Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Transfer TSP to Roth IRA Your Smart Strategy Guide

Thinking about moving your TSP to a Roth IRA? This is done through a process known as a Roth conversion, a smart strategy that shifts your pre-tax retirement money into an after-tax account. You’ll pay income tax on the amount you move now, but in return, that money can grow and be withdrawn completely tax-free once you retire.

Why a TSP to Roth IRA Transfer Makes Sense

Moving your hard-earned Thrift Savings Plan funds over to a Roth IRA is more than just an administrative shuffle; it's a strategic financial pivot. The core idea is simple: you accept a tax bill today for the guarantee of tax-free income down the road. For many federal employees, this is a powerful move that unlocks a new level of flexibility and control over their retirement savings.

The main reason people do this usually boils down to one thing: taxes. If you suspect your income tax rate—or federal tax rates in general—will be higher in the future, it makes sense to pay the taxes now while your rate is lower. You're effectively locking in today's tax rates on your retirement funds for good.

Gaining Control and Flexibility

Beyond just the tax calculations, a Roth IRA brings several key advantages to the table that the TSP simply can't offer. This move is especially appealing if you want more hands-on control over your financial legacy and how you take withdrawals in retirement.

Here’s what you stand to gain:

- Wider Investment Choices: The TSP is great, but it has a limited menu of five core funds. A Roth IRA, on the other hand, opens up a massive universe of investment options. You can pick and choose from individual stocks, bonds, ETFs, and thousands of mutual funds to build a portfolio that truly fits your goals.

- Elimination of RMDs: With a traditional TSP or IRA, you’re forced to start taking Required Minimum Distributions (RMDs) once you hit age 73. Roth IRAs have no RMDs for the original owner, which means your money can continue to grow tax-free for your entire lifetime.

- A Tax-Free Legacy: When you leave a Roth IRA to your kids or other heirs, they get a powerful gift: a tax-free asset. This is a huge benefit for estate planning, as anyone inheriting a Traditional TSP would owe income tax on every dollar they pull out.

Real-World Scenarios for a Conversion

This strategy isn't a one-size-fits-all solution, but it’s a game-changer in certain situations. Let’s say you retire at 62 but plan to hold off on taking Social Security until you’re 70. Those eight years could be your lowest-income years as an adult, creating an ideal window to convert TSP funds while you're in a much lower tax bracket.

A transfer from a TSP to a Roth IRA is more than a simple transaction; it's a calculated decision to trade a known, immediate tax cost for future tax certainty and financial freedom.

Here's another scenario: a market downturn. While it feels scary, a down market can be an opportunity. When your TSP balance is temporarily lower, you can convert the same number of shares but pay a smaller tax bill. As the market bounces back, all that recovery and subsequent growth happens inside your tax-free Roth IRA.

Ultimately, the decision to move your TSP is about looking ahead and positioning your savings for maximum benefit when you need it most.

Grappling with the Tax Bill from Your Conversion

When you decide to transfer TSP to Roth IRA funds, there's one immediate, unavoidable consequence: the tax bill. This isn't some far-off problem you can deal with later; it’s a real, present-day cost you absolutely must plan for.

Because your traditional TSP contributions were made with pre-tax money, the entire amount you convert gets added to your ordinary income for the year you make the move. This sudden spike in income can do some serious damage to your tax situation. I've seen it happen time and again—a large conversion can easily bump someone from a comfortable tax bracket into a much higher one, creating a tax liability that catches them completely off guard.

It’s the classic "pay taxes now to avoid them later" scenario, but the "now" part can pack a real punch.

Getting a Realistic Handle on Your Tax Cost

Let's walk through a real-world example. Imagine you're a single filer with a taxable income of $80,000. That puts you squarely in the 22% marginal tax bracket. You decide to convert $100,000 from your TSP into a new Roth IRA.

Here’s the critical part: that $100,000 isn't just taxed at a flat 22%. It gets stacked right on top of your existing income, filling up each tax bracket as it goes.

Your new taxable income for the year becomes $180,000. While the first chunk of your conversion will indeed be taxed at your old 22% rate, a significant portion will spill over into the next bracket, where it gets taxed at 24%. This cascading effect means your total tax bill is going to be higher than a simple back-of-the-napkin calculation might suggest. For a deeper dive into the strategic reasons for a conversion, you can read what some financial experts at stwserve.com have to say.

