Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

How to Maximize Social Security

If you only learn one thing about Social Security, let it be this: waiting to claim your benefits is the single most powerful move you can make. It's the simplest and most effective way to boost your guaranteed income for the rest of your life.

While you can start collecting checks as early as age 62, holding off until your full retirement age (FRA), or even better, age 70, dramatically increases your monthly payment.

Your Most Powerful Move for Maximizing Social Security

Timing is everything when it comes to Social Security. The system is intentionally designed to reward those who can afford to wait, and the difference between claiming early and delaying can be absolutely massive over the course of a long retirement.

For every year you wait past your FRA (which is 67 for anyone born in 1960 or later), you earn what are called delayed retirement credits. These aren't just small bumps; they permanently increase your monthly benefit by a guaranteed 8% per year up until you turn 70.

This decision doesn't just affect you, either. A larger benefit for you often means a larger potential survivor benefit for your spouse down the road.

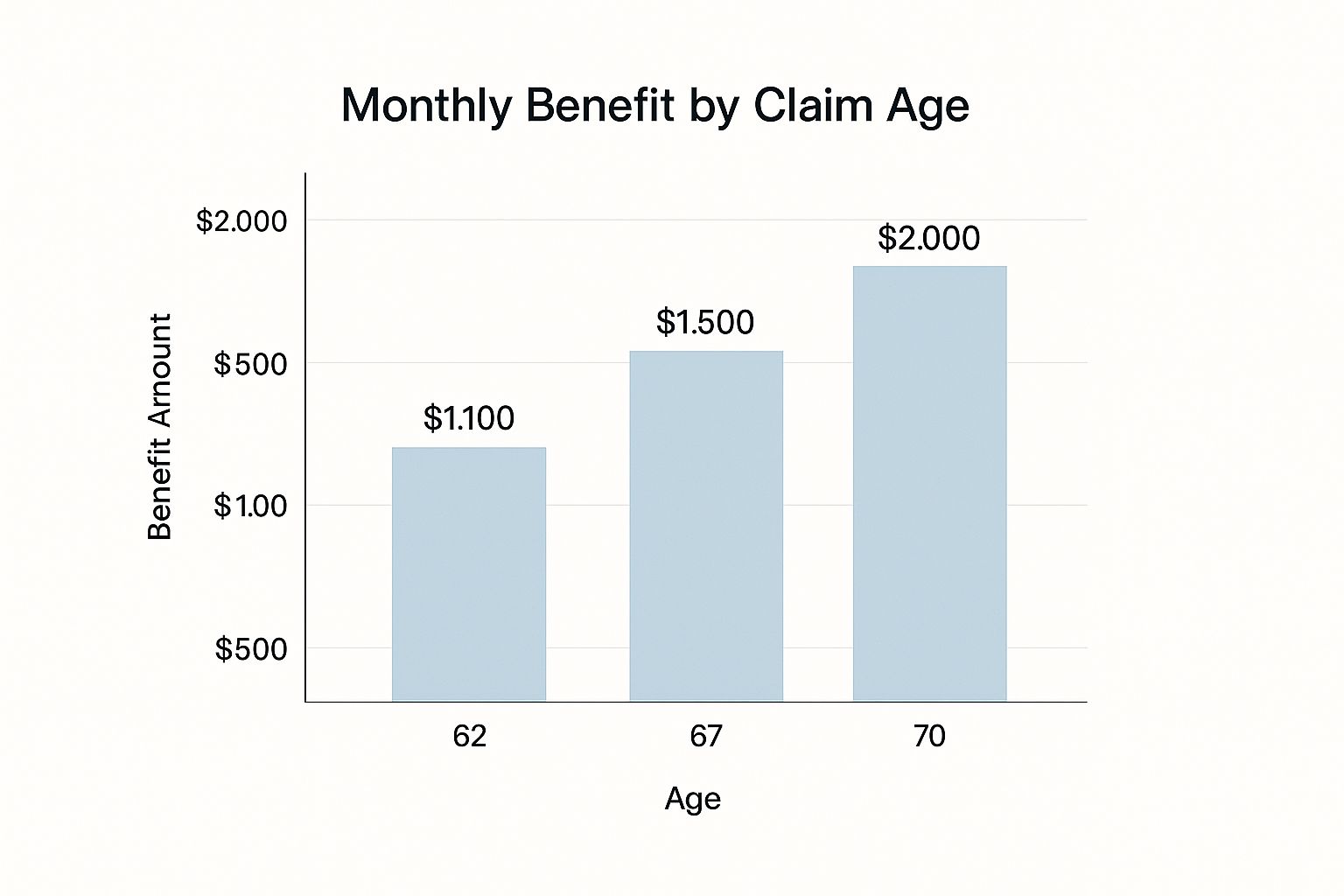

The Financial Impact of Waiting

Let's look at a real-world example. Say your benefit at your FRA of 67 is calculated to be $2,000 per month.

- If you claim at age 62, that benefit is permanently reduced by 30%, leaving you with just $1,400 a month.

- But if you wait until age 70, your benefit grows by 24% above your FRA amount, giving you $2,480 a month.

That’s a difference of over $1,000 every single month, for life. The chart below paints a clear picture of how waiting pays off.

As you can see, the jump in income from 62 to 70 is substantial, providing a much healthier income stream to support you throughout your retirement years.

To really grasp the power of delaying, this table shows the maximum possible monthly benefit a high-earner could receive in 2025 based on their claiming age.

Impact of Claiming Age on Maximum Monthly Benefits

This table compares the maximum potential monthly Social Security benefit based on three key claiming ages, illustrating the financial advantage of delaying.

| Claiming Age | Maximum Monthly Benefit (2025) | % Change from Full Retirement Age |

|---|---|---|

| 62 | $2,710 | -30.0% |

| Full Retirement Age (67) | $3,895 | 0.0% |

| 70 | $4,873 | +25.1% |

These numbers highlight the huge financial incentive for waiting. Delaying from FRA to age 70 results in a more than 25% increase in guaranteed lifetime income for a top earner.

Understanding Your Personal Numbers

The absolute best way to see what this means for you is to look at your own numbers. The Social Security Administration makes this easy.

Just head over to their website and create a secure my Social Security account. It's a fantastic tool that gives you personalized estimates of your benefits at age 62, your FRA, and age 70, based on your actual earnings record. It completely removes the guesswork.

The potential upside is significant. For more detailed scenarios and data, financial publications like Kiplinger offer in-depth analysis on how different claiming ages affect your total payout.

By far, the most effective strategy for the average person is to wait until age 70. Think of it as a form of longevity insurance—it protects you financially if you live a good, long life by locking in the highest possible guaranteed monthly income.

How Your Earnings History Shapes Your Benefits

While the timing of your claim is a huge factor, the actual dollar amount you’ll receive boils down to decades of your life's work. The Social Security Administration (SSA) doesn't just guess; they run the numbers on your entire career.

The magic number here is 35. The SSA calculates your benefit based on your highest 35 years of earnings. They adjust those earnings for inflation (to make what you earned in 1990 comparable to today) and then average them out. This calculation produces your "primary insurance amount," or PIA—the foundation for all your future payments.

Understanding this 35-year rule is absolutely key. Every year you work, especially later in your career, has the potential to sweeten the pot.

The Power of One More Year

Many people assume their highest-earning years are behind them by the time they hit their 60s, but this is often when you can make the biggest impact on your future benefit. Why? Because a high-earning year now can replace a low-earning year from way back when.

Think about it. Maybe you worked part-time in college or had a few lean years starting a family in your 20s. If you work just one more year at your current, higher salary, that income can knock one of those old, lower-earning years out of the calculation for good.

This one simple swap directly bumps up your lifetime average, which means a bigger monthly check for the rest of your life. It’s one of the most straightforward ways to give yourself a raise in retirement.

The Problem with Zeros

What happens if you don’t have 35 years of work history? The SSA formula is unforgiving. For every year you fall short, a big, fat $0 gets plugged into your average.

This is more common than you might think. It can happen if you:

- Stayed home to raise children

- Faced a long period of unemployment

- Went back to school mid-career

Every one of those zero-dollar years drags your average down, sometimes significantly. Working an extra year to replace a zero provides a much bigger boost than replacing an already existing low-earning year.

Your earnings record is the foundation of your future Social Security income. Regularly reviewing it and strategically adding higher-earning years can be one of the most effective ways to build a stronger financial future in retirement.

Aiming for the Earnings Cap

If you’re still in your peak earning years, there’s a specific target to aim for: the Social Security taxable maximum. This is the income cap on which you pay Social Security taxes each year. Earning at or above this amount ensures you get the maximum credit possible for that year.

The SSA’s formula uses your 35 highest-earning (inflation-indexed) years to calculate your Average Indexed Monthly Earnings (AIME). People who consistently earn near the taxable maximum, which is set to be $176,100 in 2025, will have the highest possible AIME and, in turn, the largest retirement checks. You can dig into the nitty-gritty of the benefit formula on the official SSA website.

Your Most Important Financial Checkup

Given how critical these numbers are, you simply can't afford to have an error on your earnings record. It happens more often than you'd think, and a single mistake could cost you thousands in benefits over your lifetime.

Thankfully, checking your record is easy. The SSA gives you a complete, year-by-year breakdown.

Here’s what you need to do:

- Create an account: Head over to the SSA's website and set up a my Social Security account. It only takes a few minutes.

- Download your statement: Once you're in, you can view and save your full Social Security statement.

- Review it carefully: Pull out your old tax records or W-2s and compare them to the earnings listed on your statement. Look for any numbers that seem off.

- Report errors ASAP: If you spot a discrepancy, contact the SSA right away. There are time limits for getting records corrected, so don't put it off.

I tell my clients to make this an annual ritual. It's a quick, simple step that ensures the SSA is working with the right numbers. Think of it as a small investment of your time that protects a massive asset: your future income.

Juggling Work and Benefits? Here’s What You Need to Know

While waiting until age 70 to claim Social Security is often the best-case scenario, life has a funny way of not sticking to the plan. You might need or want to claim your benefits a bit earlier while you’re still working, whether full-time or just picking up a few shifts.

If this sounds like your situation, there's a crucial rule you absolutely must understand: the Social Security earnings test.

This rule comes into play if you start collecting benefits before your Full Retirement Age (FRA) and still have income from a job. Earn too much, and the Social Security Administration (SSA) will temporarily hold back some of your benefit payments. It’s not a tax or a penalty; think of it as a temporary reduction designed to keep people from "double-dipping" with a full salary and their full early retirement benefits.

Getting a handle on how this works is key to avoiding any nasty surprises and making sure your retirement-work hybrid plan goes off without a hitch.

How the Earnings Test Actually Works

The SSA sets an income limit each year, and if your work earnings go over that line, your benefits are temporarily reduced. It’s important to know this only applies to earned income—the money you make from a job. Income from pensions, 401(k)s, IRAs, or investments doesn't count.

There are two different limits to keep in mind, and they depend on how close you are to your Full Retirement Age.

- If you’re under your FRA for the whole year: The SSA will hold back $1 in benefits for every $2 you earn above the annual limit.

- In the year you actually reach your FRA: The rule gets much friendlier. A higher earnings limit applies, and they only withhold $1 for every $3 you earn above it. Plus, they only look at your earnings in the months before your birthday month.

The moment you hit your FRA, the earnings test vanishes. Poof. You can earn as much as you want from a job, and your Social Security check won't be touched.

Let’s Look at a Real-World Example

Imagine Sarah is 64, and her Full Retirement Age is 67. She decides to start her Social Security benefits, which are $1,500 a month ($18,000 a year). She also keeps working part-time, earning $32,120 for the year.

The 2024 earnings limit for someone in her situation is $22,320. Here’s how the math plays out:

- First, we figure out how much she earned over the limit: $32,120 - $22,320 = $9,800.

- Now, we apply the withholding formula ($1 for every $2): $9,800 ÷ 2 = $4,900.

- The SSA will hold back $4,900 of her benefits that year.

So, how do they collect it? They don't just shrink your monthly check. Instead, they typically stop sending payments altogether until they've withheld the full amount. For Sarah, they would likely hold three of her $1,500 checks (that's $4,500) and then a small part of a fourth one to get to the total $4,900.

Good News: That Money Isn't Gone Forever

This is the part everyone gets wrong. The benefits that are withheld are not permanently lost. I repeat, you don't lose the money.

When you finally reach your Full Retirement Age, the SSA automatically recalculates your benefit. They give you credit for any months your benefits were held back due to the earnings test. This adjustment boosts your monthly payment for the rest of your life, ensuring you eventually get that money back over time.

The earnings test can feel like a penalty, but it’s really more of a forced delay. The SSA essentially treats those withheld months as if you had delayed claiming, which results in a permanently higher monthly check once you hit your FRA.

The Rules Ease Up in the Year You Reach FRA

Things get a lot better in the calendar year you hit your Full Retirement Age. A much higher earnings limit applies—for 2025, it's $62,160. If you go over that, they only withhold $1 for every $3 you earn above the limit, and only for the months before your FRA birthday. You can find the official numbers in the 2025 limits announcement from the SSA.

The “Do-Over”: A Unique Strategic Option

What happens if you claim early and then immediately regret it? Maybe a fantastic job opportunity falls into your lap, or you realize you just don’t need the cash yet. The SSA offers a one-time "do-over," but the window is tight.

If it’s been less than 12 months since you started getting paid, you can file a Form SSA-521 to withdraw your entire application. The catch? You have to repay every dollar in benefits you and your family received. Once you do, it's like you never claimed in the first place, and your benefit can continue growing until you're ready to file again, all the way up to age 70.

Coordinating Spousal and Survivor Benefits

It’s easy to think of Social Security as an individual account, but that's a mistake. For married couples, it's really a form of family insurance, and learning how to coordinate your benefits is one of the most powerful things you can do for your financial future. When you start thinking of your benefits as a single team asset, you unlock strategies that can lead to a much higher income for both of you over your lifetimes.

The foundation of this approach is the spousal benefit. This is a crucial provision that lets a lower-earning spouse claim a benefit based on their partner's work record. It can be worth up to 50% of the higher earner's full retirement age (FRA) benefit—a real game-changer if one of you earned significantly more or took time away from the workforce to raise a family.

The Power of Coordinated Claiming

One of the most effective strategies I see couples use involves the higher earner waiting as long as possible to claim their own benefit, ideally until age 70. This simple delay accomplishes two critical goals at once. First, it pumps up their own monthly check with delayed retirement credits. Second, and just as important, it secures the highest possible survivor benefit for their spouse.

Here's why that second part is so vital: when one spouse passes away, the survivor gets to keep the larger of the two Social Security checks. By delaying, the higher earner is essentially creating a bigger, more durable financial safety net for their partner down the road.

Let's walk through a real-world example:

- Tom's FRA benefit: $2,800

- Mary's FRA benefit: $1,200

If Tom claims his $2,800 at his FRA (age 67), Mary could receive a spousal benefit of $1,400 (50% of Tom's amount), which is better than her own $1,200. More importantly, if Tom were to pass away, Mary’s benefit would jump to $2,800 per month for the rest of her life.

But watch what happens if he waits. By delaying until age 70, Tom’s benefit grows to about $3,472. While Mary's spousal benefit is still calculated from his FRA amount, the real win is the survivor benefit. If Tom passes away, Mary’s check now becomes $3,472 a month. That's a massive difference in her long-term financial security.

Thinking collaboratively is key. The decision of when the higher earner claims directly impacts the financial well-being of the surviving spouse for what could be decades. This single choice can be worth tens or even hundreds of thousands of dollars over a lifetime.

Unlocking Benefits After a Divorce

Here’s something many people don't realize: divorce doesn't automatically cut you off from your ex-spouse's Social Security record. If your marriage lasted at least 10 years and you haven't remarried, you might be eligible to claim benefits based on their work history.

This is a fantastic provision because your claim has zero impact on your ex-spouse's benefits or the benefits of their current spouse. You can even claim this benefit if your ex-spouse has remarried or hasn't even started collecting their own checks yet, as long as they are eligible.

To qualify for these divorced-spouse benefits, you need to check a few boxes:

- The marriage lasted for 10 consecutive years or more.

- You are currently unmarried.

- You are at least 62 years old.

- Your own Social Security benefit is less than the amount you'd get from your ex-spouse's record.

This is a frequently overlooked source of retirement income, especially for people who might have lower lifetime earnings because of the role they played during their marriage.

Key Rules for Spousal and Survivor Benefits

The rules can feel a little tangled at first, but a few key points make them much easier to grasp. For the nitty-gritty details, I always recommend checking the official Social Security Administration blog for direct, up-to-date information.

First, remember that claiming any benefit before your Full Retirement Age—whether it's your own or a spousal benefit—results in a permanent reduction. For spousal benefits, that reduction can be pretty steep, so it's a critical piece of any timing strategy.

Finally, it’s important to know you can't "double-dip" by receiving your own full benefit and a full spousal benefit. Social Security will always pay your own benefit first. If the spousal benefit you're entitled to is higher, they'll simply add an extra amount to bring your total payment up to that higher level. This ensures you always get the maximum benefit you qualify for.

Keep More of Your Hard-Earned Benefits by Managing Taxes

Getting a bigger Social Security check is great, but it's only half the picture. The other, often overlooked, part is keeping that money out of the IRS's hands. It comes as a shock to many retirees, but yes, your Social Security benefits can be considered taxable income.

The key to understanding this lies in a specific calculation the IRS uses called "provisional income." You won't find this term on your standard 1040 tax form, but getting a handle on it is one of the most important things you can do to manage your tax bill in retirement.

So, what is it? Think of it as a special formula: your adjusted gross income (AGI), plus any nontaxable interest (from things like municipal bonds), plus—and this is the important part—50% of your Social Security benefits. If that total number crosses certain thresholds, a chunk of your benefits suddenly becomes taxable.

The Tax Tripwires You Need to Know

Here’s the real kicker: the income thresholds that trigger this tax are surprisingly low. Worse, they are not indexed for inflation. That means every year, as costs of living and incomes creep up, more and more retirees get caught in this tax net.

To see how your benefits might be taxed, you first need to calculate your "provisional income" and see where it falls.

This table shows how your 'provisional income' and filing status determine the percentage of your Social Security benefits that may be subject to federal income tax.

Federal Income Tax on Social Security Benefits

| Filing Status | Provisional Income Threshold | Taxable Portion of Benefits |

|---|---|---|

| Individual | Between $25,000 and $34,000 | Up to 50% |

| Individual | Above $34,000 | Up to 85% |

| Married Filing Jointly | Between $32,000 and $44,000 | Up to 50% |

| Married Filing Jointly | Above $44,000 | Up to 85% |

As you can see, you don't need a huge income to start paying taxes on your Social Security. A couple with just $45,000 in provisional income could see up to 85% of their benefits get taxed. This is exactly where smart, strategic planning comes into play.

Think of these income thresholds as tripwires. Your goal in retirement isn't just to generate income; it's to generate it in a way that avoids setting off these tax alarms. Every dollar you can keep below those lines is a dollar saved.

Smart Strategies to Lower Your Provisional Income

Managing your provisional income means you have to be more thoughtful about where your money comes from each year. Instead of just taking cash from the most convenient account, you need a deliberate withdrawal strategy. Doing it right can dramatically reduce, or even completely eliminate, taxes on your benefits.

Here are a few of the most effective ways to control your income and protect your Social Security checks.

Use Roth Accounts to Your Advantage

This is, without a doubt, the most powerful tool in your tax-management toolbox. Withdrawals from a Roth IRA or a Roth 401(k) are 100% tax-free. More importantly, they do not count toward your provisional income.

Imagine you’re close to a tax threshold. If a withdrawal from your traditional IRA would push you over the edge, you can simply pull from your Roth account instead. You get the cash you need, and your provisional income for the year doesn't budge. This flexibility is priceless.

Make Your Charitable Giving Tax-Smart with a QCD

If you are age 70½ or older and enjoy giving to charity, the Qualified Charitable Distribution (QCD) is a brilliant strategy. It allows you to donate up to $105,000 (the limit for 2024) directly from your traditional IRA to a charity of your choice.

The magic of a QCD is that it does two things at once:

- The amount you donate counts toward satisfying your Required Minimum Distribution (RMD) for the year.

- The money goes straight to the charity and is never included in your adjusted gross income.

By lowering your AGI, you directly lower your provisional income. This helps you stay under the Social Security tax thresholds while still supporting causes you believe in. It's a true win-win.

Be Strategic About When You Take Gains

Finally, always be mindful of when you cash in on other investments. Selling stock, a rental property, or another asset can create a large capital gain, which will absolutely spike your provisional income for that year.

It might make perfect sense to delay a sale until January if it means keeping your Social Security from being taxed at that punishing 85% rate. Planning these big financial moves around your Social Security tax situation can save you thousands.

Answering Your Top Questions About Maximizing Benefits

https://www.youtube.com/embed/aUm_4A8T33w

As you start applying these strategies to your own situation, some very specific questions are bound to come up. It's totally normal. Getting a handle on these "what if" scenarios is what turns a good plan into a great one.

Let's walk through a few of the most common questions I hear from people trying to get this right.

What if I Claim Early and Then Regret It?

It happens more often than you'd think. You file for benefits at 62, only to land a great new job or have your financial situation improve a few months later. You're not necessarily stuck. The Social Security Administration (SSA) gives you one chance at a do-over, but the clock is ticking from day one.

This option is officially called withdrawing your application. You only have 12 months from the date you started receiving benefits to make this move.

There are two major strings attached:

- You have to repay every single penny you and your family received. That includes any spousal benefits and even money that was withheld to pay for your Medicare premiums.

- If you manage that, the slate is wiped clean. It's as if you never filed, allowing your delayed retirement credits to start growing again for a bigger benefit down the road.

Think of it as a powerful reset button, but the tight timeline and full repayment rule mean you have to act fast if you get cold feet.

How Does My Claiming Decision Affect My Spouse After I’m Gone?

For married couples, this is probably the most important piece of the puzzle. Your decision today has a direct and permanent impact on your partner's financial security after you pass away. Your surviving spouse is entitled to a survivor benefit, which is 100% of the benefit amount you were receiving.

The higher earner's claiming choice essentially sets the high-water mark for that future survivor benefit. If you're the higher earner and you claim early at 62, you not only lock in a smaller check for yourself but also a permanently lower survivor benefit for your spouse.

By delaying your own claim, especially if you are the higher earner, you are directly purchasing a larger, guaranteed, lifelong income stream for your surviving spouse. This single act can be one of the most impactful financial gifts you leave behind.

For instance, waiting from age 67 to 70 boosts your own benefit by a significant 24%. That same 24% increase carries over to the survivor benefit your spouse will eventually receive, providing them with critical financial stability for years, or even decades.

Can I Still Work While Receiving Social Security?

Absolutely. But there’s a catch if you haven’t reached your Full Retirement Age (FRA) yet. Your earnings from work can temporarily reduce your Social Security payments due to something called the earnings test.

The good news? Once you hit your FRA, the earnings test vanishes. You can earn any amount of money from a job and your Social Security check won't be reduced by a single penny.

Here's the crucial thing to remember about that earnings test: the money they withhold isn't lost forever. The moment you reach your FRA, the SSA recalculates your benefit amount to give you credit for the months they withheld payments. This leads to a slightly higher monthly check for the rest of your life, effectively paying you back over time. For the latest on these kinds of rules, the official Social Security Administration blog is a great place to check.

Knowing these details is what builds a rock-solid strategy. Understanding you have a limited window for a do-over or seeing how your choices can safeguard your spouse gives you the clarity to truly maximize your benefits for the long haul.

Navigating federal benefits can be a complex process, but you don't have to do it alone. The team at Federal Benefits Sherpa specializes in helping federal employees understand and optimize their retirement benefits, from TSP to Social Security. Schedule your free 15-minute benefit review today and take the first step toward a secure retirement. Learn more and book your session at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved