Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Do Federal Employees Get a Pension? A Clear Guide

Yes, absolutely. Federal employees are eligible for a pension, which is a core component of their overall benefits package. This isn't like a 401(k) where your retirement income is tied to the whims of the stock market. Instead, it's a defined-benefit plan, meaning you get a guaranteed, predictable check every month for the rest of your life.

This promise of a steady income stream is one of the biggest draws of a career in public service.

How the Federal Pension System Works

If you're wondering whether federal employees get a pension, you're really asking about one of the most stable retirement plans still available. The whole system is built on a straightforward idea: the government makes a commitment to you for your years of service. Your future pension amount is calculated using a formula based on your salary and how long you've worked, not on investment returns.

This provides a level of security that's become increasingly rare. Today, nearly all federal workers are part of the Federal Employees Retirement System (FERS), while a smaller group of long-time employees are still covered by the older Civil Service Retirement System (CSRS).

The Bedrock of Your Retirement

The fundamental principle is rewarding longevity and dedication. The more you earn (specifically, your highest average salary over three consecutive years) and the longer you serve, the larger your monthly pension payment will be. It's designed to be the financial foundation you can build the rest of your retirement on.

Think of a federal pension as your financial bedrock. It’s a guaranteed income stream that isn't at the mercy of market volatility, giving you a stable base to plan your future around.

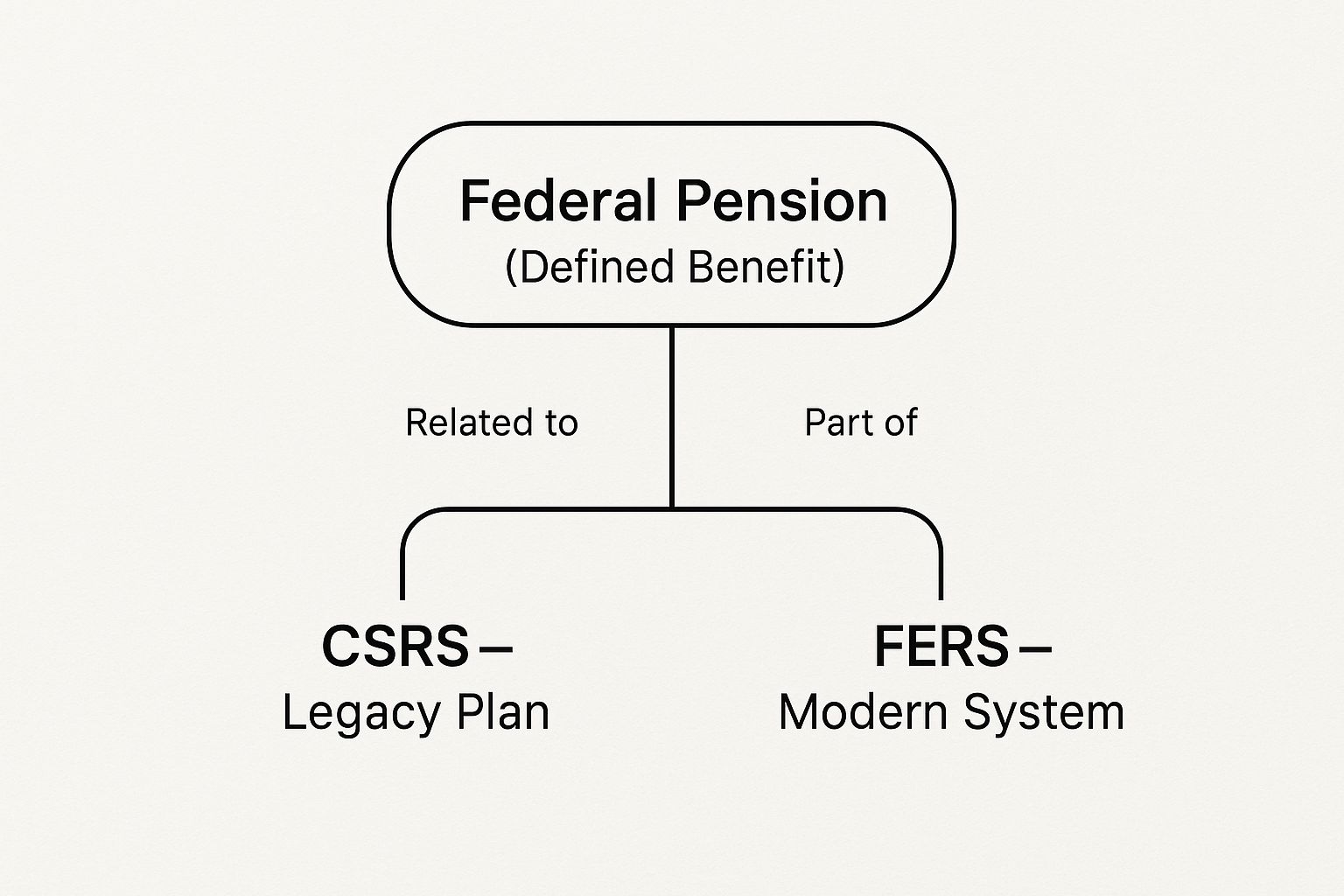

The visual below gives you a quick snapshot of the two main pension systems that have shaped federal retirement over the years.

As you can see, there's a clear difference between the old-school, standalone CSRS and the modern, three-part FERS. This really shows how the government's approach to retirement planning has evolved.

To put it in real-world terms, a FERS employee who retires with 30 years of service can generally expect an annual pension that’s about 30% of their "high-3" average salary. So, if your high-3 average salary was $100,000, your pension would provide around $30,000 per year. This income is designed to work alongside your Social Security benefits and Thrift Savings Plan (TSP) savings. You can find more in-depth analysis on federal retirement trends over at GovExec.com.

Understanding the Two Federal Retirement Systems

To really understand federal pensions, you have to know that the government essentially runs two completely different retirement programs. I like to think of them as two generations of cars. One is a powerful, old-school classic designed to do one thing very well. The other is a modern hybrid, built to draw power from multiple sources for a more flexible ride.

The classic model is the Civil Service Retirement System (CSRS). This is the legacy plan for federal employees hired before January 1, 1984. CSRS was built to be a standalone system, providing a generous pension that was meant to be the main source of income in retirement. Employees paid a higher percentage of their salary into CSRS and, crucially, they didn't pay Social Security taxes on their federal earnings.

The Shift to a Modern Hybrid System

By the early 1980s, it became clear that a new approach was needed—one that was more sustainable and worked with Social Security, not separate from it. This thinking led to the creation of the modern hybrid: the Federal Employees Retirement System (FERS). If you were hired after 1984, you're almost certainly covered by FERS.

Moving from CSRS to FERS marked a huge shift in the philosophy behind federal retirement. Instead of putting all the eggs in one big pension basket, the government created a diversified, three-part structure. This new approach recognizes that a secure retirement is often built on multiple income streams, which helps manage risk and gives employees more direct control over their savings.

This layered approach means that if one part of your retirement income changes—say, due to market fluctuations in your investments—you still have the other two components providing a solid foundation.

Comparing CSRS and FERS

The real difference between the two systems comes down to what they include and how they connect with other benefits like Social Security.

- CSRS (The Classic Model): This is a single, large pension annuity. Since employees didn't pay into Social Security, their federal pension is the star of the show, supplemented only by their personal savings.

- FERS (The Modern Hybrid): This system is a three-part package. It includes a smaller basic pension, mandatory Social Security coverage, and the Thrift Savings Plan (TSP), which is the government's version of a 401(k).

FERS is often described as a "three-legged stool" for a reason. It combines a basic pension, Social Security, and personal TSP savings. The idea was to create a more balanced and portable retirement package for a modern workforce.

This structure is why a federal employee today gets a pension in addition to their other retirement benefits. The FERS pension is just one piece of a much bigger financial puzzle. CSRS was all about that single, powerful engine, while FERS is about the synergy between three complementary parts working together.

Even though CSRS is a legacy plan, it's still affected by new laws. For example, the Social Security Fairness Act has been a hot topic because it aims to change rules that often reduce Social Security benefits for people with a CSRS pension. This shows how federal retirement policy continues to evolve, even for plans that have been closed to new members for decades.

How Your FERS Pension Is Calculated

So, how much can you actually expect from a federal pension? It's a question every FERS employee thinks about, and thankfully, the answer isn't buried in some indecipherable government code. The formula is surprisingly straightforward, and once you understand the moving parts, you can get a solid idea of your future retirement income.

Think of your pension as a recipe with three main ingredients. The final amount you receive depends entirely on the quantity of each ingredient you contribute over your career. Tweak any one of them, and the result changes.

Here’s the basic recipe:

High-3 Salary x Years of Service x Pension Multiplier = Annual Pension

Let's unpack what each of these really means for your bottom line.

Your High-3 Average Salary

The first ingredient is your "High-3" average salary. This isn't just your final year's salary; it’s the average of your highest basic pay over any 36 consecutive months of your federal service. For most folks, this will naturally be their last three years on the job, when their earnings are likely at a career peak.

This averaging method provides a fair and stable foundation for the calculation. It smooths out any unusual pay fluctuations and bases your pension on your sustained earning power, not just a last-minute salary bump.

Years of Creditable Service

Next up is your years of creditable service. This is exactly what it sounds like: the total amount of time you’ve spent working in a FERS-covered position. Every single year, month, and day counts and directly contributes to a larger pension check.

This part of the formula is what truly rewards a long and dedicated career. All else being equal, someone with 30 years of service will receive a pension twice as large as a colleague with 15 years.

The Pension Multiplier

The final piece of the puzzle is the pension multiplier. For the vast majority of FERS employees, this multiplier is a simple 1%. But there's a valuable kicker if you work a little longer.

If you retire at age 62 or older with at least 20 years of service, that multiplier gets a bump up to 1.1%. It might not sound like much, but that's a 10% increase to your pension payment, every single year, for the rest of your life. It’s a powerful incentive to stay on the job a bit longer if you can.

Putting It All Together: A Real-World Example

Let's see how this plays out for a hypothetical federal employee named Sarah.

- High-3 Salary: Sarah’s peak earning period gives her a High-3 average of $90,000.

- Years of Service: She’s dedicated 30 years to public service.

- Multiplier: She plans to retire at age 62, so she qualifies for the enhanced 1.1% multiplier.

Now, we just plug her numbers into the formula:

$90,000 (High-3) x 30 (Years) x 0.011 (Multiplier) = $29,700 per year.

This simple calculation means Sarah will receive a guaranteed pension of $29,700 annually, which breaks down to $2,475 every month. That's a reliable stream of income she can count on for life.

This kind of defined-benefit plan is a cornerstone of government employment, and public pensions collectively hold nearly $6 trillion in assets across the nation. While once common, they have become increasingly rare in the private sector. For a deeper dive into the numbers, you can check out the U.S. Census Bureau’s annual survey on public pension data.

Meeting the Eligibility Requirements for Your Pension

Qualifying for your federal pension isn't just a matter of putting in the time. You have to hit specific age and service milestones set by the government. Think of it as a roadmap with a few critical checkpoints you need to pass along the way.

The very first checkpoint is becoming "vested."

Vesting is a simple but powerful concept. It means you've officially earned a legal right to a future pension, even if you decide to leave federal service before you're old enough to retire. For most FERS employees, this happens remarkably quickly—after just five years of creditable civilian service. Once you’re vested, that future benefit is locked in. It's your foundational piece of the retirement puzzle.

Of course, being vested doesn't mean you can start cashing checks the next day. That’s where the next set of rules—the requirements for an immediate retirement—come into play.

Pathways to an Immediate Pension

The ultimate goal for most feds is an immediate, unreduced pension. This is the one that provides a steady, predictable income stream starting the moment you hand in your badge. To get there, you need to meet one of several specific age and service combinations.

Here are the most common paths under the FERS system:

- Age 62 with 5 Years of Service: This is the most straightforward route. If you've got at least five years in and you've reached age 62, you're eligible for your full, unreduced pension.

- Age 60 with 20 Years of Service: For those with longer careers, the government lets you retire a bit earlier. Hitting age 60 with two decades of service also unlocks your full pension benefits.

- Minimum Retirement Age (MRA) with 30 Years of Service: This is the classic path for career federal employees. Your MRA depends on your birth year (it's between 55 and 57), and hitting it with 30 years of service means you qualify for an immediate pension.

Your Minimum Retirement Age (MRA) is a crucial date to circle on your calendar. For anyone born in 1970 or later, your MRA is 57. Knowing this number is key to accurately mapping out your retirement timeline.

Getting a handle on these different options is vital. It allows you to be strategic about your career and pinpoint exactly when you can tap into the pension benefits you've worked so hard for.

What If You Don't Meet These Rules?

Life happens, and plans don't always work out perfectly. What if you leave federal service after you're vested but before you meet the age and service rules for an immediate pension? You're not out of luck.

You can still apply for a deferred retirement. This just means you'll start receiving your pension payments later, once you reach the eligible age (usually 62). There are also special provisions for early retirement in certain situations, though that might mean your benefit is reduced. The system has built-in flexibility to ensure your years of public service are still rewarded.

The Three Pillars of Your FERS Retirement

When the government designed the FERS system, they built it for stability. Think of it like a sturdy, three-legged stool—if one leg wobbles, the other two keep you from tipping over. Your retirement income is built on three different sources that all work together to support you financially. Getting a handle on how they fit together is the key to making the most of your future.

First up is the FERS Basic Benefit Annuity. This is the official term for your pension, and it’s the bedrock of your retirement plan. You'll receive this guaranteed payment every month for the rest of your life. The amount is calculated based on your years of service and your "high-3" average salary, providing a predictable income stream you can always count on.

The second pillar is Social Security. Just like your friends in the private sector, you've been paying into Social Security with every paycheck. That means you’ll be eligible for those monthly benefits when you retire, adding another layer of dependable income to your plan. This integration with Social Security is a core feature of the FERS system.

The Flexible Pillar: The Thrift Savings Plan

The third and most powerful pillar is the Thrift Savings Plan (TSP). If you’re familiar with a 401(k), the TSP will feel very familiar—it’s the federal government’s version of a retirement savings plan. This is where you have direct control, choosing how your money is invested to grow over time.

What really makes the TSP a fantastic deal is the government's contribution. It’s essentially free money, and it comes in two parts:

- Automatic 1% Contribution: Your agency deposits an amount equal to 1% of your basic pay into your TSP account, no matter what. You get this even if you don't contribute a single penny yourself.

- Matching Contributions: This is where you can really accelerate your savings. The government will match your contributions dollar-for-dollar on the first 3% of your pay you put in. For the next 2% you contribute, they’ll add fifty cents on the dollar.

To get the full government match, you only need to contribute 5% of your pay. Not doing so is like turning down a guaranteed 100% return on your money right from the start. It’s one of the best deals in any retirement plan, public or private.

To help you visualize how these components create your total retirement package, here’s a quick breakdown of the FERS system.

FERS Retirement Income Sources

| Component | Description | Source of Funding |

|---|---|---|

| Basic Benefit Annuity | Your traditional pension, providing a guaranteed monthly payment for life. | Contributions from you and your agency throughout your career. |

| Social Security | Standard Social Security benefits that you've earned over your working years. | Payroll taxes paid by you and your agency. |

| Thrift Savings Plan (TSP) | A retirement savings and investment account, similar to a 401(k). | Your contributions, plus automatic and matching agency contributions. |

This table shows that your retirement isn't just a single pension check; it’s a complete system designed to provide income from different sources.

How the Three Pillars Work in Harmony

These three pillars weren’t created in a vacuum—they were designed to work as a team. Your FERS pension provides a secure floor, Social Security adds another guaranteed income stream, and the TSP gives you the opportunity for growth and much-needed flexibility.

For instance, your TSP account can be a lifesaver for those big, one-time retirement expenses like a new car or a roof repair. Or, you can draw from it to supplement your monthly income for travel and hobbies. It gives you options that your fixed pension and Social Security payments simply can’t.

By understanding and managing all three components, federal employees can build a truly robust retirement income that will provide security for years to come. If you're looking for clarity on your own numbers, a personalized benefits review can show you exactly how these pillars will support your retirement.

How Your Federal Pension Is Funded and Protected

It's a fair question to ask: how safe is my federal pension, really? After all, it's the foundation of your future financial security. The good news is that the federal retirement system is built like a fortress, designed to withstand just about anything the economy or political landscape can throw at it.

Unlike a lot of other retirement plans you might hear about, your federal pension isn't just an IOU. It’s backed by a massive, dedicated trust fund. Think of it like a reservoir that's constantly being filled from three separate rivers.

- Your Contributions: A small percentage is automatically deducted from your basic pay.

- Agency Contributions: Your employer, the federal government, makes a much larger contribution on your behalf.

- Investment Earnings: The money in the fund is invested, and the returns help it grow even more.

A System Built for Stability

This three-pronged approach creates a remarkably stable financial foundation. It ensures there's always enough money flowing in to cover the payments owed to every single retiree, now and in the future. This isn't just a hopeful projection; it's a legal requirement. Federal law mandates that the pension system remains fully funded.

That legal backing is what really sets your federal pension apart. Your benefits aren't at the mercy of stock market swings or what gets decided during annual budget battles in Congress. Even when the government shuts down, pension checks to retirees keep going out without a hitch.

The federal retirement trust is uniquely stable. Unlike many state or private pensions, it's fully funded, meaning it has enough assets to cover all its current and future liabilities.

In fact, the system is so financially sound that it has occasionally been used as a temporary financial backstop during federal debt ceiling debates. This just underscores how critical and reliable the fund is to the nation's overall fiscal health.

The bottom line? Your pension is one of the most secure retirement benefits you can find anywhere. For a deeper dive into the numbers, you can check out this in-depth analysis of federal benefits. It's the kind of rock-solid security that lets you plan for retirement with genuine peace of mind.

Common Questions Federal Employees Ask About Their Pension

Even with a good grasp of the basics, some specific scenarios always pop up. Let's walk through some of the most common questions I hear from federal employees to clear up any lingering confusion about your benefits.

What If I Leave My Federal Job Before I Can Retire?

This is a big one. What happens if your career path changes and you leave federal service?

Good news: if you've put in at least five years, you're vested. That means the pension benefit you've earned is yours to keep. You can't just take it with you when you leave, but you can apply for a deferred retirement once you hit the minimum retirement age, which for most is age 62.

So, even if you move into the private sector, those years of public service will still be waiting to provide a steady income stream in your later years.

Can My Spouse Receive Benefits After I’m Gone?

Absolutely. Both FERS and CSRS have built-in survivor benefits, which is a critical piece of the puzzle for your family's financial security.

When you're filling out your retirement paperwork, you'll have the option to elect a survivor annuity. Choosing this will mean a small reduction in your own monthly pension, but it guarantees your spouse a portion of that income for the rest of their life after you pass away.

Think of the survivor annuity as a lifelong insurance policy for your spouse. It's a powerful way to ensure they have continued financial stability, providing real peace of mind.

Will My Pension Keep Up with Inflation?

This is one of the most valuable features of a federal pension. The answer is a resounding yes.

Most federal retirees receive annual Cost-of-Living Adjustments (COLAs). These are designed to increase your monthly pension payment to help it keep pace with the rising costs of, well, everything.

This inflation protection is a massive advantage over many private-sector pensions and 401(k) plans, ensuring your buying power doesn't get whittled away over a long retirement.

Getting these details right is the key to a truly secure retirement. At Federal Benefits Sherpa, we offer personalized guidance to help you make sense of all your options. Start with a free 15-minute benefit review to get clarity on your financial future.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved