When Can I Withdraw From My TSP Without Penalty? A Complete Guide

The big question for most federal employees isn't if they can access their TSP, but when and how. Generally, you can get to your money when you leave federal service, hit age 59½, or find yourself in a qualifying financial hardship.

The timing, however, is everything. Your age—specifically whether you've reached 55 or 59½—is the magic number that often determines if you'll get hit with a hefty 10% early withdrawal penalty. Getting these rules straight from the start is the best way to protect the retirement savings you've worked so hard to build.

Your Guide to TSP Withdrawal Options

Think of your TSP account as a vault. You have a few different keys, but each one works only at a specific time or under certain circumstances. Some keys let you in early but will cost you in penalties. Others only work once you hit a major milestone, like retirement, but grant you full, penalty-free access.

When you can pull money from your TSP really boils down to three main scenarios:

- While you're still working for the government.

- After you've separated from federal service.

- Once you've reached the key retirement age of 59½.

Each path comes with its own set of rules, potential taxes, and strategic considerations. Let's map out what this looks like for you.

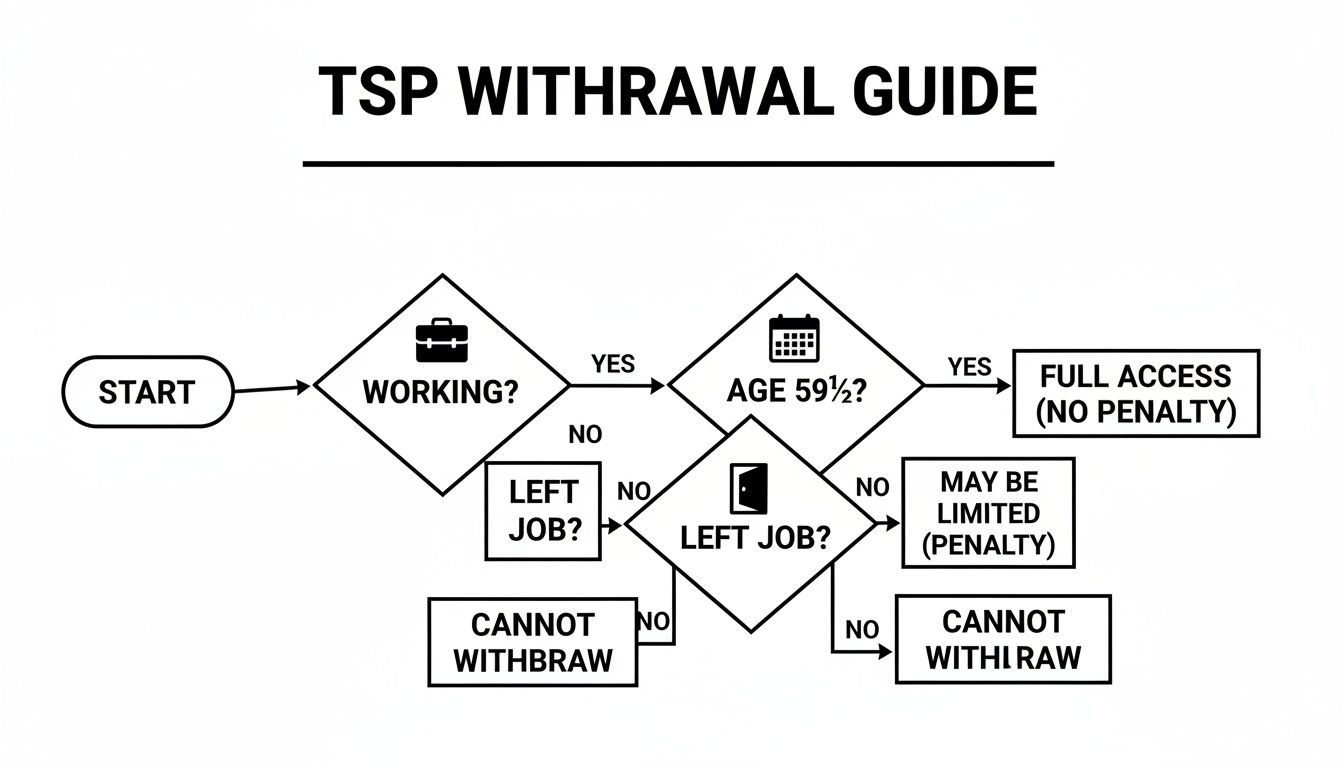

Navigating Your Withdrawal Timeline

To make sense of these complex rules, it helps to see the big picture. This flowchart lays out the main decision points based on your employment status and age, showing you which path you might be on.

As you can see, your options change dramatically depending on whether you’re still on the payroll or have already turned in your badge.

To break it down even further, here is a quick overview of the most common withdrawal situations.

Key TSP Withdrawal Scenarios and Rules

This table provides a high-level summary of the primary conditions, ages, and rules for accessing your Thrift Savings Plan (TSP) funds. Think of it as your cheat sheet for understanding the basics.

| Withdrawal Scenario | Key Age or Condition | Is It Penalty-Free? | Primary Options Available |

|---|---|---|---|

| Still Working | Age 59½ or older | Yes | Up to four in-service withdrawals per year. |

| Still Working | Any age | No | Financial hardship withdrawal (subject to penalty). |

| Separated from Service | In the year you turn 55 or later | Yes | Full or partial withdrawals, installment payments. |

| Separated from Service | Before age 55 | No | Full or partial withdrawals (subject to penalty). |

This table is a great starting point, but it's important to remember that a withdrawal is a permanent decision—the money is gone from your account for good. This is very different from taking out a TSP loan, which you pay back over time.

For temporary cash needs, a loan might be a better fit. You can learn more by checking out our complete guide to borrowing from your TSP. Each of these scenarios has details and nuances we’ll explore further.

It's a common misconception among federal employees that their Thrift Savings Plan is completely off-limits until retirement. While the TSP is absolutely designed for the long haul, life happens, and sometimes you need access to your funds sooner. The good news is, there are a couple of very specific situations where you can tap into your TSP while still on the job.

Think of your TSP as a retirement nest egg you're carefully protecting. You wouldn't want to crack it open for just anything, but for a true emergency or once you hit a key age, the rules allow for some flexibility. The two main ways to access your TSP while still employed are for a financial hardship or after you reach age 59½.

Financial Hardship Withdrawals

A financial hardship withdrawal is exactly what it sounds like—it's meant for serious, unforeseen financial emergencies. This isn't for putting in a new kitchen or booking a cruise. The TSP has a very strict definition of what qualifies.

To even be considered, you have to prove your need stems from one of these specific scenarios:

- Recurring Negative Cash Flow: You’re consistently in the red each month, with expenses outstripping your income.

- Medical Expenses: For you, your spouse, or your dependents, specifically for costs that insurance won't cover.

- Personal Casualty Losses: You've suffered uninsured damage to your property from a disaster like a fire, flood, or hurricane.

- Legal Expenses: This is for attorney fees and court costs related to a legal separation or divorce.

It’s critical to understand that a hardship withdrawal is a one-way street. It’s not a loan; you can't pay it back. The money you take out is gone for good, along with all the future growth it would have generated.

Important Takeaway: A hardship withdrawal should be your absolute last resort. Before you even think about it, you should have already exhausted every other option, like tapping into an emergency fund or securing a personal loan.

On top of that, these withdrawals almost always come with a hefty tax bill. The amount you take is taxed as ordinary income, and if you're under age 59½, you'll likely get hit with an extra 10% early withdrawal penalty. To get a complete picture, you can read our in-depth guide covering the specific TSP hardship withdrawal rules.

The Age 59½ In-Service Withdrawal

Hitting age 59½ while you're still working is a major milestone for your TSP. It unlocks a much more flexible and powerful option: the age-based in-service withdrawal. At this point, you can take money from your TSP for any reason at all—no hardship justification needed. Best of all, you avoid that nasty 10% early withdrawal penalty.

This is a real game-changer for older employees. It gives you the freedom to supplement your income, wipe out high-interest debt, or finally make that big purchase you've been planning, all without having to separate from service. Thanks to the TSP Modernization Act, you can even make up to four of these age-based withdrawals each calendar year.

Recent data shows just how much financial pressure federal workers are under, with hardship withdrawals climbing to 3.9% in 2024—the highest they've been in five years. This trend really underscores why having penalty-free access at 59½ is such a valuable tool.

This flexibility makes the age-based withdrawal a fantastic strategic financial tool when used correctly.

Example Scenario

Let’s say you’re a 60-year-old federal employee with a nagging $20,000 car loan. Instead of juggling that monthly payment, you could request an age-based withdrawal from your TSP. You'll still owe income tax on the $20,000, but you'll completely sidestep the 10% penalty, making it a far smarter financial move than a hardship withdrawal would have been.

The Magic Number: What Happens at Age 59½

For federal employees with a Thrift Savings Plan, hitting age 59½ is a big deal. It’s like being handed the keys to your financial kingdom, unlocking your retirement funds without the usual alarms and penalties going off. This age is the most straightforward and flexible milestone for accessing your TSP money, whether you're still on the job or have already moved on.

The single greatest benefit is that the 10% early withdrawal penalty vanishes. This extra tax is designed to keep people from raiding their retirement accounts too soon, but once you reach 59½, the government essentially says, "Okay, you're old enough to manage your own money." This opens up a whole new playbook for your financial strategy.

If you’re still working, this newfound flexibility can be a powerful tool. You can use it to supplement your income, wipe out high-interest debt, or pay for a major life event like a child's wedding—all without having to leave your career.

A New Era of Flexibility

It wasn’t always this easy. The old TSP rules were incredibly rigid, often forcing you into a single, irreversible decision about your money after you left service. Thankfully, things have changed for the better, transforming your TSP into a much more adaptable account.

One of the biggest improvements came from the TSP Modernization Act. If you're a federal employee who is 59½ or older, you can now take up to four in-service withdrawals each calendar year. This is a massive leap forward from the old, restrictive rules. The changes also let you adjust payment amounts whenever you need to and choose between quarterly or annual payouts, not just monthly ones. To see how these updates fit into a broader plan, you can explore more TSP withdrawal strategies.

This shift from a one-and-done choice to a flexible, multi-access system puts you firmly in control of your financial future, both in your final working years and throughout retirement.

How Your Withdrawals Get Taxed

Even though the 10% penalty is off the table after 59½, you still need to think about income tax. How your withdrawal is taxed depends entirely on where the money comes from: your Traditional TSP balance or your Roth TSP balance.

It helps to think of them as two separate buckets with opposite tax rules.

Traditional TSP: This is your pre-tax bucket. Since you didn't pay taxes on the money when it went in, you have to pay them when it comes out. Any money you withdraw from your Traditional TSP is taxed as ordinary income in the year you take it.

Roth TSP: This is your after-tax bucket. You already paid income tax on these contributions, which means qualified withdrawals are completely tax-free. That includes both what you put in and all the earnings it has generated over the years.

When you request a withdrawal, you can specify whether to pull from your Traditional balance, your Roth balance, or a proportional mix of both. This is a critical decision, as it directly impacts how much you'll owe in taxes for that year.

Key Insight: The ability to choose between Traditional and Roth withdrawals after 59½ is a powerful tool for managing your taxable income. For instance, in a year where your income is lower, you might pull from your Traditional TSP. But in a higher-earning year, you could stick with tax-free Roth funds to keep your tax bill down.

Getting a handle on this distinction is crucial for making smart moves. Taking money out isn't just about getting cash in hand; it's about managing your financial health for the long haul and keeping your tax burden as low as possible. A little planning goes a long way in making the age 59½ milestone work for you.

The "Rule of 55" and Other Early Separation Perks

While age 59½ gets all the attention as the magic number for penalty-free TSP access, it’s far from the only game in town. For federal employees who hang up their hats a bit earlier, a powerful provision known as the "Rule of 55" can be a complete game-changer.

Think of it as a special handshake from the IRS, designed to help bridge the financial gap between an early career exit and traditional retirement age. It allows you to start taking withdrawals from your TSP without that nasty 10% early withdrawal penalty, as long as you separate from federal service during or after the calendar year you turn 55.

How the Rule of 55 Works in the Real World

The logic is refreshingly simple. If you leave your federal job anytime in the year you turn 55—or any year after that—you get immediate, penalty-free access to your TSP funds. It doesn't matter if you turn 55 in January and separate in December, or if you separate in March and your 55th birthday isn't until November. As long as both events happen in the same calendar year, you're golden.

This rule provides incredible flexibility. It means you can start drawing an income from your TSP to cover living expenses long before you hit your late fifties. Of course, remember that while the penalty is waived, any withdrawals from your Traditional TSP balance are still treated as ordinary income and subject to taxes.

An Even Better Deal for Public Safety Officers

The rules get even more generous for certain federal employees. If you're a qualified public safety officer—think federal law enforcement officers, firefighters, and air traffic controllers—you get an even earlier window of opportunity.

These professionals can separate from service and begin taking penalty-free TSP withdrawals as early as age 50. This special provision is a nod to the physically demanding nature of their careers and their earlier retirement eligibility.

Critical Distinction: Keep Your Money in the TSP to Use This Perk

These penalty exceptions—both the Rule of 55 and the age 50 rule for public safety officers—only apply to funds that remain in your TSP account. If you roll your TSP over to an IRA, you lose this unique benefit. The standard IRA rules take over, meaning you generally have to wait until age 59½ to access those funds without a penalty.

This is a make-or-break detail when deciding where to house your retirement funds after separating from service.

Comparing Early TSP Withdrawal Penalty Exceptions

To help you visualize these different pathways, it's useful to see the key provisions side-by-side. Each rule opens a different door to your retirement funds, depending on your age and career.

| Rule or Exception | Who It Applies To | Minimum Age Requirement | Key Condition |

|---|---|---|---|

| Standard Age Rule | All TSP Participants | Age 59½ | No penalty on any withdrawal, whether you're still working or have separated. |

| Rule of 55 | Most Federal Employees | Age 55 | You must separate from federal service in or after the calendar year you turn 55. |

| Public Safety Officer Exception | Qualified LEOs, Firefighters, ATCs, etc. | Age 50 | You must separate from service in or after the calendar year you turn 50. |

Getting a firm grasp on these rules is essential for making smart decisions about your retirement timeline. Whether you're planning to leave at 50, 55, or later, knowing your options helps you build a withdrawal strategy that protects your hard-earned savings from unnecessary penalties.

Taxes, Penalties, and Required Distributions

Knowing when you can pull money from your TSP is just one piece of the puzzle. The other, arguably more important piece, is understanding the financial strings attached to that withdrawal. Taking money out of your TSP isn't as simple as hitting the ATM; every dollar is governed by tax rules, potential penalties, and eventually, mandatory distributions.

Think of it as the financial "fine print" on your retirement plan. If you ignore it, you could be hit with a surprisingly large tax bill or hefty penalties that eat into the nest egg you worked so hard to build. Let's get a firm grip on these rules so you can make smarter withdrawal decisions.

The 10 Percent Early Withdrawal Penalty Explained

The rule most people have heard of—and rightly fear—is the 10% early withdrawal penalty. This is an extra tax the IRS slaps on withdrawals from retirement accounts like the TSP if you haven't yet reached age 59½. Its whole purpose is to keep you from raiding your retirement savings before you actually retire.

But as we've seen, there are some powerful exceptions that let you sidestep this penalty. The big ones include:

- Reaching age 59½.

- Separating from federal service during or after the year you turn 55 (this is the famous "Rule of 55").

- Separating as a public safety officer during or after the year you turn 50.

Now, here's the critical part: avoiding the penalty does not mean you avoid taxes. Even if your withdrawal is penalty-free, you will still owe ordinary income tax on every pre-tax dollar you take out.

Traditional vs. Roth TSP Tax Treatment

How much tax you actually owe hinges on which "bucket" of money you're pulling from: your Traditional TSP or your Roth TSP. These two have completely opposite tax treatments, and knowing the difference is key to smart retirement planning.

Traditional TSP: This is your tax-deferred account. The money you put in was pre-tax, so it got to grow without taxes taking a bite year after year. Well, the tax bill comes due when you withdraw. Every dollar you take from your Traditional TSP is taxed as ordinary income in the year you receive it.

Roth TSP: This is a tax-advantaged account. You contributed money after you paid taxes on it. Because of that, any qualified withdrawal is completely tax-free. That includes not just what you put in, but all the earnings it generated over the years. A "qualified" withdrawal is one made after you're 59½ and at least five years have passed since your first Roth contribution.

By strategically deciding which balance to draw from, you can actively manage your taxable income in retirement. This flexibility is one of the most powerful financial tools at your disposal.

Understanding Required Minimum Distributions (RMDs)

Lastly, you can't just leave your money in the TSP forever. Uncle Sam eventually wants his tax revenue, which brings us to Required Minimum Distributions, or RMDs. These are mandatory annual withdrawals you have to start taking once you hit a certain age.

The current rule says you must start taking RMDs by April 1 of the year after you turn age 73, assuming you've already separated from federal service. The TSP calculates the exact amount for you based on your account balance and an IRS life expectancy table.

Don't ignore this. Failing to take your full RMD on time comes with a painful penalty—currently 25% of the amount you were supposed to withdraw. Planning for your RMDs is an essential part of any long-term retirement strategy.

A Step-by-Step Guide to Requesting a Withdrawal

Figuring out when you can tap into your TSP is one thing, but knowing how to do it is the other side of the coin. Thankfully, the process of actually requesting a withdrawal online is pretty straightforward once you know where to look.

Let's walk through the exact steps you'll take.

Everything starts on the official TSP website. The first step is to log into your secure "My Account" portal. Think of this as your personal command center for your entire TSP—it's where you'll do everything from checking your balance to actually starting a withdrawal.

Here’s a look at the TSP login page you'll see. You'll just need your user ID and password to get in.

Once you're logged in, you'll land on your account dashboard. This is the secure area where you’ll manage the whole process from start to finish.

Initiating Your Withdrawal Request

Inside your account, navigate to the section labeled "Withdrawals and Rollovers." This is your starting point. The online tool will then walk you through a series of questions to make sure the withdrawal is set up exactly how you need it.

You'll need to make a few important decisions:

- Select Your Withdrawal Type: Are you taking a one-time partial withdrawal, pulling out the entire balance, or setting up recurring monthly payments?

- Specify the Amount: If you chose a partial withdrawal, you'll enter the exact dollar amount you want to take out.

- Choose the Source: This is a big one for taxes. You have to decide if the money should come from your Traditional TSP, your Roth TSP, or a proportional split between the two.

- Set Up Your Payment Method: You can have the money sent directly to your bank account via direct deposit or get a physical check in the mail. Direct deposit is almost always the faster and safer option.

Pro Tip: Before you hit submit, double- and triple-check your bank account and routing numbers. A simple typo here is the number one culprit behind delayed payments.

Completing and Submitting Your Request

After making your selections, the system will give you a summary of your entire request. This is your chance to review everything for accuracy, including the estimated amount that will be withheld for taxes. You may also be asked to complete an identity verification step—a crucial security measure to protect your account.

Once you’re confident that all the details are correct, you can electronically sign and submit the request.

Processing times can vary, but you can typically expect the funds to arrive within several business days to a couple of weeks. And if you're thinking about moving your money to a different type of account, our guide on how to rollover your TSP to an IRA breaks down that specific process in detail.

By following these steps, you can make sure the whole experience is as smooth and painless as possible.

Frequently Asked Questions About TSP Withdrawals

When it comes to your TSP, knowing the rules can feel like trying to hit a moving target. Let's clear up some of the most common questions federal employees have about accessing their retirement funds.

Can I Pick and Choose Which TSP Funds to Withdraw From?

The short answer is no. You can't, for example, decide to pull money only from your G Fund to protect your stock investments in the C or S Funds.

TSP withdrawals are always handled proportionally. If 40% of your TSP balance is invested in the C Fund, then 40% of any withdrawal you make will come directly from that fund. This is a built-in feature of the TSP, so it's something you have to plan around, as it automatically rebalances your withdrawal across your entire portfolio.

What Happens to My TSP Loan if I Leave Federal Service?

This is a big one. If you separate from service with an outstanding TSP loan, you’re at a crossroads. You can either pay the loan back in full or the TSP will declare a "taxable distribution."

If that happens, the entire unpaid loan balance is treated as income for that year. Worse, if you're under 59½, you'll likely get hit with the 10% early withdrawal penalty on top of the income tax. It's crucial to have a plan for your loan before you leave to avoid a painful, unexpected tax bill.

This is a classic financial trap for employees leaving federal service. Forgetting about that loan can turn a smooth transition into a very costly tax mistake.

Does the "Rule of 55" Carry Over if I Roll My TSP into an IRA?

Absolutely not, and this is a critical detail that trips up many people. The "Rule of 55" is an exception that only applies to employer-sponsored plans like the TSP.

If you leave your federal job in the year you turn 55 (or later) and immediately roll your TSP into an IRA, you lose that special access. The money is now subject to IRA rules, which means you generally have to wait until age 59½ for penalty-free withdrawals. If you intend to use the Rule of 55, you must take the money directly from your TSP before you do any rollovers.

How Many Withdrawals Can I Make From My TSP Each Year?

The number of withdrawals you can take depends on whether you're still working.

- After Separating from Service: You can request multiple partial withdrawals as long as you have at least $1,000 in your account. The only catch is you have to wait 30 calendar days between each request.

- Age-Based In-Service Withdrawals: If you're 59½ or older and still on the job, you get up to four of these penalty-free withdrawals per calendar year. The same 30-day waiting period between each one applies.

Getting these details right can make a huge difference in your retirement outcome. For a personalized review of your federal benefits and a clear path forward, schedule a free 15-minute consultation with Federal Benefits Sherpa. We can help you build a confident financial future. Learn more at https://www.federalbenefitssherpa.com.