Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Borrowing from TSP A Guide to Using Your Savings

Thinking about tapping into your Thrift Savings Plan for a loan? It's a common move for federal employees, and for good reason. You're essentially borrowing from yourself, and the interest you pay goes right back into your own retirement account.

It can be a smart way to handle a big expense without getting tangled up with high-interest bank loans or credit cards. But it's not a decision to take lightly.

The big catch? While that money is out on loan, it’s not invested. That means it's not growing. You're missing out on the power of compounding, which is the real engine of your retirement savings. You have to weigh your immediate need for cash against the potential long-term growth you'll be sacrificing. It’s a classic short-term vs. long-term financial puzzle.

Should You Borrow From Your TSP Account?

So, is a TSP loan the right call for you? It really boils down to your specific situation. The idea of paying interest to yourself instead of a bank is definitely appealing. It feels less like a traditional debt and more like a structured way to access your own money when you need it.

But let's be clear: this isn't "free money." The real cost is the opportunity cost. If the market has a great year while your loan is outstanding, that borrowed portion of your account misses out completely. You're hitting the pause button on a chunk of your retirement savings, and that can have a real impact down the road.

Understanding the Two Types of TSP Loans

The TSP keeps things pretty straightforward by offering just two kinds of loans. Knowing which one fits your needs is the first step.

General Purpose Loan: This is your flexible, all-purpose option. Need to pay off some credit card debt, fix your car, or cover a medical bill? This is the loan for that. No questions asked, no documentation needed about how you'll use the money. The catch is you have to pay it back within five years (60 months).

Residential Loan: As the name suggests, this one is exclusively for buying or building your primary home. Because this is a major life event, the TSP gives you a much longer leash for repayment—up to 15 years (180 months). You will need to provide documentation, like a signed purchase contract, to prove that’s what the funds are for.

The Bottom Line: A general purpose loan is for short-term needs, offering quick cash with a faster payback. A residential loan is a long-term tool for what's likely the biggest purchase of your life.

If you're buying a house, that longer 15-year repayment window on a residential loan can make the monthly payments much more manageable. For just about anything else, the general-purpose loan is your go-to, but you've got to be prepared to pay it back relatively quickly.

Before you make a final decision, it helps to see the key differences side-by-side.

TSP Loan At a Glance: Key Considerations

| Factor | General Purpose Loan | Residential Loan |

|---|---|---|

| Purpose | Any reason (debt, emergency, etc.) | Purchase or construction of a primary residence only |

| Documentation | None required | Proof of purchase/construction is required |

| Repayment Term | 1 to 5 years (12-60 months) | 1 to 15 years (12-180 months) |

| Flexibility | High – use the funds for anything | Low – strictly for housing |

| Best For | Short-term financial needs | Long-term, major home purchase |

This quick comparison should help clarify which path might be better for you. The residential loan offers a much longer runway for repayment, but the general purpose loan provides unmatched flexibility for life's other big expenses.

How Much Can You Actually Borrow from Your TSP?

Before you start earmarking funds for that new roof or to pay off a high-interest credit card, you first need to figure out if you're even eligible for a TSP loan. The Thrift Savings Plan has some pretty clear-cut rules, and not everyone can just dip into their account whenever they want. Let's walk through the requirements.

First things first, you have to be a federal employee currently in a pay status. This is a big one. If you’ve already separated from federal service, taking a new loan is off the table. You also need to have at least $1,000 of your own contributions (and their earnings) in your TSP account.

The Essential Eligibility Checklist

Think of these as the gatekeepers to getting a loan. The TSP has these rules to make sure you have a solid account balance to borrow against and that the loan can be repaid smoothly through automatic payroll deductions.

You absolutely must meet all of these conditions:

- You’re currently a federal civilian employee or a member of the uniformed services.

- You’re in an active pay status (meaning you're receiving pay from your agency).

- You have at least $1,000 of your own contributions and earnings in your account.

- You haven’t paid off a loan of the same type within the past 60 days.

If you've got all those covered, great! You’re most likely in the clear. Now comes the interesting part: calculating how much you can actually get.

Breaking Down the Maximum Loan Amount

The amount you can borrow isn't just a number you pull out of thin air. It’s calculated using a specific formula that looks at your account balance, any outstanding TSP loans you might have, and some firm IRS limits.

The maximum loan amount is always the lesser of these two figures:

- 50% of your total vested account balance.

- $50,000 minus the highest outstanding balance of any other TSP loan you've had in the last 12 months.

Let's look at a real-world example. Say your vested TSP balance is $80,000 and you've never taken a TSP loan before. The first calculation gives you $40,000 (which is 50% of $80,000). The second calculation is $50,000 since you have no other loans. Because you have to take the lesser of the two, your maximum loan amount is $40,000. Simple enough.

A critical point to remember: Agency contributions and their earnings aren't part of your loan calculation until you're fully vested. For most FERS employees, that takes three years of service.

Now, let's flip the scenario. Imagine you have a $120,000 balance. Half of that is $60,000. But here, the IRS rule kicks in, capping the loan at $50,000. So even though your balance is high, the absolute most you could borrow is $50,000.

This rule is in place for a good reason—it prevents federal employees from treating their TSP like an unlimited ATM and helps protect the core purpose of the account: your retirement. Knowing these limits from the start lets you plan realistically and avoid any surprises when you go to fill out the application.

A Practical Walkthrough of the TSP Loan Application

So, you've weighed the pros and cons and decided a TSP loan is the right move for you. The good news is the application process itself is pretty painless. It’s all handled online through the main TSP website, and as long as you have your info ready, you can get through it quickly.

Your first stop is the "My Account" login page on the TSP site. This is your command center for everything related to your retirement savings. You'll need your usual login credentials, and be ready for any two-factor authentication you have set up.

Kicking Off Your Loan Request

Once you're logged in, you’ll land on your account dashboard. Find the "Loans and Withdrawals" link in the main menu. This is where the magic happens. Before you get too far, the system will do a quick check to make sure you're actually eligible based on your account balance and current employment status.

After you pass that initial check, you'll need to plug in a few key pieces of information:

- Loan Type: Is this a General Purpose loan or a Residential loan for a primary home?

- Loan Amount: Tell them exactly how much you need to borrow.

- Repayment Term: Choose how long you'll take to pay it back. This can be up to 60 months for a general purpose loan, or all the way up to 180 months (15 years) for a residential loan.

This first screen is simple, but don't rush it. I've seen people accidentally type an extra zero and get a real shock. Double-check your numbers before you click "next."

Dealing with Paperwork and Spousal Consent

If you're applying for a residential loan, you'll need to prove it. This is where documentation comes in. The TSP will ask for things like a signed purchase agreement or a contract to build your primary residence. You can upload these documents directly through the online portal—no faxing or mailing required.

Now, here’s a step that trips up a lot of people: spousal consent. If you're a married FERS employee, your spouse absolutely must sign a consent form for the loan. It doesn't matter how much you're borrowing; their signature is required. The system will generate the form for you to handle.

My Advice: This isn't something to spring on your spouse at the last minute. Talk it over with them well before you even start the application. Making sure they're on board and available to sign will prevent a major headache and keep your application from getting stuck in limbo.

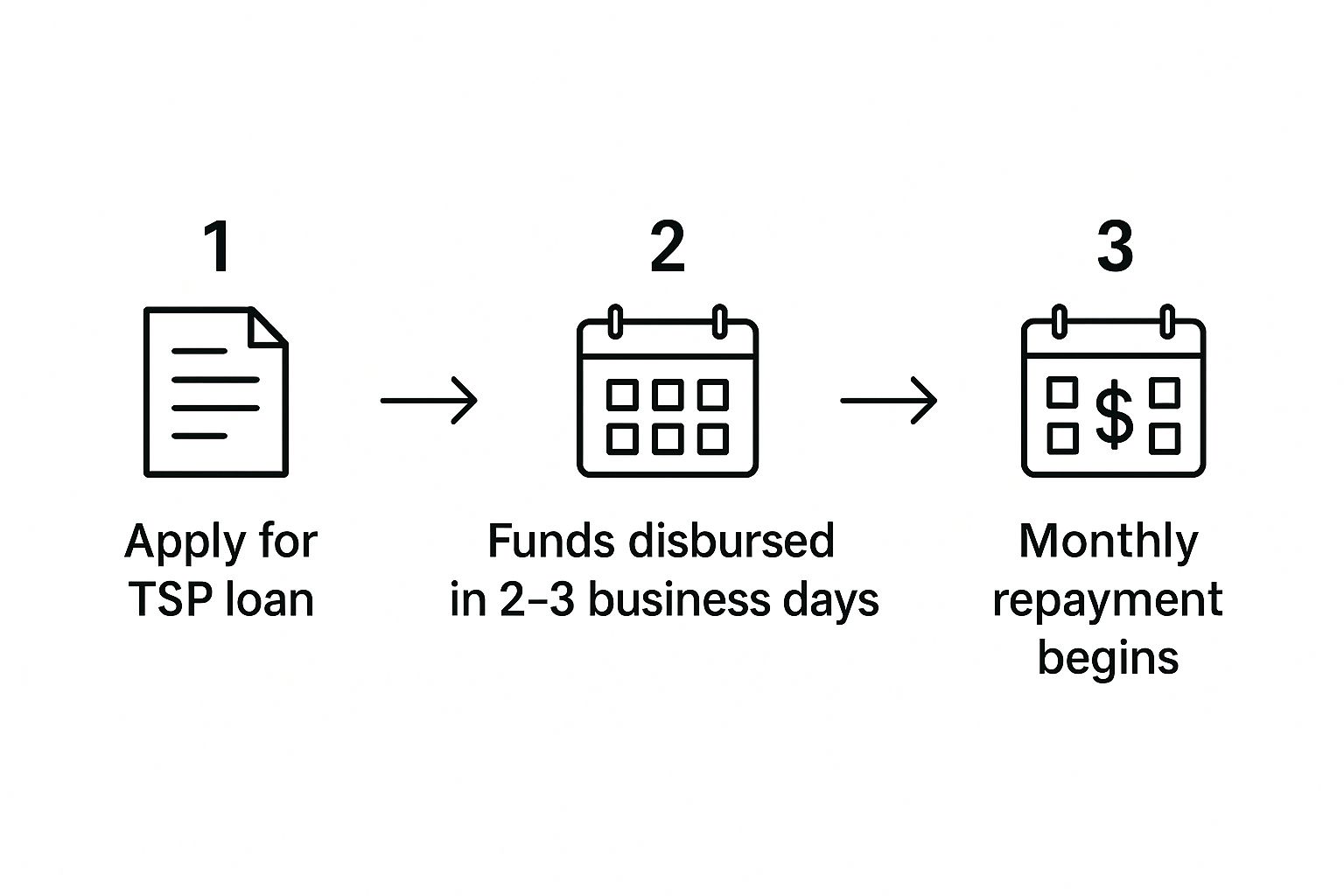

The infographic below gives you a general idea of what to expect once you hit submit.

As you can see, things move pretty fast once the application is in. You can expect to see the money in a few business days, and the repayments will start hitting your paycheck shortly after.

Finalizing and Submitting

The last thing you'll do is review everything one final time. The system lays it all out for you on a summary screen: the loan amount, your interest rate (which is always tied to the G Fund rate), the repayment period, and what your bi-weekly or monthly payroll deduction will be. Read every single line carefully.

Once you’re confident that all the details are correct and your documents are uploaded, you'll electronically sign and submit the application. That's it! From there, the TSP handles the rest, and you can watch its progress right from your "My Account" portal.

Understanding Your Repayment and Tax Obligations

Getting the money from your Thrift Savings Plan is usually the easy part. The real challenge—and where things can get expensive if you're not careful—is navigating your repayment and tax obligations.

One of the best things about a TSP loan is how simple the repayment process is. Your payments are automatically pulled from your paycheck each pay period, so you literally can't miss one. It's a true "set it and forget it" system that keeps you on track without any extra hassle.

Even better, the interest you pay doesn’t line a bank's pocket. It goes directly back into your own TSP account. You're essentially paying yourself back, which helps your account recover from the loan over time.

How Loan Repayments Are Calculated

When you take out the loan, the TSP figures out your payment amount based on how much you borrow, the repayment term you choose, and the interest rate. That rate is locked in for the entire life of the loan and is tied to the G Fund’s interest rate for the month your loan is approved.

This gives you a ton of stability. Your payment amount will never change, which makes budgeting and long-term financial planning much more predictable.

We've seen more federal employees lean on their TSP for loans recently. In fact, loan usage just hit 8.6% among all participants—the highest it’s been in a while. This tells us that federal workers need access to cash, but it also means it's more important than ever to understand the rules. If you're curious, you can explore more data on this trend and see how it’s affecting federal retirement savings.

The Serious Tax Consequences of Defaulting

Okay, this is the part you absolutely need to pay attention to. Borrowing from your TSP is straightforward, but failing to pay it back can create a financial nightmare. If you leave your federal job or otherwise stop making payments, the TSP can declare your outstanding loan a taxable distribution.

When that happens, a few painful things are set in motion:

- It becomes ordinary income: The entire unpaid loan balance gets added to your taxable income for the year. This can easily bump you into a higher tax bracket.

- You'll face a penalty: If you're under age 59½, the IRS will likely hit you with an additional 10% early withdrawal penalty on top of the income tax.

Let's walk through a quick, real-world scenario to see just how damaging this can be.

Example: Sarah is 45 and leaves her federal position with a $20,000 outstanding TSP loan. If she doesn't repay it in full within the grace period, that entire $20,000 is treated as income. In a 22% federal tax bracket, that's an immediate $4,400 tax bill. But it gets worse. The 10% early withdrawal penalty adds another $2,000 to her tab.

All told, her $20,000 loan just cost her an extra $6,400 out of pocket in taxes and penalties. This is precisely why having a solid repayment plan is non-negotiable, especially if you think you might change jobs. A TSP loan can be a fantastic tool, but you have to respect the rules that come with it.

The Hidden Risks of a TSP Loan

Borrowing from yourself and paying yourself back interest sounds almost too good to be true, doesn't it? On the surface, a TSP loan can feel like a perfect, low-cost solution. But there are some serious risks lurking beneath the surface that you absolutely need to understand before you pull the trigger.

The biggest, and most easily missed, danger is opportunity cost. This isn't a fee you'll ever see on a statement. It's the silent loss of all the growth your money would have earned if you’d just left it invested.

When you take out a loan, that money is pulled directly out of your investment funds. It's no longer in the market, so it can't benefit from stock market gains, dividend payments, or the incredible power of compounding. A relatively small loan taken out today can have a much bigger, and more painful, impact on your retirement balance than you might think.

The Long-Term Cost of a Short-Term Loan

Let's walk through a real-world example to see how this plays out. Say you take a $15,000 general purpose loan and plan to pay it back over five years. Let’s assume the market sees a pretty average 7% annual return during that time.

- In that first year alone, your $15,000 has already missed out on $1,050 in potential growth.

- As you slowly pay the loan back, the remaining uninvested portion continues to miss out on gains year after year.

By the time you've paid it all back, you've lost thousands of dollars in direct market gains. But the real damage goes much deeper. That lost growth also lost the chance to keep growing and compounding for the rest of your career. Fast forward 20 or 30 years, and that single $15,000 loan could easily leave your final TSP balance $30,000 to $50,000 smaller.

A Critical Takeaway: When you take a TSP loan, you're not just repaying the loan amount plus interest. You're also fighting an uphill battle to replace the lost time and growth your investments missed out on—and that's a gap that's nearly impossible to close.

The Pressure of Leaving Federal Service

There's another major risk that comes into play if you leave your federal job with an outstanding loan. It doesn’t matter if you resign, retire, or are terminated—the moment you separate from service, the rules change dramatically.

Your automatic payroll deductions stop, and a 90-day countdown begins. You have to repay the entire remaining balance of your loan within that window. If you can’t, the TSP is required to declare the unpaid amount a taxable distribution.

This is where it gets really painful. A taxable distribution triggers two immediate financial hits:

- The full outstanding balance is reported to the IRS as ordinary income for that year, potentially pushing you into a higher tax bracket.

- If you're under age 59½, you'll also get hit with a 10% early withdrawal penalty on top of the income tax.

What started as a manageable loan can instantly become a massive tax bill and a financial emergency. This is why it's so critical to only consider a TSP loan if your job is secure and you have a solid plan for paying it off, no matter what happens.

Got Questions About TSP Loans? Let's Clear Them Up.

Tapping into your retirement savings is a big deal, and it's smart to have questions. Even with all the rules laid out, specific situations always pop up. Let's walk through some of the most common things federal employees ask when they're thinking about a TSP loan.

First off, many people wonder if they can juggle more than one loan. You absolutely can. The TSP allows you to have two loans out at the same time, but they have to be different types: one general purpose loan and one residential loan.

Can I Pay My TSP Loan Off Early?

Yes, and honestly, it’s a smart move if you're able to. There’s a huge upside to paying it off ahead of schedule with no prepayment penalties to worry about.

Getting that money back into your account means it starts working for you again, benefiting from market growth and compounding. You can make extra payments or pay it all off in one go right from the "My Account" section on the TSP website.

What Happens if I Leave Federal Service with an Outstanding Loan?

This is the big one, and it's a detail you can't afford to overlook. If you leave your federal job—whether you resign, retire, or are terminated—the clock starts ticking.

You have just 90 days to repay the entire remaining balance of your loan. If you miss that deadline, the TSP is required to treat the outstanding amount as a taxable distribution. Not only will you owe income tax on the money, but if you're under age 59½, you’ll also get hit with a 10% early withdrawal penalty.

A Word of Caution: Think hard about your job security before you borrow. That 90-day repayment window is unforgiving and can quickly turn a helpful loan into a major tax headache if you change jobs unexpectedly.

Does a TSP Loan Affect My Credit Score?

Here’s one of the biggest draws of a TSP loan: it has zero impact on your credit. Since you’re borrowing your own money, the traditional credit system isn't involved at all.

What does this mean for you?

- No credit check: Your application won’t trigger a hard inquiry.

- No credit reporting: Your loan activity isn't shared with Experian, Equifax, or TransUnion.

- No score impact: Taking the loan, making payments, or even defaulting won't touch your credit score.

This keeps your financial business private and ensures your ability to get a mortgage, car loan, or other credit line remains completely unaffected. It’s a powerful advantage that you just don't get with a standard bank loan.

Feeling confident about your federal retirement plan is crucial, but you don't have to figure it all out on your own. At Federal Benefits Sherpa, we provide personalized guidance to help you make the most of your TSP and other benefits. Take the first step toward a secure future by scheduling a free 15-minute benefit review today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved