Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Retirement Eligibility Explained

Figuring out when you can retire from federal service can feel like trying to solve a puzzle. You have to line up the right pieces—your age, your years on the job, and which retirement system you fall under. The two big ones, FERS and CSRS, have their own unique sets of rules that determine when you can finally start drawing your well-earned pension.

Getting a handle on which system you're in and what its rules are is the absolute first step. It's the foundation for your entire retirement plan.

Decoding Your Federal Retirement Eligibility

While the maze of federal retirement rules might seem intimidating at first, it really boils down to a few core factors. Once you understand how your age and years of service work together, the whole picture becomes much less confusing. This clarity lets you plan your future with real confidence.

Think of your career as a long road trip. Retirement isn't just one single exit; it's a series of different off-ramps. Your age and service time determine which of those exits are available to you. The key is to find the one that gets you to your desired destination smoothly and on time.

The Main Pathways to Retirement

There's no single, one-size-fits-all path to retiring from the federal government. Instead, there are several distinct routes, each built for different career lengths, ages, and life situations. Knowing these options is crucial for making the right call for your future.

Here are the primary ways you can retire:

- Immediate Retirement: This is the classic path. You hit the required combination of age and years of service and can start receiving your pension payment right after you leave your job.

- Deferred Retirement: Maybe you leave federal service before you're eligible for an immediate pension but have at least 5 years of service under your belt. With this option, you can claim your pension later on, usually once you turn 62.

- Early Retirement: Sometimes, agencies need to restructure and offer what's known as Voluntary Early Retirement Authority (VERA). This lets employees hang up their hats sooner than the standard rules would allow.

- Disability Retirement: If a medical condition prevents you from providing "useful and efficient service" in your role, this option provides a way to retire and receive benefits.

Getting to know these different pathways is so important because they offer flexibility. Your retirement date isn't just one fixed point in the future; it's a series of opportunities that open up as your career progresses.

FERS Retirement Eligibility at a Glance

For most federal employees, the FERS system is what matters. To make it easier to see your options, here’s a quick summary of the most common ways to achieve immediate retirement under FERS.

| Retirement Type | Minimum Age | Minimum Years of Service | Key Feature |

|---|---|---|---|

| Voluntary | 62 | 5 | The most straightforward option for those with shorter careers. |

| Voluntary | 60 | 20 | A popular choice for long-term employees ready to retire. |

| Voluntary | MRA | 30 | The earliest full retirement option for those with long careers. |

| MRA + 10 | MRA | 10 | An early retirement option, but with a reduced pension. |

This table is just a starting point, of course. Each of these paths has specific details and implications for your final pension calculation, which we'll explore throughout this guide.

Why This Knowledge Is Power

Knowing your retirement eligibility isn't just about circling a date on the calendar. It's the bedrock of your financial future. It dictates when you can start your pension, how much you'll receive, and whether you can keep your valuable Federal Employees Health Benefits (FEHB) and Federal Employees' Group Life Insurance (FEGLI) in retirement.

If you don't have a firm grip on these rules, you could easily miscalculate your retirement date, leading to an unexpected and stressful income gap. Worse, you might leave money on the table that you were entitled to. By taking the time to understand the system now, you're empowering yourself to build the secure and comfortable retirement you've worked so hard for.

FERS and CSRS: The Two Federal Retirement Systems

Before you can even begin to think about your federal retirement eligibility, you have to answer one simple question: which system are you in? The U.S. government has operated under two completely different retirement frameworks for decades, and the rules for each are like night and day. Knowing which one covers you is the absolute first step in charting a course for your future.

I like to think of the older Civil Service Retirement System (CSRS) as a well-traveled two-lane highway. For a long time, it was the only road for federal employees. It was a straight shot, and your pension was the main destination. Simple, but it didn't offer the diversified income streams that are so crucial for a secure retirement today.

Realizing this, the government paved a new path in 1987: the Federal Employees Retirement System (FERS). This wasn't just another road; it was a modern superhighway designed with multiple lanes. FERS integrates several financial components to create a more robust retirement income, and today, it covers almost every federal employee.

What is the CSRS System?

The Civil Service Retirement System was the retirement plan for the vast majority of federal civilian employees hired before 1984. It’s a traditional pension plan, plain and simple. Your retirement benefit is a defined annuity based on a formula that considers your years of service and your "high-3" average salary.

Under CSRS, you contributed a pretty hefty chunk of your paycheck—7% for most people—into the retirement fund. A critical detail here is that CSRS employees generally don't pay Social Security taxes on their federal earnings, which means they also don't earn Social Security benefits from that service. The pension was designed to do all the heavy lifting.

The Modern FERS Framework

The switch to FERS represented a total change in philosophy. Instead of relying on a single, hefty pension, FERS is built on what experts call a "three-legged stool." The idea is to combine different income streams to give you a more stable financial footing in retirement. If your federal career started after 1983, you're almost certainly covered by FERS.

This modern system is made up of three parts working together:

- FERS Basic Benefit: This is your pension. It functions like the old CSRS annuity but is calculated with a smaller formula. Because of this, your contribution is also much lower—somewhere between 0.8% and 4.4% of your salary, depending on when you were hired.

- Social Security: Unlike your CSRS colleagues, as a FERS employee, you pay Social Security taxes just like someone in the private sector. This means you’re earning credits toward Social Security retirement (and disability) benefits, which will become a key piece of your income puzzle.

- Thrift Savings Plan (TSP): This is the government's version of a 401(k). The TSP is where you really get to take control. Your agency automatically contributes 1% of your salary to your account, even if you contribute nothing. On top of that, they'll match your own contributions up to another 4%. If you put in 5%, you get a 5% match from the government. It’s an unbeatable deal.

The core difference is diversification. While CSRS put all its eggs in one pension basket, FERS spreads the responsibility—and the income sources—across a government pension, Social Security, and your personal investments in the TSP.

This structure gives you more direct control over your financial future, but it also means you have a greater responsibility to save and invest wisely through your TSP. Ultimately, your federal retirement eligibility rules are tied directly to which of these two systems you fall under, affecting everything from when you can retire to how your final annuity is calculated. Knowing your system isn't just important—it's everything.

Your Key Numbers: Age and Service Requirements

Think of qualifying for federal retirement like opening a combination lock. You need the right numbers, in the right order, for the tumblers to click into place. For federal employees, those two magic numbers are your age and your years of creditable service. When they line up according to the FERS rules, the door to retirement swings open.

Getting a handle on these key pairings is the most straightforward way to map out your own retirement timeline.

This isn't just about government regulations; it's about a massive, real-world trend. The federal workforce is getting older, which has huge implications for retirement planning. As of September 2024, a staggering 28% of the 2.1 million permanent federal employees were 55 or older. That's a huge portion of the workforce nearing eligibility.

Interestingly, the average retirement age has crept up to 62.3, which tells us many feds are working longer to hit those crucial age and service milestones. You can dig deeper into these federal workforce age trends on USAFacts.org.

Defining Your Minimum Retirement Age

One of the most foundational concepts you need to grasp is your Minimum Retirement Age (MRA). Don't think of it as a single, fixed number like 65. Instead, your MRA is on a sliding scale that depends entirely on the year you were born. It’s the absolute earliest you can retire and receive a full, unreduced pension—if you have enough years of service to go with it.

For most people planning their exit, the MRA is the first number they circle on the calendar.

- Born Before 1948: Your MRA is 55.

- Born in 1953 through 1964: Your MRA is 56.

- Born in 1970 or Later: Your MRA is 57.

If your birth year falls between those benchmarks, the MRA goes up by two months for each year. For instance, a 1965 birth year gives you an MRA of 56 and 2 months. Pinpointing your exact MRA is the essential first step.

The Three Main FERS Retirement Scenarios

Once you know your MRA, you can see where it fits within the three primary paths to an immediate, unreduced FERS retirement. Most federal employees are aiming for one of these combinations.

Key Insight: These aren't just guidelines—they are hard-and-fast rules. If you miss one of the requirements by even a single day of age or a month of service, you simply aren't eligible for that particular retirement option yet.

Let's walk through each one.

Scenario 1: MRA with 30 Years of Service

This is the classic path for career federal employees. It's the "gold standard" that lets you retire as early as your MRA, which could be 55, as long as you've put in at least 30 years of creditable service.

- Example: Let's meet David, who was born in 1968. His MRA is 56 and 8 months. He started his federal career at 25 and has now logged 31 years of service. Since he's met both his MRA and the 30-year service mark, David is eligible for an immediate, unreduced pension.

Scenario 2: Age 60 with 20 Years of Service

This option is a great fit for people who started their federal careers a little later. If you have at least 20 years of creditable service, you can hang up your hat with a full pension the day you turn 60.

- Example: Consider Maria, who joined the government at age 40. She’s now turning 60 and just celebrated her 20-year service anniversary. Because she meets both the age and service thresholds, she can retire immediately with her full FERS benefits.

Scenario 3: Age 62 with 5 Years of Service

The third pathway provides an option for those with shorter federal careers. As long as you have a minimum of 5 years of creditable service, you become eligible for a full pension once you hit age 62.

- Example: Take Robert, who worked in the private sector before becoming a federal employee at 55. He is now 62 and has 7 years of service under his belt. He officially meets the requirements for an immediate, unreduced pension.

Calculating Your Creditable Service

So, what exactly counts as "creditable service"? For most, it's pretty simple: it's the time you've spent as a permanent federal civilian employee.

But other types of service can often be counted toward your total, provided you take the right steps to make them official.

- Military Service: Your time on active duty doesn't count automatically. You have to formally "buy back" that time by making a deposit to have it added to your civilian service record.

- Temporary or Seasonal Work: In some cases, time spent in non-permanent federal jobs can be credited if you eventually become a permanent employee and make a deposit to cover that period.

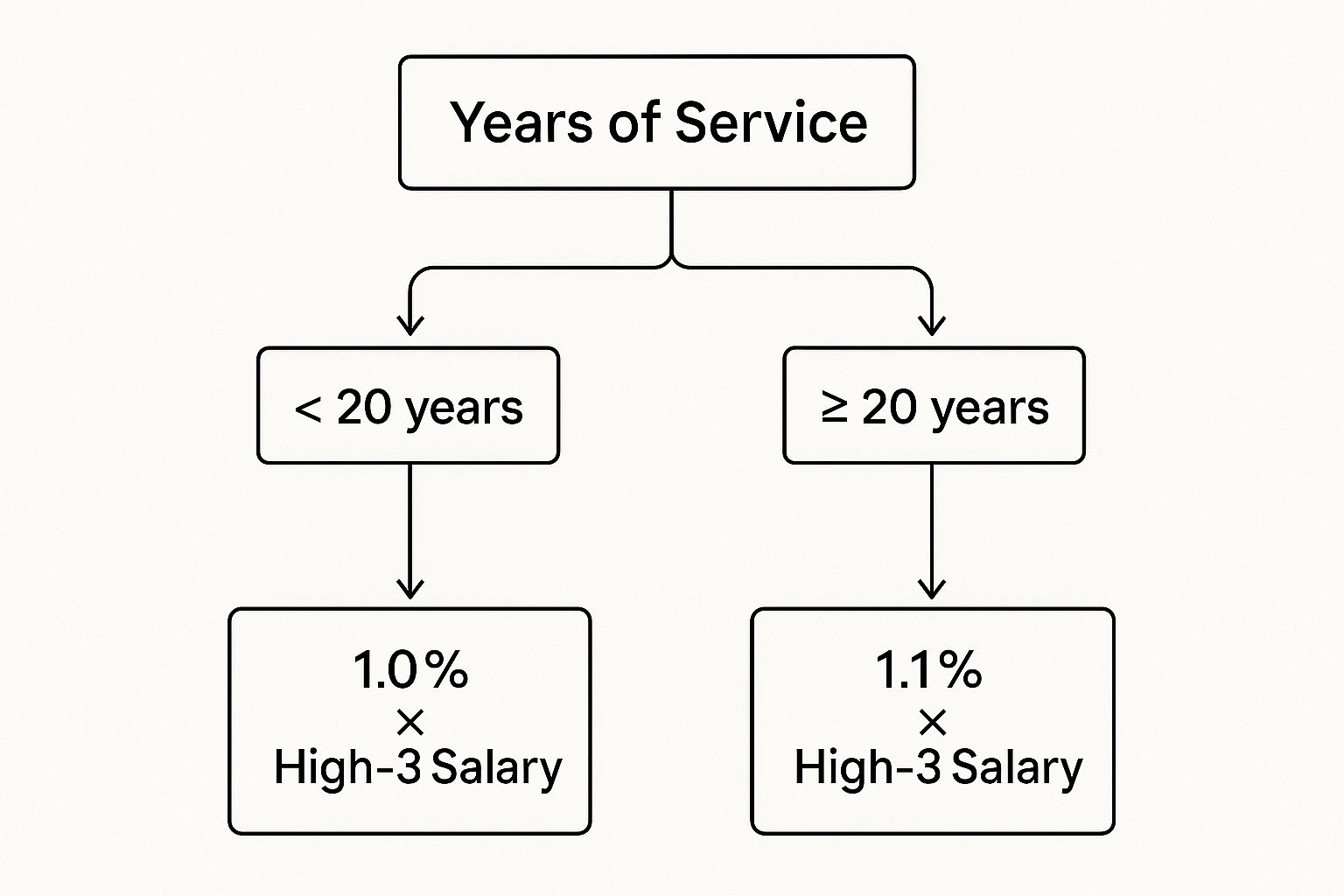

This decision tree visualizes how your years of service play a critical role in your final pension calculation.

As you can see, hitting at least 20 years of service and waiting to retire until age 62 or later is a game-changer. It bumps your pension multiplier from 1.0% to 1.1%—giving you a permanent 10% boost to your annual pension for the rest of your life.

Navigating Special and Early Retirement Provisions

While the standard retirement paths offer a clear finish line, what happens if your career journey needs an earlier off-ramp? The federal system has several special provisions that act as alternate routes, designed for unique situations like agency reorganizations or personal health challenges.

Getting a handle on these options is crucial for anyone serious about retirement planning. They offer a ton of flexibility but often come with trade-offs that can affect your finances for decades. Knowing the rules of these less-traveled paths ensures you're making a fully informed decision, not just a convenient one.

The MRA+10 Early Retirement Option

Let’s say you’ve hit your Minimum Retirement Age (MRA) and have somewhere between 10 and 29 years of service. You're getting close, but you don't quite have the 30 years needed for a full, unreduced retirement. This is the exact scenario the MRA+10 provision was made for—think of it as an early access pass to your FERS pension.

But be warned, this convenience comes at a steep price. If you retire under this rule and start drawing your annuity before you turn 62, your pension gets hit with a permanent reduction. The penalty is a hefty 5% for every single year you are under age 62.

It’s a pretty straightforward calculation, but the impact is huge. Imagine your MRA is 57 and you decide to retire. You’re five years shy of 62, which means your pension will be permanently slashed by 25% (5 years x 5%). That’s a massive trade-off between getting income now versus having a much larger benefit for the rest of your life.

You do have another move, though. You can postpone when you start receiving your annuity to lessen or even eliminate the penalty. If you retire at 57 but wait until you turn 60 to start your payments, the reduction drops to just 10% (2 years x 5%).

Standard vs. MRA+10 Retirement Comparison

To really see the difference, let’s compare a standard retirement against an MRA+10 retirement. The numbers below highlight the long-term financial consequences of that early pension reduction.

| Feature | Standard Retirement (e.g., Age 62+5) | MRA+10 Retirement |

|---|---|---|

| Eligibility | Age 62 with 5+ years of service | Reach MRA with 10-29 years of service |

| Annuity Calculation | 1% of High-3 Salary | 1% of High-3 Salary |

| Pension Reduction | None. You receive the full, unreduced amount. | 5% reduction for each year under age 62. |

| Financial Impact | Higher lifetime income and greater financial security. | Significantly lower monthly and lifetime income. |

| Best For | Employees who can work until full eligibility. | Employees needing to leave federal service early. |

The choice often comes down to immediate need versus long-term financial health. While MRA+10 provides a valuable option, waiting for a standard, unreduced retirement almost always puts you in a stronger financial position.

Early Optional Retirement Opportunities

Every so often, a federal agency needs to downsize, restructure, or just plain trim its workforce. When that happens, they can get permission from the Office of Personnel Management (OPM) to offer a Voluntary Early Retirement Authority (VERA), which most feds simply call an "early out."

This isn't a permanent program; it's a specific management tool used for a limited time to meet a specific goal. To be eligible, you generally need to meet one of two conditions:

- Be at least age 50 with 20 years of creditable service.

- Have 25 years of service at any age.

What makes a VERA so appealing? Unlike the MRA+10 option, an annuity under an "early out" is not reduced. Your pension is calculated as if you had met the standard retirement age and service requirements, making it a fantastic deal if your agency offers it and you're ready to go.

When Health Prevents You from Working

Life is unpredictable. If a medical condition—whether physical or mental—makes it impossible for you to perform your job duties efficiently, you may be eligible for Disability Retirement. This is an absolutely essential safety net for employees who can no longer work.

Under the FERS system, the main requirement is that you must have at least 18 months of creditable civilian service. Your disability must be expected to last for at least a year, and your agency has to certify that it can't accommodate your condition or find another vacant position for you at the same pay grade. The application process is rigorous and requires detailed medical documentation.

Deferred Retirement for Former Employees

What if you leave federal service before you're eligible to retire? If you have at least five years of creditable service, you don't walk away with nothing. Your pension isn't lost—it's just waiting for you. This is called a Deferred Retirement.

You can apply to start collecting this earned pension once you reach a certain age, which is typically age 62. The annuity will be calculated based on your high-3 salary and service time from when you left. There is, however, one major catch: you generally lose the ability to carry your Federal Employees Health Benefits (FEHB) into retirement with a deferred annuity. For many federal employees, keeping those world-class benefits is a top priority, a goal you can learn more about at Federal Benefits Sherpa.

The FERS Annuity Supplement Explained

So, you're planning to retire before you're eligible for Social Security. That common scenario can create a tricky income gap, leaving you with less cash flow than you expected for a few years. Thankfully, the Federal Employees Retirement System (FERS) has a built-in solution for this exact problem: the FERS Annuity Supplement.

Think of it as a temporary bridge payment. It's specifically designed to approximate the Social Security benefit you earned while working under FERS, giving you an extra income stream from the day you retire until you hit age 62. At that point, the supplement stops, and you become eligible to start drawing your actual Social Security.

This supplement is easily one of the most valuable—and most frequently misunderstood—perks of the FERS system, especially for those aiming for an early retirement.

Who Actually Qualifies for the Supplement?

Not every federal retiree gets this benefit. It’s not automatic. Eligibility is tightly linked to your specific retirement path and is really reserved for those who put in a full career and retire before they turn 62.

Generally, you're in line for the FERS Annuity Supplement if you retire with an immediate, unreduced pension in one of these situations:

- You retire at your Minimum Retirement Age (MRA) with 30 or more years of service.

- You retire at age 60 with 20 or more years of service.

- You take an early optional retirement (VERA) offered by your agency.

Crucial Takeaway: If you retire under the MRA+10 provision, you are not eligible for the annuity supplement. This is a massive trade-off to consider, as that "early out" comes with a reduced pension and no supplement to bridge the gap.

How the Math Works

The calculation for the supplement can seem a bit convoluted, but the core idea is straightforward. The goal is to estimate the portion of your Social Security benefit that you earned specifically during your years as a FERS employee. It completely ignores any Social Security credits you might have from private-sector jobs or military service.

Here's a simplified look at the formula:

- Estimate Your Social Security Benefit at Age 62: The Social Security Administration provides an estimate of what your full benefit would be if you started drawing at age 62.

- Figure Out Your Service Ratio: This is your total years of creditable FERS service divided by the number 40. Why 40? It represents a standard working lifetime in the eyes of Social Security. For someone with 30 years of service, the ratio would be 30/40, or 0.75.

- Calculate the Supplement: Multiply your estimated Social Security benefit by that service ratio.

Let’s use an example. If your estimated age-62 Social Security benefit was $2,000 per month and you put in 30 years of FERS service, your supplement would be around $1,500 per month ($2,000 x 0.75).

The Big Catch: The Earnings Test

Now for the part that trips a lot of people up. The annuity supplement is subject to an earnings test, the very same one that applies to Social Security benefits. This means if you leave federal service and take on another job, your supplement payments can be reduced or even completely eliminated.

For 2024, the earnings limit is $22,320. For every $2 you earn over that limit, your supplement is cut by $1. If you earn enough from a post-retirement job, you could wipe out the entire supplement for that year. This is a critical detail for anyone planning on a second career after retiring from their federal post.

This supplement is a key part of federal retirement eligibility planning for many. The FERS supplement, bridging the income gap for retirees under 62, currently averages about $18,000 annually. Around 21,000 new annuitants begin receiving it each year, but legislative proposals are considering its elimination for new retirees starting in 2028. You can learn more about the latest federal retirement numbers and projections.

How the World Outside Can Change Your Retirement Clock

Figuring out your retirement eligibility is one thing; deciding when to actually pull the trigger is another beast entirely. While the age and service rules are set in stone, your personal timeline can be seriously swayed by forces completely outside of your control. These are the real-world pressures that can turn "someday" into "right now."

Think of your retirement eligibility as having a fully packed car, gassed up and ready for a cross-country trip. You might have a departure date circled on the calendar, but if you hear a massive blizzard is forecast to hit the day after, you might just decide to leave a little earlier. That's exactly how external factors work with your federal retirement—they can make you want to hit the road sooner than you planned.

The Power of Policy and Economic Rumors

Nothing gets the federal grapevine buzzing like talk of new legislation, budget cuts, or a shaky economy. Even whispers of potential changes to your benefits—like tweaking how your pension is calculated or raising your health insurance costs in retirement—can send shockwaves through the workforce.

When federal employees sense that the benefits they’ve earned might be less generous tomorrow, a powerful instinct kicks in. It’s a classic “use it or lose it” scenario. Why wait and risk getting less when you can retire now and lock in the benefits you were promised under the current system?

This isn't just a hunch; we see it happen time and again. Uncertainty is a massive motivator. When the future feels unstable, federal employees often choose the security of retiring today over the gamble of waiting to see what happens.

The proof is in the numbers. Retirement application rates often jump dramatically whenever there's a big debate in Congress or a new policy floating around that could affect federal retirement eligibility. Take the numbers from mid-2025, for example. By the end of June, the Office of Personnel Management (OPM) had already received 70,351 retirement applications.

That’s a huge leap—almost a 40% increase from the 50,305 applications they saw during the same timeframe in 2024. Many experts believe this spike was a direct reaction from employees trying to get ahead of potential benefit changes. You can read a deeper analysis on why federal retirements are spiking on GovExec.com.

Your Best Defense? Staying in the Know.

You can't control what happens in Washington, but you can control how you prepare for it. A solid retirement plan needs to be built on the official rules but also flexible enough to bend when these outside pressures start to build.

Here are a few simple ways to keep your finger on the pulse:

- Follow Federal News: Keep up with trusted sources that report specifically on issues affecting the federal workforce.

- Check OPM Updates: The Office of Personnel Management is the official source for any rule changes. If it's real, you'll see it there.

- Talk to an Expert: A financial professional who lives and breathes federal benefits can help you cut through the noise and make smart choices based on what's actually happening, not just what might happen.

At the end of the day, you're the one who decides when to retire. But making that call with a clear view of both the rulebook and the road ahead is what turns a good retirement into a great one.

Common Questions About Federal Retirement

When you start digging into federal retirement rules, you'll quickly find that your own situation rarely fits neatly into a textbook example. What if you served in the military? What if you left your federal job for a few years? These are the kinds of real-world questions that pop up all the time.

Let's tackle some of the most common ones. Getting these details right is more than just checking a box; a small misunderstanding can have a huge impact on when you can retire and how much you'll have to live on.

Can I Count Military Service Toward Federal Retirement?

Absolutely. But it’s not automatic. You have to take a specific step to get credit for your active-duty military time. It’s a process called making a "military service credit deposit."

Think of it as "buying back" your military years so they officially count toward your civilian retirement. You'll pay a deposit, which is usually a small percentage of your military base pay plus any interest it’s accrued. Making this deposit is one of the smartest moves you can make—it adds directly to your years of service, which can help you retire sooner and, just as importantly, will increase your final pension amount.

What Happens If I Leave Federal Service Before Retiring?

Let's say you leave your federal career before you’re old enough to retire, but you already have at least five years of service under your belt. You don't lose everything you've worked for. You have a couple of options.

The most popular choice is a deferred retirement. This means you can wait and start collecting your pension later on, typically once you turn 62. The pension amount is calculated based on your service time and high-3 salary from when you left. The biggest catch? You usually can't keep your Federal Employees Health Benefits (FEHB) in retirement if you go this route.

Alternatively, you could ask for a refund of all your retirement contributions. This gives you a lump sum of cash, but it’s a permanent decision. Taking a refund means you give up your right to any future pension from that service, forever.

Key Takeaway: Leaving federal service early doesn't mean your pension vanishes. A deferred retirement puts it on hold for you, while a refund cashes you out completely.

How Does Part-Time Service Affect My Retirement?

Working part-time has a unique, two-part impact on your retirement.

First, when it comes to meeting your eligibility requirements (like hitting the 5, 20, or 30-year marks), a year is a year. It doesn't matter if you worked 20 hours a week or 40—that full year counts toward your service total for eligibility.

But when it's time to calculate the amount of your pension, things change. The Office of Personnel Management (OPM) will prorate your benefit. They figure out what your pension would have been if you’d worked full-time your whole career and then reduce it based on the proportion of part-time hours you actually worked. So, part-time work gets you to the retirement finish line, but it does mean your monthly check will be smaller.

Planning for retirement can feel overwhelming, but you don't have to do it alone. At Federal Benefits Sherpa, we specialize in helping federal employees make sense of their benefits to build a secure future. Schedule your free 15-minute benefit review today at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved