Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

TSP Hardship Withdrawal Rules: Your Essential Guide

Your Thrift Savings Plan (TSP) is your retirement lifeline, but sometimes life throws you a curveball that demands immediate financial attention. The TSP hardship withdrawal rules are designed for those exact moments, allowing you to tap into your retirement savings for an immediate and heavy financial need.

Think of it less like a loan and more like an emergency escape hatch. It's there for a true crisis, but using it means that money is gone for good, permanently affecting your future retirement.

What Is a TSP Hardship Withdrawal

A TSP financial hardship withdrawal is a permanent distribution from your account, and it should always be your last resort. The key thing to remember is that, unlike a TSP loan, you cannot repay the money you take out. This makes it a very serious decision with lasting consequences for your financial security down the road.

This option is only available when you're facing a significant financial burden and have already exhausted all other reasonable sources of cash. The TSP has very specific criteria for what qualifies as a hardship, and you’ll have to formally certify that your situation meets these strict standards.

To give you a quick overview, here's a breakdown of the key aspects of a TSP hardship withdrawal.

| Aspect | Key Detail |

|---|---|

| Eligibility | You must be an active federal employee facing an immediate and significant financial need. |

| Purpose | Designed as a last resort after exhausting all other reasonable financial options. |

| Repayment | Not allowed. The money is permanently removed from your account. |

| Taxation | The withdrawn amount is subject to federal (and likely state) income tax. |

| Penalty | If you are under age 59½, a 10% early withdrawal penalty typically applies. |

| Consequence | You lose out on all future compound growth for the money you withdraw. |

This table highlights the gravity of the decision. Let's dig a little deeper into what that means for your bottom line.

Understanding the Financial Impact

When you take a hardship withdrawal, the financial hit comes from multiple angles. First, the amount you take out is considered taxable income, so it will be subject to federal and, in most cases, state income tax. On top of that, if you're under age 59 ½, you’ll likely get hit with a 10% early withdrawal penalty.

When you combine those taxes and penalties, the actual cash you receive can be significantly less than the amount you requested. But the most damaging part isn’t the immediate cost—it’s the loss of future growth. Every dollar you remove from your TSP stops working for you, permanently shrinking the nest egg you're counting on for retirement.

Who Uses Hardship Withdrawals

So, who is actually turning to this option? Recent data shows a clear link between economic pressure and hardship withdrawals. In 2024, the usage rate was highest among the second-lowest paid group of federal employees, with 8.47% of participants in this bracket taking a hardship withdrawal.

This figure represents a noticeable jump, underscoring how financial stress is hitting mid-career employees the hardest. You can read more about these trends in the 2024 TSP Annual Report summary.

A hardship withdrawal is not a simple transaction; it's a permanent decision that impacts your financial future. It's crucial to understand the rules and consequences before proceeding.

This guide will walk you through every part of the TSP hardship withdrawal process to help you make a truly informed choice.

So, how do you know if you actually qualify for a TSP hardship withdrawal? It all boils down to one crucial question: are you facing what the TSP officially calls an "immediate and heavy financial need"?

This isn't a vague suggestion; it's a strict standard. You have to be in a genuine financial crisis that you simply can't solve with any other money you could reasonably get your hands on.

That means you have to certify that you’ve already tried everything else. Before you can touch your TSP, you’re expected to have looked into selling off other assets, trying to get a loan from a bank, or even hitting pause on your own TSP contributions for a while.

The Four Approved Reasons for a Hardship Withdrawal

To get approved, your emergency has to fit neatly into one of four specific categories defined by the TSP. Think of these as the only four doors that lead to a hardship withdrawal. If your situation doesn't fit through one of them, it's a non-starter.

Here are the only four qualifying reasons:

- Recurring Negative Cash Flow: This is for when your monthly bills are consistently higher than your income, putting you in the red month after month.

- Medical Expenses: This covers out-of-pocket medical bills for you, your spouse, or your dependents that your insurance won't pay for.

- Personal Casualty Loss: This is for major, uninsured damage to your primary home caused by events like a fire, flood, or hurricane.

- Legal Fees: This applies only to specific legal costs associated with a separation or divorce.

Each of these requires solid proof and a clear demonstration that you absolutely need the money.

You can only take out the exact amount you need to cover the emergency. For example, if you have a $5,000 medical bill that insurance didn't cover, you can only withdraw $5,000, plus an estimate for the taxes you'll owe on that money.

This rule is in place to make sure a hardship withdrawal is used as a last-resort lifeline, not a way to get a lump sum of cash for other purposes.

What This Looks Like in Real Life

Let's put these official rules into real-world context. A "personal casualty loss," for instance, isn't about a minor home repair. It's for serious, uninsurable damage.

Imagine a hurricane floods your home, leaving you with $15,000 in structural repairs that your insurance policy specifically excludes. That's a textbook example of a qualifying event. A simple leaky faucet? Not so much.

The same logic applies to "medical expenses." This isn't for elective cosmetic surgery. It's for necessary treatments or procedures that your health plan won't cover. Paying for your child's essential surgery after your insurance has paid its part is exactly what this category is for.

These lines are drawn to show just how serious a situation needs to be. It's a tool for true emergencies, and the data backs this up. Between 2018 and 2022, the rate of hardship withdrawals stayed between 7.9% and 8.9%. Unsurprisingly, usage was highest among the lowest-paid federal employees, showing a direct link between income pressure and the need to tap into retirement funds early. You can dig into these trends yourself in the official TSP annual report.

Getting familiar with these specific criteria is the absolute first step. It's how you'll know if a TSP hardship withdrawal is even a possibility for you.

Your Step-by-Step Guide to Applying and Getting Approved

When you're dealing with a financial emergency, the last thing you want is a mountain of confusing paperwork. I get it. Let’s walk through the TSP hardship withdrawal application process together, step-by-step, so you know exactly what to expect. Think of it as your roadmap from identifying the need to getting the cash in hand.

You have two ways to kick things off: you can either log into your My Account on the TSP website or give the ThriftLine a call. Honestly, the online portal is usually the fastest and most straightforward path. It walks you through each section and makes it pretty clear what information you need to provide.

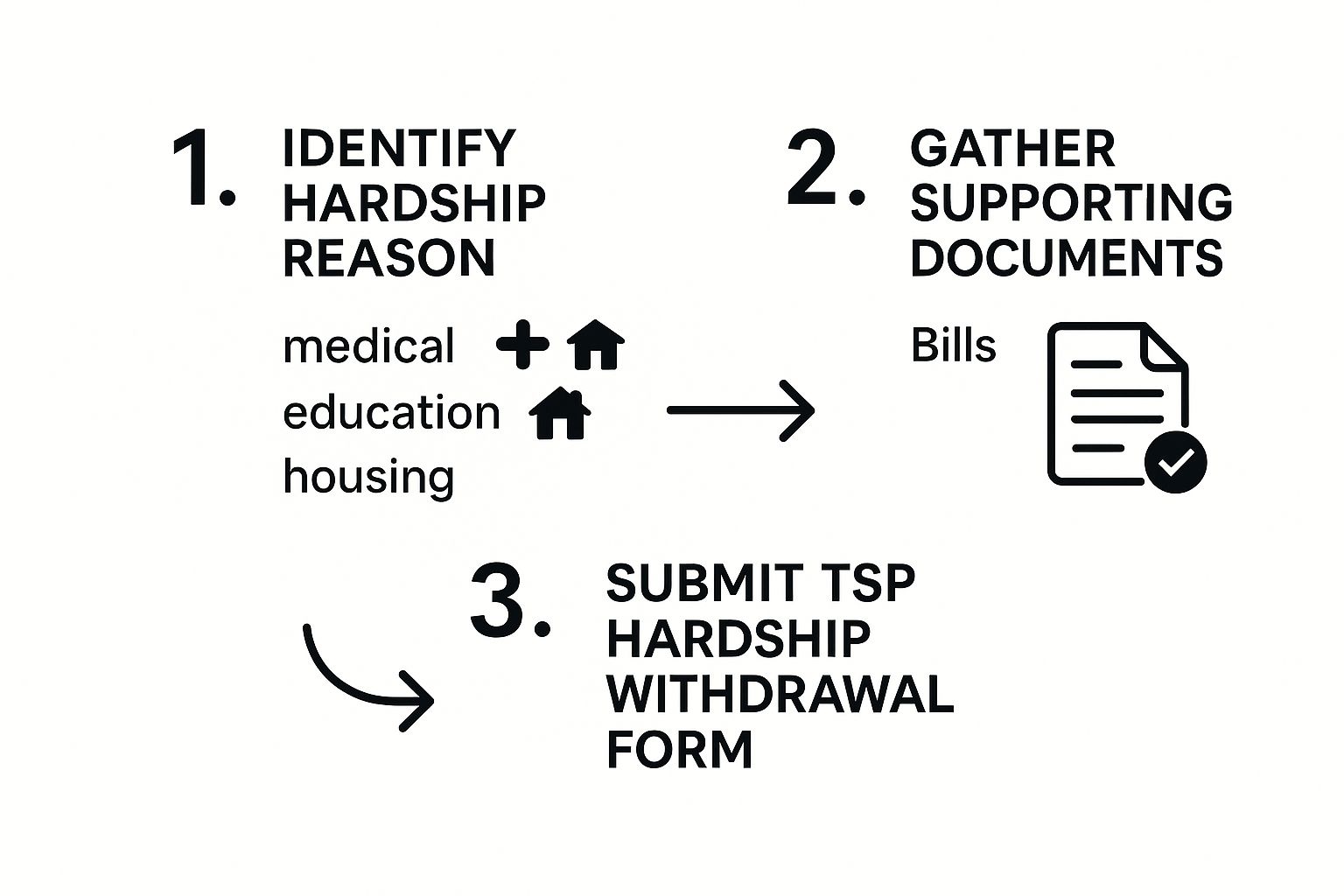

The whole journey can really be broken down into three main stages: figuring out your hardship, gathering the right proof, and submitting your request.

As you can see, that middle step—getting your paperwork in order—is what makes or breaks your application. It’s the bridge between your financial need and getting the TSP’s approval.

Getting Your Paperwork in Order

This is, without a doubt, the most critical part of the entire process. The TSP needs solid proof to verify that your situation fits their strict hardship criteria. In my experience, incomplete or incorrect documentation is the number one reason applications get delayed or denied.

Here’s a quick rundown of the kind of proof you’ll need to have on hand:

- Medical Expenses: You'll need things like itemized bills from the doctor or hospital, an Explanation of Benefits (EOB) from your insurance company showing your out-of-pocket costs, or other official statements.

- Avoiding Eviction or Foreclosure: This requires official documents. Think a formal foreclosure notice from your lender, an eviction notice signed by your landlord, or a letter showing how much you're behind on rent or mortgage payments.

- Personal Casualty Losses: For things like damage from a natural disaster, you’ll need repair estimates from contractors, insurance claim paperwork that details what isn't covered, or reports from agencies like FEMA.

- Legal Fees: This is for divorce or separation. You'll need a signed fee agreement from your lawyer and itemized invoices for their work.

Here's the most important thing to remember: When you sign your application, you're doing so under penalty of perjury. You are legally swearing that the amount you're requesting is what you truly need and that you have no other reasonable way to get the money.

The Self-Certification and What to Expect on Timing

That legal declaration is a core part of the process, known as self-certification. It’s your official statement confirming that your situation is genuinely dire and that you’ve already looked into other options, like personal loans or selling assets, and come up empty. Take this seriously—it's a legal requirement, not just a box to check.

So, what’s the timeline look like? Once you submit a complete and accurate application with all your documents, the TSP is usually pretty quick. They typically process requests within 7 to 10 business days. After that, allow a few more days for the funds to hit your bank via direct deposit or for a check to arrive in the mail. A good rule of thumb is to expect the money within two to three weeks, as long as your application is perfect.

The Real Cost and Tax Implications

Before you even think about pulling money from your TSP for a hardship, you have to get brutally honest about the true cost. This isn't just about getting cash for an emergency; it's a decision with major, long-lasting financial shockwaves. Think of it like selling a piece of your future home to fix a leaky roof today. Sure, you solve the immediate problem, but you're left with less equity for your future.

The first hit you'll take is from taxes. That withdrawal isn't tax-free cash. It’s treated as ordinary income, meaning it gets slapped with both federal and, depending on where you live, state income taxes. Right off the bat, the amount you actually get in your bank account is less than what you took out.

The Double Impact of Taxes and Penalties

On top of the income tax, there’s another painful sting if you’re under the age of 59 ½. The IRS imposes a 10% early withdrawal penalty on money you take out of retirement accounts. This isn't just a fee; it's a penalty for breaking the long-term savings deal you made with yourself.

When you add that penalty to your income tax bill, the amount of cash you're left with can be shockingly low. It’s a calculation you absolutely must run before you commit to the withdrawal.

A TSP hardship withdrawal isn’t a lifeline of free money. It's an expensive loan you take from your future self, with steep taxes and penalties serving as the immediate interest payment.

Let’s get down to brass tacks and see what this looks like with real numbers.

The True Cost of a $10,000 TSP Hardship Withdrawal

Let's say you need $10,000 to cover a qualifying financial emergency. You apply for a TSP withdrawal, and here's a breakdown of how the math could shake out. The table below shows just how quickly your withdrawal amount shrinks.

| Financial Impact | Estimated Cost (Example) | Explanation |

|---|---|---|

| Initial Withdrawal | $10,000 | The gross amount requested from your TSP account. |

| Federal Income Tax | $2,200 | Assuming a 22% federal tax bracket. This can vary based on your income. |

| 10% Early Withdrawal Penalty | $1,000 | The standard penalty for participants under age 59 ½. |

| Total Immediate Reduction | $3,200 | The combined total of taxes and penalties you owe. |

| Your Net Payout | $6,800 | The actual cash you receive after all deductions. |

As you can see, to solve a $10,000 problem, you're only left with $6,800. You still owe the full $10,000 for whatever your hardship is, which means you’ve just created a new $3,200 shortfall you have to cover from somewhere else. This is a critical detail in the TSP hardship withdrawal rules that many people overlook.

The Hidden Cost of Lost Compound Growth

The most devastating consequence, however, isn't the tax bill or the penalty. It’s the permanent, silent killer of your retirement dreams: lost compound growth. The $10,000 you pull out of your TSP stops working for you. Forever.

Money in a retirement account is supposed to be your workhorse, growing exponentially over the years. When you take it out early, you forfeit every penny of future earnings that money would have generated. Over 20 or 30 years, that $10,000 could have easily ballooned to $50,000 or more, depending on how the market performs.

This damage is irreversible. Unlike a TSP loan, you can't pay back a hardship withdrawal. The money, and all its future potential, is gone for good. You're left with a permanent hole in your retirement nest egg that will be incredibly difficult to patch. When you're weighing this decision, you have to ask if the immediate need is worth this lasting blow to your financial future. For help sorting through these complex choices, getting guidance from a specialist at Federal Benefits Sherpa can bring much-needed clarity.

Exploring Alternatives to a Hardship Withdrawal

Before you pull the trigger on a hardship withdrawal—a decision with permanent financial fallout—it’s worth taking a hard look at every other path available. Think of it like the emergency glass on a fire alarm. You only break it when every other exit is blocked and the situation is truly dire.

The most common alternative, and one that keeps you within the TSP ecosystem, is a TSP loan. While both a loan and a hardship withdrawal get you access to your retirement money, they are fundamentally different. A loan is temporary; a withdrawal is forever.

TSP Loans vs. Hardship Withdrawals: The Key Difference

Taking a TSP loan is like borrowing from your future self, but with a structured plan to make yourself whole again. You pay the money back, plus interest, directly into your own account, usually through simple payroll deductions. This process keeps your retirement savings more or less on track.

A hardship withdrawal, on the other hand, is a one-way street. That money is gone from your account for good. You don't have to pay it back, but you'll pay in other ways—namely, in immediate taxes and a likely 10% early withdrawal penalty. Even more costly is the loss of all the future growth that money would have generated for you over the years.

The core decision comes down to this: A TSP loan preserves your retirement principal while providing temporary cash, whereas a hardship withdrawal sacrifices a piece of your retirement permanently.

The data shows just how often federal employees are facing these tough choices. Between 2018 and 2022, the number of in-service withdrawals more than doubled, jumping from 134,519 to a staggering 317,505. These spikes often coincide with periods of economic uncertainty. For example, there was a 26% increase in hardship withdrawals during the 2018-2019 government shutdown. You can dig into a full analysis of these withdrawal trends and participant behaviors.

Other Financial Lifelines to Consider

Looking beyond the TSP, there are several other lifelines that can provide the financial breathing room you need without raiding your retirement funds. It’s absolutely essential to check these out before you decide a hardship withdrawal is your only move.

Give these options some serious thought:

- Personal Loans or Lines of Credit: Sure, they come with interest, but these options from a bank or credit union leave your retirement nest egg completely untouched.

- Home Equity Line of Credit (HELOC): If you're a homeowner with some equity built up, you might be able to borrow against it, often at a much better interest rate than a personal loan.

- Negotiating with Creditors: You’d be surprised how often a simple phone call can make a difference. Many companies are willing to work with you on a payment plan if you're open about facing a temporary crisis.

- Credit Counseling Services: Non-profit credit counseling agencies are pros at this. They can help you map out a budget and even negotiate with creditors for you, providing a structured way to get back on solid ground.

Common Questions About TSP Hardship Rules

Even when you think you have a handle on the process, getting into the nitty-gritty of a hardship withdrawal can bring up a lot of questions. The TSP hardship withdrawal rules have some specific nuances that are easy to overlook, so let's clear up a few of the most common points of confusion.

We’ve put together the questions we hear most often from federal employees to give you direct answers and help you move forward with confidence.

How Long Does It Take to Get My Money After Applying?

This is usually the first thing on everyone's mind. Once you’ve submitted a complete application with all the right documentation, the TSP is pretty quick. They typically process requests within 7 to 10 business days.

Of course, "processed" doesn't mean the money is instantly in your hands. You'll need to factor in a few more days for a direct deposit to hit your bank account or for a check to arrive in the mail. A good rule of thumb is to expect the full process to take about two to three weeks. Just be aware that any mistakes or missing documents will bring everything to a halt, so it pays to double-check your paperwork.

Can I Pay Back a TSP Hardship Withdrawal Later?

The short answer is a hard no. You cannot repay a TSP hardship withdrawal. This is probably the biggest difference between a hardship withdrawal and a TSP loan—and it's a critical one to understand.

Once you take that money out, it's gone for good. It’s a permanent distribution. You’re not just losing the principal amount; you're also losing out on all the future compound growth that money would have generated. This is exactly why a TSP loan is almost always the better option if you can qualify for one.

A hardship withdrawal is a one-way street. Unlike a loan, you can't put the money back. The impact on your long-term retirement savings is permanent.

Will Taking a Withdrawal Stop Me from Making TSP Contributions?

Thankfully, this is one area where the rules have gotten much better. In the past, taking a hardship withdrawal meant you were blocked from contributing to your TSP for six months. It was a painful penalty on top of an already difficult situation.

That rule is gone. Now, you can continue making your regular contributions without any interruption, even right after taking a hardship withdrawal. This is a huge improvement, as it lets you get back to rebuilding your retirement savings immediately without a forced waiting period. It's a key update to the TSP hardship withdrawal rules that really helps.

How Much Am I Allowed to Withdraw for a Hardship?

The amount you can take out is tied directly to your proven financial need. You can't just pull out a round number; you can only withdraw the amount necessary to fix the specific problem. For example, if you have a qualifying medical bill for $7,500, that’s the most you can request (plus a little extra to cover the estimated taxes you'll owe).

There's another major limitation to know:

- You can only withdraw money from your own employee contributions and the earnings on them.

- You cannot touch any of the agency matching contributions or the earnings on that money.

This rule really underscores that a hardship withdrawal is an emergency measure, not a way to tap into your entire TSP balance. It keeps the employer-funded portion of your retirement nest egg protected.

Navigating the web of federal benefits and making these kinds of critical financial decisions can feel like a heavy weight. At Federal Benefits Sherpa, we specialize in guiding federal employees through these exact situations. We offer personalized retirement planning and gap analysis to make sure you see the full picture. Secure your financial future by booking a free 15-minute benefits review at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved