Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Retirement Calculator for FERS: Your Ultimate Planning Tool

Trying to map out your retirement as a federal employee can feel like you're navigating a maze. A good retirement calculator for FERS is like having a GPS—it cuts right through the noise and shows you the path forward. It’s your financial crystal ball, really.

Why a FERS Calculator Is Your Best Planning Tool

You can't just plug your numbers into any old retirement calculator and expect it to work. Generic tools simply don't understand the unique components of your federal benefits package.

A FERS-specific calculator, on the other hand, is built from the ground up to handle the "big three" of your federal retirement: your pension, your Thrift Savings Plan (TSP), and your survivor benefit options.

This is where the magic happens. By plugging in a few key pieces of information, you can get a surprisingly clear picture of your financial future.

To get started, you'll need to gather a few essential data points. Think of these as the core ingredients for an accurate retirement projection.

Essential Inputs for Your FERS Calculator

This table gives you a quick look at the key data points you'll need to gather for an accurate FERS retirement projection.

Data PointWhat It DeterminesRetirement Service Computation Date (RSCD)This calculates your total years of creditable service, a crucial factor in your pension formula.High-3 Average SalaryThe calculator uses the average of your highest 36 consecutive months of basic pay to determine your pension amount.TSP Balance and ContributionsInputting your current TSP balance and contribution rate helps project your future account growth.Leave BalancesYour unused sick leave balance is converted into additional creditable service, which can boost your pension.Survivor Benefit ElectionChoosing a survivor benefit will reduce your pension, and the calculator shows you exactly by how much.

Once you have these numbers, the calculator does the heavy lifting, translating complex formulas into a tangible monthly income estimate.

Instead of guessing, you get a clear snapshot of your retirement readiness. It’s the difference between hoping for the best and actually having a plan. You can learn more about how these calculators work on planwellfp.com and see for yourself.

This single tool empowers you to see exactly where you stand and make smarter decisions for your future, long before you ever fill out a single piece of retirement paperwork.

Getting Your Ducks in a Row: What You'll Need

Any retirement calculator for FERS is only as good as the numbers you put into it. It’s a classic case of "garbage in, garbage out," so taking a few minutes to gather the right documents is the most important first step.

Your Key Documents

Before you even open a calculator, you'll want to have these items handy:

Your most recent SF-50 (Notification of Personnel Action): This is where you’ll find your Service Computation Date (SCD), which is the starting point for figuring out your total creditable service.

Your current Thrift Savings Plan (TSP) statement: Grab the latest one to get an accurate picture of your investment balance.

Your High-3 Average Salary: You'll need a realistic estimate of this. Your High-3 is the average of your highest 36 consecutive months of basic pay.

These three pieces of information are the foundation of your retirement calculation.

While a good calculator gives you a powerful projection, it's always smart to cross-reference the numbers. Your agency’s HR department can provide official estimates, and it’s a good practice to request one. You can also learn more about how federal retirement estimates are officially prepared to better understand the process.

Getting an Accurate Projection: What to Input and Why It Matters

Alright, you've gathered your documents and you're ready to plug some numbers into a FERS retirement calculator. This is where the magic happens, but it's also where small mistakes can lead to big inaccuracies. Let's walk through it with a real-world mindset to make sure you get a projection you can actually trust.

The High-3: Don't Use Today's Salary

This is the single most common mistake I see people make. They just pop in their current salary and call it a day. But your FERS annuity isn't based on your current salary; it's based on your High-3 average salary.

Let's say you plan to retire in two years. You need to project what your salary will be over those final three years of service, including any expected step increases or promotions. That estimated average is the number you should be using. It's a bit of forecasting, but it's absolutely crucial for getting a realistic number.

Your Retirement Type and Sick Leave

Next up, you'll need to select your retirement type. Are you planning for an "Immediate" retirement? Or maybe an "MRA+10" with a postponed annuity? Each choice has different rules and will absolutely change the final calculation, so play around with the options if you're unsure.

And whatever you do, don't forget your unused sick leave! It's not just a pat on the back for not taking a day off—it gets converted directly into creditable service time, which can give your final annuity a nice little bump.

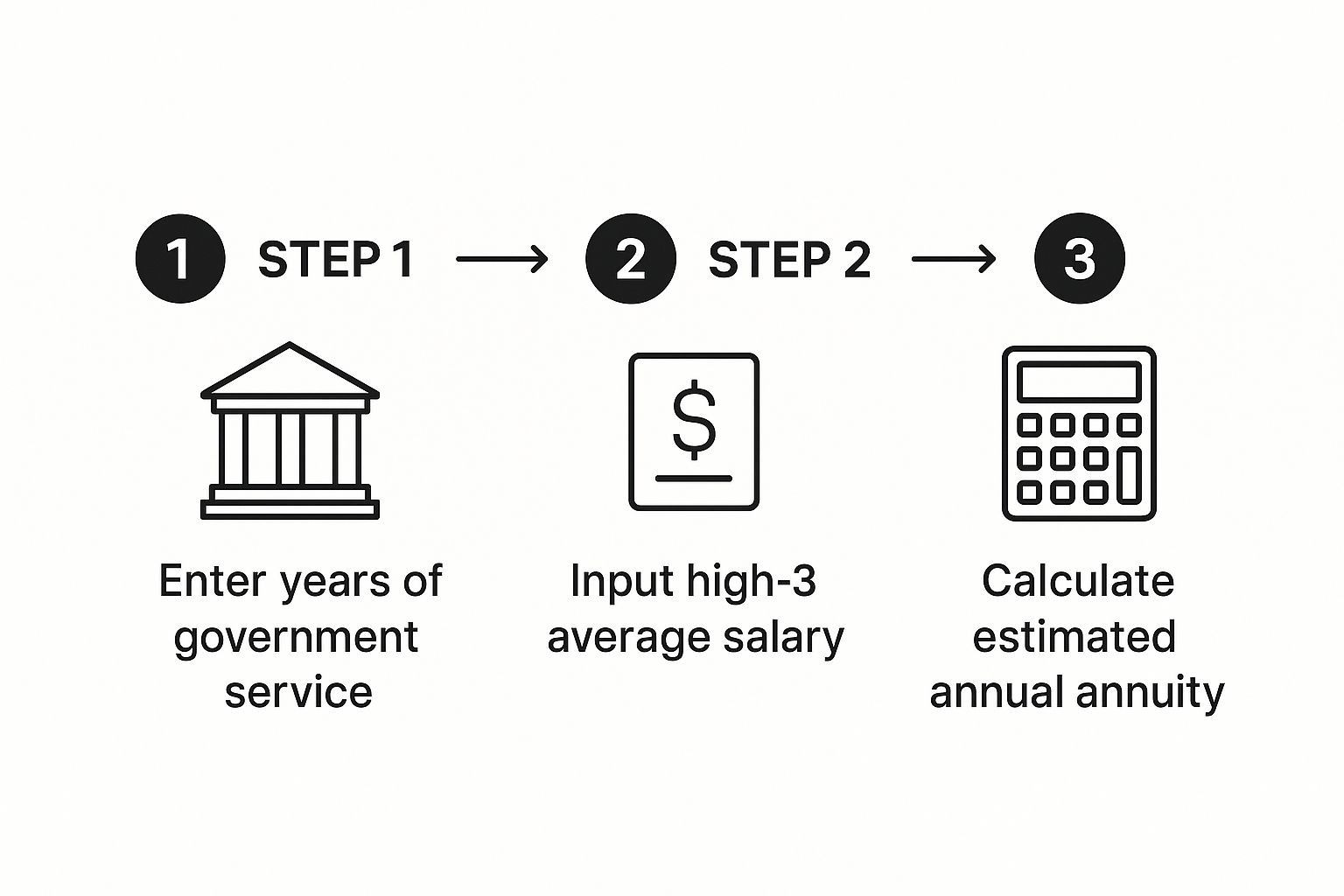

This image breaks down how these key inputs flow into the final calculation.

As you can see, it all boils down to your years of service and your final salary. Getting those two inputs right is more than half the battle.

Making Sense of Your FERS Calculation Results

Alright, you've punched in all your numbers and the retirement calculator for FERS has spit out the results. Now, what are you actually looking at?

Think of these figures as a snapshot of your financial future based on your federal career. You'll see an estimated monthly FERS annuity, potential deductions for survivor benefits, and how your Thrift Savings Plan (TSP) builds on that foundation to create your total retirement income.

A key piece of this puzzle is the annuity multiplier. For most federal employees, the formula uses a straightforward 1% factor.

But here’s a pro-tip that can make a real difference: if you retire at age 62 or older with at least 20 years of service, that multiplier gets a bump up to 1.1%. It might not sound like much, but that extra 0.1% can translate into thousands of additional dollars over the course of your retirement. You can dig deeper into how your high-3 salary's role in this calculation plays into these numbers.

Fine-Tuning Your FERS Retirement Scenarios

Getting that first number from a retirement calculator for FERS is a fantastic start, but it’s just that—a start. Think of it as your baseline, not the final word on your financial future.

The real magic happens when you start playing with the variables and running different scenarios. This is where you move from simple calculation to true strategic planning.

For instance, what happens if you decide to work just two more years? That small change has a ripple effect. Your High-3 salary average will almost certainly go up, and your years of service will increase, both of which directly boost your monthly pension payment.

Don’t just get one number and forget it. A smart planner treats their calculator as a living tool, updating it annually or after a promotion. This shifts you from a one-time check to ongoing strategic planning.

You should also consider how a different retirement date could affect your pension through Cost-of-Living Adjustments (COLAs). Retiring a few months earlier or later can sometimes make a surprising difference once COLAs kick in.

Answering Your Top FERS Calculator Questions

When you start digging into FERS retirement calculators, a lot of the same questions tend to pop up. It's completely normal. Let's walk through some of the most common ones I hear from federal employees so you can get clear, direct answers and feel more confident in your planning.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved