Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Guide to Discontinued Service Retirement

For federal employees, losing your job unexpectedly can feel like the rug has been pulled out from under you. Discontinued Service Retirement, often called DSR, is a critical provision that acts as a financial safety net in these exact situations.

It’s not your standard, planned-for retirement. Instead, it allows a long-serving federal employee who loses their job through no fault of their own to start drawing their pension immediately, rather than having to wait until they hit the normal retirement age. This can be a lifesaver during a sudden and stressful career change.

What Is Discontinued Service Retirement?

Think of your federal career path as a long road trip with a set destination—a comfortable retirement, probably around age 62. Now, imagine an unexpected and unavoidable roadblock appears, bringing your journey to a halt. A Discontinued Service Retirement is like an official, pre-approved detour that lets you access your retirement funds right away, even though you haven't reached your original destination.

DSR isn't just an early retirement; it's a specific benefit triggered by an involuntary separation. This is the key. You can't just decide you want it. It's designed as a financial bridge for dedicated public servants who are let go for reasons completely outside their control, like a major reorganization or budget cuts.

The Involuntary Separation Trigger

The entire concept of DSR hinges on that one word: involuntary. This means you didn't quit, get fired for cause, or otherwise choose to leave. Your agency initiated the separation.

The Office of Personnel Management (OPM) has very specific rules about what counts. It’s not just any job loss. It's a special retirement option for U.S. government employees who are forced out due to agency actions.

Here are the most common scenarios that trigger DSR eligibility:

- Reduction in Force (RIF): This is the classic example, where an agency has to eliminate positions because of budget cuts, a reorganization, or simply a lack of work.

- Job Abolishment: Your specific role is permanently eliminated from the organization.

- Directed Reassignment: You are ordered to take a new job in a location outside your normal commuting area, and you decline the move.

- Transfer of Function: Your entire department or function is relocated to another geographic area beyond a reasonable commute, and you choose not to go with it.

Essentially, if the agency makes a decision that directly forces you out of your current job, and you didn't do anything to cause it, you might be looking at a DSR-qualifying event. It’s the government’s way of saying, "Thank you for your service; we know this wasn't your choice."

This is fundamentally different from a regular voluntary retirement, where you are in the driver's seat, deciding when to leave once you hit the right combination of age and years of service. DSR is a reactive measure, designed to soften the financial impact of an unexpected job loss for employees who have already invested a significant portion of their careers in public service.

To make the distinction crystal clear, let's compare DSR side-by-side with a standard, voluntary retirement.

DSR vs. Voluntary Retirement At a Glance

The table below breaks down the primary differences between these two federal retirement paths.

| Attribute | Discontinued Service Retirement (DSR) | Standard Voluntary Retirement |

|---|---|---|

| Trigger | Involuntary separation (RIF, job abolishment, etc.) | Employee's choice to retire |

| Eligibility | Specific age/service combos (20 years at age 50; 25 years at any age) | Standard age/service combos (e.g., MRA + 30 years, 60 + 20, 62 + 5) |

| Annuity Start | Immediately upon separation | The month after retirement |

| Control | Employee has no control over the separation event | Employee has full control over the retirement date |

| Purpose | To provide a financial safety net after job loss | To begin a planned retirement after a full career |

As you can see, while both lead to a federal pension, the circumstances and eligibility rules are worlds apart. DSR is a specific solution for a very specific problem—an unforeseen and involuntary end to your federal career.

How to Qualify for Discontinued Service Retirement

Getting approved for a Discontinued Service Retirement (DSR) is a bit like threading a needle. It’s not just about losing your job—your specific situation has to line up perfectly with a strict set of rules from the Office of Personnel Management (OPM).

Knowing these rules is the first and most important step. Let’s break down exactly what it takes to qualify, as the core requirements are the same for both the modern FERS system and the older CSRS.

The Core Age and Service Requirements

First things first, you have to meet a specific age and service threshold. Think of this as the price of admission. It proves you’ve had a long-term career in federal service.

You must hit one of these two milestones by the time you separate:

- Age 50 with 20 Years of Service: You're at least 50 years old with a minimum of 20 years of creditable federal service.

- 25 Years of Service at Any Age: You have at least 25 years of creditable service, regardless of how old you are.

These combinations are designed for career employees who've dedicated a huge chunk of their working lives to the government. If you don't meet one of these, a DSR simply isn't on the table for you, even if you lose your job involuntarily.

Your age and service years are the foundation. Without that solid base, the rest of the DSR structure—the involuntary separation—can't be built. It's the government's way of making sure this powerful benefit goes to its most tenured employees caught in a tough spot.

The Involuntary Separation Mandate

Meeting the time-in-service rules is only half the equation. The other, absolutely critical piece is how you leave your job. The separation must be genuinely involuntary.

This means you were pushed out of your position against your will, for reasons that have nothing to do with misconduct or poor performance. You can’t just quit and claim DSR; the agency has to initiate the separation.

Common qualifying events include a Reduction in Force (RIF), having your position completely eliminated, or declining a directed reassignment to a location far outside your normal commute.

Understanding the Reasonable Offer Rule

Now, here’s where things can get tricky. If your agency is downsizing, they might try to find another job for you. If you turn down what they consider a "reasonable offer," you could lose your DSR eligibility.

So, what does OPM consider a "reasonable" offer?

- Location: The new job must be within your current commuting area.

- Grade Level: It has to be at the same pay grade, or no more than a two-grade step-down.

If an offer checks both of these boxes and you say no, OPM will see your separation as voluntary. From their perspective, you chose to leave instead of accepting a comparable role.

Example Scenario: John vs. Jane

Let’s look at a quick example of how this plays out for two federal employees caught in the same RIF.

John's Situation:

John is 52, a GS-13 with 22 years of service in Washington, D.C. when his position is abolished. His agency offers him a different GS-13 job with similar duties just three miles away. John turns it down because he's heard bad things about the new manager. Because he declined a reasonable offer, John is not eligible for DSR.

Jane's Situation:

Jane is 48, a GS-12 with 25 years of service, also in D.C. Her position is also eliminated. The agency offers her a GS-12 position in Philadelphia. Since Philadelphia is well outside her commuting area, the offer is not considered reasonable. By declining it, Jane keeps her eligibility for Discontinued Service Retirement.

This distinction is crucial. You have to carefully evaluate any job offer you receive during a separation event because your decision has huge financial implications. If you’re ever unsure how the rules apply to your specific case, the experts at Federal Benefits Sherpa can help you navigate your options.

Navigating the DSR Application Process

When that separation notice lands on your desk, the path to Discontinued Service Retirement can seem like a mountain of paperwork and deadlines. It’s completely normal to feel overwhelmed. Let's break it down into a clear, step-by-step roadmap you can follow.

First things first, you’ll need the right form. For most federal employees today, that’s the SF 3107 for FERS. It’s always a good idea to double-check with your agency to make sure you have the absolute latest version before you even think about putting pen to paper.

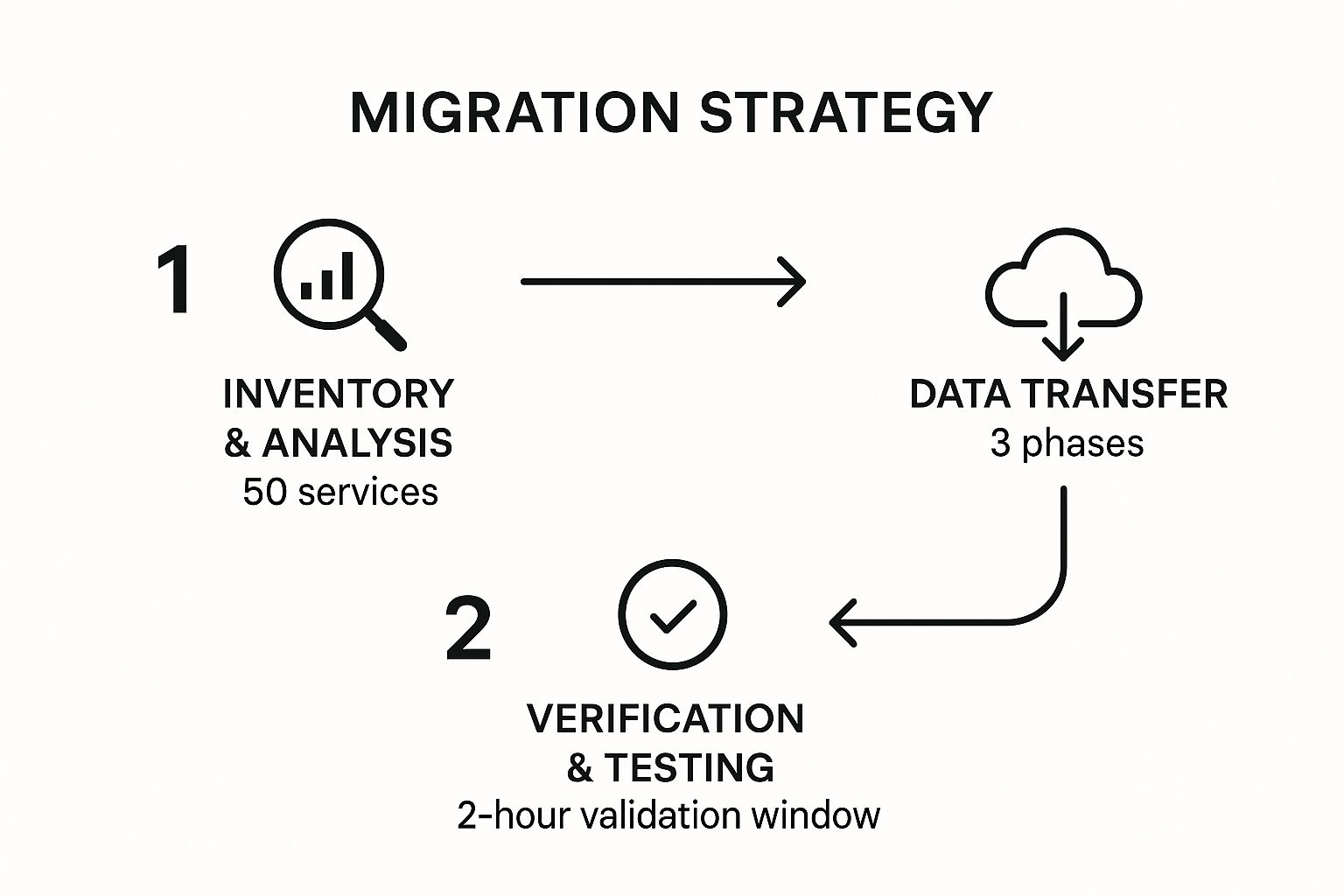

The infographic below gives you a bird's-eye view of the three main phases of the application journey.

Think of it as your game plan, showing you where to focus your energy as you move from gathering your documents to getting the final sign-off.

For example, you'll need to round up everything from proof of service letters and your RIF notice to any separation memos from supervisors. Make a photocopy of everything. Trust me, having a complete paper trail is your best friend in this process.

And don't forget the deadlines. They're critical. OPM generally needs your completed application within 60 days of your separation to get your annuity payments started on time. Missing that window can cause some serious headaches and delays.

Gathering Required Documents

Your agency's HR department is your key partner here. They’re the ones who will officially verify your service history and confirm that you’re eligible for DSR. They'll typically provide an employment data statement or a similar verification letter.

Before you start filling out any forms, make sure you have these key documents in hand:

- Employment Data Statement: This is the official record of all your positions and pay grades.

- Separation Notice: The formal letter detailing the RIF, restructuring, or transfer of function.

- Proof of Service Computation Date: Your Leave and Earnings Statements or an SF 50 will have this.

- Offer Letters: Keep a record of any "reasonable offer" you either accepted or turned down.

Having these pieces of the puzzle ready from the start proves to OPM that you meet their strict requirements.

I also recommend keeping a simple communication log. Every time you talk to someone in HR, jot down the date, their name, and what you discussed. This little notebook can be a lifesaver if there's ever a dispute about when you submitted something or who you talked to.

A few practical tips: set calendar reminders for every deadline. When you submit a form, email a scanned copy to yourself to create a digital timestamp. It’s also smart to ask for a quick email acknowledgment whenever you hand something in.

"Keeping detailed records is your best defense against processing errors." — Federal Benefits Sherpa

Submitting and Tracking Your Application

When it’s time to send in your application, don’t just drop it in the mail. Use a service with tracking, like certified mail, or your agency’s secure e-Fax. You need proof that it was delivered. Once it's sent, start following up weekly to confirm it landed safely with either your HR office or OPM.

After OPM receives your package, they'll assign you a case number. You can use this number to check the status of your application through their e-Retirement system. Checking in regularly helps you catch any snags—like a missing signature—before they turn into major delays.

Here’s a quick checklist to keep you on track:

- Complete the SF 3107 (or the CSRS equivalent) with care.

- Attach all your supporting documents—the separation notice, service history, etc.

- Include your direct deposit information for your annuity payments.

- Sign and date every single form where it’s required.

- Submit it via a tracked service or your agency’s approved online portal.

- Write down your confirmation or tracking number and follow up.

This checklist turns a complicated process into a series of manageable steps, which drastically cuts down on the chances of an administrative hiccup.

Avoiding Common Application Pitfalls

You’d be surprised how often people forget to attach their separation notice. It’s probably the most common mistake, and it brings the whole process to a screeching halt. Another frequent issue is having mismatched dates between different forms and letters, which always triggers a request for corrections.

Before you submit anything, pull out your SF 50s and your RIF notice and compare all the dates. If you find a discrepancy, get it corrected with HR right away and get that correction in writing.

Here are a few other common tripwires and how to sidestep them:

- Missing Signatures: Flip through every page and sign everywhere you’re supposed to.

- Late Submission: Use calendar alerts to stay ahead of all deadlines.

- Incorrect Forms: Always confirm the form numbers and versions with HR.

- Unclear Addresses: Only use the official mailing addresses or contact info provided by OPM or your agency.

Final Submission Reminders

Before you sign on that final dotted line, do one last review. Check every field and make sure the information matches your official personnel records perfectly.

Once you’ve sent it off, keep a copy of every single document, both digitally and in a physical file, for at least seven years.

And what if you’re waiting and waiting? If your application has been processing for more than 90 days without an update, it’s time to get on the phone. Contact your agency’s HR liaison and OPM directly to ask for a status update.

A little proactivity and consistent follow-up can make a huge difference in shortening your wait time and getting your well-earned annuity started.

Weighing the Pros and Cons of DSR

Deciding whether to take a Discontinued Service Retirement is one of the most significant financial choices you'll face. It's a powerful option that can provide a much-needed safety net if your federal career ends unexpectedly, but it's certainly not the right move for everyone.

To make the best decision for your future, you need a clear-eyed view of what you gain and what you might be giving up. Let’s walk through the advantages and the potential long-term drawbacks you need to consider.

The Key Advantages of Taking DSR

The single biggest benefit of DSR is immediate financial stability. When your career is cut short through no fault of your own, this is huge. You get to start your pension right away instead of having to wait years to reach your Minimum Retirement Age (MRA).

This immediate income acts as a crucial bridge, helping you cover your bills while you figure out what's next. Whether you plan to find a new job or ease into a different chapter of life, that pension check provides a foundation to build on.

Another massive plus is keeping your federal benefits. If you’ve been covered under the Federal Employees Health Benefits (FEHB) program for the five years leading up to your separation, you can carry that insurance with you into retirement. For many federal employees, this is the most critical piece of the puzzle. Finding affordable, quality health insurance on the open market is a serious challenge, and DSR solves that problem. The same goes for your Federal Employees' Group Life Insurance (FEGLI).

So, what are the main draws?

- Immediate Annuity Payments: Your federal pension starts right after you separate, providing a reliable income when you need it most.

- Continued Health Insurance: You get to keep your valuable FEHB coverage, paying the same premiums as any other federal retiree.

- Retained Life Insurance: Your FEGLI coverage can continue, ensuring your family has a financial safety net.

For many, DSR is the essential lifeline that turns a potential financial crisis into a manageable transition. It provides immediate security and preserves hard-earned benefits at a critical moment.

Potential Drawbacks to Consider

Of course, there's no such thing as a free lunch. Accessing your retirement benefits early comes with some real trade-offs. The most important one is that your annuity will be permanently smaller than it would have been if you had worked longer.

Your pension is calculated based on your years of service and your high-3 average salary. By leaving early, you lose out on the chance to add more years to that calculation and miss potential pay raises that would have boosted your high-3. This reduction will affect your income for the rest of your life. An amount that seems perfectly fine today might feel a lot tighter 10 or 20 years down the road.

On top of that, if you're a FERS employee who hasn't hit age 62 yet, you won't get the FERS Annuity Supplement. This supplement is specifically designed to fill the income gap until you can start collecting Social Security. Missing out on it means your monthly income will be noticeably lower during your early retirement years.

A Clear Comparison

To help you see the whole picture, it's useful to lay everything out side-by-side. Think of it as a decision matrix for your Discontinued Service Retirement.

Decision Matrix for Discontinued Service Retirement

This table summarizes the key advantages and potential disadvantages you'll want to think through before opting for DSR.

| Consideration | Key Advantages (Pros) | Potential Disadvantages (Cons) |

|---|---|---|

| Annuity Income | Payments begin immediately upon separation. | The final annuity amount will be permanently smaller. |

| Health Benefits | You can continue your FEHB coverage into retirement. | No direct disadvantage; this is a major benefit. |

| FERS Supplement | N/A | You are not eligible for the supplement until age 62. |

| TSP Growth | You maintain full control over your TSP funds. | You stop making contributions, missing potential growth. |

| Peace of Mind | Provides immediate financial security and stability. | May create long-term financial pressure due to a lower income. |

Ultimately, choosing to take a discontinued service retirement is a deeply personal decision. It all comes down to balancing your immediate need for security against the long-term goal of maximizing your retirement income.

For expert guidance tailored to your specific situation, the team at Federal Benefits Sherpa can help you analyze the numbers and make a confident decision.

Managing Your Finances After Taking DSR

Getting your Discontinued Service Retirement approved is a huge step, but it's really just the beginning of a new financial chapter. Navigating this transition successfully is about more than just the paperwork—it requires a solid plan.

That shift from a steady paycheck to a fixed annuity can feel abrupt. Suddenly, your entire income structure has changed. But with some thoughtful management, you can build a secure and rewarding life post-career. The key is to get proactive with your resources, from your new pension to your lifelong savings. This means getting real about your budget, making smart moves with your TSP, and understanding how taxes will work now.

Let's walk through the practical steps to take control of your financial future after an unexpected end to your federal service.

Creating a Budget for Your New Reality

First things first: you need a budget that reflects your new income. Your DSR annuity is almost certainly going to be less than your old salary, so getting a crystal-clear picture of where your money goes is non-negotiable. Don't think of it as a restriction; think of it as a financial GPS.

Start by tracking every dollar you spend for a month or two. This will give you the raw data you need. From there, sort everything into two buckets: essential needs (like your mortgage, utilities, food, and healthcare) and discretionary wants (things like travel, hobbies, and eating out). This simple exercise quickly reveals where you can trim the fat without hurting your quality of life.

A solid budget is your foundation. It's the tool that gives you peace of mind, ensuring your annuity and savings will last for the long haul after a discontinued service retirement.

Making Smart Decisions with Your Thrift Savings Plan

Your Thrift Savings Plan (TSP) is likely one of your biggest assets, and your decisions about it now will echo for decades. You've got a few paths you can take, and none of them should be chosen lightly.

- Leave It In: You can simply keep your money right where it is in the TSP. It will continue to grow in those famously low-cost funds. For many, this is the simplest and often most effective option.

- Roll It Over: Another choice is to move your TSP funds into an Individual Retirement Account (IRA). The main draw here is a much wider menu of investment options, from individual stocks to countless mutual funds, which might appeal if you're a more hands-on investor.

- Start Withdrawals: You can also begin taking payments from your TSP, either as monthly installments, a lump sum, or by purchasing a TSP annuity. Just be very aware of the tax hit that comes with any withdrawal.

Your TSP is your long-term nest egg. The decision of how to manage it should align with your overall retirement goals, risk tolerance, and the timeline for when you'll need the funds. Hasty decisions can be costly.

This is one area where getting a second opinion from a professional can be incredibly valuable. A financial advisor who specializes in federal benefits can help you map out a strategy that fits your unique situation. If you're looking for that kind of specialized help, the folks at Federal Benefits Sherpa can offer personalized guidance.

Preparing for Taxes in Retirement

Retirement doesn't mean you stop paying taxes. In fact, your tax situation can get a bit more complicated. Your federal annuity is generally taxable at the federal level, though a small slice of it might be tax-free if you made after-tax contributions to the retirement system over the years.

Then there are state taxes, which are all over the map. Some states won't tax your pension income at all, while others will tax it just like any other income. You absolutely must figure out your state's rules to avoid a nasty surprise come tax time.

You'll also need to decide whether to have taxes withheld directly from your annuity payments or if you'd rather make estimated tax payments yourself each quarter. The right choice depends on your total financial picture—including any TSP withdrawals or other income sources. Getting your tax strategy right is a crucial piece of the retirement puzzle.

How DSR Compares to Private Sector Severance

When you look at how the federal government handles involuntary separations, it’s a whole different ballgame compared to the private sector. Both worlds have ways to soften the blow of a layoff, but the federal discontinued service retirement is a unique beast, built specifically for a career civil service system.

In the corporate world, if you're laid off, you're likely looking at a severance package. This usually comes as a lump-sum check or maybe a few months of continued pay, calculated based on how long you were with the company. The goal is simple: to give you a financial cushion while you pound the pavement looking for a new job.

The core difference is the outcome. Private sector severance is a temporary bridge to new employment, whereas DSR is a permanent bridge to retirement income.

This really gets to the heart of a philosophical divide. A severance package is transactional—it’s a final payout to close the books on your time with the company. DSR, on the other hand, is a recognition of long-term service. It doesn’t just end the relationship; it accelerates a benefit you've been earning for years: your pension.

A Look at Global Approaches

This approach is pretty specific to the U.S. federal system. Around the world, countries handle workforce reductions in many different ways, but you’d be hard-pressed to find another system that offers an immediate, penalty-free retirement annuity to long-serving employees who are let go.

In most developed countries across Europe and Asia, laid-off workers typically get severance pay, beefed-up unemployment benefits, or access to job retraining programs. The U.S. federal government’s willingness to grant an immediate FERS pension without age penalties is a rare and incredibly valuable benefit. You can dig into a full report on global retirement systems to see just how unique this is.

Key Structural Differences

Let's get down to brass tacks. How do these two safety nets really stack up against each other?

- Form of Payment: Severance is typically a one-shot lump sum. DSR is a lifelong annuity—a check that shows up in your bank account every single month for the rest of your life.

- Health Insurance: With a corporate layoff, you might get a temporary subsidy for COBRA, but then you're on your own. With DSR, you can keep your Federal Employees Health Benefits (FEHB) coverage for life, just as if you had retired on your own terms.

- Purpose: Severance is a short-term patch to get you to your next job. DSR is a long-term income stream designed to support you permanently in retirement.

At the end of the day, discontinued service retirement truly reflects the unique promise of a federal career. It’s not about giving you a temporary payout; it's about providing a lasting solution.

Answering Your Top Questions About DSR

Making a big decision like discontinued service retirement always comes with a lot of "what ifs." It's completely normal to wonder how this choice will ripple out and affect your career, your savings, and the benefits you've worked so hard to earn.

Let's walk through some of the most common questions federal employees have. Getting clear, straightforward answers is the best way to feel confident that you're making the right move for your future.

Can I Go Back to Work for the Feds After DSR?

The short answer is yes, you can. But it’s not as simple as just picking up where you left off, and you absolutely need to know the rules before you accept another federal job.

When you're reemployed, your DSR annuity payments will stop for as long as you're working. On top of that, your new salary is typically reduced by the amount of the annuity you were receiving. When you decide to retire for good from that new position, your pension will be recalculated to factor in your additional years of service.

Before you even think about accepting another federal role, it's critical to talk to OPM and the HR department of your potential new agency. They can help you understand the precise financial implications.

What Happens to My TSP If I Take DSR?

Your Thrift Savings Plan (TSP) is your money, and it stays that way. Taking DSR doesn’t negatively impact your account or your control over it in any way.

You’ll have all the same withdrawal options as anyone else who separates from federal service.

- Keep your money in the TSP and let it continue to grow.

- Roll it over into an Individual Retirement Account (IRA).

- Start taking withdrawals, following the standard TSP rules.

The bottom line is that DSR doesn't force your hand. It gives you the flexibility to manage your TSP savings in a way that makes the most sense for your personal retirement strategy.

How Will DSR Affect My Social Security?

Taking DSR doesn't come with a direct penalty for the Social Security benefits you’ve already earned. The main impact comes from the fact that you're leaving federal service earlier than you planned.

Since you'll stop contributing to Social Security sooner, your lifetime earnings average might be a bit lower than if you'd worked for several more years. This could result in a slightly smaller Social Security check down the road. For most FERS employees, though, there aren't any major reductions or direct offsets to worry about.

CSRS employees, on the other hand, might run into the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO). But it's important to remember this isn't a DSR-specific penalty—it's just part of how the CSRS system works with Social Security, no matter how you retire.

Trying to make sense of federal benefits during an unexpected career change can feel overwhelming. Federal Benefits Sherpa is here to give federal employees the clarity and support they need to navigate these complex decisions. We can help you see exactly how DSR fits into your complete retirement picture. Schedule your free benefits review today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved