. You can set up payments to be sent to you monthly, quarterly, or annually, giving you a reliable source of cash to cover your bills and living expenses.

You have two ways to structure these payments:

Fixed Dollar Amount: You tell the TSP exactly how much you want, like $2,000 per month. Payments will continue until your account runs dry.

TSP Life Expectancy Calculation: The TSP will calculate a payment for you based on your age and account balance, using IRS life expectancy tables. The goal is to make the money last for your lifetime, and the amount is recalculated every year.

The real power of installment payments is their flexibility. You can start them, stop them, or change the amount whenever you want. If an unexpected expense pops up, you can increase your payments for a while. If you start drawing Social Security and need less, you can dial them back. This level of control makes it a go-to choice for retirees who want a steady paycheck without locking their money away for good.

4. The TSP Life Annuity

Your final option is to use some or all of your TSP balance to purchase a life annuity. This is done through the TSP's annuity provider, currently MetLife. In simple terms, you are trading a chunk of your account balance for a guaranteed monthly check that will continue for the rest of your life—no matter how long you live.

This is the ultimate "sleep-at-night" option. It completely eliminates market risk and the fear of outliving your savings. But that peace of mind comes with a trade-off. Once you buy the annuity, the decision is irreversible. You lose control over that money, it no longer has the potential to grow with the market, and depending on which survivor options you pick, there may be little or nothing left for your heirs when you pass away.

Comparing Your Post-Separation TSP Withdrawal Options

To make things clearer, here’s a side-by-side look at the main withdrawal methods. This table can help you quickly grasp the pros and cons of each approach for your retirement.

Withdrawal OptionFlexibility and ControlTax ImpactLong-Term Growth PotentialBest Suited ForLump-Sum (Full)High initial control over the cash.Very high, as the entire amount is taxed as income in one year.None, since the funds are no longer invested in the TSP.Paying off large debts or moving all funds to another investment account immediately.Lump-Sum (Partial)High flexibility for specific needs.Moderate and controllable, based on the amount taken.High, as the remaining funds stay invested and can continue to grow.Covering large, one-time expenses while preserving the bulk of your savings.Installment PaymentsVery high; you can start, stop, or change payment amounts.Moderate and predictable, as income is spread out over many years.High, as the account balance continues to be invested between payments.Creating a flexible, customized income stream to supplement your pension or Social Security.TSP Life AnnuityLow, as the decision is generally irreversible.Moderate, with predictable taxation on each monthly payment.None, because the funds are converted into a fixed income stream.Retirees who prioritize maximum security and want a guaranteed lifelong paycheck.

In the end, there's no single "best" answer. Many federal retirees find success by using a combination of these thrift saving plan withdrawal options. For instance, you could roll a portion of your TSP to an IRA to get more investment choices, set up monthly installment payments for your core expenses, and still keep a healthy balance in the TSP for future partial withdrawals. The right strategy is the one that fits your personal finances, your comfort with risk, and your vision for retirement.

Tapping Into Your TSP Before You Leave Federal Service

It’s a common misconception that your Thrift Savings Plan (TSP) is completely off-limits until the day you officially separate from federal service. The truth is, under certain specific circumstances, you can access your retirement funds while you’re still on the payroll. These are called in-service withdrawals, and they can be a critical financial tool when you know how they work.

Getting familiar with these pre-retirement withdrawal options is essential because each comes with its own set of rules and potential consequences. The TSP offers two distinct paths for in-service withdrawals: one for employees who are 59½ or older (age-based) and another for those facing a legitimate financial crisis (hardship).

The 59½ "Practice Retirement" Withdrawal

Once you hit that magic age of 59½, the TSP rules loosen up quite a bit. You gain access to what’s known as an age-based in-service withdrawal. I like to think of it as a penalty-free preview of your retirement funds, without having to actually hang up your hat.

You can take out all or just a portion of your vested account balance. This option is pretty attractive for a few reasons:

No 10% Early Withdrawal Penalty: You've met the age requirement, so the IRS won't hit you with that pesky penalty.

Use It for Anything: The money is yours to use for any reason—paying down your mortgage, buying a boat, you name it. There's no need to justify the expense.

Keep on Saving: Taking an age-based withdrawal doesn't stop you from continuing to contribute to your TSP. Your regular contributions can keep flowing.

Just keep in mind, any money you pull from your traditional (pre-tax) TSP balance will be taxed as ordinary income at the federal level and, in most cases, at the state level too. It’s a fantastic way to get some liquidity, but it's not free money—you're still dipping into the nest egg you'll need later.

Financial Hardship Withdrawals

Life happens. Sometimes, a true financial emergency can turn your world upside down. For these specific, dire situations, the TSP offers a financial hardship withdrawal. Unlike its age-based counterpart, this isn't about convenience; it’s strictly for well-documented, pressing financial needs.

To even qualify, your situation has to fall into one of the specific categories defined by the IRS. We're talking about things like:

Negative monthly cash flow

Unreimbursed medical bills

Losses to your home not covered by insurance

Legal fees for a divorce or separation

A financial hardship withdrawal should be your absolute last resort. You are permanently removing money from your retirement account, and it comes with heavy consequences—including taxes and a likely 10% early withdrawal penalty if you're under 59½.

Recent data shows that financial strain is on the rise among federal workers. Hardship withdrawals and TSP loans have climbed to their highest rates in five years, reaching 3.9% and 8.6% usage, respectively. These numbers, detailed in a report on TSP withdrawal trends, are especially high for mid-career and lower-paid employees feeling the pinch of inflation.

Given the serious, long-term impact on your retirement security, it's crucial to understand every detail. For a deep dive, read our comprehensive guide on TSP hardship withdrawal rules. In almost every case where you're facing a temporary cash crunch, a TSP loan is a much smarter move. A loan lets you pay the money back—with interest—to yourself, preserving your retirement savings and avoiding the permanent damage of a hardship withdrawal.

Understanding Taxes, Penalties, and Rollovers

Figuring out your TSP withdrawal options isn't just about picking how to get your money; it’s about understanding the rules of the road that dictate how much you actually get to keep. This is where smart planning really makes a difference, because taxes, potential penalties, and strategic moves like rollovers can fundamentally change your retirement picture.

Every choice you make needs to be viewed through a financial lens. What seems like a simple decision today can create ripple effects for years, influencing everything from your annual income to your tax bracket and how long your nest egg will last.

Traditional TSP vs. Roth TSP Withdrawals

The first fork in the road is understanding the difference between your Traditional and Roth TSP balances. The way you contributed over the years determines exactly how the IRS treats your money when it comes out.

Think of your Traditional TSP as a tax-deferred garden. You got a tax break on the seeds (your contributions) and didn't pay taxes on the rain and sun (the growth). But when it’s time to harvest in retirement, every dollar you take out is taxed as ordinary income.

Your Roth TSP is the opposite. You already paid taxes on the seeds when you planted them. Because you made contributions with after-tax money, the entire harvest—both your original contributions and all the earnings—is completely tax-free. This is, of course, provided you meet two simple conditions:

You are at least age 59½.

At least five years have passed since your very first Roth contribution.

This tax-free growth and withdrawal make the Roth TSP an incredibly powerful tool for creating predictable income in retirement.

Sidestepping the 10 Percent Early Withdrawal Penalty

The IRS isn’t a fan of people tapping their retirement funds too early. To discourage this, they generally slap a 10% penalty on withdrawals taken before age 59½, and the TSP is no exception. This stings because it’s on top of the regular income tax you’ll owe.

But for federal employees, there’s a major exception to this rule. It’s a game-changer.

If you separate from federal service during or after the year you turn 55, any withdrawals you make directly from your TSP are exempt from the 10% early withdrawal penalty. This is a special rule that doesn’t apply to IRAs.

Other exceptions exist for situations like total and permanent disability, certain medical expenses, or payments to a beneficiary after your death. Knowing these rules is absolutely critical if you're planning an early retirement before age 59½.

The Power of a Rollover to an IRA

While the TSP is a fantastic, low-cost way to save, it's not without its limits—especially when it comes to investment choices. This is precisely why many feds and retirees choose to perform a rollover, moving their TSP funds into an Individual Retirement Account (IRA).

A rollover isn't a typical withdrawal. It's a tax-free transfer from one retirement account to another, and it opens up a whole new world of possibilities.

Key Benefits of a TSP to IRA Rollover:

Vastly Expanded Investment Choices: An IRA gives you access to a nearly endless universe of stocks, bonds, ETFs, and mutual funds, allowing you to build a truly customized portfolio.

Greater Withdrawal Flexibility: IRAs often give you more control, like selling specific assets to raise cash, which is a big contrast to the TSP's pro-rata withdrawal rule.

Consolidated Account Management: It’s an opportunity to bring old 401(k)s and other retirement accounts under one roof, making your financial life much simpler to manage.

Doing this correctly is key to avoiding an unnecessary tax bill. For a step-by-step walkthrough, check out our guide: how to rollover your TSP to an IRA in our complete guide.

Navigating Required Minimum Distributions

Finally, you can't keep your money in your TSP forever. The IRS eventually wants its cut, so it mandates that you start taking Required Minimum Distributions (RMDs) once you hit a certain age (currently age 73 for most people).

The TSP actually makes this pretty painless. If you haven't started taking money out by your RMD deadline, the TSP will automatically calculate the correct amount and send it to you. This is a great safety net, as failing to take your full RMD can result in a hefty IRS penalty.

Getting a handle on the tax side of your TSP is a non-negotiable part of good retirement planning. For a deeper dive, you can explore resources like these tax insights on TSP withdrawals from BlueSage Tax. While the rules might seem complex at first, mastering them is how you build a retirement income strategy that truly works for you.

Building Your Personal TSP Withdrawal Strategy

Knowing the rules of the road is one thing, but figuring out how to apply them to your own life is something else entirely. The "best" way to take money from your TSP isn't a one-size-fits-all answer. It's deeply personal and hinges on your unique situation, your comfort with risk, and what you want your retirement to look like.

To help bridge that gap from theory to practice, let's walk through a few common scenarios. We'll follow the decision-making process of three different federal employees to see how different withdrawal strategies can be tailored to specific goals. These stories should give you a tangible framework for thinking about your own plan.

Pre-Retiree Paula's Income Plan

First up is Paula, a 61-year-old FERS employee who is just a couple of years away from hanging it up. Her number one priority is creating a steady, predictable income stream to go along with her FERS pension and Social Security. She’s not chasing aggressive growth anymore; she just wants stability and the peace of mind that comes with knowing her money will last.

For someone like Paula, a blended approach makes a ton of sense:

TSP Installment Payments: She decides to set up monthly payments for a fixed dollar amount. This essentially creates a personal pension, giving her a reliable "paycheck" to cover her core living expenses. She also loves the flexibility—if her needs change, she can just hop online and adjust the payment amount.

Partial Lump-Sum Reserve: Paula is smart enough to leave a good chunk of her balance in the TSP even after starting her installments. This account now serves as her reserve fund for emergencies or just plain fun. If she needs $20,000 for a new car or a dream vacation, she can request a partial withdrawal without messing up her monthly income flow.

This two-pronged strategy gives Paula the best of both worlds: the consistency of a pension-like payment combined with the on-demand access of a savings account.

Mid-Career Mark's Emergency Decision

Now let's look at Mark, a 45-year-old fed who just got hit with a major financial curveball. A nasty storm damaged his home, and the repairs are going to cost $15,000 more than his insurance is covering. He needs cash, and he needs it fast. His first thought is his TSP, but he's weighing a loan against a financial hardship withdrawal.

The hardship withdrawal seems tempting at first because it feels direct. But once he digs into the details, he sees the long-term damage it would do. Taking that $15,000 out permanently means he'd immediately owe income taxes on it, plus he'd get slammed with the 10% early withdrawal penalty.

Instead, Mark wisely opts for a TSP loan. This is a much better move for his situation.

A TSP loan isn't really a withdrawal. You're just borrowing from yourself, and you pay yourself back with interest. This keeps your retirement savings whole and helps you sidestep the brutal taxes and penalties that come with a hardship withdrawal.

This is a critical distinction, especially during tough economic times. When government shutdowns happen, for instance, you often see a spike in hardship withdrawals as people scramble for cash. But as this analysis of TSP hardship trends explains, it's almost always better to exhaust every other option first. By choosing the loan, Mark keeps his nest egg growing for the future.

New Retiree Nancy's Rollover Strategy

Finally, let's talk about Nancy. She just retired at 64 with a healthy TSP balance, but she’s starting to feel a bit boxed in. She's not a fan of the TSP's limited investment options and, more importantly, wants to have more sophisticated estate planning tools to pass her assets on to her kids.

After sitting down with a financial advisor, Nancy decides her best move is to roll her TSP over to a traditional IRA.

This one decision immediately opens up a whole new world of possibilities for her:

Expanded Investment Universe: In her new IRA, Nancy can invest in almost anything—individual stocks, thousands of different mutual funds, ETFs, you name it. This allows her to fine-tune a portfolio that perfectly aligns with her goals.

Strategic Withdrawals: Unlike the TSP's pro-rata rule, her IRA lets her choose which specific assets to sell when she needs cash. If the stock market is down, she can sell bonds to raise money and let her stock funds recover.

Estate Planning Flexibility: An IRA gives her far more advanced beneficiary options. She can set up "stretch" provisions for her heirs, which is a much more tax-efficient way for them to inherit the money.

By rolling her funds into an IRA, Nancy gains a level of control and customization that the TSP simply wasn't designed to offer. It empowers her to manage her retirement—and her legacy—on her own terms.

A Step-By-Step Guide to Requesting a Withdrawal

Alright, you’ve done the hard work of figuring out which Thrift Savings Plan withdrawal option is right for you. Now it's time to actually get your money. The good news is that the TSP has made this part pretty painless, with most of the action happening right on their website. Think of it less like filling out stacks of complicated government forms and more like having the right information ready to go.

It’s a bit like getting ready for a road trip. You wouldn't just hop in the car; you'd gather your map, snacks, and make sure you have a full tank of gas. Taking a few minutes to collect the necessary details before logging into TSP.gov will make the whole process go much smoother.

Preparing for Your Withdrawal Request

A little prep work up front can save you a world of headaches later. Getting timed out of the system because you had to dig through a file cabinet for your bank's routing number is just frustrating.

Here’s a quick checklist of what to have on your desk before you start:

Bank Information: If you want the money sent directly to your bank, you'll need the routing number and your account number. It's a good idea to pull up your bank's website or have a check handy to get these exactly right.

Rollover Details: Moving funds to an IRA or another retirement account? You'll need the name and address of that financial institution, plus your account number there.

Spousal Information: This is a big one. If you’re a married FERS employee, your spouse has to give their consent for most types of withdrawals. This isn't just a TSP rule; it's a legal protection.

Don't underestimate the spousal consent requirement. It’s a formal step designed to protect both of you. Your spouse will usually have to sign a consent form, and it often needs to be notarized. Factor that extra time into your planning.

Submitting and Tracking Your Request

Once you have all your info gathered, log into your TSP account and navigate to the withdrawals section. The site uses a straightforward wizard that walks you through every decision. You'll confirm the type of withdrawal (like a lump sum or monthly installments) and the specific amount. The whole interface is designed to prevent mistakes, guiding you one step at a time.

After you hit "submit," you won't be left wondering what happens next. You can track the entire process from your TSP account dashboard. While processing times can vary, you’ll be able to see exactly when your request was received, when it’s approved, and when the money is on its way. It gives you clear visibility from start to finish.

Common Questions About TSP Withdrawals

Once you've separated from federal service, you'll likely have questions as you start managing your TSP in retirement. Getting clear, straightforward answers is key to feeling confident about the decisions you make with your hard-earned savings.

Let's tackle some of the most common questions federal retirees have.

Can I Change My TSP Installment Payments?

Yes, you absolutely can. The TSP is surprisingly flexible when it comes to installment payments, which is a huge plus for retirees whose financial needs might change over time.

You can simply log into your online TSP account at any time to adjust the payment amount, change how often you receive them (monthly, quarterly, or annually), or even pause them altogether. If your situation changes again, you can just as easily restart them.

What Happens to My TSP If I Pass Away?

If you pass away, your entire vested TSP account balance will be paid out to your designated beneficiaries. This is why keeping your beneficiary information updated is so incredibly important.

The official form for this is the Form TSP-3, Beneficiary Designation. If you don't have a valid form on file, the TSP will distribute your money according to a standard "order of precedence"—starting with your spouse, then children, and so on. This default order may not be what you actually want, so don't leave it to chance.

Does a TSP Loan Affect Post-Separation Withdrawals?

It certainly does, and this is a critical point to understand. If you leave federal service with an outstanding TSP loan, you have to deal with it.

If you don't repay the loan, the TSP will declare the entire outstanding balance a "taxable distribution." This means it gets added to your income for the year and is taxed accordingly. Even worse, if you're under age 59 ½, you could also get hit with a 10% early withdrawal penalty on top of the taxes.

To get a deeper understanding of how these penalties work and how you might avoid them, check out our complete guide on when you can withdraw from your TSP without penalty.

Planning your federal retirement can feel like a puzzle, but you don't have to put the pieces together alone. At Federal Benefits Sherpa, we specialize in helping federal employees build retirement strategies that are clear and effective.

Schedule your free 15-minute benefits review today and get the clarity you deserve for your future.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved