Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

How Are Spousal Social Security Benefits Calculated: A Federal Guide

Spousal Social Security benefits are calculated based on your spouse's full retirement benefit, allowing you to receive up to 50% of their Primary Insurance Amount (PIA). The actual amount you get depends on when you decide to claim and whether you have your own work record. Don't worry, the system is designed to give you whichever benefit is higher—yours or the spousal benefit.

Let's walk through how this all works, step by step.

Your Guide to Calculating Spousal Social Security Benefits

For a lot of couples, Social Security is a shared financial resource. Spousal benefits can be a huge help in retirement, even if one person was the primary breadwinner or if you're receiving a federal pension. Figuring out how these benefits are calculated is the key to creating a solid retirement plan together.

Think of it this way: your spouse's earned Social Security benefit is the foundation. The spousal benefit you might be eligible for is built directly on top of that foundation, giving you a share of their retirement income.

Why This Calculation Matters

Understanding the math here is more than just an academic exercise—it's about making smart, strategic decisions. When you file for benefits, how your own earnings stack up, and whether special rules for federal employees apply can dramatically change your monthly check. Getting this right can easily translate to tens of thousands of dollars more over the course of your retirement.

My goal here is to pull back the curtain on these rules and make them easy to understand. We'll go through everything from the basic building blocks to how they play out in different real-life situations, so you can feel confident in your choices.

You don’t need to be a financial expert to understand spousal benefits. The system is built on a few key principles that, once understood, make the entire process much clearer and less intimidating.

We're going to break down several key areas to give you a complete picture of how spousal Social Security benefits are calculated:

- The Foundational Number: We’ll start with the Primary Insurance Amount (PIA), which is the most important number in any Social Security calculation.

- The Timing Factor: You will see how the age you claim benefits can permanently increase or decrease your payments.

- Special Circumstances: We’ll look at the specific rules for divorced spouses, caregivers, and survivors, as they can change who is eligible and for how much.

- Federal Employee Considerations: If you're a federal retiree, rules like the Government Pension Offset (GPO) are critical to understand, and we'll cover them in detail.

The Bedrock of Your Benefit: Understanding the Primary Insurance Amount

Before we can even talk about spousal benefits, we have to start with the building block for all Social Security payments: the Primary Insurance Amount, or PIA. Think of the PIA as the starting number, the master figure from which everything else is calculated.

It's the full, unadjusted retirement benefit a person is due at their own Full Retirement Age (FRA), based entirely on their lifetime earnings. Every other calculation—whether for a spouse, a survivor, or for someone taking benefits early—stems from this single number. So, to figure out your potential spousal benefit, you first have to get a handle on how your spouse's PIA is determined.

How Social Security Comes Up With the PIA

The Social Security Administration (SSA) doesn't just glance at a worker's last few paychecks. They go through a very specific process to figure out a person's PIA, and it all boils down to their earnings over their entire career.

Here’s a simplified look at how it works:

- Look Back at All Earnings: The SSA compiles a complete list of a worker's annual earnings.

- Adjust for Inflation: They then "index" those earnings to bring past wages up to today's values. This is a crucial step that makes sure a dollar earned in, say, 1985 is given its proper weight compared to a dollar earned today.

- Find the Average: From that indexed history, the SSA zeroes in on the 35 highest-earning years and calculates a monthly average. This number has its own fancy name: the Average Indexed Monthly Earnings (AIME).

It's important to know the PIA isn't just a straight average. The formula is intentionally weighted to give lower-income workers a proportionally higher benefit, acting as a stronger financial safety net. This is done using what the SSA calls "bend points."

The AIME is then run through a formula that changes every year. For 2024, it looks like this:

- 90% of the first $1,174 of the AIME

- 32% of the amount between $1,174 and $7,078

- 15% of any amount over $7,078

Add those three pieces together, and you get the worker's PIA. This is the magic number that dictates your potential spousal benefit.

How a Spouse's PIA Affects You

So, why does all this matter for you? Because the maximum spousal benefit you can receive is exactly 50% of your spouse's PIA. Simple as that. If your spouse’s PIA is calculated at $3,000 a month, your maximum potential spousal benefit, if you wait until your own full retirement age, is $1,500.

Of course, a lot has changed over the years. We're a long way from the single-earner households of the past. Today, it’s far more common for both partners to have their own work histories, which directly impacts how spousal benefits work.

For example, a look at Gen X wives shows their average combined monthly benefit is $1,683, but only about 61% of that amount comes from their husband’s record. The rest is from their own earned benefit. This reflects a massive shift in the workforce—women's labor participation has climbed from 43% back in 1970 to nearly 57% by 2023. You can see more on these trends in the Social Security Administration's detailed analysis.

Ultimately, the SSA will always look at your own work record first. If your own PIA is more than half of your spouse's, you'll just receive your own, higher benefit. But if it's less, Social Security pays your benefit first, then adds a spousal "top-up" to bring you to that 50% level. This is sometimes called "dual-entitlement," but the key takeaway is that you receive the higher of the two amounts, not both combined.

The Spousal Benefit Calculation Formula Explained

Once you understand the Primary Insurance Amount (PIA), figuring out the spousal benefit is surprisingly straightforward. The whole calculation hinges on one simple rule: at most, a spousal benefit is worth 50% of the higher-earning spouse's PIA.

That 50% figure is your starting point. But your final monthly check will be adjusted by two critical factors—your own Full Retirement Age (FRA) and the specific age you decide to start taking benefits.

Think of it like a recipe. The worker's PIA is the main ingredient. Your claiming age is the cooking time. If you take it out of the oven too early, you get a smaller, permanently reduced amount. Wait until it's fully "baked" at your FRA, and you get the full portion.

Full Retirement Age: The Most Important Number

Your Full Retirement Age is the magic number set by the Social Security Administration that entitles you to 100% of your own earned benefit, or in this case, the full 50% of your spouse's PIA. This age isn't the same for everyone; it depends on the year you were born.

Here’s a quick look at how it breaks down:

- Born 1943-1954: Your FRA is 66.

- Born 1955: Your FRA is 66 and 2 months.

- Born 1956: Your FRA is 66 and 4 months.

- Born 1957: Your FRA is 66 and 6 months.

- Born 1958: Your FRA is 66 and 8 months.

- Born 1959: Your FRA is 66 and 10 months.

- Born 1960 or later: Your FRA is 67.

If you claim your spousal benefit right at your FRA, you lock in that maximum percentage. Claim any earlier, and that benefit is permanently slashed.

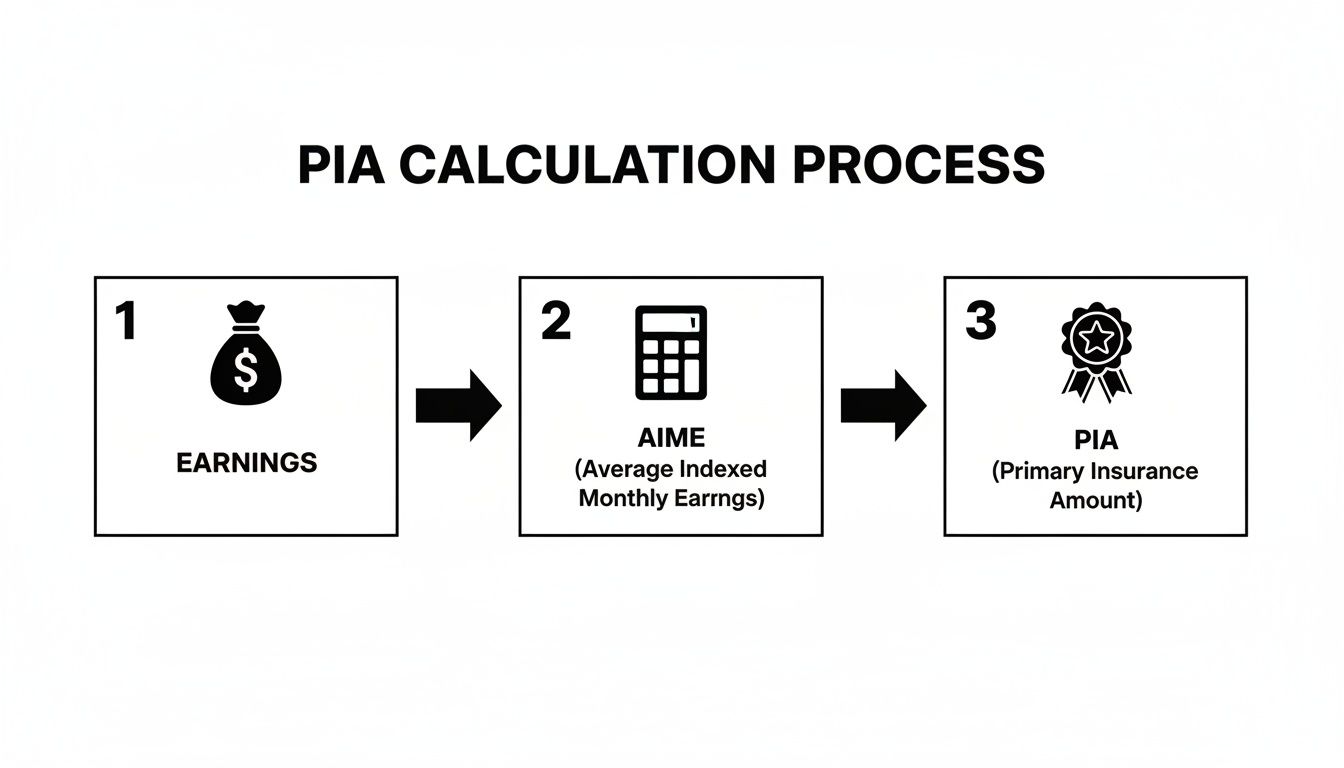

The flowchart below shows how your spouse's lifetime earnings are distilled down into their PIA, which is the foundational number for your own spousal benefit.

This entire process funnels decades of work into a single monthly figure, which then becomes the jumping-off point for what you can receive as a spouse.

The Impact of Claiming Early

You can start claiming spousal benefits as early as age 62, but be warned: doing so comes with a big, permanent haircut. The system is designed so that, on average, you get about the same amount of total money over your lifetime no matter when you file. Claiming early just means you get smaller checks, but for a longer time.

The reduction isn't arbitrary; it's calculated for every single month you claim before your FRA. For someone whose FRA is 67, claiming right at age 62 means you'll only get 32.5% of your spouse's PIA—not the full 50%. That’s a permanent reduction of nearly a third.

The table below breaks down exactly how your claiming age affects your benefit percentage, assuming your Full Retirement Age is 67.

Spousal Benefit Percentage by Claiming Age (for FRA of 67)

| Spouse's Claiming Age | Percentage of Worker's PIA Received | Example Monthly Benefit (Worker's PIA = $2,400) |

|---|---|---|

| 62 | 32.50% | $780 |

| 63 | 35.00% | $840 |

| 64 | 37.50% | $900 |

| 65 | 41.67% | $1,000 |

| 66 | 45.83% | $1,100 |

| 67 | 50.00% | $1,200 |

As you can see, every year you wait brings a significant jump in your monthly payment. For many, delaying is well worth the bigger, lifelong income stream it creates.

The "Dual-Entitlement" Rule: You Get the Higher Amount

One of the most common points of confusion is what happens when you've worked enough to earn your own Social Security benefit. The short answer: you don't get both. Instead, the "dual-entitlement" rule kicks in, and you get the higher of the two amounts.

Here's a step-by-step look at how it works:

- First, Social Security calculates the retirement benefit based on your own earnings record.

- Next, they figure out your potential spousal benefit, which is up to 50% of your spouse's PIA.

- You'll always be paid your own benefit first. If your spousal benefit is larger, Social Security adds a "top-up" amount to bring your total payment up to that higher figure.

For example, let's say your own benefit is $800 a month and your spousal benefit works out to be $1,100. You would receive your $800 plus a $300 spousal supplement, for a total monthly check of $1,100.

This is especially relevant for federal employees, who often have a solid FERS annuity and a decent personal Social Security benefit. In those cases, the spousal benefit might just be a small, but still valuable, top-up. If you're trying to figure out how to best coordinate all these moving parts, our guide on how to maximize Social Security has more detailed strategies.

Putting the Numbers to Work: Real-World Examples

Theory is one thing, but seeing how the math plays out in real life makes all the difference. To really get a feel for how spousal benefits work, let's walk through a few common scenarios. These examples will show you exactly how factors like your spouse's earnings, your claiming age, and your own work record all fit together.

For these examples, let's assume the higher-earning spouse, we'll call him David, has a Primary Insurance Amount (PIA) of $3,000 per month. His spouse, Sarah, was born in 1960, which means her Full Retirement Age (FRA) is 67.

Scenario 1: The Maximum Benefit at Full Retirement Age

Let's start with the most straightforward case. Sarah has decided to wait until she turns 67—her Full Retirement Age—to claim her spousal benefit. She doesn't have a significant work history of her own, so her own potential Social Security payment is either very small or nonexistent.

The calculation here is simple and direct.

- David's PIA: $3,000

- Maximum Spousal Percentage: 50%

- Calculation: $3,000 x 0.50 = $1,500

Because Sarah waited until her FRA, she gets the full 50% of David's PIA. This gives her a monthly spousal benefit of $1,500. There are no reductions, and this is the highest possible spousal benefit she can receive based on David's record.

Scenario 2: The Early Claiming Penalty

Now, let's change just one crucial detail. What if Sarah needs or wants to start receiving benefits as soon as she's eligible at age 62? While this gets money in her pocket sooner, it comes with a permanent—and significant—reduction.

Since her FRA is 67, claiming at 62 means she’ll only receive 32.5% of David's PIA, not the full 50%.

The decision to claim early is one of the most impactful financial choices you'll make for retirement. While getting money sooner is tempting, the permanent reduction in your monthly benefit can result in a substantially lower lifetime payout if you live a long life.

Here’s how the math for claiming early shakes out:

- David's PIA: $3,000

- Early Claiming Spousal Percentage (Age 62): 32.5%

- Calculation: $3,000 x 0.325 = $975

By claiming five years early, Sarah's monthly benefit drops from a potential $1,500 to $975. That's a loss of $525 every single month for the rest of her life. This really highlights how powerfully your claiming age affects your final benefit amount.

Scenario 3: The "Top-Up" for Dual Entitlement

Our final example covers a very common situation: what happens when Sarah does have her own work record and is entitled to her own Social Security benefit? This is where the "dual-entitlement" rule kicks in, making sure she receives the higher of the two possible benefits.

Let's say Sarah worked long enough to qualify for her own retirement benefit. At her FRA of 67, her own PIA is $1,000 per month.

Here's how Social Security handles this:

- First, they look at her own benefit: Sarah is entitled to $1,000 based on her own work.

- Next, they calculate her full spousal benefit: This is 50% of David's PIA, or $1,500.

- Then, they compare the two: The spousal benefit ($1,500) is higher than her own ($1,000).

- Finally, they pay the difference: Social Security will first pay her own $1,000 benefit. Then, it will add a spousal "top-up" of $500 to bring her total monthly payment up to the higher $1,500 amount.

In this scenario, Sarah's total check at her FRA would be $1,500. The key takeaway is that she doesn't get both amounts added together; she simply gets the larger of the two. This top-up ensures her benefit from David's record supplements her own, giving her the maximum amount she's eligible for.

How Special Rules Affect Your Spousal Benefit

The standard rules for calculating spousal benefits cover most people, but let's be honest—life is rarely standard. A handful of special circumstances can completely change who qualifies, when they can file, and how much they’ll get.

For federal employees, especially, getting a handle on these unique rules is a must. Provisions for divorced spouses and caregivers can open up new doors, but others, like the Government Pension Offset, can unfortunately slam them shut.

Let's walk through these important exceptions one by one.

Benefits For a Divorced Spouse

One of the first questions people ask after a marriage ends is about Social Security. The good news is that a divorce doesn't automatically disqualify you from claiming spousal benefits on an ex-spouse's record, as long as your marriage hit a certain milestone.

You can claim benefits on your ex-spouse's record if you meet these four conditions:

- Your marriage lasted for 10 years or longer.

- You are currently unmarried.

- You are at least 62 years old.

- Your ex-spouse is entitled to Social Security retirement or disability benefits.

Here’s a critical point that brings a lot of peace of mind: your claim has absolutely no financial impact on your ex-spouse or their current family. Their benefit amount isn't touched, and the Social Security Administration won't even notify them when you apply. The math for calculating a divorced spousal benefit is exactly the same as for a current spouse.

These rules, which have been around since 1965, are a vital lifeline. For example, if your ex-spouse’s PIA is $3,000, you could be eligible for up to $1,500 per month at your full retirement age, even if they haven't started taking their own benefits yet.

An Exception for Spouses Caring for a Child

While most talk about spousal benefits starts at age 62, there's a powerful exception for a spouse who is caring for a young or disabled child. This rule allows you to receive benefits at any age, without the usual reductions for claiming early.

You may be eligible for these "mother's or father's benefits" if you're caring for your spouse's child who is either under age 16 or receives Social Security disability benefits. In this case, your benefit is a straight 50% of your spouse's PIA, regardless of how old you are.

This provision acts as a financial bridge, providing essential support for a parent who may have left the workforce to care for a young child, ensuring the family has a stable income source.

Keep in mind, though, that these payments stop once the youngest child turns 16 (unless they are disabled). At that point, you’d have to wait until you turn 62 to become eligible for spousal benefits again, and those would be subject to the normal age-based reductions.

Understanding Survivor Benefits

When a spouse passes away, the spousal benefit ends. It’s replaced by something different: a survivor benefit. While they're related, they are calculated differently and are often much more generous.

Instead of being capped at 50% of the worker's PIA, a survivor can receive up to 100% of what the deceased spouse was actually receiving (or was entitled to receive). The exact percentage you get depends on your age when you claim and whether your spouse had already started their benefits.

- Claiming at your Full Retirement Age: You get 100% of your late spouse's benefit.

- Claiming between age 60 and FRA: Your benefit is reduced, ranging from 71.5% to 99%.

- Caring for a child under 16: You can receive 75% of the benefit.

This is a crucial distinction. The switch from a spousal to a survivor benefit can significantly boost your monthly income and provide a much stronger financial safety net during a difficult time.

The Impact of GPO and WEP on Federal Retirees

Now for the big one affecting many federal employees. If you have a pension from a job where you didn't pay into Social Security—like the Civil Service Retirement System (CSRS)—two provisions can throw a wrench in the works: the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP).

The Government Pension Offset (GPO) hits your spousal or survivor benefit directly. It reduces your Social Security payment by an amount equal to two-thirds of your government pension. For many people, this offset is large enough to completely wipe out their spousal benefit.

For instance, say you have a CSRS pension of $3,000 per month. The GPO reduction would be $2,000 ($3,000 x 2/3). If your potential spousal benefit was $1,500, that $2,000 offset reduces it all the way down to zero.

The Windfall Elimination Provision (WEP) is different; it reduces your own Social Security benefit, not the one you'd collect from a spouse's record. But it's often mentioned in the same breath as GPO because it affects the same group of government retirees. If you need to dig into the details, our Windfall Elimination Provision explained for federal employees article breaks it all down. Understanding these complex rules is non-negotiable for any federal retiree planning their future.

Getting Your Personalized Spousal Benefit Estimate

Moving from theory to practice is where retirement planning gets real. Understanding the math behind spousal benefits is one thing, but getting a solid number you can actually build your plan around is the goal.

The best place to start is right at the source: the official Social Security Administration (SSA) website. The SSA has a handful of online calculators that can give you a pretty good baseline estimate. To get the most out of them, you'll need a key piece of information—your spouse's complete earnings record.

Your Most Powerful Tool: The My Social Security Account

The simplest and most accurate way to get this data is for both you and your spouse to create your own my Social Security accounts. Think of this online portal as your direct connection to the SSA. It gives you access to your official statements, which list your entire earnings history and provide personalized benefit estimates for different claiming ages.

Setting up an account is straightforward, and it's a non-negotiable step for anyone serious about accurate planning. It gives you instant access to the exact numbers the SSA will use to determine your final benefits.

But a word of caution: while the online calculators are an excellent starting point, they often paint a simplified picture. They typically don’t account for the complex ways federal pensions and other income sources can interact with your Social Security.

This is especially true for federal employees. The standard SSA calculators won’t automatically factor in the Government Pension Offset (GPO) or the Windfall Elimination Provision (WEP). These provisions can dramatically reduce your final benefit amount, and an estimate that ignores them can lead to a huge—and very unwelcome—surprise in retirement.

For a deeper dive, check out our guide to Social Security claiming strategies for federal employees.

To get a truly complete view of your retirement income, you need a plan that pulls together every piece of your financial puzzle—FERS, TSP, and Social Security. Book a complimentary benefit review with us. Our team at Federal Benefits Sherpa can help you see the whole picture, ensuring your plan is built on precision, not just estimates.

Frequently Asked Questions About Spousal Benefits

Even when you've got a handle on the formulas, real-world questions always pop up when you're planning for retirement. Let's tackle some of the most common ones about claiming Social Security spousal benefits.

Can I Claim Spousal Benefits While Working?

Yes, you can, but there's a catch. If you haven't hit your Full Retirement Age (FRA) yet, your benefits will be subject to the Social Security earnings test.

For 2024, the annual income limit is $22,320. For every $2 you earn over that limit, the Social Security Administration (SSA) will temporarily hold back $1 from your benefits. Don't worry, that money isn't gone forever; the SSA re-adjusts your benefit amount once you reach FRA to credit you for those withheld payments. After you reach your FRA, the earnings test disappears completely, and you can earn as much as you want without it affecting your benefits.

Does My Spouse Have To Be Retired?

This is a big one. You can't claim spousal benefits until your spouse has officially filed for their own Social Security retirement benefits. It doesn't matter if they've reached retirement age—they have to actually start the process.

Their application is the key that unlocks your ability to claim a spousal benefit on their record. So, if your spouse decides to delay their own filing to rack up delayed retirement credits, you'll have to wait right along with them.

What Is Deemed Filing and How Does It Affect Me?

Deemed filing is a rule that essentially says when you apply for one benefit, you're applying for all benefits you're eligible for at that time. If you file for your own retirement benefit, the SSA automatically considers it an application for spousal benefits, too.

You'll simply be paid the higher of the two amounts.

This rule closed a loophole that allowed for strategies like "file and suspend," where one spouse could collect a spousal benefit while letting their own benefit grow. Now, the process is more straightforward: you apply, and the SSA gives you the biggest check you're entitled to.

If My Spouse Passes Away, Do My Spousal Benefits Continue?

No, they don't continue—they actually convert into something better. Your spousal benefits will automatically become survivor benefits.

Survivor benefits are calculated differently and are often much higher, potentially paying up to 100% of what your spouse was receiving. This is a significant jump from the 50% cap on spousal benefits and provides a more secure financial footing for the surviving partner. Beyond federal benefits, many people also need to understand state-specific financial support. For instance, you can learn more about Florida's alimony laws to see how it might fit into your overall financial picture.

At Federal Benefits Sherpa, we help you navigate these rules to create a retirement plan built on clarity and confidence. Book your complimentary 15-minute benefit review today!

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved