Mastering the FERS Pension Calculator Your Retirement Guide

A FERS pension calculator is the first tool I recommend to any federal employee starting to get serious about retirement planning. It takes the guesswork out of one of the most important parts of your future income—your FERS annuity. By plugging in a few key details about your career, it translates the complex government formula into a clear, tangible dollar amount you can expect to receive each month.

It's about turning abstract numbers like your salary and years of service into a concrete figure that you can actually build a plan around.

Why A FERS Calculator Is Your Best First Step

Trying to plan for retirement without knowing your pension amount is like trying to drive to a new city without a map. You might get there eventually, but you'll have no idea what the journey looks like. A good FERS calculator gives you that map.

Remember, your federal retirement is often called a "three-legged stool" for a reason. It's built on:

- Your FERS Pension (Annuity)

- Your Social Security benefits

- Your Thrift Savings Plan (TSP)

The calculator gives you a solid projection for that first, most predictable leg of the stool. Once you have a reliable estimate of your guaranteed pension income, you can make much smarter decisions about your TSP and Social Security.

Understanding The Core Calculation

At its core, a FERS calculator simply automates the government's official annuity formula. It's not magic, just math. For most federal employees, that basic formula is:

1% x High-3 Average Salary x Years of Creditable Service

There's a well-known "bonus" to this formula, too. If you work until at least age 62 with 20 or more years of service, the multiplier gets a boost from 1% to 1.1%. That 10% increase might not sound like a lot, but over a 20- or 30-year retirement, it adds up to a significant amount of money.

This is where a calculator really shines. It lets you play with "what if" scenarios. What if I work two more years? What if I get that promotion I've been eyeing? You can instantly see how those decisions impact your bottom-line pension amount. For a deeper dive, you can explore more about how pension formulas shape public sector retirement plans.

Key Inputs For An Accurate Estimate

To get a number you can actually trust, you need to feed the calculator accurate information. The old saying "garbage in, garbage out" is especially true here. Before you begin, take a few minutes to gather these details from your records.

This table outlines the critical data points you'll need to use any FERS pension calculator effectively. Gather these details for a reliable annuity estimate.

Key Inputs for an Accurate FERS Pension Calculation

| Data Point | What It Represents | Why It's Essential |

|---|---|---|

| Creditable Years of Service | Your total time in a FERS-covered job, plus any bought-back military time and a portion of your unused sick leave. | This is a direct multiplier in the annuity formula. More service equals a higher pension. |

| High-3 Average Salary | The average of your highest 36 consecutive months of basic pay—usually your final three years. | This is the foundation of your entire calculation. An accurate number is non-negotiable. |

| Estimated Retirement Date | The specific date you plan to leave federal service. | This determines your age and total years of service, which can affect eligibility and the formula's multiplier (1% vs. 1.1%). |

| Retirement Type | Whether you're taking a standard retirement, an early out (VERA), or a deferred retirement. | Different retirement types have different rules and potential reductions that the calculator must account for. |

Getting these four inputs right is the key to unlocking a clear, actionable forecast of your financial future. With these numbers in hand, you’re ready to see what your retirement really looks like.

Gathering Your Data for an Accurate Forecast

Any FERS pension calculator is powerful, but its projections are only as good as the numbers you feed it. Think of it like a high-performance engine—it needs the right fuel to give you a reliable result. Your best sources for that fuel are your official federal documents.

The two documents you'll absolutely need are your SF-50 (Notification of Personnel Action) and your Leave and Earnings Statement (LES). Your most recent SF-50 is a goldmine, containing your official service computation date, your retirement plan details (like FERS), and your salary history.

Pinpointing Your High-3 Salary

Your High-3 is simply the average of your highest 36 consecutive months of basic pay. For most feds, this lines up neatly with their last three years on the job.

But here’s a common trip-up: it’s not based on calendar years. A promotion or a step increase mid-year can actually shift that 36-month window. The key is to find the period where your earnings were at their peak.

Another mistake I see all the time is including pay that doesn't count. You want to stick to your basic salary and locality pay. Don't include things like:

- Overtime pay or performance bonuses

- Awards or cash allowances

- Recruitment or retention incentives

While those extras are great for your wallet now, they won't factor into your pension calculation. Including them will only give you an inflated, inaccurate estimate.

Determining Your Creditable Service

Next up is figuring out your total creditable service. This is often more than just the time between your start and end dates. Your service computation date (SCD) on your SF-50 is the official starting point, but it doesn't always tell the whole story.

Did you have prior military service? If you "buy back" that time by making a deposit to the FERS system, those years get added to your service time, boosting both your eligibility and your final annuity. It can make a huge difference.

And don't forget about your unused sick leave. When you retire, your entire sick leave balance gets converted into additional creditable service. Every 2,087 hours of unused sick leave adds one full year of service credit to your calculation. This is a fantastic—and often overlooked—way to give your final pension a nice little bump.

Expert Tip: Don't guess on these figures. Seriously, pull out your Leave and Earnings Statements from the last three years. They give you a clear, precise history of your salary changes and will help you map out your highest 36 months perfectly. A little accuracy now prevents a lot of disappointment later.

Getting these inputs right is the foundation of a solid pension forecast. For a more detailed walkthrough, our guide on how to calculate FERS retirement like a pro dives even deeper with more examples. Once you have this solid data, you can move forward and use a calculator to confidently see what your financial future looks like.

Putting a FERS Pension Calculator to Work

Alright, you've gathered your documents and you're ready to see what the numbers say. Let's walk through how a FERS pension calculator takes your information and turns it into a clear retirement picture. To make this real, we'll follow a federal employee named Sarah. She's 58 and starting to seriously plan her next steps.

Sarah has her SF-50 and a stack of recent Leave and Earnings Statements. From these, she's determined her High-3 average salary is $95,000 and she has 28 years of creditable service. Now, it's time to plug these details in and see what her financial future holds.

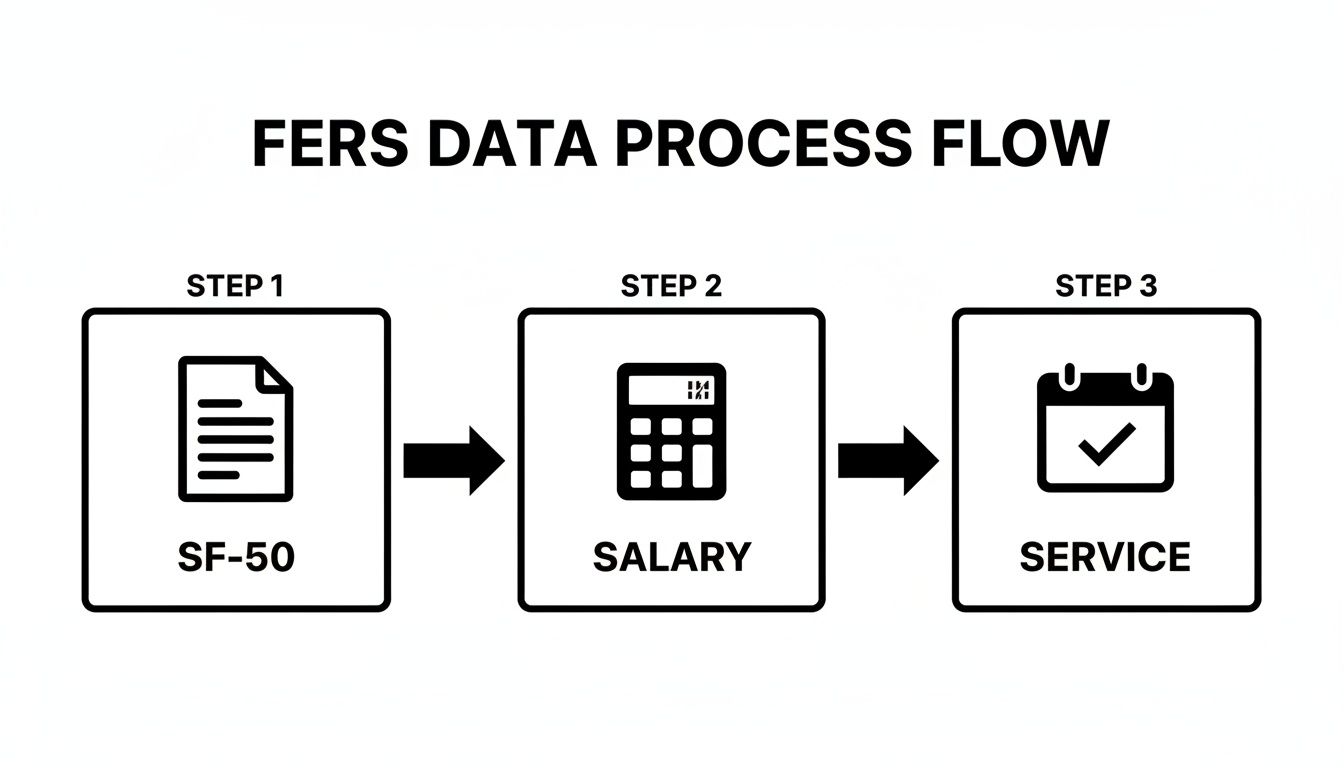

The process is pretty straightforward—it all starts with your official records.

As you can see, documents like the SF-50 are the bedrock. They provide the two most important pieces of the puzzle: your High-3 salary and your total service years. Get those right, and you're well on your way.

Entering Your Core Information

The first few fields in any decent FERS calculator are the basics: your age, High-3, and years of service. Sarah punches those in. But the real magic happens when you start playing with different retirement scenarios.

This is where you can see the direct impact of your choices. Sarah is weighing two options: retire now at 58 or work until she’s 62. That one decision changes the entire formula.

- Retiring at 58: She's eligible because she has met her Minimum Retirement Age (MRA) and has well over 10 years of service. The calculator will use the standard 1.0% multiplier for her pension.

- Retiring at 62: If she sticks it out for four more years, she'll hit 32 years of service at age 62. Because she meets the age and service requirements, the calculator automatically bumps her up to the enhanced 1.1% multiplier.

This is what makes a calculator so powerful. In an instant, it shows you the real-dollar consequence of working a few more years. No guesswork needed.

Understanding Key Multipliers and Annuity Types

As Sarah clicks through the tool, she’ll likely see a dropdown menu for "Retirement Type." This is a frequent source of confusion for federal employees. She’s planning a regular, voluntary retirement, which is the most common selection.

But other options like "Deferred" or "MRA+10" have their own unique rules—and potential penalties—that the calculator is built to handle.

A huge mistake I see people make is choosing an MRA+10 retirement before age 62 without understanding the age reduction. A good calculator will automatically apply the penalty, which is a 5% reduction for every year you are under 62. That’s a detail that can be devastatingly easy to miss if you're trying to calculate it all by hand.

The calculator will also ask about survivor benefits. This is where Sarah can model the financial trade-off of providing a full or partial survivor annuity for her spouse. She’ll see her gross monthly pension decrease, but she gets a concrete number to weigh against the peace of mind of protecting her family.

Once all the information is in, Sarah gets her results. She can see the two scenarios side-by-side. It becomes crystal clear that waiting until 62 doesn't just add four years of service—it also unlocks that higher multiplier, leading to a much larger pension over her lifetime. She's no longer just thinking about her future; she's making an informed decision based on hard numbers.

Making Sense of Your Pension Calculation Results

So, you’ve plugged in your numbers and the FERS calculator has spit out a result. That big number you see—your gross monthly annuity—is an exciting starting point, but it's not what will actually land in your bank account each month.

This is a critical distinction that trips up a lot of federal employees. They build their retirement budget around that gross figure, only to be unpleasantly surprised by their first few pension checks. To avoid that shock, let’s peel back the layers and figure out what your real take-home pay will look like.

From Gross Annuity to Net Income

Think of the gross annuity as your pre-deduction salary. Before that money is yours, a few things have to come out. For most retirees, the biggest subtractions are for survivor benefits and health insurance.

Here’s a quick rundown of the usual suspects:

- Survivor Annuity: If you're married, deciding to provide for your spouse with a survivor benefit is a major decision with a direct impact on your monthly payment. Electing the full survivor annuity (50% of your pension) will reduce your gross amount by 10%. If you choose the partial annuity (25%), the reduction is smaller, at 5%.

- Federal Employees Health Benefits (FEHB): Good news—you get to keep your health insurance. The premiums will just be deducted from your pension instead of your paycheck. The cost will be the same as what an active employee pays for the plan you’ve chosen.

- Other Deductions: You might also see smaller deductions for things like federal income tax withholding, dental and vision insurance (FEDVIP), or long-term care insurance (FLTCIP).

Once you subtract these costs, you’re left with a much more realistic net income figure. That’s the number you can confidently use to build your retirement budget.

This pension is just one piece of a much larger puzzle. It's designed to work in concert with your other retirement assets to create a stable financial future.

The Bigger Retirement Picture

Your FERS pension is a slice of a massive financial pie. By the second quarter of 2025, U.S. retirement assets hit a staggering $45.8 trillion, and government plans like FERS accounted for $9.3 trillion of that. A calculator helps you see your specific portion, but remember, it’s designed to work alongside your TSP and Social Security.

It's vital to see how these three pillars of your retirement support each other. Your TSP offers investment growth and flexibility. Your pension provides a guaranteed, predictable income stream for the rest of your life. And Social Security adds another foundational layer of financial security.

To get a handle on that third piece, our complete guide on Social Security benefits for federal employees is a great resource for understanding how it all fits together.

Understanding Special Provisions

There are two other key factors that can change the value of your pension over time: Cost-of-Living Adjustments (COLAs) and the FERS Annuity Supplement.

COLAs are the annual increases that help your pension keep up with inflation. The important thing to know is that they typically don't kick in until you turn 62.

The FERS Annuity Supplement is a different animal altogether. It’s a temporary benefit paid to FERS employees who retire before they're eligible for Social Security at age 62. It's meant to bridge that income gap, and a good calculator will help you estimate what that supplement could be, giving you a clearer picture of your income in those early retirement years.

Watch Out for These Common Fers Calculator Mistakes

A FERS pension calculator is a fantastic planning tool, but it's only as good as the information you feed it. I've seen it time and time again: a small input error can ripple through the entire calculation, leading to a wildly inaccurate retirement forecast.

Even the most detail-oriented federal employees can make these simple mistakes. Let's walk through the most common pitfalls so you can double-check your own work and trust the numbers you're seeing.

High-3 Salary Hiccups

One of the most frequent missteps is getting the High-3 salary wrong. It's a common assumption that this is just an average of your last three calendar years of pay, but that's not how the OPM calculates it.

Your High-3 is your highest average basic pay over any 36 consecutive months of your career. This period often starts and ends mid-month, especially if you had a promotion or step increase that bumped your salary. Using the wrong timeframe can really skew the results.

Forgetting Key Service Time

It's also surprisingly easy to get your service dates wrong. Did you buy back your military time? What about that extra service credit you get from unused sick leave?

Every month of creditable service counts, as it directly impacts your pension multiplier. Leaving out even a few months of bought-back time or sick leave credit will cause the calculator to spit out a lower pension amount than you've actually earned.

And what about part-time work? If you ever worked a part-time schedule, your pension needs to be prorated. Forgetting to account for this is a surefire way to get an overly optimistic estimate.

Don't treat the calculator like a magic box. You have to be meticulous. Pull out your official documents—your SF-50s and Leave and Earnings Statements—and check every single input. A reliable forecast is built on a foundation of accurate data.

Not Understanding the Rules of the Game

Finally, a major source of error comes from simply not knowing the specific retirement rules that apply to your situation. The MRA+10 retirement is a classic example.

Many feds know they can retire at their Minimum Retirement Age (MRA) with as few as 10 years of service. But what they often forget is the penalty. If you retire under this provision before age 62, your pension is permanently cut by 5% for every year you are under 62. Ouch.

A good FERS calculator will factor this in automatically, but only if you select the correct retirement type. If you mistakenly choose a standard retirement option, you won't see this massive reduction in your forecast, and that’s a dangerous blind spot.

The FERS system, like other strong global pension systems, is built to balance adequacy with long-term sustainability. The best systems, like those in the Netherlands and Denmark, have built-in rules to encourage smart retirement timing. You can learn more about what makes these systems work by reading the Mercer CFA Institute Global Pension Index.

By understanding and avoiding these common errors, you can be much more confident that the number you're planning your future around is the right one.

Your Next Steps in Federal Retirement Planning

Getting your FERS pension estimate is a huge step. It gives you a solid, foundational number to work with, but it's just that—a foundation. Now, the real work begins: taking that number and building a complete, strategic retirement plan around it.

Think of your FERS annuity as the bedrock. It's the guaranteed income you can count on, month in and month out, no matter what the stock market is doing. But a truly comfortable retirement rests on all three pillars of the federal system: your pension, your Thrift Savings Plan (TSP), and your Social Security benefits.

Integrate Your Pension with Your TSP

With a clear pension figure in hand, you can now make much smarter decisions about your TSP. The TSP is the flexible, growth-oriented part of your retirement savings, and its role is to supplement that guaranteed pension income.

This is the perfect time to ask yourself some critical questions. Does your current C, S, I, F, or G fund allocation still make sense now that you know exactly what your pension will provide? Maybe you can afford to be a little more conservative, or perhaps a little more aggressive.

Our in-depth guide to Thrift Savings Plan withdrawal options walks you through different strategies for turning that TSP balance into another reliable income stream.

Model Your Complete Retirement Income

The next move is to see how all your income sources will flow together. This is more than just adding three numbers on a page; it’s about understanding the timing and how each piece affects the others.

- Run Social Security Scenarios: The age you claim Social Security has a massive impact on your monthly check. Claiming at 62 versus 70 can mean a difference of thousands of dollars over your lifetime. Use a good online calculator to see how different start dates affect your total income when layered on top of your FERS annuity.

- Build a Real-World Budget: It's time to get brutally honest about your post-retirement expenses. Map out everything from healthcare and taxes (yes, your retirement income is taxable!) to the fun stuff like travel and hobbies. Does the combined income from your pension, TSP, and Social Security cover everything with a comfortable cushion?

The goal here is to shift from looking at isolated numbers to creating a cohesive cash flow plan for your future. The calculator gave you one essential variable; now your job is to solve the rest of the equation by planning how all your assets will work together to fund the retirement you've been dreaming of.

This is the phase where a fuzzy financial picture snaps into sharp focus, turning decades of hard work into a retirement you can feel truly secure and excited about.

Your federal benefits are complex, but planning your retirement doesn't have to be. At Federal Benefits Sherpa, we specialize in helping federal employees build clear, confident retirement roadmaps.

Book your free 15-minute benefit review today and let's make sure you're on the right path. Get Your Free Review.