Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Health Insurance Options Guide

Trying to figure out federal health insurance options can feel a bit like decoding a complex map. You have different paths for different people, and knowing which one is yours is the first step. This guide is designed to be your compass, breaking down the main routes: FEHB for employees, Medicare for retirees, and Medicaid for those with lower incomes.

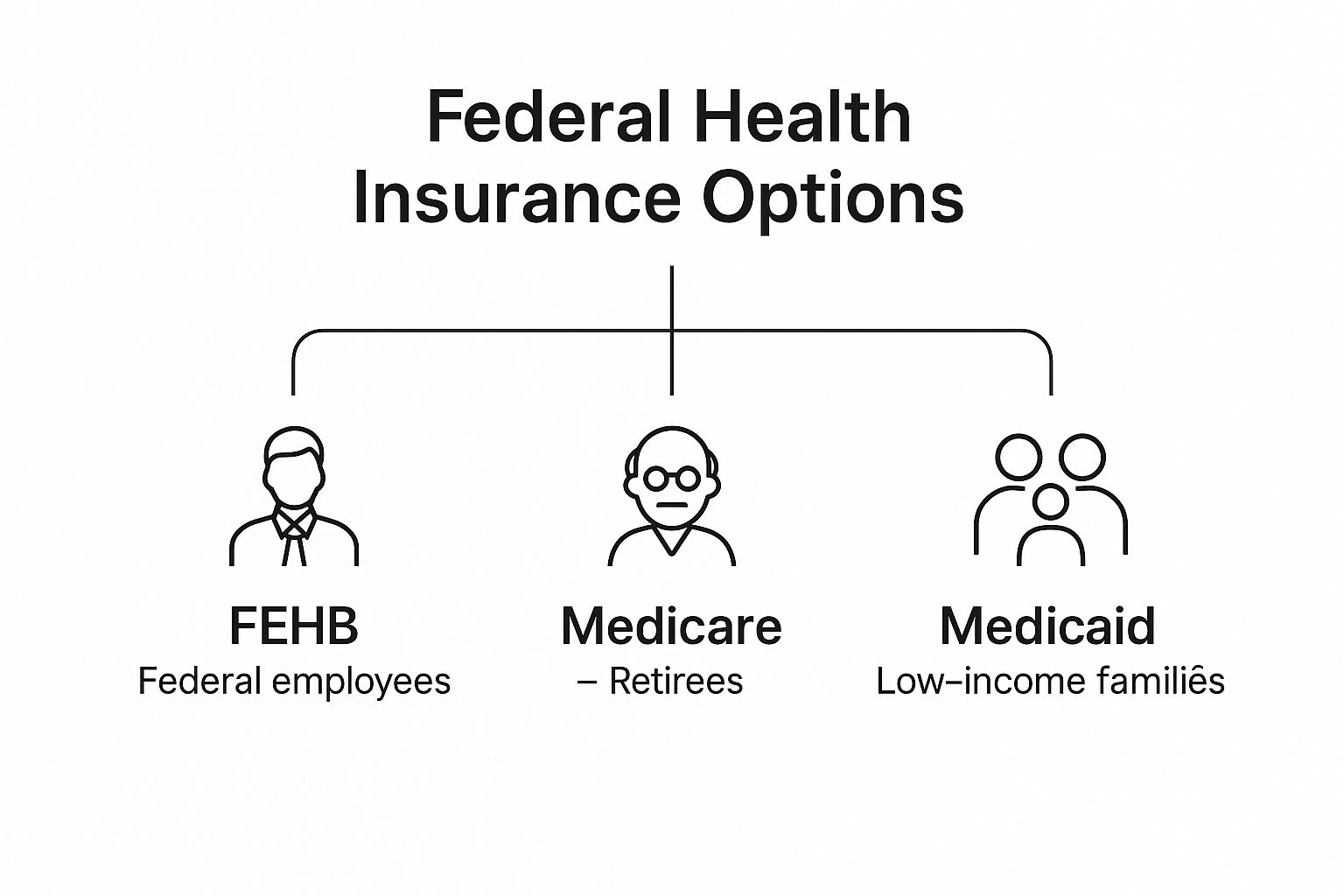

Mapping Your Federal Health Insurance Options

Think of each federal health insurance program as being built for a specific group of people at different stages of their lives. Once you figure out which group you fall into, everything else starts to click into place. We’ll kick things off with a high-level overview of the major programs to help you quickly see where you fit.

This is a big deal. The global health insurance market was valued at an eye-watering $2.3 trillion in 2023, and government programs are a huge piece of that puzzle. Here in the U.S., federal plans like Medicare and Medicaid provide coverage for roughly a quarter of the entire population, making them a cornerstone of the country's healthcare system. If you're interested in the numbers, you can learn more about these health insurance coverage statistics to see the broader context.

The Main Health Coverage Routes

To cut through the confusion, let’s categorize the options based on who they're designed to help. Each program comes with its own set of rules for eligibility, costs, and benefits, all tailored for its specific audience.

Here’s a simple look at the core federal health insurance programs.

As you can see, the system branches out to cover distinct groups: people currently working for the government, those who have retired, and individuals and families who meet certain income requirements.

Why This Matters for You

Picking the right health plan is about more than just dodging hefty medical bills. It’s about making sure you can get the care you need, right when you need it. A plan that lines up with your life stage and budget offers genuine peace of mind.

Understanding your options is the first and most critical step toward making an informed decision. The differences between these programs are significant, and selecting the wrong one can lead to coverage gaps or unnecessary expenses.

In the next few sections, we'll dive deep into each of these major federal health insurance options. We’ll break down who qualifies, what’s covered, and how the enrollment process works, giving you the clarity you need to choose the best possible plan for you and your family.

Getting to Know the Federal Employees Health Benefits (FEHB) Program

If you're a federal employee or retiree, the Federal Employees Health Benefits (FEHB) program is your go-to for health coverage. It's not a single insurance plan but a massive marketplace of private insurance carriers, all competing for your business under one umbrella. This is what really sets FEHB apart from other federal health insurance options—you get incredible choice, and the government picks up a big chunk of the bill.

You're not stuck with a one-size-fits-all plan. Instead, you get to shop around for different plan types, like Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs), to find the perfect fit for your family's health needs and your wallet.

Your Coverage Choices: Self, Self Plus One, or Family?

When you enroll in FEHB, you'll need to pick an enrollment tier. Getting this right is key to making sure your loved ones are covered without you paying for more than you need.

- Self Only: Just what it sounds like. This covers you and only you.

- Self Plus One: This is for you and one eligible family member, like your spouse or a child.

- Self and Family: This tier covers you, your spouse, and all eligible children under your roof.

A common question is when to choose "Self Plus One" versus "Self and Family." The math is simple: if you're covering yourself and just one other person, "Self Plus One" is almost always cheaper. But the moment you need to cover two or more family members, "Self and Family" becomes the right and necessary choice.

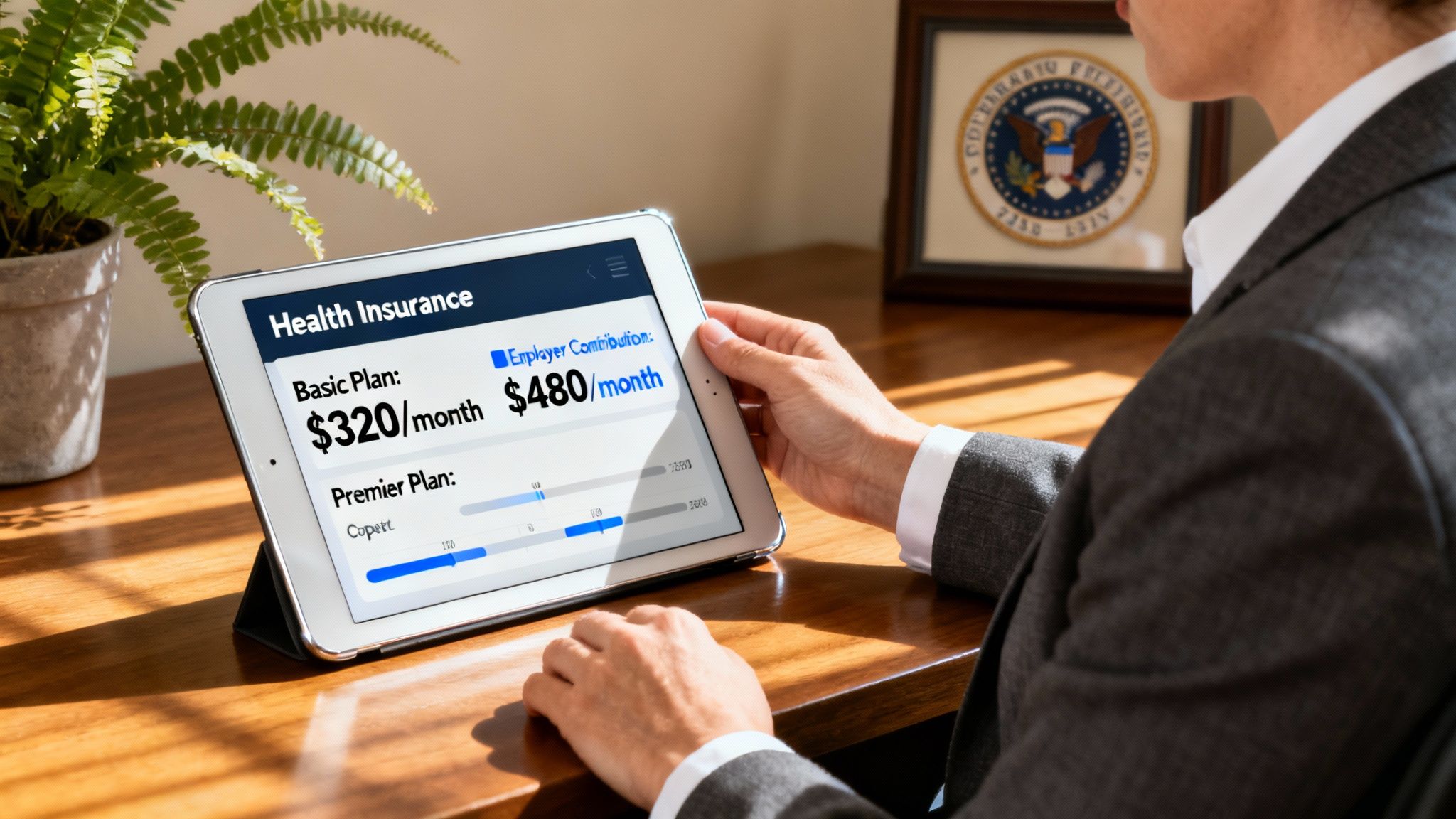

How the Government Helps Pay Your Premiums

Here's the best part of the FEHB program: the government subsidy. A significant portion of your premium is paid by the government, which makes your share much more manageable.

The government pays up to 72% of the weighted average premium of all plans in the FEHB program. This cost-sharing makes top-tier health insurance far more affordable than what most people can find in the private sector.

This government contribution has a direct, positive impact on your take-home pay. For instance, in 2025, the maximum bi-weekly government contribution toward family plans can be as high as $714.23. That’s a huge savings. To see how it all works for your specific situation, it's worth taking a look at the official 2025 premium rates to see how the numbers add up.

To help you sort through the options, here's a quick breakdown of the most common plan types you'll encounter.

FEHB Plan Types At a Glance

| Plan Type | Primary Feature | Best For | Cost Structure |

|---|---|---|---|

| PPO (Preferred Provider Org) | Flexibility to see in-network and out-of-network doctors | People who want choice and don't mind paying more for out-of-network care | Higher premiums, deductibles, and co-pays for out-of-network services |

| HMO (Health Maintenance Org) | Coordinated care within a specific network of doctors | Individuals who are comfortable using a specific network and want lower costs | Lower premiums, often no deductible, but requires referrals from a Primary Care Physician |

| HDHP (High Deductible Health Plan) | Low premiums paired with a Health Savings Account (HSA) | Healthy individuals who want to save for future medical costs tax-free | Low premiums but a high deductible that must be met before insurance pays |

| FFS (Fee-for-Service) | Maximum freedom to choose any licensed provider or hospital | Those who need ultimate flexibility and are willing to manage claims and higher costs | You pay a percentage of the bill (coinsurance) after meeting a deductible |

Each of these plan types comes with its own trade-offs between cost and flexibility.

Every year during Open Season, you get a chance to review all of these federal health insurance options. It's the perfect time to compare your current plan's premium against its deductible, out-of-pocket maximums, and doctor network. A quick yearly check-up on your plan ensures it’s still the best one for your family as life changes.

Understanding Medicare for Retirement and Beyond

As retirement gets closer, your healthcare needs will naturally shift, and that's when Medicare usually enters the conversation. It’s the bedrock of healthcare coverage for most Americans aged 65 and over. While you can, and many federal employees do, keep your FEHB plan in retirement, figuring out how the two work together is the key to getting the most out of your benefits without overpaying.

Getting a handle on Medicare can feel like trying to decipher a secret code. You’ve got Part A, Part B, Part C, and Part D. Let's break down this alphabet soup so you know exactly what you're looking at.

The Four Main Parts of Medicare

Think of each part of Medicare as a different puzzle piece, each covering a specific area of your healthcare. When you put them together, they form a pretty solid safety net.

Part A (Hospital Insurance): This is your coverage for the big stuff—inpatient hospital stays, skilled nursing facility care, hospice, and certain home health services. The good news? Most people get Part A premium-free because they've paid Medicare taxes throughout their careers.

Part B (Medical Insurance): This covers your more routine medical care. Think doctor's appointments, outpatient services, necessary medical supplies, and preventive care. You'll pay a monthly premium for this coverage.

Part D (Prescription Drug Coverage): Just like it sounds, this part helps you pay for your prescription medications. These plans aren't run by the government directly but by private insurance companies that have Medicare's stamp of approval.

Part C (Medicare Advantage): This is a different path you can take. It’s an "all-in-one" package offered by private companies that bundles Parts A and B. Most of these plans also include Part D prescription drug coverage and may even throw in extras like dental or vision benefits.

The official Medicare.gov website is your best starting point for digging into these federal health insurance options.

As you can see, the site is designed to get you straight to what you need: signing up, finding plans, and figuring out costs. It's truly the central hub for making these important decisions.

How Medicare and FEHB Work Together

For federal retirees, it's rarely a matter of choosing between FEHB and Medicare. The real strategy lies in making them work as a team.

Once you have both, Medicare almost always steps into the role of primary insurer. This means it gets the bill first and pays its share. Your FEHB plan then comes in as the secondary insurer to help cover what Medicare didn't, like deductibles, copayments, and other gaps.

A lot of federal retirees discover that enrolling in Medicare Part A and Part B while holding onto their FEHB plan creates fantastic, wrap-around coverage. This one-two punch can dramatically lower what you pay out-of-pocket for medical care in retirement.

Timing your enrollment is absolutely crucial. Your Initial Enrollment Period for Medicare typically begins three months before your 65th birthday and ends three months after. If you miss that window, you could get hit with late enrollment penalties that stick with you for life. Planning this transition is a major step toward a financially secure retirement.

A Look at Medicaid and CHIP for Families

Beyond health plans connected to a job or retirement, there are a couple of crucial federal programs that serve as a lifeline for millions. Medicaid and the Children's Health Insurance Program (CHIP) are foundational programs that offer free or low-cost health coverage to those who need it most: low-income adults, kids, pregnant women, seniors, and people with disabilities.

It helps to think of these programs as a partnership between the federal government and each state. The federal government sets the ground rules and provides a big chunk of the funding, but each state runs its own version of Medicaid and CHIP. Because of this state-level management, the exact eligibility rules and what's covered can really differ depending on where you call home.

Who Is Eligible for Medicaid and CHIP?

At its core, eligibility for both Medicaid and CHIP hinges on your income, specifically your Modified Adjusted Gross Income (MAGI). This is basically your household's taxable income, plus or minus a few specific things. The income cutoffs are based on the Federal Poverty Level (FPL) and are set by each individual state.

This means a pregnant woman, for example, might qualify with a higher income than a single adult without kids. The whole system is designed to catch those who might otherwise fall through the cracks, making sure that a low income doesn't stand in the way of getting necessary medical care.

These programs aren't just numbers on a spreadsheet; they are a genuine safety net. They're the reason kids get their well-child checkups, expecting mothers receive proper prenatal care, and adults with ongoing health issues can stay on top of their treatments.

As a massive federal-state effort, Medicaid and CHIP are huge. Based on early 2025 data, these two programs cover roughly 44.1 million Americans. That number alone shows just how vital they are to the country's public health system. If you want to dig into the numbers yourself, you can explore the government's performance plan for a more detailed breakdown.

What Do These Programs Actually Cover?

While the specifics can change from one state to another, federal law mandates that all state Medicaid programs have to cover a core set of essential services. This creates a solid baseline of care you can expect, no matter which state you live in.

These foundational benefits almost always include:

- Doctor and hospital visits for everything from a routine checkup to an emergency room visit.

- Preventive care for children, like immunizations and regular developmental screenings.

- Lab work and X-ray services needed for proper diagnosis.

- Family planning services to support reproductive health choices.

- Transportation to medical appointments, which helps remove a major obstacle for many people.

On top of these required services, many states go further by offering optional benefits like prescription drug coverage, dental care, and vision, rounding out the health coverage for their residents.

Using the ACA Marketplace for Individual Coverage

If you don't get health insurance through a job, the Affordable Care Act (ACA) Marketplace is one of the most important federal health insurance options you should know about. Think of it as a centralized online shop where you can compare and buy health plans from private insurance companies.

The whole point of the ACA Marketplace, which you'll find at HealthCare.gov, is to make getting individual health coverage simpler and more affordable. It’s the go-to place for individuals and families to browse plans, figure out if they qualify for financial help, and sign up for a policy that actually works for them.

Making Coverage Affordable with Financial Help

One of the biggest features of the Marketplace is how it helps lower costs for people who qualify. This financial assistance comes in two main flavors, both designed to take some of the sting out of paying for health insurance.

- Premium Tax Credits: This is a subsidy that cuts down your monthly insurance bill (your premium). The amount of help you get is tied to your estimated household income for the year.

- Cost-Sharing Reductions (CSRs): These are extra savings that reduce what you pay out-of-pocket when you actually go to the doctor, like your deductible, copayments, and coinsurance. The catch? You have to enroll in a Silver-level plan to get these.

For millions of Americans, these subsidies are a lifeline. They're often the deciding factor that makes getting solid health coverage possible, preventing people from being priced out of the market entirely.

Understanding the Metal Tiers

When you start shopping on the Marketplace, you'll see plans grouped into four "metal" tiers: Bronze, Silver, Gold, and Platinum. Don't mistake these for quality ratings—they have nothing to do with the quality of care. Instead, they tell you how you and your insurance plan will split the costs.

The metal tiers represent a trade-off between your monthly premium and your out-of-pocket expenses. Choosing the right one depends entirely on your health needs and your budget.

Here's a simple way to think about them:

- Bronze: You'll pay the lowest monthly premium, but you'll also have the highest costs when you need care.

- Silver: This is the middle ground, with moderate monthly premiums and moderate costs for care. Crucially, it's the only tier where you can get Cost-Sharing Reductions.

- Gold: Expect a high monthly premium, but you'll pay low costs when you see a doctor or get services.

- Platinum: This tier has the highest monthly premium, but in return, you'll have the lowest costs when you receive care.

So, a healthy person who rarely sees a doctor might find a Bronze plan to be a perfect fit. On the other hand, someone managing a chronic condition with regular appointments would probably save money in the long run with a Gold or Platinum plan.

When Can You Enroll?

You can't just sign up for a Marketplace plan whenever the mood strikes. Enrollment happens during specific times. The main window is the Open Enrollment Period, which rolls around every year, usually in the fall.

But life happens. Big events—like losing your health coverage from a job, getting married, having a baby, or even moving—can trigger a Special Enrollment Period (SEP). This gives you a 60-day window outside of the main Open Enrollment to get into a new plan, so you aren't left without coverage when you need it most.

How to Choose Your Best Federal Health Plan

Knowing your federal health insurance options is one thing, but now for the hard part: picking the right one. The secret is that there's no single "best" plan. The best plan is the one that fits your life, your family, and your budget.

Think of it like shopping for a car. You wouldn't just buy the cheapest one on the lot. You'd consider your commute, your family size, and what you can truly afford in monthly payments and potential repair bills. A plan with a low premium might look great on paper, but it could hit you with surprisingly high costs if you actually need to use it.

Assess Your Family's Health Needs

Before you even glance at a plan brochure, take an honest look at your family's health over the last year. This isn't the time for wishful thinking; your past usage is the most reliable predictor of your future needs. Pull up your records and get specific.

- Doctor Visits: How many times did everyone in your family go for a check-up, a sick visit, or a follow-up? Tally it up.

- Prescriptions: Does anyone take medication regularly? List every single one, as a plan’s drug coverage can make or break your budget.

- Specialist Care: Do you see a specialist regularly, or do you expect to need one—like an allergist or a physical therapist—in the next year?

- Major Life Events: Is a baby on the way? Is a planned surgery finally on the calendar? These big-ticket events will have a huge impact on your choice.

Answering these questions gives you a clear, personalized health profile. This profile becomes the lens through which you'll evaluate every single plan.

Your goal is to find the perfect marriage between your family’s health profile and a plan’s financial structure. A family with young kids and frequent ear infections might thrive with a low-deductible plan, while a young, healthy single person might save a bundle with a high-deductible option.

Compare Key Financial Metrics

With your health profile in hand, it's time to crunch the numbers. Don't get lost in the sea of details. Instead, zero in on the three financial figures that will have the biggest impact on your wallet.

For every plan you consider, find these three numbers:

- Premium: This is the non-negotiable amount deducted from your paycheck to keep your coverage active.

- Deductible: Think of this as the amount you have to "unlock" by paying out-of-pocket before the insurance company starts paying its share for most services.

- Out-of-Pocket Maximum: This is your financial safety net. It’s the absolute most you will pay for covered medical care in a single year, no matter what happens.

When you hold these numbers up against your family's health needs, the best choice often becomes surprisingly clear.

A Few Common Questions About Federal Health Plans

It's one thing to understand the plans on paper, but real life always brings up specific questions, especially when things don't go exactly as planned. Let's tackle a few of the most common scenarios federal employees ask about.

For starters, what if you and your spouse are both feds? It's a great question. You don't need to double-up on family plans. You could each grab a "Self Only" plan, but it’s almost always cheaper for one of you to enroll in a "Self and Family" or "Self Plus One" plan that covers you both.

What Happens If My Situation Changes Mid-Year?

The annual Open Season is the main event for changing your health plan, but life doesn't always wait for a specific time of year. That's where a Qualifying Life Event, or QLE, comes in.

A QLE is a major life change that lets you adjust your health insurance outside of the normal Open Season window. When one of these events happens, it kicks off a Special Enrollment Period, giving you a chance—usually 30 to 60 days—to make the necessary updates to your coverage.

What counts as a QLE? Here are the big ones:

- Getting married or divorced: This allows you to add a new spouse or remove a former one.

- A new child enters the family: Whether by birth or adoption, you can add your new dependent.

- Losing other health insurance: If you or a family member involuntarily lose coverage from another job or plan, you can enroll in FEHB.

- Your employment status changes: Moving from a non-eligible position to one that qualifies for benefits is a classic example.

Think of a QLE as a special permission slip. It’s the system’s way of acknowledging that life happens, ensuring your health plan can keep up with your family's needs without making you wait until November.

Can I Keep My Federal Health Insurance in Retirement?

Absolutely, and this is easily one of the most valuable benefits of a federal career. You can carry your FEHB coverage right into retirement, but there's a key requirement you have to meet.

It's called the "five-year rule." To be eligible, you must have been continuously covered by an FEHB plan for the five years of service immediately before you retire. You can't just sign up a year before you leave and expect to keep it.

This incredible benefit allows retirees to maintain top-notch health insurance, which works beautifully alongside Medicare to create a comprehensive safety net for the rest of their lives.

Making sense of these rules is the key to a secure future. Federal Benefits Sherpa provides one-on-one guidance to help you see your options clearly and plan for a retirement without financial stress. You can schedule your free 15-minute benefit review to get started.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved