Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

How Does the Thrift Savings Plan Work Simplified

The Thrift Savings Plan, or TSP, is essentially the federal government's version of a 401(k) plan. It’s a powerful tool designed to help you build a secure retirement by saving money directly from your paycheck.

At its heart, the TSP's power comes from a simple but potent combination: your savings, free government money, and the magic of compound growth. When you put money in, your agency often adds its own contributions, and then all that money gets invested to grow over time.

Your Quick Guide to the Thrift Savings Plan

Think of it like building your retirement dream home. Every paycheck, you lay down some bricks—those are your personal contributions. For most federal employees, the government then drops off a pallet of free, high-quality bricks to add to your project. This is the agency match. It helps you build that house much faster and stronger than you ever could on your own.

This guide will break down exactly how your TSP works, so you can start building with a solid blueprint. The principles of creating effective how-to guides emphasize clarity and actionable steps, which is exactly what we aim to provide here.

For a quick overview, this table breaks down the core elements of the TSP.

TSP at a Glance: Key Features

FeatureDescriptionEligibilityOpen to federal employees (FERS, CSRS) and members of the uniformed services.Contribution TypesTraditional (pre-tax) contributions lower your current taxable income. Roth (after-tax) contributions allow for tax-free withdrawals in retirement.Agency MatchFERS employees receive an automatic 1% agency contribution and a dollar-for-dollar match on the first 3% of their contributions, plus 50 cents on the dollar for the next 2%.Investment OptionsA mix of individual funds (G, F, C, S, I) and target-date Lifecycle (L) Funds that automatically adjust their risk level as you near retirement.Tax AdvantagesYour investments grow tax-deferred in a Traditional TSP or tax-free in a Roth TSP, helping your money grow faster.

Understanding these features is the first step toward making the TSP work for you.

The Four Pillars of Your TSP

Your success with the Thrift Savings Plan really comes down to mastering four key areas. Each one plays a critical role in building your long-term financial security.

Your Contributions: This is the money you decide to put away from each paycheck. It’s the foundation of your retirement savings and the part you have the most direct control over.

Government Match: For FERS employees, this is an incredible benefit. Your agency contributes money to your account simply because you are. It’s essentially free money that turbocharges your savings.

Investment Funds: This is where your money goes to work. The TSP offers a streamlined selection of funds, from ultra-safe government securities to funds that track the stock market.

Tax Advantages: The TSP gives you a choice. You can save with Traditional contributions to lower your taxable income today, or use Roth contributions to get tax-free income in retirement.

The TSP isn't a small program; it's one of the largest retirement plans in the world. As of early 2025, it serves over 7.25 million accounts and manages assets exceeding $939 billion.

For 2025, federal employees can contribute up to $23,500 into either the Traditional or Roth options, a limit set to increase to $24,500 in 2026. This scale, detailed in reports from the Federal Retirement Thrift Investment Board, shows just how vital this benefit is for millions of federal employees and service members.

Building Your Nest Egg with TSP Contributions and Matching

The real power behind your Thrift Savings Plan comes from two places: your own consistent contributions and the government's generous match. Think of it as a one-two punch for growing your retirement savings. Understanding how this money gets into your account is the first, and most important, step to building long-term wealth.

It all starts with your paycheck. Your contributions are automatically deducted from your salary based on a percentage you set. The money goes straight into your TSP account before it ever hits your bank, which makes saving a consistent, effortless habit.

Traditional vs. Roth TSP: Your First Big Decision

Right out of the gate, you have to make a key decision: will your contributions be Traditional or Roth? This choice boils down to a simple question: Do you want to pay taxes now or later?

Traditional (Pre-Tax) Contributions: When you choose Traditional, the money comes out of your paycheck before federal and state income taxes are calculated. This lowers your taxable income for the year, meaning you pay less in taxes today. The trade-off? When you withdraw this money in retirement, every dollar—both your contributions and all the earnings—is taxed as regular income.

Roth (After-Tax) Contributions: With a Roth TSP, you contribute money that's already been taxed. You don't get an immediate tax break, so your take-home pay might feel a little smaller. But the payoff is huge: every qualified withdrawal you make in retirement, including all that investment growth, is 100% tax-free.

Let's say you earn $60,000 and decide to contribute 5% ($3,000). A Traditional contribution would lower your taxable income to $57,000 now, but you'll owe taxes on that money down the road. A Roth contribution means you're taxed on the full $60,000 today, but your retirement withdrawals are yours to keep, tax-free. Your best bet depends on your personal situation and whether you think your tax rate will be higher or lower when you retire.

Unlocking Free Money with the Government Match

Your own savings are the foundation, but the government match is the rocket fuel. For federal employees under the FERS system, this is hands-down one of your most valuable benefits. It's like getting a guaranteed, immediate return on your investment.

The matching formula is simple but incredibly powerful. Here’s how it works for FERS employees:

Automatic 1% Contribution: Your agency automatically puts 1% of your basic pay into your TSP, even if you don't contribute a single dime. This is truly free money, just for showing up.

Dollar-for-Dollar Match: Your agency will then match the first 3% of your pay that you contribute, dollar-for-dollar.

50 Cent Match: For the next 2% you contribute (from 3.01% up to 5%), your agency kicks in 50 cents for every dollar.

If you remember only one thing, make it this: you must contribute at least 5% of your basic pay to get the full government match. Anything less, and you are literally walking away from free retirement money.

When you put in 5%, the government puts in another 5% (the 1% automatic plus the 4% match). You've just doubled your money! You're saving 10% of your salary, but only 5% is coming out of your paycheck. This is the secret weapon for building wealth. Our guide offers more tips on maximizing your government matching TSP contributions.

The Power of the Match in Action

Don't underestimate this benefit. The TSP match is so effective that the vast majority of federal employees take full advantage of it. For many, the combination of their TSP, FERS pension, and Social Security can replace 30-40% of their pre-retirement income. You can dig into the numbers by exploring the latest findings on TSP participation.

This matching system is how the Thrift Savings Plan supercharges your savings, turning small, steady contributions into a seriously impressive nest egg over your career.

Choosing Your Investment Strategy Inside the TSP Funds

Okay, so you've got money flowing into your Thrift Savings Plan. Now for the big question: where does it actually go? This is the point where you take control and build a personal strategy.

The TSP offers a simple, focused menu of investment funds, each known by a single letter. At first glance, it might seem a bit cryptic, but these funds are really just different tools in your financial toolbox. Some are built for safety and stability, others for growth. The right mix depends entirely on what you’re trying to build—your secure retirement.

Let's break down each fund and what it really means for your money.

The Five Core TSP Funds Explained

The entire TSP is built on five individual funds. Think of them as the core ingredients you can use to create your own investment recipe. Getting to know these five is the first step to building a portfolio that truly works for you.

G Fund (Government Securities Investment Fund): This is the TSP’s version of an ironclad savings account. It invests in special U.S. Treasury securities that are backed by the full faith and credit of the U.S. government. Its whole job is to preserve your money, meaning it's designed to never lose principal. You won't see dramatic gains here, but you'll get steady, reliable interest. It's the go-to for anyone who puts safety above all else or is getting very close to retirement.

F Fund (Fixed Income Index Investment Fund): Think of the F Fund as a big basket of bonds. It tracks an index made up of U.S. government, corporate, and mortgage-backed bonds. It’s a step up in risk from the G Fund, and its value will go up and down a bit, but it also offers a better shot at higher returns over time. It’s a good middle-ground option for people who want a little more growth than the G Fund without the full volatility of the stock market.

C Fund (Common Stock Index Investment Fund): This is your ticket to owning a piece of the biggest names in American business. The C Fund simply tracks the S&P 500 index, which means you're investing in 500 of the largest U.S. companies—think Apple, Microsoft, and Amazon. It comes with serious growth potential, but also the natural ups and downs of the stock market. For most long-term investors, this fund is a cornerstone of their growth strategy.

S Fund (Small Cap Stock Index Investment Fund): While the C Fund focuses on the giants, the S Fund is all about the up-and-comers. It tracks an index of small- and medium-sized U.S. companies that aren't in the S&P 500. These are the companies with more room to run, offering the potential for even higher returns than the C Fund. Of course, with that higher potential comes higher risk and more volatility.

I Fund (International Stock Index Investment Fund): The I Fund takes you beyond U.S. borders. It invests in a collection of stocks from more than 20 developed countries across Europe, Australia, and Asia. This is a great way to diversify your portfolio, since international markets don't always move in lockstep with the U.S. market. It has stock market risk, but it can help smooth out the ride for your overall portfolio.

Here's a quick side-by-side look at how these funds stack up.

Comparison of TSP Core Investment Funds

FundWhat It HoldsRisk LevelBest For Investors Who...GUnique U.S. Treasury SecuritiesLowestPrioritize capital preservation above all else.FU.S. Government & Corporate BondsLowWant returns better than cash but with low volatility.CStocks of 500 Large U.S. CompaniesMedium-HighAre seeking long-term growth and can handle market swings.SStocks of Small/Mid-Sized U.S. CompaniesHighWant aggressive growth and are comfortable with higher risk.IStocks of Large Companies in Developed NationsMedium-HighWant to diversify their stock holdings internationally.

This simple menu of funds is incredibly powerful, largely because the TSP's administrative expenses are astonishingly low. With expense ratios under 0.05%, almost every dollar of your return goes straight into your pocket. Low fees, combined with strong market performance, are a recipe for success.

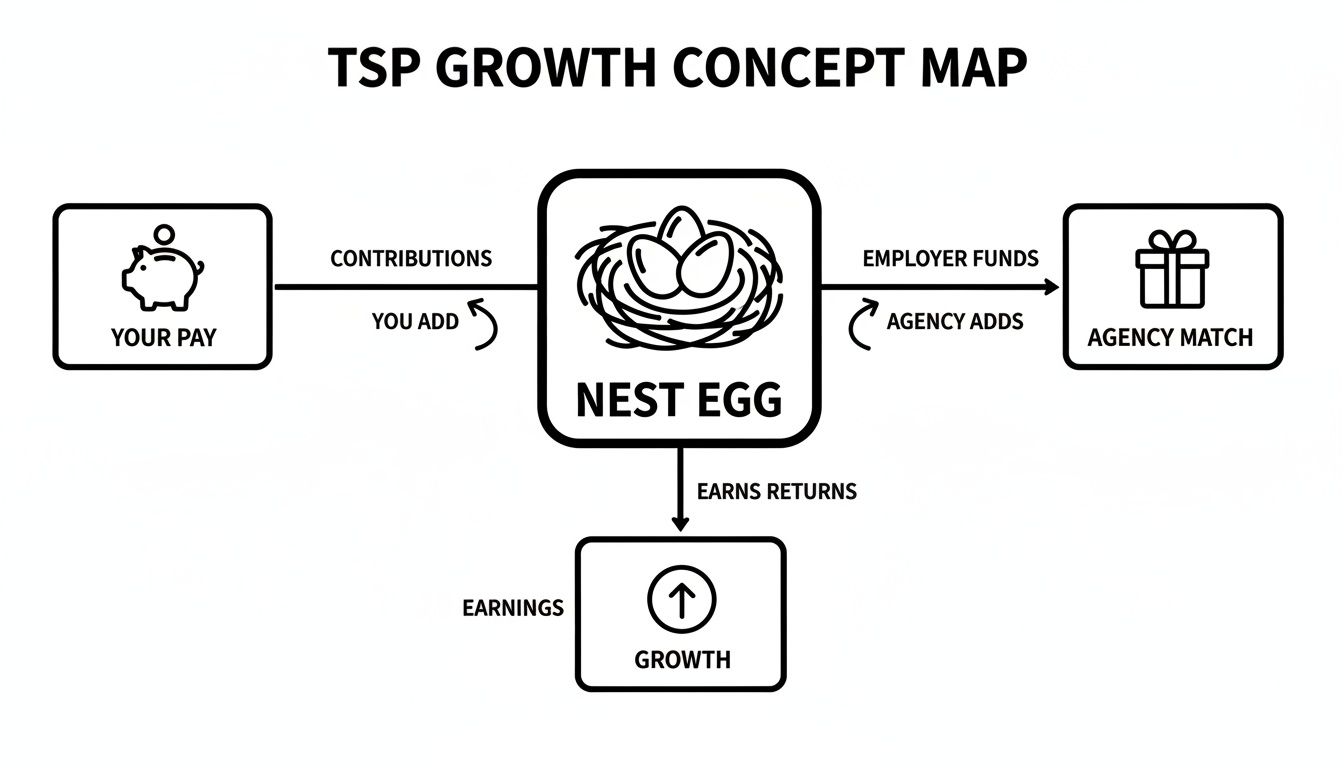

This image shows exactly how these different pieces come together to fuel your retirement account's growth.

As you can see, the real magic happens when your own contributions, the government match, and the compound earnings from your funds all start working together.

The Lifecycle L Funds: Your Autopilot Option

Feeling a bit overwhelmed by the idea of picking and choosing your own funds? The TSP has a fantastic solution for that: the Lifecycle (L) Funds. These are essentially pre-mixed "target-date" funds that put your investment strategy on autopilot.

The idea is simple: You pick the L Fund with a date closest to when you think you'll need the money, which for most people is their target retirement year. The fund handles the rest.

Each L Fund is a professionally managed portfolio holding a mix of the five core funds (G, F, C, S, and I). When your target date is decades away, the fund stays aggressive, holding more stocks (C, S, and I) to maximize your growth potential.

But as you get closer to that date, the fund automatically and gradually shifts your money into the safer bond and government security funds (F and G). This "glide path" approach helps protect the wealth you’ve built up over your career.

It’s the ultimate "set-it-and-forget-it" strategy, taking all the guesswork out of managing your asset allocation over time. If you want to dive deeper into whether a custom mix or an L Fund is right for you, check out some of the top TSP investment strategies for federal employees.

Accessing Your Funds: TSP Loans and Withdrawal Rules

Putting money into your TSP is only half the story. Just as important is knowing how you can get that money back out when you need it. The TSP has clear rules for accessing your funds, both while you're still a federal employee and after you’ve moved on.

These options offer a good deal of flexibility, but they come with strings attached. It's critical to understand the rules of the road, because one wrong turn could lead to unnecessary taxes, penalties, or lost investment growth. Let's walk through the ways you can tap into your TSP account.

Taking a Loan While Still Employed

Life happens, and sometimes a big expense pops up before retirement. The TSP lets active federal employees borrow from their own accounts through what's called an in-service loan. In essence, you're borrowing your own money and paying yourself back, with interest.

You have two main loan options, each built for a different purpose.

General-Purpose Loan: Just like it sounds, you can use this money for anything—from paying off high-interest credit cards to funding a much-needed vacation. There’s no need to provide documentation for how you'll use it. The repayment term is between one and five years.

Residential Loan: This loan is specifically for buying or building your primary home. It requires paperwork to prove the funds are going toward your residence, but in exchange, you get a much longer repayment window of one to fifteen years.

A TSP loan can feel like an easy source of cash, but it has a hidden cost. The moment you borrow that money, it's pulled out of your investment funds. That means you completely miss out on any market gains it could have earned while you're paying it back. You're not just repaying the loan; you're also giving up future compound growth.

Before you jump in, it's vital to weigh the pros and cons carefully. For a deeper dive, check out this comprehensive guide to borrowing from your TSP.

Withdrawing Funds After Leaving Federal Service

Once you separate or retire from your federal job, your options for getting to your TSP money expand significantly. You're no longer limited to just taking out a loan. Now, you can actually start taking withdrawals to support your life in retirement.

The way you choose to take out your money will shape your income and tax situation for years to come, so it's a decision worth thinking about. Fortunately, the TSP provides a few flexible methods to match different financial strategies.

Your Post-Separation Withdrawal Choices

After leaving federal service, you have full control over your vested TSP balance. You can get your money out in a few different ways, or even mix and match these options over time.

Installment Payments: You can set up a steady, predictable stream of income by arranging for recurring payments. You can choose a specific dollar amount to receive each month or have payments calculated based on your life expectancy. It feels a lot like getting a regular paycheck.

Single or Partial Lump-Sum Withdrawal: Need a chunk of cash all at once? You can take a single withdrawal of your entire balance or just a partial withdrawal of at least $1,000. This is often used for big-ticket items or to roll the money over into another retirement account, like an IRA.

Purchase a Life Annuity: With this option, you take some or all of your TSP balance and use it to buy an annuity from a private insurance company. In return, you get guaranteed monthly payments for the rest of your life (and potentially your spouse's, too), providing the ultimate peace of mind.

Understanding these withdrawal rules is a key part of making the TSP work for you in retirement. Your choice should fit into your larger financial plan, considering things like taxes and your other income sources. For many people, this is the perfect time to sit down with a financial professional to make sure the strategy you choose makes the most of the nest egg you've spent a career building.

Taking Your TSP to the Next Level: Advanced Strategies

Once you've got the basics down, it's time to start thinking about how to really make your TSP work for you. Moving beyond simple contributions and fund choices can turn your account from a basic retirement plan into a powerful wealth-building engine.

These strategies are perfect for federal employees who are further along in their careers or anyone who wants to get serious about accelerating their savings. It’s all about treating your TSP as the central pillar of your financial future. Let's dig into a few of the most effective ways to do just that.

Supercharge Your Savings with Catch-Up Contributions

As you get closer to retirement, your earning power is often at its peak, and the finish line is finally in sight. This is the perfect time to give your savings one last big push, and the TSP has a special tool just for this: catch-up contributions.

The moment you hit the year you turn 50, you unlock the ability to contribute thousands of extra dollars each year, well above the standard limit. This is your chance to make up for earlier years when you might not have been able to save as much, or simply to build an even bigger nest egg for the years ahead.

Think of it as hitting the turbo button on your retirement savings. It's a straightforward but incredibly powerful way to beef up your balance when it matters most.

Simplify Your Life: Rolling Old Retirement Accounts into Your TSP

If you had a private-sector job before joining the government, you probably have an old 401(k) or 403(b) account sitting around. Juggling multiple retirement accounts is not only a headache, but it can also be quietly eating away at your returns. A TSP rollover lets you clean things up by moving that money into your TSP.

So, why would you do this? The big win here is the TSP’s rock-bottom costs.

Slash Your Fees: The expense ratios on TSP funds are some of the lowest you'll find anywhere. Lower fees mean more of your money keeps working for you, not for a fund manager.

Keep It Simple: Managing one account is far easier than tracking three or four. You get a single, clear view of your entire retirement portfolio.

Get Access to Unique Funds: Rolling money in allows you to invest it across the TSP’s fund lineup, including the G Fund, which has no private-sector equivalent.

This strategy streamlines your finances, making your life easier and potentially leaving you with a lot more money in the long run.

Make a Strategic Move: The Roth In-Plan Conversion

Here's a more advanced technique for those who like to play the long game with taxes: the Roth in-plan conversion. This powerful feature lets you move money from your Traditional (pre-tax) TSP balance over to your Roth (after-tax) balance.

The catch? You have to pay income tax on the entire amount you convert, right now, in the year you do it. Why on earth would you choose to pay taxes sooner rather than later? Because once that money is in the Roth TSP, it—and all the growth it ever generates—can be withdrawn 100% tax-free in retirement.

This is a strategic play. It makes sense if you expect to be in a higher tax bracket in retirement or if you just want the security of knowing you'll have a bucket of tax-free money to draw from when you need it.

Don't Leave Money on the Table: Understanding Vesting

Finally, you need to know about vesting. It’s a simple concept that determines when you have full ownership of the money the government contributes to your account. The money you put in is always yours, 100%, from the first day. But the government’s contributions have a waiting period.

For FERS employees, you have to complete three years of federal service to be fully vested in the Agency Automatic (1%) Contributions. The good news is that you are always immediately vested in any Agency Matching Contributions.

Knowing your vesting date is critical. If you leave your federal job before you're fully vested, you'll have to leave some of that "free" government money behind.

Making Your TSP Part of a Bigger Picture

Getting a handle on the Thrift Savings Plan is a fantastic start, but it's only one piece of the puzzle. The real magic happens when you see your TSP not as a separate account, but as a core component of your entire federal benefits package.

Think of your retirement income like a three-legged stool. The first leg is your TSP, the second is your FERS Basic Benefit (your pension), and the third is Social Security. For a stable and worry-free retirement, you need all three legs to be strong and working in harmony. If you build an amazing TSP but don't consider how it fits with your other income sources, you could end up with some serious financial gaps down the road.

Weaving Everything Together

Building a plan that you can actually rely on means making sure these powerful assets are coordinated. It's about stepping back and asking how they all fit together.

Mind the Gap: Will your pension and Social Security cover your non-negotiable monthly expenses? If there's a shortfall, how will you use your TSP to bridge that gap without burning through it too fast?

The Tax Question: Your pension is taxable. So is Social Security (often). And withdrawals from your Traditional TSP are, too. How will all these income streams combine to affect your overall tax bracket in retirement?

Planning for the Long Haul: Does a TSP annuity make sense for guaranteed income, or would you be better off with a more flexible withdrawal strategy to protect against inflation and leave a legacy for your family?

Answering these questions forces you to look at the whole picture. This isn't just about picking funds anymore; it's about engineering a reliable income stream that will last for the rest of your life.

This is where a one-size-fits-all approach just doesn't cut it. A generic plan can't possibly account for your specific career, your family situation, or what you truly want out of retirement.

That’s precisely why we offer a free federal benefits review. Our specialists can help you see the big picture, showing you how to align your TSP, pension, and Social Security to build the future you've worked so hard for. Let's make sure every single one of your benefits is pulling in the same direction—yours.

Your Top Thrift Savings Plan Questions, Answered

As you get deeper into managing your TSP, you're bound to have questions. It's only natural. Here are some straightforward answers to the things federal employees ask us most often.

Can I Lose Money in the TSP G Fund?

Simply put, no. You cannot lose the money you put into the G Fund. It's invested in special U.S. Treasury securities that are backed by the full faith and credit of the U.S. government, which guarantees you'll get your principal and interest back.

This makes the G Fund the safest place to park your money within the TSP. It’s built to protect your capital while earning a modest, steady rate of interest. Just keep in mind that this safety comes with a trade-off: its returns will almost always be lower than the stock funds over the long haul.

What’s the Real Difference Between a Traditional and Roth TSP?

The biggest difference boils down to a simple question: Do you want to pay taxes now or pay them later?

Traditional TSP: Your contributions are made with pre-tax dollars. This is great for your current budget because it lowers your taxable income right now, meaning a smaller tax bill this year. The catch is that every dollar you withdraw in retirement—both your original contributions and all the growth—will be taxed as regular income.

Roth TSP: You contribute with after-tax dollars, so you don't get that immediate tax break. The powerful advantage comes later. In retirement, qualified withdrawals are 100% tax-free. That includes all the investment earnings your money has generated over the decades.

One crucial detail: No matter which option you choose for your own contributions, all agency matching funds automatically go into your Traditional TSP balance.

How Often Can I Change My TSP Investments?

You have a good deal of control, but the TSP has rules designed to encourage you to think like a long-term investor, not a day trader. You can change where your future pay-check contributions go at any time. This is called a contribution allocation.

If you want to move the money already in your account between the various funds, that's called an interfund transfer. You get two of these unrestricted moves per calendar month. If you make a third transfer (or more) in the same month, you're restricted to moving money only into the ultra-safe G Fund.

What Happens to My TSP If I Leave My Federal Job?

Your TSP account is yours, and it doesn't vanish when you leave federal service. You have a few paths you can take, and the right one really depends on your age, your overall financial picture, and what you want your retirement to look like.

Your TSP account doesn't disappear when your federal career ends. You retain full control and can decide to leave it, move it, or begin taking withdrawals to fund your next chapter.

Here are your main options:

Leave it put. You can keep your money right where it is in the TSP, letting it benefit from the plan's incredibly low-cost investment funds.

Roll it over. You can move your balance into an Individual Retirement Account (IRA) or another company's 401(k) plan.

Start taking withdrawals. You can set up installment payments, take out a single lump sum, or use your balance to purchase a life annuity for guaranteed income.

At Federal Benefits Sherpa, we help you answer these questions and more by looking at your entire financial picture. A strong TSP is vital, but integrating it with your pension and Social Security is what creates a truly secure retirement. Book your free benefits review with us today.

Learn more and schedule your complimentary consultation at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved