Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Employee Social Security Your Ultimate Guide

Trying to figure out how Social Security fits into your federal retirement can feel like you've been handed a puzzle with half the pieces missing. It’s confusing, and the stakes are high.

This guide is designed to give you those missing pieces. We’ll walk through the critical differences between the FERS and CSRS retirement systems and clarify how each one connects with your Social Security benefits. We'll also demystify intimidating topics like the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

The goal here isn't just to throw information at you. It's to give you a clear roadmap so you can confidently make the strategic decisions that will shape the retirement you've worked so hard to earn.

Your Roadmap to Federal Retirement and Social Security

The first and most important question for any federal employee is this: which retirement system are you in? Your entire Social Security picture—how much you get, and when—depends on whether you're covered by the Federal Employees Retirement System (FERS) or the older Civil Service Retirement System (CSRS).

These two systems couldn't be more different. FERS, which covers almost everyone hired after 1983, was built from the ground up to include Social Security. It’s a three-legged stool: your FERS pension, the Thrift Savings Plan (TSP), and Social Security all work together to create your retirement income.

On the other hand, CSRS is a standalone system created long before federal workers paid into Social Security. If you're under CSRS, you generally don't contribute to Social Security from your federal paycheck, which creates a whole different set of rules you need to know.

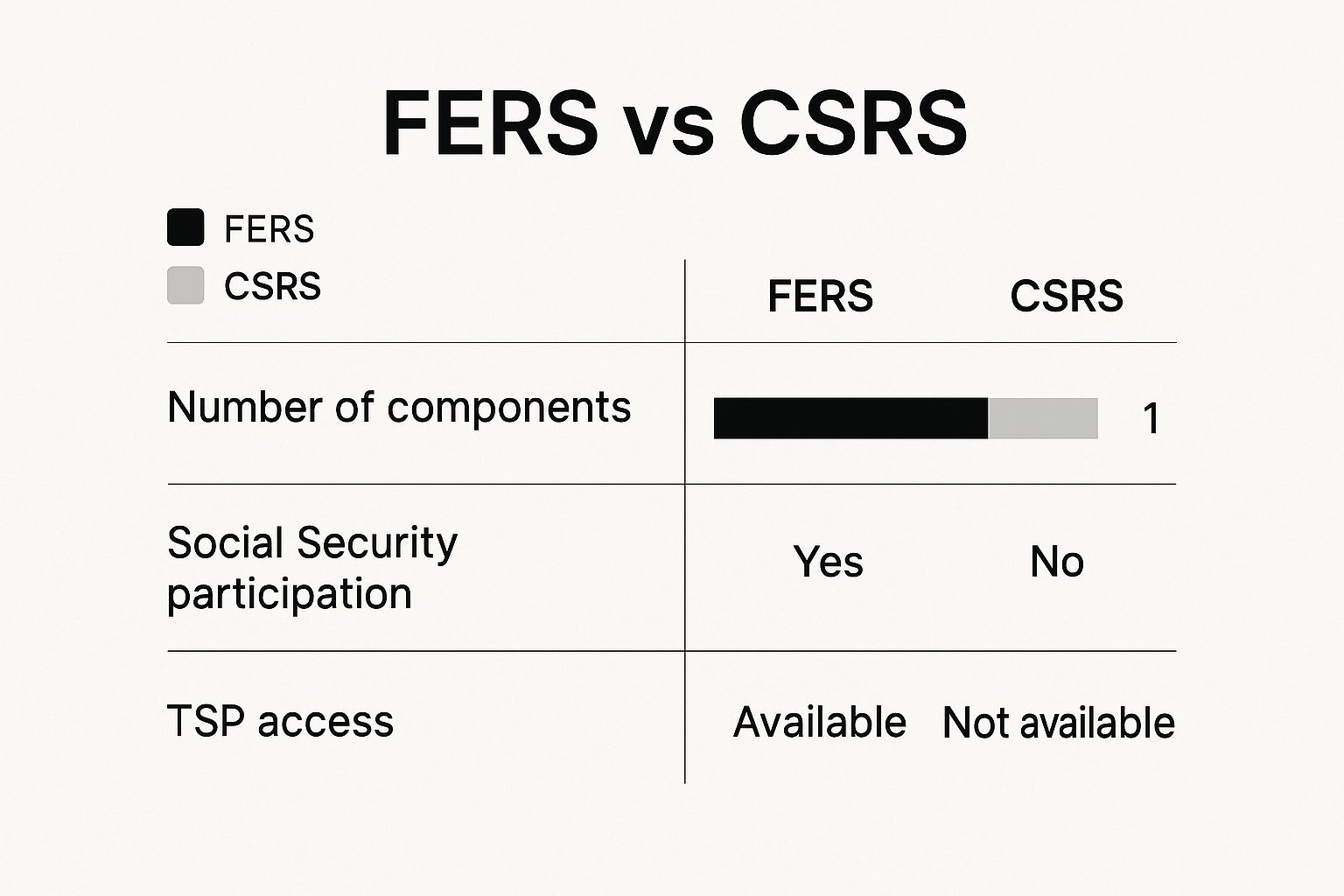

FERS vs. CSRS: A Quick Comparison

The easiest way to think about it is integration. FERS is designed to integrate Social Security, while CSRS was designed to operate without it. This simple fact changes everything, from what comes out of your paycheck to how your income streams will work in retirement.

This infographic gives you a great visual breakdown of the two systems and how they relate to Social Security and the TSP.

As you can see, FERS is a complete package deal with Social Security built-in. CSRS stands on its own.

The core takeaway is simple: For most modern federal employees under FERS, Social Security is not an optional extra—it is an essential, built-in component of your retirement plan that you contribute to with every paycheck.

Getting a firm grasp on this fundamental difference is the absolute first step. Once you know which system you're in, you can start building a smart, informed strategy for your future.

FERS vs. CSRS: How They Work with Social Security

To really get a handle on your Social Security benefits as a federal worker, you first have to know which retirement system you fall under: the Federal Employees Retirement System (FERS) or the Civil Service Retirement System (CSRS). The two are fundamentally different, especially in how they treat your federal employee Social Security contributions.

Your answer to that one question dictates whether Social Security is a central piece of your retirement puzzle or a completely separate benefit you might have earned from other work.

FERS: The Three-Legged Stool

The easiest way to picture the FERS system is as a three-legged stool—it’s designed for stability, with each leg representing a different source of your retirement income. All three work together to support you.

- Leg 1: FERS Basic Annuity: This is your traditional government pension, the reward for your dedicated years of service.

- Leg 2: Social Security: As a FERS employee, you pay into Social Security just like someone in the private sector. It’s a critical part of your future income.

- Leg 3: Thrift Savings Plan (TSP): Think of this as your 401(k). It’s the account where you save and invest for the long haul.

Because of this design, Social Security isn't just an add-on for FERS employees; it's a foundational pillar of the entire retirement plan.

CSRS: The Standalone Pillar

On the other hand, the older CSRS system is built more like a single, massive pillar. It was designed decades ago to be an all-encompassing pension, created long before federal employees were brought into the Social Security system.

If you’re covered by CSRS, you don’t pay Social Security taxes on your federal salary. That means your time in government service doesn't earn you credits toward Social Security. You might still qualify for benefits based on other work—say, a job before you joined the government or from a side hustle—but that benefit is entirely separate from your CSRS pension.

The crucial distinction is this: FERS was built with Social Security in mind, while CSRS was built without it. This historical divide is the key to understanding why benefits are calculated so differently for each group.

The switch from one system to the other happened decades ago. Generally, workers hired before 1984 were placed in CSRS, while those hired after 1983 fall under FERS, which fully integrates Social Security. If you want to dig deeper into this history, the Social Security Administration provides a good overview of how federal workers are covered.

FERS vs CSRS Social Security Coverage at a Glance

To make this crystal clear, here’s a simple side-by-side look at the key differences between the two systems when it comes to Social Security.

| Feature | FERS (Hired after 1983) | CSRS (Hired before 1984) |

|---|---|---|

| Social Security | Yes, a core component. You pay taxes and earn benefits. | No, not part of the system. You do not pay taxes on federal wages. |

| Structure | Three-part system: Pension, Social Security, and TSP. | Self-contained, single-pension system. |

| Design Philosophy | Integrated and collaborative retirement income sources. | A comprehensive, standalone retirement benefit. |

Knowing which path you’re on is the absolute first step. It has a direct impact on your eligibility, how your benefits might be adjusted later on, and the best strategies for planning a secure financial future.

Cracking the Code on the Windfall Elimination Provision

If you’ve heard federal employees talking about the Windfall Elimination Provision (WEP), it probably sounded like some kind of penalty. Let’s clear the air on that common myth right away. The WEP isn’t designed to punish you; it’s simply a different way of calculating your Social Security benefit to keep things fair across the board.

This rule really only comes into play for people who have a pension from a job where they didn't pay Social Security taxes—like CSRS federal employees—but who also worked other jobs long enough to qualify for a Social Security benefit.

Why a Different Formula is Necessary

Here’s the thing: the standard Social Security formula is weighted. It’s designed to give a bigger boost to lower-income workers, replacing a higher percentage of their earnings in retirement.

So, when the Social Security Administration (SSA) looks at the earnings history of a CSRS employee, they see a lot of years with zero or very low reported earnings. Why? Because your federal salary wasn't part of the Social Security system. From their perspective, it looks like you were a lifelong low-wage worker.

Without an adjustment, you'd get a "windfall"—a much larger, heavily weighted Social Security check than intended for someone who also has a solid government pension. The WEP is the adjustment that prevents this from happening. It uses a modified formula that better reflects the years you actually paid into the system.

The whole point of the WEP is to stop the standard formula from accidentally overpaying people who have a pension from a non-covered job. It's about proportionality.

It’s just a mechanism to ensure a career CSRS employee who worked a side gig isn't treated the same as someone who genuinely worked low-wage jobs their entire life to make ends meet.

The WEP in Action: A Practical Example

Let’s imagine a retired teacher, Sarah. Many state teachers, much like CSRS employees, are in pension plans that don’t pay into Social Security.

But for over 15 years, Sarah also worked summers at a bookstore, where she did pay Social Security taxes. That part-time work was enough to make her eligible for her own Social Security benefit.

Without the WEP, the calculation would look at her record and see decades of "zero" earnings from her teaching career, making her summer income look like her only income. The system would flag her as a low earner and automatically calculate a higher, weighted benefit for her.

This is where the WEP steps in. It modifies the math, specifically by reducing the percentage applied to the first chunk of your earnings (what the SSA calls a "bend point"). This brings the final benefit amount down to a level that's more in line with what she actually paid into the system over the years.

It's important to know the reduction has limits. It can never be more than half of your government pension, and the impact gets smaller the more years you have of "substantial earnings" under Social Security. If you really want to get into the weeds, the Congressional Research Service has a very detailed report on the WEP that breaks down all the numbers.

Understanding the Government Pension Offset

While the Windfall Elimination Provision (WEP) can take a bite out of your own Social Security benefits, the Government Pension Offset (GPO) is a different animal altogether. This rule has nothing to do with your personal Social Security earnings. Instead, it targets any spousal or survivor benefits you might be eligible for through your spouse.

If you’re a federal employee, especially one covered by the old CSRS system, this is a distinction you can't afford to ignore.

The whole point of the GPO is to prevent what lawmakers saw as an unfair advantage—essentially, collecting both a full government pension from work where you didn't pay into Social Security and a full Social Security benefit as a spouse or survivor. The logic is to put federal retirees on a more even footing with private-sector workers.

How the GPO Formula Works

The GPO's math is brutally simple, but its effect can be devastating. It reduces your Social Security spousal or survivor benefit by two-thirds of your government pension.

Let’s walk through a quick example to see it in action:

- Say your monthly CSRS pension is $3,000.

- The GPO calculation takes two-thirds of that amount, which is $2,000 ($3,000 x 2/3).

- Now, imagine you were eligible for a $1,800 Social Security survivor benefit from your spouse's record.

- Because the $2,000 GPO reduction is more than your potential benefit, your Social Security payment is completely eliminated. You get $0.

This often comes as a nasty surprise to retirees who were banking on that income, especially after losing a loved one. It’s a powerful provision that can completely upend a household’s retirement plan.

At its heart, the GPO tries to simulate what happens in the private sector. A worker with their own Social Security benefit usually has it offset or eliminated before they can claim a spousal benefit. The GPO applies a similar principle to government pensions.

GPO in a Real-World Scenario

Let's look at Robert, a retired CSRS employee who receives a $4,500 monthly pension. His wife, Maria, spent her whole career in the private sector and paid into Social Security. After she passed away, Robert learned he was eligible for a $2,100 monthly survivor benefit based on her earnings history.

Here’s where the GPO steps in. The reduction is two-thirds of his $4,500 CSRS pension, which comes out to $3,000.

Since the $3,000 GPO reduction is greater than the $2,100 survivor benefit he was due, his Social Security payment is reduced to zero. Robert still gets his full CSRS pension, of course, but the survivor benefit from Social Security is off the table.

This is exactly why understanding federal employee social security rules is so critical, especially for couples where one spouse is under CSRS. Social Security is a cornerstone of retirement for millions. As of April 2025, it was paying monthly benefits to nearly 73.9 million people, with the average retiree getting close to $2,000 a month. You can dig deeper into these Social Security statistics in a recent Pew Research Center analysis. For federal retirees hit by the GPO, this vital income stream simply might not exist.

How Your Social Security Benefit Is Calculated

For federal workers under FERS, Social Security isn't just some extra cash—it's a foundational pillar of the retirement income you’ve been building for decades. So, how exactly does the Social Security Administration (SSA) take a lifetime of work and turn it into a reliable monthly check? The process has a few moving parts, but it’s actually quite logical once you see how they fit together.

It all starts with your lifetime earnings. The SSA looks at every single year you paid into the system, including all your federal service time, and adjusts those earnings for inflation. This step, known as indexing, is crucial because it brings the value of what you earned in, say, 1995 up to today's wage levels. This ensures the money you made early in your career is given its proper weight.

Finding Your Average Indexed Monthly Earnings

After indexing your entire work history, the SSA zeroes in on your 35 highest-earning years. They pick the best ones, regardless of when they happened.

What if you don't have a full 35 years of earnings? The SSA will use a zero for each year you fall short, which can definitely pull your average down.

Once those 35 years are identified, the indexed earnings are added up and divided by 420 (that’s just the number of months in 35 years). The result is your Average Indexed Monthly Earnings, or AIME. Think of the AIME as the key number that represents your average monthly earnings over your peak working years.

From AIME to Your Actual Benefit

Now, your AIME isn't what you'll see on your check. It's the starting point for calculating your Primary Insurance Amount (PIA), which is the monthly benefit you'd get if you claimed right at your full retirement age.

The SSA uses a formula with what they call "bend points" to figure out your PIA from your AIME. For 2024, the formula looks like this:

- You get 90% of the first $1,174 of your AIME.

- Then you get 32% of your AIME between $1,174 and $7,078.

- Finally, you get 15% of any AIME amount over $7,078.

This tiered system is intentional. It's designed to give lower-income workers a stronger safety net by replacing a higher percentage of their pre-retirement earnings. For a career federal employee, this formula is what ultimately shapes your final Social Security payment.

The best way to cut through the theory and see your own numbers is to create an account on the official Social Security Administration website. Your personalized statement takes your actual earnings record and gives you a real-world estimate, turning these calculations from an abstract concept into a concrete number you can plan around.

Knowing how this calculation works gives you the power to plan with confidence. You can check your earnings record for accuracy and use the SSA’s online tools to get a much clearer picture of what to expect from your Social Security benefits as a federal employee.

Strategic Social Security Claiming for Federal Employees

https://www.youtube.com/embed/RHgcQoSu3CU

Deciding when to turn on your Social Security benefits is easily one of the biggest financial decisions you'll ever make. For federal employees, this isn't a choice you can make in a vacuum. It needs to be carefully woven into your FERS pension and Thrift Savings Plan (TSP) withdrawal strategy to build a reliable and tax-smart retirement income.

There’s no magic answer here. The best time to file depends entirely on your personal situation—your health, your family’s needs, and what you want your retirement to look like. Every option comes with a straightforward trade-off: do you want smaller checks for a longer time, or larger checks for a shorter period?

Comparing Your Claiming Options

Let's walk through the three main milestones for claiming benefits and see what each one really means for your wallet. Thinking about these different scenarios is the key to matching your federal employee Social Security plan with your bigger financial picture.

Claiming Early at 62: You can start your benefits as soon as you hit 62. While this gets cash flowing immediately, your monthly payment will be permanently slashed by as much as 30% compared to what you’d get at your Full Retirement Age (FRA).

Claiming at Full Retirement Age (FRA): This is the age when you're entitled to 100% of the benefit you've earned. For most people retiring now, that’s somewhere between 66 and 67. Filing at your FRA gets you your full, unreduced benefit.

Delaying Until Age 70: Here's where patience pays off. For every year you hold off past your FRA, your benefit grows by about 8%, all the way up to age 70. This strategy locks in the highest possible monthly payment for the rest of your life.

This decision has become even more critical when you consider the long-term health of the Social Security program. The system is facing some serious headwinds due to changing demographics. In fact, the 2025 Social Security Trustees Report estimates that without changes from Congress, the main trust fund could run low by 2033. If that happens, it could trigger an automatic benefit cut of around 23% across the board. You can read more about what the latest numbers say about Social Security on GovExec.com.

A powerful strategy, especially for married federal employees, is to coordinate your benefits. If one spouse was the higher earner, it might make sense for them to delay claiming until 70. This not only maximizes their own check but also secures the largest possible survivor benefit for their spouse down the road.

At the end of the day, your goal is to create a retirement paycheck you can count on. By thoughtfully timing your Social Security claim to work in concert with your FERS pension and TSP income, you can build a strong financial foundation to enjoy the years ahead.

Your Top Questions Answered

When you dig into the specifics of Social Security and federal benefits, a lot of questions tend to pop up. Let's tackle some of the most common ones I hear from federal employees.

Can I Get Social Security If I'm Under CSRS?

Yes, you absolutely can, but there’s a catch. To be eligible, you need to have earned at least 40 credits from other work—usually about 10 years of private-sector employment where you paid into the Social Security system.

Just be aware that your Social Security benefit won't be calculated like everyone else's. It will almost certainly be reduced by the Windfall Elimination Provision (WEP), a rule designed to adjust for the fact that you're also receiving a CSRS pension from non-covered earnings.

What Exactly Is the FERS Special Retirement Supplement?

Think of the FERS Special Retirement Supplement (SRS) as a stand-in for your Social Security benefits, but only until you reach age 62. It's specifically for FERS employees who decide to retire before they're old enough to claim Social Security.

The supplement gives you an income stream that's meant to approximate the Social Security pension you earned while working under FERS. It’s a financial bridge that helps make early retirement possible, but remember, it stops cold the month you turn 62, whether you start your actual Social Security benefits or not.

The FERS Special Retirement Supplement is one of the most valuable—and often misunderstood—parts of the FERS package. It’s the key that unlocks a viable early retirement for many federal workers by smoothing out their income until Social Security begins.

As a FERS Employee, Am I Paying into Social Security?

You bet. Being part of FERS means you're fully integrated into the Social Security system. From every paycheck, you contribute the same Social Security (OASDI) and Medicare taxes as your friends in the private sector.

It's these ongoing contributions throughout your federal career that build up your eligibility for Social Security retirement and disability benefits later on.

Can My Spouse Collect Benefits From My Federal Service?

The answer hinges completely on whether you're FERS or CSRS.

- If you're under FERS: Yes. Your spouse can qualify for spousal or survivor benefits based on your earnings record, following the same rules that apply to any private-sector worker.

- If you're under CSRS: This is where it gets tricky. The answer is almost always no. Even if your spouse is otherwise eligible for a spousal or survivor benefit from your Social Security record (if you have one), that benefit will likely be wiped out by the Government Pension Offset (GPO).

Trying to piece all these rules together on your own can feel overwhelming. At Federal Benefits Sherpa, we live and breathe this stuff. Our expertise is in guiding federal employees through these complexities to build a retirement plan that truly works. Let's talk—get a free, personalized 15-minute benefit review to see where you stand.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved