A Complete Guide to Federal Life Insurance (FEGLI)

When we talk about federal life insurance, we're really talking about the Federal Employees' Group Life Insurance program, better known as FEGLI. It just so happens to be the largest group life insurance plan in the world, providing a foundational layer of financial security for federal and postal employees.

Unpacking Your Federal Life Insurance Benefits

For many feds, the benefits package can feel like a tangled web of acronyms and rules. One of the most critical threads in that web is your federal life insurance, a program designed to give your loved ones a financial cushion if something happens to you.

It's tempting to see FEGLI as just another box you check when you're hired, but it’s so much more than that. Think of it as a set of building blocks. You get to decide how to arrange them to build a financial safety net that truly fits your family's needs. Understanding how these blocks work is a cornerstone of smart financial planning for your entire career.

Your insurance needs aren't static; they'll evolve with your salary, your age, and major life events like getting married or having children. FEGLI is built to be flexible, but only if you know how to navigate its options. And its scale is massive—the U.S. insurance market is the largest in the world, with premiums hitting about $3.3 trillion. Group life programs like FEGLI are a huge piece of that pie, which tells you just how important they are. You can get a sense of this scale from the Treasury's annual report on the insurance industry.

The Four Pillars of FEGLI

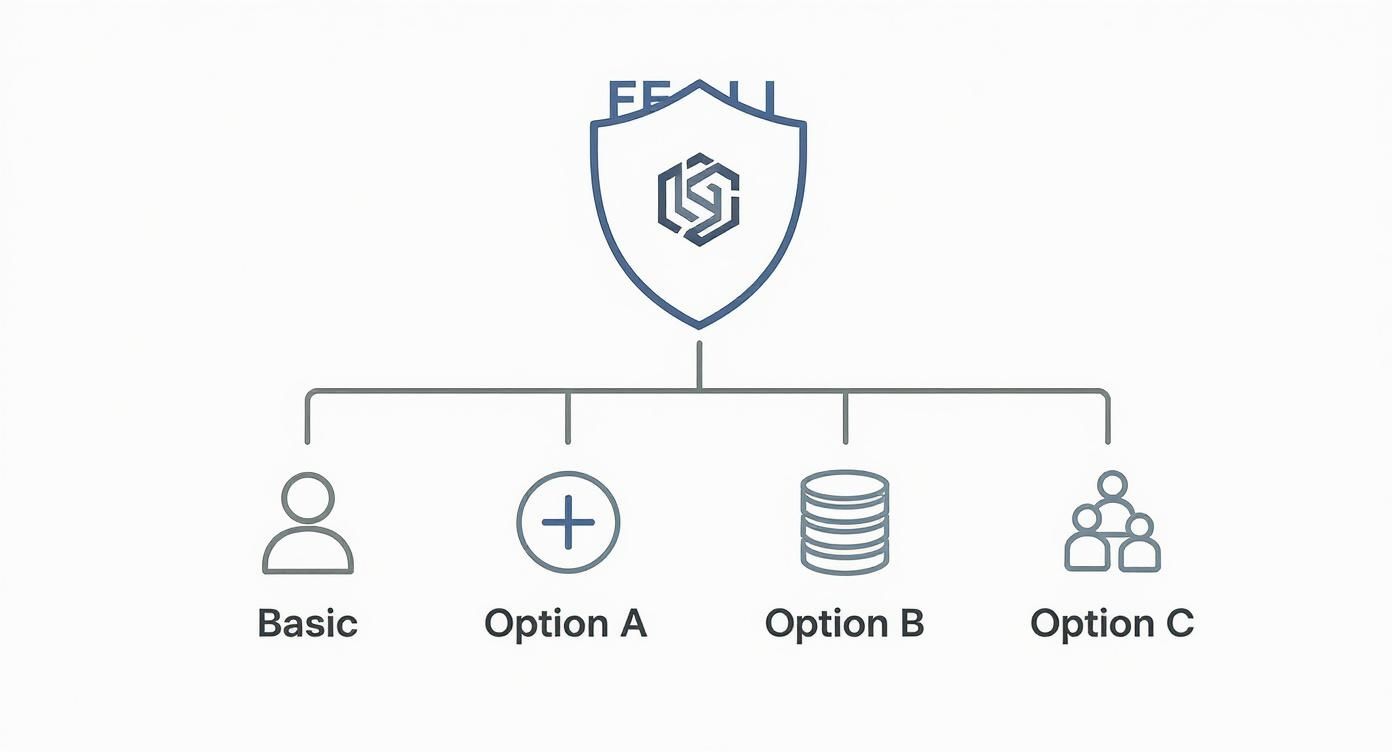

At its heart, the FEGLI program is made up of four distinct parts. Each one has a different job, and learning what they do is the key to making good decisions.

Basic Insurance: This is the starting point. It's the automatic, foundational coverage most employees get, and its value is linked directly to your annual pay.

Option A (Standard): A simple, optional add-on that provides a flat $10,000 of coverage. No complicated math here.

Option B (Additional): This is where you get real flexibility. It lets you buy extra coverage in multiples of your salary, from one to five times your annual pay.

Option C (Family): This one is for your family, offering coverage for your spouse and eligible dependent children, also in multiples.

Think of Basic coverage as the foundation of your house. Options A, B, and C are like adding extra rooms—a home office, a bigger garage, or a playroom for the kids. You build what your family needs, based on your own situation and budget.

We'll break down each of these components in this guide, getting into the details of their costs, benefits, and how they all work together. If you're looking for a bird's-eye view of how all your benefits fit together, take a look at our quick and clear guide to the Federal Employee Benefits Handbook. Once you get these concepts down, you’ll be in a much better position to build a strong financial safety net for the people who count on you.

Breaking Down Your FEGLI Coverage Options

Think of your federal life insurance not as a rigid, one-size-fits-all policy, but as a customizable package. The Federal Employees' Group Life Insurance (FEGLI) program is really just a set of four distinct components you can layer together. Your job is to assemble them in a way that creates a meaningful safety net for your family.

So, let's unpack these building blocks and see how they work.

This graphic gives a great visual of how the four pieces of the FEGLI puzzle fit together, with the core Basic coverage as the starting point and the three optional layers you can add on.

It’s clear from this that Basic Insurance is your foundation. Options A, B, and C are the voluntary additions you can select to really build out your coverage.

The Foundation: Basic Insurance

The first piece of the puzzle, and the one most people start with, is Basic Insurance. In fact, for most new feds, you're automatically enrolled in this unless you go out of your way to waive it. This is the cornerstone of your entire FEGLI plan.

The value of your Basic Insurance is directly tied to your paycheck. The formula is simple: take your annual basic pay, round it up to the next thousand, and then add $2,000. For instance, if your salary is $61,500, it gets rounded up to $62,000. Add the extra $2,000, and your Basic Insurance Amount becomes $64,000.

One of the best built-in features here is the Extra Benefit. This feature doubles the payout for employees who pass away at age 35 or younger, and it costs you nothing extra. The bonus coverage gradually shrinks by 10% each year after 35 and disappears entirely by age 45. It’s a powerful, automatic boost for younger employees who are more likely to have young kids and a brand new mortgage.

Optional Add-Ons For More Coverage

With your Basic Insurance in place, you can start layering on more protection. These options—A, B, and C—are completely voluntary, meaning you have to actively sign up for them.

Option A (Standard)

This is the simplest add-on. Option A provides a flat $10,000 death benefit, plain and simple. It’s a straightforward, fixed amount that has nothing to do with your salary. For many, it's an affordable way to tack on a little extra for things like final expenses or to clear out small debts.

Option B (Additional)

Now, this is where you can get some serious coverage. Option B is by far the most powerful and flexible part of FEGLI. It lets you buy extra life insurance in multiples of your salary, anywhere from one to five times your annual basic pay.

Let's go back to our employee with the $61,500 salary (which rounds to $62,000 for insurance math). They could add anywhere from $62,000 (a 1x multiple) all the way up to $310,000 (a 5x multiple) in additional coverage.

Think of Option B like adding floors to your financial house. Basic is the ground floor, and each multiple of Option B is another level of protection you build on top, giving you the height and security your family needs.

This is the tool you use to tailor your coverage for the big stuff—replacing your income for years, paying off the house, or making sure college is funded.

Option C (Family)

Finally, Option C is all about protecting your family members directly. It provides a life insurance benefit for your spouse and eligible dependent children. Just like Option B, it’s sold in multiples, from one to five.

Each multiple buys you:

$5,000 of coverage on your spouse.

$2,500 of coverage on each eligible dependent child.

So, if you elect five multiples of Option C, your spouse gets $25,000 in coverage ($5,000 x 5), and each child gets $12,500 ($2,500 x 5). This money can be a real lifeline, helping a surviving parent handle immediate costs without having to raid savings or retirement funds.

To give you a clearer picture, here's how the different FEGLI options stack up against each other.

FEGLI Coverage Options at a Glance

Coverage TypeBenefit CalculationWho is CoveredKey FeatureBasic InsuranceYour annual salary rounded up to the next $1,000, plus $2,000.You (the employee)The foundational coverage that includes an "Extra Benefit" for younger employees.Option A (Standard)A flat $10,000 benefit.You (the employee)A simple, fixed amount for a modest coverage boost.Option B (Additional)1, 2, 3, 4, or 5 times your annual salary.You (the employee)The most flexible option for adding significant amounts of coverage.Option C (Family)Up to 5 multiples of $5,000 for a spouse & $2,500 per child.Your spouse & eligible childrenProvides a small benefit to cover final expenses for family members.

By mixing and matching Basic Insurance with Options A, B, and C, you can build a life insurance strategy that truly fits your life and protects what matters most.

How Your FEGLI Premiums Are Calculated

It’s one thing to understand the what of your federal life insurance coverage, but the how—specifically, how it hits your paycheck—is where it gets real. The cost of your FEGLI benefits is a huge piece of your financial puzzle, and the premium calculations are a mix of government help, your age, and the exact coverage you decide on.

Let's pull back the curtain on the numbers so you can see exactly what you're paying for and why.

The Government's Share: Your Basic Insurance Premium

One of the best perks of the FEGLI program is the government's direct contribution to your Basic Insurance. You aren't footing this bill alone. The federal government chips in to pay for one-third of the premium for your Basic coverage. This subsidy makes it an incredibly affordable foundation for your financial safety net.

You're on the hook for the remaining two-thirds. This shared-cost approach makes Basic Insurance a fantastic value, particularly when you're earlier in your career.

Think of the government subsidy as a built-in discount on your core life insurance. It’s a direct financial advantage of being a federal employee that you just won't find in most private group plans.

But keep in mind, this cost-sharing deal only applies to Basic Insurance. The moment you start adding optional coverage, the financial responsibility shifts completely to you.

Your Share: The Cost of Optional Coverages

For any extra layers of protection you choose—Option A, Option B, and Option C—you pay 100% of the premium. There is no government contribution for these optional benefits. This is a critical distinction to remember when you're deciding how much coverage you truly need.

What's more, the cost of these optional coverages isn't set in stone. It climbs as you get older, a fact that can have a major impact on your budget down the road.

Here’s a quick rundown of how the costs for each add-on are structured:

Option A ($10,000 Standard): Your premium is tied to your age and goes up every time you enter a new five-year age bracket (e.g., 35-39, 40-44, 45-49).

Option B (Additional): The cost here is also based on your age and the number of multiples you've selected. Just like with Option A, the rate you pay per multiple jumps every five years.

Option C (Family): This one is based on your age, not the age of your spouse or kids. The premium covers all your eligible family members under a single rate that also increases in five-year age brackets.

This age-banded pricing means that while optional FEGLI coverage might look like a bargain early in your career, it can become surprisingly expensive as you get older, especially in retirement.

Putting It All Together: A Sample Calculation

To see how this works in the real world, let's look at a hypothetical employee. Meet Sarah, a 42-year-old federal employee earning an annual salary of $80,700.

First, we calculate her Basic Insurance Amount (BIA). We round her salary up to the next thousand ($81,000) and add $2,000, which gives her a BIA of $83,000. She is responsible for paying two-thirds of the premium for this amount.

Now, let's say Sarah decides she needs more coverage:

She elects 3 multiples of Option B. This adds another $243,000 in coverage (3 x $81,000). She'll pay the full premium for this, based on her 40-44 age bracket.

She also chooses 2 multiples of Option C. This provides $10,000 for her spouse and $5,000 for each of her children. Again, she pays the full premium, determined by her current age bracket.

Sarah's total bi-weekly premium is the sum of these three parts: her share of the Basic premium, the full cost of her Option B coverage, and the full cost of her Option C coverage. In a few years, when she moves into the 45-49 age bracket, the premiums for her Option B and Option C coverage will automatically go up.

Navigating FEGLI During Life Changes and Retirement

Your federal life insurance isn't something you can just "set and forget." Think of it as a living part of your financial plan—as your life changes, your coverage needs to change right along with it.

Major milestones are the perfect checkpoints. Getting married, having a baby, or getting serious about retirement planning are all moments when you absolutely need to take a fresh look at your FEGLI elections. The goal is to make sure your coverage still makes sense for your family's new reality.

Adapting Your Coverage with Qualifying Life Events

Thankfully, the government knows that life doesn't stand still. The FEGLI program has a built-in mechanism that lets you increase your coverage outside of the very infrequent Open Seasons, but only when you experience what's called a Qualifying Life Event (QLE).

These are specific life changes that open a special, temporary window for you to make adjustments.

Some of the most common QLEs include:

Marriage: A perfect time to add or increase coverage for your new spouse.

Divorce: This event often requires updating beneficiaries and rethinking your coverage amounts.

Death of a Spouse: A difficult time that unfortunately can shift your financial responsibilities.

Acquiring an Eligible Child: This covers birth, adoption, or even when you gain a stepchild.

When a QLE happens, you get a 60-day window to make your move. This is your chance to elect or increase your Basic, Option B, and Option C coverage. For instance, after getting married, you have 60 days to add Option C for your new spouse or bump up your Option B multiples to better protect your shared future.

Crucial Takeaway: Don't let this 60-day window close on you. If you miss it, you're stuck waiting for a FEGLI Open Season, which can be years away. It’s a very common and costly mistake.

The Critical Retirement Decision Point

As you get closer to retirement, you'll face some of the biggest decisions of your career regarding your life insurance. The choices you make here will echo through your retirement years, affecting both your family's safety net and your monthly budget.

First things first, you can't just carry your FEGLI into retirement automatically. You have to meet the "5-year rule." This simply means you must have been enrolled in FEGLI for the five consecutive years leading up to your retirement date. No exceptions.

If you clear that hurdle, you then have to decide what to do with your Basic Insurance. This is where the options get a bit tricky and the costs can really start to add up.

Your Three Post-Retirement Reduction Choices

When you retire, your Basic Insurance Amount (BIA) doesn't just stay the same. You're forced to choose one of three reduction schedules, and each has a vastly different impact on your wallet and your death benefit.

75% Reduction: This is the default option and the one most people take. Your coverage will shrink by 2% every month after you turn 65 (or when you retire, if that's later) until it's worth just 25% of what it was. The huge upside? Once it's fully reduced, this coverage is free for the rest of your life.

50% Reduction: If you want to keep a bit more coverage, you can choose this option. Your death benefit will reduce by 1% per month until it hits 50% of its original value. You’ll pay a higher premium for this than you would for the 75% reduction, but you're left with a larger benefit.

No Reduction: This option lets you keep 100% of your Basic Insurance value for life. It sounds great, but it comes with a steep and ever-increasing price tag. The premiums for No Reduction become incredibly expensive as you get older, making it a financially difficult choice for most retirees.

Deciding how to handle your federal employee life insurance after retirement is a major financial crossroads. We dive much deeper into these choices in our complete federal employee life insurance after retirement guide.

This focus on life insurance planning isn't just a federal thing. The entire U.S. individual life insurance market has seen a surge in interest, with policy sales reaching levels not seen in over 40 years. More and more people are realizing they need a solid financial backstop. As you can see from these insights on the U.S. life insurance market, proactive planning is becoming a top priority for American families. Carefully considering your FEGLI options is your chance to do the same.

Evaluating If Your FEGLI Coverage Is Enough

For many federal employees, the Federal Employees' Group Life Insurance (FEGLI) program is the first—and sometimes only—life insurance they have. It's a solid benefit and a great starting point for your financial safety net. But assuming it's the complete solution without taking a closer look can be a costly mistake.

The real question isn't just, "Do I have life insurance?" It's a much more important one: "Is my federal life insurance enough to truly protect my family?"

This is where a simple but eye-opening exercise called a gap analysis comes into play. Think of it like a financial roadmap. On one side, you list out all of your family's future financial needs if you were no longer around. On the other, you list your existing resources, including your FEGLI death benefit. That space in the middle? That's your "gap."

This process takes you from a vague sense of worry to a set of concrete numbers. It gives you a clear, honest picture of what’s truly at stake.

Calculating Your Family's Financial Needs

To kick off your gap analysis, you need to tally up the major financial burdens your family would face without you. This goes way beyond just final expenses; it's about making sure they can maintain their quality of life for years to come.

Your calculation should cover a few key areas:

Income Replacement: How many years of your salary would your family need to replace to stay on their feet?

Mortgage Payoff: Is it important for them to stay in the family home without the financial strain of a mortgage?

Other Major Debts: Don't forget car loans, student loans, and any significant credit card balances.

College Funding: What will it cost to fund your children's education down the road?

When you add these figures up, you get a realistic estimate of your family's total need. This number is often a surprise and clearly shows why just relying on the Basic FEGLI coverage might leave a dangerous shortfall. More importantly, it gives you a clear target to aim for in your planning.

Comparing FEGLI with Private Insurance

Once you know your target number, the next step is to weigh your options. While FEGLI has some great features, it’s crucial to see how it stacks up against what the private market can offer. The global insurance market is massive, with the U.S. leading the world in premium income, which means you have plenty of choices. You can get more insights on the growth of the global insurance market from Allianz, which underscores the variety of products available.

Strengths of FEGLI:

Guaranteed Eligibility: You can get coverage without a medical exam. For anyone with a pre-existing health condition, this is a huge advantage.

Convenience: The premiums come right out of your paycheck. It’s a simple "set-it-and-forget-it" system.

Potential Downsides of FEGLI:

Rising Costs: The premiums for optional coverage jump every five years based on your age band, getting incredibly expensive as you get older.

Coverage Limits: Option B is capped at five times your salary. This might not be nearly enough for high earners or those with big mortgages and college tuitions on the horizon.

Post-Retirement Reductions: Your coverage automatically starts to shrink in retirement unless you pay steep premiums to keep it.

Private term life insurance offers a powerful alternative: level premiums. This means you can lock in a rate for 20 or 30 years that will never go up. This gives you long-term budget predictability that FEGLI’s optional coverage simply can’t offer. For a deeper look at how life insurance works with your other benefits, read our guide to federal employee survivor benefits.

For most federal employees, the best strategy isn't an "either/or" decision. It’s often a hybrid approach. You keep the affordable Basic FEGLI coverage and then buy a private term life policy to fill the rest of the gap. This lets you combine the strengths of both systems to build a financial safety net for your family that is both robust and cost-effective.

Common Questions About Federal Life Insurance

Once you get past the official handbooks, you start running into the real-world questions about federal life insurance. The program makes sense on paper, but what does it mean for your life and your decisions?

Let's dig into some of the most common questions we hear about the Federal Employees' Group Life Insurance (FEGLI) program.

Can I Keep My Federal Life Insurance if I Leave My Job?

Yes, but it's not a simple continuation. When you leave federal service, you have the right to convert your FEGLI group coverage into a private, individual policy. The huge advantage here is you can do this without a medical exam.

This is a critical lifeline for anyone with health conditions that might make getting new insurance difficult or expensive.

But there are two big catches you need to know about. First, the clock is ticking—you have a strict 31-day window after leaving your job to apply for this conversion. Miss it, and the option is gone for good. Second, prepare for sticker shock. You'll be paying the full commercial rate, not the subsidized group rate you had as an employee, so the premiums will be significantly higher.

How Do I Change My FEGLI Beneficiary?

You can change your beneficiary anytime, and the process itself is pretty simple. You'll need to fill out the "Designation of Beneficiary" form (SF 2823) and get it to your agency's human resources office.

It’s absolutely critical to understand this: the change isn't official until your agency receives and accepts the form. Just mailing it isn't enough.

We always recommend reviewing your beneficiaries after any major life event—a marriage, a divorce, the birth of a child. An outdated form is one of the most common and heartbreaking mistakes we see. It could mean your life insurance benefit goes to a former spouse instead of your current one, no matter what your will says.

What Happens to My Coverage During Leave Without Pay?

If you go on Leave Without Pay (LWOP), your FEGLI coverage doesn't just vanish. Your Basic and Optional life insurance will continue for up to 12 months while you're in a non-pay status. Even better, you don't have to pay any premiums during this time.

Once you pass the 12-month mark on LWOP, your coverage terminates. At that point, you'll get the same 31-day window to convert your policy to an individual plan, just as if you had left your job. Be aware that special rules might apply if you're on LWOP for military service, which can extend your coverage. It's always a smart move to talk with your HR department about the specifics before taking a long-term leave.

Are FEGLI Benefits Taxable?

This is a great question, and the answer is mostly good news. For your beneficiaries, the lump-sum payout from a FEGLI policy is typically not subject to federal income tax. If you have a $500,000 policy, they get the full $500,000, tax-free.

The one area to watch is estate tax. While the payout isn't considered income, it is included in the total value of your estate. If your estate is large enough to exceed the federal exemption threshold, it could be subject to estate tax. Frankly, this is only a concern for people with a very high net worth.

Also, if your beneficiaries opt to receive the money in installments instead of one lump sum, any interest they earn on those funds could be taxed as income. As with any financial matter, they should always run it by a qualified tax professional to be sure.

Getting a handle on the details of your federal life insurance is a cornerstone of a secure financial plan. The choices you make today will echo for years, shaping your family's future.

At Federal Benefits Sherpa, our job is to help federal employees cut through the complexity and map out a clear path to a retirement they can feel confident about. If you have more questions or want to see exactly how FEGLI fits into your big picture, schedule your free 15-minute benefit review today.