The key is to stop thinking of the conversion as a single, all-or-nothing event. Instead, treat it as a strategic income addition. The goal is to manage this new income to keep yourself in the most favorable tax brackets possible.

A much smarter approach is to avoid converting the entire balance at once. You can break the conversion into smaller, more manageable chunks over several years. This strategy, sometimes called a Roth conversion ladder, helps you avoid that massive income jump in any single year.

For instance, instead of one giant $100,000 conversion, you could convert $25,000 annually for four years. This keeps your taxable income much lower each year, potentially saving you thousands in taxes over the life of the conversion.

The table below gives you a clearer picture of how this works.

Estimated Tax Impact of a TSP to Roth IRA Conversion

This table illustrates how converting different TSP amounts can affect your taxable income and potentially push you into a higher federal tax bracket (using hypothetical single filer brackets for simplicity).

| Original Taxable Income | TSP Conversion Amount | New Taxable Income | Potential New Marginal Tax Bracket |

|---|---|---|---|

| $75,000 | $20,000 | $95,000 | 24% |

| $75,000 | $100,000 | $175,000 | 32% |

| $150,000 | $50,000 | $200,000 | 35% |

| $150,000 | $25,000 | $175,000 | 32% |

As you can see, even a moderate conversion can have a significant effect. Careful planning is the only way to manage this and make sure the long-term benefits of the Roth IRA are worth the immediate tax cost.

Smart Moves to Soften the Tax Hit

Careful planning is everything when it comes to minimizing your tax burden. Before you even think about starting a transfer, you need to calculate your potential tax liability and look for ways to lessen the impact.

Here are a few proven strategies I recommend to my clients:

- Time It for a Low-Income Year: If you know you'll have a year with lower-than-usual income—maybe that gap between retiring and starting your Social Security benefits—that's a golden opportunity. Converting during this "tax valley" means that extra income is taxed at a much lower rate.

- Have Cash Ready for the Tax Bill: This is non-negotiable. Never, ever use the money you just converted to pay the resulting tax bill. If you're under 59 ½, the IRS treats that as an early withdrawal, slapping you with a 10% penalty on top of the income tax you already owe. Always have the tax money set aside in a separate savings or non-retirement brokerage account.

- Look at Your Whole Financial Picture: Be aware of other things happening in your financial life. Are you planning to sell investments and realize significant capital gains this year? A large Roth conversion in the same year could create a perfect storm of tax consequences.

By forecasting your tax impact accurately, you can make a clear-headed decision, weighing the upfront cost against the incredible long-term power of tax-free growth and withdrawals.

Can You Actually Move Your TSP to a Roth IRA? Let's Check

Before you get lost in the paperwork, the very first step is figuring out if you're even allowed to make the move. The rules for transferring your TSP to a Roth IRA can feel a bit convoluted, but they really boil down to a few key situations.

For most federal employees, the green light comes when you separate from service. Once you’ve retired or simply moved on to a new job, you have the flexibility to roll over your entire TSP balance. This is the moment many people wait for, as it unlocks a much wider world of investment choices and tax strategies.

But what if you're still working? You're not necessarily stuck. If you're age 59½ or older, you can do what’s called an "in-service withdrawal." This lets you move a portion of your vested TSP funds without having to quit your job. It's not an all-or-nothing deal, either—you can make a single transfer to start things off.

The Myth About Income Limits

This is where a lot of people get tripped up. We’ve all heard about the strict income limits that prevent high earners from contributing directly to a Roth IRA. This often leads people to believe that a Roth account is completely off-limits for them.

Here's the critical distinction: those income limits do not apply to Roth conversions. Your salary has absolutely no bearing on your ability to convert TSP funds into a Roth IRA.

This is a huge deal. While the IRS might cap direct Roth contributions—for 2025, the ability for single filers to contribute begins phasing out between $150,000 and $165,000 of modified adjusted gross income (MAGI)—there is no such cap on conversions. This "backdoor" method of funding a Roth IRA is a powerful tool available to everyone, regardless of income. To get a deeper dive, check out how Vanguard explains Roth IRA conversions and why they can be so beneficial.

What If My TSP Has Both Traditional and Roth Money?

It’s pretty common to have a mix of pre-tax (Traditional) and post-tax (Roth) money in your TSP. If that’s you, you need to know about the pro-rata rule.

When you go to take money out, the TSP won't let you pick and choose which pot to pull from. Your withdrawal will be taken proportionally from both your Traditional and Roth balances.

- Here's a quick example: Let's say your TSP is 80% Traditional and 20% Roth. If you decide to roll over $50,000, the TSP will automatically pull $40,000 (80%) from your Traditional side and $10,000 (20%) from your Roth side.

The $40,000 from your Traditional balance becomes a taxable conversion, while the $10,000 from your Roth balance just rolls over tax-free. The good news is both amounts can land in the same new Roth IRA.

Nailing down these eligibility rules is your foundational first step. Once you confirm you meet the age or separation requirements and understand how mixed balances work, you can move forward with confidence.

How to Execute Your TSP Rollover Seamlessly

You've made the big decision to move your TSP funds to a Roth IRA, and that's a huge step. Now, let's talk about the mechanics of making it happen without any hitches. The process itself isn't complicated, but getting the details right is critical to avoid delays or, worse, surprise tax bills.

First thing's first: you need a destination for your money. You'll have to open a Roth IRA with a brokerage firm. Most people go with one of the big names like Fidelity, Vanguard, or Charles Schwab, but the choice is yours.

Once that new account is open and you have your account number in hand, you're ready to get the ball rolling with the TSP. This next part is where you face a fork in the road, and taking the right path is non-negotiable: you have to choose a direct rollover.

The Importance of a Direct Rollover

So, what’s a direct rollover? It’s simple. The TSP sends your money straight to your new Roth IRA provider. The funds never pass through your hands or your personal bank account, which is exactly what you want.

If you make the mistake of choosing an indirect rollover, the TSP will mail a check directly to you. By law, they have to withhold 20% of your money for federal taxes. This creates an immediate and completely avoidable problem. You'd then be on the hook to make up that 20% with your own cash to deposit the full rollover amount into your Roth IRA, and you only have 60 days to do it.

Miss that deadline, and the amount withheld is considered a taxable distribution. If you’re under age 59 ½, you’ll also get hit with a painful 10% early withdrawal penalty. It’s a messy, expensive situation.

A direct rollover is your best and only real option. It neatly sidesteps the mandatory 20% tax withholding, gets rid of the stressful 60-day clock, and removes any risk of accidental penalties. It just works.

To kick things off, log into your account on the TSP website. Thankfully, the days of wrestling with paper forms like the old TSP-70 are pretty much over. You can handle the whole request online. You’ll need the details for your new Roth IRA, including the account number and the exact name of the financial institution. I can't stress this enough: double-check every single number. A simple typo is the number one reason these transfers get rejected or delayed.

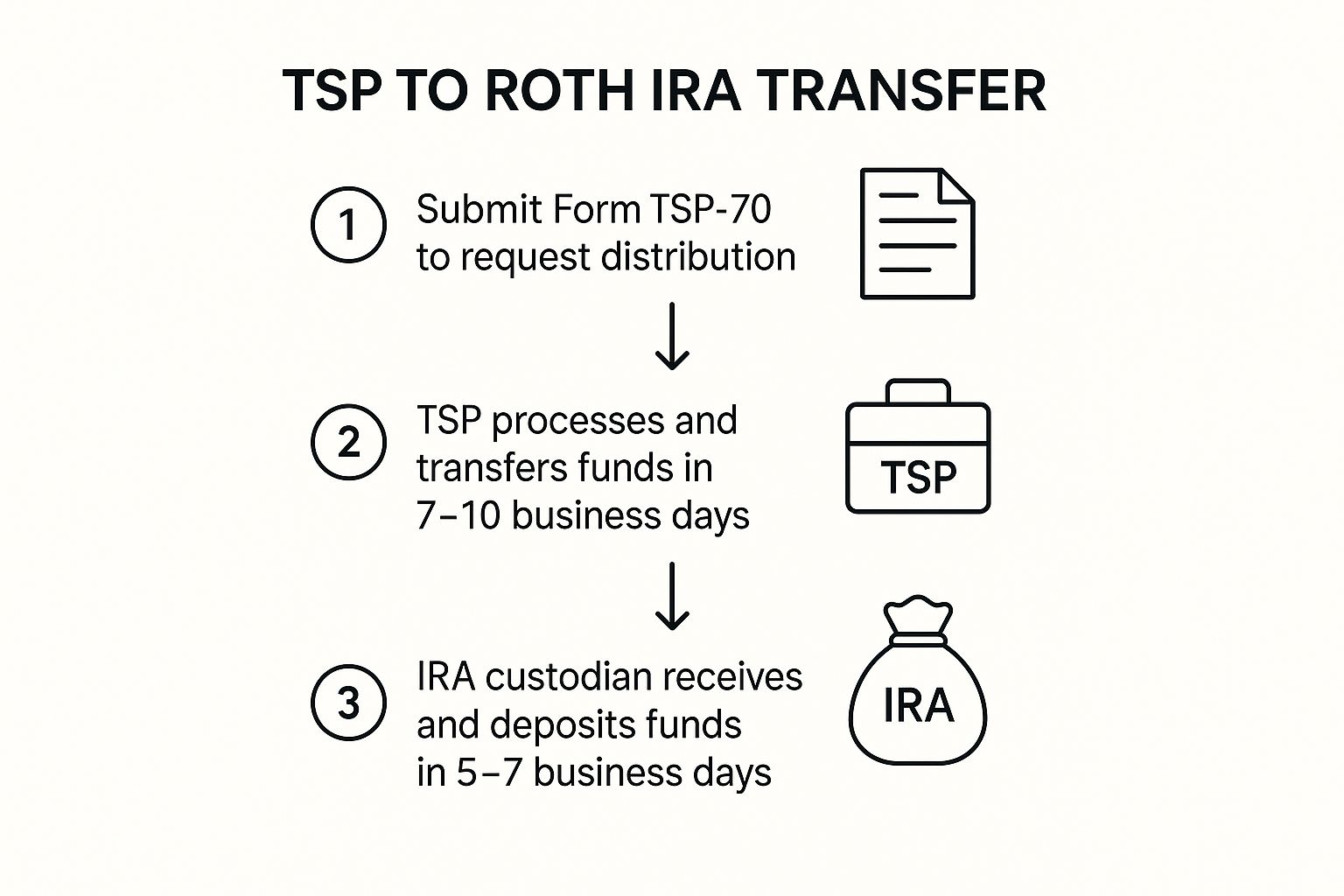

This infographic gives you a good idea of the timeline you can expect after you hit "submit."

As you can see, this isn't an overnight process. It can easily take a few weeks for the money to move between institutions, so a little patience will go a long way.

Seeing the Transfer Through to Completion

Once you’ve submitted your request, don't just set it and forget it. A little proactive follow-up is the secret to a stress-free transfer. Think of it as a simple checklist to make sure everything stays on track.

- Check with the TSP: Give it about a week, then log back into your TSP account or give them a call. You just want to confirm they’ve processed the withdrawal and the funds are officially on their way.

- Give Your New Broker a Heads-Up: As soon as the TSP gives you the green light, get in touch with your new IRA custodian. Let them know an electronic transfer or check is coming and ask what their typical processing time is.

- Confirm the Landing: This is the final step. Once your new brokerage says the money has arrived, log into your new Roth IRA and see it for yourself. Make sure the full, correct amount is sitting in the account. Only then is the job truly done.

Don't just assume the system will work perfectly on its own. A couple of quick phone calls can save you weeks of wondering and worrying, and it ensures your retirement funds get put back to work in their new home without any unnecessary downtime.

When Does a TSP to Roth IRA Conversion Make Sense?

Figuring out whether to transfer TSP to Roth IRA funds isn't about how to do it, but when. The entire decision boils down to one critical question: do you expect to be in a higher tax bracket during retirement than you are right now?

If you think the answer is yes, then paying the taxes on a conversion today could be one of the savviest financial decisions you'll ever make. This isn't just a hunch; it's a strategic calculation based on your career path, potential changes to tax laws, and other income you'll have in retirement, like a pension. The key is to find those golden opportunities when the tax hit from converting is as low as possible.

Finding Your Prime Conversion Window

The best time for a conversion is almost always during what I call a "tax valley"—a year where your income is lower than usual. These temporary dips can dramatically reduce the tax bill on the amount you convert, supercharging the long-term, tax-free growth.

Look for these kinds of scenarios:

- The "Gap Year" Before Retirement: Many feds retire but wait a few years before drawing a pension or starting Social Security. This often creates a low-income window, making it the perfect time to move some of your TSP over to a Roth IRA at a much more favorable tax rate.

- A Down Market: It feels counterintuitive, but a market downturn can be a gift for Roth conversions. When your account value is temporarily down, you can convert the same number of shares for a much smaller tax bill. Once the market bounces back, all that recovery and future growth happens inside your tax-free Roth account.

The real power of a Roth conversion is magnified by the difference between your tax rate today versus your rate in retirement. A detailed analysis from Elm Wealth on Roth conversion benefits found that for someone whose tax rate falls from 43% to 33% in retirement, converting $1 million could result in a 6.1% net benefit over 30 years.

The Lasting Advantages Go Beyond Taxes

A smart conversion does more than just optimize your tax situation. It gives you more control over your money in retirement and provides a more powerful financial legacy for your family.

The biggest perk? No more Required Minimum Distributions (RMDs). Your Traditional TSP and IRAs will eventually force you to take money out, but the original owner of a Roth IRA never has to. Your money can keep growing, completely tax-free, for the rest of your life.

This is a huge deal. It means you decide when to tap into your funds, not the IRS.

On top of that, any money left in a Roth IRA passes to your beneficiaries completely tax-free. They won't owe income tax on what they inherit, which is a massive advantage compared to a Traditional TSP, where your heirs would get hit with a tax bill on every dollar they withdraw. This makes the transfer TSP to Roth IRA strategy a fantastic estate planning move that protects your hard-earned money for the next generation.

Answering Your TSP to Roth IRA Transfer Questions

Even after mapping out the process, you're bound to have some specific questions about the finer points of moving your TSP money. Let’s tackle some of the most common ones I hear from federal employees to clear up any lingering confusion.

Can I Transfer My Roth TSP to a Roth IRA?

Yes, absolutely. This is one of the most straightforward moves you can make. Moving funds from your Roth TSP directly into a Roth IRA is a direct rollover, not a conversion. Since the contributions to your Roth TSP were already made with after-tax dollars, the entire transaction is tax-free and penalty-free.

It’s a popular strategy for federal employees who want to bring all their retirement funds together under one roof or who are looking for a much wider range of investment choices than the TSP offers.

A critical point that trips many people up is the TSP's pro-rata rule. You can't just pick one account type to move. The TSP requires any withdrawal to come proportionally from both your Traditional and Roth balances.

This rule is non-negotiable and catches a lot of people by surprise, so make sure you understand how it works before you start any paperwork.

What if I Have Both Traditional and Roth TSP Funds?

This is where things get a bit more complex, and that pro-rata rule I just mentioned really comes into play. You simply can't tell the TSP, "Hey, just roll over my Roth money." Any amount you withdraw will be pulled proportionally from your Traditional and Roth balances.

Let's walk through a real-world example. Say your total TSP balance is $200,000.

- $160,000 (80%) is in your Traditional TSP.

- $40,000 (20%) is in your Roth TSP.

You decide you want to move $50,000 over to a Roth IRA. Here’s how the TSP will handle it:

- $40,000 (80% of your $50,000 withdrawal) will be taken from your Traditional balance. This is a taxable conversion.

- $10,000 (20% of your $50,000 withdrawal) will be taken from your Roth balance. This part is a tax-free rollover.

Both amounts can land in the same new Roth IRA, but you absolutely must be ready to pay income tax on that $40,000 chunk that came from your Traditional TSP.

How Long Does the TSP Transfer Process Actually Take?

When you’re moving retirement funds, a little patience goes a long way. This isn't like a Zelle payment; it takes time. From my experience, you should plan for the entire transfer process to take somewhere between three to four weeks from the day you submit your request to the day the funds are settled in your new account.

Here's a rough timeline:

- The TSP usually takes about 7-10 business days just to process your forms and cut the check.

- Then, they mail that check—snail mail—directly to your new IRA provider.

- Once your new brokerage receives the check, it can take another few business days for them to process it and get the funds invested in your account.

The bottom line is, don't expect the money to be available to invest overnight.

Navigating federal benefits can feel like trying to solve a puzzle with half the pieces missing. You don't have to go it alone. At Federal Benefits Sherpa, we specialize in helping federal employees build retirement plans that provide clarity and confidence. Schedule your free 15-minute benefit review at https://www.federalbenefitssherpa.com and let us help you find the missing pieces.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved