Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Mastering Your Federal Retirement Calculation

When you start thinking about federal retirement, it can all seem a bit complicated. But at its core, the federal retirement calculation really just comes down to a simple formula.

Think of it this way: your final annuity is a product of your high-3 average salary multiplied by your years of creditable service, which is then multiplied by a specific percentage called a pension multiplier. Getting a firm grip on these three pieces is the key to unlocking what your future income will look like.

Your Guide to Federal Retirement Systems

Before we can start crunching any numbers, the very first thing you need to know is which retirement system you're in. The federal government has two main systems, and your hire date is what determines where you land.

Most federal employees today are covered by the Federal Employees Retirement System (FERS). FERS was put in place back in 1987 and is designed as a three-part retirement plan.

It works by combining benefits from three different places to build your retirement income:

Basic Benefit Plan: This is your actual pension, and it's the part we'll be focused on calculating here.

Social Security: You pay into Social Security, just like someone in the private sector, and you’ll draw those benefits when you retire.

Thrift Savings Plan (TSP): This is a lot like a 401(k). You contribute, and your agency contributes, building a nest egg for your future.

The older system is the Civil Service Retirement System (CSRS). If you were hired before 1984, this is likely your plan. CSRS is a single, more generous pension, but there’s a major trade-off: employees in this system typically don't contribute to Social Security or receive its benefits based on their federal service.

FERS vs CSRS At a Glance

To quickly see the main differences, take a look at this comparison. It’s crucial to know which system you fall under because the math, multipliers, and even cost-of-living adjustments (COLAs) are completely different for each.

FeatureFERS (Federal Employees Retirement System)CSRS (Civil Service Retirement System)Established19871920EligibilityMost employees hired on or after January 1, 1984Most employees hired before January 1, 1984Core Components1. Basic Benefit (Pension) 2. Social Security 3. Thrift Savings Plan (TSP)Single, comprehensive pensionSocial SecurityYes, full participation and benefitsNo, typically not eligible based on CSRS servicePension GenerosityLower multiplier, designed to work with other componentsHigher multiplier, designed as the primary income source

As you can see, these are two very different paths to retirement. With an average of 100,000 employees retiring from federal service each year, understanding your specific path is the foundation of a solid plan.

Your retirement is a combination of your efforts and the system you're in. FERS is built on a "three-legged stool" model, spreading your income sources, while CSRS relies on a single, powerful pension benefit.

To get your retirement calculation right, you have to start by confirming your system. You can find this information on your personnel action forms (like the SF-50). Getting this right from the start prevents a world of headaches and ensures your projections are based on the correct rules.

Now that we've covered the basics, we can dive into the specific formulas for each system.

Figuring Out Your FERS Annuity Payment

If you’re a federal employee today, chances are you’re under the Federal Employees Retirement System (FERS). This is the system that will shape your retirement income, so getting a handle on the federal retirement calculation is non-negotiable. Luckily, the core formula is pretty straightforward.

Your FERS annuity boils down to three key numbers multiplied together:

Your high-3 average salary

Your total years of creditable service

A pension multiplier (this is usually 1% or 1.1%)

That’s it. This simple equation determines the annual pension you’ll receive for the rest of your life. While the math itself isn’t complex, the details behind each of those components—especially that multiplier—can really swing your final benefit amount.

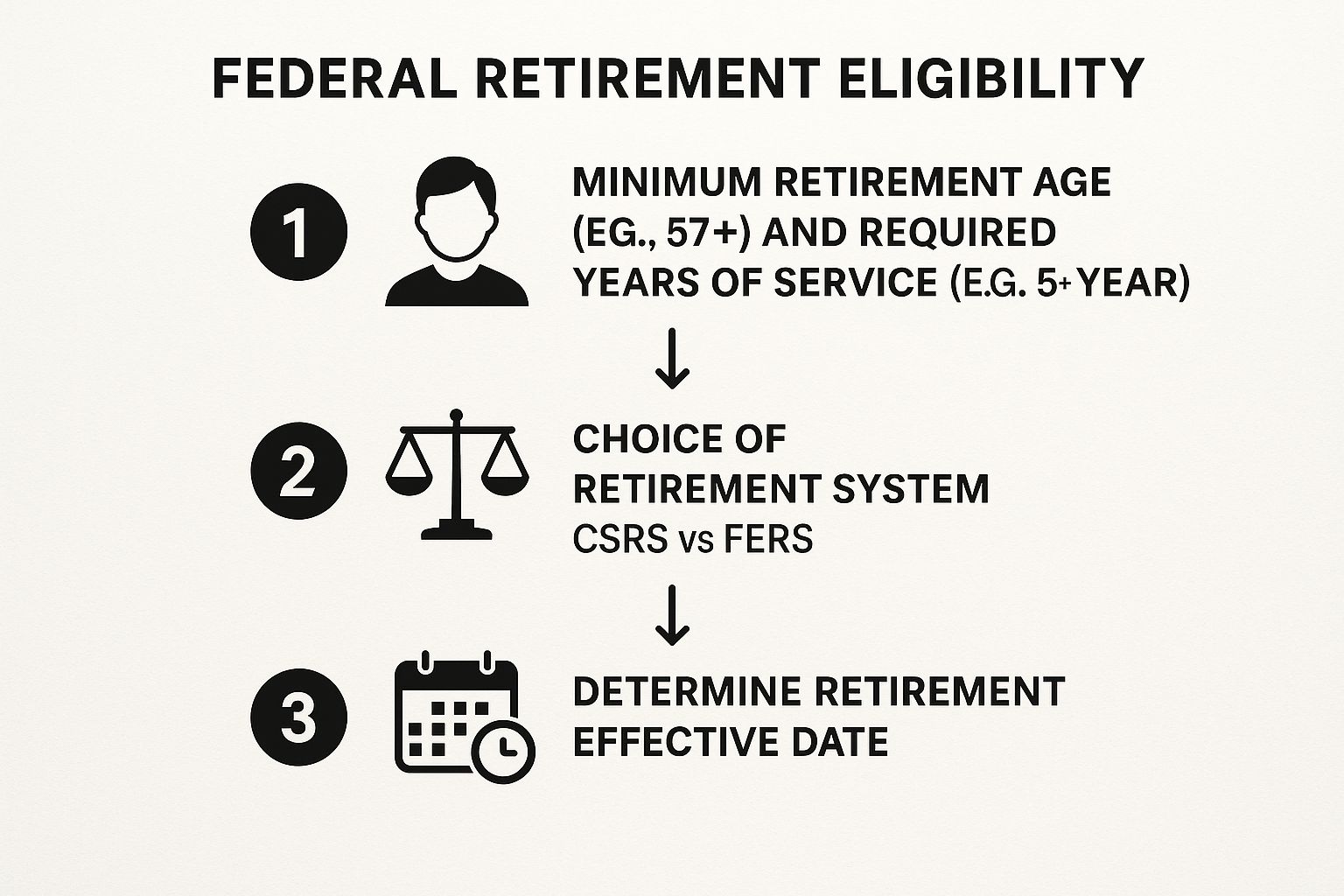

The infographic below gives you a bird's-eye view of the retirement journey, starting with the basic eligibility milestones all federal employees need to hit.

As you can see, it all starts with meeting the minimum age and service requirements for your specific retirement system. From there, the real calculations begin.

The Standard 1% Pension Multiplier

For most FERS employees, the pension multiplier is a flat 1%. Just think of it this way: for every single year you work, you’re banking 1% of your high-3 salary for retirement. It's a steady, predictable way to build your pension over your career.

Let's put this into practice. Say we have a federal employee, Alex, who's ready to retire at age 60. Alex has 25 years of service under his belt and a high-3 average salary of $90,000.

Here's how his calculation works out:

$90,000 (High-3) x 25 (Years of Service) x 0.01 (1% Multiplier) = $22,500 per year

This gives Alex an annual pension of $22,500, which comes out to $1,875 per month. You can see how directly your time on the job and your salary history feed into your final payout.

Unlocking the Enhanced 1.1% Multiplier

Now, here’s a detail that can make a surprisingly big difference: the enhanced 1.1% multiplier. That extra 0.1% might not look like much on paper, but it translates to a 10% boost in your basic annuity. That's a significant increase that compounds over your entire retirement.

So, how do you get it? You have to meet two specific conditions when you retire:

You must be at least age 62.

You must have at least 20 years of creditable service.

If you check both of those boxes, the 1.1% multiplier automatically applies to your entire federal retirement calculation. Let's go back to Alex. What if he decided to work just two more years and retire at age 62 with 27 years of service? (We'll keep his high-3 the same for this example).

The new math looks like this:

$90,000 (High-3) x 27 (Years of Service) x 0.011 (1.1% Multiplier) = $26,730 per year

By working just two extra years to hit that age 62 milestone, Alex increased his annual pension by $4,230. This shows how strategically timing your retirement can have a massive impact, especially if you’re close to those thresholds.

The Special Retirement Supplement: A Bridge to Social Security

The FERS system has a really unique feature called the Special Retirement Supplement (SRS). It’s a critical benefit for anyone who retires before they’re eligible for Social Security at age 62. Think of the SRS as a temporary income bridge that mimics the Social Security benefits you earned during your time as a federal employee.

Generally, you're eligible for the SRS if you retire:

After hitting your Minimum Retirement Age (MRA) with 30 years of service.

At age 60 with 20 years of service.

This supplement is specifically designed to fill that income gap until you can start drawing your actual Social Security. One thing to keep in mind, however, is that the SRS is subject to an earnings test, just like Social Security. If you take on another job and earn income after your federal retirement, your supplement could be reduced or even eliminated. The SRS also stops cold the day you turn 62, regardless of whether you decide to claim your Social Security benefits right away or delay them.

The FERS retirement calculation is a dynamic formula. Your decisions about when to retire and how long to work can directly influence whether you receive a standard benefit, an enhanced one, or supplemental income to bridge you to your next chapter.

At its core, the FERS calculation multiplies your high-3 salary by your years of service and a pension multiplier, typically 1% or 1.1%. For example, an employee retiring at 62 with 25 years of service and an $80,000 high-3 salary would receive an annual pension of $22,000 ($80,000 × 25 × 1.1%). This annuity is the backbone of your retirement income, though it can be adjusted by things like cost-of-living increases or early retirement reductions. To dive deeper into how these pieces fit together, check out more detailed calculation examples at Fedelaw.com.

Defining Your High-3 Salary and Service Time

Once you have a handle on the basic pension formulas, it's time to get into the nuts and bolts of your personal numbers. Two figures have the biggest impact on your final annuity: your high-3 average salary and your total creditable service time.

Getting these numbers right isn't just a suggestion—it's absolutely critical for any realistic retirement planning. Think of your high-3 as the peak of your earning power and your service time as the years you put in to reach that peak. They are the two main ingredients in your retirement recipe.

Nailing Down Your High-3 Average Salary

Your "high-3" is exactly what it sounds like: the average of your highest basic pay during any 36-consecutive-month period of your federal career.

Most people assume this is simply their last three years on the job, and for many, that's true thanks to regular step increases and promotions. But it's not a guarantee. If you, for example, took a lower-paying role later in your career, your highest-earning period might have been a few years back. The system will automatically find whichever 36-month stretch was your most lucrative.

So, what actually goes into that calculation? It’s based on your basic pay, which generally includes:

Your regular salary (grade and step)

Locality pay

Other specific premium pay, like law enforcement availability pay

Just as important is knowing what doesn't count. Things like overtime pay, performance bonuses, travel allowances, or cash awards are typically excluded and won't inflate your high-3 number.

Calculating Your Creditable Service

The other side of the coin is your total creditable service. This isn't just a simple count of the years you've worked; it's the total time—down to the year and month—that the government recognizes for your pension.

Getting this number precise is a big deal. Even a few extra months of service can translate into a higher annuity payment that you'll receive for the rest of your life.

Your creditable service is typically made up of a few key parts:

Civilian Service: This is the core of your service time—any period where you were a federal employee contributing to the retirement system. You can track this down by reviewing the Service Computation Date (SCD) on your SF-50 forms.

Military Service: Active-duty military time can often be counted, but there's a catch. For it to be included in your FERS or CSRS calculation, you almost always have to make a deposit to "buy back" that time.

Unused Sick Leave: Here’s a fantastic perk. Both FERS and CSRS allow you to convert your final unused sick leave balance into additional service time. It's a powerful way to boost your pension right at the finish line.

Let's see how this works with a quick example. Imagine Maria is retiring with 29 years and 8 months of dedicated federal service. She's also been diligent about saving her sick leave and has a balance of 870 hours.

First, we need to convert those hours into service time. For a full-time federal employee, a work year is 2,087 hours. A quick calculation shows that Maria's 870 hours of sick leave adds about 5 months to her service.

When we add that to her work history, her total creditable service for her annuity calculation becomes 30 years and 1 month.

The accuracy of your high-3 salary and creditable service is paramount. A small error in either figure can lead to a miscalculation that impacts your income for the rest of your life. Always verify these details with your agency's HR department before finalizing your plans.

Don't leave this to chance. Be proactive and request a copy of your Official Personnel Folder (OPF) to meticulously review your service history. If you have military time, get in touch with HR to find out exactly what it costs to make that deposit. This due diligence ensures your retirement calculations are built on a solid foundation.

Understanding these details is the key to navigating your benefits with confidence. For those looking to dig deeper, resources from experts like Federal Benefits Sherpa can provide invaluable guidance to help you maximize your retirement income.

How COLAs Affect Your Long-Term Income

Getting your initial federal retirement calculation right is a huge first step, but that number isn't set in stone. Think of it as a starting point. Over the decades you'll be retired, that annuity has to keep pace with the rising cost of everything, from groceries to gas. This is where Cost-of-Living Adjustments (COLAs) come in, and they are absolutely critical to your long-term financial health.

COLAs are annual adjustments meant to protect the buying power of your pension from being chipped away by inflation. But here's the catch: not all COLAs are created equal. The way they're calculated and applied is starkly different between the CSRS and FERS retirement systems, which can lead to wildly different income paths over time.

The Different Rules for FERS and CSRS

For retirees under the old Civil Service Retirement System (CSRS), the COLA calculation is refreshingly straightforward. They typically get the full COLA percentage, which is tied directly to the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Simple as that.

The Federal Employees Retirement System (FERS), on the other hand, plays by a much different, more restrictive set of rules. I often call it the "diet COLA" because FERS retirees frequently receive a smaller adjustment than their CSRS peers, especially when inflation is running hot.

Here’s a breakdown of how the FERS COLA formula works:

If the CPI-W increase is 2% or less: You get the full amount.

If the CPI-W is between 2% and 3%: You get a flat 2% COLA.

If the CPI-W jumps by 3% or more: You get the CPI-W increase minus 1%.

This structure means that when costs are rising quickly, your FERS benefits are designed to grow just a little bit slower than inflation. It’s a fundamental difference you absolutely have to account for in your planning.

The disparity in COLA calculations between FERS and CSRS is one of the most significant long-term factors in your retirement income. A single year's difference might not look like much, but the compounding effect over 20 or 30 years can be massive.

Historical COLA Comparison FERS vs CSRS

The gap between the two systems isn't just theoretical; it shows up in the real numbers year after year. The table below illustrates how the FERS "diet COLA" has resulted in smaller adjustments compared to the full COLA received by CSRS retirees during recent periods of fluctuating inflation.

YearCPI-W IncreaseCSRS COLA AppliedFERS COLA Applied20243.2%3.2%2.2%20238.7%8.7%7.7%20225.9%5.9%4.9%20211.3%1.3%1.3%20201.6%1.6%1.6%

As you can see, in years with low inflation (like 2020 and 2021), both groups received the same adjustment. But when inflation surged from 2022 to 2024, the FERS COLA cap kicked in, and the gap between the two systems became significant. This consistent difference, even if just 1%, compounds over time and gradually erodes the purchasing power of a FERS annuity compared to a CSRS one.

COLAs in Action: A Real-World Comparison

To see just how this plays out, let's look back at 2023, a year with a major spike in inflation. The CPI-W increase was a huge 8.7%.

CSRS retirees saw their annuity increase by the full 8.7%.

FERS retirees, because of the "minus 1%" rule, only received a 7.7% COLA.

Now, a 7.7% raise is nothing to sneeze at, but that 1% difference is the key. Over time, it translates to hundreds or even thousands of dollars in lost purchasing power. The rules create a permanent gap that just gets wider with each year of high inflation.

This trend is an ongoing feature of the system. For example, the COLA for CSRS retirees and Social Security recipients in 2024 was 3.2%. Because this falls into the "over 3%" category, the FERS COLA was capped at 2.2% (3.2% minus 1%). These adjustments hammer home the more conservative benefits approach under FERS. You can find more details on the latest federal retirement figures and estimators at PlanWellFP.com.

The Compounding Effect Over a Full Retirement

Let's imagine two federal employees retiring at the same time, one FERS and one CSRS, both with a starting pension of $40,000 a year. How might their incomes look after a decade, just from the COLA differences?

Over time, that seemingly small gap becomes a chasm. After just a decade, the FERS retiree's annual income could easily be $3,000 less than their CSRS counterpart's, and that's based on some fairly normal inflation assumptions. Project that out over a 30-year retirement, and the cumulative impact on your total income and what you can actually buy with it is staggering.

This is exactly why understanding these COLA rules isn't just an academic exercise—it's a non-negotiable part of creating a realistic financial plan. It allows you to see how your income will truly evolve and prepare for the road ahead.

What's on the Horizon? Proposed Reforms and Future Changes

The rules that govern your federal retirement aren't set in stone. As economic realities and budget priorities shift in Washington, so do the discussions around potential changes to federal benefits. Knowing what's being talked about is crucial for understanding the long-term outlook for your retirement income.

These conversations aren't meant to cause alarm. Instead, they offer a clear-eyed view of the policy landscape. Proposals to tweak the federal retirement system pop up regularly during budget negotiations, and understanding what’s on the table helps you stay informed and prepared for any shifts that might come down the line.

The "High-5" Debate

One of the most persistent reform ideas involves changing a core piece of your annuity formula: the High-3 average salary. For years, some lawmakers have pushed to change this to a High-5 average salary.

At first glance, it might not seem like a big deal, but the financial impact could be huge. Stretching the calculation period from your highest 36 months of earnings to 60 months almost always results in a lower average salary. Because that "high" number is the very foundation of your entire annuity calculation, a lower base means a permanently smaller pension.

Let's say your highest three years of earnings average out to $95,000. If you factor in two earlier, lower-paying years, your five-year average might drop to something like $88,000. That single change would directly reduce your annuity payment for the rest of your life.

Other Potential System Adjustments

Beyond the High-3 vs. High-5 debate, other parts of the federal retirement system are often targeted for reform. The goal is nearly always the same: to reduce long-term government spending by adjusting the benefits paid out to future retirees.

Some of the most common proposals we see include:

Eliminating the FERS Annuity Supplement: This would get rid of the "income bridge" for those who retire before they can claim Social Security at age 62. It would create a significant income gap for many early-career retirees.

Modifying COLA Formulas: Further reducing or even getting rid of Cost-of-Living Adjustments for FERS retirees is another recurring proposal, which would erode the purchasing power of your annuity over time.

Increasing Employee Contributions: Some plans would require federal employees to pay a much higher percentage of their salary toward their own retirement benefits, shrinking their take-home pay today.

"Understanding these potential shifts is not just about the numbers; it’s about recognizing that the benefits promised today may be debated tomorrow. Your engagement and awareness are the best tools you have to advocate for the retirement you've earned."

The Rationale and the Reality

Any proposal to alter the Federal Employees Retirement System (FERS) carries major weight for your financial future. The shift from a High-3 to a High-5 average, for example, could realistically lower your pension by 5-10%. Other ideas, like scrapping the FERS annuity supplement or forcing employees to contribute more, are all driven by cost-saving goals that would simply reduce the total compensation for federal workers. It's a conversation that continues, even though FERS is fully funded, which makes you wonder about the true necessity of such cuts. You can find more detailed analysis on these ongoing benefit discussions at FederalPensionAdvisors.com.

While a complete system overhaul is unlikely to pass without a major fight, smaller, incremental changes are always on the table. Your best strategy is to stay plugged in through federal news outlets and employee advocacy groups. By keeping an eye on the horizon, you can better prepare your own financial plan for whatever comes next, making sure your retirement remains on solid ground.

Your Biggest Federal Retirement Questions, Answered

The retirement formulas might seem straightforward on paper, but your career isn't. It's full of unique circumstances, and that's where the real questions pop up. Getting a handle on these personal scenarios is what turns a vague retirement estimate into a plan you can actually count on.

It's these specific, nuanced situations that often cause the most confusion and stress for federal employees. Let's walk through some of the most common questions I hear every day and get you some clear, direct answers.

What Happens to My Unused Sick Leave?

This is one of the most valuable—and most overlooked—perks of federal service. Don't just let that sick leave balance sit there without understanding its power. At retirement, every single hour of unused sick leave gets converted into additional creditable service, which directly boosts your annuity payment.

The math is based on a standard work year, which OPM defines as 2,087 hours. Your total sick leave balance is divided by that number to figure out how many years, months, and days of extra service time you get.

Think of it this way: if you retire with 1,044 hours of unused sick leave, that’s almost exactly six months of extra service. For a FERS employee with a $90,000 high-3 salary and 25 years on the books, that extra six months could add more than $400 to their pension, every year, for the rest of their life.

Should I Make a Deposit for My Military Time?

If you're a veteran now in federal civilian service, this is a big one. You have the option to "buy back" your military time by making a military service deposit. Doing so adds your years of active duty to your civilian service time, which can give your pension a massive lift.

The cost is usually pretty reasonable—typically 3% of your military base pay for FERS employees, plus interest. The catch is the interest. It accrues over time, so the longer you wait to make that deposit, the more expensive it gets.

The decision to buy back military time is a major financial fork in the road. In my experience, for most federal employees, the long-term annuity increase far outweighs the initial cost, especially if you get it done early in your career.

How Does Part-Time Work Affect My Pension?

Working part-time doesn't knock you out of the running for a solid federal pension, but it does change the calculation. The two main ingredients of your annuity—your high-3 average salary and your creditable service—are handled differently.

Your High-3 Salary: This is always calculated using the full-time equivalent salary rate. Even if you worked part-time during your three highest-earning years, your pension is based on what you would have made as a full-time employee.

Your Creditable Service: This part is prorated. It’s pretty logical—if you worked half-time for ten years, you get credit for five years of service when your annuity is calculated.

This two-part adjustment ensures your final pension is a fair reflection of the total hours you put in over your career.

How Do Survivor Benefits Work?

Thinking about what happens to your loved ones is a non-negotiable part of retirement planning. You can choose to provide a survivor annuity for your spouse, which means they'll keep receiving a portion of your pension after you're gone.

You have two main choices:

Full Survivor Annuity: This gives your spouse 50% of your basic annuity. To fund this, your own annuity is reduced by 10%.

Partial Survivor Annuity: This option provides your spouse with 25% of your basic annuity, and it costs you a 5% reduction in your own pension.

Choosing a survivor benefit is a deeply personal decision. You're balancing your own income needs in retirement against the long-term financial security of your spouse. It’s a choice that many federal employees wrestle with. The key is to understand the numbers so you can make a clear-headed decision that provides peace of mind for both of you.

Navigating these kinds of specific situations is where getting some professional guidance can make all the difference. At Federal Benefits Sherpa, we help you untangle these complexities to build a retirement plan that truly fits your life. Start with a free 15-minute benefit review at Federal Benefits Sherpa to get clear answers to your toughest retirement questions.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved