Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Guide to Early Withdrawal of TSP Funds

At its core, an early withdrawal of TSP funds is just what it sounds like: taking money out of your Thrift Savings Plan before you hit age 59 ½. But it's rarely that simple. This move almost always triggers some pretty hefty financial penalties, starting with a 10% early withdrawal penalty from the IRS, plus the regular income tax you'll owe on the money.

Understanding the Basics of a TSP Early Withdrawal

Your Thrift Savings Plan was built for one primary purpose: to be your long-term retirement nest egg. The rules are strict for a reason—they’re designed to protect your future self by making it difficult (and costly) to dip into those funds early.

Think of your TSP like a retirement savings fortress. The early withdrawal penalties are the high walls and deep moat, put there to make you think twice before raiding the castle for short-term needs.

This initial cost is a one-two punch that can seriously shrink the amount you actually walk away with. The IRS puts these rules in place to make sure retirement accounts are used for, well, retirement.

The Immediate Financial Impacts

When you pull the trigger on an early TSP withdrawal, the financial consequences are swift and automatic. It’s absolutely critical to understand exactly how much you'll lose to taxes and penalties before you commit.

Here’s a quick breakdown of what you can expect to happen the moment you take money out.

Immediate Financial Impacts of an Early TSP Withdrawal

A summary of the financial consequences you'll face when taking money from your TSP before retirement age.

| Financial Consequence | How It Affects Your Money |

|---|---|

| 10% Early Withdrawal Penalty | The IRS immediately takes a 10% cut off the top for most distributions taken before you are 59 ½. |

| Ordinary Income Tax | The withdrawal amount is added to your annual income. This means it gets taxed at your regular federal and state rates, potentially pushing you into a higher tax bracket. |

| Lost Compounding Growth | This is the hidden cost. The money you take out can no longer grow and compound. Over decades, this can cost you tens or even hundreds of thousands of dollars in future earnings. |

These deductions aren't just paperwork; they significantly reduce the net cash you'll receive. Understanding this math is the first step in making an informed decision.

Why These Rules Exist

The TSP's structure isn't random; it's a carefully crafted system meant to help you build wealth over a long federal career. The penalties are a powerful deterrent, protecting you from making a snap financial decision today that could seriously compromise your security tomorrow.

The whole point of the penalties is to encourage you to leave the money alone. By making it painful to access early, the system helps ensure your savings are actually there for you when you retire.

Getting a handle on these foundational rules is your starting point. Before we get into the exceptions and specific situations, it’s vital to accept what happens by default. This guide will walk you through everything, from calculating the real cost of a withdrawal to finding safer alternatives, so you have the full picture.

Calculating the True Cost of a TSP Withdrawal

When people think about pulling money from their TSP early, the first thing that usually comes to mind is the 10% early withdrawal penalty. But honestly, that’s just the tip of the iceberg. The real cost of an early withdrawal of TSP funds is a painful combination of penalties and taxes that can take a huge chunk out of the cash you actually get.

Thinking about a withdrawal in terms of the big, round number you're requesting is like looking at your gross paycheck. It feels good for a second, but it’s not what hits your bank account. To make a smart decision, you have to run the numbers and see what you'll be left with after everyone—the IRS and maybe even your state—takes their cut.

Breaking Down the Financial Impact

When you ask for an early withdrawal, the TSP doesn't just cut you a check for the full amount. They're required to withhold money for taxes and penalties right away, and you'll likely owe more later.

Let's walk through a real-world example to see how this plays out. Imagine a federal employee needs $20,000 for a home repair and decides the only way to get it is by tapping into their Traditional TSP.

- Gross Withdrawal Amount: $20,000

- Immediate 10% Early Withdrawal Penalty: $2,000

- Mandatory 20% Federal Tax Withholding: $4,000

So, right off the bat, a whopping $6,000 is held back. The check that arrives in the mail is for $14,000, not the $20,000 they desperately needed. And unfortunately, the financial hit doesn't stop there.

Factoring in Your Full Tax Liability

That mandatory 20% withholding is just a down payment on your federal tax bill. Your actual tax rate depends on your total income for the year, and it could easily be higher.

If our federal employee is in the 22% federal tax bracket, their total tax on the withdrawal is actually $4,400 ($20,000 x 22%). Since $4,000 was already withheld, they'll have to come up with another $400 for the IRS when they file their taxes.

Don't forget state income tax. This is the one people almost always overlook, and it can take another significant bite. While some states don't tax retirement income, many do, adding another layer of cost.

Let’s say this person lives in a state with a 5% income tax:

- State Income Tax: $20,000 x 5% = $1,000

Now we can pull all these numbers together to see the true damage.

The Real Cost of a $20,000 TSP Withdrawal

Here’s the final tally for our hypothetical federal employee. The difference between the amount requested and the cash in hand is pretty stark.

| Cost Component | Amount |

|---|---|

| Gross Withdrawal | $20,000 |

| 10% Early Withdrawal Penalty | -$2,000 |

| Total Federal Income Tax (22%) | -$4,400 |

| Total State Income Tax (5%) | -$1,000 |

| Total Costs and Taxes | -$7,400 |

| Net Cash Received | $12,600 |

It's a tough pill to swallow. To get $12,600 in usable cash, they had to pull $20,000 out of their retirement. That’s a 37% loss right from the start, which shows just how misleading that initial 10% penalty can be. This is exactly why you have to calculate the full cost before making a move.

Traditional TSP vs Roth TSP Withdrawals

The tax hit also depends entirely on whether your money is in a Traditional or Roth TSP. This is a critical distinction.

- Traditional TSP: You contributed pre-tax money, so it grew tax-deferred. When you withdraw it, the entire amount—your contributions and the earnings—is treated as ordinary income. It gets hit with income tax and, if you're under 59½, the 10% penalty.

- Roth TSP: You contributed after-tax money. Because of this, your contributions always come out tax-free and penalty-free. It's only the earnings portion of the withdrawal that gets subjected to income taxes and the 10% penalty.

Knowing this is key. An early withdrawal from a Roth TSP might be a little less painful since you're only paying taxes and penalties on the growth. Still, you're sacrificing future tax-free growth, which is one of the most powerful wealth-building tools you have. For help navigating these complexities in your own plan, a resource like Federal Benefits Sherpa can offer guidance tailored to your situation.

When to Consider a TSP Financial Hardship Withdrawal

Life can throw some serious curveballs, and when a real financial crisis hits, the money in your Thrift Savings Plan might feel like your only safety net. The TSP has a specific provision for these moments—a financial hardship withdrawal—but it's a tool that comes with some very strict rules and significant consequences.

This isn't for a surprise car repair or a leaky roof. The TSP requires you to prove an "immediate and heavy financial need." Think of it as the absolute last resort, because unlike a loan, you can never put the money back. Once you take it out, it's gone for good, along with all the potential growth it would have earned for your retirement.

What Actually Counts as a "Financial Hardship"?

The TSP is very specific about what qualifies as a hardship. You can't just say you need the money; your situation has to fit neatly into one of their approved categories, and you'll need the paperwork to back it up.

Here are the main situations where the TSP might approve a hardship withdrawal:

- Recurring Negative Cash Flow: This means your essential monthly expenses are consistently higher than your income, and you're falling further behind each month.

- Major Medical Expenses: We're talking about significant medical bills for you, your spouse, or your dependents that your insurance won't cover.

- Personal Casualty Losses: This is for financial damage from a disaster like a fire, flood, or hurricane that isn't covered by your insurance policy.

- Specific Legal Fees: This is limited to costs directly related to a separation or divorce, such as attorney's fees or court costs.

A critical point to remember is that you can only withdraw the exact amount needed to solve the problem. If you have a $15,000 medical bill, you can’t request $30,000. The entire process is designed to provide targeted relief, not a cash-out opportunity.

Documentation is Everything

When you apply, get ready to prove your case. The TSP requires solid documentation that supports your claim, and they won't just take your word for it. Incomplete or unconvincing paperwork is a fast track to getting denied, so being organized is key.

A hardship withdrawal is not a loan. It's a permanent distribution that shrinks your retirement savings forever. You don't just lose the amount you take out; you lose decades of potential compound growth on that money.

For example, if you're applying due to medical bills, you'll need to round up the invoices from doctors, hospital statements, and the explanation of benefits from your insurer that shows what they refused to cover. If it's a casualty loss, you'll need things like insurance claim documents, repair estimates, or even a police report. Your goal is to build an undeniable, documented case showing why this withdrawal is absolutely essential.

A Real-World Hardship Scenario

Let's walk through an example. Imagine Sarah, a federal employee, is hit with an unexpected medical crisis. Her child requires a major surgery, and even after insurance, the family is left with a staggering $25,000 bill. They’ve drained their emergency fund but are still coming up short.

- The Application: Sarah logs into her TSP account and starts a hardship withdrawal request, selecting "medical expenses" as the reason.

- The Paperwork: She gathers every document she can find—the surgeon's invoice, the hospital bill, and the official statement from her insurance company that details exactly what she owes.

- Approval and Aftermath: Her request is approved. The $25,000 is taken from her account, but after the 10% early withdrawal penalty and income taxes are withheld, the amount she actually receives is much less. That $25,000 is now permanently gone from her retirement fund, with no chance to grow over the remaining 20 years of her career.

This story highlights the tough trade-off. The withdrawal solved Sarah's immediate crisis, but it created a permanent hole in her retirement plan. Recent data shows more federal employees are facing this dilemma, with hardship withdrawals climbing to 3.9%—the highest level ever recorded. This trend shows just how many people are being forced to tap into their retirement savings to stay afloat today. You can discover more insights about this trend and its impact on TSP participants.

How to Avoid the 10 Percent Early Withdrawal Penalty

While that 10% early withdrawal penalty feels like a brick wall designed to keep you from your retirement savings, it's not completely solid. The IRS understands that sometimes life happens, and they've built in a few specific exceptions for times when you truly need the money, not just want it. Knowing these rules is critical if you're ever faced with a situation that might require an early withdrawal of TSP funds.

But let's get one thing straight right away: even if you qualify for an exception and dodge the 10% penalty, you will still owe ordinary income tax on any money you pull from a Traditional TSP. These exceptions get you out of the penalty, but they don't get you out of your tax bill.

Think of it this way: the IRS has a tollbooth on the bridge to your retirement money. For certain emergencies, they’ll wave the 10% toll, but you still have to pay the regular income tax once you cross.

Separating from Service After Age 55

This is one of the most common and powerful exceptions out there. It's often called the "Rule of 55," and it's a lifeline for many early retirees.

If you leave federal service—whether you retire or just separate—during or after the calendar year you turn 55, you can take money from your TSP without that nasty 10% penalty. This is a huge deal for people who plan to retire early and need to tap into their TSP to bridge the financial gap until other income sources, like a FERS supplement or Social Security, kick in.

Key Takeaway: The "Rule of 55" is tied to the year you turn 55, not your actual birthday. If your birthday is in December, you could leave your job in January of that same year and still qualify for penalty-free TSP withdrawals.

For example, let's say a federal employee turns 55 in November but decides to retire in March of that year. Any TSP withdrawals they make after separating from service will be completely exempt from the 10% early withdrawal penalty.

Qualifying for Total and Permanent Disability

If you become totally and permanently disabled, the IRS allows you to access your retirement funds without the 10% penalty. This exception is a crucial safety net, recognizing that a severe disability can prevent you from working and create an immediate and significant financial hardship.

To qualify, you must have medical proof showing you can’t perform any substantial gainful work because of a physical or mental impairment. The condition must also be expected to be fatal or to last for a long, continuous, and indefinite period.

- Documentation is Key: You'll need to provide clear documentation from a physician to both the TSP and the IRS to prove your disability status.

- Forms, Forms, Forms: This usually involves filling out specific IRS forms that your doctor must complete, certifying the nature and severity of your condition.

This provision is there to provide financial relief when a career is cut short by a serious and unexpected health crisis.

Covering High Unreimbursed Medical Expenses

Facing a mountain of medical bills? There’s an exception for that, too. You can take a penalty-free withdrawal to cover unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI).

Let's break that down. Say your AGI for the year is $80,000. To qualify, your out-of-pocket medical bills would need to total more than $6,000 ($80,000 x 7.5%). You could then withdraw any amount above that $6,000 threshold without getting hit with the 10% penalty.

- Real-World Example: If your AGI is $80,000 and you have $10,000 in unreimbursed medical bills, you could withdraw $4,000 ($10,000 - $6,000) penalty-free.

- Good to Know: You don't have to itemize your deductions on your tax return to use this exception, but you absolutely must meet that 7.5% AGI threshold.

If you think you might need to use this exception, keep meticulous records of every single medical bill and payment. You’ll need them.

Distributions to a Beneficiary After Death

When a TSP participant passes away, any money paid out to their designated beneficiaries is not subject to the 10% early withdrawal penalty. This holds true no matter the age of the participant who died or the age of the person inheriting the account.

This rule ensures your loved ones can access the funds without an extra financial hit, although they will still owe income taxes on any distributions from a Traditional TSP. Beneficiaries have a few different ways to receive the money, and each has its own tax rules, so getting professional advice is always a smart move.

Trying to make sense of federal benefits, especially in these kinds of unique situations, can be overwhelming. For one-on-one help, services like Federal Benefits Sherpa can walk you through your options and make sure you're meeting all the requirements.

Exploring Alternatives to a TSP Withdrawal

When you're in a financial bind, tapping into your TSP funds early can feel like the only way out. But it's a permanent move with serious, irreversible consequences. Once that money is gone, you can never put it back, and you forfeit all the future growth it would have generated. Before you go down that road, it's critical to view an early withdrawal not as your only option, but as your absolute last resort.

Fortunately, you have other, smarter ways to get the cash you need without torpedoing your retirement savings. Each has its own pros and cons, but taking the time to explore them could save you a fortune in penalties and protect you from the long-term regret of a depleted nest egg.

The TSP Loan: A Smarter First Step

Your best first alternative is almost always a TSP loan. The best way to think about it is borrowing from yourself, not from a bank. You're temporarily accessing your own retirement money with a formal plan to pay it back. This is a world away from a permanent withdrawal.

The biggest advantage? You preserve your retirement principal. A withdrawal permanently shrinks your account, but a loan keeps your core savings intact while you handle your immediate need.

- You Pay Interest to Yourself: The interest you pay on a TSP loan doesn't go to a lender; it goes right back into your own TSP account. This helps make up for some of the market growth you miss while the funds are withdrawn.

- No Credit Check Required: Since it's your money, your credit score doesn't matter for approval. This can be a huge relief if your credit has taken a hit.

- Avoids Taxes and Penalties: A TSP loan isn't considered income, so you completely sidestep the immediate income tax bill and that painful 10% early withdrawal penalty.

Of course, it’s not a free-for-all. You generally have to repay the loan within five years (though terms can be longer for a primary residence), and if you leave federal service, the entire balance could become due immediately. If you fail to repay it on time, the outstanding amount is reclassified as a taxable distribution, which brings back all the taxes and penalties you were trying to avoid in the first place.

Other Financial Tools to Consider

Looking beyond the TSP, other financial products can act as a lifeline during tough times without forcing you to raid your retirement. These options will involve a traditional lender and a credit check, but they leave your retirement account untouched.

- Personal Loans: An unsecured personal loan from a bank or credit union gives you a lump sum of cash. Interest rates will depend on your creditworthiness, but the terms are clear, and it has absolutely no impact on your TSP.

- Home Equity Line of Credit (HELOC): If you're a homeowner with equity built up, a HELOC allows you to borrow against that value. These often come with lower interest rates than personal loans, but the major catch is that your home is used as collateral.

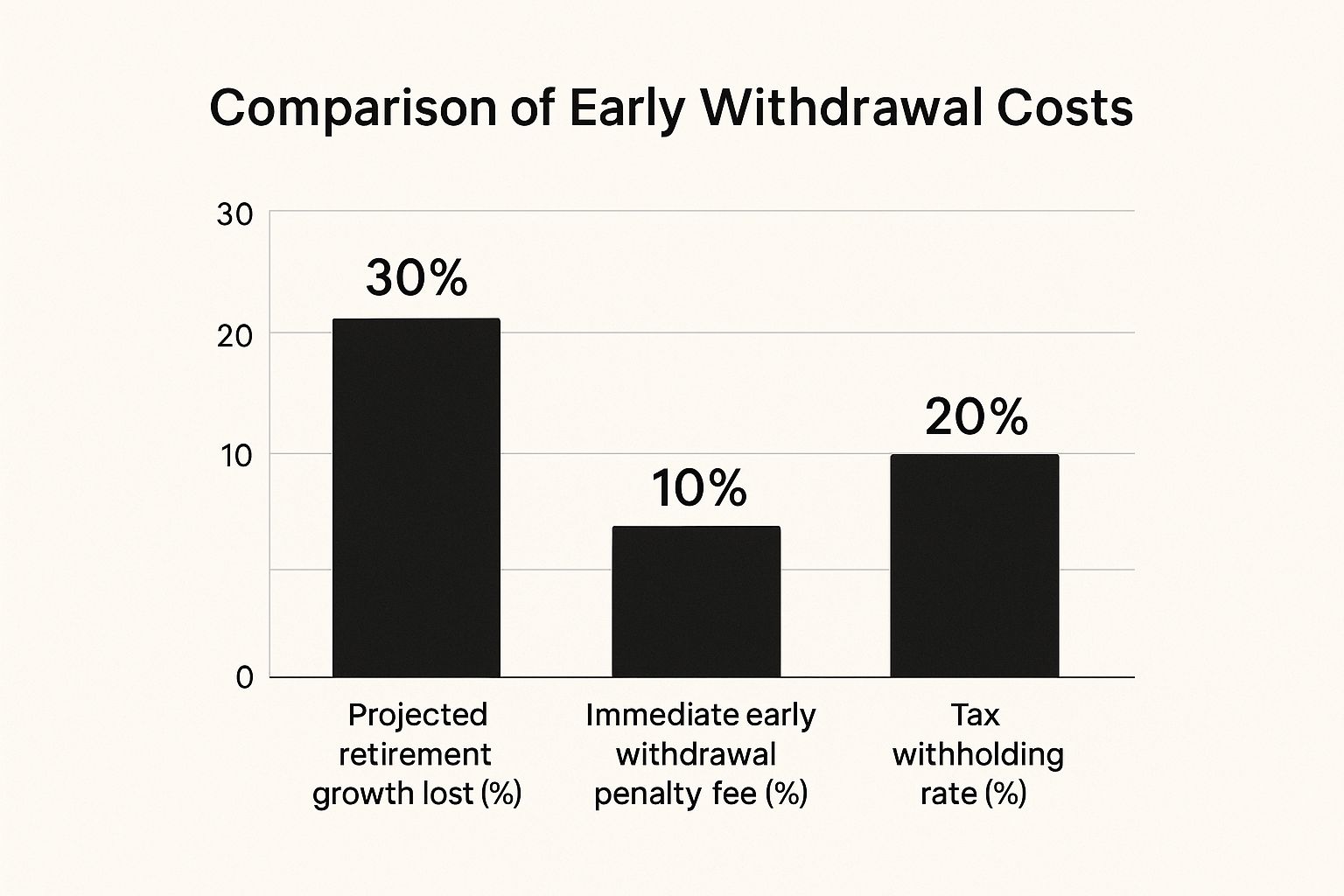

The infographic below really drives home the severe financial damage an early withdrawal can cause, showing exactly why exploring alternatives is so crucial.

As you can see, the immediate penalties and taxes are just the tip of the iceberg when it comes to the true financial loss.

Choosing an early withdrawal means accepting a permanent reduction in your future financial security. A loan, in contrast, is a temporary solution that keeps your long-term goals within reach.

Studies have shown that people often turn to early withdrawals during economic downturns. For instance, research analyzing behavior during the Great Recession found that early withdrawals from retirement accounts spiked as people lost jobs or faced other financial shocks. These actions provided much-needed short-term relief but came at a staggering long-term cost. You can read the full research about these withdrawal trends to see the data for yourself.

To make the right choice, it helps to see the options side-by-side.

TSP Withdrawal vs TSP Loan vs Personal Loan

This table provides a comparative analysis to help you decide on the best way to access funds based on your financial situation.

| Feature | Early TSP Withdrawal | TSP Loan | Personal Loan |

|---|---|---|---|

| Impact on Retirement | Permanent loss of principal and future growth. | No loss of principal; funds are repaid. | No impact on your TSP balance. |

| Taxes & Penalties | Subject to income tax + 10% early withdrawal penalty. | Not a taxable event; no penalties if repaid. | Not a taxable event; no penalties. |

| Credit Check | No | No | Yes, credit score impacts approval and rates. |

| Repayment | Not possible. The money is gone for good. | Required, with interest paid back to your own account. | Required, with interest paid to a lender. |

| Best For | Absolute last-resort financial emergencies. | Short-term cash needs when you can afford repayments. | Covering expenses without touching retirement funds. |

Ultimately, while the lure of quick cash from your TSP is strong, pausing to compare it with a TSP loan or other financing options is one of the most important financial decisions you can make. The goal is to solve today's problem without creating a bigger one for your future self.

Common Questions About Early TSP Withdrawals

Thinking about taking money out of your TSP early can bring up a lot of questions. The rules aren't always straightforward, and making the wrong move can be costly. Let's clear up some of the most common points of confusion federal employees run into.

Getting a handle on these details is the first step toward making a smart decision for your financial future.

Can I Withdraw Only My Contributions to Avoid Taxes?

This is a big one. Many people wonder if they can just take out their own contributions from a Traditional TSP and leave the earnings behind to avoid paying income tax on the withdrawal. It's a logical thought, but unfortunately, the IRS doesn't see it that way.

Your TSP is governed by something called the pro-rata rule. This rule dictates that any money you pull out is a proportional mix of your contributions and the earnings your money has generated. You can't just pick and choose.

Think of your TSP account like a big glass of iced tea you've been adding to over the years. You can't just take a sip of the original tea concentrate; every sip you take is a mix of the tea and the melted ice (the earnings). The IRS taxes the entire sip as ordinary income.

This is a fundamental concept to grasp. It means you can't game the system to avoid taxes on a withdrawal. The entire distribution is treated as taxable income in the year you receive it.

How Long Does a TSP Withdrawal Take?

Once you've pulled the trigger and submitted your withdrawal request, the next question is always, "When will I get my money?" While the TSP is pretty efficient, it's definitely not an instant process.

On average, you can expect it to take about 7 to 10 business days for the TSP to process your request and send out the funds. But keep in mind, this timeline can shift based on a few things:

- How you apply: Submitting your request online is almost always faster than mailing in paper forms.

- Verification hurdles: If there are any snags verifying your identity or bank account information, expect delays.

- How you get paid: Direct deposit will have the money in your account much faster than waiting for a physical check to travel through the mail.

A good rule of thumb is to plan for the whole process to take about two weeks. It's best not to make any urgent financial commitments assuming the cash will show up in just a day or two.

What Happens After a Hardship Withdrawal?

Taking a financial hardship withdrawal is a serious decision with permanent consequences for your retirement. Unlike a TSP loan, you can never put the money back.

The moment you take that withdrawal, your account balance is permanently reduced by the full amount. This isn't just a loss of the principal you took out; it's also a loss of all the future compound interest that money could have earned between now and when you retire. That can add up to a staggering amount over a couple of decades.

Finally, know that this is a one-way street. Once the TSP processes your request and the money is sent, the transaction is final. You can't change your mind or cancel it. Be absolutely sure this is the right move for you before you commit.

Navigating the complexities of your federal benefits and making critical decisions about your TSP requires expert guidance. Federal Benefits Sherpa offers personalized planning to help you understand all your options and secure a stress-free retirement. Get your free 15-minute benefit review today at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved