Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Employee Medical Retirement Explained

When a serious health condition suddenly puts your federal career on hold, the future can feel incredibly uncertain. That's where federal medical retirement comes in. It’s a lifeline for public servants who can no longer perform their duties due to a medical issue.

This benefit, officially known as FERS Disability Retirement, isn't a temporary solution. Think of it more as a permanent early retirement, providing a steady income and continued health benefits when you're forced to leave your job sooner than planned.

Understanding Federal Medical Retirement

Imagine you've dedicated years to public service, but a physical or mental health condition now makes it impossible to do your job effectively. Federal medical retirement is the system designed for this exact situation. It’s a safety net that ensures a debilitating health issue doesn't lead to financial ruin.

The whole program is managed by the Office of Personnel Management (OPM). They're the gatekeepers, and they meticulously review every application to see if it meets their strict standards. The core question they're trying to answer is whether your condition prevents you from providing "useful and efficient service" in your position.

Core Components of the Program

Medical retirement is far more than just a monthly annuity check; it's a comprehensive support system designed to bridge the gap between your unexpected career end and when you would have normally retired.

Here’s a quick look at what it provides:

A Stable Annuity: You'll receive a reliable, recurring income. The amount is calculated based on your years of service and your salary history.

Continued Health Insurance: This is a huge one. In most cases, you can keep your Federal Employees Health Benefits (FEHB) coverage, which is invaluable when you're dealing with a health condition.

Life Insurance Coverage: Your Federal Employees' Group Life Insurance (FEGLI) can also be continued, giving your family a layer of financial protection.

Ongoing Creditable Service: You actually keep earning creditable service time until you turn 62. This is a fantastic feature because it means your regular retirement annuity will be higher when you eventually reach that age.

This program is built on a simple premise: a dedicated federal career shouldn't end in financial disaster because of an unexpected disability. It's a structured way to honor your service by providing a secure foundation when you need it most.

To give you a clearer picture, here's a quick summary of what the FERS medical retirement program offers.

FERS Medical Retirement At a Glance

ComponentWhat It Means For YouEligibility RequirementYou need at least 18 months of creditable federal service to qualify.Annuity CalculationYour payment is based on your "high-3" average salary and years of service.Health & Life InsuranceYou can continue your FEHB and FEGLI coverage into retirement.Future Service CreditYou keep earning service credit until age 62, boosting your future regular retirement.Private Sector WorkYou can work in the private sector, but earnings are capped at 80% of your former position's current salary.

This table highlights the key benefits that provide long-term stability for you and your family.

How It Works in Practice

So, how does this all come together? If you're a federal employee under the Federal Employees Retirement System (FERS) and a medical condition stops you from doing your job, you can apply. You’ll need at least 18 months of creditable federal service under your belt and solid medical proof of your inability to work.

Your annuity is calculated using your "high-3 average salary"—the average of your highest-paid 36 consecutive months. Beyond the steady income and health insurance, you're also allowed to work in the private sector. The only catch is that your earnings can't go over a specific limit, or it could impact your benefits. To dig deeper into how these benefits are calculated and applied, you can find more information at federaldisability.com.

Qualifying for Federal Medical Retirement

Figuring out if you qualify for federal medical retirement isn't as simple as filling out a form. It's about telling a clear, consistent story to the Office of Personnel Management (OPM) that proves your case. Think of it less like an application and more like building a legal argument—you need solid evidence that lines up with their specific rules.

The first gate you have to pass through is a simple one. You must have completed at least 18 months of creditable federal civilian service. This is the baseline requirement that shows you're established in the federal system and eligible to apply for this kind of benefit.

The Disabling Medical Condition Standard

Once your service time is confirmed, the entire focus shifts to your health and how it directly torpedoes your ability to do your job. The OPM needs to see proof that you have a "disabling medical condition" that’s expected to stick around for at least one year.

It's a common misconception that the condition has to be work-related. It absolutely does not. Whether it's a chronic illness you've managed for years, an injury from a weekend accident, or a serious mental health challenge, what matters is the impact, not the origin.

The real challenge is drawing a bright, unmissable line between your medical condition and your job duties. You have to prove that your health issues prevent you from providing "useful and efficient service" in your position. That phrase is the absolute heart of a successful application.

Proving You Cannot Perform Your Job

A doctor's note with a diagnosis is just the start; it won't get you across the finish line. You have to demonstrate, in detail, how the symptoms and limitations of that diagnosis clash with the essential functions of your role.

Let’s look at a couple of real-world examples:

An IT Specialist with Severe Migraines: Imagine an IT pro who suffers from chronic migraines that bring on visual disturbances and an inability to focus. Staring at a screen is a fundamental part of their job, but the unpredictable nature of the migraines makes it impossible to reliably code, troubleshoot, or meet project deadlines.

A Law Enforcement Officer with a Back Injury: An officer with degenerative disc disease can no longer run, stand for long periods, or physically restrain a suspect without severe pain and risk of further injury. These physical demands are non-negotiable parts of the job, and they simply can't meet them anymore.

In both of these situations, there’s a direct link from the medical condition to the inability to perform the job's core functions. That’s the kind of connection OPM is looking for.

The goal is to paint a clear picture for OPM. Your medical evidence must not only describe your condition but also explicitly detail how it incapacitates you from fulfilling the specific duties outlined in your official position description.

The Agency Accommodation Requirement

Before OPM even considers your application, your own agency has to go on the record and certify that they can't accommodate your condition. This is a critical step that shows retirement is truly the last resort, not just an easy way out.

Your agency has to try two main things first:

Reasonable Accommodation: They must look at your current job and see if any reasonable changes could help you keep working. This might mean getting you an ergonomic chair, allowing a more flexible schedule, or shifting a few minor tasks to a coworker.

Reassignment: If accommodating you in your current role isn't workable, the agency must look for another open position you're qualified for. This is sometimes called the "accommodation of last resort."

But there are important limits here. The agency only has to look for a job at the same grade or pay level and within your same commuting area. You don’t have to accept a demotion or move across the state. If they offer you a suitable position and you turn it down, your medical retirement application is almost certain to be denied.

However, if they search and come up empty, their certification that no accommodation or reassignment was possible becomes a powerful piece of evidence in your favor.

Navigating the OPM Application Process

Applying for federal employee medical retirement can feel like you're facing a mountain of paperwork. But here’s a better way to think about it: you’re starting a structured conversation with the Office of Personnel Management (OPM), telling them a clear, evidence-based story about why you can no longer do your job.

The whole process unfolds step-by-step, starting with gathering your medical records and ending with submitting a complete application package. Each form has a job to do, fitting together like pieces of a puzzle to create a full picture of your case. Getting those pieces assembled correctly is the secret to a smooth application.

Gathering Your Core Documentation

Before you even fill out a single form, you need to collect your medical evidence. This is the foundation of your entire application. It’s not just about having a diagnosis; it’s about proving how your condition directly impacts your ability to perform your professional duties.

A strong medical file will always include:

Objective Medical Tests: These are the hard facts—things like MRIs, X-rays, bloodwork, or formal psychological evaluations that provide unbiased data about your condition.

Detailed Treatment History: This shows OPM you’ve been proactive. Include records of surgeries, physical therapy, medications, and visits to specialists.

A Physician’s Narrative: This is absolutely critical. You need a detailed letter from your doctor that explains your diagnosis, your prognosis, and—most importantly—your specific functional limitations as they relate to your job.

