Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Complete Guide to Roll Over TSP Into 401k

Yes, you absolutely can roll your Thrift Savings Plan (TSP) into a 401(k) once you've left federal service. For many former federal employees, the big motivation is consolidation—bringing all their retirement savings under one roof with their new private-sector employer.

It just makes life easier.

Is a TSP Rollover to a 401(k) Actually Your Best Move?

When you make the jump from a federal career to the private sector, figuring out what to do with your TSP is a major decision. The go-to move for many is to roll over the TSP into a 401(k) to keep things simple. But this choice is about more than just convenience. You need to weigh what the TSP does well against what your new 401(k) brings to the table.

There's a real comfort in having a single retirement account with your current job. It simplifies everything from tracking performance to managing beneficiaries. But don't forget, the TSP is legendary for its incredibly low administrative and investment fees, and those low costs can have a massive impact on your nest egg's growth over time.

Before you pull the trigger, just know this: you're likely trading the TSP's low-cost, simple structure for the wider investment choices—and different fee schedule—of a 401(k).

Comparing Your Options Side-by-Side

The decision really boils down to a head-to-head comparison. Your new 401(k) might offer a whole universe of mutual funds, ETFs, or even individual stocks that the TSP just doesn't have. The catch? Those options almost always come with higher expense ratios.

You really need to think about the TSP's track record for performance and cost-effectiveness. The numbers tell an interesting story. By the end of 2023, the average TSP account balance hit $175,692. For comparison, the average 401(k) balance was $112,572 in late 2022. You can dig into this data more in GovExec's analysis. That gap shows just how powerful the TSP's low-fee advantage can be for long-term wealth building.

To get a clearer picture, let's lay it all out.

TSP vs 401(k) At a Glance

A side-by-side look can make the differences really pop. Here’s a breakdown of the most important features to consider when you're deciding between keeping your TSP and rolling it into your new employer's 401(k).

| Feature | Thrift Savings Plan (TSP) | Typical Employer 401(k) |

|---|---|---|

| Fees & Expenses | Extremely low; among the lowest in the industry due to its scale and simple structure. | Varies widely; often higher due to administrative, investment, and advisory fees. |

| Investment Choices | Limited to a small selection of core funds (G, F, C, S, I) and Lifecycle (L) funds. | Can offer a wide range of mutual funds, ETFs, and sometimes individual stocks. |

| Loan Options | Not available to separated or retired participants. | Often available, allowing you to borrow against your account balance while employed. |

| Withdrawal Rules | Rules are specific to the plan and can sometimes be less flexible than 401(k)s. | Withdrawal options and rules are determined by the specific plan administrator. |

| Creditor Protection | Strong federal protections from creditors under ERISA and other federal laws. | Protected by federal ERISA laws, but state-level protections can vary. |

Ultimately, there's no single right answer. The best choice comes down to your personal financial goals, how hands-on you want to be with your investments, and, frankly, how good your new 401(k) plan actually is. Digging into these details is the most critical first step you can take.

Doing Your Homework Before the Rollover

Before you even think about filling out a single form to roll over your TSP into a 401(k), you need to hit the pause button and do some reconnaissance. A little homework now can save you a world of headaches later and stop you from heading down a path that’s a dead end.

First things first: your employment status. This is the big one. You can only move money out of the TSP after you’ve separated from federal service. It’s a hard and fast rule. If you're still on the federal payroll, a rollover to an outside account like a 401(k) is off the table.

Once you've cleared that hurdle, your next move is to put your new 401(k) plan under the microscope. Don't just assume it’s ready to accept your TSP funds.

Make Sure Your New 401(k) Will Actually Take the Money

It might sound strange, but not all 401(k) plans are built to accept rollovers from other retirement accounts. And the TSP, with its unique government structure, can sometimes be a special case. The last thing you want is to get the ball rolling with the TSP, only to have your new plan’s administrator say, "Sorry, we can't accept that."

Your first call should be to your new employer’s HR team or, even better, the 401(k) plan administrator directly. Be very specific with what you ask.

I've seen this go wrong, so here’s a checklist to get you started:

- "Does my 401(k) plan accept a direct rollover from the federal Thrift Savings Plan, or TSP?"

- "Are there any specific forms on your end that I need to fill out for an incoming rollover?"

- "Can you give me the exact name and address for the receiving institution? I'll need this for the TSP paperwork."

- "Who is my point of contact here if the TSP has questions during the transfer?"

Try to get these answers in an email. Having it in writing is your best defense against a rollover that gets stuck in limbo.

Get the Real Story on Your New 401(k)'s Costs

The TSP is legendary for its incredibly low expense ratios. Before you move a nest egg you've spent years building, you have to know exactly what fees are hiding in your new 401(k). These costs can take a serious bite out of your returns over the long haul.

A classic mistake is just glancing at the fund expense ratios. The true cost of a 401(k) is often buried in multiple layers of fees that aren't immediately obvious.

You'll need to dig a little deeper. Ask the plan administrator for a full fee disclosure statement and keep an eye out for these specific costs:

- Administrative Fees: These are the costs for running the plan—things like record-keeping and compliance. They might be a flat annual fee or a percentage of your assets.

- Investment Fees: This is the expense ratio on each fund. Put them side-by-side with the TSP's fund fees to see the real difference.

- Advisory Fees: Some plans offer managed accounts or financial advice for an extra fee. Find out if this is optional or baked into the plan.

This kind of detailed review ensures you’re making a decision with your eyes wide open. For a broader look at all your options after federal service, our Thrift Savings Plan withdrawal options guide covers distributions and rollovers in much more detail.

Check Out the Investment Lineup and Plan Rules

Fees are a huge part of the equation, but they aren't everything. You also need to make sure the new plan actually fits your investment style and doesn't come with any surprise restrictions.

Does the new plan have the kind of investment diversification you're looking for? Are there enough options to build the portfolio you want?

Also, and this is a big one, ask about blackout periods. These are specific windows of time, often when a plan is switching providers, where you can't make any changes to your account. You definitely don’t want your rollover check to arrive just as a blackout period starts, leaving your money sitting on the sidelines and out of the market. Getting these details sorted out is what makes for a smooth, successful transfer.

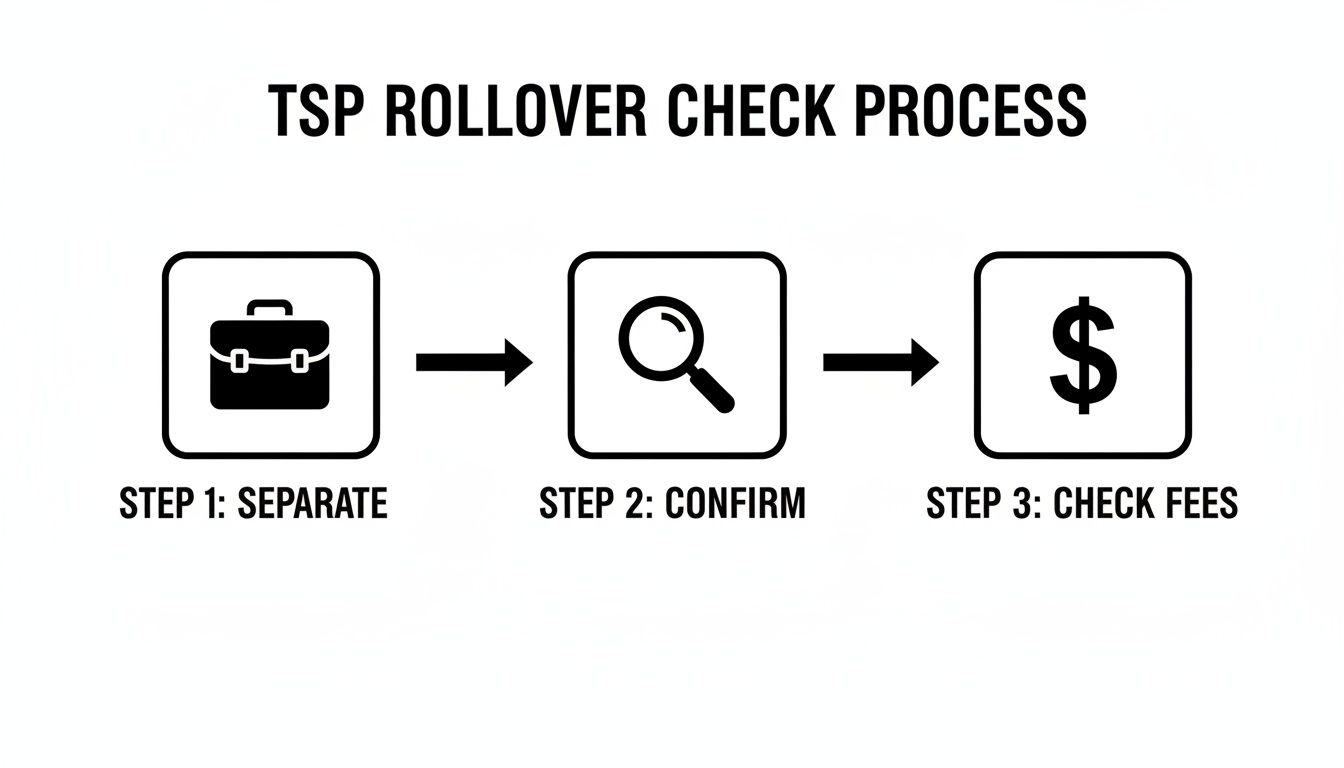

How to Navigate the TSP Rollover Process

Alright, you've done your homework and decided to move forward. Let’s get into the nuts and bolts of how you actually roll over your TSP into a 401(k). This is where the rubber meets the road, and getting the details right is crucial for a smooth, penalty-free transfer.

The whole process really boils down to one key choice: will this be a direct or an indirect rollover? It might sound like a minor detail, but your decision has major tax and logistical consequences. One path is clean and simple; the other is a minefield of potential penalties and tax headaches.

Direct Rollover: Your Safest Bet

A direct rollover is exactly what it sounds like. The TSP sends your money straight to your new 401(k) plan administrator. The funds never pass through your personal bank account, which is the key to its simplicity and safety. Think of it as a non-stop flight for your retirement savings—it’s the fastest and most secure way to get your money where it needs to go.

Because the cash moves directly between the two retirement accounts, the IRS sees it as a simple transfer, not a withdrawal. That means no mandatory tax withholding, no penalties, and no temptation to dip into the funds. Honestly, a direct rollover is the best option for nearly everyone.

Indirect Rollover: The Path with More Risk

Then there’s the indirect rollover. In this scenario, the TSP cuts a check made out to you for your account balance. You then have 60 days to deposit that money into your new 401(k). While this gives you temporary custody of your money, it comes with some serious strings attached.

Here’s the biggest catch: the TSP is legally required to withhold 20% of your traditional TSP balance for federal income taxes. So, if you’re rolling over $100,000, you’ll only get a check for $80,000. To complete the rollover correctly and avoid a huge tax bill, you have to deposit the full $100,000 into your new 401(k). That means you have to come up with that missing $20,000 from your own pocket.

If you can't come up with the extra cash or miss the 60-day deadline, any portion not rolled over gets treated as a taxable distribution. And if you're under age 59½, the IRS will hit you with an additional 10% early withdrawal penalty. For most people, the risks just aren't worth it.

The infographic below breaks down the key decision points you should think about before starting the rollover.

Use this as a quick visual checklist to make sure you've covered your bases.

The Paperwork and Coordination Game

Once you’ve settled on the direct rollover method, it’s time to tackle the paperwork. The main document you'll need from the TSP is Form TSP-70, Request for a Full Withdrawal. You can usually find and fill this out online after logging into your account on the official TSP website.

Accuracy here is non-negotiable. A simple mistake on the form can set you back weeks. Double-check these details:

- Receiving Institution Info: You need the exact name of your 401(k) plan's administrator, their mailing address, and your new account number. Call your new 401(k) provider and have them give you this information directly. Don't guess.

- Direct Rollover Selection: This is the most important part of the form. Make absolutely sure you check the box for a direct rollover.

- Spousal Consent: If you’re a FERS employee with an account balance over $3,500, your spouse must sign a consent waiver on the form.

Don't just submit the form and hope for the best. A week or so after sending it in, make a couple of quick phone calls. First, call the TSP to confirm they’ve received and processed your request. Then, call your new 401(k) administrator to give them a heads-up that funds are on the way.

This kind of proactive follow-up is smart, especially since the retirement landscape is always shifting. For example, the TSP is set to launch Roth in-plan conversions in January 2026, a new feature that's already getting a lot of attention. You can actually see some of the public's interest in upcoming TSP features on analytics.usa.gov. By staying in touch with both administrators, you ensure you're working with the most current rules and prevent your money from getting stuck in limbo.

Understanding Rollover Tax Implications and Penalties

When it comes to moving your TSP money into a 401(k), how you do it matters. A lot. The method you pick can have some serious tax consequences, and a simple misstep can turn a straightforward transfer into a costly headache. The core of it all comes down to understanding how the IRS views a direct rollover versus an indirect one.

Your safest, cleanest, and most recommended path is a direct rollover. Think of it as a behind-the-scenes transfer where your money goes straight from the TSP to your new 401(k) plan. You never actually touch the funds.

Because the money never lands in your personal bank account, the IRS sees it as a non-event for tax purposes. This means no automatic tax withholding, zero risk of early withdrawal penalties, and no complicated tax forms to deal with later. It’s the simplest way to keep your retirement savings growing, tax-deferred, without any surprise bills.

The High Cost of an Indirect Rollover

Now, let's talk about the other route: the indirect rollover. This is where the TSP cuts you a check. While it might sound simple, this method is riddled with financial landmines. The second you choose this option, the TSP is legally required to withhold a mandatory 20% of your Traditional TSP balance for federal taxes.

That withholding creates an immediate problem. To complete the rollover and avoid penalties, you have to deposit the entire original amount into your new 401(k) within 60 days. That means you’re on the hook for coming up with that missing 20% from your own pocket.

Let's say you're rolling over a $100,000 Traditional TSP. The TSP only sends you a check for $80,000, with the other $20,000 going straight to the IRS. To do the rollover correctly, you have to deposit the full $100,000 into your new plan, which means finding an extra $20,000 somewhere else.

What happens if you can't find that extra cash or you miss the 60-day deadline? The fallout is painful. Any part of the distribution that doesn't make it into the new plan is treated as taxable income. And if you're under 59½, the IRS will slap you with a nasty 10% early withdrawal penalty on top of it.

A Real-World Indirect Rollover Scenario

Let’s stick with that $100,000 rollover. You get the $80,000 check but just can't scrape together the other $20,000. You deposit the $80,000 into your new 401(k) before the 60-day clock runs out.

Here’s what the damage looks like:

- The $20,000 that didn't get rolled over is now taxable income. If you're in a 24% federal tax bracket, that's a $4,800 tax bill.

- Since you're under 59½, you'll also owe a 10% early withdrawal penalty on that same $20,000, which adds another $2,000 to the tab.

- Don't forget potential state income taxes, which will make the final cost even higher.

In this case, a seemingly small decision has just cost you $6,800 in taxes and penalties. Even worse, you've permanently pulled $20,000 out of your tax-deferred retirement savings. This is exactly why almost every financial expert will tell you to stick with the direct rollover.

How Roth vs. Traditional Funds Are Treated

The tax rules also depend on whether your TSP money is Traditional or Roth. The system is designed to keep your money’s tax status consistent as it moves.

- Traditional TSP to Traditional 401(k): This is a simple like-for-like move. As long as it's a direct rollover, it's completely tax-free. Your money just keeps on growing tax-deferred.

- Roth TSP to Roth 401(k): Same principle here. You're moving post-tax money to another post-tax account. A direct rollover is a non-issue, with no taxes or penalties.

- Traditional TSP to Roth 401(k): This is where things get interesting. This move is a Roth conversion, and the entire amount you transfer will be counted as taxable income in the year you do it. While this can be a smart long-term strategy, you need to be prepared for a substantial tax bill.

If you’re thinking about moving funds into a Roth account, you might want to look at all your options. Our guide to the TSP to Roth IRA rollover gets into the nitty-gritty of the conversion process and what it means for your taxes. Always weigh these outcomes before you start the transfer process.

So, What Are Your Other Options Besides a 401(k) Rollover?

While the idea to roll over your TSP into a 401(k) is a popular move for consolidating accounts, it’s certainly not your only play. Before you jump, it's crucial to understand the other powerful options on the table.

Each path has its own set of pros and cons that might fit your long-term financial picture better. Taking a moment to weigh these strategies ensures you're not just making the easy choice, but the right one for your retirement. Let’s dig into the two main alternatives: leaving your money right where it is, and moving it to an Individual Retirement Account (IRA).

The Case for Leaving Your Money in the TSP

You know, sometimes the smartest move is no move at all. The Thrift Savings Plan is famous for its straightforward, effective design and some of the lowest costs in the entire industry. These aren't just minor details; they can add up to a significant difference in your final nest egg.

Here’s why you might want to keep your money parked in the TSP:

- Rock-Bottom Fees: The TSP’s administrative and investment expense ratios are almost unbeatable. Higher fees in a typical 401(k) or IRA can seriously eat away at your returns over decades.

- Simplicity That Works: With a curated menu of core funds (G, F, C, S, I) and the target-date Lifecycle (L) funds, the TSP cuts through the noise. It helps you avoid the "analysis paralysis" that can strike when you're faced with hundreds of choices.

- Strong Creditor Protection: As a federal plan, your TSP assets get powerful protection from creditors under federal law. This can often be stronger than the protections for IRAs, which can vary wildly from state to state.

The numbers don't lie. The TSP's structure encourages good saving habits. By 2023, an impressive 87% of FERS participants were contributing enough to get their full 5% agency match—the highest rate ever recorded, according to the official TSP annual report. You don't always see participation that high in private-sector 401(k)s.

Rolling Your TSP into an IRA

Another powerful option is to roll your TSP funds into an IRA. This move completely opens up your investment universe and offers a new level of flexibility, though it’s a path that requires a bit more hands-on management.

An IRA rollover is a classic trade-off. You’re essentially swapping the TSP’s simplicity and low-cost structure for nearly limitless investment choices and different rules for withdrawals.

The biggest draw here is flexibility. While the TSP offers a handful of excellent core funds, an IRA at a major brokerage gives you access to thousands of mutual funds, ETFs, individual stocks, bonds, and more. For an investor who wants to be in the driver's seat, that kind of freedom is priceless.

If this sounds appealing, our complete guide on how to rollover a TSP to an IRA breaks down that specific process step-by-step.

Just remember, with great freedom comes great responsibility. You’ll need to be diligent about managing fees and making smart investment choices on your own, without the curated, low-cost environment of the TSP to guide you.

Decision Matrix Rollover to 401(k) vs Rollover to IRA

To really get a feel for what’s best for you, it helps to see the options laid out side-by-side. I've put together this table to help you compare the key factors when deciding whether to move your TSP into a new 401(k) or an IRA.

| Consideration | Rollover to 401(k) | Rollover to IRA |

|---|---|---|

| Investment Choices | Limited to the options offered by the new employer's plan, which can be limited. | Nearly unlimited choices, including stocks, bonds, ETFs, and mutual funds. |

| Fee Structure | Varies widely; can include administrative, record-keeping, and investment fees. | Can be very low-cost, but requires careful selection to avoid high expense ratios and advisory fees. |

| Loan Availability | Often available, allowing you to borrow against your balance if the plan permits. | Not permitted. You cannot take a loan from an IRA. |

| Creditor Protection | Strong federal ERISA protections. | Protections vary significantly by state law and can be less robust than a 401(k). |

| Account Consolidation | Simplifies management by keeping all retirement funds with your current employer. | Consolidates funds outside of an employer plan, giving you total control regardless of job changes. |

Ultimately, deciding to roll over your TSP into a 401(k) is just one of several solid strategies. By carefully weighing the real-world benefits of keeping your money in the TSP or moving it to an IRA, you can make sure your hard-earned retirement savings are positioned to work best for you.

Common Rollover Mistakes and When to Get Expert Help

When you’re moving your TSP nest egg into a 401(k), a simple slip-up can turn into a costly headache. I've seen it happen time and again—even the most careful federal employees can get tripped up by a few common mistakes during the rollover process.

One of the easiest traps to fall into is messy paperwork. A single transposed digit in an account number or a forgotten signature is all it takes to halt the entire process. This leaves your money sitting on the sidelines, out of the market, for far longer than you want.

Another classic oversight is not digging into the fee structure of the new 401(k). You might be leaving the ultra-low-cost world of the TSP for a plan with significantly higher administrative fees or fund expenses, which can seriously erode your returns over the long haul.

But the real showstopper—the mistake with the biggest financial sting—is botching an indirect rollover. If you fail to get that money into the new account within the strict 60-day window, the IRS considers it a taxable distribution. That means income tax on the full amount, plus a potential 10% early withdrawal penalty.

Sidestepping Common Rollover Pitfalls

The best way to keep your transfer smooth is to treat it like a mini-project with a clear checklist. A little proactive effort upfront can save you a world of trouble.

- Verify, Then Verify Again: Before you send anything, call the administrator of your new 401(k). Verbally confirm every detail of the receiving account, and if possible, ask them to email you the instructions so you have a paper trail.

- Get the Fee Schedule: Don't just take their word for it on fees. Ask for the plan’s official fee disclosure document. This lets you compare the numbers side-by-side with the TSP’s famously low costs.

- Stick to the Direct Route: I almost always recommend a direct rollover. Unless you have a very specific, well-vetted reason for doing an indirect rollover, just don't. The direct transfer completely sidesteps the 60-day deadline and the mandatory 20% tax withholding, making it the safest and simplest path.

Your goal here is a seamless transition, not a surprise tax bill. Think of a direct rollover as your built-in insurance policy against preventable errors. It keeps your retirement funds tax-deferred and working for you without interruption.

Knowing When to Call a Professional

A straightforward rollover is definitely something you can manage on your own. But when things get complicated, it's wise to bring in an expert. A financial advisor who truly understands the nuances of federal benefits can be invaluable.

It’s probably time to get some help if:

- You’re trying to move both Roth and Traditional TSP funds and are fuzzy on the tax rules for keeping them separate.

- You’re nearing retirement age (59½ or older) and this rollover is part of a bigger retirement income strategy.

- You simply feel out of your depth and want the peace of mind that comes from knowing it’s being handled perfectly.

While good planning helps you avoid problems, sometimes mistakes happen. If a botched rollover results in a huge tax bill you can't manage, it's crucial to know there are options. In these extreme situations, programs like the IRS Offer in Compromise program can provide relief, though it's a path you want to avoid at all costs. A qualified professional can help make sure you never get to that point.

Common Questions About TSP Rollovers

Even with a step-by-step guide, you’ll probably have a few lingering questions. It’s completely normal. Let's tackle some of the most common ones I hear from federal employees when they’re thinking about moving their TSP funds.

Can I Just Roll Over a Portion of My TSP?

Absolutely. This is a common and often smart strategy. Once you've separated from service, the TSP gives you the flexibility to do a partial rollover. You can move a specific dollar amount or a percentage of your balance over to your new 401(k).

Why do this? Many people choose this route to keep a foothold in the TSP, holding onto some of their money to benefit from its famously low-cost G, F, C, S, and I funds, while consolidating the rest with their new employer's plan. It’s a great way to get the best of both worlds.

What Happens to My TSP Loan If I Leave My Job?

This is a big one, and you need to handle it carefully. You cannot roll over an outstanding TSP loan. If you leave federal service with a loan against your account, you’re at a crossroads.

Your options are to either pay the loan back in full, right away, or the TSP will treat the entire outstanding balance as a taxable distribution.

A "taxable distribution" is exactly what it sounds like. The loan amount is reported to the IRS as income for that year. If you're under 59½, you'll also get hit with the 10% early withdrawal penalty on top of the income tax. It can be a costly mistake.

How Long Does This Whole Rollover Thing Take?

From start to finish, a direct rollover from the TSP to a 401(k) usually takes about two to four weeks once the TSP has all your correct paperwork in hand.

Keep in mind, that's an estimate. The final timeline really depends on how quickly both the TSP and your new 401(k) administrator process things on their end. A good rule of thumb is to call both institutions about a week after you submit your forms just to make sure the ball is rolling and they don't need anything else from you.

Figuring out the nuances of your federal benefits is key to building a retirement you can feel confident about. At Federal Benefits Sherpa, we work with federal employees every day to help them make these exact kinds of decisions. If you want to talk it through, book a free 15-minute consultation to make sure you’re on the right path.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved