What Is the FERS Supplement Your Guide to This Retirement Bridge

For federal employees eyeing an early retirement, one of the biggest questions is always, "How do I bridge the income gap until my Social Security kicks in?" That's where a unique and often misunderstood benefit comes into play: the FERS Supplement.

Think of it as a financial stand-in. It's a temporary payment designed to approximate the Social Security benefits you earned during your years of federal service, paid out until you officially turn 62.

Your Guide to This Retirement Bridge

If you're mapping out your retirement timeline, getting a handle on the FERS Supplement is absolutely critical. It's a key piece of the financial puzzle for anyone planning to leave federal service before becoming eligible for Social Security.

This guide will break down exactly what it is, who gets it, and how it fits into your larger retirement strategy.

What Is the FERS Supplement, Really?

The FERS Supplement—officially called the FERS Annuity Supplement or Special Retirement Supplement (SRS)—is a monthly payment for eligible FERS employees who retire before age 62. Its entire job is to fill the financial void until you're old enough to claim your actual Social Security benefits.

It's important not to confuse it with your main FERS pension, which is a lifetime benefit. The supplement is temporary and has a firm expiration date: the month you turn 62.

For a wider view on how these types of benefits work, it's helpful in understanding supplemental retirement plans in general. While the private sector has similar concepts, the FERS version is built specifically for the federal workforce with its own set of rules.

To give you a quick overview, here's a simple breakdown of its core features.

FERS Supplement at a Glance

ComponentDescriptionPurposeTo "bridge the gap" between your FERS retirement date and Social Security eligibility at age 62.Payment SourcePaid out of the FERS Retirement and Disability Fund, not the Social Security Administration.DurationBegins at retirement and stops at age 62, regardless of when you claim Social Security.EligibilityRequires a specific combination of age and years of service at retirement (not all FERS retirees qualify).Earnings TestSubject to an annual earnings test, which can reduce or eliminate the payment if you have earned income.

This table shows that while it acts like a Social Security preview, the supplement is its own distinct benefit with its own rules.

The core purpose of the supplement is to ensure that long-serving federal employees who retire early don't face a significant income drop while waiting for Social Security to begin. It's a reward for a career in public service.

This benefit is especially valuable for those in physically or mentally demanding roles—like law enforcement or air traffic control—who often retire as soon as they become eligible. It provides the financial stability needed to transition smoothly into the next chapter of life.

Who Actually Qualifies for the FERS Supplement?

The FERS Supplement is a fantastic benefit, but let's be clear: it isn't for every federal employee who retires early. Think of it as a special bridge to Social Security, built specifically for those who’ve put in a long and dedicated career in public service.

To get across that bridge, you have to be eligible for an immediate, unreduced annuity. That means you start drawing your pension the month after you retire, not putting it off until later. On top of that, you have to hit a specific combination of age and years of service.

The Main Pathways to Eligibility

For most feds, there are two common scenarios that open the door to receiving the supplement. You’ll need to meet one of these two requirements:

Retire at your Minimum Retirement Age (MRA) with at least 30 years of creditable service.

Retire at age 60 with at least 20 years of creditable service.

Your MRA is a key number in all of this, and it’s based on the year you were born, landing somewhere between age 55 and 57. If you're fuzzy on your MRA or exactly how your service time adds up, it's worth digging into a federal retirement eligibility explained guide to get your specific numbers straight.

One critical point: retiring under the MRA+10 provision (hitting your MRA with between 10 and 29 years of service) does not make you eligible for the FERS Supplement.

Special Provisions for Demanding Careers

The rulebook looks a bit different for federal employees in certain high-stress jobs. Because roles like law enforcement and firefighting are so physically demanding, the government created special retirement provisions for them.

This group includes:

Federal Law Enforcement Officers

Firefighters

Air Traffic Controllers

These professionals can retire much earlier and still qualify for the FERS Supplement. Typically, they become eligible as soon as they separate from service, provided they've met their unique criteria—often age 50 with 20 years of service, or any age with 25 years of service. This setup ensures they have a steady income stream from the day they retire until they turn 62.

The FERS Supplement is designed to reward a full career. It's there for those who retire under the standard or special provisions, but it's not available to people who leave federal service mid-career and choose a deferred or postponed retirement.

At the end of the day, it all comes down to knowing your numbers—your age, your years of service, and the specific retirement option you’re taking.

How Your FERS Supplement Is Calculated

At first glance, the official formula for the FERS Supplement can look like something out of a high school algebra textbook. But don't let that fool you—the idea behind it is actually pretty simple. The government is trying to estimate what your Social Security benefit would be based only on your years as a federal employee.

Think of it this way: your actual Social Security benefit is calculated using your entire working history, from your first part-time job to your final day at your agency. The supplement, however, isolates just one piece of that puzzle: your FERS career. It's a way to credit you for that specific time before you're eligible for the real deal.

To do this, the government essentially runs a two-step process. First, they project what your Social Security benefit would likely be at age 62. Then, they adjust that number based on how long you actually worked under FERS.

The Two Key Ingredients in the Formula

To calculate your supplement, the Office of Personnel Management (OPM) only needs two key pieces of information. These two numbers are the foundation for your personalized estimate.

Your Estimated Social Security Benefit at Age 62: This is the starting block. OPM gets an estimate from the Social Security Administration (SSA) of what your full benefit would be if you started drawing it at age 62.

Your Years of Creditable FERS Service: This is simply the total time you’ve worked and paid into the FERS system. The more years you have, the higher your supplement will be.

Once they have these two figures, they plug them into a straightforward formula to determine your final monthly supplement payment.

The calculation is an estimate, not a guarantee of your future Social Security income. Its sole purpose is to create a temporary payment that bridges the gap until you can claim the real thing.

Let's walk through a quick, practical example to see how OPM puts these pieces together to turn your years of service into a concrete dollar amount.

A Practical Calculation Example

Let's put this into practice with a federal employee we'll call Alex, who is getting ready to retire.

Alex has 30 years of creditable FERS service.

The Social Security Administration estimates his benefit at age 62 will be $2,000 per month.

The formula OPM uses is based on a standard 40-year working career. So, the first step is to figure out what portion of that standard career Alex spent under FERS. They take his 30 years of service and divide it by 40.

Step 1: Find the Service Ratio

(30 Years of FERS Service / 40) = 0.75

This 0.75 (or 75%) represents the slice of a "full" working life that Alex spent in his federal role. Now, they multiply this ratio by his estimated Social Security benefit.

Step 2: Calculate the Supplement

$2,000 (Estimated Social Security) x 0.75 = $1,500

In this case, Alex’s estimated monthly FERS supplement would be $1,500. As you can see, the payment is directly tied to his time in service.

This is a simplified estimate, of course, and your official numbers will be on your benefits statement. To see how your years of service play into the bigger picture, our FERS retirement calculation offers a practical guide that pairs perfectly with this information.

Understanding the Annual Earnings Test

Getting the FERS supplement is a fantastic perk for retiring early, but it comes with a major string attached: the annual earnings test. Think of it less as a penalty and more as a rule you need to plan around. If you decide to work a job or become self-employed after leaving federal service, this rule can reduce—or even completely wipe out—your supplement payment.

Essentially, it’s a temporary income cap. While the supplement is active, the government keeps an eye on your "earned income." If you make more than a specific amount (a threshold set by the Social Security Administration each year), your supplement gets cut back. The whole point is to make sure this benefit goes to people who have genuinely stepped back from the workforce, not those just starting a second high-earning career.

What Counts as Earned Income

This is where things get interesting, and it’s critical to know which money counts and which doesn’t. Not all income is created equal in the eyes of the earnings test.

The test only cares about earned income. This is money you actively work for, like:

Wages from a job: Any salary or hourly pay from an employer.

Net earnings from self-employment: The profit you make if you start a business, consult, or freelance.

On the other hand, plenty of common retirement income sources are completely exempt. You can receive the following without it touching your supplement:

Your FERS basic annuity (your pension)

Withdrawals from your Thrift Savings Plan (TSP)

Other investment income, like stock dividends or capital gains

Income from rental properties

This distinction is huge. It means you can pull money from your retirement accounts without worrying about the earnings test. Only the income you get from going back to work is capped.

How the Reduction Is Calculated

The math is pretty simple, but the impact can be significant. For every $2 you earn above the annual limit, your FERS supplement is reduced by $1. This one-for-two reduction mirrors the same rule Social Security uses for people who claim benefits before their full retirement age. You can find more analysis on how this affects federal retirement proposals over at FedWeek.com.

Let’s walk through an example: The earnings limit for 2024 is $22,320.

Say you take a part-time consulting gig and earn $32,320 for the year. That puts you $10,000 over the limit.

Your supplement would be reduced by $5,000 for that year ($10,000 divided by 2). This reduction isn't taken as a lump sum; it's typically spread out over your supplement payments for the following year.

A lot of people mistakenly think this is a permanent loss, but it's not. The reduction only applies for the years you're both receiving the supplement and earning over the limit. The moment you hit age 62, the supplement stops, and the earnings test vanishes along with it. Planning your post-retirement work with this rule in mind is absolutely essential for a successful early retirement strategy.

A Critical Retirement Decision: The Supplement vs. The 10% Pension Bump

As a federal employee, you’ll face plenty of forks in the road on your journey to retirement, but few are as impactful as this one. Should you retire as soon as you’re eligible and start collecting the FERS Supplement, or is it smarter to work a few more years to lock in a permanent boost to your pension?

This isn't just a simple choice; it’s a strategic decision between immediate cash flow and a higher, lifelong income. The FERS Supplement is an incredible tool, offering a financial bridge that provides a steady income stream from the day you retire until you turn 62. But on the other hand, delaying your retirement until age 62 can unlock a powerful, permanent enhancement to your pension.

The Power of the 1.1% Multiplier

This "10% bump" is a true game-changer for your FERS pension calculation. Under the standard FERS rules, your basic annuity is calculated as 1% of your high-3 average salary multiplied by your years of creditable service.

However, if you hit age 62 with 20 or more years of service, that multiplier jumps to 1.1%. That might not sound like much, but it amplifies your entire pension—and any survivor benefit—by 10% for the rest of your life.

This creates a classic retirement dilemma. Do you take the temporary supplement now or hold out for the permanent pension increase later? There’s no single right answer; it depends entirely on your personal circumstances, including your health, financial needs, and what you want your retirement to look like.

Modeling Your Financial Future

Let’s walk through a scenario to see how this plays out. Imagine a federal employee retiring at their Minimum Retirement Age (MRA) of 57 with 30 years of service and a high-3 salary of $100,000.

Path 1: Retire at MRA with the Supplement. Their initial pension would be $30,000 per year (1% x $100,000 x 30). They would also receive the FERS Supplement for five years, from age 57 until 62.

Path 2: Work Until Age 62. If they work five more years, their pension calculation changes dramatically. They now have 35 years of service and qualify for the 1.1% multiplier. Their pension becomes $38,500 per year (1.1% x $100,000 x 35)—a permanent $8,500 annual increase for life.

To make this even clearer, here’s a side-by-side comparison.

Retire at MRA vs. Working to 62: A Financial Snapshot

FactorRetire at MRA with SupplementWork to Age 62 for 1.1% PensionPension Amount$30,000 per year (at MRA)$38,500 per year (at 62)Supplement IncomeYes, receives supplement from MRA to 62No supplement receivedPension Multiplier1% (Standard)1.1% (Enhanced)Immediate BenefitProvides immediate income to bridge the gap to Social Security.N/ALong-Term BenefitSmaller pension base for life.10% higher pension for life, plus higher survivor benefits.

As you can see, the decision hinges on balancing short-term needs with long-term financial security. One isn't inherently better than the other—it's about what's right for you.

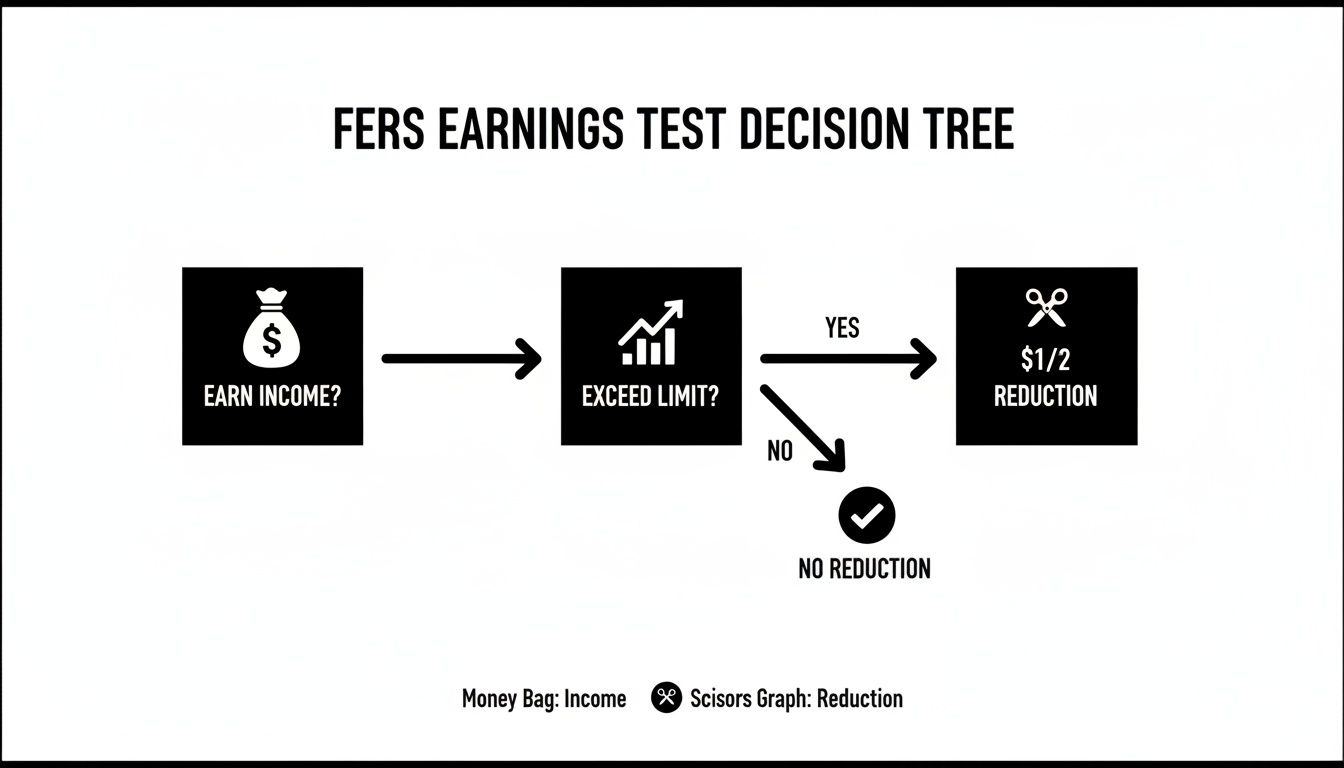

The FERS Earnings Test is another key piece of this puzzle, especially for those who plan to retire early but continue working elsewhere.

This visual guide shows that earning income above the annual limit will trigger a reduction in your supplement, which can significantly alter the financial math of retiring early.

From a purely financial standpoint, the long-term advantage often lies with working until 62. The compounding effect of that higher pension base adds up significantly over a 20- or 30-year retirement. However, for those who need or simply want to retire early, the supplement provides an essential income stream.

Of course, this decision doesn't happen in a vacuum. It's crucial to integrate it with your TSP and Social Security strategies. Our guide on how to maximize Social Security can help you build a more complete financial picture and make the best choice for your future.

Frequently Asked Questions About the FERS Supplement

Even after you've got the basics down, a few common questions always seem to pop up about how the FERS supplement works in the real world. Let's walk through some of the most frequent points of confusion to make sure you have the full story.

Is the FERS Supplement the Same as Social Security?

Not at all. Think of the FERS supplement as a stand-in, a temporary bridge payment from your former employer—the federal government. It's designed to mimic the Social Security benefit you would have earned, but it's calculated only using your years of FERS civilian service.

Your actual Social Security is a completely separate, lifelong benefit that you’ll claim directly from the Social Security Administration. That official payment is based on your entire working life, including any private-sector jobs you ever had.

Do I Have to Pay Taxes on the FERS Supplement?

Yes, you do. The FERS supplement is treated as taxable income by the IRS, just like your regular FERS pension. State tax rules can be a different story, though, so you'll want to check the laws for your specific state of residence.

Here's a small silver lining: The supplement is not subject to FICA taxes (the 7.65% for Social Security and Medicare). You won't see those payroll taxes deducted from your supplement checks, which is a nice little financial break.

What Happens to My FERS Supplement When I Turn 62?

This is one of the most critical rules to burn into your memory: the supplement has a non-negotiable end date. It automatically stops the month you turn 62, no exceptions.

It doesn't matter if you decide to delay taking your actual Social Security benefits until age 67 or 70. The moment you hit 62, that bridge payment from OPM disappears. From that point on, you’ll be relying on your pension, TSP, and other savings until you decide to turn on your Social Security faucet.

Does Everyone Who Retires Early Get the Supplement?

No, this is a common misconception. The supplement isn't an automatic handout for every federal employee who retires early. You have to meet very specific age and service requirements to qualify.

For instance, you must retire at your Minimum Retirement Age (MRA) with 30 years of service or at age 60 with 20 years. Federal employees who leave under a deferred retirement or use the MRA+10 provision are generally not eligible to receive it.

Understanding your benefits is the first step toward building a solid retirement plan. Federal Benefits Sherpa offers a free 15-minute benefit review to help you cut through the confusion and create a clear roadmap for your future. Learn more and book your review today.