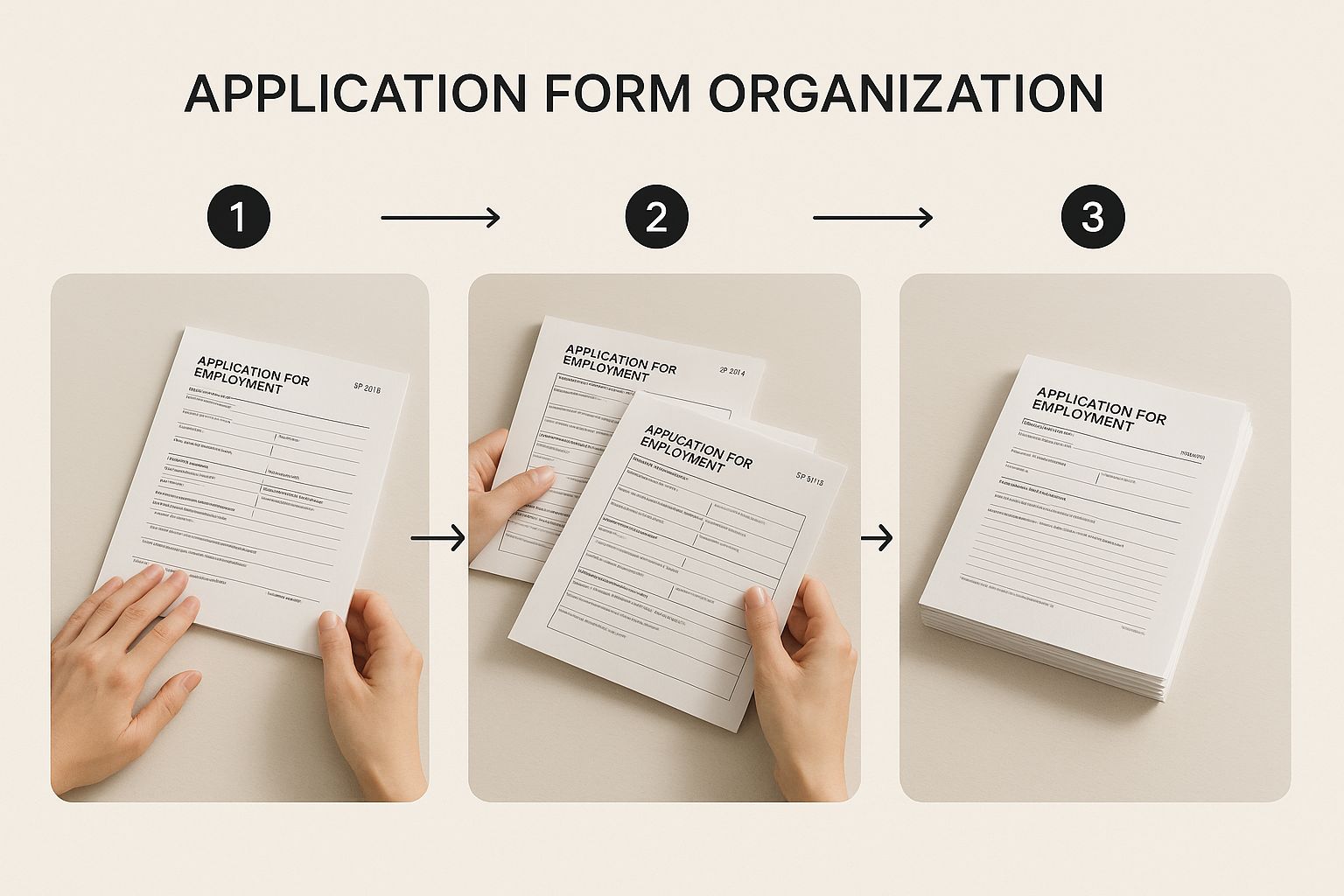

This image gives you a bird's-eye view of the key steps you'll take to get your application organized and submitted.

As you can see, a successful application is built on a bedrock of meticulously organized documents, where every form plays a part in telling your story to OPM.

Understanding the Key Application Forms

The application itself consists of several Standard Forms (SF) designed to gather information from you, your agency, and your doctor. Think of them as the official chapters of your story.

To help you understand the most important forms, here is a quick breakdown of their roles.

Key Application Forms and Their Purpose

Form NumberForm TitlePrimary PurposeSF 3112AApplicant's Statement of DisabilityThis is your narrative. You get to explain, in your own words, how your medical condition prevents you from performing your job duties.SF 3112BSupervisor’s StatementYour supervisor provides their perspective on your performance, attendance, and any efforts made to accommodate your condition.SF 3112CPhysician’s StatementYour doctor provides the medical backbone of your case, detailing your condition, treatments, and specific work-related limitations.SF 3112DAgency Certification of Reassignment and Accommodation EffortsYour agency officially documents that they could not accommodate your condition or find another suitable position for you.

Each of these forms should reinforce the others. For example, the limitations you describe on the SF 3112A need to match what your doctor outlines on the SF 3112C. Consistency across the board is what builds a credible, compelling case.

Crucial Takeaway: The Physician's Statement (SF 3112C) is arguably the most influential document in your entire application. Make sure your doctor has a copy of your official position description so they can draw direct, explicit lines between your medical limits and your job duties.

The Submission and Review Timeline

Once you’ve compiled your evidence and completed the forms, it’s time to submit the package. How you do this depends on your current employment status.

If you are still employed (or separated for 30 days or less): Your application has to go through your agency’s HR or benefits office. They'll add their required forms and send the whole package to OPM on your behalf.

If you have been separated for 31 days or more: You are responsible for sending your application directly to OPM. Be mindful of the deadline—you have a strict one-year window from your separation date to file.

After you submit, you have to be patient. OPM's review is incredibly thorough and can easily take six to twelve months, sometimes even longer if a case is particularly complex. It’s a good idea to have a financial plan in place for this waiting period, as you might be on Leave Without Pay (LWOP).

Your best bet for avoiding delays is submitting a rock-solid application from the start. If OPM has to request more information, they'll pause their review, stretching out the timeline. By giving them a complete, clear, and consistent package, you make it easier for them to make a decision without all the back-and-forth.

For anyone feeling overwhelmed by this process, the expert team at Federal Benefits Sherpa can provide guidance to help you navigate these complexities.

What Does This Mean for Your Retirement Benefits and Annuity?

Getting approved for federal medical retirement is a huge relief, but it immediately raises a critical question: what now? What does this actually mean for your finances and your family’s security? Knowing exactly how your annuity is calculated—and which benefits you get to keep—is the first step toward planning your future with confidence.

It helps to think of your disability annuity less like a standard pension and more like a financial support system that adapts as you age. The initial amount you receive is intentionally designed to be higher when you're younger and can't yet draw from other retirement sources.

How Your FERS Annuity Is Calculated

The starting point for everything is your “high-3 average salary.” This is simply the average of your highest basic pay during any 36-consecutive-month period of your federal career. For most people, this is their last three years of service, but it can be any three-year stretch where you earned the most.

From there, the Office of Personnel Management (OPM) applies a two-stage formula that changes once you turn 62. This built-in adjustment is designed to help your benefits integrate smoothly with your regular retirement and any Social Security you're eligible for.

Here’s how the math works:

For the First 12 Months: Your annuity is 60% of your high-3 average salary, minus 100% of any Social Security Disability Insurance (SSDI) you receive.

After Year One (Until You Turn 62): The formula shifts to 40% of your high-3 average salary, minus 60% of your SSDI payment.

This structure provides a stronger financial cushion right when you need it most, then settles into a stable, long-term income stream.

Let's Walk Through an Example

To see how this plays out in the real world, let's imagine a federal employee named Alex. Alex’s high-3 average salary is $80,000, and he has also been approved for an SSDI benefit of $1,500 a month ($18,000 a year).

Here’s what Alex’s annual FERS annuity would look like:

During the First Year:

60% of $80,000 = $48,000

Subtract 100% of his SSDI ($18,000) = $30,000

Alex's FERS Annuity: $30,000 (He also receives the $18,000 from Social Security).

From Year Two Until Age 62:

40% of $80,000 = $32,000

Subtract 60% of his SSDI ($10,800) = $21,200

Alex's FERS Annuity: $21,200 (He continues to receive the $18,000 from Social Security).

Once you hit age 62, your annuity gets refigured into a standard FERS retirement benefit, just as if you had kept working the whole time.

The most powerful part of this is that you continue earning creditable years of service all the way to age 62, even while on disability. This ensures your final retirement isn't penalized because a medical condition forced you to stop working early.

What About Your Other Benefits?

Thankfully, medical retirement isn't just about a monthly check. You can also hang on to the other core benefits that provide a safety net for you and your loved ones.

In most cases, you can continue your coverage for:

Federal Employees Health Benefits (FEHB): To be eligible, you must have been enrolled in an FEHB plan for the five consecutive years leading up to your retirement.

Federal Employees' Group Life Insurance (FEGLI): The same rule applies here—you need to have been enrolled in FEGLI for the five years right before your retirement to keep your life insurance.

For many, keeping this high-quality health and life insurance is just as valuable as the annuity itself, especially when managing a chronic health issue.

Can You Still Work in the Private Sector?

One final, common question is whether you can work at all. The answer is yes, you can. Medical retirement doesn’t mean you’re barred from ever earning an income again.

However, there's a very important rule. You are allowed to work in the private sector, but your earnings are capped. Each year, you cannot make more than 80% of the current salary for the exact federal position you retired from.

If you go over that limit, OPM will determine you are "restored to earning capacity," and your disability annuity payments will stop. This rule is in place to make sure the benefit serves its intended purpose: supporting those who are genuinely unable to earn at their previous level due to a disability.

Common Application Pitfalls and How to Avoid Them

Getting that denial letter from the Office of Personnel Management (OPM) after months of waiting is a gut punch. It can feel completely devastating. The good news? Many of these denials are entirely preventable.

By understanding where people commonly trip up, you can build a much stronger case for your federal employee medical retirement right from the start. Think of it like building a legal case: you have to present an airtight argument, leaving OPM with no reason to say no. A single weak spot, whether it's flimsy evidence or a missed deadline, can bring the whole thing crashing down.

Inadequate Medical Documentation

By far, the most common reason for a denial is weak or insufficient medical evidence. OPM needs more than just a quick doctor’s note with a diagnosis. They need objective, detailed proof that directly links your medical condition to your inability to do your specific job.

A vague statement like "the patient has chronic back pain and cannot work" is almost guaranteed to get rejected. The people reviewing your case at OPM aren't doctors, so they depend entirely on the paperwork you submit to understand the full picture of your limitations.

To steer clear of this pitfall, your medical evidence has to be solid and specific.

Provide Objective Evidence: This means hard data. Things like MRI reports, X-rays, nerve conduction studies, or formal psychological evaluations provide unbiased proof of your condition.

Show a Consistent Treatment History: Include records from physical therapy, surgeries, specialist visits, and prescribed medications. This shows OPM you’ve been actively trying to get better.

Secure a Detailed Physician’s Narrative: This is crucial. Your doctor needs to write a comprehensive report explaining your diagnosis, your prognosis, and—most importantly—your specific functional limitations. For instance, "cannot sit for more than 20 minutes" or "is unable to lift over 10 pounds."

A powerful application tells a consistent story. The limitations you describe in your statement must be explicitly supported by the objective medical evidence and your doctor's detailed narrative.

Failing to Connect Your Condition to Job Duties

Another huge mistake is not drawing a clear, undeniable line between your medical limitations and the core duties of your job. It’s not OPM's job to connect those dots—that's on you.

You have to spell out exactly how your symptoms stop you from providing "useful and efficient service." For example, if you're an analyst with a cognitive disorder, you need to explain precisely how brain fog and memory issues prevent you from performing data analysis and writing reports, both of which are essential to your position.

The best way to do this is to have your physician's statement reference your official position description. When your doctor directly addresses how your medical restrictions interfere with your listed duties, it creates a powerful link that OPM simply can't ignore.

Navigating the Reconsideration Process

Even with a perfectly prepared application, denials can still happen. The OPM disability retirement approval rate usually hovers between 60% and 70%, so it's smart to be ready for what comes next. If your initial application is denied, you have the right to request reconsideration. For a deeper dive, you can learn more about the factors that influence approval rates from legal experts who specialize in these federal cases.

You have just 30 days from the date on the denial letter to file your request for reconsideration. This isn't a do-over; it's your chance to strengthen your original case. You can submit new medical evidence, offer clarification, and directly address the specific reasons OPM gave for the denial. That tight deadline means you have to act fast to pull together any new information that can help turn the decision in your favor.

A Few Common Questions About Medical Retirement

When you start digging into federal medical retirement, it's natural for a lot of "what if" scenarios to pop into your head. Even with a good grasp of the basics, you're bound to have questions about how it all works in the real world, especially when it comes to other benefits or what might happen down the line.

Let's tackle some of the most frequent questions that come up. Think of this as filling in the details so you can move forward with a clearer picture of the road ahead.

Can I Also Apply for Social Security Disability?

Yes, you can—and for most FERS employees, you have to. The Office of Personnel Management (OPM) actually requires that you apply for Social Security Disability Insurance (SSDI) benefits when you apply for FERS medical retirement.

This isn't just a box-ticking exercise; it directly affects your bottom line. The two benefits are designed to work in tandem, and OPM will reduce your FERS disability annuity based on what you get from the Social Security Administration (SSA).

Here's the breakdown of that offset:

For the first year: Your FERS disability annuity is reduced dollar-for-dollar, or by 100% of any SSDI benefit you're paid.

After 12 months: The reduction eases up. From then on, your FERS annuity is offset by 60% of your SSDI payment for as long as you're receiving both.

What if you don't apply for SSDI? That can cause real problems. OPM has the authority to simply estimate what your Social Security benefit would have been and reduce your FERS annuity by that amount anyway. It's absolutely critical to apply for both to avoid any nasty financial surprises.

What Happens if My Health Gets Better?

A federal medical retirement isn't necessarily a life-long arrangement. It's granted with the understanding that your medical condition is currently preventing you from doing your job, but OPM knows that situations can change.

For that reason, they'll check in on you. OPM may ask for updated medical records from time to time, but the most common check-in is an annual earnings survey. They want to see how much you're earning in the private sector.

If your earned income in any calendar year hits 80% or more of the current salary for the position you retired from, OPM will consider you “restored to earning capacity.” At that point, your disability annuity payments will stop.

If that happens, you aren't just left high and dry. OPM is supposed to help you find another job within the federal government. And if your health takes a turn for the worse again, you may be able to have your disability annuity reinstated. The system is built to provide a safety net when you need it, but it's not meant to be a permanent solution if you're able to return to work.

How Long Does OPM Take to Approve an Application?

This is the hard part: waiting. Once your agency sends your complete application package over to OPM for a final decision, you'll need to settle in for a bit.

On average, you can expect to wait anywhere from six to twelve months for an initial decision. Honestly, it can sometimes take even longer.

Several things can slow the process down:

A Complex Case: Straightforward applications with clear medical evidence tend to move faster. Cases with multiple conditions or conflicting doctor's notes will naturally take more time to review.

An Incomplete Application: If OPM has to hit pause and ask for more medical records or get clarification from your doctor, you can count on significant delays.

OPM's Workload: Sometimes, the hold-up has nothing to do with you. If OPM is swamped with applications, a backlog can develop that's completely out of your control.

The best thing you can do to speed things along is to make sure your application is rock-solid from day one—complete, organized, and with all the supporting evidence they need. Since many people are on Leave Without Pay (LWOP) during this period, having a financial plan to get you through the wait is an absolute must.

At Federal Benefits Sherpa, we know how overwhelming these details can be. Our team is here to help you make sense of your federal benefits and plan a future you can feel confident about. If you have more questions or want personalized guidance, book a free 15-minute benefit review with us today. Learn more at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved