Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Employee Health Benefits Explained

If you're a federal employee, you've probably heard of the Federal Employee Health Benefits (FEHB) program. It's more than just an insurance plan—it's one of the most valuable parts of your compensation package. Think of it as a dedicated marketplace for health coverage, created just for federal employees, retirees, and their families, with the government picking up a big chunk of the tab.

This guide is designed to cut through the complexity and give you a clear, practical roadmap for understanding and choosing the best plan for you.

Your Guide to Federal Employee Health Benefits

Navigating health insurance can feel overwhelming, but the FEHB program is built around choice. It's not a one-size-fits-all situation where you're handed a single corporate plan. Instead, you get access to a competitive marketplace filled with different carriers and plan types.

This structure puts you in the driver's seat. It's about empowering you to find coverage that genuinely fits your life—whether you're single, have a growing family, or are planning for retirement. Our goal here is to help you move from confusion to confidence, turning what can seem like a chore into a straightforward decision.

The Power of Government Contribution

Here’s the single biggest advantage of the FEHB program: the government subsidy. This isn't just a small discount; it’s a massive contribution that makes excellent healthcare affordable. Each payday, this subsidy drastically lowers the amount you pay for your premiums.

This financial partnership is the foundation of your federal employee health benefits. On average, the government covers about 72% of the weighted average premiums for all FEHB plans. To put that in perspective, while the total biweekly premium for Self and Family coverage might average around $1,080.60, the government's share cuts your out-of-pocket cost down to a much more manageable level. You can explore more about these contributions and see just how powerful this benefit is compared to private-sector jobs.

This cost-sharing model is a key tool the government uses to attract and retain top talent. It’s truly one of the most significant perks of federal service.

What This Guide Will Cover

We’ve structured this guide to be your step-by-step manual for the FEHB. We'll break down everything you need to know into simple, actionable information. The focus is on giving you the practical knowledge you need to feel confident in your choices.

Here's a quick look at what we'll walk through together:

Eligibility Requirements: We’ll clarify who can enroll—from brand-new hires to retirees—and how you can cover your family.

Plan Categories Explained: You’ll get a straightforward breakdown of the different plan types, like HMOs, PPOs, and HDHPs, so you know exactly what you’re choosing.

Enrollment Windows and Deadlines: We’ll cover the all-important Open Season, your initial enrollment period, and what a Qualifying Life Event (QLE) means for your coverage.

Strategies for Maximizing Coverage: We’ll share tips on how to compare plans like a pro and pick the one that gives you the best bang for your buck.

Who Qualifies for FEHB Coverage

Before you can dive into comparing plans, the first thing to figure out is whether you're even eligible for federal employee health benefits. It's the critical first step. While the program is designed to cover most of the federal workforce, your eligibility isn't a given—it really hinges on the specific terms of your job appointment.

If you're a permanent employee, things are pretty straightforward. Whether you’re full-time or part-time, if you’ve been hired for a permanent role, you are generally eligible for FEHB from your first day on the job. Your position is considered "FEHB-eligible," which means it's built to include this essential benefit right from the start.

This approach ensures that the core of the federal workforce has access to stable, long-term health coverage they can rely on.

Defining an Eligible Position

So, what does an "FEHB-eligible" position actually look like? It all comes down to the fine print in your employment agreement. The vast majority of federal jobs qualify, as long as they aren't explicitly labeled as temporary or intermittent.

The key factor is that your appointment can't have a designated end date of less than one year from when you were hired. For example, a newly hired program analyst starting their first permanent federal job is good to go immediately. Likewise, a seasoned employee getting ready to retire can keep their coverage as long as they meet the specific requirements for continuing it into retirement.

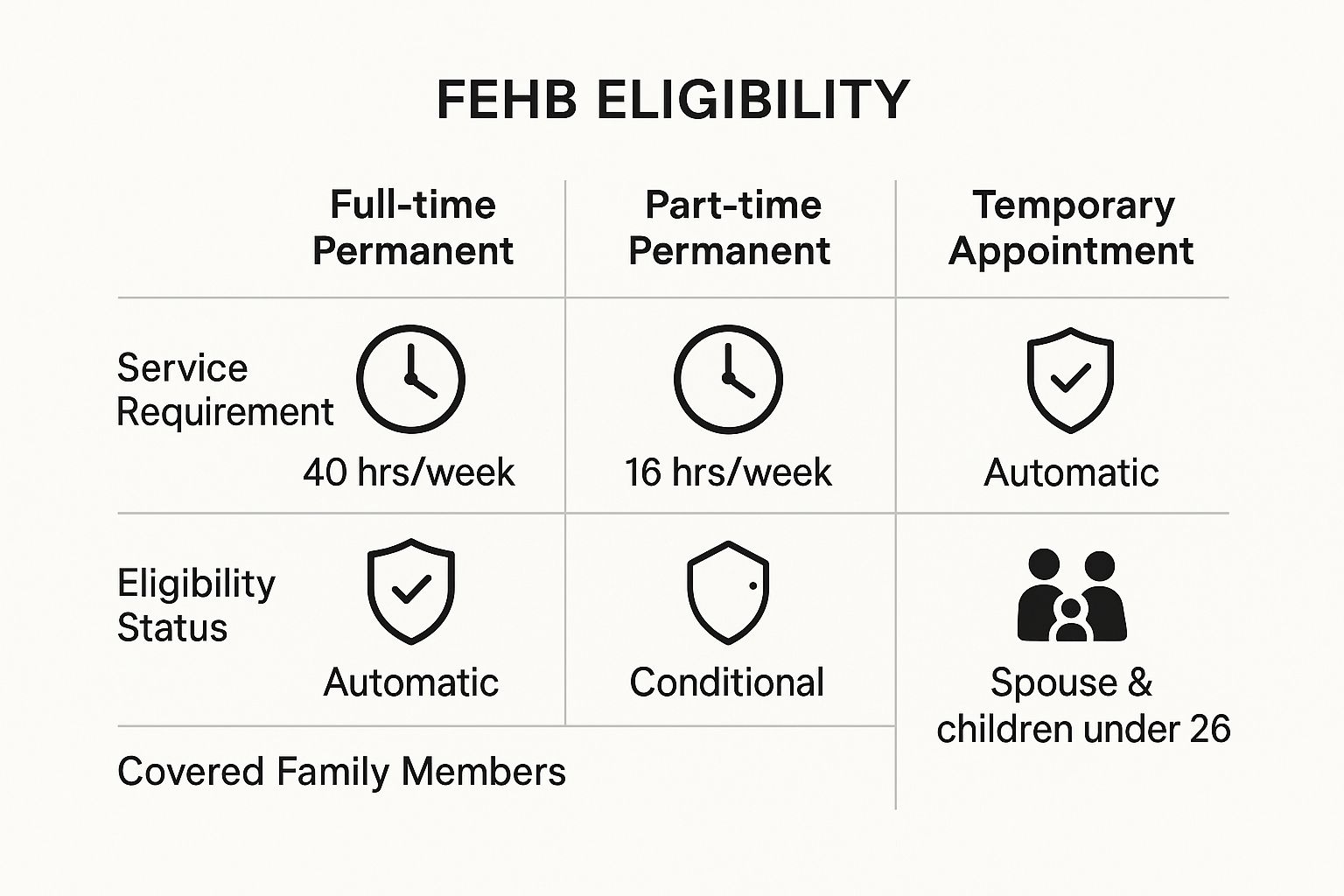

This handy infographic breaks down the main eligibility pathways for different federal job types.

As you can see, both full-time and part-time permanent employees get automatic eligibility. For temporary employees, it's a bit more conditional.

Coverage for Temporary and Part-Time Employees

Not every federal job is a full-time, permanent gig, but that doesn't necessarily mean you're out of luck. The FEHB program has specific rules that bring many other types of employees into the fold.

If you're a part-time career employee with a regular, set schedule, you can enroll in FEHB. The government’s share of your premium is simply prorated based on your weekly hours. For instance, if you work 20 hours a week—which is half-time—the government will pay half of its normal contribution, and you'll be responsible for the difference.

Temporary employees can get in on the action, too, but the path is a little narrower. You might become eligible after you’ve completed one full year of continuous employment, provided you’re expected to keep working. In some cases, temporary appointments scheduled to last more than 90 days can also grant eligibility. Your best bet is always to check with your agency's HR office to know for sure.

Don't ever assume you are—or are not—covered. Your appointment papers and your agency’s HR specialists are your best resources for confirming eligibility, and it's smart to do it early.

Who Counts as an Eligible Family Member

Once you've confirmed you're eligible, the next step is figuring out who in your family you can cover. The FEHB program has very clear definitions for who qualifies as a family member, which is great for planning.

You can add the following people to a Self Plus One or Self and Family plan:

Your current spouse: This includes legally married spouses (both opposite-sex and same-sex) and, in states that recognize them, common-law spouses.

Your children under age 26: This is a broad category covering biological children, stepchildren, adopted children, and foster children. Their eligibility isn't affected by whether they're married, in school, or financially dependent on you.

Adult children with disabilities: If you have a child over age 26 with a mental or physical disability that began before they turned 26 and makes them unable to support themselves, you can keep them on your plan.

Getting a handle on these rules is key to making sure your loved ones are protected. Here at Federal Benefits Sherpa, our whole purpose is to help federal employees navigate these kinds of details so you can make the absolute most of your benefits package.

Decoding the Different FEHB Plan Types

Trying to choose a federal employee health benefits plan can feel like you’re trying to order from a menu in a foreign language. You're hit with a sea of acronyms—HMO, PPO, HDHP—and it’s easy to get lost. We're going to translate that jargon into practical, real-world terms so you can find the perfect fit for your life.

Think of each plan type as a different way to approach your healthcare. Some are like a guided tour with a dedicated coordinator, while others hand you a map and let you explore freely. Your job is to figure out which style best suits your health, your budget, and how you like to do things.

Let’s unpack the main categories you'll see in the FEHB marketplace.

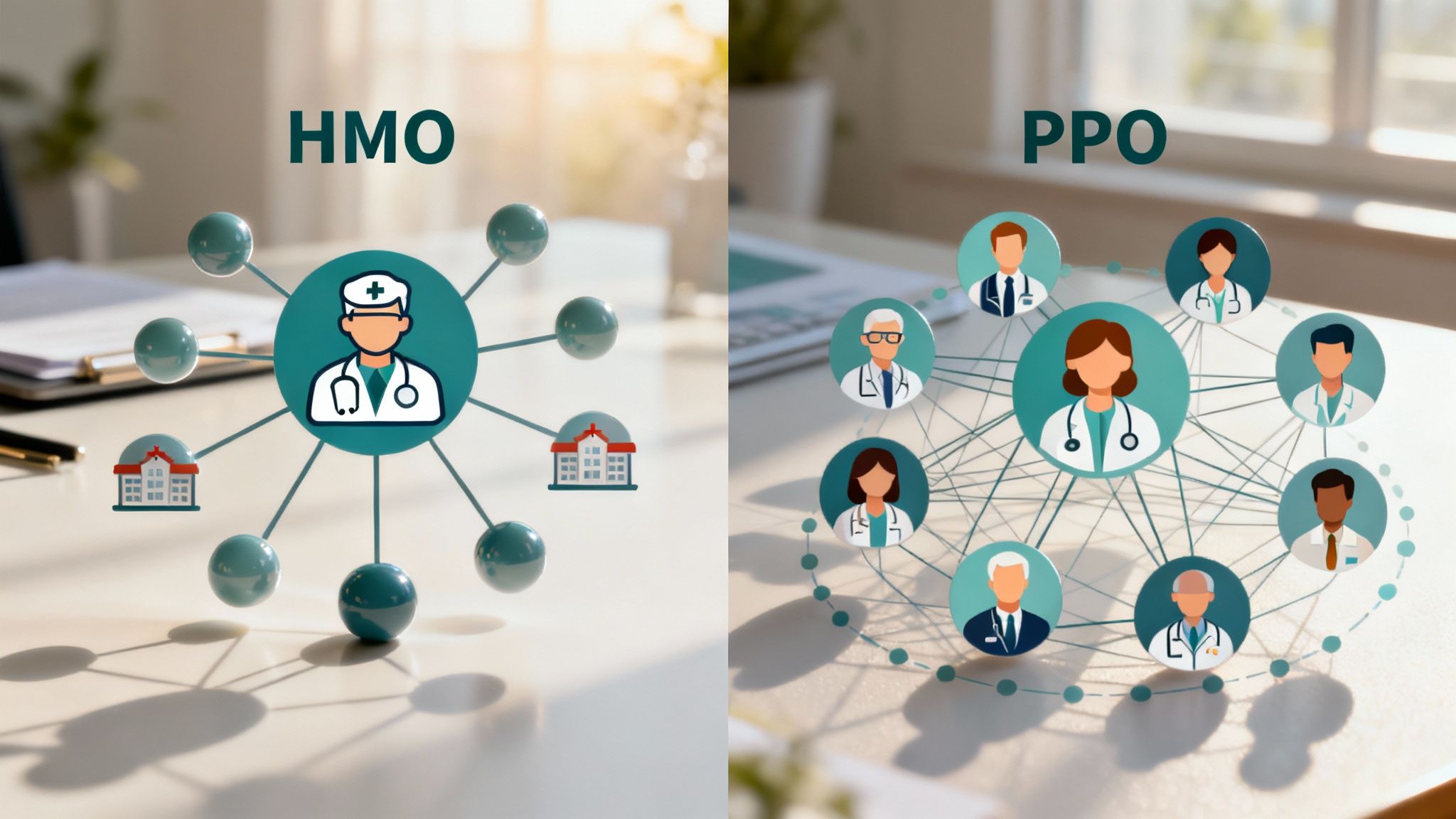

HMOs: The Guided Tour

A Health Maintenance Organization (HMO) is built around having a dedicated healthcare "home base." Everything is coordinated through your Primary Care Physician (PCP), who acts as your personal health guide. If you need to see a specialist, you just go to your PCP first, and they'll give you a referral to an expert within the plan's network.

This structure is all about being streamlined and cost-effective. Because you stay within a specific network of doctors and hospitals that have agreed-upon rates, HMOs usually have lower premiums and predictable copays.

Here’s what that really means for you:

Structured Care: Your PCP is the central hub for all your medical needs, which helps ensure your care is coordinated and consistent.

In-Network Focus: Coverage is almost entirely limited to providers within the HMO's network, with the exception of true emergencies.

Lower Premiums: This guided approach often leads to some of the most affordable monthly costs in the entire FEHB program.

If you value simplicity and don't mind having your care managed through a single point of contact, an HMO can be an excellent, budget-friendly choice.

PPOs: The All-Access Pass

If an HMO is a guided tour, a Preferred Provider Organization (PPO) is the all-access pass. It gives you maximum flexibility and freedom to choose your own healthcare providers. You don’t need a PCP to coordinate your care, and you can see a specialist directly without getting a referral first.

This freedom also applies to which doctors you see. PPOs have a "preferred" network of providers, and you'll pay the lowest rates when you stick with them. But the real draw is that you can also go "out-of-network" to see any doctor you want, though you’ll have to pay a higher share of the cost.

The core trade-off with a PPO is cost versus flexibility. You pay higher premiums for the freedom to direct your own healthcare and see any provider you choose, whether they are in-network or not.

This makes PPOs a very popular choice for families who want to keep their current doctors or need the ability to see specialists across different health systems without any hassle.

HDHPs: Putting You in the Driver's Seat

High Deductible Health Plans (HDHPs) operate on a completely different model. An HDHP is always paired with a Health Savings Account (HSA), which is a tax-advantaged account you use to pay for medical expenses. Think of it as putting you firmly in the driver's seat of your healthcare spending.

With an HDHP, you pay much lower monthly premiums, but you have a higher deductible you need to meet before the plan starts paying for most services. The money in your HSA—which both you and sometimes your plan can contribute to—helps you cover those out-of-pocket costs completely tax-free.

Here’s the appeal of this approach:

Lower Premiums: Your monthly payroll deduction is significantly less than with a PPO or most HMOs.

Tax Advantages: Contributions to your HSA are tax-deductible, the money grows tax-free, and any withdrawals for qualified medical expenses are also tax-free. It's a triple tax benefit.

Long-Term Savings: Any money left in your HSA at the end of the year rolls over and continues to grow. It becomes a powerful savings tool for future health expenses or even for retirement.

HDHPs are a fantastic option for federal employees who are generally healthy, want to actively save for future medical costs, and feel comfortable managing their healthcare budget more directly.

To make it even clearer, here's a quick side-by-side comparison to help you see how these plans stack up.

FEHB Plan Types At a Glance

A quick comparison of the main features of each FEHB plan type to help you find your best match.

FeatureHMO (Health Maintenance Organization)PPO (Preferred Provider Organization)HDHP (High Deductible Health Plan)PremiumsTypically lowestHighestLower than PPOs/HMOsDeductiblesLow or noneLow to moderateHighProvider ChoiceLimited to in-network only (except emergencies)High flexibility; in-network and out-of-network optionsHigh flexibility; in-network and out-of-network optionsReferrals to SpecialistsUsually required from your PCPNot requiredNot requiredBest ForIndividuals who want predictable costs and coordinated care.Individuals who want maximum freedom and are willing to pay more.Healthy individuals who want to save on premiums and build a health fund.Key FeatureYour Primary Care Physician (PCP) manages all your care.You can see any doctor, but you save money by staying in-network.Paired with a tax-advantaged Health Savings Account (HSA).

Ultimately, the right plan depends on your personal situation. By understanding these core differences, you’re in a much better position to choose a plan that works for you, not against you.

Mastering Enrollment and Open Season

Timing is everything when it comes to your federal employee health benefits. You can't just wake up one Tuesday and decide to switch plans. Instead, you have very specific windows of opportunity to enroll or make adjustments, and knowing when they are is the key to getting the right coverage.

Think of it like trying to catch a train. There are only a few scheduled departures, and if you miss one, you’re stuck waiting on the platform for the next. For FEHB, these "departures" boil down to three main times: right when you're hired, during the annual Open Season, or after a major life event.

Getting a handle on this schedule means you'll never be stuck with a plan that's a poor fit for your life.

Your Initial Enrollment Opportunity

Your first chance to jump into an FEHB plan happens right after you're brought on board in an eligible federal job. This is your golden ticket to get coverage rolling from the get-go. You’ll typically have 60 days from your official start date to sort through the options and make a decision.

If you let this window close without enrolling, you'll most likely have to wait until the next Open Season rolls around. That's why it's so important to act fast. Your agency's HR department will get you set up with the forms and access to an online portal, like Employee Express, where you can make your selection.

Navigating the Annual Open Season

The one everyone knows about is the annual Open Season. This is your yearly chance to give your health plan a thorough check-up. You can review your coverage, switch to a totally different plan, or just stick with what you’ve got—no special reason needed.

Open Season is a fixture on the calendar, usually running from the Monday of the second full work week in November through the Monday of the second full work week in December. Go ahead and mark your calendar for next year.

During this time, you have the power to:

Enroll in a plan if you decided against it when you were first hired.

Switch from one plan to another, maybe to find better benefits or a lower premium.

Change your enrollment type (for example, moving from Self Only to Self and Family).

Cancel your coverage completely if you have other insurance.

The world of health insurance is always changing. Recently, the FEHB program saw premiums jump by an average of 13.5%, and the number of available plans actually shrank from 158 to 130. At the same time, new benefits popped up, including better coverage for in vitro fertilization (IVF) and mandates for certain anti-obesity drugs. You can learn more about recent FEHB program changes to see why giving your plan an annual review is so critical.

When Life Changes Your Plans

Of course, life doesn't always wait for Open Season. A major change can trigger a special enrollment period, letting you adjust your coverage right when you need it most. We call this a Qualifying Life Event (QLE).

A QLE is a specific event that directly changes your health insurance needs. The catch? You usually have just 60 days from the date of the event to make a change to your FEHB plan, so you can't afford to procrastinate.

Common examples of a Qualifying Life Event include:

Marriage or divorce: This lets you add a new spouse or remove a former one.

Birth or adoption of a child: The perfect time to upgrade to a Self and Family plan.

A change in employment status: If you or your spouse gain or lose other health coverage.

A move outside your HMO's service area: This forces a change, allowing you to pick a plan that works in your new location.

By understanding these three key enrollment windows, you can take full control of your federal health benefits and make sure your coverage always keeps up with your life.

Understanding Your FEHB Premiums and Costs

When you look at your payslip, you see a deduction for health insurance, but that number doesn't tell the whole story. To really get a handle on your federal employee health benefits, you need to understand how the costs are shared between you and the government. It's a powerful arrangement, but it has a few moving parts.

Think of your health plan's total price tag like a pie. The biggest slice is the premium—the fixed amount needed every two weeks to keep your coverage active. The good news? The government pays a huge chunk of that for you. The smaller slices are the costs you pay out-of-pocket when you actually go to the doctor or fill a prescription.

Getting familiar with these out-of-pocket expenses is key to choosing the right plan and avoiding sticker shock later on.

Breaking Down Your Share of the Costs

Beyond the regular premium taken from your paycheck, there are three other costs you'll run into when you use your health plan. Knowing what they are and how they differ is the secret to comparing plans like a pro.

Deductible: This is the amount you have to pay for certain medical services before your insurance plan starts chipping in. It's like a spending threshold you have to meet each year.

Copayment (Copay): This is a flat fee, like $30, that you pay for a specific service, such as a visit to your primary care doctor. You usually pay it right at the front desk.

Coinsurance: Instead of a flat fee, this is a percentage of the bill you're responsible for. For example, your plan might pay 80% of a hospital stay after you’ve met your deductible, leaving you to cover the remaining 20%.

So, a routine check-up might just involve a simple copay. But for something more significant, like surgery, you'd likely have to meet your deductible first, and then pay coinsurance on the final bill.

The Government Contribution: The FEHB Advantage

Here’s what makes the FEHB program such a great deal: the government pays a massive portion of your premium. This isn't just a small discount; it's the core feature that makes top-tier health insurance affordable for federal employees.

By law, the government typically covers up to 72% of the weighted average premium across all plans in the program. This massive subsidy is what keeps your biweekly contribution so much lower than what someone would pay for a similar plan on the private market.

This government contribution is the financial engine of the FEHB program. It ensures federal employees have access to premier health coverage at a fraction of what it would cost on the open market.

Of course, the final amount you pay depends on your choices. A national PPO plan with the freedom to see any doctor will naturally have a higher premium than a local HMO. And covering a family will cost more than covering just yourself. Your choices have a direct impact on your bottom line.

Real-World Premium Examples

Let's put some numbers to this. Looking at program-wide weighted averages, the total biweekly premium for Self Only coverage is around $451.05. Of that, the government pays up to $324.76. For a Self and Family plan, the total premium jumps to about $1,080.60, but the government’s share is a staggering $778.03.

These figures change a bit each year, but they perfectly illustrate how the subsidy makes your share manageable. You can always see the latest official premium rates directly from OPM to see the full breakdown for every plan.

At Federal Benefits Sherpa, we help federal employees make sense of these numbers every day. Our goal is to help you see beyond the premiums and find the plan that fits your life and your financial goals, setting you up for a secure and worry-free retirement.

How to Choose the Right FEHB Plan for You

Alright, you've got the basics down on plan types and when you can enroll. Now for the hard part: turning all that information into the right decision for you. Choosing your federal employee health benefits plan isn't about chasing the lowest premium. It's about finding the best overall value for your specific situation. This is where you put on your analyst hat.

Think of it like buying a car. You wouldn't just pick the one with the smallest monthly payment, right? You'd look at gas mileage, expected repair costs, safety features, and whether it can fit the whole family. Your health plan deserves that same level of careful thought, looking past the sticker price to what it will actually cost you in the long run.

Before you even glance at a plan brochure, you need to take an honest look at your own life—your health, your family's needs, and your budget.

Start with a Personal Health Audit

Before jumping into the official OPM plan comparison tool, hit pause and do a quick self-assessment. This is probably the most important step, as it helps you build a personal shopping list of "must-haves" versus "nice-to-haves" in a health plan.

Get together with your family and ask some direct questions:

How often do we really go to the doctor? If you're all generally healthy and only go for annual checkups, a lower-premium HDHP could be a perfect fit. But if you're managing a chronic condition, the predictable copays of an HMO might offer more peace of mind.

Do we see specialists? If someone in your family needs regular appointments with, say, a cardiologist or an allergist, a PPO gives you the freedom to see them without needing a referral every time. That convenience can be a game-changer.

What about prescriptions? Write down every medication your family takes regularly. Some plans have fantastic drug formularies with low copays that can literally save you thousands of dollars a year.

Are our doctors in the network? This is a big one. If you love your family doctor or have a trusted specialist, make sure they're in-network for any plan you consider. Switching providers you've relied on for years is a tough pill to swallow.

Any big life events coming up? If you're planning on having a baby, scheduling a major surgery, or getting braces for a teenager, you'll want to lean toward plans with robust coverage in those specific areas.

Weighing Premiums Against Total Costs

The bi-weekly premium is the number you see coming out of every paycheck, so it’s easy to focus on. But it’s just one piece of the puzzle. A plan with a rock-bottom premium could have a sky-high deductible or a punishing out-of-pocket maximum, leaving you vulnerable if a real medical crisis hits.

The goal is to find that sweet spot where your premium is comfortable, but your potential out-of-pocket expenses won't break the bank. It's a balancing act between what you pay for sure every month and what you might have to pay if things go wrong.

Once you have your personal needs figured out, use the official OPM comparison tool to put a few contenders side-by-side. Pay close attention to the deductible, copays for doctor visits, coinsurance rates for hospital stays, and the crucial out-of-pocket maximum. That maximum is your financial safety net—it’s the absolute ceiling on what you'll pay for covered medical care in a year.

Here at Federal Benefits Sherpa, our job is to help federal employees connect the dots. We look at your entire financial picture to help you choose a plan that protects not just your health, but also your long-term retirement goals. A smart choice today means you're ready for whatever comes your way tomorrow.

Navigating Your FEHB Through Life's Changes

Even after you've got a handle on the basics of the federal employee health benefits program, life happens. Big career moves, retirement planning, and other major events always bring up new questions. Let's tackle some of the most common "what if" scenarios federal employees run into.

Think of this as your go-to guide for those pivotal moments. You've earned this coverage, and the last thing you want is to lose it during a transition.

Can I Keep My Health Insurance When I Retire?

Yes, you can—and it's one of the best perks of a federal career. But it isn't automatic. To carry your FEHB coverage into retirement, you have to meet what's known as the "five-year rule."

Simply put, you must be enrolled in an FEHB plan for the five full years of service right before you retire. You can switch plans during that time, but your coverage has to be continuous. No gaps.

Pro Tip: Don't just assume you're covered. As you get closer to your retirement date, it’s smart to double-check your service records and confirm you’ve met this five-year requirement. A quick check now can save you a massive headache later.

What If I Leave My Federal Job Before Retirement?

If you leave federal service before you're eligible to retire, your FEHB plan will terminate shortly after you separate. You won’t be immediately cut off from all options, but the alternatives get expensive fast.

The government offers something called Temporary Continuation of Coverage (TCC), which lets you keep your plan for up to 18 months. It’s a safety net, but a pricey one.

With TCC, you're on the hook for the entire premium cost. That means you pay:

100% of the premium (both your share and the portion the government used to pay).

A 2% administrative fee on top of that.

TCC is really meant to be a short-term bridge to your next health plan, but it's an important option for ensuring you don't have a gap in coverage.

How Do FEHB and Medicare Work Together?

For federal retirees, FEHB and Medicare coordinate to give you incredibly comprehensive coverage. Once you enroll in Medicare, it steps up as your primary insurance, handling your medical bills first.

Your FEHB plan then shifts into a secondary role. It picks up many of the costs Medicare leaves behind, like deductibles and coinsurance. In fact, many FEHB plans will waive their own deductibles and co-pays when Medicare is your primary insurer, which can seriously reduce your out-of-pocket health expenses during retirement.

Understanding the fine print in these situations is where having an expert in your corner really pays off. At Federal Benefits Sherpa, we help you navigate the details so you can make confident decisions for yourself and your family. Book your free 15-minute benefit review with us and let’s make sure your financial future is secure.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved