Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Employee Long Term Care Insurance Guide

Let's get one thing straight right away: your federal health benefits and Medicare will not pay for long-term care. It's a hard truth, but facing it is crucial. This gap means that without a dedicated plan, you're on the hook for the potentially crushing costs of help with daily life—things like bathing, eating, or getting dressed—if you ever need that support.

Why Long Term Care Planning Is a Critical Federal Benefit Gap

It’s a common misconception among federal employees that their fantastic benefits package has them covered for every possible health scenario down the road. But your standard health insurance, even the excellent Federal Employees Health Benefits (FEHB) Program, is built for medical treatment—doctor visits, hospital stays, and prescriptions. It was never designed to cover what the industry calls custodial care.

Here’s a simple way to think about it: Your car insurance pays to repair your car after an accident (that's the medical care). It won't, however, pay for a private driver to get you around while you're recovering (that's the long-term care). This kind of non-medical help is what allows you to maintain your quality of life, but it exists in a totally separate world from your health plan.

The Real Cost of Being Unprepared

The financial and emotional weight of needing long-term care without a plan can be absolutely devastating. All too often, families are forced to liquidate retirement accounts, sell the family home, or shoulder the burden of full-time caregiving themselves, creating incredible stress. And the price tag for professional care? It's already steep and climbing every year.

A recent study found that at least 70% of people over age 65 will need some form of long-term care in their lifetime. Simply hoping you'll be in the other 30% isn't a strategy; it's a massive financial gamble that can wipe out a lifetime of careful saving.

This stark reality turns proactive planning from a "nice-to-have" into an essential pillar of your retirement strategy. It's about protecting the assets you've worked so hard for, but it’s also about preserving your dignity and sparing your loved ones from an incredibly difficult situation.

Finding a Path Forward

Recognizing this gap is the first, most important step. The next is to explore the solutions built specifically to fill it. The government-sponsored Federal Long Term Care Insurance Program (FLTCIP) was created for exactly this reason, but its current suspension for new applicants has completely changed the game for many feds.

This guide is here to help you navigate this new landscape. We'll cover:

- What the FLTCIP is and its current status.

- The powerful private market alternatives available to you.

- How to calculate the real costs you might be facing.

- A clear process for building a strategy that protects your future.

By tackling this head-on, you can put a solid plan in place. You’ll be prepared for whatever comes your way, freeing you up to enjoy the secure and peaceful retirement you deserve.

What Is The Federal Long Term Care Insurance Program (FLTCIP)?

To really get a handle on your federal benefits, you have to understand the government's answer to long-term care: the Federal Long Term Care Insurance Program (FLTCIP). It was created as a financial safety net, giving the federal community a way to plan for the kind of expensive care that your regular health insurance simply won't cover.

Think of it as a massive group insurance plan negotiated on behalf of the entire federal family. It wasn't just for current feds; eligibility was pretty broad, extending to active and retired federal and postal workers, military members, and even their qualified relatives—spouses, parents, and adult children could get in on it, too.

The whole idea was to leverage the government’s immense buying power to offer long-term care insurance at, theoretically, better rates. The coverage itself was designed to be flexible, helping with everything from a home health aide who assists with daily chores to a full-on stay in a nursing home or assisted living facility.

The Original Promise of FLTCIP

Established back in 2000, the FLTCIP was built for a specific purpose: to help federal employees, retirees, and their families deal with the skyrocketing costs of long-term care. These are the kinds of expenses that neither your federal health benefits nor Medicare are designed to handle.

Even with its important mission, the program was always optional. It was never an automatic benefit. If you wanted in, you had to make the conscious choice to enroll and pay the premiums out of your own pocket. For more background on the program's history and challenges, you can find a good overview of the federal program on stwserve.com.

The Current Reality: A Sudden Halt

And that brings us to the single most important update you need to know. The FLTCIP is completely closed to new applicants.

On December 19, 2022, the Office of Personnel Management (OPM) slammed the brakes on the program and suspended all new applications. This freeze was a drastic but necessary move to grapple with major concerns about the program's financial health, and it’s expected to last until at least the end of 2026.

