Your Guide to the Federal Benefit Open Season

If you're a federal employee, you've probably heard the term "Open Season" thrown around every fall. But what does it really mean? Simply put, the federal benefit open season is your one dedicated window each year to enroll in, switch, or even cancel your health, dental, and vision insurance plans.

This is your moment to make sure your benefits actually fit your life and your budget for the year ahead. Getting it right is crucial.

What Is Federal Benefit Open Season and Why It Matters

Think of Open Season as your annual benefits check-up. It’s a specific period, almost always running from the second Monday of November through the second Monday of December, when you, along with other federal employees and annuitants, can make these critical decisions.

Now, you could do nothing. If you don't take any action, your current plans just roll over for another year. While that sounds easy, it can be a surprisingly expensive mistake. The plan that was a perfect match last year might be a terrible fit now. Maybe your family grew, your health needs changed, or the plan itself jacked up its premiums.

This isn't just about healthcare—it's about smart financial planning. The choices you lock in during Open Season will directly affect your paycheck and what you'll pay out-of-pocket for all of next year.

The Power of an Annual Review

Ignoring Open Season is a bit like letting your car insurance renew on autopilot without ever shopping around. You could be overpaying for coverage you don't use, or worse, find yourself seriously underinsured when a medical emergency hits. Life happens, and your benefits need to keep up.

A common pitfall we see all the time is what I call "passive enrollment inertia"—the habit of just sticking with the same plan year after year. This can cost you thousands in missed savings or leave you with a plan that doesn't cover what you need when you need it most.

To make the right moves, you first have to understand the major programs involved. Federal Open Season really boils down to three key areas.

Key Programs Covered During Open Season

This table gives you a quick snapshot of what's on the table during this period.

Open Season at a Glance: Key Information

ComponentDetailsStandard TimelineThe second Monday in November through the second Monday in December.Health Insurance (FEHB)Enroll, change your plan, switch options (e.g., Self to Self and Family), or cancel.Dental & Vision (FEDVIP)Enroll, change your plan, or cancel your coverage. This is separate from FEHB.Flexible Spending (FSAFEDS)MUST RE-ENROLL every year to contribute pre-tax dollars for health or dependent care.

This breakdown shows just how much control you have during this short window.

Getting a handle on these programs is the foundation for building a benefits package that truly works for you. Let's look a little closer at each one.

Federal Employees Health Benefits (FEHB) Program: This is the big one—your main health insurance. You can enroll for the first time, switch between dozens of plans, change your coverage level (like from Self Only to Self and Family), or drop coverage entirely.

Federal Employees Dental and Vision Insurance Program (FEDVIP): Your dental and vision coverage is completely separate from your health plan. During Open Season, you can enroll in a new plan, switch providers, or cancel.

Federal Flexible Spending Account Program (FSAFEDS): This is the program that lets you set aside pre-tax money for out-of-pocket health and dependent care costs. Here's the critical part: you must actively re-enroll in your FSA every single year. Your contributions don't just continue automatically.

Knowing how these pieces fit together is everything. For a more detailed look at the entire benefits ecosystem, our team created a quick and clear guide on the federal employee benefits handbook. Taking a little time now to review your options is the best way to protect your family’s health and financial future for the year to come.

What Are the Key Benefit Programs?

To make the most of Open Season, you need to get familiar with its three main components. Think of them as the pillars supporting your health and financial well-being. Each one serves a unique purpose, and understanding how they fit together is the key to building a solid strategy for the year ahead.

These three programs are the Federal Employees Health Benefits (FEHB), the Federal Employees Dental and Vision Insurance Program (FEDVIP), and the Federal Flexible Spending Account Program (FSAFEDS). They’re all managed during the same window, but they are completely separate. Let's break down what each one does.

The Foundation: Your Federal Health Benefits (FEHB)

Your FEHB plan is the cornerstone of your entire benefits package. It’s what covers your doctor visits, hospital stays, and major medical needs. This is likely the biggest decision you’ll make during Open Season, as it has a direct and significant impact on both your health and your finances.

A major reason to re-evaluate your FEHB plan each year is the premium adjustments. The federal benefits system covers over 8 million people, and costs inevitably shift. For the 2025 plan year, the average FEHB premium shot up by 11.2%, with the portion you pay increasing by a hefty 13.5%. You can dig into the specifics in the official OPM summary of the 2025 plan year highlights.

These kinds of increases make reviewing your plan a must-do, not a maybe. A plan that felt affordable last year might suddenly put a real strain on your budget, making it worthwhile to see if another option offers better value without sacrificing the care you need.

Filling the Gaps: Dental and Vision (FEDVIP)

This is a common point of confusion. Many federal employees assume their health insurance automatically includes good dental and vision coverage. While a few FEHB plans might offer some minimal benefits, they are rarely comprehensive. For that, you need to enroll in FEDVIP, a completely separate program.

Signing up for FEDVIP lets you pick from a list of dedicated dental and vision carriers. This is how you get solid coverage for things like:

Dental: Cleanings, fillings, root canals, and even orthodontics.

Vision: Eye exams, prescription glasses, and contact lenses.

Skipping FEDVIP can leave you facing some serious out-of-pocket costs if you need a crown or your child needs braces. Remember, during Open Season you can enroll in, change, or cancel your FEDVIP plan, and that decision has no bearing on your FEHB choice.

A frequent mistake we see is people forgetting that FEDVIP is a separate election. They assume their health plan covers it all, then get a nasty surprise bill after a dental emergency. Always treat your dental and vision needs as a distinct decision.

It can also be helpful to step back and gain an understanding the broader concept of employee benefits packages to see how all these pieces form a complete safety net.

Supercharge Your Savings: The Flexible Spending Account (FSAFEDS)

The Federal Flexible Spending Account (FSA) is probably the most powerful and most overlooked savings tool you have. An FSA lets you set aside money from your paycheck before taxes are taken out, which you can then use for eligible healthcare and dependent care costs. This lowers your taxable income, meaning you pay less in taxes and keep more of what you earn.

But FSAFEDS has one giant, non-negotiable rule: You must actively re-enroll every single year.

Your FSA election does not carry over automatically. If you do nothing during Open Season, your FSA balance for the new year will be $0. It's a "use-it-or-lose-it" benefit in two senses: you lose the chance to save if you don't sign up, and you can lose most of the money left in the account at the end of the year. Getting a handle on these three programs gives you a solid foundation for making smart choices, not just hopeful guesses.

Your Step-By-Step Open Season Checklist

It’s that time of year again. The federal benefit open season can feel a bit overwhelming, but it doesn't have to be. Think of it less as a chore and more as your annual opportunity to give your benefits a tune-up.

Instead of just letting your current plans roll over, a little bit of legwork now can save you a lot of money and headaches next year. This checklist will walk you through it, step by step, so you can feel confident you've made the right calls for you and your family.

1. Give Your Current Plan a Performance Review

Before you can decide where you're going, you need to know where you've been. How did your current health plan actually work for you this past year? Don't just go off a vague feeling; a quick reality check will tell you everything you need to know.

Grab a notepad and ask yourself a few honest questions:

How was routine care? Were you happy with your doctor? Was it easy to get appointments for checkups or when you felt sick?

What happened when something unexpected came up? Think about that trip to urgent care or any specialist visits. Were you blindsided by the bill that came a month later?

Were your doctors in-network? Did you find it easy to stay in-network, or did you constantly have to double-check if your preferred doctor or hospital was still covered?

Jotting down the answers helps you pinpoint the real frustrations. Maybe your deductible was so high you avoided going to the doctor, or you were fed up with needing a referral for everything. Those are the problems you want to solve this year.

2. Look Ahead to Next Year's Needs

Now, shift your focus to the future. Life changes, and your benefits need to keep up. The single biggest mistake federal employees make is choosing a plan based on last year's needs without thinking about what's on the horizon.

Take a moment to map out what you expect for the next 12 months:

Is there a baby on the way?

Are you or your spouse finally planning that knee surgery?

Did someone get a new diagnosis that will require regular specialist visits or medication?

Will your teenager need braces, or is it time for new glasses for you?

Even something as simple as a doctor prescribing a new brand-name drug can dramatically change which plan is the most cost-effective. By anticipating these events, you can compare plans based on how they'll actually perform for your specific situation.

3. Use OPM's Official Comparison Tool (It’s a Must)

You aren't expected to figure this all out on your own. The U.S. Office of Personnel Management (OPM) has a fantastic online tool specifically for comparing plans. Seriously, this should be your first stop.

The OPM Plan Comparison Tool is your best friend during Open Season. It pulls all the official data into one place, allowing you to filter plans by premiums, deductibles, and other key features. Neglecting this resource is like trying to find your way in a new city without a map.

A word of caution: don't just sort by the lowest bi-weekly premium. That's a classic rookie mistake. A rock-bottom premium often hides a sky-high deductible or weak coverage that could leave you on the hook for thousands if you actually need to use your insurance. You have to look at the whole picture.

4. Run the Numbers: Calculate the True Total Cost

This is where it all comes together. The premium is just the entry fee. What you really need to figure out is your potential worst-case scenario—your maximum out-of-pocket cost for the year. This simple calculation will protect you from nasty financial surprises.

Here’s a basic formula to get you started:

Total Potential Cost = (Annual Premiums) + (Plan Deductible) + (Your Best Guess at Coinsurance/Copays)

Run this math for your top two or three contenders. You’ll quickly see that the "cheapest" plan isn't always the one that costs you the least. This methodical approach is what separates a guess from an informed decision, ensuring you're choosing a plan during the federal benefit open season that truly has your back.

How to Choose the Right Health Plan for Your Needs

Picking your health plan during the federal benefit open season is easily one of the most important financial decisions you'll make all year. It's about so much more than just the premium coming out of your paycheck. The right plan should be a perfect fit for your family’s actual healthcare needs and your long-term financial picture. The real secret is understanding the trade-offs between different types of plans.

You'll generally run into three main options: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High Deductible Health Plans (HDHPs). Each one is built differently, which directly impacts everything from which doctors you can see to how much you'll pay out-of-pocket when you actually need care.

I like to compare it to picking a cell phone plan. An HMO is like a budget plan that works great as long as you stay within its specific network of towers—it’s a solid value, but you have to play by its rules. A PPO is the premium, nationwide plan; it costs more upfront but gives you the freedom to go almost anywhere. And an HDHP? Think of that as a "pay-as-you-go" option with a super low monthly fee but higher costs when you use it, often paired with a fantastic savings account.

Comparing Your Core Health Plan Options

Getting into the nitty-gritty of these plans is what separates a good decision from a great one. Let’s break down what these differences actually mean for you.

To help you see the key distinctions at a glance, we've put together this comparison table. It lays out how each plan type handles the things that matter most, like doctor choice and out-of-pocket costs.

Comparing Federal Health Plan Types

FeatureHMO (Health Maintenance Organization)PPO (Preferred Provider Organization)HDHP (High Deductible Health Plan)Doctor ChoiceYou must use doctors, specialists, and hospitals within the plan's network.You have the flexibility to see both in-network and out-of-network doctors.You can see any provider, but costs are much lower when you stay in-network.ReferralsA primary care physician (PCP) referral is typically required to see a specialist.No referrals are needed to see specialists, giving you more direct access to care.No referrals are required, offering similar flexibility to a PPO.Upfront CostsPremiums are generally lower, and you often have low or no deductibles.Premiums are typically higher to cover the flexibility of a larger network.Premiums are the lowest, but you must meet a high deductible before the plan pays.Best ForIndividuals and families who want predictable costs and don't mind staying in a local network.Those who want maximum flexibility, need to see specific specialists, or travel often.Healthy individuals or families who want low premiums and a tax-advantaged savings tool.

As you can see, there's no single "best" plan. The right choice is completely personal. What’s perfect for a young, single employee is almost never the right fit for a family managing a few chronic conditions.

Matching a Plan to Your Life Stage

Let's make this real. Imagine a healthy 28-year-old who might only see a doctor once a year. For them, an HDHP is a brilliant choice. The low monthly premium is a huge plus, and they can sock away the savings into a Health Savings Account (HSA) to build a medical nest egg for the future.

Now, picture a family with two young kids and a spouse who needs regular asthma treatments. They’d probably be much better off with an HMO or a low-deductible PPO. Their consistent need for doctor visits and prescriptions makes a higher premium a smart trade-off for much lower and more predictable costs all year long.

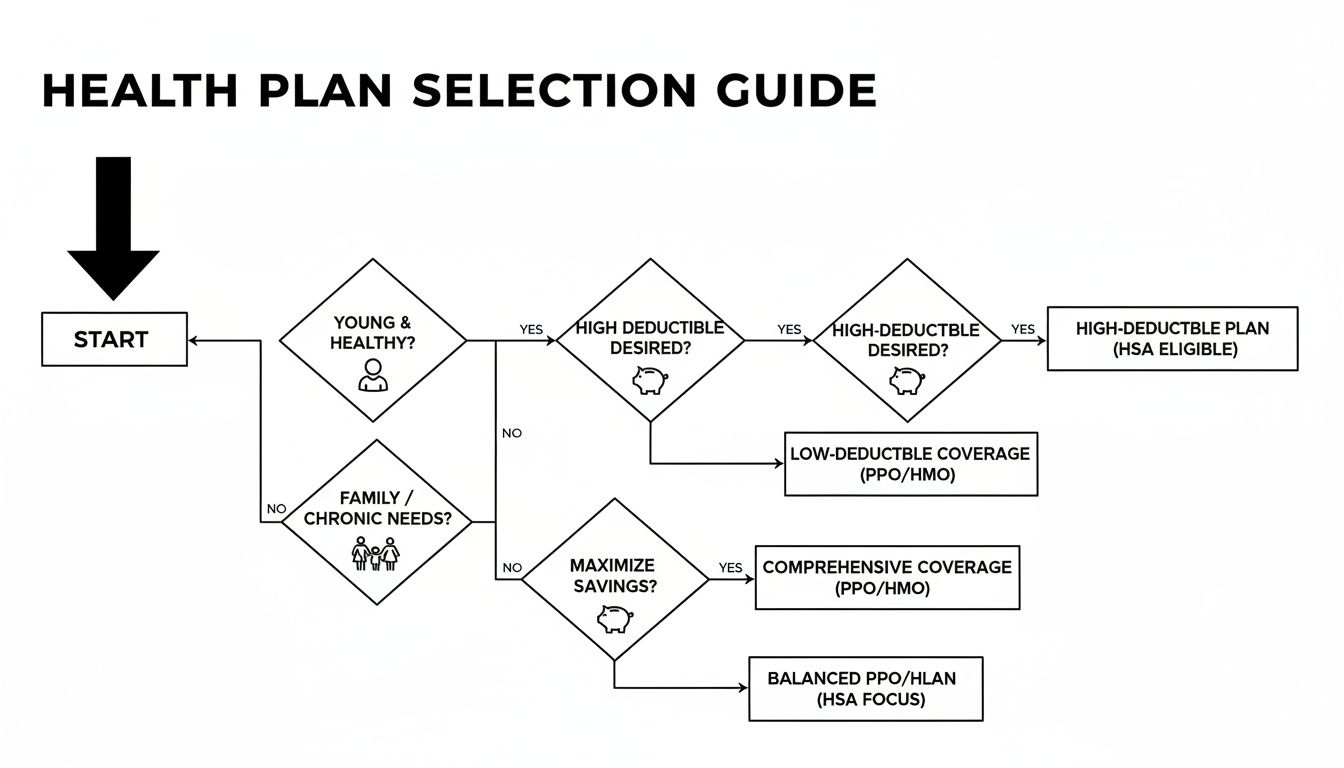

This decision-making process is laid out nicely in this flowchart.

It shows how your personal health, family situation, and budget priorities should be the main things guiding you to the right plan.

The HDHP and Health Savings Account (HSA) Strategy

One option that really deserves a closer look is the High Deductible Health Plan, specifically when it’s paired with a Health Savings Account (HSA). An HSA isn't just for medical bills; it's a tax-advantaged savings account that you own outright. Frankly, it can be a powerhouse for both your healthcare and retirement planning.

Here’s the magic behind it:

Triple Tax Advantage: Your contributions are tax-deductible, the money grows completely tax-free, and any withdrawals you make for qualified medical expenses are also tax-free. It’s the trifecta of tax savings.

Agency Contributions: Many federal agencies will actually deposit money directly into your HSA for you. This is often called a "premium pass-through," and it’s essentially free money.

Long-Term Growth: Unlike a Flexible Spending Account (FSA), your HSA balance rolls over every single year. You can even invest the funds, letting it grow just like a 401(k) or TSP.

This strategy turns your health insurance into a potent financial vehicle. We go much deeper into this in our comprehensive guide to the Federal Employees Health Benefits program.

And for those nearing retirement or already Medicare-eligible, it's critical to explore Medicare options to see how everything fits together. At the end of the day, taking a little extra time to match a plan to your life is the best way to protect both your health and your wallet.

Maximizing Your Savings with an FSA

While picking your health plan gets all the attention during the federal benefit open season, skipping your Flexible Spending Account (FSA) is like turning down free money. An FSA is an incredibly powerful tool that lets you set aside pre-tax dollars for those inevitable medical and dependent care costs, which in turn, lowers your taxable income for the year.

Think of it this way: you get an instant discount on everything from prescriptions to daycare. By contributing to an FSA, you reduce the portion of your salary that gets taxed, meaning more of your hard-earned money stays right where it belongs—in your pocket. For many federal employees, this simple move can easily add up to hundreds, or even thousands, of dollars in tax savings each year.

Understanding the Different Types of FSAs

FSAFEDS offers a few distinct types of accounts, and choosing the right one for your situation is key. Each is built for a specific purpose, and it's important to remember that you have to enroll in them individually.

Health Care FSA (HCFSA): This is the go-to account for most people. It covers a huge range of medical, dental, and vision expenses that your insurance doesn't, like deductibles, copayments, prescription drugs, and even orthodontics.

Limited Expense FSA (LEX HCFSA): This one is specifically designed for feds who are enrolled in a High Deductible Health Plan (HDHP) and have a Health Savings Account (HSA). It lets you save pre-tax money just for eligible dental and vision costs, which helps preserve your HSA funds for major medical expenses or long-term investment.

Dependent Care FSA (DCFSA): This account is a lifesaver for working parents. It covers costs related to caring for your kids (under age 13) or other dependents who can't care for themselves. Think daycare, preschool, and after-school programs that allow you and your spouse to work.

Navigating the Critical FSA Rules

Unlike your health and dental/vision plans, which often roll over without any action on your part, FSAs have a few strict rules you absolutely cannot ignore. Getting these right is the difference between saving money and losing it.

The single most important rule to remember about FSAFEDS is that you must re-enroll every single year during Open Season. Your contributions from this year will not automatically continue into the next. If you forget, your balance will be $0 for the entire year.

This mandatory re-enrollment catches thousands of federal employees off guard every year. You also have to be smart about the famous "use-it-or-lose-it" policy. While FSAFEDS has built-in safety nets, the general idea is that you need to spend down your FSA funds by the end of the plan year.

Thankfully, FSAFEDS gives you some breathing room:

HCFSA Carryover: You can carry over a certain amount of unspent HCFSA or LEX HCFSA funds into the next plan year (up to $680 for 2026).

DCFSA Grace Period: For dependent care, you get an extra 2.5-month grace period into the new year to incur eligible expenses and use the previous year's funds.

One of the smartest financial strategies is pairing an FSA with a powerful HDHP/HSA combination. If you're exploring that route, our complete guide to the GEHA Health Savings Account breaks down exactly how to make these accounts work together to supercharge your savings. By taking a few minutes to estimate your annual expenses and re-enrolling on time, you can turn your FSA into a serious financial advantage.

Common Open Season Mistakes to Avoid

The single biggest mistake you can make during Open Season? Doing absolutely nothing. It’s easy to let your current plans just roll over—we all get busy. But what feels like the path of least resistance can be a surprisingly costly mistake, locking you into coverage that no longer fits for another 12 months.

Plans change every single year. Premiums go up, doctor networks shift, and prescription drug formularies get shuffled. The plan that was a perfect fit for your family last year might have a nasty premium hike or could have dropped your kid's pediatrician for the upcoming year. Simply "setting it and forgetting it" is a gamble on your health and your wallet.

Focusing Only on Low Premiums

I see this all the time. People open the comparison tool, sort by the lowest bi-weekly premium, and pick the cheapest option. This is a classic trap. A rock-bottom premium often comes with a sky-high deductible or skimpy coverage that leaves you on the hook for thousands if a real medical issue pops up.

Think about it this way: a plan with a slightly higher premium but a much lower deductible and better prescription coverage could easily save you more money over the year. You have to look at the total potential cost—that's your premiums plus the maximum out-of-pocket limit—to understand your true financial risk.

Forgetting to re-enroll in your Flexible Spending Account (FSA) is like leaving a pile of cash on the table. Unlike your health insurance, your FSA election does not carry over. You must actively sign up again every single open season to get those crucial tax savings.

Overlooking Dental and Vision Needs

Another common pitfall is assuming your main health plan (FEHB) has you covered for dental and vision. While some plans throw in a few basic benefits, they almost never cover the big stuff like root canals, crowns, orthodontia, or the full cost of glasses and contacts.

There's a reason the Federal Employees Dental and Vision Insurance Program (FEDVIP) is a separate enrollment. Ignoring it can lead to massive, unexpected bills down the road. Take a moment to think about your family's actual needs for the coming year:

Does a teenager need braces? Orthodontic work can run into the thousands without a proper dental plan.

Is it time for new glasses for multiple family members? A solid vision plan can cut those costs dramatically.

Do you think you might need any major dental work? Waiting until a toothache becomes an emergency is the most expensive way to deal with it.

Skipping FEDVIP enrollment because you think your FEHB plan is "good enough" is one of the most frequent and regrettable mistakes I see people make. Take the time to review these separate benefits—it’s the only way to make sure your family is truly protected from those predictable, and often expensive, life events.

Your Top Open Season Questions Answered

It’s completely normal to have a few lingering questions, even after you’ve done your homework. Let's tackle some of the most common ones we hear from federal employees every year. Think of this as a quick-reference guide to help clear up any final uncertainties before you lock in your choices.

We've compiled these answers based on what your fellow feds ask us most often.

What Happens If I Miss the Open Season Deadline?

If you miss the deadline, your current health (FEHB) and dental/vision (FEDVIP) plans simply roll over into the new year. It's an automatic continuation, so you won't be without coverage.

But there's one major exception: Flexible Spending Accounts (FSAs). FSAs are a "use it or lose it" benefit that require you to actively re-enroll every single year. If you don't take action, you won't have an FSA for the upcoming year, period. After the deadline, no other changes can be made unless you have a Qualifying Life Event (QLE), like getting married or having a baby.

Can I Change My Thrift Savings Plan Contributions?

No, Open Season is specifically for your health, dental, vision, and flexible spending accounts. It has nothing to do with your retirement savings.

Your Thrift Savings Plan (TSP) is on a completely different track. You can start, stop, or change your TSP contribution amount any time you want throughout the year. Just log into your agency’s payroll portal—no need to wait for this specific enrollment window.

The only way to be 100% sure your doctor is in-network is to check the plan's official provider directory and then call the doctor's office directly. This two-step process is crucial before you enroll to avoid surprise bills later.

How Do I Know If a Doctor Is in a New Network?

This is probably one of the most important things to verify before switching plans. Start by going to the insurance carrier's website and using their "Find a Doctor" tool. You can usually find direct links to these provider directories right in the plan brochures on OPM's website.

But don't stop there. The online lists can sometimes be out of date. The next, vital step is to call your doctor's office. Speak to the front desk or billing manager and ask a very specific question: "For next year, will you be accepting [Full Plan Name and Option]?" This final verbal confirmation is your best defense against unexpected out-of-network charges.

Navigating Open Season is a critical part of securing your financial future. At Federal Benefits Sherpa, we specialize in helping federal employees make these decisions with confidence. Schedule your free 15-minute benefit review and gap analysis today to ensure your benefits are perfectly aligned with your retirement goals.