Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Guide to Federal Employee Life Insurance

As a federal or postal employee, you're part of a massive group life insurance program called FEGLI. It's designed to give your loved ones a financial safety net, and the best part is that you're often automatically enrolled in basic coverage right when you're hired. Think of it as a foundational piece of your financial plan that you can build on throughout your career.

A Primer on Your Federal Life Insurance

The Federal Employees' Group Life Insurance (FEGLI) program is, quite simply, one of the biggest group life insurance plans in the world. Run by the Office of Personnel Management (OPM), it was built to be a straightforward and easy-to-access benefit for millions of public servants. For most people just starting their federal career, enrollment in the "Basic Insurance" plan is automatic.

This starter coverage is linked directly to your pay, and the government even helps out by paying for one-third of the premium. This cost-sharing arrangement makes it an incredibly affordable way to get immediate peace of mind for your family from your very first day on the job.

But FEGLI isn't just a one-size-fits-all policy. It’s set up like a menu, allowing you to add more layers of protection as your life changes—maybe you get married, have kids, or buy a house. These extra options are paid for entirely by you, but they give you the flexibility to seriously boost your coverage when you need it most.

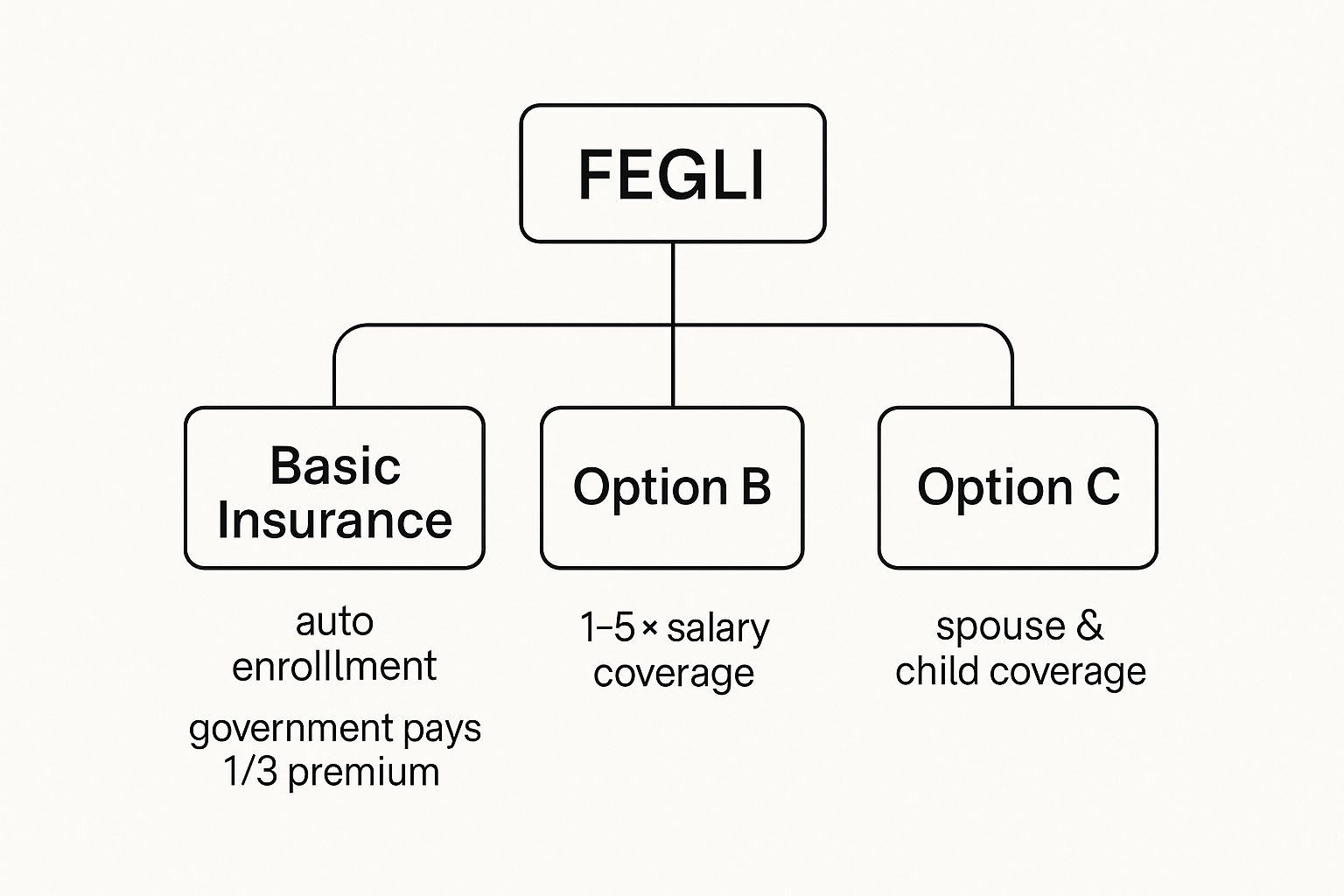

The program is broken down into a few key parts:

- Basic Insurance: This is the automatic, employer-subsidized foundation.

- Option A: Adds a standard, fixed amount of extra coverage.

- Option B: Lets you buy coverage in multiples of your annual salary.

- Option C: Specifically covers your spouse and eligible dependent children.

This structure allows you to start with a solid base and then customize your plan to fit your family's unique situation.

As you can see, the program flows from the automatic Basic Insurance to the optional layers, giving you clear pathways to tailor coverage for yourself and your family.

Understanding the Scale and Stability of FEGLI

FEGLI has been around since 1954, so it has a long, proven track record of providing reliable benefits. To figure out your Basic Insurance death benefit, the government takes your annual salary, rounds it up to the next thousand-dollar mark, and then adds an extra $2,000. The premium for this basic coverage has barely budged in decades, which really speaks to the program's solid financial footing. You can discover more insights about the long-standing FEGLI program and its premium structure on the OPM website.

The real beauty of FEGLI is its accessibility. It gives nearly every federal employee a guaranteed baseline of life insurance coverage without needing a medical exam to get started. That alone removes a huge hurdle that many people run into on the private market.

This guaranteed issue is a massive perk, especially if you have pre-existing health conditions that could make private insurance expensive or even impossible to get. As we dig deeper into the different options, you'll see exactly how you can use this foundational benefit to build a truly comprehensive protection plan.

Decoding Your FEGLI Coverage Options

Think of your federal life insurance not as one single policy, but more like a set of building blocks. The Federal Employees' Group Life Insurance (FEGLI) program gives you a solid foundation with its Basic coverage. But the real power comes from how you can stack optional layers on top to build a plan that truly fits your life.

Each option has a specific job, whether it's covering your family or multiplying your salary in benefits. Getting a handle on these components is the first step toward creating a real financial safety net for your loved ones. Let's pull apart each piece of the FEGLI puzzle so you can see exactly how they fit together.

The Foundation: Basic Insurance Amount

Every FEGLI plan begins with the Basic Insurance Amount (BIA). This is the coverage you're automatically enrolled in as a new federal employee, and the government even chips in to pay for one-third of the premium.

The coverage amount is calculated in a specific way: they take your annual salary, round it up to the next thousand-dollar mark, and then add $2,000. So, if your salary is $54,500, it gets rounded up to $55,000, and with the extra $2,000, your Basic coverage is $57,000. Simple enough, but there’s a great built-in kicker for younger employees.

The Extra Benefit: If you're under the age of 45, your Basic coverage automatically includes an "Extra Benefit" at no additional cost to you. This nifty feature doubles your BIA death benefit until you hit age 36. After that, it slowly decreases each year until it disappears completely at age 45.

This is a fantastic, cost-free boost in protection during those years when you might be starting a family, buying a home, and taking on more financial responsibilities.

Adding More Protection With Optional Coverage

While the Basic coverage is a great start, you can seriously ramp up your protection by adding optional layers. You pay the full premium for these options, but they give you the flexibility to adapt your coverage as your life changes.

Option A (Standard): This is the most straightforward add-on. It gives you a flat $10,000 of extra life insurance coverage. It’s a simple way to bump up your death benefit a little.

Option B (Additional): This is where you can get some serious coverage. Option B is by far the most popular and powerful choice, letting you buy additional insurance in multiples of your annual salary—one, two, three, four, or even five times your basic pay. For a mid-career professional with a family, adding five times their salary can mean the difference between hardship and financial stability for their loved ones.

Option C (Family): This option is designed specifically to cover your family members. You can get coverage for your spouse and eligible dependent children all under one policy. It’s sold in multiples, providing up to $25,000 for your spouse and $12,500 for each eligible child.

Building Your Custom FEGLI Plan

The real beauty of the FEGLI program is how you can mix and match these options. You're not stuck with a one-size-fits-all plan; you can put the pieces together to match your exact needs.

Let’s look at how this plays out in the real world.

Scenario 1: The New Employee

A 28-year-old single employee making $50,000 a year might feel their Basic coverage is plenty for now. Their BIA would be $52,000, which gets automatically doubled to $104,000 thanks to the Extra Benefit. That's a strong financial cushion with very little out-of-pocket cost.

Scenario 2: The Mid-Career Parent

Now, picture a 42-year-old employee who makes $95,000. They have a spouse, two kids, and a mortgage, so their needs are much greater. They could put together a really comprehensive plan:

- Basic Coverage: $97,000

- Option B: 5x their salary, which adds another $475,000 in coverage.

- Option C: 5 multiples, providing $25,000 for their spouse and $12,500 for each child.

This combination creates a total death benefit of $572,000 for the employee, on top of the separate coverage for their family.

Once you understand each building block, you can make smarter decisions and ensure your federal life insurance truly protects what matters most. For personalized help sorting through these choices, you might consider talking with a specialist at Federal Benefits Sherpa who can help you map out the right strategy.

How to Figure Out Your FEGLI Costs and Premiums

Getting a handle on the real cost of your federal life insurance is a must for any solid financial plan. FEGLI is definitely convenient, but the way your premiums are set up can really start to pinch your budget down the road, especially as you get older.

For your Basic Insurance, the math is simple and the cost is low. The government chips in to pay for one-third of the premium, which makes it a fantastic, affordable foundation of coverage for almost any federal employee. You just pay the other two-thirds through a small deduction from your paycheck.

But the story changes once you start adding the optional coverages—Option A, B, and C. For those, you're on the hook for 100% of the cost. And those costs don't stay the same. They're built to go up as you age, and that's the detail you really need to pay attention to.

The Five-Year Itch: How Age Bands Drive Up Your Premiums

The single biggest thing that affects your FEGLI costs for optional coverage is the five-year age band system. You can think of it like a subscription that automatically gets more expensive every five years after you turn 35. As soon as you cross into a new age bracket (say, from 39 to 40, or 49 to 50), your premium for the exact same amount of coverage jumps up.

This means that while your premiums for Option A and B might feel like a bargain early in your career, they can become a serious budget item later in life. What's convenient today can easily become a financial headache tomorrow. That's the core trade-off you have to consider with the FEGLI program.

To put it in perspective, optional FEGLI coverage can end up costing you a lot more than a private term life policy. For instance, a standard non-smoker might pay a total of $12,584 for $100,000 of FEGLI Option B coverage by age 65. In contrast, a 25-year private term policy locked in at age 40 could cost just $7,775 for that same period. You can always discover more insights about federal benefits straight from the source at OPM.

This escalating cost structure is the most misunderstood part of FEGLI. A lot of employees get a nasty surprise when their life insurance deduction suddenly increases, just because a birthday pushed them into a new, more expensive age band.

A Look at How Option B Costs Increase

Let's break this down with a real-world example to see how the costs climb. This table gives you a clear picture of how the bi-weekly premium for $100,000 of Option B coverage changes as you move through your career.

Sample FEGLI Option B Bi-Weekly Premiums by Age

| Age Group | Bi-Weekly Premium for $100,000 Coverage |

|---|---|

| 35-39 | $3.00 |

| 40-44 | $4.00 |

| 45-49 | $6.00 |

| 50-54 | $10.00 |

| 55-59 | $20.00 |

| 60-64 | $44.00 |

Note: These premiums are for illustration and are not official OPM rates.

Look closely at those numbers. The cost more than doubles when you move from your late 40s to your early 50s, and then it doubles again in your late 50s. This is exactly why you need to think about your life insurance strategy ahead of time. When you understand these future costs now, you can make a smarter decision about whether to stick with FEGLI alone or mix in other options that give you more stable, predictable pricing for the long haul.

Navigating FEGLI Enrollment and Life Changes

Treating your federal life insurance as a "set it and forget it" benefit is a common mistake. The reality is, your life and your family's needs are constantly changing, and your coverage should keep pace. Knowing when and how to adjust your FEGLI is crucial for making sure your loved ones are truly protected.

When you first start your federal career, the process is incredibly simple. You're automatically covered by Basic FEGLI from your first day on the job. The government gives you a golden opportunity right out of the gate: a 60-day window to sign up for any of the optional coverages—Options A, B, and C—with no medical questions asked.

This is, without a doubt, the easiest time to get all the coverage you think you'll need. If you let that initial window close, getting more insurance later usually means passing a physical exam, and your health could become a barrier.

When Life Happens: Using Qualifying Life Events

Outside of that initial hiring period, your main opportunity to change your FEGLI coverage comes from what's known as a Qualifying Life Event (QLE). Think of these events as special keys that unlock your ability to make changes when you need them most.

A QLE is a major life milestone that shifts your financial landscape and, by extension, your insurance needs.

A Qualifying Life Event is your chance to make sure your FEGLI benefits are in sync with your family's new reality. You have to act fast, though—the 60-day window after a QLE closes before you know it.

You get exactly 60 days from the date of the event to submit your changes. Some of the most common QLEs that let you increase your life insurance include:

- Marriage or Divorce: Tying the knot usually means adding a spouse you want to protect financially. A divorce might mean you need to rethink your beneficiary designations and overall strategy.

- Birth or Adoption of a Child: Bringing a new child into your life is probably the most classic reason people realize they need more life insurance.

- Death of a Spouse: A devastating loss can also mean you're now the sole provider for your children or other dependents, requiring an immediate coverage review.

For example, getting married allows you to enroll in Basic coverage if you initially turned it down, and you can also add Option B (for your spouse and other family members) and Option C (for your children).

Don't Count on an Open Season

Many federal employees are used to the annual Open Season for health benefits and assume life insurance works the same way. It doesn’t. FEGLI Open Seasons are incredibly rare—so rare that you absolutely can't plan for one.

The Office of Personnel Management (OPM) calls them very infrequently; there have only been a few since the program started back in the 1950s.

Waiting for a hypothetical Open Season to get the coverage your family needs is a huge gamble. Your life can change overnight, and waiting years for the next slim chance to enroll just isn't a reliable plan.

That's why it's so important to make the most of your initial 60-day enrollment period and any QLEs that come your way. These are your moments to be proactive and make sure your federal employee life insurance is always working for you.

How FEGLI Works When You Retire

Retirement changes everything, and that definitely includes your federal life insurance. The decisions you make about FEGLI right before you hang up your hat can have a massive impact on your family's financial security for years to come. This isn't something to figure out on your last day of work—it requires some serious thought ahead of time.

To keep your FEGLI coverage at all, you first have to clear a major hurdle: the “5-year rule.” It’s pretty simple—you must have been continuously enrolled in any FEGLI coverage you want to keep for the five years leading right up to your retirement date.

If you're a newer employee and haven't been in the federal system for a full five years, you can still qualify, but you must have been enrolled for your entire period of service. Meeting this requirement is non-negotiable; it's the ticket to carrying your life insurance into your post-career life.

The Critical 5-Year Rule for Eligibility

Think of this rule as a loyalty perk. By staying enrolled, you’re essentially proving your commitment to the program, and in return, you get the option to continue this valuable benefit long after you stop receiving a federal paycheck.

This is where a lot of people get tripped up. If you waived FEGLI early in your career and only signed up a year or two before retiring, you won't be able to keep that coverage. It’s a common and costly mistake that really drives home the need for long-term planning with your federal benefits.

Your Three Choices for Basic Insurance Reduction

Once you've cleared the 5-year hurdle, you're faced with a big decision about your Basic Insurance Amount (BIA). You have three options, and each one strikes a different balance between how much you’ll pay in premiums and the final death benefit your loved ones will receive.

You can think of these as dials you can turn to customize your coverage for your new lifestyle.

- 75% Reduction: This is the default choice and, by far, the most affordable. After you turn 65, your BIA gradually shrinks by 2% each month until it bottoms out at just 25% of its original value. The best part? Once you hit 65, the premiums for this reduced coverage stop completely. You pay nothing more.

- 50% Reduction: With this option, your BIA reduces by 1% per month after age 65 until it hits 50% of its original amount. You'll pay a higher premium than the 75% reduction choice, but you lock in a larger death benefit for your beneficiaries.

- No Reduction: Just like it sounds, this option lets you keep 100% of your Basic Insurance for the rest of your life. It provides the maximum possible payout, but it comes at a significant price—the premiums are much higher, and you'll keep paying them deep into retirement.

This is one of the most important benefit decisions you'll make. The 75% Reduction can save you thousands in premiums, but the No Reduction option ensures your family gets the full amount you planned for.

It's helpful to know why the costs are structured this way. With 42% of federal employees over age 50—compared to just 33% in the general U.S. workforce—the program's costs are heavily weighted toward an older population. You can discover more insights about federal employee demographics to see how these trends influence your benefit planning.

What Happens to Your Optional Coverage

Your optional coverages—Options A, B, and C—have their own set of rules. Just like with Basic, you must have been enrolled in them for the five years leading up to retirement to keep them.

Option A coverage also reduces after age 65, eventually hitting $2,500, but the premiums become free at that point.

For Option B and Option C, you can choose to continue them, but you’ll be on the hook for the full, age-adjusted premiums for as long as you want the coverage. Be warned: these costs can get very expensive as you get older, so it's critical to review the numbers carefully.

Making the right choices for your federal employee life insurance in retirement means understanding these trade-offs. A professional at Federal Benefits Sherpa can help you walk through the numbers and build a strategy that truly protects your legacy.

Should You Supplement FEGLI with Private Insurance?

Here’s a question every federal employee should ask themselves: Is my Federal Employees' Group Life Insurance (FEGLI) enough to truly protect my family? For a surprising number of people, the answer is no. While FEGLI is a fantastic starting point—incredibly convenient and guaranteed when you first join—it often isn't the complete puzzle for your long-term security.

Think of FEGLI as the solid foundation of your financial safety net. It's reliable, it's there from day one, and it's easy. But if you have a growing family, a mortgage, student debt, or dreams of sending kids to college, that foundation alone might not be enough to withstand a major life event. A private policy can be the frame and roof, giving you the comprehensive coverage your family actually needs to feel secure.

It really comes down to understanding the trade-offs. FEGLI’s biggest selling points are its simplicity and accessibility. But the costs for optional coverage jump every five years as you get older, and the policy isn't portable—if you leave federal service before you're eligible to retire, you can't take it with you. This is exactly where private insurance, especially a good term life policy, often has the edge with level premiums that are locked in for decades.

Analyzing Different Career Stages

Your insurance needs are never set in stone; they change as your career grows and your life evolves. Let’s walk through how a blended strategy might look at different points in your federal journey.

The Young, Single Employee: Just starting out? The automatic Basic FEGLI, especially with the Extra Benefit doubling the payout, is often more than enough. The cost is low, and the coverage is high, making it an unbeatable deal early on.

The Growing Family with a Mortgage: This is when supplementing becomes a real game-changer. Imagine a 35-year-old with a spouse, two kids, and a 30-year mortgage. They could stick with their Basic FEGLI and then add a private 20 or 30-year term policy for a substantial amount, like $500,000 or even more. This private plan locks in an affordable rate while they're young and healthy, creating a massive, cost-effective safety net when their financial responsibilities are at their peak.

The Pre-Retiree: If you're in your 50s, you've probably noticed your FEGLI Option B premiums getting painfully high. At this stage, it often makes sense to reduce or even drop Option B and replace it with a more affordable private term policy that gets you to, or just past, your planned retirement date. This secures your financial plan without the sticker shock of escalating group rates.

The smartest play for most feds is to layer FEGLI with private insurance. Use FEGLI for its guaranteed-issue convenience, and bring in a private policy for its cost stability and the ability to get much higher coverage amounts.

Making the Right Financial Decision

Don't forget that the government's commitment to benefits like FEGLI is a huge perk of public service. Access to group life insurance is far from guaranteed in the private sector. In fact, for companies with fewer than 100 workers, only 42% of employees even have access to life insurance. That’s a world away from the 90% access rate in firms with 500 or more employees. You can dig into these workplace benefit gaps in the latest U.S. labor statistics.

At the end of the day, the choice to supplement your federal employee life insurance is a personal one. By comparing the predictable, locked-in costs of a private term policy against the age-based price hikes of FEGLI’s optional coverage, you can build a financial safety net that is both stronger and more affordable. Talking with a professional who understands federal benefits, like the team at Federal Benefits Sherpa, can help you crunch the numbers and find that perfect balance for your family.

Your Top Questions About Federal Employee Life Insurance

Even when you think you've got the Federal Employees' Group Life Insurance (FEGLI) program figured out, real life has a way of throwing curveballs. What happens if you need to change a beneficiary? What if you leave your job or take an extended leave of absence?

These aren't just minor details; getting them right is crucial to making sure the policy works the way you expect it to. Let's walk through some of the most common scenarios federal employees run into.

How Do I Change My FEGLI Beneficiaries?

This is a big one, and thankfully, it’s pretty straightforward. To update who receives your life insurance payout, you have to use the official Designation of Beneficiary form (SF 2823). You just fill it out and get it to your human resources office. That's it.

It's a really good idea to revisit this form after any major life event—getting married, a divorce, a new baby, you name it.

One of the most costly mistakes people make is thinking their will automatically takes care of this. It doesn't. For FEGLI, the SF 2823 form on file is the legally binding document. It will always trump what's written in your will, so keeping it updated is absolutely essential.

Can I Keep FEGLI if I Leave My Federal Job Early?

If you leave federal service before you're eligible to retire, your FEGLI coverage doesn't just stick with you. But you're not left completely high and dry. The program gives you a very specific, time-sensitive way to hang onto your coverage.

You have a 31-day window from your separation date to convert your group FEGLI coverage into an individual whole life insurance policy. The best part? No medical exam is required, which is a huge benefit if you have pre-existing health conditions. The catch, however, is that the premiums on these private policies are usually much, much higher than what you were paying as an employee. You’ll need to weigh the pros and cons and act fast before that 31-day window slams shut.

What Happens to My FEGLI During Leave Without Pay?

Going on Leave Without Pay (LWOP) doesn't mean your life insurance just vanishes. Your FEGLI coverage actually continues for up to one full year while you’re in LWOP status.

The key difference is who foots the bill. While on leave, you're on the hook for the entire premium—your share and the portion the government usually covers for your Basic Insurance. Once you're back on the payroll, those accumulated premiums will be deducted from your paychecks until you're all caught up.

Navigating these rules is key to getting the most out of your benefits. If you want to explore how these scenarios apply to your specific situation, Federal Benefits Sherpa provides personalized guidance to help you make confident decisions. You can schedule a free benefits review at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved