Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Ideal Age to Retire From Federal Government Guide

When is the best age to retire from federal government? It's a question with no single answer. The right time is a deeply personal decision, hinging on your retirement system, how long you've served, and what your financial picture looks like.

For many federal employees, the magic numbers hover around the Minimum Retirement Age (MRA) or age 62, which can unlock significant pension benefits.

Navigating Your Federal Retirement Roadmap

Figuring out when to retire from federal service can feel like trying to solve a complex puzzle. There’s no universal formula; your path is unique to you. The rules for the newer Federal Employees Retirement System (FERS) and the older Civil Service Retirement System (CSRS) lay out very different timelines and options.

Think of this guide as your personal roadmap. We're here to cut through the jargon and give you a clear view of the road ahead. We’ll start by unpacking that big question: what’s the ideal age to retire? As you'll see, it’s less about a specific birthday and more about a strategic calculation.

Key Factors Influencing Your Retirement Age

A few critical variables will dictate your retirement timeline. Getting a handle on how they work together is the first step in creating a solid plan. Consider these the coordinates on your retirement map.

Your Retirement System: Are you covered by FERS or CSRS? The rules for eligibility, pension calculations, and benefit amounts are completely different.

Years of Creditable Service: Simply put, the longer you've worked, the sooner you can qualify for a full, unreduced pension.

Your Minimum Retirement Age (MRA): This is the earliest age you can retire and begin drawing an immediate pension. It’s not one-size-fits-all; it’s tied directly to the year you were born.

The goal is to replace confusion with confidence. Once you grasp these core concepts, you'll have the power to pinpoint when you can retire and how to get the most out of the pension you’ve worked so hard to earn.

The Bigger Picture of Federal Retirement Trends

Your personal decision doesn't happen in a vacuum. It’s helpful to understand the broader trends shaping the federal workforce. Federal employees are, on average, working longer than they used to.

The average retirement age for federal workers climbed to 62.3 years in fiscal year 2022. That's a noticeable jump—nearly five years higher than it was back in 1998.

As of 2024, a significant portion of the workforce is approaching or already at retirement age. Roughly 28% of the 2.1 million permanent federal employees are 55 or older. For more details on these demographics, you can explore the data on the federal workforce from USAFacts. This context isn't just trivia; it helps you see where you stand and why certain retirement ages have become the norm.

Understanding Your Retirement System: FERS vs. CSRS

Before you can even think about what age to retire from federal service, you have to answer one critical question: are you covered by FERS or CSRS? This isn't a minor detail—it's the entire foundation of your retirement plan. Everything from your eligibility date to the size of your pension check is determined by which system you're in.

The dividing line is pretty clear. If you were hired after 1983, you're almost certainly in the Federal Employees Retirement System (FERS). If your career started before then, you might be under the older Civil Service Retirement System (CSRS). Let's dig into what that means for you.

The Modern Approach: FERS

Think of FERS as a modern, diversified approach to retirement. It’s often described as a "three-legged stool" because your retirement income is designed to come from three distinct sources, giving you a more stable financial base. This is the system that covers the vast majority of federal employees today.

Here are the three legs of the FERS stool:

FERS Basic Benefit: This is your monthly pension. It’s a defined benefit calculated from a formula based on your years of service and your "high-3" average salary.

Social Security: A key difference from the old system is that FERS employees pay into Social Security throughout their careers. This means you'll receive those benefits in retirement, just like most workers in the private sector.

Thrift Savings Plan (TSP): This is the federal government's version of a 401(k). It’s a powerful wealth-building tool, especially since the government provides a generous 5% matching contribution.

The whole idea behind FERS is shared responsibility. Your pension is just one piece of the puzzle, designed to work alongside your own savings in the TSP and the broader safety net of Social Security.

The Legacy System: CSRS

The Civil Service Retirement System is the classic, old-school pension plan. It was designed in an era when a single, generous pension was meant to be your entire retirement. There’s no three-legged stool here—just one massive pillar.

Here’s what makes CSRS different:

A Larger Pension: The CSRS pension formula is much more generous on its own. It was designed to be the primary source of income, so it pays out a significantly higher percentage of your high-3 salary compared to the FERS pension.

No Social Security: Generally, CSRS employees don't pay Social Security taxes on their federal earnings, which means that federal service time doesn't count toward Social Security benefits.

Voluntary TSP: While someone in CSRS can still contribute to a TSP account, there is no government matching. It’s purely a supplemental savings account, not a core, matched part of the retirement package.

Figuring out which system you're in is step one, and it's non-negotiable. It dictates the age and service rules you have to follow, how your benefits are calculated, and what your financial planning should focus on. Your system is the blueprint for finding the perfect age to retire from federal government.

Finding Your Minimum Retirement Age Under FERS

For federal employees under the Federal Employees Retirement System (FERS), your entire retirement plan hinges on one key number: your Minimum Retirement Age (MRA). Think of it as the starting gate for retirement. It's the earliest you can hang up your hat and start drawing an immediate pension, though the amount you get depends heavily on how many years you've put in.

Your MRA isn't one-size-fits-all. It's a sliding scale that's tied directly to the year you were born, ranging from age 55 for those born before 1948 up to age 57 for anyone born in 1970 or later. This system was put in place to gradually increase the retirement age over time, so finding your specific MRA is the absolute first step in mapping out your future.

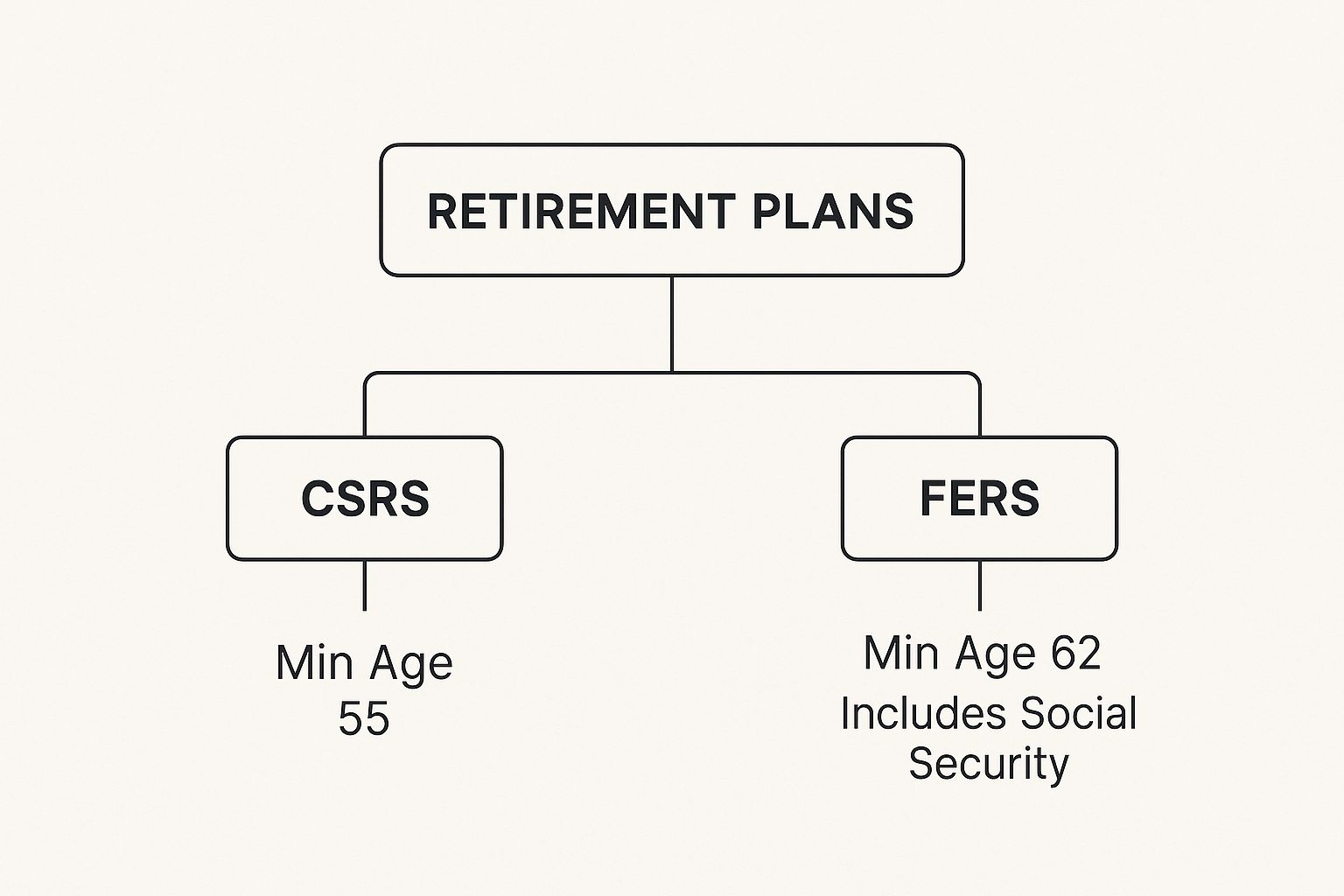

This image lays out the basic age requirements for the two main federal retirement plans.

As you can see, FERS has more pathways to retirement, most of which start with hitting your MRA. The older Civil Service Retirement System (CSRS) is a bit more straightforward with its age rules.

Pinpointing Your Exact MRA

Let's get rid of any guesswork. Finding your MRA is simple—all you need is your birth year. Once you have that number, you can start to see which retirement scenarios are actually on the table for you under FERS.

To find your MRA, just check the table below. It's a straightforward guide based on your birth year.

FERS Minimum Retirement Age (MRA) by Birth Year

If You Were Born...Your MRA Is...Before 194855In 194855 and 2 monthsIn 194955 and 4 monthsIn 195055 and 6 monthsIn 195155 and 8 monthsIn 195255 and 10 monthsIn 1953 - 196456In 196556 and 2 monthsIn 196656 and 4 monthsIn 196756 and 6 monthsIn 196856 and 8 monthsIn 196956 and 10 monthsIn 1970 or later57

Now that you've found your MRA, you've got the first major piece of your retirement puzzle. The next step is to see how it lines up with your years of creditable service to figure out exactly what kind of retirement you qualify for.

How Your MRA and Service Years Work Together

Knowing your MRA is just part of the equation. The real magic happens when you pair it with your years of service. Under FERS, reaching your MRA opens up two main doors to an immediate retirement annuity, but each one has a very different impact on your wallet.

Here are the two primary MRA-based retirement options:

MRA + 30: This is the ideal scenario for an unreduced, early retirement. If you’ve hit your MRA and have at least 30 years of creditable service, you can retire right then and there with a full, immediate pension. No strings, no penalties.

MRA + 10: Think of this as a fallback option. If you’ve reached your MRA but only have between 10 and 29 years of service, you can still retire with an immediate pension. The catch? Your benefit will be permanently reduced.

That reduction is no small thing. With the MRA + 10 option, your pension is cut by 5% for every single year you are under age 62. For someone with an MRA of 57, retiring at that age means a permanent 25% reduction to their pension (5 years x 5%).

Let's make this real. Say we have a federal employee, Sarah, whose MRA is 57. If she has 30 years under her belt when she turns 57, she's golden—she can retire with her full pension. But if she only has 15 years of service at age 57, she can still retire, but her pension will be slashed by 25% for the rest of her life.

Understanding how these numbers interact is absolutely critical when deciding on the best age to retire from federal government. Your MRA sets the earliest date you can leave, but your years of service truly dictate the financial outcome. For a personalized look at your situation, talking with an expert at Federal Benefits Sherpa can help you find the clearest path forward.

Why Age 62 is a Federal Retirement Power Play

Hitting your Minimum Retirement Age (MRA) is a huge milestone—it’s the first time you can even think about retiring with an immediate pension. But for many FERS employees, the real magic doesn't happen until age 62. This birthday isn't just another number; it's a strategic target that can permanently boost your pension.

Think of it this way: your MRA gets you in the game, but age 62 is when you can make a power play. The federal retirement system is designed to reward those who stay a little longer, and this is one of the biggest rewards on the table.

The 1.1 Percent Multiplier: Your Key to a Bigger Pension

The single biggest reason age 62 is so important comes down to a small but powerful change in your pension formula. Under standard FERS rules, your pension is calculated using a 1% multiplier. But if you meet two specific conditions, that multiplier gets a 10% bump to 1.1%.

To unlock this much better multiplier, you have to hit both of these targets:

You must be at least age 62 when you retire.

You must have 20 or more years of creditable service.

It might not look like much on paper, but that tiny 0.1% increase is a game-changer. A 10% boost to your base pension, paid out every single month for the rest of your life, adds up to a staggering amount of money over a long retirement.

This shift from a 1% to a 1.1% multiplier is one of the most effective ways to maximize the pension you've spent a career earning. It’s a simple change on paper that has a massive real-world impact on your retirement income.

The Financial Impact of Waiting Until 62

Let's look at a real-world example to see what this means in dollars and cents. Meet David, a federal employee with a "high-3" average salary of $90,000. His MRA is 57, and he'll have 30 years of service when he hits that age.

Scenario 1: David Retires at His MRA of 57

Here, he gets a full, unreduced pension right away.

Formula: 1% x $90,000 (High-3) x 30 (Years of Service)

Annual Pension: $27,000

Not bad at all. He can retire relatively early with a respectable income.

Scenario 2: David Works Until Age 62

If David decides to work five more years, he’ll have 35 years of service. Because he’s now over 62 with more than 20 years in, he qualifies for the enhanced 1.1% multiplier.

Formula: 1.1% x $90,000 (High-3) x 35 (Years of Service)

Annual Pension: $34,650

By waiting just five years, David increases his annual pension by $7,650. That’s a 28% raise to his yearly retirement income—an increase that will stick with him and grow with every cost-of-living adjustment for the rest of his life.

The Broader Strategic Context

Of course, deciding when to retire involves more than just numbers; it's a personal call based on your health, lifestyle, and overall financial picture. For federal employees, though, certain ages unlock huge advantages. Retiring at your MRA (like 57) might get you out the door sooner with the FERS Supplement, but you'll leave that 10% pension bonus on the table.

Waiting until 62 often means a bigger lifetime benefit, but it requires more time on the job. The decision of what age to retire from federal government is a careful balancing act. To get a better sense of how these milestones fit into a complete retirement strategy, you can find a deeper dive into the best ages for federal retirement on FedWeek.com.

What About Early or Special Retirement Options?

While most federal employees follow a pretty standard path to retirement, life doesn't always stick to the script. Sometimes, situations pop up that might lead to an earlier-than-planned exit from your career. The good news is that the federal system has a few alternative routes for specific circumstances.

Think of these as special exit ramps off the main retirement highway. They aren't open to everyone all the time, but they can be a lifesaver when an agency is going through big changes like downsizing or reorganization.

When Your Agency Offers an "Early Out"

Two of the most common early retirement scenarios you'll hear about are Voluntary Early Retirement Authority (VERA) and Discontinued Service Retirement (DSR). They might sound similar, but they're triggered by different events.

VERA (Voluntary Early Retirement Authority): This is the classic "early out." If an agency needs to reshape its workforce, it can offer VERA to employees who wouldn't otherwise be eligible to retire. It's a voluntary way to leave service ahead of schedule.

DSR (Discontinued Service Retirement): This one isn't voluntary. DSR kicks in if you're separated from your job through no fault of your own, like during a reduction-in-force (RIF) where your position is eliminated. It acts as a crucial safety net.

To grab one of these early options, you typically need to meet one of two thresholds: be at least age 50 with 20 years of service, or have 25 years of service at any age. The biggest perk? You get an immediate, unreduced pension, which is a fantastic deal for those who qualify.

It’s important to remember that VERA and DSR aren't just sitting there for the taking. Agencies have to get special permission to offer them, usually only during major shake-ups like downsizing, realigning priorities, or big office moves.

Special Rules for High-Stakes Jobs

Beyond agency-wide changes, some federal careers just operate on a different timeline altogether. We're talking about jobs that are incredibly demanding, both physically and mentally, and the retirement system is set up to reflect that reality.

Federal law enforcement officers, firefighters, and air traffic controllers fall into this "special category." Their work is so intense and critical that the system allows for an accelerated retirement path. It’s a practical way to ensure these vital roles are always filled by people at the top of their game.

The rules for these folks look quite different:

Mandatory Retirement Age: Many of these jobs have a mandatory retirement age, often 57, to ensure the workforce maintains peak performance and readiness.

Early Eligibility: They can retire much sooner, typically at age 50 with 20 years of their special category service under their belt.

Bigger Pension: Their pension calculation is also more generous. It's often figured at 1.7% for their first 20 years of service, a significant boost from the standard 1% or 1.1% that most other FERS employees receive.

These special provisions are a clear acknowledgment of the extraordinary pressures these federal employees face every day, giving them a well-defined and more rewarding path to a retirement they've certainly earned.

How Social Security Impacts Your Retirement Date

Your FERS pension is a huge piece of your retirement plan, but it's not designed to work alone. It's really one part of a three-legged stool, and to figure out the best time to retire, you have to look at how it works with Social Security. These two benefits are deeply connected, and the decisions you make about one directly ripple through the other.

Think of your FERS pension and Social Security as two engines on the same plane. For a smooth, stable flight into retirement, you need to understand how both of them work together—especially if you're thinking about retiring before you turn 62.

The FERS Supplement: Your Bridge to Social Security

So, what happens if you retire at your MRA of 57 but can’t touch your Social Security for another five years? That's where a really unique and powerful FERS benefit comes into play: the FERS Annuity Supplement.

This supplement was created specifically to bridge that financial gap between your last federal paycheck and your first Social Security check. It gives you a monthly payment that's designed to be a rough estimate of the Social Security benefit you earned while working as a FERS employee.

To qualify for the supplement, you generally need to:

Retire with an immediate, unreduced pension.

Be younger than 62.

Have at least one full calendar year of FERS service.

But here’s the critical part: the supplement stops cold the month you turn 62. It doesn't matter if you actually start claiming your Social Security benefits then or decide to wait. It's also subject to an earnings test, so if you get another job after retiring, earning too much can reduce or even eliminate your supplement payment.

Timing Your Social Security Claim

Your strategy for claiming Social Security is the other massive piece of this retirement puzzle. You can start drawing benefits as early as age 62, but grabbing it early means you're locking in a permanently reduced monthly payment for the rest of your life.

The full retirement age (FRA) for Social Security has been creeping up for years. It used to be 65, but now it’s age 67 for anyone born in 1960 or later. Claiming before your FRA results in a significant, permanent reduction. On the flip side, waiting past your FRA to claim can substantially increase your monthly check. You can learn more about the changes to Social Security's full retirement age from CBS News.

This leaves you with a major strategic choice: retire early and live on a smaller Social Security benefit for life, or work longer to maximize both your FERS pension (by getting that 1.1% multiplier at age 62) and your Social Security payout.

This isn’t a decision to be made in a vacuum. It requires taking a hard look at all your income streams—your pension, your TSP, and any other savings you have. It’s all about finding the right balance between the freedom of an earlier retirement and the long-term financial security you get from maximizing every single benefit you've worked so hard to earn.

Of course. Here is the rewritten section with a more natural, human-written tone.

Clearing Up Common Federal Retirement Questions

Once you start digging into the details of federal retirement, a lot of "what if" scenarios pop up. It's totally normal. Even the best-laid plans can leave you wondering about unique situations, like whether you can pick up a part-time job or what happens if you leave government work sooner than expected.

Let's tackle some of the most frequent questions federal employees ask. Getting these answers straight can help you sidestep any last-minute surprises on your road to retirement.

Can I Work After Retiring From Federal Service?

You bet. Working after you retire from the federal government is absolutely an option, but you need to be smart about it. The type of job you take can have a real impact on your bottom line.

For the most part, if you go to work for a private company or even another government entity outside of your own state's public system, you can earn as much as you want without it affecting your FERS or CSRS pension. Where things get tricky is if you decide to go back to work for a public employer in your own state.

Many state-level retirement systems, like New York's NYSLRS for example, have strict earnings limits for their own retirees who come back to public service before age 65. If you earn more than their cap, they could reduce or even suspend your state pension benefits.

Heads Up: The FERS Annuity Supplement is a different animal. This benefit, designed to tide you over until you can claim Social Security at age 62, comes with an earnings test. If you're collecting the supplement and start a new job, earning too much can shrink or even wipe out that payment until you hit age 62.

What Happens If I Leave Before I’m Eligible to Retire?

Leaving federal service before you meet the age and service requirements for an immediate pension doesn't mean you walk away with nothing. You’ve earned a benefit, but you'll likely be looking at a deferred retirement.

Think of it like putting your pension on hold until you're old enough to claim it. As long as you have at least five years of creditable civilian service under your belt when you leave, you can apply for your deferred pension annuity once you turn 62.

Here's an example: Imagine a FERS employee leaves her federal job at age 45 with 15 years of service. She can't retire right away. But, 17 years later when she turns 62, she can file the paperwork to start receiving her deferred monthly pension.

The big trade-off here, and it's a major one, is that taking a deferred retirement usually means you forfeit your eligibility to carry your federal health and life insurance (FEHB and FEGLI) into retirement.

Do I Have to Pay Taxes on My Federal Pension?

Yes, your federal pension is generally considered taxable income by the IRS. Both FERS and CSRS annuities are subject to federal income tax, though the exact amount you’ll owe depends on your total financial picture in retirement. In your first few years, a portion of your annuity might be tax-free, as it's considered a return of the after-tax contributions you made while working.

When it comes to state taxes, it's a completely different story. Every state has its own rules. Some will tax your federal pension just like any other income, others offer partial breaks, and a few states won't tax it at all. This is a huge factor to consider when deciding where you want to live after you retire.

Tax laws are always changing, so it pays to stay current. For example, there have been recent pushes in Congress to reduce how much Social Security is taxed for seniors, which just goes to show how the rules for retirement income can shift over time.

How Does Sick Leave Factor Into My Retirement?

For FERS and CSRS employees, that bank of unused sick leave you’ve built up is a real asset. When you retire, every last hour is converted into additional creditable service, which then gets plugged directly into your pension calculation.

The more sick leave you’ve saved, the more service time you get credited with, which translates into a slightly higher monthly pension payment for the rest of your life. It's a nice little bonus for all those days you pushed through a headache and came to work.

But there's one critical distinction to understand:

For Your Pension Calculation: Unused sick leave absolutely counts toward your total service time.

For Retirement Eligibility: Sick leave cannot be used to get you to the finish line. You have to meet the MRA, age, and service thresholds with actual time on the job.

So, if you have 29 years and 10 months of service and need 30 years to qualify for an MRA+30 retirement, having four months of sick leave won't do the trick. You'll still need to work those final two months to become eligible.

Navigating these complexities is what we do best. At Federal Benefits Sherpa, we help federal employees across the country make sense of their benefits to build a retirement plan that works for them. If you have questions about your specific situation, let our experts guide you. Claim your free 15-minute benefit review today!

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved