Your Guide to VERA Federal Retirement

When your agency starts talking about downsizing or restructuring, the term VERA often enters the conversation. But what exactly is it?

Think of a VERA—or Voluntary Early Retirement Authority—as a special early-out opportunity. It’s a management tool federal agencies can use to reshape their workforce without having to go through painful, involuntary actions like a Reduction in Force (RIF). It's essentially a formal, regulated "early access pass" to your retirement benefits, letting you bypass some of the standard age requirements.

For employees who qualify, it’s a chance to start their retirement years sooner than they ever thought possible, all while securing an immediate annuity.

What Is a VERA Federal Retirement Offer?

A VERA isn't a benefit you can just apply for whenever you feel ready to hang up your hat. Instead, it’s a strategic tool that agencies can pull out of their toolbox during specific times of change. This could be during a major reorganization, a budget-driven downsizing, or a push to bring in new skills.

To offer a VERA, an agency first needs to get the green light from the Office of Personnel Management (OPM).

When an agency gets that approval, it creates a win-win scenario. The agency can reduce its headcount or realign its teams with volunteers, which is far better for morale than forced layoffs. And for employees, it opens a surprise door to an accelerated retirement timeline, sometimes shaving off several years from their planned departure date.

Why Agencies Use VERA

So, why does the government lean on VERA? It's a humane and practical way to navigate workforce transitions. With a steady stream of federal employees hitting retirement age every year anyway, offering an early-out just makes sense.

The numbers back this up. OPM data shows the flow of new federal retirees jumped from around 77,000 in FY 2001 to over 114,000 in FY 2022. This trend makes voluntary offers like VERA a go-to strategy for managing the federal workforce.

This guide will break down everything you need to know about a VERA federal retirement, including:

Who actually qualifies for a VERA offer

How it affects your FERS or CSRS annuity calculation

What it means for your TSP, FEHB, and FEGLI benefits

The real-world pros, cons, and common mistakes to watch out for

Getting a handle on these details is the only way to know if accepting a VERA offer truly fits your personal and financial roadmap. For a more detailed look at the mechanics, you can dive into our complete guide to Voluntary Early Retirement.

A VERA is more than just an early exit; it’s a calculated decision that can significantly alter your financial future. Understanding its impact on your annuity, health benefits, and long-term income is essential before making a choice.

Before we dive deeper, the table below gives you a high-level summary of what a VERA offer typically includes.

VERA at a Glance: Key Eligibility and Impact

This table provides a high-level summary of the essential components of a VERA offer, covering the typical eligibility criteria and the primary benefits affected.

ComponentDescriptionPurposeTo allow agencies to reshape their workforce by offering voluntary early retirement.EligibilityTypically requires age 50 with 20 years of service, or any age with 25 years of service.AnnuityProvides an immediate, unreduced annuity for eligible FERS employees under age 62.TimingOffered during specific "windows" determined by the agency; not always available.

Think of this as your starting point. Now, let's get into the specifics of how these pieces come together.

Getting the Green Light: Who Is Actually Eligible for VERA?

So, how do you know if you can even get a VERA? You can't just raise your hand and ask for one. It’s a two-part process. First, your agency has to get permission from the Office of Personnel Management (OPM) to offer early retirement. Second, you have to personally meet the age and service requirements.

Think of it like needing two keys to open a lock. The agency holds the first key (the authority to offer VERA), and your service record holds the second. You need both to unlock the door to an early retirement opportunity.

Let's break down exactly what it takes to qualify, because understanding these rules is the first real step in figuring out if VERA is on your radar.

The Two Paths to VERA Eligibility

OPM has laid out two clear-cut ways you can become eligible for a VERA. The good news is you only have to meet one of them.

Path 1: Be at least 50 years old with at least 20 years of creditable service.

Path 2: Be any age with at least 25 years of creditable service.

This setup offers a good bit of flexibility. It means a long-time federal employee in their late 40s could be just as eligible as a colleague in their mid-50s who started their career a bit later. As long as you hit one of those two benchmarks, you’re in the running.

But here’s the critical part: just because you meet these minimums doesn’t mean an offer is coming your way. Your agency can get very specific, limiting its VERA window to certain job series, locations, or departments to hit its strategic targets.

A lot of people think that once you're VERA-eligible, an offer is guaranteed. That’s not how it works. Your agency is in the driver's seat and decides who gets an offer, even among the pool of employees who meet OPM's criteria.

What “Creditable Service” Really Means

That term, "creditable service," is the bedrock of your retirement eligibility. So, what actually counts? It’s the total amount of time OPM recognizes for your retirement calculation, and it's often more than just your regular civilian job.

For most feds, creditable service includes:

Federal Civilian Service: This is the bulk of it—all the years you’ve spent working directly for Uncle Sam.

Military Service: If you served on active duty, you can often "buy back" that time so it counts toward your federal retirement. This involves making a deposit to the retirement fund to cover what your employee contributions would have been during that period.

It is absolutely crucial to double-check that all your service—especially any military time—is correctly documented in your official file. A simple paperwork error could be the one thing that stands between you and eligibility.

VERA Is an Agency Tool, Not an Employee Right

I can't say this enough: VERA is a management tool. It is not an employee entitlement. Even if you meet the age and service rules to a T, you won't get an offer unless your agency decides it needs to open a VERA window.

Why would they do this? Agencies use VERA to solve specific problems, like:

Downsizing: When budgets get tight and they need to reduce headcount.

Restructuring: To reshape their workforce to tackle new mission goals or technologies.

Avoiding a RIF: Offering a voluntary "out" is much better for morale than going through the painful process of involuntary layoffs (a Reduction in Force).

Because these offers are tied directly to an agency's needs, they are almost always time-sensitive and highly targeted. If a VERA window opens up, it's a unique chance that might not circle back.

This is why it pays to be prepared. Knowing your eligibility status before an offer ever hits your desk means you can make a calm, informed decision when the pressure is on.

How VERA Impacts Your Federal Annuity

When you're staring down a VERA offer, the first—and most important—question is always, "Okay, but what does this actually do to my pension?" It's a simple question with a complex answer that hinges entirely on whether you're a FERS or CSRS employee. For one group, it's a financial game-changer; for the other, it's more about getting a head start.

At its core, a VERA lets you start collecting your annuity payment the moment you walk out the door. But the real power of this early retirement option is reserved for those under the Federal Employees Retirement System (FERS). It’s like being handed a golden key that unlocks your full pension years ahead of schedule.

The Major Advantage for FERS Employees

Under the standard FERS retirement rules, leaving before you hit age 62 can come with a steep price. If you retire under an MRA+10 or MRA+20 option, your annuity is hit with a permanent penalty of 5% for every single year you are shy of 62. It's a significant reduction designed to account for the longer payout period.

A VERA completely wipes that penalty off the table.

If you take a VERA offer, you can retire before 62 and immediately start receiving your unreduced annuity. This is, without a doubt, the single biggest financial reason a FERS employee would jump at the chance.

The core value of a VERA is its ability to let you bypass the standard age-reduction penalty. This can easily translate into tens of thousands of dollars in annuity payments you would have otherwise lost while waiting to reach age 62.

Let's look at a quick, real-world example:

Federal Employee: A 55-year-old FERS employee with 25 years of service.

High-3 Salary: $90,000.

Without VERA: If this person retired at 55, they would be seven years away from age 62. Their annuity would be permanently slashed by a staggering 35% (7 years x 5%).

With VERA: That 35% penalty vanishes. They get their full, earned annuity right away.

The difference in your bank account is enormous, which is what makes VERA such a powerful tool for those who qualify.

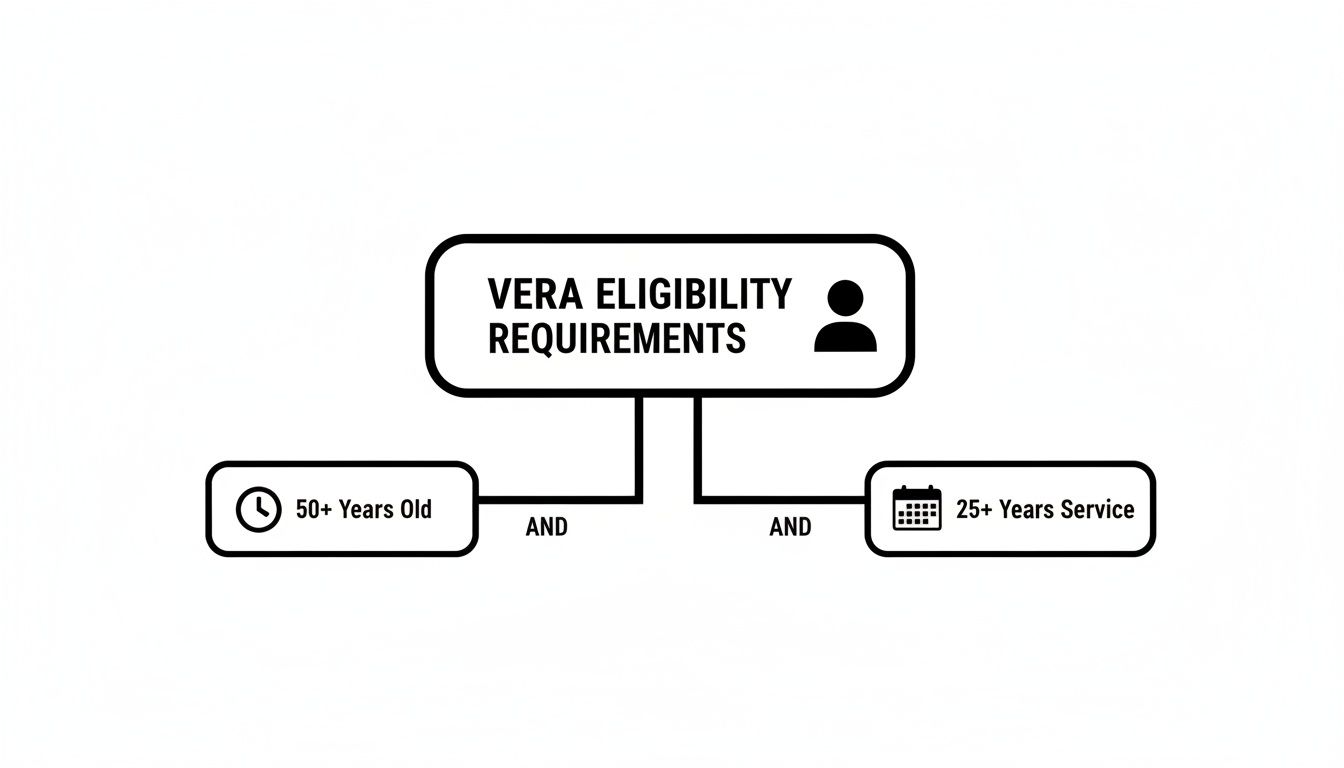

This infographic breaks down the two primary ways you can become eligible for a VERA.

As you can see, hitting one of these combinations of age and service is the ticket to unlocking these valuable annuity benefits.

What About CSRS Employees?

For feds under the older Civil Service Retirement System (CSRS), a VERA offer doesn't have the same dramatic financial impact. This is because the CSRS annuity formula was built differently and doesn't include the same kind of age-based reduction penalties found in FERS.

So, for a CSRS employee, a VERA is mostly about timing. It’s an opportunity to retire and start drawing your pension earlier than you planned, but it doesn't fundamentally alter the calculation of your annuity payment itself. The benefit is simply getting access to your money sooner.

Long-Term Considerations and COLAs

While getting an immediate, unreduced pension sounds great, you have to think about the long game. One critical piece of the puzzle is how Cost-of-Living Adjustments (COLAs) are handled. For 2026, for instance, OPM has announced that CSRS retirees are set to receive a 2.8% COLA, while FERS retirees will only get 2.0%.

That might not sound like much, but on a $40,000 annuity, that's a $320 annual difference that compounds year after year—especially as things like FEHB premiums continue to climb. It's wise to learn more about how FERS and CSRS COLAs compare and work this into your financial projections.

On top of that, FERS employees who take a VERA before age 62 might also get the FERS Annuity Supplement. This is often called the "Social Security bridge" because it's designed to fill the income gap until you can claim Social Security at 62. The supplement approximates the Social Security benefit you earned during your federal career, making it a crucial income stream for early retirees. Be sure to check out our detailed guide on the FERS Annuity Supplement to understand how it works and if you qualify.

What Happens to Your TSP, FEHB, and FEGLI in an Early Retirement?

While your annuity is the core of your retirement income, it’s only one piece of the puzzle. A VERA doesn't just fast-forward your pension eligibility; it directly impacts your Thrift Savings Plan (TSP), Federal Employees Health Benefits (FEHB), and Federal Employees' Group Life Insurance (FEGLI).

Figuring out how these benefits transition is every bit as crucial as calculating your pension check. For many federal employees, the ability to keep their health and life insurance is the single biggest factor in deciding whether to accept an early retirement offer.

Securing Your Health and Life Insurance for the Long Haul

Losing health insurance is one of the biggest fears people have about retiring early. The great news is that a VERA makes this a non-issue, as long as you meet one key requirement for both your FEHB and FEGLI.

It’s often called the "five-year rule." Simply put, to carry your health and life insurance into retirement, you must have been enrolled in those programs for the five consecutive years leading up to your separation date. If you've got that covered, you can continue your coverage seamlessly, paying the same premiums as any other federal retiree.

This continuity is a massive perk. It means you won’t have to hunt for expensive private insurance or deal with the health insurance marketplace to cover you until you’re eligible for Medicare.

Shifting Your TSP from Savings to Strategy

Your TSP plays a different role when a VERA comes along. While FEHB and FEGLI are about maintaining coverage, your TSP becomes an active financial tool. An early-out offer is a clear signal to shift your mindset from just saving to strategically maximizing your contributions in your final months on the job.

A VERA window gives you a golden opportunity to aggressively fund your TSP. This final push can create a critical income bridge, helping you cover expenses until you start drawing Social Security or other retirement funds.

Think of a VERA offer as a final sprint in your retirement savings marathon. The extra funds you contribute in your last year of work can significantly bolster your nest egg, giving you more flexibility and security for decades to come.

To get a clear picture of how your TSP can support your long-term goals, you might consider building comprehensive financial models in Excel. This can help you project your income and make smarter decisions about your nest egg.

To make this clearer, let's look at how VERA impacts your core benefits side-by-side with a standard retirement.

VERA Impact on Key Federal Benefits

BenefitImpact of VERA RetirementKey Requirement/ConsiderationTSPNo change to access rules. You can begin withdrawals as a separated employee. A VERA creates an urgent opportunity to maximize final contributions.Your withdrawal strategy becomes critical. Plan how to use these funds as an income bridge until other sources (like Social Security) kick in.FEHBContinuity is guaranteed if you meet the eligibility rules. You'll keep your plan and pay the same retiree premiums.You must have been enrolled in FEHB for the 5 consecutive years immediately before retiring. No exceptions.FEGLIContinuity is guaranteed under the same rules as FEHB. Your coverage options (Basic, Option A, B, C) can be carried into retirement.You must have been enrolled in FEGLI for the 5 consecutive years immediately before retiring. Your premium costs will change in retirement.

As you can see, the government makes it straightforward to keep your most important benefits. The responsibility is on you to meet the requirements and have a solid plan for your TSP.

Maximizing Your Final TSP Contributions

The government sets generous contribution limits, and you should know them by heart. The IRS has announced that for 2026, the elective deferral limit for the TSP will increase to $24,500. On top of that, employees aged 50 and over can add another $8,000 in catch-up contributions, bringing their total possible contribution to an impressive $32,500.

For a federal employee earning $100,000 a year, maxing that out would mean contributing 32.5% of their salary in that final year. Here’s how you could tackle it:

Standard Contribution: Adjust your payroll deductions to hit the regular contribution limit.

Catch-Up Contributions: If you're 50 or older, make sure you're also contributing to the separate catch-up limit.

Agency Matching: Don't forget that your agency matches your contributions on the first 5% of your salary. At a minimum, contribute enough to get the full match—it’s free money.

Of course, once you retire, you'll need a plan for taking money out. To get ahead of those decisions, read our guide on Thrift Savings Plan withdrawal options. A smart withdrawal strategy is key to making sure your TSP lasts as long as you do.

Weighing the Pros and Cons of a VERA Offer

A VERA offer can feel like hitting the jackpot—a golden ticket to retire years sooner than you ever thought possible. But before you pop the champagne and start planning that victory lap, it's critical to slow down and treat this for what it is: a major business decision.

Accepting a VERA is a one-way street; there are no do-overs. The immediate perks are incredibly tempting, but they come with serious trade-offs. This isn't just about leaving your job. It's about fundamentally reshaping your entire financial future, and you need to look at both sides of the coin with a clear head.

The Upside of an Early Exit

Let's be honest, the most powerful reason to even consider a VERA is the chance to retire early without the usual penalties. For a FERS employee, this is a massive win.

Immediate Unreduced Annuity: You start receiving your full pension payment right away. This lets you sidestep the standard 5% per year reduction for retiring before age 62, a penalty that can cost you a fortune over a lifetime.

Continued Health Insurance: As long as you meet the five-year requirement for carrying your insurance into retirement, you get to keep your FEHB coverage. That peace of mind alone is priceless.

A Welcome Escape Hatch: Maybe your work environment has grown toxic, your position is on the chopping block, or you're just plain burned out. A VERA provides a graceful and financially sound way out.

For many federal employees, these benefits are life-changing. It's an opportunity to reclaim your time, start a new chapter, or simply step away from the daily grind on your own terms.

Think of a VERA as more than just an early retirement. It’s a strategic tool that lets you dodge the uncertainty of a Reduction in Force (RIF) while locking in the core federal benefits you've worked so hard for.

The Financial Realities and Trade-Offs

While the pros are compelling, the cons are rooted in cold, hard math. When you leave the federal workforce early, you’re turning off your primary wealth-building engines ahead of schedule.

The biggest drawback is simple: you stop accumulating service time. This has a direct, permanent, and compounding effect on your two most important retirement assets—your annuity and your Thrift Savings Plan.

Let’s dig into what you’re giving up.

Impact on Your High-3 Salary

Your FERS annuity is built on a formula using your years of service and your "high-3" average salary, which is the average of your highest 36 consecutive months of pay.

By retiring early, you’re forfeiting all future pay raises, promotions, and cost-of-living adjustments that would have pushed that high-3 number higher. Even just a few more years on the job can significantly boost that final calculation. When you leave early, you lock in a lower high-3 for life, meaning your monthly pension check will be smaller than it could have been.

Less Time for TSP Compounding

The other major financial hit is to your TSP. Every year you keep working is another year you get to:

Make Contributions: You lose the chance to shovel thousands more into your nest egg.

Receive Agency Matching: You walk away from the 5% agency match—that’s free money you’re leaving on the table.

Benefit from Compounding: Your TSP balance has fewer years to grow before you need to start drawing from it.

This shortened runway means you'll end up with a smaller TSP balance to fund what is now going to be a much longer retirement.

Understanding the FERS Annuity Supplement

One key benefit that can soften the financial blow of a VERA is the FERS Annuity Supplement. Think of it as a bridge payment designed to fill the income gap between your early retirement day and the day you become eligible for Social Security.

The supplement is calculated to approximate the Social Security benefit you earned during your FERS service. It kicks in when you retire and stops cold at age 62, no matter when you actually decide to claim your Social Security.

But there’s a catch: not everyone who takes a VERA gets it. You must have at least one full calendar year of FERS service and meet your Minimum Retirement Age (MRA). More importantly, the supplement is subject to an earnings test. If you take on a new job after retiring, earning more than the annual limit ($22,320 in 2024) will reduce or completely wipe out your supplement payments.

Ultimately, deciding on a vera federal retirement comes down to a deeply personal cost-benefit analysis. You have to weigh the immediate freedom and unreduced pension against the long-term impact of a lower high-3, a smaller TSP, and more years of retirement to fund.

What's Next? Making the Right Call with an Expert in Your Corner

You've just absorbed a lot of information about VERA. We’ve covered everything from eligibility and annuity calculations to how it all interacts with your TSP, FEHB, and FEGLI. But here’s the thing: knowing the rules is one thing, applying them to your life is another challenge entirely.

This isn't a decision to be made lightly or rushed. It's one of the biggest financial choices of your career. Now's the time to shift from understanding the general concepts to building a concrete plan based on your unique circumstances. And you don't have to do it alone.

From Theory to a Personalized Strategy

At Federal Benefits Sherpa, our entire focus is helping federal employees like you find clarity in these complex moments. A VERA offer isn't a simple yes-or-no question; it's a puzzle with dozens of interlocking pieces. A generic approach just won't cut it. Our team specializes in taking all the dense, confusing federal benefits rules and turning them into a simple, clear roadmap for your retirement.

We’ll help you get definitive answers to the questions that are probably keeping you up at night:

Does this VERA offer actually line up with the retirement lifestyle I've envisioned?

What will my cash flow really look like in the years before I can start collecting Social Security?

Is there some small detail I’ve missed that could put my family’s financial security at risk?

Your Path Forward to a Confident Choice

Making the best decision starts with seeing the whole picture—not just pieces of it. We’ve built our services to give you that complete view, so you can look at your VERA offer and know, without a doubt, that you're making the right move.

A VERA offer is more than just an early exit from work; it's a major fork in the road. The direction you take will define the next chapter of your life. Getting expert guidance means you're not just hoping for the best—you're planning for it.

We firmly believe that every federal employee deserves access to professional advice when facing these big decisions. That’s why we start with a free 15-minute benefit review. It’s a no-pressure conversation where we can discuss your specific situation and pinpoint the most important things you need to think about right now.

If you need to go deeper, our detailed retirement planning and gap analysis reports can map out your financial future with precision. Ready to turn all this information into a plan you can act on? Book your complimentary review today and get on the path to a secure retirement.

Your VERA Questions, Answered

Even when you understand the basics, a VERA offer can feel overwhelming. It's natural for a lot of very specific, practical questions to pop up. Let's tackle some of the most common ones we hear from federal employees facing this big decision.

Can I Negotiate a VERA Offer?

This is probably the number one question people ask, and the answer is a simple, straightforward no. The terms of the VERA itself—the age and service requirements, how your annuity is calculated—are set in stone by OPM regulations. There’s no wiggle room there.

What you might see, however, is a VSIP (Voluntary Separation Incentive Payment) offered alongside the VERA. Think of this as a cash buyout, a "golden handshake." While the VERA rules are rigid, sometimes there's flexibility in the VSIP amount, but that's entirely up to your agency's internal policy and is quite rare.

What if I Say No to a VERA?

Nothing happens immediately if you turn down a VERA. It’s a voluntary program, after all. You just keep working, and your job, salary, and benefits stay exactly as they are.

But it’s crucial to understand the bigger picture. Agencies don’t offer early outs for fun; they do it to avoid painful, involuntary cuts like a Reduction in Force (RIF). If not enough people take the VERA, the agency might have to move forward with a RIF. Declining the offer is essentially a bet that your position will be safe if the agency has to make deeper cuts later.

Declining a VERA offer is a calculated risk. While you keep your job for the moment, it doesn't guarantee immunity from future workforce changes if the agency's downsizing goals aren't met through voluntary separations.

How Does Taking a VERA Affect My Social Security?

Taking a VERA has no direct impact on your eligibility for Social Security. You’ll still be able to claim your benefits based on your lifetime earnings, with the earliest you can start being age 62.

The real consideration here is a financial one. When you retire early, you stop paying into Social Security sooner, which can slightly reduce your final benefit amount. More importantly, you'll have a longer gap to bridge between when your federal annuity starts and when you can begin drawing Social Security. This is where having a healthy TSP balance becomes absolutely critical.

How Long Does the VERA Process Usually Take?

The timeline can differ from one agency to the next, but once a VERA window is announced, the process follows a fairly predictable path.

The Offer Window: Your agency announces the VERA, detailing who is eligible and setting a deadline. This period can be surprisingly short—often just 30 to 90 days.

Application and Counseling: You’ll submit your paperwork and should be offered retirement counseling to go over the numbers and what it all means for you.

Approval: HR reviews and gives the final green light on your application.

Separation: You officially leave federal service on a date set by the agency.

From the day the offer lands in your inbox to your last day on the job, the whole thing can wrap up in just a few months. That tight timeframe is exactly why you need to have a good handle on your finances before a VERA is ever on the table.

Navigating a VERA offer is a major life decision that hinges on your personal finances and what you want for your future. At Federal Benefits Sherpa, our experts specialize in helping federal employees make these critical choices with confidence. To get a clear, personalized assessment of your situation, book your free 15-minute benefit review today.