Social Security Supplement for Federal Employees: Explained

If you're a federal employee eyeing retirement before you hit 62, there's a special provision you need to know about: the social security supplement for federal employees. Most people in the federal world know it simply as the FERS supplement.

Think of it as a financial bridge. It's designed to span the income gap between the day you retire from federal service and the day you turn 62, which is your first eligibility date for Social Security benefits. This isn't an advance on your Social Security; it's a separate benefit paid out from the Federal Employees Retirement System (FERS) to make an earlier retirement more financially stable.

Understanding the FERS Retirement Supplement

Let's use a simple analogy. Imagine your federal career is one side of a canyon and your full Social Security eligibility is the other. That gap in between—the years from your early retirement until age 62—can look pretty daunting. The FERS supplement is the bridge that gets you across without a scary drop in your income.

This "bridge payment" is a really important piece of the FERS retirement puzzle. Its whole purpose is to give you an amount that's roughly equal to the Social Security benefit you earned while you were a FERS civilian employee. This provides a steady, predictable income stream until your actual Social Security can take over.

Who Is This Benefit For?

This isn't for every federal retiree. The FERS supplement is specifically for FERS employees who qualify for an immediate, unreduced retirement based on their age and years of service. It’s a benefit aimed squarely at long-term public servants who decide to hang up their hats before the traditional Social Security age.

Here are a few critical things to remember about it:

It’s temporary. The supplement payments stop cold the month you turn 62. It doesn't matter if you decide to apply for your real Social Security benefits then or wait longer—the supplement is done.

It has its own rules. The Office of Personnel Management (OPM) is in charge here, not the Social Security Administration. All the eligibility and payment calculations come from OPM.

It is subject to an earnings test. This is a big one. If you retire and then go get another job, your earnings from that new gig can shrink or even completely wipe out your supplement payment for that year. Anyone planning a post-retirement career needs to factor this in.

For many federal employees, this benefit is the key that unlocks the door to early retirement. It provides the financial confidence to retire on your own terms, knowing your income will hold steady until your other retirement benefits begin.

Getting a solid handle on the social security supplement for federal employees is absolutely crucial for mapping out your retirement timeline. Without it, retiring before 62 would be a much tougher financial nut to crack. It’s a unique benefit that truly recognizes the dedicated service of FERS employees.

Who Actually Gets the FERS Supplement?

Figuring out if you'll get the social security supplement for federal employees can feel a bit like solving a puzzle, but the rules are actually very clear-cut. It’s not something every FERS retiree gets automatically; you have to hit a specific sweet spot of age and years of service to qualify for an immediate, unreduced retirement.

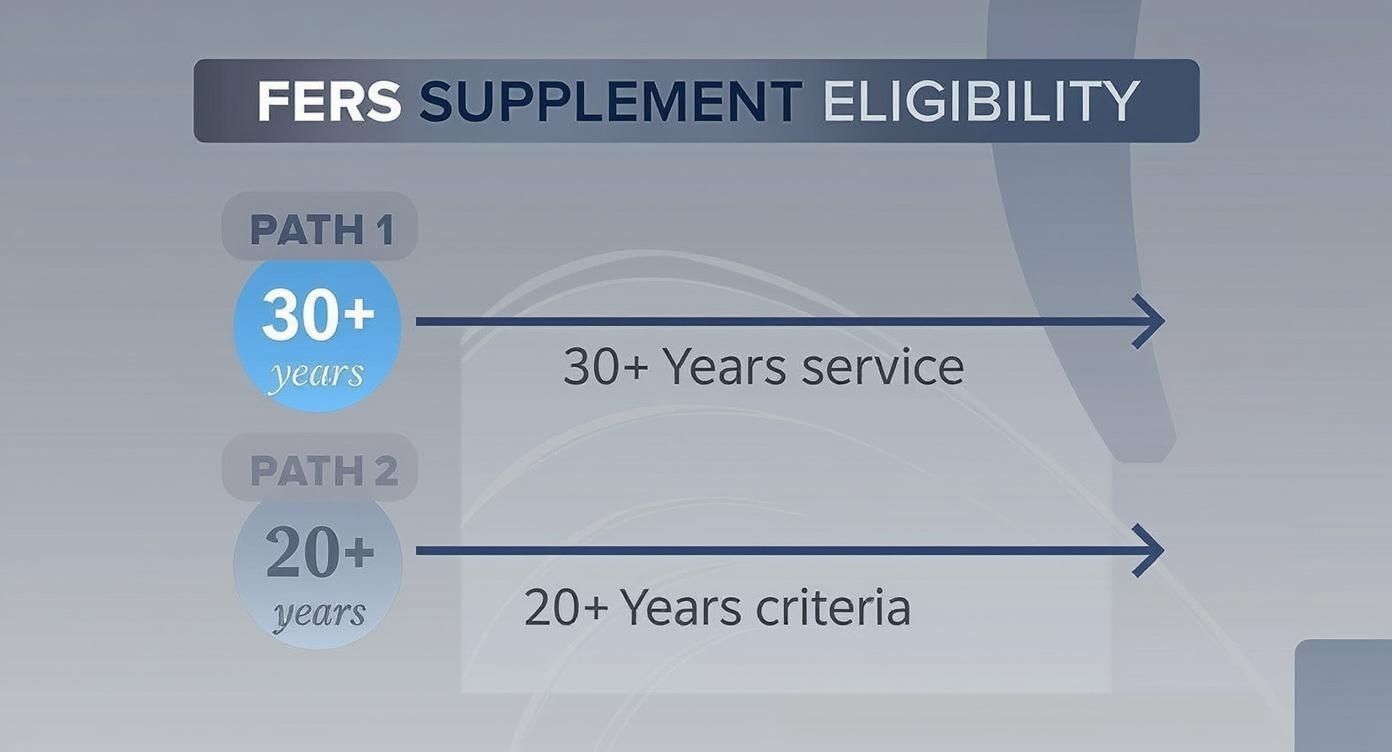

Think of it this way: there are two main gateways to this benefit. If you can walk through either one, the supplement is yours until age 62. Let's look at exactly what it takes to get through those gates.

The Two Main Paths to Eligibility

The most common way federal employees qualify is by meeting one of two specific criteria for an immediate retirement. "Immediate" is the key word here—it means your pension starts the month after you separate from service.

You're on the right track if you retire:

At your Minimum Retirement Age (MRA) with at least 30 years of service. Your MRA is based on when you were born, but for most feds, it falls somewhere between age 55 and 57. This is the classic path for long-haul career employees.

At age 60 with at least 20 years of service. This second path is for those who reach age 60 and have put in a solid two decades or more with the federal government.

A critical point here is that these years of service must be creditable civilian service under the FERS system. This is the time you spent working for the government and paying into FERS.

The Bottom Line: The FERS supplement isn't a universal benefit. It’s a bridge payment specifically for career federal employees who retire before they can draw Social Security but have already put in a long and full career.

Understanding Creditable Service and Special Cases

What if you have military time? Those years only count toward your eligibility for the supplement if you've made a military service deposit to "buy back" your time. If you haven't made that deposit, your military years won't help you meet the 20 or 30-year service requirements for this specific benefit.

It’s just as important to know who doesn't qualify. Ruling yourself out can save you from a nasty surprise when you're planning your retirement budget.

The supplement is not available to these groups of retirees:

Disability Retirees: If you retire on FERS disability, you are not eligible to receive the supplement.

MRA+10 Retirees: This is a big one. If you retire at your MRA with between 10 and 29 years of service, you don't qualify, even if you postpone your pension to avoid the age reduction. This is not considered an unreduced retirement for supplement purposes.

Deferred Retirees: If you leave federal service before you're eligible to retire and apply for your pension later, you won't get the supplement.

CSRS Employees: This benefit is exclusive to the FERS system. Those under the Civil Service Retirement System (CSRS) have a different pension calculation and are not eligible.

By matching your personal situation to these rules, you can get a clear picture of whether this income stream will be part of your financial future. If you're still unsure about where you stand, consider getting a free benefit review from an expert at Federal Benefits Sherpa.

How Your FERS Supplement Is Calculated

At first glance, the formula for the social security supplement for federal employees can seem a little intimidating. But it’s not as complex as it looks. Think of it less like high-level algebra and more like a simple recipe with three key ingredients. Once you understand what goes into it, you can get a solid estimate of what to expect.

The whole point of the calculation is to figure out a stand-in for the Social Security benefit you earned during your time as a FERS employee. To do that, it takes a projection of your future Social Security check and pairs it with your years of dedicated federal service.

Let's walk through it step-by-step.

Step 1: Estimate Your Social Security Benefit

First things first, you need a starting point: your estimated Social Security benefit at age 62. The Social Security Administration (SSA) actually calculates this for you. Just log in to your personal account on the SSA website to find your statement.

This number is the bedrock of the entire calculation. It's the SSA's best guess of what your monthly check would be if you started drawing benefits at the earliest possible age. It’s critical that you use the age 62 estimate. Using the higher estimates for your full retirement age or age 70 will throw off your numbers completely.

Step 2: Count Your FERS Service Years

Next up is the easy part. Tally up your total years of creditable FERS civilian service. This is simply a count of how long you’ve worked for the federal government under the FERS system.

For this formula, you always round down to the nearest whole year. So, if you have 25 years and 8 months of service, you’ll use 25 years. If you’ve worked for 31 years and 2 months, you’ll use 31 years. This keeps the calculation clean and consistent.

The infographic below shows the two main ways you can become eligible for the supplement in the first place.

As you can see, hitting either 30 years of service by your Minimum Retirement Age (MRA) or 20 years by age 60 is what opens the door to this benefit.

Step 3: Put It All Together

Now it's time to combine the pieces. The calculation takes your projected Social Security benefit and multiplies it by a fraction that represents your FERS career. The FERS Special Retirement Supplement is essentially a prorated portion of what you’d get from Social Security at 62.

Let's look at an example. If your estimated Social Security benefit at 62 is $1,600 per month and you have 30 years of FERS service, your supplement would come out to $1,200 per month. You can dive deeper into how this provides a crucial income bridge with resources from experts like Federal Pension Advisors.

The Formula: (Your Estimated Social Security Benefit at 62) x (Your Years of FERS Service ÷ 40) = Your Monthly Supplement

The "40" in the formula represents a standard working lifetime in the eyes of Social Security. The calculation basically gives you a prorated credit for those 40 years based on how long you actually spent in federal service. Once you plug in your own numbers, you'll have a powerful estimate to help guide your retirement planning.

Navigating The Supplement Earnings Limit

The social security supplement for federal employees is an incredible bridge that helps you retire early, but it comes with one major string attached: the earnings limit. If you’re thinking about picking up a part-time gig or launching a second career after your federal service, you absolutely need to know how this rule works. It can directly impact your monthly income.

Think of it as a test. The Social Security Administration (SSA) sets a cap on how much you can earn while collecting benefits before your full retirement age. Since the FERS supplement is designed to stand in for Social Security, it’s subject to the very same earnings test. Go over that limit, and your supplement starts to shrink.

The rule itself is pretty simple: for every $2 you earn above the annual limit, your supplement is reduced by $1. While the math isn't complicated, the effect on your budget can be huge if you aren't paying attention.

Understanding The Reduction Formula

First, let's be clear about what kind of money we're talking about. The earnings limit only applies to earned income—that means wages from a job or net profits from a business you run. It does not count your FERS pension, TSP withdrawals, investment returns, or any other retirement income.

For 2025, the annual earnings limit for FERS retirees receiving the supplement is $23,400.

Let's walk through an example. Say you retire and take on a consulting project that pays you $33,400 for the year. That puts you $10,000 over the limit. Applying the $1-for-$2 reduction, your supplement would be cut by $5,000 for the year ($10,000 ÷ 2 = $5,000). You can learn more about how the earnings limit impacts federal retirees on Fedweek.com.

It’s critical to keep a close eye on your earnings. If it looks like you’re going to blow past the limit, you can contact the Office of Personnel Management (OPM) and ask them to stop your supplement payments for the rest of the year. This proactive step can save you from the headache of an overpayment and having to pay money back later.

Crucial Takeaway: Don't panic about your main retirement benefit. The earnings limit only affects your FERS supplement. Your basic FERS annuity pension is completely safe and will not be reduced, no matter how much you earn.

Practical Scenarios And Planning

To illustrate how these reductions play out in the real world, let's explore a few different income levels with the $23,400 limit.

FERS Supplement Reduction Scenarios

This table illustrates how different levels of earned income above the annual limit affect the FERS Special Retirement Supplement payment.

Annual Earned IncomeAmount Over LimitAnnual Supplement Reduction$25,400$2,000$1,000$33,400$10,000$5,000$50,000$26,600$13,300

As you can see, the impact ranges from a minor adjustment to completely wiping out the supplement. If your annual supplement was $12,000, earning $50,000 would reduce it to zero for that year.

Knowing this rule ahead of time puts you in the driver's seat. You can make a conscious decision to keep your post-retirement earnings under the limit to receive your full supplement. Or, you might decide a higher-paying job is worth the trade-off. The most important thing is to plan for it so there are no financial surprises in your early retirement years.

The Future of the FERS Supplement

If you're planning to retire early from federal service, you’ve probably wondered about the long-term stability of the FERS supplement. Is this benefit actually here to stay? It's a smart question, especially when you hear whispers about potential changes to federal benefits.

The FERS supplement wasn't created by accident; it's a core piece of the retirement puzzle, designed to act as a financial bridge. When the FERS system was launched, it was built on the assumption that retirees would eventually get Social Security. The supplement fills the gap for those who retire before age 62, giving them a steady income stream from their pension, TSP, and the supplement until Social Security can begin.

Will the Supplement Be Eliminated?

It's true that over the years, various proposals have surfaced to either change or get rid of the FERS supplement entirely, usually as a way to cut federal spending. The argument is often that it's an overly generous perk that private-sector workers don't receive.

For instance, the Congressional Budget Office has crunched the numbers on proposals to end the supplement for new retirees. One scenario looked at eliminating it for those retiring in 2028 or later, projecting a massive $10 billion in savings over ten years. With the average supplement paying out around $18,000 a year, you can see how those savings would stack up. You can dive deeper into these kinds of proposals in a recent analysis from GovExec.com.

But here’s the thing about these proposals: they almost never affect people who are already retired or close to it.

Key Reassurance: Historically, whenever major changes to federal retirement benefits are made, they include a "grandfather clause." This clause protects the benefits of current and soon-to-be-eligible employees, applying the new rules only to those hired in the future.

This approach prevents pulling the rug out from under people who have spent decades planning their financial future based on the rules in place. So, while no one can promise a benefit will last forever, the track record for protecting earned benefits is incredibly strong. Your best move is to stay informed, but don't let the headlines derail your retirement plans.

Common Questions About the FERS Supplement

As you get closer to retirement, the specifics of the social security supplement for federal employees can feel a bit overwhelming. It's a fantastic benefit designed to bridge the income gap until you're eligible for Social Security, but the devil is in the details. Let's walk through some of the most common questions federal employees have so you can plan with confidence.

Getting these details right is crucial. It can mean the difference between a smooth financial transition and an unexpected surprise on your first retirement check.

Does the FERS Supplement Automatically Stop at Age 62?

Yes, it does, and this is a hard-and-fast rule you absolutely need to plan for. Think of the FERS supplement as a temporary bridge. That bridge has a clear end point: the month you turn age 62.

This isn't negotiable. The supplement stops whether you start drawing your actual Social Security benefits or not. Many people choose to delay their Social Security to get a bigger monthly payment later on, but even if you wait until age 70, the FERS supplement payment will still disappear at 62. You have to build this planned income drop into your long-term budget.

Is the FERS Supplement Taxable?

It sure is. At the federal level, the income you get from the FERS supplement is treated just like your regular salary was. It's considered ordinary income and will be taxed at your marginal tax rate, right alongside your FERS annuity and any traditional TSP withdrawals.

Where things get a little tricky is with state taxes. The rules are all over the map.

Some states are retirement-friendly and don't tax your FERS pension or supplement at all.

Other states will tax it fully, just like the federal government does.

And then there are states that offer partial tax breaks or exemptions for pension income.

Because there's so much variation, it's a good idea to check your own state's tax laws or talk to a financial professional who understands them.

Remember, the supplement is treated as regular income for tax purposes. If you don't account for both federal and state taxes, your net income could be quite a bit lower than you expected. Plan for withholding from day one.

Do I Need a Separate Application for the Supplement?

Good news here: no, you don't. The process is handled automatically, which is one less piece of paperwork to worry about.

When you fill out your standard application for your FERS retirement benefits, the Office of Personnel Management (OPM) takes care of the rest. If you meet all the criteria for an immediate, unreduced retirement that qualifies you for the supplement, OPM will calculate it and simply add it to your monthly FERS annuity payment. It's an integrated process, so no extra forms or hoops to jump through.

What Happens to the Supplement if I'm a Disability Retiree?

This is a really common point of confusion, but the rules are clear: federal employees who retire under a FERS disability retirement are not eligible for the Special Retirement Supplement.

The supplement is specifically for those who choose to retire voluntarily once they meet the age and service requirements (like MRA+30 or 60+20). Disability retirement is a completely different path with its own set of rules and benefit calculations. While it's an incredibly important safety net, it just doesn't include the supplement as part of the package.

Making sense of these rules is the key to a secure retirement. Federal Benefits Sherpa offers a free 15-minute benefit review to help you sort through your unique situation and make the most of your federal benefits. Get personalized guidance for your retirement journey and start planning today.