Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Using the Federal Pension Calculator FERS

A federal pension calculator for FERS is simply a tool that helps you estimate your future retirement annuity. You plug in a few key numbers—your years of service, your High-3 average salary, and when you plan to retire—and it gives you a solid snapshot of your potential income. It's the best way to take the guesswork out of your financial planning.

Your First Step to FERS Retirement Clarity

Let’s be honest, planning for federal retirement can feel like a maze. The Federal Employees Retirement System (FERS) is a complex beast, full of its own unique rules, timelines, and formulas. I've seen countless federal employees put off planning simply because they're overwhelmed and don't know where to start. This is exactly where a good federal pension calculator for FERS becomes your best friend.

Think of it as a financial GPS for your future. It takes all those years of hard work and turns them into a tangible number, giving you a real baseline to build the rest of your retirement plan around. Instead of getting bogged down in dense government handbooks, a calculator cuts right to the chase and gives you clarity.

Why Start with a Calculator

Using a pension calculator is the most logical first move you can make, and for good reason. It immediately grounds your planning in reality, pulling you away from abstract goals and into the world of concrete figures. That initial estimate is the foundation for everything that comes next.

It also gives you a powerful way to see how your career choices play out. For example, you can instantly model the difference it makes to work an extra two years or see how that promotion you're chasing will boost your High-3 salary and, ultimately, your final pension. That kind of knowledge is incredibly empowering.

A common mistake I see is people waiting until they're on the doorstep of retirement to run the numbers. The truth is, the earlier you start, the more control you have. Running estimates every few years keeps you on track and lets you make smart adjustments along the way.

What This Tool Can Tell You

A quality FERS calculator does more than just spit out a single number. It provides a detailed breakdown that sheds light on all the different pieces of your retirement income, which is crucial for building a solid plan.

Here's what you can expect to see:

Gross Monthly Annuity: This is the big one—your estimated pension before any deductions like taxes or insurance.

Impact of Retirement Age: You can easily compare scenarios. See what retiring at your Minimum Retirement Age (MRA) looks like versus waiting until age 62 or later.

Survivor Benefit Costs: The tool will show you exactly how much your monthly payment will be reduced if you choose to provide a survivor benefit for your spouse.

Ultimately, using a federal pension calculator for FERS early and often is the key to turning retirement planning from a source of stress into a confident, data-driven process. It gives you the clarity you need to make the best possible decisions for your financial future.

Getting Your Numbers Straight for the Calculator

To get a truly useful estimate from any FERS pension calculator, you have to start with accurate information. It's a classic "garbage in, garbage out" situation. If you feed the calculator vague or incorrect numbers, you’ll get a retirement forecast that isn't worth the screen it's displayed on.

This isn't about guessing or pulling numbers from memory. It’s about digging into your career records to find specific, documented details. Let's walk through exactly what you need to hunt down to make sure your pension estimate is built on a rock-solid foundation.

Before you even open a calculator, you need to do a bit of homework. I've put together a quick-reference table to help you gather everything you'll need for an accurate calculation.

Key Inputs for Your FERS Pension Calculation

Data PointWhat It IsWhere to Find ItCreditable ServiceThe total years and months of service that count toward your pension.Your SF-50 (Standard Form 50), specifically the "Service Computation Date" for retirement.High-3 Average SalaryThe average of your highest basic pay during any 36-month period.Your Leave and Earnings Statements or historical SF-50s.Unused Sick LeaveThe total hours of sick leave you'll have when you retire.Your current Leave and Earnings Statement (and project forward).Military Service DepositProof of payment for any "bought back" military time.Your personnel file or records from the Defense Finance and Accounting Service (DFAS).Planned Retirement AgeThe age you plan to stop working.This is your personal target, but it determines which rules and multipliers apply.

Having these documents and figures ready will make the process much smoother and give you a pension estimate you can actually rely on for your financial planning.

Pinpointing Your Creditable Service

First up is your total creditable service. This is more than just a simple count of the years you've been on the job; it includes specific types of service that directly impact both your eligibility to retire and the size of your monthly check.

Your best friend here is your collection of SF-50s (Standard Form 50). Buried in that paperwork is your "Service Computation Date" (SCD) for retirement, which is the official starting point for this whole calculation.

Don't forget to include these pieces:

Civilian Service: All your time working under the FERS system.

Military Service: If you made a military service deposit to "buy back" your time, you can add those years to your total.

Unused Sick Leave: When you retire, your leftover sick leave balance is converted into additional service time. It all adds up!

I've seen so many federal employees completely forget about their sick leave balance. It might not seem like a game-changer, but every single month of service nudges that pension payment up. A good rule of thumb is to look at your current balance and project how much you'll have accumulated by your target retirement date.

Calculating Your High-3 Average Salary

Next on the list is your High-3 average salary. This is the average of your highest basic pay earned during any consecutive 36-month period in your federal career. For most people, this ends up being their final three years of work.

To figure this out, you’ll need to look at your salary history. Your SF-50s and Leave and Earnings Statements are the official sources. A critical point: only your basic pay counts. Overtime, performance awards, and bonuses don't factor into the High-3. If you're still a few years away from retiring, you'll have to make an educated guess on future pay raises to get a realistic estimate.

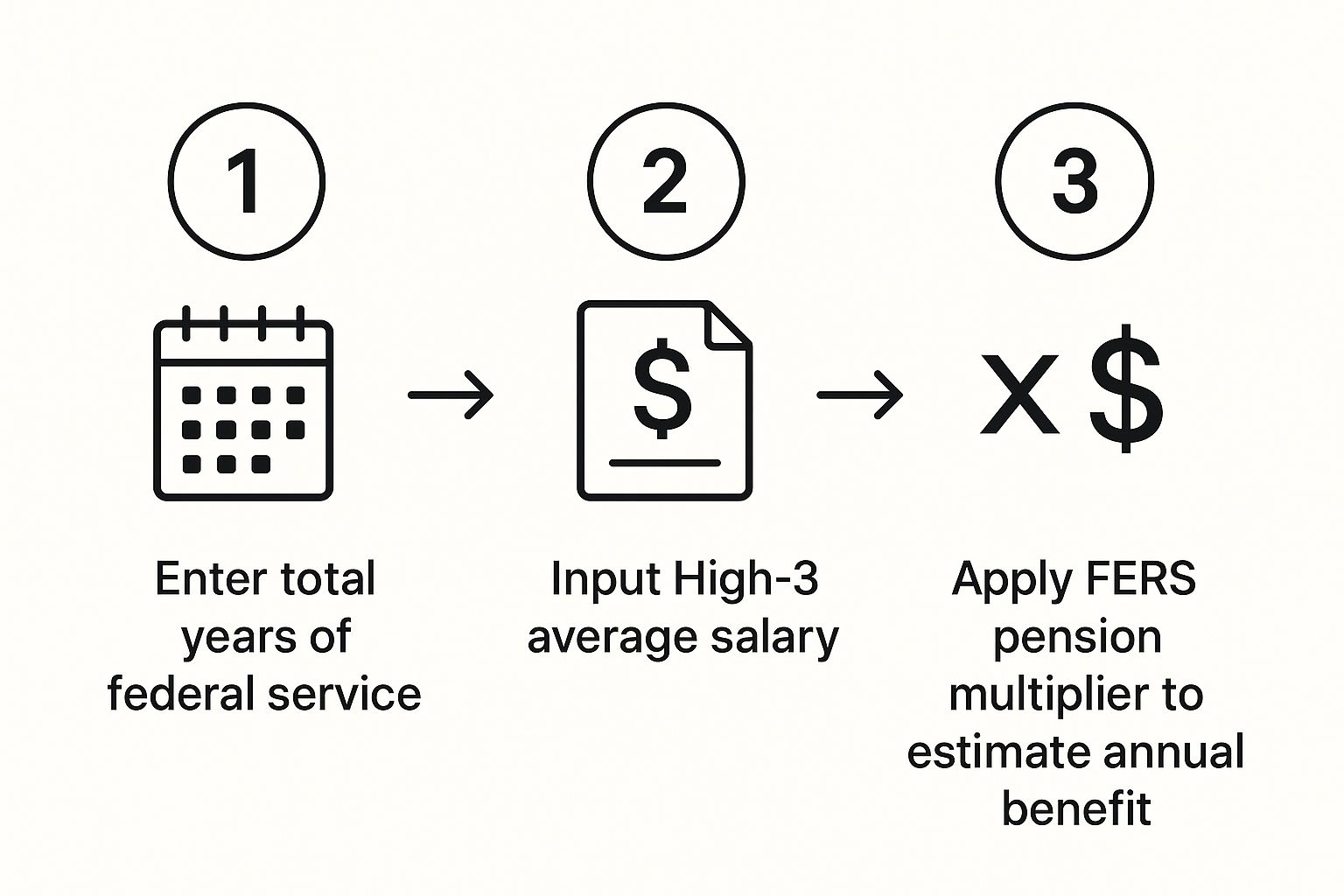

This image really breaks down how these key inputs feed into the final pension calculation.

As you can see, your years of service and your salary are the two biggest levers that determine the size of your FERS annuity.

Your Retirement Age and Other Factors

Last but not least, your planned retirement date is a huge factor. The math changes based on your age and service combo.

For example, retiring at age 62 or older with at least 20 years of service is a major milestone. Why? Because it bumps your pension multiplier from the standard 1% up to 1.1%. That 0.1% difference can mean thousands of extra dollars over the course of your retirement.

It takes a little bit of effort to gather these details, but it's easily the most important step. When you start with accurate inputs, you can finally move from vague guesswork to a clear, actionable retirement forecast.

How the Core FERS Pension Formula Works

To get the most out of any federal pension calculator for FERS, you really need to peek "under the hood" and see how it works. It’s not some black box with a mysterious algorithm. The calculation is actually quite simple, built on a formula that directly reflects your years of service and your salary progression.

Once you grasp the moving parts, you can see exactly how career choices—like sticking it out for one more year or landing that promotion—will concretely affect your financial future.

At its core, your annual pension is determined by just three key ingredients:

Your High-3 Average Salary

Your total Creditable Service (in years)

A special Pension Multiplier (either 1.0% or 1.1%)

The formula just multiplies these three numbers together. Think of each one as a lever. Your job throughout your career is to push each of those levers as high as you can.

Breaking Down the Components

Let's look at each piece of the puzzle.

First up is your High-3 average salary. This is simply the highest average basic pay you earned during any 36-month consecutive period in your federal career. For almost everyone, this winds up being their last three years on the job. This figure is the foundation of the entire pension calculation. For more on what to expect, check out the 2025 FERS annuity estimator from PlanWellFP.

Next, you have your creditable service. This is the total time you’ve put in that counts toward your pension. It includes all your FERS service, any military time you may have "bought back," and even your unused sick leave, which gets converted into extra service time when you finally retire.

But the real game-changer is the pension multiplier. For most federal employees, the multiplier is a straightforward 1.0%. However, if you retire at age 62 or older with at least 20 years of service, you get a 10% bonus, pushing that multiplier up to 1.1%. It sounds small, but that little bump can add up to thousands of extra dollars over your lifetime.

Putting It All Together: A Practical Example

Let's walk through a real-world scenario to see how this plays out. Meet Alex, a federal employee mapping out retirement.

Here are the numbers:

Retirement Age: 62

Creditable Service: 25 years

High-3 Salary: $80,000

Because Alex is hitting the magic numbers—retiring at age 62 with over 20 years of service—Alex qualifies for the enhanced 1.1% multiplier.

The math is simple:

$80,000 (High-3) x 25 (Years of Service) x 1.1% (Multiplier) = $22,000 per year

This gives Alex a basic annual pension of $22,000. That's about $1,833 per month before any taxes or other deductions are taken out.

Now, consider what would have happened if Alex had retired just before turning 62. The multiplier would have been 1.0%, dropping the annual pension to $20,000. By waiting until that 62nd birthday, Alex permanently added $2,000 to their annual retirement income.

This is exactly why a good federal pension calculator for FERS is such an essential planning tool. It lets you play with these variables and see the powerful impact of your decisions.

What the FERS Calculator Results Really Mean

So you’ve plugged your numbers into a federal pension calculator for FERS, and it spits out a big, bold number: your estimated gross monthly annuity. It’s exciting to see, but hold on a second. That number is your starting point, not what will actually hit your bank account.

Think of it like your gross salary on a job offer—it looks great on paper, but taxes and other deductions haven't had their say yet. To build a retirement budget that actually works, you have to dig a little deeper. These aren't just minor tweaks; they're the details that will define your real-world retirement income.

From Gross Estimate to Net Reality

The figure you first see is just the top layer. To get to a number you can actually plan with, you need to subtract all the things that come out of your check. This is what turns a hopeful estimate into a practical, usable figure for your financial plan.

Here are the most common deductions you’ll need to account for:

Survivor Benefits: If you choose to provide a continuing pension for your spouse after you’re gone, it will reduce your monthly payment. It's a critical decision with a direct impact on your annuity.

Federal Health Insurance (FEHB): Good news—you can keep your excellent health insurance. The premiums will just come straight out of your retirement check, same as they do now.

Federal Life Insurance (FEGLI): If you decide to keep your federal life insurance, those premiums will also be subtracted from your monthly total.

Federal and State Taxes: Your pension is considered taxable income. Don't forget that Uncle Sam (and maybe your state) will want a piece of it.

Nailing these down is how you avoid a nasty surprise when that first retirement check arrives.

I’ve worked with retirees who built their entire budget around the gross annuity number. They were shocked to discover their actual income was 15-25% less than they'd planned for once all the deductions came out. Always, always plan using a conservative net estimate.

How Salary Projections Shape Your Estimate

The accuracy of your pension forecast hangs on one major assumption: your future salary growth. Calculators have to make an educated guess about how much your pay will increase over your remaining years to figure out your High-3 average salary.

The Office of Personnel Management (OPM), for example, often models a long-term salary increase of around 3.75% per year. The best calculators let you tweak this assumption. This is a great feature because you can see how a faster promotion track—or a period of stagnant pay—might change your final benefit. If you want to get into the weeds, you can explore the official FERS computation details to see exactly how these numbers come together.

Don't Forget the FERS Annuity Supplement

If you're planning to retire before age 62, the FERS Annuity Supplement is a critical piece of the puzzle. This is a separate payment designed to bridge the income gap until you’re eligible for Social Security.

Think of it as a temporary bonus, but it's not for everyone. You have to retire with an immediate, unreduced pension to qualify. The amount is calculated to approximate the Social Security benefit you earned during your FERS service years.

Here’s the crucial part: this supplement stops cold at age 62, whether you start taking Social Security then or not. It's a planned income cliff you absolutely must budget for. A good federal pension calculator for FERS will show you not only what this supplement adds to your monthly income, but also when it vanishes.

What If the FERS System Changes?

A good retirement plan isn't static. While today's FERS rules give us a clear path for planning, it's smart to remember that the system can—and does—evolve. Keeping an ear to the ground for potential legislative proposals lets you stay ahead of the curve and use your federal pension calculator for FERS to explore a few "what-if" scenarios.

These conversations in Washington aren't just background noise; they could directly affect your income in retirement. The best way to plan is to understand what’s being discussed and model how those changes might hit your bottom line. This proactive thinking transforms your calculator from a simple estimator into a genuine strategic tool, making sure you aren't blindsided by a policy shift years from now.

The Big One: From a High-3 to a High-5

One of the most persistent proposals that comes up is a shift from a "High-3" to a "High-5" average salary for calculating your pension. Right now, your pension is based on your highest average basic pay over any 36-month period. Changing that to a 60-month period would be a fundamental rewrite of the math.

So, what’s the big deal? A five-year average almost always includes lower-earning years, watering down the impact of the big salary jumps many feds get near the end of their careers. The result is a lower average salary figure, which directly leads to a smaller lifetime annuity.

The rationale behind a High-5 system is to reduce the government's long-term pension costs. For you, it means that last-minute promotions or step increases would have less of an impact on your final pension. It makes slow and steady career-long salary growth much more valuable.

Other Potential Shifts to Watch

The High-3 vs. High-5 debate isn't the only thing on the table. Several other parts of the FERS system are frequently targeted in legislative discussions, and it pays to know what they are.

Here are a few other areas I always keep an eye on:

The FERS Annuity Supplement: This is a big one. Proposals often surface to either shrink or completely eliminate this supplement, which acts as a crucial income bridge for feds who retire before they can start collecting Social Security at age 62.

Employee Contribution Rates: We’re also seeing ongoing talk about making employees contribute a higher percentage of their paychecks into the FERS system, often without any corresponding bump in their final pension benefit.

This is where a good federal pension calculator for FERS becomes indispensable. A change to a "High-5" system could easily lower your annual pension by 5% to 10% because it smooths out those late-career pay raises. For instance, someone with a $95,000 High-3 average might see their calculation base fall to around $88,000 under a High-5 model.

When you start combining that with the potential loss of the annuity supplement and higher paycheck deductions, the potential impact on your retirement security becomes pretty clear. To see how these numbers might play out, you can find more details about the federal pension estimator and potential 2025 changes on planwellfp.com.

Got Questions About FERS Calculators? You're Not Alone.

When you first dive into a federal pension calculator for FERS, it’s normal to have a few questions. These are powerful tools, but some of the inputs and outputs can seem a bit cryptic. Let's walk through some of the most common sticking points federal employees run into.

Getting these details right is the key to moving from a rough guess to a reliable forecast. Understanding the nuances, like what to do with your unused sick leave or military time, is what makes the final estimate truly accurate.

Why Do Different Calculators Give Me Different Numbers?

So, you ran your numbers through a couple of different FERS calculators and got slightly different results. Don't panic—this happens all the time and usually isn't a red flag. The small variations almost always come down to the assumptions baked into each tool's software.

For instance, one calculator might project future salary increases at 3.5% annually, while another might use 4.0%. Some tools round your years and months of service differently. The best approach is to find a calculator that’s transparent about its assumptions and, ideally, lets you tweak them. As long as the results are in the same general ballpark, you can feel confident you're on the right track.

How Does My Unused Sick Leave Fit In?

This is easily one of the most powerful—and most overlooked—parts of your FERS calculation. When you retire, every single hour of your unused sick leave gets converted directly into more creditable service. The impact on your final pension can be huge.

The magic number is 2,087. For every 2,087 hours of unused sick leave you have saved up, you get credit for one full year of additional service. It’s not uncommon for long-term feds to retire with thousands of hours, adding one, two, or even more years to their service history. That's a direct boost to your annuity check, every month, for the rest of your life.

A good federal pension calculator for FERS will always have a specific spot for you to enter your sick leave balance. Make sure you fill it out to see what your pension really looks like.

What About My Time in the Military?

Yes, your military service can absolutely count toward your FERS pension, but there’s a critical step you have to take first: you must make a military service deposit. This is often called "buying back" your military time. You're essentially paying a deposit to the government—usually 3% of your total military base pay, plus any accrued interest—to get FERS credit for that time.

Once you’ve paid that deposit, you can add those years of service right into the calculator along with your civilian time.

Just keep these key rules in mind:

You Must Pay the Deposit: No deposit, no credit. It’s that simple. The time won't count toward your FERS pension unless it's officially bought back.

No "Double Dipping": You can't receive a military retirement pension and also use those same years for your FERS pension. To get the FERS credit, you have to waive your military retirement pay.

Add It to Your Service: After the deposit is paid, just add the years and months to your civilian service total when you're punching numbers into the calculator.

Nailing these details is what transforms a rough estimate into a solid financial forecast. The clearer you are on these points, the more confidence you'll have in the plan you build for your future.

Are you ready to take control of your federal retirement plan? Federal Benefits Sherpa provides personalized guidance to help you make sense of your benefits and maximize your future income. Start with a free 15-minute benefit review to get the clarity you deserve. Visit us at https://www.federalbenefitssherpa.com to secure your financial future.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved