Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

How to Calculate FERS Retirement Like a Pro

Figuring out your FERS retirement benefit really boils down to a single, core formula: High-3 Salary x Years of Service x Pension Multiplier.

That’s it. That’s the starting point for everything. While there are a lot of nuances we’ll get into, understanding these three pieces is the first real step toward getting a clear picture of your financial future after federal service.

Your Quick Answer to Calculating FERS Retirement

Let's cut right to it. The federal retirement system can feel overwhelmingly complex, but your basic pension calculation is surprisingly straightforward. Every FERS employee can get a solid baseline estimate by focusing on just three key numbers that represent their entire career.

Think of this as your foundational knowledge. Before you even start worrying about the FERS supplement or survivor benefits, getting this core calculation down will give you the confidence to tackle the more complex parts of your retirement plan.

Breaking Down the Three Core Components

To get an accurate pension estimate, you need to know exactly what each part of that formula means. Each one represents a critical piece of your career and directly influences the annuity you'll receive for the rest of your life.

Here's the quick rundown of what you'll need to find:

- High-3 Average Salary: This is the big one. It’s not just your last paycheck; it's the average of your highest 36 consecutive months of basic pay. For most people, this ends up being their final three years on the job.

- Creditable Service: This is the total time you’ve worked in a FERS-covered position. It can also include any military service you’ve "bought back" by making deposits, and it often includes your unused sick leave, which can add valuable months to your service time.

- Pension Multiplier: This is a percentage set by law. For the vast majority of FERS employees, it’s 1.0%. However, there’s a special circumstance where it bumps up to 1.1%, giving your pension a nice little boost.

To help you keep these straight, here is a simple table breaking down each component.

FERS Annuity Formula Components at a Glance

| Component | What It Means | Key Details |

|---|---|---|

| High-3 Salary | The average of your highest basic pay over any 36-month period. | Usually your last three years of service. Excludes overtime, bonuses, and certain allowances. |

| Creditable Service | Your total years and months of federal service. | Includes FERS-covered time, bought-back military service, and unused sick leave. |

| Pension Multiplier | A fixed percentage used to calculate your final annuity. | 1.0% for most retirees. Becomes 1.1% if you retire at age 62 or older with at least 20 years of service. |

As you can see, each piece of the puzzle is clearly defined. The magic happens when you see how they all work together.

The real power comes from understanding how these elements interact. For instance, working one extra year not only increases your "Years of Service" but could also raise your "High-3 Salary," compounding the growth of your annuity.

Why That Little Multiplier Makes a Big Difference

Don't underestimate the power of that tiny 0.1% increase in the multiplier. Getting the enhanced 1.1% factor is a goal for many federal employees. To qualify, you must retire at age 62 or older with at least 20 years of creditable service.

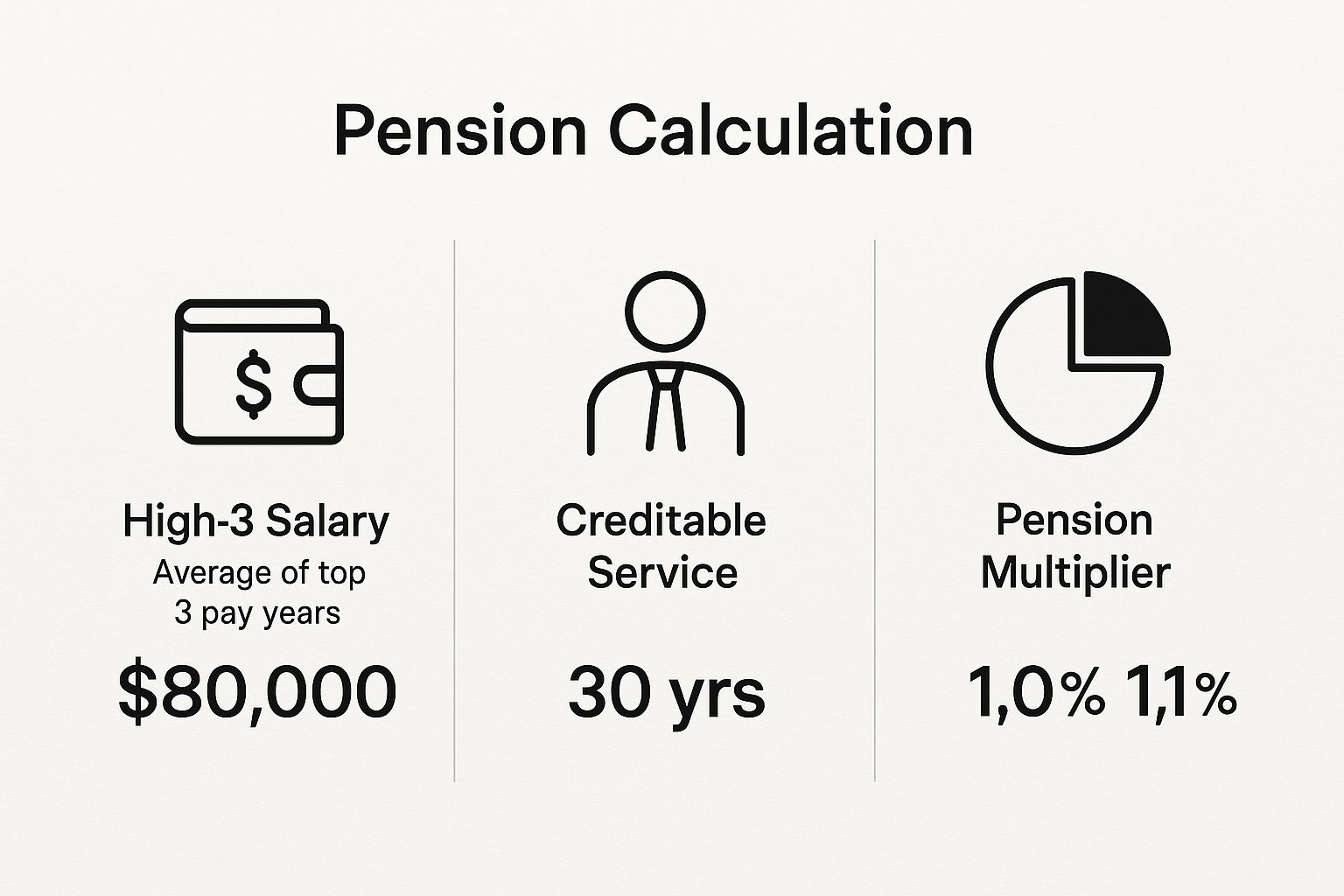

Let’s put it into perspective. Say you have a 30-year career and your High-3 salary is $80,000. If you retire at 62, that 0.1% difference adds up to an extra $2,400 per year. Every single year. For life.

Over a 20 or 30-year retirement, that small percentage point can easily translate into tens of thousands of extra dollars. You can see how different scenarios play out by using a federal annuity estimator, which helps visualize the long-term impact of that seemingly small detail.

Breaking Down the FERS Annuity Formula

Alright, let's get into the nuts and bolts of your FERS annuity. To really understand what your retirement will look like, you have to get comfortable with the core formula. It all boils down to three key numbers that you need to track down and verify. Getting these right is the first, most critical step in building a realistic retirement plan.

This infographic lays it out pretty clearly—it's a simple, powerful formula.

As you can see, your final pension is a direct product of your salary, your years on the job, and the age you decide to retire. Let's break down each piece so you know exactly what to look for.

Identifying Your High-3 Average Salary

First up is your High-3 average salary. This isn't just your final paycheck; it's the average of your highest "basic pay" over any 36 consecutive months of your federal career. For most people, this usually happens to be their last three years, when their salary is at its peak.

To nail this number down, you'll need to look at your basic pay, which includes your base salary and locality pay. It’s just as important to know what doesn't count.

- Overtime

- Bonuses and cash awards

- Travel allowances

- Severance pay

While these extras are nice, they aren't part of the High-3 calculation. The best place to find your official basic pay rates over the years is on your SF-50s (Notification of Personnel Action).

Calculating Your Total Creditable Service

Next, we need your creditable service. This is the total time you've worked in a FERS-covered position, but it’s often more than just the time between your start and end dates. There are a few ways to add to this total, and they can make a real difference.

Civilian Service: This is the bedrock of your calculation—all the time you've spent as a federal employee under FERS.

Military Service: If you have prior military service, you may be able to get credit for that time. It's not automatic, though. You have to make a military deposit to "buy back" this time, essentially paying the FERS contributions you would have made. For many, this is a fantastic way to add several years to their service total.

Unused Sick Leave: I often call this the "second pension," and for good reason. Your entire bank of unused sick leave is converted into additional service time when you retire. The official OPM conversion is that 2,087 hours of sick leave equals one full year of creditable service. This can substantially boost your final annuity. Just remember, you can't use this converted time to meet your minimum retirement eligibility, like hitting 20 years of service.

Here's a pro tip: guard your sick leave, especially in the last few years before you plan to retire. Every single hour you save directly translates into a higher pension payment for the rest of your life.

Understanding Your Pension Multiplier

The last piece of the puzzle is the pension multiplier. This is a percentage determined by your age and service at retirement. For most FERS employees, the multiplier is a flat 1.0% (or 0.01).

But there's a huge incentive to work just a little longer. If you retire at age 62 or older with at least 20 years of service, that multiplier gets a permanent boost to 1.1% (or 0.011).

A tenth of a percent might not sound like a game-changer, but it's actually a 10% increase in your annual pension, for life.

Putting It All Together with a Real Example

Let's walk through how this works with a real-world scenario. Meet Sarah, a federal employee planning her next chapter.

- High-3 Salary: After pulling her records, Sarah's highest three years of basic pay were $98,000, $100,000, and $102,000. This gives her a High-3 average of $100,000.

- Creditable Service: Sarah has 28 years of civilian service under her belt. She also saved up 1,044 hours of sick leave, which OPM converts to an extra 6 months. Her total creditable service comes out to 28.5 years.

- Retirement Plan: Sarah is planning to retire right at age 62.

Because Sarah will be 62 with well over 20 years of service, she qualifies for that enhanced 1.1% multiplier. Now, let's plug her numbers into the formula:

$100,000 (High-3) x 28.5 (Years) x 0.011 (Multiplier) = $31,350 per year

This calculation gives Sarah her basic annual annuity. This is the foundational number she'll use to start planning for other things, like survivor benefits or the FERS supplement. Getting this core calculation right is the essential first step. For a personalized look at your own numbers, it can be helpful to connect with an expert from a service like Federal Benefits Sherpa who can walk you through the specifics.

How Different Retirement Scenarios Can Drastically Change Your Numbers

The FERS retirement formula might seem straightforward, but your final pension amount is incredibly sensitive to when and how you decide to call it a career. It's one thing to understand the math in theory, but seeing it play out with real numbers is what truly brings it home.

Let's walk through three common retirement paths with some realistic employee profiles. You'll see firsthand how the same person's career could lead to wildly different outcomes based on their timing and choices.

The Gold Standard: A Full Voluntary Retirement

First up is Anna. She's the picture of a well-planned federal career and is ready to retire on her own terms. She hit all the right milestones to get the most out of her FERS pension.

- Her Stats: Age 62, with 30 years of creditable service and a High-3 salary of $110,000.

Anna’s situation is exactly what you hope for. Because she’s retiring at age 62 with well over 20 years of service, she unlocks the enhanced 1.1% pension multiplier. This little bonus is a reward for sticking it out and makes a real difference.

Here’s how her FERS pension calculation works out:

$110,000 (High-3) x 30 (Years) x 0.011 (Multiplier) = $36,300 per year

That gives her an immediate, unreduced annuity of $36,300 a year, or about $3,025 a month. By timing her retirement perfectly, Anna gets her full, maximized FERS benefit without a single penalty.

The Trade-Off: An Early MRA+10 Retirement

Now, let's look at Ben. He joined the federal workforce a little later in life and is looking for a way out before he hits his 60s. The MRA+10 option gives him that flexibility.

- His Stats: Age 57 (his Minimum Retirement Age), with 15 years of service and a High-3 salary of $95,000.

Ben technically qualifies for early retirement since he's at his MRA with more than 10 years in. But this early exit comes with a hefty price tag: a permanent age reduction penalty. The rule is a 5% reduction for every single year you are under age 62.

For Ben, being five years younger than 62 means a painful 25% cut (5 years x 5%).

First, let's calculate his pension before the penalty:

$95,000 (High-3) x 15 (Years) x 0.010 (Multiplier) = $14,250 per year

Now, let's apply that 25% penalty:

$14,250 x 0.25 = $3,562.50 reduction

$14,250 - $3,562.50 = $10,687.50 final annual annuity

His decision to retire early drops his annual pension to just $10,687.50. He could choose to postpone his payments until age 62 to avoid the cut, but that means five years with no pension income at all. It's a tough choice that really shows the high cost of the MRA+10 path.

The Office of Personnel Management provides key FERS information on its website, covering these retirement types and eligibility rules. It’s a must-read resource for understanding the specific path that fits your circumstances.

The Long Game: A Deferred Retirement

Finally, meet Chloe. She put in a solid decade with the government before a great opportunity in the private sector came along. She didn't retire; she simply separated from service, leaving her FERS contributions behind to grow.

- Her Stats: Left federal service at age 45 with 12 years of service. Her High-3 salary at that time was $80,000.

Chloe is eligible for a deferred retirement. She can't touch her pension right away, but she can file for it once she's old enough. Since she had more than 10 years of service, she can start collecting an unreduced benefit at age 62.

The catch? Her pension is calculated using the numbers from when she left years ago.

$80,000 (High-3) x 12 (Years) x 0.010 (Multiplier) = $9,600 per year

When Chloe finally turns 62, she can activate her FERS pension and will receive $9,600 annually. It’s certainly a nice stream of supplemental income, but that dollar amount hasn't been adjusted for inflation since she left, meaning its purchasing power has significantly decreased over time.

Key Takeaway: Your retirement date is one of the most powerful financial levers you can pull. As these scenarios show, two employees with similar salaries can have vastly different outcomes based purely on their retirement timing and eligibility.

Deciding when to retire is a bigger deal than ever. The federal workforce is seeing some major shifts, with the Office of Personnel Management (OPM) receiving a staggering 70,351 retirement applications in the first half of 2025 alone. That's a nearly 40% jump from the same period in 2024. If you're curious, you can explore more about why federal retirements are spiking and how it might be linked to policy uncertainty.

The different retirement avenues can be confusing, so this table breaks down the core differences between the options we just discussed.

Comparison of FERS Retirement Types

| Retirement Type | Minimum Age & Service | Annuity Calculation Impact | Best For |

|---|---|---|---|

| Voluntary | Age 62 with 5+ years, Age 60 with 20+ years, or MRA with 30+ years | Unreduced annuity. Eligible for the 1.1% multiplier at 62 with 20+ years. | Employees seeking to maximize their FERS pension with no penalties. |

| Early (MRA+10) | MRA with 10-29 years of service | Annuity is permanently reduced by 5% for each year under age 62. | Individuals who need to leave federal service early and can afford the benefit reduction. |

| Deferred | Separated employees with 5+ years of service | Benefit is calculated on service and salary at separation. No COLAs until activated. | Former federal employees who left service before being eligible for an immediate retirement. |

Ultimately, understanding these paths is critical. Calculating your FERS retirement isn't just about plugging numbers into a formula; it's about seeing how your career and life decisions directly shape that final result.

What Else Shapes Your Final FERS Annuity?

Getting your basic annuity calculation right is a great start, but it’s really just the foundation. Several other critical factors can significantly adjust that number up or down, and understanding them is essential for a realistic retirement plan.

These aren't just minor tweaks. They involve major financial decisions about protecting your spouse, keeping up with inflation, and bridging the gap until Social Security kicks in. Let's break down what you need to know.

The FERS Special Retirement Supplement: A Bridge to Social Security

For many FERS employees who retire before age 62, the FERS Special Retirement Supplement (SRS) is a huge deal. Think of it as a temporary payment that approximates the Social Security benefits you earned during your years of federal service. It’s designed to tide you over until you’re eligible for actual Social Security.

But it’s not for everyone. To get the SRS, you need to retire with an immediate, unreduced annuity. That generally means you must retire:

- At your Minimum Retirement Age (MRA) with 30 or more years of service.

- At age 60 with 20 or more years of service.

The SRS is a fantastic perk for early retirees, but it does have a catch. It's subject to the same annual earnings test as Social Security. If you take a job after retiring and earn more than the limit ($22,320 in 2024), your supplement gets reduced or even wiped out completely. No matter what, it stops cold the month you turn 62.

The future of the supplement has been debated in Congress before. While it appears safe for now, it's smart to stay informed. You can read more about the recent discussions on federal retirement benefits to keep up with any potential changes that might affect your plan.

Keeping Up with Inflation: Your Cost of Living Adjustments

One of the most valuable features of your FERS pension is its built-in protection against inflation. Cost-of-Living Adjustments (COLAs) are designed to give your annuity a boost most years to help it keep up with rising prices. Without COLAs, a pension that looks great on day one could feel painfully small 20 years down the road.

Now, for most FERS retirees, these adjustments don't start right away—you won't see your first COLA until you turn 62. The formula is also a little different from the one Social Security uses. Here’s how it works:

- If inflation (measured by the CPI) is 2% or less, your COLA matches it.

- If inflation is between 2% and 3%, your COLA is capped at 2%.

- If inflation is over 3%, your COLA is the inflation rate minus 1%.

This means your FERS pension will grow, but it might not always keep perfect pace with inflation, especially in high-inflation years.

Your annuity is a living benefit, not a static number. Understanding how COLAs work is essential for long-term financial planning, ensuring your income can support your lifestyle for decades to come.

The Survivor Benefit: A Critical Decision for Your Spouse

When you fill out your retirement paperwork, you'll face one of the most important—and irreversible—decisions of the entire process: whether to elect a survivor benefit. Choosing to provide one means you accept a reduction in your own monthly pension to guarantee your spouse receives an income from it after you pass away.

You have two main choices here:

- Full Survivor Annuity (50%): Your spouse receives 50% of your unreduced basic annuity. This costs you a permanent 10% reduction in your own pension.

- Partial Survivor Annuity (25%): Your spouse receives 25% of your unreduced basic annuity. This comes with a smaller 5% reduction to your pension.

This decision is about more than just income; it's also tied directly to health insurance. For your spouse to continue their Federal Employees Health Benefits (FEHB) coverage after your death, you must have elected a survivor annuity for them. Skipping it means their health insurance ends when you're gone. It’s a heavy choice with lifelong consequences.

Don't Confuse Your TSP with Your FERS Annuity

Finally, let's clear up a common point of confusion. Your Thrift Savings Plan (TSP) is completely separate from your FERS pension. I see people lump them together all the time, but they are two distinct pillars of your retirement.

Your FERS annuity is a defined benefit pension, a guaranteed monthly payment from the government for the rest of your life.

Your TSP is a defined contribution plan, like a 401(k) in the private sector. The money in it is based on what you contributed, what your agency matched, and how your investments performed over the years. It is not part of your FERS annuity calculation. Your total retirement income will be a combination of your FERS annuity, Social Security, and what you draw from your TSP.

Tools and Resources for an Accurate FERS Calculation

While running the numbers yourself is a fantastic way to get a feel for how your FERS pension works, you definitely shouldn't stop there. Think of your own spreadsheet as your first draft. To build a retirement plan you can truly depend on, the next step is to verify those numbers using official tools and expert resources.

Luckily, you have some great options for double-checking your math and getting the peace of mind that comes with confirmation.

The best place to begin is with the calculators provided by the Office of Personnel Management (OPM). They have online tools designed specifically to give you a solid, albeit unofficial, estimate of your basic FERS annuity. Because they’re built on the official formulas and rules, they’re an authoritative source for a quick gut check.

To use an OPM calculator effectively, you'll need to have your key career data handy—your service computation date, your best guess at a High-3 salary, and when you plan to retire. The more precise you are with the information you plug in, the more accurate the estimate will be. This is a great way to see how your personal calculations line up with what the government's system will likely produce.

Leveraging Official OPM Calculators

I like to think of using the OPM calculator as the final exam for my own math. If my numbers and OPM's estimate are in the same ballpark, I know I'm on the right track.

But what if the numbers are way off? Don't panic. A big difference is just a signal to go back and review your work to see what might have been missed.

From my experience, discrepancies usually pop up in a few common areas:

- Creditable Service: Did you correctly calculate your military buy-back or the conversion of your unused sick leave? It's easy to make a small error here.

- High-3 Salary: Double-check that you only used your basic pay and that you averaged the correct 36 consecutive months.

- Retirement Type: Make sure you applied the right multiplier—1.0% versus the 1.1% bonus—and accounted for any potential age reductions if you’re retiring early.

Beyond Annuity Calculators

Remember, your FERS pension is just one part of your retirement puzzle. You can't forget about your Thrift Savings Plan (TSP). It’s a massive part of the equation.

By mid-2025, the TSP had ballooned to over $1 trillion in assets across more than 7.2 million participants. For FERS employees, the average TSP balance was a hefty $196,668, which really highlights how critical this account is for your financial future. You can dig into more of these federal employee retirement numbers for 2025 to see the full picture.

Your most reliable resource is your own agency. About 6 to 12 months before your planned retirement date, you should formally request an official FERS annuity estimate from your human resources department. This is the gold standard.

This official estimate isn't a guess; it's generated using your actual personnel records. It’s the most accurate projection you can get before you submit your final paperwork. Comparing this document to your own calculations is the final, crucial step to ensure there are no unwelcome surprises when that first retirement check arrives. If you want another set of eyes on it, working with a specialist, like the folks at Federal Benefits Sherpa, can help you make sense of the official estimate and finalize your plan with confidence.

Common Questions About Your FERS Calculation

Even after you get the hang of the basic FERS formula, some real-world situations can throw a wrench in the works. The FERS system is full of specific rules that can seem a bit confusing at first, but understanding them is key to maximizing your retirement.

Getting clear on these common points of confusion is vital for an accurate calculation. Let's dig into some of the most frequent questions I hear from federal employees trying to nail down their numbers.

How Does Unused Sick Leave Affect My Calculation?

Think of your unused sick leave as a powerful asset you've been building for years. Every hour you've saved up gets converted into additional creditable service, which gives your final annuity calculation a direct boost.

The Office of Personnel Management (OPM) uses a standard 2,087-hour work year as the basis for this conversion. So, if you manage to bank 2,087 hours of sick leave, you get credit for one full, extra year of service. Even a smaller balance makes a difference—522 hours, for example, adds another three months to your total service time.

This is a direct reward for your diligence over your career. It's important to know that this extra service time is added after you've already met the minimum age and service requirements for retirement. It can't be used to make you eligible to retire, but it will absolutely increase your pension once you are.

This makes saving your sick leave, especially in your final years, a really smart financial move. It's one of the few ways you can actively bump up your service time right up until your last day.

What Is the FERS Special Retirement Supplement?

The FERS Special Retirement Supplement, which you'll often hear called the SRS, is basically a bridge payment. It's designed for FERS employees who retire before they're eligible for Social Security at age 62. The goal is to give you an amount that approximates the Social Security benefit you earned while you were a federal employee.

To get this valuable supplement, you typically have to retire with an immediate, unreduced annuity. This usually means retiring at your Minimum Retirement Age (MRA) with 30 years of service, or at age 60 with 20 years.

Just remember, the SRS is subject to an earnings test. If you take on another job after retiring and your income goes over the annual limit, your supplement can be reduced or even wiped out completely. The SRS automatically stops for everyone at age 62, which is when you become eligible to file for your own Social Security benefits.

Does Part-Time Service Change My FERS Calculation?

Yes, it absolutely does. If you have a history of part-time work, your FERS calculation involves an extra step to make sure your annuity is a fair reflection of the hours you actually worked.

First, OPM calculates your annuity as if all your service was full-time. They use your full-time equivalent salary to figure out your High-3, creating a baseline pension amount.

Then, they take that baseline amount and multiply it by a proration factor. This factor is pretty straightforward: it’s the total hours you actually worked during your career divided by the total hours you would have worked if you'd always been a full-time employee. The final number is a prorated annuity that accurately reflects your service history.

It's a crucial adjustment that ensures your final benefit is proportional to your actual time on the job.

Are There Any Proposed Changes I Should Know About?

While the FERS system is quite stable, it’s always smart to keep an eye on legislative discussions that could impact future retirees. From time to time, lawmakers float reforms aimed at adjusting federal retirement benefits.

For instance, past proposals have included ideas like shifting the annuity calculation from a High-3 to a High-5 average salary, or increasing the FERS employee contribution to 4.4%. While these specific changes haven't been enacted, they show that the conversation around federal benefits is always ongoing. You can discover more insights about potential FERS reforms to stay informed on the topic.

Navigating all the nuances of your FERS benefits can feel overwhelming, but you don't have to figure it all out alone. Federal Benefits Sherpa is here to help you make sense of your retirement options and ensure you're on the right path. Get a free, personalized 15-minute benefits review to clarify your situation and plan your future with confidence. Schedule your complimentary review with Federal Benefits Sherpa today!

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved