What Is a Pension and How Does It Work A Guide for Beginners

Think of a pension as a retirement promise from your employer. For every year you work, they set aside money that will eventually turn into a steady, reliable paycheck for you in retirement. It's their way of saying "thank you" for your years of service.

Understanding Your Pension: A Retirement Lifeline

At its heart, a pension is a structured plan designed to give you financial stability when you're no longer working. It’s fundamentally different from something like a 401(k) or TSP, where you're in the driver's seat making investment decisions. A pension is more like a long-term reward program. Your loyalty and service build up over time, creating a guaranteed income stream you can count on later in life.

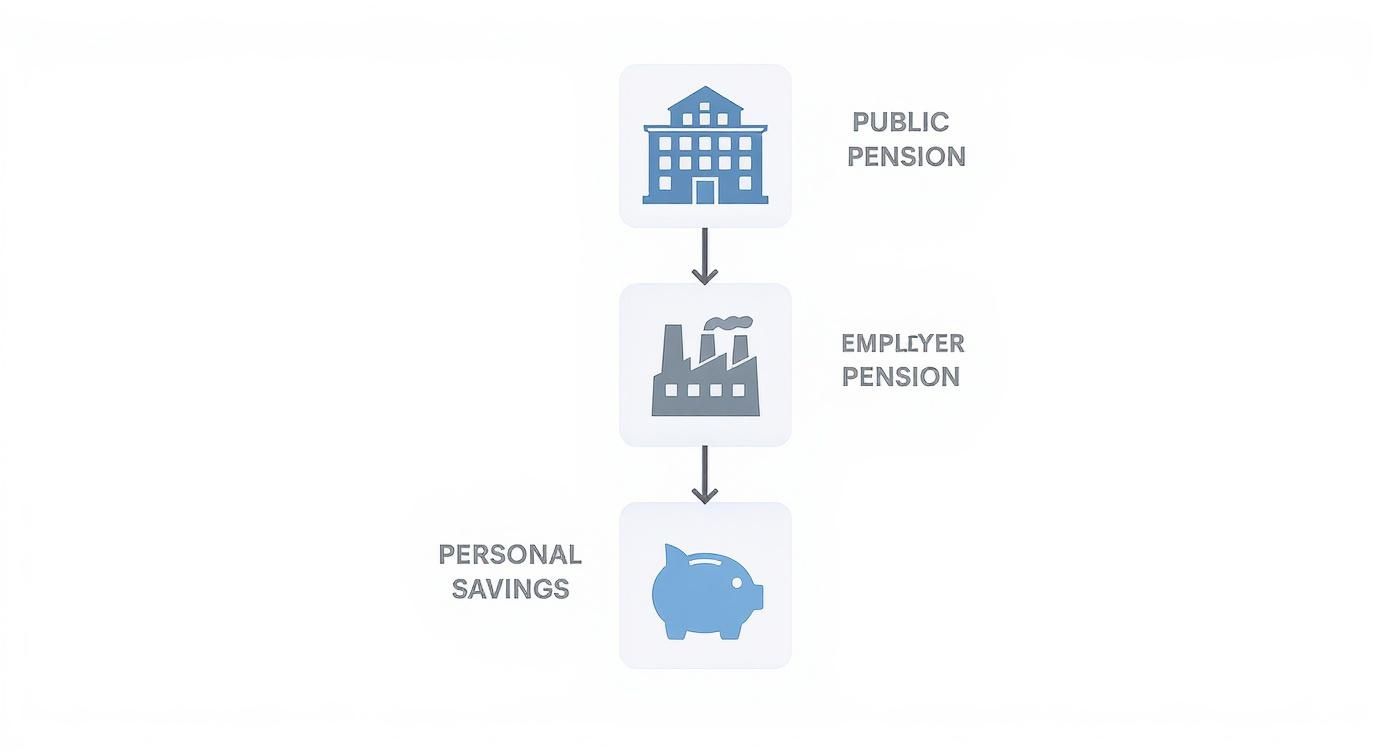

This isn't just a U.S. concept. Pension systems are a global cornerstone for ensuring people have financial security after they retire. Experts often talk about three "pillars" of retirement income worldwide: government-provided benefits (like Social Security), employer-sponsored plans (like the pension we're discussing), and personal savings. In fact, the Mercer CFA Institute Global Pension Index regularly ranks the pension systems of 52 different countries, which cover about 65% of the world's population, showing just how important these plans are on a global scale.

Why Pensions Still Matter Today

In a world full of do-it-yourself retirement accounts, the old-school pension offers something increasingly rare: predictability. Its main job is to replace a portion of the salary you were earning before you retired, providing a dependable foundation for your finances. While the value of a 401(k) can swing wildly with the stock market, a pension is designed to deliver a specific, calculated benefit. That makes it an incredibly powerful tool for long-term security.

For a quick overview of what defines a pension plan, take a look at the table below.

Pension Plan Key Characteristics at a Glance

CharacteristicDescriptionSponsorTypically sponsored and funded primarily by an employer.GoalTo provide a predictable, regular income stream in retirement.Funding SourceEmployer contributions are the main source; some plans also require employee contributions.RiskThe employer or plan administrator bears most of the investment risk.BenefitThe payout is usually based on a formula (e.g., salary, years of service).

This structure makes a pension a cornerstone of a secure retirement for many people.

A pension shifts the primary responsibility of retirement saving from the individual to the employer. This structure is designed to deliver a consistent and reliable income stream, shielding retirees from much of the market volatility that can affect other types of retirement accounts.

What to Expect From This Guide

Getting a handle on how your pension works is the first, most critical step toward planning a successful retirement. This is especially true if you work in the public sector. For a deeper dive into that specific area, our guide on federal employee pensions has you covered.

Throughout the rest of this article, we’re going to break it all down for you. We'll cover:

The key differences between the major types of pension plans.

How you earn your benefits, when they officially become yours, and how they're calculated.

The different payout options you'll have once you decide to retire.

How things like taxes and inflation will impact your pension income over the long haul.

By the end, you'll have a much clearer picture of your pension and feel more confident about planning for a comfortable future.

The Two Main Types of Pension Plans

When you hear the word "pension," you might picture one specific thing, but the reality is that not all pension plans are created equal. They all aim to give you an income in retirement, but how they get you there can be fundamentally different. The two big categories you need to know are Defined Benefit (DB) plans and Defined Contribution (DC) plans.

Here’s a simple way to think about it: A Defined Benefit plan is like your employer promising to bake you a specific cake every month in retirement. They handle the ingredients, the oven, and all the risk to deliver that guaranteed cake. A Defined Contribution plan is more like your employer giving you a budget for groceries and a recipe; the final cake depends entirely on your shopping and baking skills.

This distinction is everything because it dictates who’s on the hook for the financial risk and how much guesswork is involved in your retirement planning.

The Guaranteed Promise: Defined Benefit Plans

The Defined Benefit (DB) plan is what most people consider a "traditional" pension. It's a straightforward promise from your employer: work for us, and when you retire, we will pay you a specific, predictable amount of money every month for the rest of your life.

This isn't just a number pulled out of thin air. The payment is calculated with a precise formula that usually hinges on three key factors:

Your years of service: How long you were with the organization.

Your final average salary: Typically based on your highest-earning years, like your "high-3."

A pension multiplier: This is a set percentage, like 1.5% or 2%, determined by the plan.

The beauty of a DB plan is its certainty. Your employer manages the investment pool and carries all the risk. If the stock market tanks, it's their problem to solve, not yours—your promised monthly check stays the same.

The Personal Investment Account: Defined Contribution Plans

A Defined Contribution (DC) plan works in a completely different way. You're probably already familiar with the most popular versions, like the 401(k) or the federal government's Thrift Savings Plan (TSP). With a DC plan, there's no promise of a specific monthly income down the road.

Instead, the only thing "defined" is the contribution. Your employer (and usually you, too) puts a set amount or percentage of your salary into a personal investment account. From there, you're in the driver's seat, choosing how to invest that money from a menu of options.

What you end up with in retirement boils down to just two things:

How much money was put into the account over your career.

How well your investments performed over time.

In this model, you shoulder all the investment risk. A great market can supercharge your account balance, but a downturn can shrink it, directly affecting your retirement nest egg.

To make the differences crystal clear, let's break them down side-by-side.

Defined Benefit (DB) vs. Defined Contribution (DC) Plans

FeatureDefined Benefit (DB) PensionDefined Contribution (DC) PlanThe PromisePromises a specific monthly income in retirement.Promises a specific contribution to an account.Who Owns the Risk?The employer. They must ensure funds are available.The employee. Your balance depends on market performance.Typical FormulaBased on salary, years of service, and a multiplier.Based on total contributions and investment returns.PredictabilityHigh. Your future income is clear and calculated.Low. Your final account balance is uncertain.Common ExamplesFederal (FERS/CSRS) pensions, many state/local government plans.401(k), 403(b), Thrift Savings Plan (TSP).

Ultimately, knowing which type of plan you have is the first step in understanding what your financial future might look like.

The infographic below helps visualize where these employer pensions fit into the overall retirement puzzle.

As you can see, your pension is a critical pillar, working alongside Social Security and your personal savings to create a stable foundation for your post-career life.

The global retirement market is massive, with total pension assets hovering around US$58.5 trillion. While traditional DB plans remain a huge part of that, there's been a steady global shift toward DC plans. This trend puts more responsibility on individuals to manage their retirement outcomes. You can dig deeper into these worldwide trends in the latest Global Pension Assets Study from the Thinking Ahead Institute. This makes it more critical than ever to understand exactly how your plan works.

How Your Pension Benefits Are Earned and Calculated

Your pension isn’t something that just magically appears the day you retire. It’s a benefit you actively build, year by year, throughout your career. To really get a handle on your retirement planning, you need to understand how the work you do today turns into that reliable paycheck down the road. It all boils down to two fundamental ideas: earning the right to your benefit (vesting) and then figuring out the exact dollar amount using a specific formula.

Understanding Pension Vesting

Think of vesting like earning tenure as a professor. You have to work for a certain number of years before the institution guarantees you a permanent spot. In the same way, you need to work for your employer for a specific period to lock in your right to a future pension. It's the company's way of rewarding long-term commitment.

Until you’re vested, the money your employer has contributed toward your pension isn't truly yours. If you leave the job before hitting that vesting milestone, you often have to walk away from the employer's contributions.

Key Takeaway: Vesting is the finish line you have to cross to secure your pension. It’s the point where the promise of a future benefit becomes a concrete guarantee, no matter where your career takes you next.

Vesting schedules aren't all the same, but they usually fall into one of two camps:

Cliff Vesting: This is an all-or-nothing approach. You gain 100% ownership of your benefit on a specific date, like after five years of service. Leave one day early, and you could get nothing from the employer.

Graded Vesting: This method eases you into ownership. You might become 20% vested after two years, 40% after three, and so on, until you finally reach 100% after a set number of years.

It’s absolutely critical to know your plan's vesting schedule. You'll find this information in your plan documents, and it tells you the exact number of years you need to work to make that pension yours.

The Pension Calculation Formula

Once you're vested and nearing retirement, your benefit isn't just a number pulled out of a hat. For traditional Defined Benefit (DB) pensions, the amount is determined by a precise and predictable formula. This formula is the engine that drives your retirement income, taking the details of your career and converting them into a specific dollar amount.

While the exact factors can vary slightly from plan to plan, the core ingredients are almost always the same.

The basic formula looks like this:

Years of Service x Final Average Salary x Pension Multiplier = Annual Pension Benefit

Let's break down what each of those pieces really means.

Years of Service

This one is pretty straightforward. It’s the total time you’ve been on the job in a role that qualifies for the pension. Every year, month, and sometimes even every day you work adds a little more to your final benefit. The longer your career, the bigger your pension.

Final Average Salary

This isn't just what you made in your last year. To prevent a single good or bad year from skewing the numbers, most plans average your salary over a specific period—usually your highest-earning years. For federal employees, this is famously known as your "high-3," which is the average of your highest 36 consecutive months of basic pay.

Pension Multiplier

This is a fixed percentage set by your pension plan, sometimes called an "accrual rate." It’s a small number, often between 1% and 2.5%, that gets multiplied by each year of your service.

A Practical Pension Calculation Example

Let's put all this together and see how it works for a real person.

Employee Name: Jane

Years of Service: 30 years

Final Average Salary (High-3): $90,000

Pension Multiplier: 1.7% (or 0.017)

Calculation:

30 (Years) x $90,000 (Salary) x 0.017 (Multiplier) = $45,900 per year

In this case, Jane's pension will pay her $45,900 every year for life. Broken down, that's $3,825 per month. You can see how each piece of the formula directly shapes the final outcome. To see how these numbers might look for your own situation, check out our in-depth guide on how to calculate pension benefits a quick guide.

Choosing Your Pension Payout Options

After decades of hard work, you’re finally at the finish line. But now comes one of the biggest financial decisions you'll ever make: how do you want your pension paid out? This isn’t just about getting a check in the mail; it’s about setting up a reliable income stream that fits your life and protects the people you care about.

Most plans boil the choice down to two main paths. You can think of it as choosing between a larger monthly check that’s just for you, or a slightly smaller one that keeps going for your spouse after you’re gone. This one decision has a massive impact on your own financial comfort and the future security of your family.

Nailing this choice is a fundamental part of understanding what a pension is and how it actually works in the real world.

The Single-Life Annuity Option

The single-life annuity is the simplest option on the table. It’s set up to give you the highest possible monthly payment from your pension. So, what’s the catch? The payments are tied directly to your life. They keep coming for as long as you live, but they stop the day you die.

This can be a smart move if you're unmarried, if your spouse has a solid retirement plan of their own, or if you have other assets set aside to take care of a survivor. The whole point here is to get the most income possible for yourself during retirement.

But the risk is pretty obvious. If you have a spouse or partner who depends on your income, they’ll get absolutely nothing from your pension after you pass away, which could leave them in a serious financial bind.

The Joint and Survivor Annuity Option

On the other hand, the joint and survivor annuity is specifically designed to create a financial safety net for your loved one. When you pick this option, you agree to take a smaller monthly pension payment. In return for that reduction, the plan guarantees it will continue making payments to your designated survivor (almost always your spouse) after you're gone.

This provides a powerful layer of protection and is often the go-to choice for married couples. The survivor's benefit is usually a percentage of your payment amount—most plans offer options like 50% or 100%.

Ultimately, you’re balancing two things: maximizing your income right now (single-life) versus guaranteeing future income for someone you love (joint and survivor). There's no single "right" answer, only the one that makes sense for your family's specific situation.

Comparing Your Payout Choices

Let’s run through a quick example to see how the numbers play out. Say your full, unreduced pension benefit—your single-life amount—is calculated to be $3,000 a month.

Payout OptionYour Monthly PaymentYour Survivor's Monthly PaymentSingle-Life Annuity$3,000$0Joint & 50% Survivor Annuity$2,700 (Reduced by ~10%)$1,350 (50% of your $2,700)Joint & 100% Survivor Annuity$2,400 (Reduced by ~20%)$2,400 (100% of your $2,400)

As the table shows, providing a benefit for your survivor comes at a direct cost to your own monthly income. The more you want them to receive later, the bigger the reduction you’ll take now. If you'd like to dive deeper into these calculations, check out our guide on how to calculate annuity payments like a pro.

This isn’t a decision to make on a whim. It’s a serious conversation to have with your spouse or partner long before you ever sign your retirement paperwork. You need to look at your entire financial picture—your combined assets, Social Security benefits, and your family's overall needs—to make a truly informed choice.

Dealing with Taxes and Inflation in Retirement

Once those pension checks start rolling in, your financial reality shifts. Two new, and very important, factors come into play: income taxes and the ever-present creep of inflation. The gross amount of your pension check is just the starting point; what really matters is how much purchasing power you have left after taxes, and how that power holds up year after year.

Figuring this out is a fundamental part of understanding how a pension actually works in the real world.

For the most part, the IRS looks at your pension payments a lot like it looked at your old paycheck. This means your monthly benefit is subject to federal income tax and, more often than not, state income tax, too. It’s crucial to get ahead of this so you aren't stuck with a massive tax bill come April.

How Your Pension Gets Taxed

When you start your pension, you’ll fill out a Form W-4P. Think of it as the retirement version of the W-4 you completed for your job. This form tells your plan administrator exactly how much federal income tax to withhold from each payment.

Keep these key points in mind:

Federal Taxes: Your pension income gets added to your other taxable income for the year—things like Social Security benefits or withdrawals from a TSP or 401(k)—to calculate what you owe Uncle Sam.

State Taxes: This is where things can get tricky, as the rules are all over the map. Some states leave pension income alone entirely, some offer partial breaks, and others tax it just like any other income.

This is why you always want to build your retirement budget around your net, or after-tax, pension amount. That’s the real number that hits your bank account.

Using COLAs to Protect Your Buying Power

While taxes take a bite out of your income, inflation slowly eats away at its value. A dollar today just won’t stretch as far ten or twenty years down the road. This is where a critical pension feature called a Cost-of-Living Adjustment (COLA) saves the day.

A COLA is an increase applied to your pension payment, usually annually, to help it keep pace with inflation. This adjustment is typically tied to an economic yardstick like the Consumer Price Index (CPI). It’s essentially a built-in "raise" that helps ensure your lifestyle doesn't shrink over a potentially long retirement.

A pension without a COLA is like a boat with a slow leak. It might seem perfectly fine when you first set sail, but over time, its ability to keep you afloat diminishes as the cost of everything—from gas to groceries—rises around you.

Many public-sector pensions, like those for federal employees, include annual COLAs. This feature, however, is a much rarer find in the private sector. One of the single most important questions you can ask your plan administrator is whether your pension includes a COLA. The answer has a massive impact on the long-term health of your retirement finances.

Pension systems worldwide are constantly under pressure from aging populations. One study found that U.S. state and local pensions have an average funded ratio of 83.1%. While that sounds pretty good, unfunded liabilities are a persistent risk, which makes robust features like COLAs even more important for a plan's long-term stability. You can dig into more of this data by reading the Allianz global pension report.

Common Myths and Questions About Pensions

https://www.youtube.com/embed/oH4T98NVVkg

Pensions are an incredible tool for building a secure retirement, but they’re also wrapped up in a lot of confusion and old-school thinking. Let's cut through the noise and tackle some of the biggest myths and most common questions out there. Getting a handle on how a pension really works means separating fact from fiction.

Right off the bat, one of the biggest misconceptions is that a pension is just another name for a 401(k). They're both for retirement, sure, but they operate on completely different principles. A 401(k) is an investment account—a defined contribution plan. The final amount you have depends entirely on how much you save and how your investments perform. You are shouldering all the risk.

A traditional pension, on the other hand, is a defined benefit plan. It’s a promise from your employer to pay you a specific, predictable monthly income for the rest of your life. Your employer manages the money and takes on the investment risk, ensuring you get a steady paycheck in retirement, regardless of Wall Street's roller coaster rides.

Is My Pension Absolutely Guaranteed?

This is a big one, and the answer isn't a simple "yes" or "no." Your employer has a legal duty to fund your pension, but let's be realistic—companies sometimes go bankrupt. That’s where a federal agency called the Pension Benefit Guaranty Corporation (PBGC) comes in, acting as a critical safety net.

If your private-sector defined benefit plan goes under, the PBGC steps in to insure your benefits up to a certain legal limit. It’s crucial to know, however, that this protection has its boundaries. The PBGC does not cover:

Pensions from government jobs (federal, state, or local).

Extra perks like health and welfare plans.

Benefit increases that were added right before the plan failed.

So, while your pension is very well-protected, it’s not a 100% ironclad guarantee against every possible disaster.

Think of the PBGC as the FDIC for your pension. It provides a strong backstop against company failure, but it’s essential to know the specific coverage limits and what isn’t protected.

What Happens If I Change Jobs?

A lot of people think that if they leave a job, their pension money vanishes. That's not how it works, thanks to something called vesting. Once you're fully vested—meaning you've worked for the company long enough to meet the plan's time requirement—that benefit is legally yours to keep.

If you leave your job after you've vested, you don't lose what you've earned. You just stop adding to it. That pension will be waiting for you when you hit the plan's official retirement age. Of course, the payout will be smaller than if you'd stayed there for your whole career, but it's still your money.

Can I Take My Pension as a Lump Sum?

This is another question that comes up all the time. Some private-sector pension plans give you the choice: take your benefit as a single lump-sum payment or as those familiar monthly checks. Taking the lump sum puts you in complete control of the cash, but it also shifts all the risk squarely onto your shoulders.

Opting for a lump sum means you’re now responsible for investing and managing that money so it lasts for your entire life. You're trading the security of a guaranteed income stream for flexibility. This is a massive financial decision, and it’s one you should never make without talking it over with a financial professional who can help you weigh the pros and cons for your unique situation.

Answering Your Top Pension Questions

Pensions can bring up a lot of "what if" scenarios, and getting clear answers is crucial for your peace of mind. Let's tackle some of the most common questions federal employees and others have about how their pension works in the real world.

What Happens If My Company Goes Bankrupt?

This is a huge worry for anyone in the private sector with a traditional pension. Thankfully, there's a safety net. Most defined benefit plans are insured by a federal agency called the Pension Benefit Guaranty Corporation (PBGC). If your company goes under, the PBGC steps in to make sure you still receive your pension payments, up to certain legal limits.

Defined contribution plans, like a 401(k) or your TSP, are a different story. Your money in these accounts is held in a separate trust, meaning it’s not part of the company’s assets. Creditors can't touch it if the business fails.

Can I Borrow Money from My Pension?

With a traditional defined benefit pension, the answer is almost always no. Think of it as a promise for a future paycheck, not a savings account you can dip into. The structure is designed to guarantee that income stream in retirement, so early withdrawals or loans just aren't possible.

Now, some defined contribution plans, including the TSP and many 401(k)s, do allow for loans. Each plan sets its own specific rules on how much you can borrow and the repayment terms, so you'll need to dig into your plan's official documents to see what's available to you.

The Bottom Line: Your pension is laser-focused on one thing: funding your retirement. While a TSP might offer a bit more flexibility, a traditional pension is a locked-in commitment for future income, which is why you can't borrow against it.

How Do I Find a Lost Pension?

It happens more often than you'd think. People change jobs, companies merge, and paperwork gets lost. If you suspect you have a pension from a former employer that's fallen off your radar, don't give up on it.

Here’s where to start your search:

Go to the Source: Your first stop should be the HR department of your old company. It's the most direct path to tracking down your benefits.

Use the PBGC's Search Tool: If the company no longer exists, has moved, or was acquired, the PBGC has a fantastic, free pension search database designed to connect people with unclaimed funds from terminated plans.

Check the National Registry: Another great resource is the National Registry of Unclaimed Retirement Benefits, a service dedicated to helping people find their lost retirement accounts.

A little bit of detective work can often uncover benefits you earned years ago. Don't assume that money is gone forever!

Trying to make sense of your federal pension and benefits can feel overwhelming, but you don't have to figure it out on your own. Federal Benefits Sherpa provides personalized guidance to help you confidently navigate your retirement plan and secure your financial future. Book your free 15-minute benefits review today at https://www.federalbenefitssherpa.com.