This isn’t just a minor delay. It’s a massive shift in the benefits landscape for federal employees. It means the main, government-sponsored route to long-term care coverage is now completely blocked for anyone not already enrolled.

Now, if you're one of the lucky ones who already has a FLTCIP policy, don't panic. Your coverage is safe and sound, as long as you keep paying your premiums. The catch? You can't apply to increase your benefits right now, either.

What This Suspension Means for You

Let's cut to the chase. If you're a federal employee and don't have a FLTCIP policy, you can't get one. The door is shut, and we have no idea when—or if—it will reopen in its old form.

This new reality has huge implications for how you plan for retirement. Sitting around and waiting for the program to come back is a gamble for a few key reasons:

- No Firm Timeline: There's no guaranteed date for its return. These things have a way of getting delayed.

- A Different Program: If FLTCIP does come back, the premiums, benefits, and even the rules for who qualifies could be completely different, and likely far more expensive.

- Your Health Isn't Waiting: Your health could change in the meantime. A new diagnosis could make it much harder, or pricier, to get any kind of long-term care insurance down the road.

This forces a change in strategy. Federal employees now have to look outside the government system to protect themselves. You need to start actively exploring the private insurance market to plug this serious hole in your financial plan. This isn't just a suggestion—it's a necessity. The private market is now your only option for this critical piece of protection.

Finding Your Plan in the Private Insurance Market

With the Federal Long Term Care Insurance Program (FLTCIP) on hold for new applicants, the private market is now the main arena for federal employees looking to plan for their future care. This might seem like a big shift, but it also opens the door to more modern and flexible insurance options than ever before. Your first step is to get familiar with the two main paths you can take.

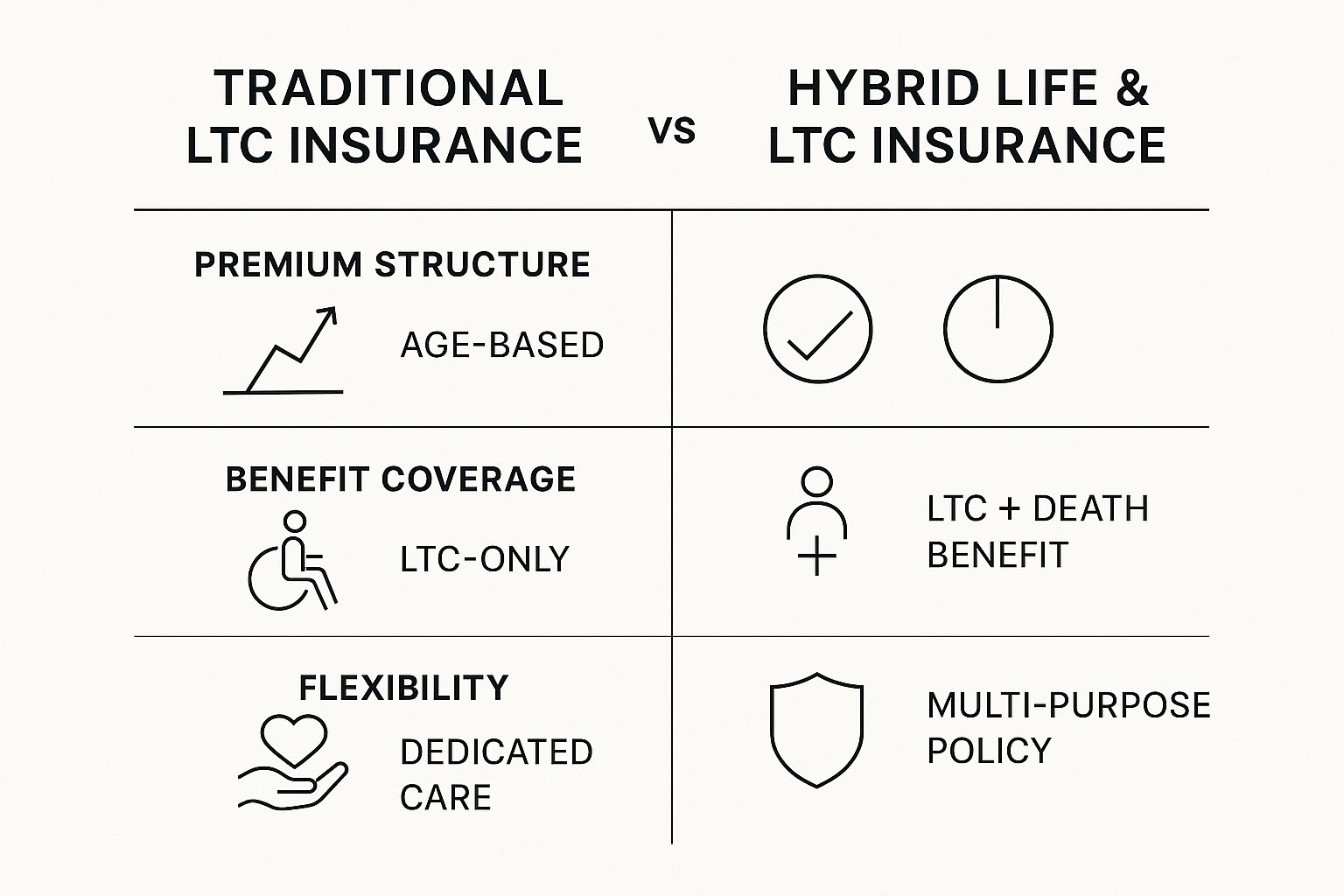

Think of it this way: traditional long-term care insurance is like a highly specialized tool, built perfectly for one critical job. On the other hand, hybrid policies are more like a Swiss Army knife—they combine long-term care coverage with life insurance, giving you more versatility. Each has its own set of pros and cons.

Traditional vs. Hybrid LTC Insurance

A Traditional LTC insurance policy is pretty straightforward. You pay your premiums, and if you ever need qualified long-term care, the policy provides a dedicated pool of money to cover those costs. It's a "use it or lose it" arrangement; if you never need care, the premiums you've paid are gone.

Hybrid policies, however, link your long-term care benefits directly to a life insurance policy. This design guarantees that the money you put in will be used one way or another. If you need care, the policy pays out. If you pass away without needing care, your family receives a death benefit. This completely removes the "use it or lose it" risk, but these policies usually have higher upfront premiums.

This infographic lays out the core differences to help you decide which approach best fits your long term care insurance strategy.

The bottom line is you're choosing between focused, often lower-cost coverage (traditional) and a more adaptable, guaranteed-payout structure that also includes life insurance (hybrid).

Understanding the Cost and Discounts

The private market works differently than FLTCIP, so it's vital to know what drives your premium costs. Insurers will look at your age, gender, and overall health. The simple truth is, the younger and healthier you are when you apply, the lower your premiums will be for the life of the policy.

The cost difference between policy types can be substantial. For example, looking at the private long-term care insurance (LTCI) market, the average annual premium for a traditional policy in 2025 is about $2,100 per year for a healthy 55-year-old man and $3,600 per year for a woman of the same age. Hybrid policies generally cost more, coming in around $5,025 per year for a 55-year-old man and $5,975 for a woman, but they come with that valuable death benefit. You can find more details in these cost breakdowns from the AALTCI.

Here's a huge plus for the private market: discounts. Unlike FLTCIP, private insurers often give significant premium reductions—sometimes 30–40%—for couples who apply together. They also offer extra discounts for being in good health.

To give you a clearer picture, here’s how these private insurance options stack up against each other.

Comparing Private Long-Term Care Insurance Options

This table illustrates the key differences between traditional and hybrid long-term care insurance policies available in the private market for federal employees.

| Feature | Traditional LTCI Policy | Hybrid (Linked-Benefit) Policy |

|---|---|---|

| Primary Purpose | Solely covers long-term care expenses. | Combines life insurance with long-term care benefits. |

| Premium Structure | Ongoing premiums, which can potentially increase over time. | Often fixed premiums; single-pay or limited-pay options exist. |

| Benefit Payout | "Use it or lose it"—no payout if care is never needed. | Guaranteed payout: either for care or as a death benefit. |

| Cost | Generally lower initial premiums compared to hybrid policies. | Higher initial premiums due to the life insurance component. |

| Best For | Individuals seeking dedicated, affordable LTC coverage. | Those wanting to ensure their investment provides value either way. |

Ultimately, your choice depends on whether you prefer a dedicated insurance product for one specific risk or a multi-functional product that guarantees your money will serve a purpose, either for you or your loved ones.

Key Policy Features to Customize

When you build a private plan, you get to make several key decisions that shape your coverage and its cost. Getting these right is the key to creating a policy that truly protects you when you need it most.

- Benefit Amount: This is the daily or monthly sum your policy will pay for care. You’ll want to research the average cost of care in your state to pick a number that makes sense.

- Benefit Period: This is the length of time your policy will pay out, typically ranging from two years to a lifetime. A longer period means more security but also a higher premium.

- Inflation Protection: This might just be the most important feature of all. A 3% compound inflation rider, for instance, makes sure your benefit amount grows each year, keeping up with the rising cost of care so your policy is still meaningful 20 or 30 years from now.

- Elimination Period: Think of this as your deductible. It's the number of days you'll pay for care out of your own pocket before the insurance benefits start. A 90-day period is a very common choice.

Because FLTCIP is closed, exploring these private market solutions isn't just an option—it's a necessary step for any federal employee who is serious about protecting their financial future. By asking the right questions now and acting while you're still in good health, you put yourself in a powerful position to build a financial shield for your retirement years.

Getting Real About the Cost of Long-Term Care

It’s one thing to understand the idea of needing long-term care, but it's a completely different ballgame to stare the actual price tag in the face. The numbers can be jaw-dropping, and frankly, ignoring them is one of the biggest financial risks a federal employee can take.

This isn't about scaring you—it's about getting clear-eyed so you can build a plan that actually works.

Think of your retirement savings as a reservoir you've spent a career filling. A long-term care event without a plan is like knocking a massive hole in the dam. The costs can drain a lifetime of savings with terrifying speed, leaving your spouse or heirs with very little.

To really prepare, you need to know what you're up against. Costs change depending on where you live and the type of care you need, but the national median numbers paint a pretty stark picture.

The National Cost Snapshot

The price of care isn’t some abstract problem for the future; it's a real-world expense that’s already sky-high and continuing to climb.

Here’s a quick look at the median annual costs for different kinds of care across the U.S.:

- In-Home Care (Homemaker Services): You're looking at about $69,800 per year. This covers help with everyday tasks like cooking, cleaning, and running errands.

- Assisted Living Facility: The median cost is roughly $64,200 a year for housing that includes help with personal care and meals.

- Nursing Home Care (Semi-Private Room): This is the big one, at over $104,000 per year for 24/7 skilled nursing care.

These numbers make it crystal clear why just hoping your savings or pension will be enough is a huge gamble. A care event lasting a few years could easily wipe out hundreds of thousands of dollars from your nest egg.

The Silent Killer: Healthcare Inflation

Today's prices are just the starting line. The real challenge is healthcare inflation, which almost always outpaces the general rate of inflation. What that means is the cost of care 20 years from now will be dramatically higher than it is today.

Waiting to make a plan doesn't just put off a decision; it all but guarantees you'll pay a lot more for the exact same level of care down the road.

A policy with 3% compound inflation protection might seem like a minor detail now, but over two decades, it can literally double your initial benefit amount. This feature is absolutely critical for making sure your federal long-term care insurance policy still has enough power when you actually need to use it.

This constant upward march in costs reveals a major gap for federal workers. Long-term care costs have been climbing for years. And while Federal Employees Health Benefits Program (FEHBP) premiums have also risen, those plans do not cover custodial or long-term care. As you can learn from these insights on how rising healthcare costs impact federal employees on govexec.com, this leaves feds with three choices: pay out-of-pocket, spend down their assets to qualify for Medicaid, or get insured.

Building Your Financial Defense

Insurance is a fantastic tool, but it should be just one part of your overall long-term care strategy. A truly secure plan means looking at all your financial resources and figuring out how they can work together. This proactive approach helps you shift from worrying about a problem to actively solving it.

Think about building your strategy on these three pillars:

- Personal Savings and Investments: Intentionally set aside a portion of your portfolio for future care. This can act as your "deductible" before the insurance kicks in or help supplement your policy's daily benefit if you need extra coverage.

- Long-Term Care Insurance: This is your main line of defense. A good policy transfers the lion's share of the financial risk to an insurance company, protecting your core retirement assets from being wiped out.

- Home Equity: For most homeowners, their house is their biggest asset. A reverse mortgage or a home equity line of credit could provide funds in a pinch, but this requires careful planning and a full understanding of the pros and cons.

By weaving these elements together, you create a multi-layered defense. You’re not just buying a policy—you're building a complete financial structure designed to withstand the immense pressure of long-term care costs with confidence and control.

How to Build Your Long Term Care Strategy

Putting together a solid long-term care plan isn't about finding a one-size-fits-all product. It's really about answering a few key questions about your own life—your finances, where you are in your career, and what your family situation looks like. If you rush it, you can end up with a policy that doesn't fit or a plan that just won't be there when you need it most.

Think of it like building a custom home. You wouldn't just grab a random blueprint. You’d carefully consider your family's size, your lifestyle, and, of course, your budget. Your long-term care strategy needs that same personal touch, starting with some foundational questions.

Your Personal Planning Checklist

Before you even start looking at insurance quotes, take a moment to think through these critical areas. Your answers will shape your entire plan, pointing you toward the right kind of coverage.

When is the best time to buy? The honest answer is almost always right now. Premiums are based directly on your age and health when you apply. Every year you wait, the cost goes up, and you run the risk of developing a health issue that could make you ineligible for coverage altogether.

How do you balance cost and benefits? This is a big one. It's tempting to go for the highest possible daily benefit, but that can lead to unaffordable premiums down the road. A smarter move is often to choose a more modest daily benefit but pair it with strong inflation protection. That way, your coverage grows over time without breaking your budget.

What is your family’s role? Be brutally honest here. While we all hope family will be there, relying on them for hands-on care can put an incredible strain on relationships and their own lives. Insurance gives you the resources to hire professionals, protecting your loved ones from caregiver burnout and preserving your family dynamic.

Tailoring Your Strategy to Your Life Stage

Long-term care isn't a static need; it changes as you move through your federal career. A cookie-cutter approach just doesn't cut it. Your strategy has to fit where you are today and where you plan to be tomorrow.

For example, a younger federal employee in their 40s needs to make inflation protection their absolute top priority. A policy without it will be worth a fraction of its original value by the time they might need it decades from now. The goal is to lock in a low premium while you’re young and healthy and let the benefits compound over the years.

On the other hand, someone in their late 50s or early 60s is on a different timeline. For them, the focus shifts to maximizing the immediate daily benefit amount. With retirement around the corner, ensuring the coverage is strong enough to handle today's care costs is the most pressing concern.

Your long-term care strategy isn't just a financial document; it's a reflection of your priorities. A single individual may prioritize a plan that guarantees independence, while a married couple might seek a policy with shared benefits to protect the healthy spouse's financial security.

Vetting Your Insurance Partner

Once you have a clear picture of what you need, the final piece of the puzzle is choosing the right insurance company. Since the FLTCIP is closed to new applicants, you'll be navigating the private market. It’s crucial to do your homework because not all insurers are created equal.

Here’s what to look for:

- Financial Stability: This is non-negotiable. Look up the company's ratings from agencies like A.M. Best. You want a carrier with a long history of financial strength—an "A" rating or higher—to ensure they'll be around to pay claims in 20 or 30 years.

- Experience in LTC: Stick with insurers that have been in the long-term care game for a long time. They have a much better handle on managing claims and keeping their pricing stable.

- Customer Service: What's it like to actually file a claim? Read reviews and ask questions about their process. A company that’s a headache to deal with will only add stress to an already difficult time.

Building your strategy is a deliberate process. By taking the time to answer these questions and selecting a rock-solid partner, you can design a plan that delivers genuine peace of mind. To make sure your choices fit with your overall retirement plan, talking things through with an expert at Federal Benefits Sherpa can help you move forward with confidence.

Your Top Questions About Federal Long Term Care

When you start digging into long-term care, a ton of "what if" questions pop up. It’s only natural. For federal employees, getting straight answers is crucial for making smart decisions about your future, especially now that the Federal Long Term Care Insurance Program (FLTCIP) is on hold for new applicants.

Let's clear up some of the most common questions and concerns that might still be lingering.

What Happens to My FLTCIP if I Leave My Federal Job?

This is a big one. A lot of folks who are already enrolled in FLTCIP worry about losing their coverage if they leave their federal job before they're ready to retire.

The good news? Your policy is portable.

Think of it as your personal property—it’s not chained to your government desk. You get to take it with you. All the premiums you've paid haven't gone to waste.

There's just one simple catch: you have to take over the payments directly. Since the premium will no longer come out of your federal paycheck, you’ll need to set up direct billing with the insurance carrier. As long as you keep those payments up, your coverage stays in place with the exact same benefits you originally signed up for.

Is Long-Term Care Insurance Tax-Deductible?

Yes, it can be, but you have to know the rules. This is a great perk that can help make your policy a little more affordable.

The IRS lets you count "qualified" long-term care insurance premiums as a medical expense. You can then lump these premiums in with your other medical costs when you itemize deductions on your tax return. The catch is that you can only deduct the total amount of medical expenses that goes above 7.5% of your adjusted gross income (AGI).

There are also limits on how much of the premium you can deduct each year, and it all depends on your age. For 2024, those caps are:

- Age 40 or under: $470

- Age 41 to 50: $880

- Age 51 to 60: $1,770

- Age 61 to 70: $4,710

- Age 71 and over: $5,880

On top of that, here's a huge plus: when your long-term care policy eventually pays out, those benefits are typically received completely tax-free. That means every dollar goes directly to your care, not to the tax man.

Of course, tax laws are tricky and everyone's situation is different. It's always a good idea to chat with a tax professional who can give you advice tailored to your finances.

Should I Wait for FLTCIP to Reopen?

With FLTCIP closed to new applications until at least late 2026, it's tempting to just sit back and wait. But honestly, waiting is a gamble, and the stakes are incredibly high.

Putting this decision on the back burner opens you up to some serious risks. First off, there's absolutely no guarantee when—or even if—the program will reopen as we knew it. If it does come back, you can bet the benefits, the rules, and especially the premiums will look very different. And almost certainly more expensive.

Waiting for FLTCIP to reopen is like pausing your TSP contributions because you hope the market will be better in a few years. You lose out on precious time and, in the insurance world, you risk your health changing and making you uninsurable.

That's probably the biggest risk of all—your health. A sudden diagnosis could slam the door shut on getting coverage, or at least make it way more expensive on the private market. The smartest move is often to lock in a plan now, while you're younger and healthier. It secures your insurability and puts that protection in place today, not years from now.

What If I Can’t Afford or Qualify for Insurance?

Long-term care insurance is a fantastic tool, but it isn't the only tool in the shed. If you find that a policy is just too expensive or you can't get approved because of your health, don't panic. You still have other solid ways to build a financial safety net.

The key is to be proactive and create a plan with multiple layers, so you aren't banking on just one solution. Here are a few strategies to look into:

- Dedicated Savings: You can set up a specific savings or investment account just for long-term care. It takes discipline to fund it, but this "self-insuring" route gives you total control over the money.

- Reverse Mortgages: If you're a homeowner age 62 or older, a reverse mortgage can turn some of your home equity into cash to pay for things like in-home care. It's a complex financial move, so you'll want to do your homework and get good advice.

- Understanding Medicaid: This is a safety net of last resort. Medicaid will cover long-term care costs, but only after you’ve spent nearly all of your own assets to meet very strict poverty-level rules. It's good to know how it works in your state as part of a crisis plan, but you don't want it to be your only plan.

Creating a strategy without a traditional insurance policy just means you need to be more deliberate with your financial planning. The goal is to be prepared on purpose, not to leave your future up to chance.

Trying to make sense of your federal benefits and plan for long-term care can feel overwhelming on your own. At Federal Benefits Sherpa, we specialize in guiding federal employees like you toward a clear, confident, and secure retirement.

To make sure your plan is built on a rock-solid foundation, book a free 15-minute benefits review with our team today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved