Your Guide to the FERS Annuity Supplement

If you're a federal employee considering retiring before age 62, you've probably heard about the FERS annuity supplement. This is one of the most important—and often misunderstood—parts of your retirement benefits. It's designed to act as a financial bridge, filling the income gap between the day you retire and the day you’re eligible to claim Social Security.

Your Financial Bridge to Social Security

Think of the supplement as a stand-in for the Social Security benefits you’ve earned as a federal employee but can't collect just yet. It isn't extra money or some kind of bonus; it’s a temporary income stream specifically designed to make retiring early a realistic option. The Federal Employees Retirement System (FERS) is built on three pillars, and this supplement is a key piece that holds it all together for early retirees.

The entire point is to prevent a major dip in your income while you wait for your Social Security to kick in. Once you hit age 62, the supplement stops—period. It doesn't matter if you decide to start your Social Security benefits right away or delay them.

What Is the Purpose of the Supplement?

At its core, the supplement provides a steady, predictable income that approximates a portion of what you'll eventually receive from Social Security. This stability allows you to maintain your lifestyle without having to dip into your Thrift Savings Plan (TSP) or other investments too heavily in those first few years of retirement.

It's calculated to reflect the Social Security benefit you earned during your FERS-covered years. For instance, let's say your estimated Social Security benefit after a full 40-year career is $2,000 a month. If you worked for 30 years under FERS, your supplement would be 75% of that $2,000, which comes out to $1,500 per month (before any potential reductions). To learn more about how federal benefits enable early retirement, you can find great insights and policy discussions on GovExec.com.

The supplement is a temporary payment intended to approximate the Social Security benefit earned while employed under FERS. It's a foundational piece of the FERS system that supports early retirement planning.

To help you get a quick handle on this benefit, here's a simple breakdown of its main features.

FERS Annuity Supplement Key Features

CharacteristicDescriptionTemporary NatureThis payment automatically stops the month you turn 62.Source of PaymentIt comes from the Office of Personnel Management (OPM), not the Social Security Administration (SSA).Earnings TestIf you work after retiring, your supplement can be reduced or even eliminated if you earn too much.EligibilityYou must meet specific age and service requirements for an immediate, unreduced retirement.

Getting these basics down is the first step. Think of it as building the foundation for a solid retirement plan. Next, we’ll get into the nitty-gritty of who qualifies and how the numbers are actually calculated.

Qualifying for the FERS Annuity Supplement

Not every federal employee who retires gets this valuable benefit. In fact, the Office of Personnel Management (OPM) has some very specific, non-negotiable rules about who qualifies. Getting this wrong can throw a serious wrench into your retirement income plan, so it's critical to know exactly where you stand.

Think of the supplement as a bridge payment—it’s designed to span the financial gap between your FERS retirement and the day you can finally claim Social Security. But you only get access to this bridge if you take a very specific retirement path.

The Core Eligibility Rules

To get your hands on the FERS annuity supplement, you have to check two main boxes. First, you need at least one full calendar year of civilian service where you paid into the FERS system. Second, and this is the big one, you must be eligible for an immediate, unreduced retirement.

Let's break that down, because this is where people often get tripped up.

An "immediate" annuity simply means your pension starts within 30 days of you leaving your job. "Unreduced" means you’ve hit the magic combination of age and years of service to get your full pension without any penalties.

The two most common ways people qualify are:

Retiring at your Minimum Retirement Age (MRA) with at least 30 years of service. This is the classic path for a full-career federal employee.

Retiring at age 60 with at least 20 years of service. Another standard, full-pension retirement scenario.

There are also special provisions for federal law enforcement, firefighters, and air traffic controllers. They operate under a different set of rules but can still qualify if they take an immediate retirement.

The bottom line is this: the supplement is for people who have put in a full career and can retire right away without taking a hit on their pension. It's not for those who leave federal service early and wait to draw their pension later.

Who Doesn't Qualify for the Supplement?

Knowing who doesn't get the supplement is just as important as knowing who does. Planning on that extra income, only to find out you're ineligible, can be a painful financial surprise.

You will not get the FERS annuity supplement if you take one of these retirement routes:

Deferred Retirement: If you leave your federal job before you’re eligible to retire and decide to start collecting your pension later on (say, at age 62), you won't get the supplement.

MRA+10 Postponed Retirement: This is a huge point of confusion. If you retire at your MRA with 10 to 29 years of service, you can postpone your pension to avoid the age reduction penalty. But even though you eventually get your full pension, taking this option makes you ineligible for the supplement.

Disability Retirement: As a general rule, those on disability retirement do not qualify for the annuity supplement.

Retiring from Congress: Members of Congress and their staff have their own retirement rules and typically don't qualify for this specific benefit.

These distinctions are absolutely critical for proper planning. For a closer look at the different ways you can retire from federal service, explore our detailed guide on federal retirement eligibility. Getting clear on these rules is the first step to making sure your early retirement is built on a solid foundation.

How Your FERS Supplement Is Calculated

At first glance, the formula for the FERS annuity supplement can seem a bit intimidating. But once you pull it apart, the logic behind it is actually pretty straightforward.

The core idea is to estimate the portion of your Social Security benefit you earned while working for the federal government. To get there, you just need two key pieces of information: your estimated Social Security benefit at age 62 and your total years of FERS service. Let's walk through it step-by-step.

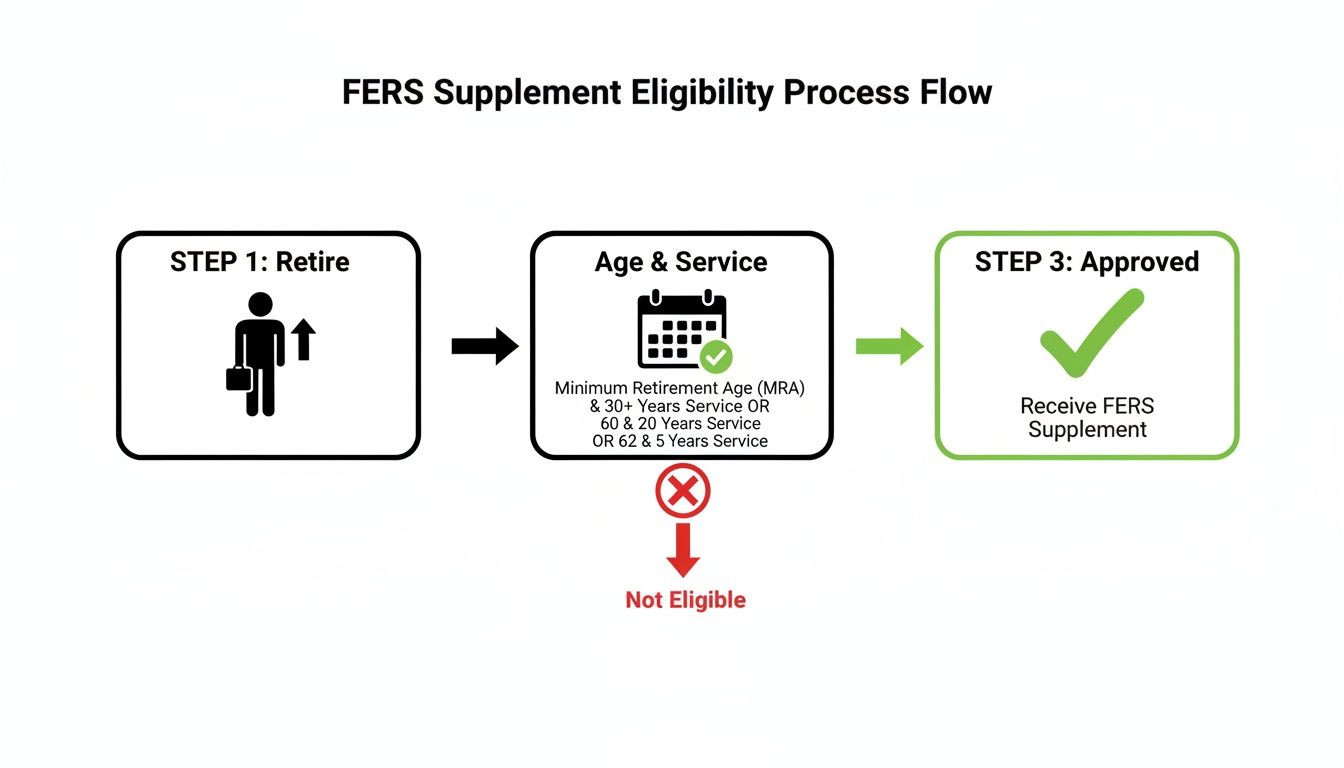

This flowchart lays out the basic path to see if you're on track to receive the supplement.

As you can see, it all starts with a qualifying retirement. From there, it’s about hitting the specific age and service milestones for an immediate, unreduced pension.

Step 1: Estimate Your Social Security Benefit at Age 62

First things first, you need a solid estimate of your Social Security benefit at age 62. This isn't just based on your federal career; it includes all the work you've ever done where you paid into Social Security, even that summer job you had in high school.

The best place to get this number is straight from the source: the Social Security Administration (SSA). Simply create a my Social Security account on the SSA website. Your personal statement will show you projected benefits at different ages, and the one we care about here is the age-62 estimate. That figure is the foundation for everything that follows.

Step 2: Determine Your Creditable Civilian Service

Next up, you’ll need to tally up your years of creditable FERS civilian service. This is simply the time you spent working for the government under the FERS system.

Keep in mind that the Office of Personnel Management (OPM) rounds this to the nearest full year. So, if you have 28 years and 7 months of service, it gets rounded up to 29 years. But if you have 28 years and 5 months, it gets rounded down to 28 years.

Step 3: Apply the FERS Supplement Formula

With those two numbers in hand, the actual calculation is surprisingly simple. Think of it as a ratio that compares your federal service to a standard 40-year working life.

The Calculation:

(Your Years of FERS Service ÷ 40) × Your Estimated Age-62 Social Security Benefit = Your FERS Annuity Supplement

Basically, the formula figures out what slice of a "full" 40-year career your FERS service represents. It then gives you that same slice of your total estimated Social Security payment. The impact of this benefit is huge. Roughly 21,000 new FERS retirees start receiving the supplement each year, with an average payout of around $18,000 annually.

If you really want to get into the weeds, you can learn more about how to calculate your FERS retirement like a pro in our other guide.

Example FERS Supplement Calculation

Let’s run through a quick example to see how this all comes together in the real world.

Meet Sarah. She's a federal employee who is retiring at her Minimum Retirement Age (MRA) of 57 with 30 years of FERS service. She logs into her my Social Security account and sees her estimated monthly benefit at age 62 is $2,000.

Now, we just apply the formula:

Step 1: Her estimated age-62 Social Security benefit is $2,000.

Step 2: Her creditable FERS service is 30 years.

Step 3: We plug those numbers into the calculation.

(30 Years of Service ÷ 40) × $2,000 = $1,500 per month

And there you have it. Sarah’s estimated FERS annuity supplement is $1,500 per month. That's a critical stream of income that will be paid to her from the day she retires until she turns 62. Of course, this is the gross amount before any potential reductions from the Social Security earnings test, which is another important piece of the puzzle we need to consider.

How the Social Security Earnings Test Can Impact Your Supplement

The FERS annuity supplement is a fantastic bridge to your full Social Security benefits, but it comes with a major string attached. If you decide to work after retiring from federal service, that extra income could shrink—or even wipe out—your supplement entirely. This is all because of something called the Social Security earnings test.

Think of the supplement as a temporary income replacement. The government provides it to fill the gap until you can draw Social Security at age 62. But if you start filling that gap yourself with a new job, the government will reduce its contribution. It’s a rule you absolutely must understand if you're thinking about consulting, working part-time, or starting a business after your federal career ends.

What OPM Considers "Earned Income"

The critical term here is “earned.” The Office of Personnel Management (OPM) only cares about the money you actively work for. This distinction is your friend, as it protects your other retirement income streams.

So, what gets counted against the limit?

Wages and salaries from any job where you get a W-2.

Net earnings from self-employment, like the profit from your freelance business or a consulting gig.

Now for the good news. A lot of your retirement income is completely off-limits and will not reduce your supplement.

This exempt income includes:

Your FERS basic annuity (your actual pension).

Any money you pull from your Thrift Savings Plan (TSP).

Income from your investments, like dividends, interest, or capital gains.

Pensions from other jobs or military retired pay.

This is a huge relief for most retirees. It means you can live off your FERS pension and TSP withdrawals without worrying about them affecting your supplement payments.

The Reduction Formula: How It Works

So, how does OPM actually calculate the reduction? It’s a simple, straightforward formula tied to an annual income limit set by the Social Security Administration.

The Rule: For every $2 you earn above the annual limit, your FERS annuity supplement is reduced by $1.

This income limit isn't set in stone; it usually goes up each year with inflation. For instance, in 2022, the earnings limit was $19,560. Staying on top of the current year's limit is crucial for your planning. If your earnings cross that line, the reduction kicks in. It's a mechanism designed to ensure the supplement truly helps those bridging the gap to Social Security.

Let’s walk through an example to see it in action.

Example Scenario

Let's say your annual FERS supplement is $18,000 a year, which works out to $1,500 per month. You decide to take a part-time job that pays you $29,560 for the year. The earnings limit for that year is $19,560.

Find Your Excess Earnings: $29,560 (Your Pay) - $19,560 (The Limit) = $10,000

Calculate the Reduction: $10,000 (Excess Earnings) ÷ 2 = $5,000

Determine Your New Supplement: $18,000 (Original Supplement) - $5,000 (Reduction) = $13,000

In this scenario, your annual supplement drops to $13,000, or about $1,083 per month. That part-time job effectively cost you $5,000 of your supplement.

Keep in mind, if you earn enough, you could easily reduce your supplement all the way to zero. This is a critical piece of the puzzle when you're deciding if working in retirement makes financial sense. Understanding how this works is also key to building a smart Social Security strategy. For a deeper dive into that topic, check out our guide on Social Security benefits for federal employees.

Fitting the Supplement into Your Retirement Plan

The FERS annuity supplement isn't an island. Think of it as a crucial, temporary gear in your bigger retirement machine, designed to work in concert with your FERS basic annuity, Thrift Savings Plan (TSP), and your eventual Social Security benefits. Figuring out how this piece fits into your financial puzzle is the key to a stable and seamless retirement transition.

I like to use a relay race analogy for retirement income. The supplement grabs the baton from your final paycheck and runs the first leg of the race, carrying you from your retirement date until you hit age 62. At that point, it hands the baton off to Social Security, which then joins your FERS pension and TSP to run the rest of the way.

This temporary income stream has a huge impact on your overall strategy. It gives you a reliable income floor in those critical early years, which lets you build a much stronger financial plan.

Strategic Financial Planning with the Supplement

Having the supplement in your corner gives you some serious flexibility. For a lot of early retirees, this predictable income means they can hold off on dipping into their TSP. Letting your TSP investments grow for a few extra years without making withdrawals can have a powerful compounding effect on your nest egg down the road.

This is especially important when you look at the numbers. In FY2022, the average FERS annuitant received a monthly payment of $2,126. Compare that to the $5,447 average for CSRS retirees, and you can see why the supplement is so essential for bridging the gap until all three FERS pillars are up and running.

The supplement truly changes the retirement math. It can be the one thing that makes retiring at your Minimum Retirement Age (MRA) a realistic option, instead of feeling like you have to work until your 60s.

The FERS annuity supplement transforms early retirement from a possibility into a practical reality for many federal employees. By bridging the income gap, it empowers you to make strategic decisions about your TSP and overall cash flow.

As you start piecing together your budget, don't forget to account for all your post-retirement expenses. When you're figuring out how the FERS Annuity Supplement fits into your financial picture, be sure to include major costs like your mortgage. You can use a handy tool to calculate ongoing housing costs with a mortgage calculator to get a clear idea of that expense.

Mapping Your Income Streams Before and After Age 62

It’s incredibly helpful to visualize how your income streams will change once you turn 62. The shift is sudden—one income source stops right as another one becomes available.

Let's break down how your primary retirement income sources shift over time.

Retirement Income Streams Before and After Age 62

Income SourceAvailable from MRA to Age 62Available from Age 62 OnwardFERS Basic AnnuityYesYesFERS Annuity SupplementYesNo (ends at 62)Social SecurityNoYes (eligible to start)TSP WithdrawalsYes (your choice)Yes (your choice)

As you can see, the supplement acts as a placeholder for Social Security. By planning for this handoff, you can create a cohesive strategy that provides a steady income, avoids nasty financial surprises, and lets you actually enjoy the early retirement you've worked so hard for.

So, What's Next? Putting It All Together

You've now got the inside scoop on the FERS annuity supplement. Think of it as a temporary bridge, designed to carry you financially from the day you retire early until you can start drawing Social Security. It’s a powerful tool, but knowing the rules is one thing—applying them to your life is another.

Navigating the labyrinth of federal benefits can feel like trying to solve a puzzle with a thousand moving parts. Your years of service, your "high-3" salary, and your personal goals all create a unique financial picture. A generic online calculator might give you a ballpark figure, but it can't see the nuances of your career or help you build a real strategy. This is where getting a second set of eyes makes all the difference.

Charting Your Course with a Clear Map

A personalized benefits analysis is like turning on the GPS for your retirement. It takes all the separate pieces—your FERS pension, the annuity supplement, your TSP, and your future Social Security—and snaps them together into one clear, easy-to-understand plan. Suddenly, abstract numbers become a concrete roadmap for the income you'll live on.

This kind of detailed planning is more critical than ever. The FERS annuity supplement is frequently on the chopping block in Washington due to budget pressures. Proposals to eliminate it for new retirees could slash federal spending by $10 billion between 2025 and 2034, making it a tempting target. If you're curious about the ongoing policy debates, the National Treasury Employees Union offers some great analysis.

Your retirement is too important to leave to chance or guesswork. A personalized review ensures your decisions are based on complete and accurate information, protecting you from expensive mistakes later on.

The journey to a secure retirement starts with one simple step. At Federal Benefits Sherpa, we're here to help you get started with total confidence.

We invite you to schedule a free 15-minute benefit review with our team. We’ll look at your specific situation, offer some initial insights, and help you take that crucial first step toward a retirement you can truly enjoy.

Frequently Asked Questions

Even after you get the basics down, a few specific questions about the FERS annuity supplement always seem to come up. Let's tackle some of the most common ones I hear from federal employees to clear up any lingering confusion. Think of this as your quick-reference guide for those practical, "what-if" scenarios.

Getting these details right can make all the difference for a smooth financial transition into retirement.

Is the FERS Annuity Supplement Taxable?

Yes, and this is a big one that often catches people by surprise. The FERS annuity supplement is considered ordinary income and is fully taxable at the federal level. You'll see it included in the total income reported on your 1099-R from the Office of Personnel Management (OPM).

On top of that, most states will tax it as regular income, too. Only a small handful of states exempt federal pension payments entirely. It's crucial to check your own state's tax laws to understand exactly how this will affect your net income.

Do I Need to Apply for the Supplement Separately?

Thankfully, no. This part of the process is refreshingly simple. If you're eligible for an immediate, unreduced retirement, OPM automatically calculates and includes the FERS annuity supplement with your monthly pension checks.

You don’t have to fill out extra forms or jump through any hoops. Your standard retirement application covers it. As long as you qualify, the supplement will start right alongside your main FERS annuity.

You don’t need to take any special action to receive the FERS annuity supplement. Eligibility is automatically determined based on your retirement application, simplifying the process for qualified early retirees.

This is a huge relief for many retirees. The system is designed to provide this bridge income seamlessly, without adding more administrative headaches to your transition out of federal service.

What If I Return to Federal Service?

If you retire, start receiving the supplement, and then decide to go back to work for the federal government, the rules are very clear. Your FERS annuity supplement will stop the day you are reemployed. This isn't a reduction based on an earnings test—it's a complete stop.

Whether you can get it back after you leave that new federal job depends on the specific circumstances. It's often complicated and not always guaranteed. This is a massive financial consideration if you're thinking about returning to federal work before you turn 62.

Understanding these nuances is key to a secure retirement. At Federal Benefits Sherpa, our experts help you navigate every detail to build a confident financial future. Take the next step by scheduling a complimentary 15-minute benefit review with our team today.