FERS Retirement Calculation A Practical Guide

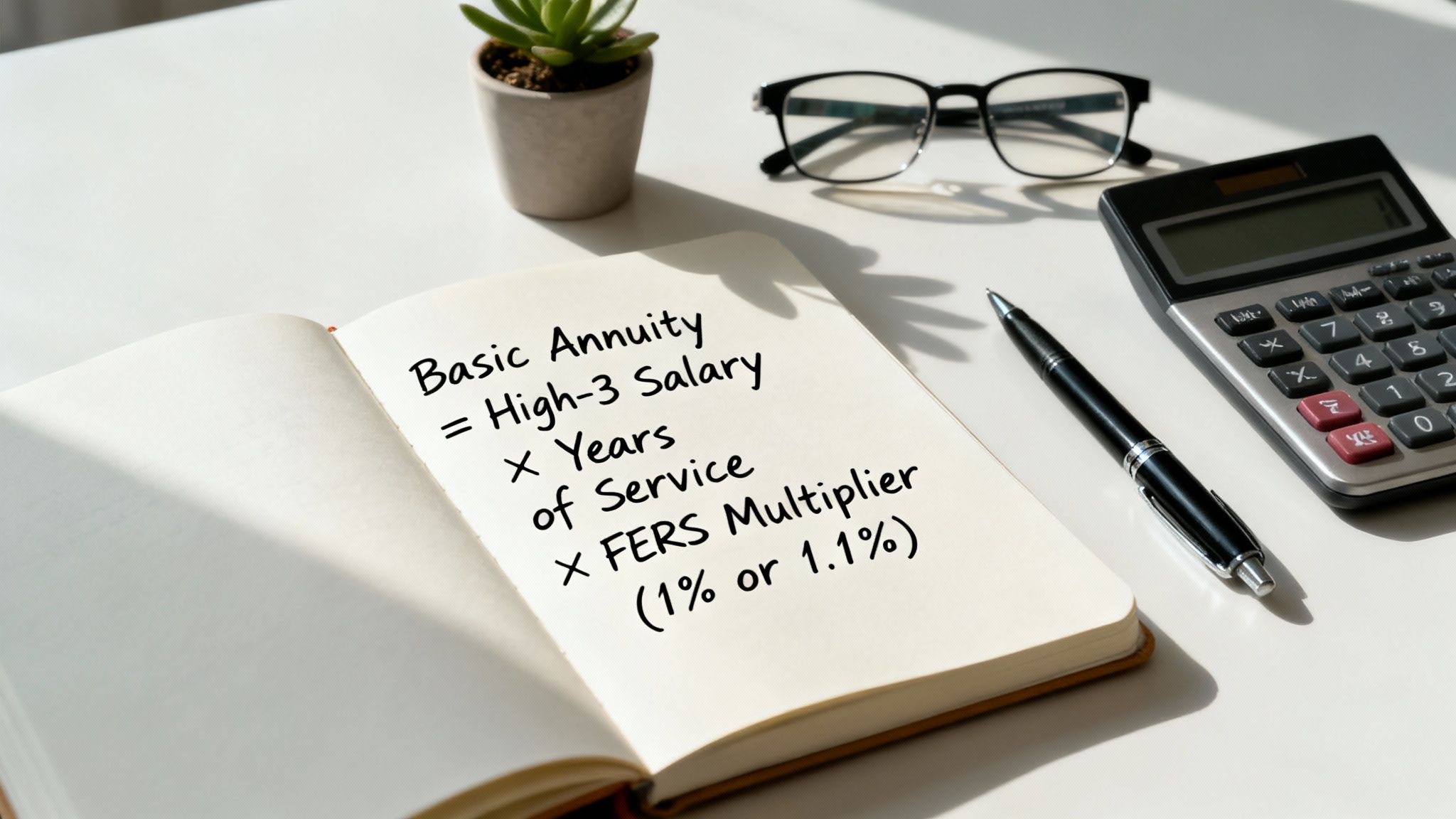

Your FERS retirement calculation really comes down to a simple formula: take your High-3 average salary, multiply it by your total years of creditable service, and then multiply that result by a pension multiplier. What you get is your gross annual FERS annuity—the core of your federal pension.

The Core Formula Behind Your FERS Retirement

Despite what you might think, the Federal Employees Retirement System (FERS) annuity isn't some mystery buried in government red tape. It’s actually a straightforward mathematical equation. Getting a handle on this formula is the most important first step you can take to plan your financial future after a career in public service.

Think about it: every career choice, from taking a promotion to picking your exact retirement date, feeds directly into this calculation. These three core components work together to determine your final pension amount.

The Three Key Ingredients of Your Pension

To run the numbers on your FERS retirement, you first need to get familiar with its three essential variables. I like to think of them as the main ingredients in your retirement recipe.

High-3 Average Salary: This is the average of your basic pay from your highest-earning 36 consecutive months. It's a common misconception that this is always your last three years; in reality, it's your most lucrative three-year stretch, whenever that occurred in your career.

Creditable Service: This is the grand total of years and full months you've spent in a FERS-covered position. It can also include certain kinds of military service and any unused sick leave you've converted.

The Pension Multiplier: This is a percentage set by the Office of Personnel Management (OPM) that acts as the final lever in the equation. For most federal employees, it’s a pretty simple figure.

Once you have these three numbers nailed down, you can plug them into the basic formula and get a surprisingly accurate estimate of your gross annual annuity.

Here’s a quick breakdown of how each piece of the puzzle works and why it matters.

FERS Annuity Formula Components Explained

ComponentWhat It IsHow It Impacts Your AnnuityHigh-3 Average SalaryThe average of your highest 36 consecutive months of basic pay.The higher your salary peak, the larger your pension base. This is the foundation of the entire calculation.Years of Creditable ServiceThe total time you've worked in a FERS position, plus any qualifying military time and sick leave.The longer you work, the more you earn. Each year directly increases your final pension amount.Pension MultiplierA set percentage, usually 1% or 1.1%, applied to your total earnings and service.This is the final factor. A small change here can create a significant increase in your lifetime income.

As you can see, the FERS calculation is designed to reward both high performance (your salary) and long-term commitment (your years of service).

Key Takeaway: The FERS basic annuity formula isn't just a math problem; it's a roadmap. By strategically focusing on boosting your High-3 salary and maximizing your years of service, you have a surprising amount of control over your final pension.

The Standard 1% Multiplier vs. the 1.1% Boost

This is where a little bit of planning can really pay off. For most federal employees, the pension multiplier is a standard 1%. Put simply, for every year you work, you get 1% of your High-3 salary as your annual pension.

But here's a pro tip: there’s a major opportunity to get more. The FERS calculation includes a special provision that bumps that multiplier from 1% up to 1.1% if you meet two specific conditions. You have to be at least age 62 at retirement and have 20 or more years of creditable service. If you're interested in the bigger picture, you can find more insights on pension trends in Mercer's global pension index.

That extra 0.1% might not sound like much, but it translates to a 10% increase in your pension for the rest of your life. It’s a powerful incentive for long-serving employees to think about working until at least age 62.

Let's run the numbers on a quick example. Imagine an employee with a $90,000 High-3 salary and 25 years of service.

Retiring at Age 60 (1% Multiplier): $90,000 x 25 x 0.01 = $22,500 per year

Retiring at Age 62 (1.1% Multiplier): $90,000 x 25 x 0.011 = $24,750 per year

That's an extra $2,250 in your pocket every single year, just for meeting the age and service requirements for that enhanced multiplier. It’s a perfect illustration of how critical your timing is when it comes to the FERS retirement calculation.

Pinpointing Your High-3 Average Salary

While your years of service are a huge piece of the puzzle, your High-3 average salary is the financial bedrock of your FERS pension. This one number carries the most weight in your entire retirement calculation, as it represents the average of your highest 36 consecutive months of basic pay. Getting this figure right is absolutely essential if you want to project your annuity with any real accuracy.

A lot of folks fall into the trap of thinking their High-3 is just their salary from their last three years on the job. For many federal employees, that might end up being true, but it's certainly not the rule. The FERS system specifically hunts for your most lucrative three-year stretch, no matter when it happened in your career.

This little detail can make a massive difference, especially for feds who might have downshifted into a lower-paying role later in their career for a better work-life balance or less stress. Your FERS calculation doesn't care about your final job title; it will always find and use your peak earning period.

What Counts as Basic Pay

Before you start plugging numbers into a calculator, you need to know exactly what the Office of Personnel Management (OPM) considers "basic pay." Your High-3 isn't based on your total paycheck. It's a very specific, defined amount, and understanding the ins and outs will keep you from either shortchanging your estimate or giving yourself false hope.

Here’s a quick rundown of what generally makes the cut for your FERS basic pay calculation:

Your Standard Salary: This is the straightforward pay for your grade and step.

Locality Pay: That geographically-based bump for your duty station is a major component of your basic pay.

Within-Grade Increases: Those regular step increases you earn are definitely included.

Shift Rates and AUO: For certain jobs, things like Administratively Uncontrollable Overtime (AUO) for law enforcement or regularly scheduled standby duty pay often count.

On the flip side, there are several types of pay that are explicitly left out of the High-3 calculation. It’s just as important to know what isn't included so you don't accidentally inflate your projections.

Things that are NOT part of your basic pay include:

Bonuses and cash awards

Traditional overtime pay

Travel allowances (per diem)

Foreign post allowances

The bottom line is this: if the pay isn't regular, recurring, and tied directly to your standard position and its duties, it probably doesn't count toward your High-3.

A Practical High-3 Scenario

Let's look at a real-world example. Imagine a federal employee, Sarah, who is mapping out her retirement. She spent the bulk of her career in Washington, D.C., a high-locality pay area. But two years before she planned to retire, she took a GS position in a lower-cost area with much less locality pay to be closer to her grandkids.

If Sarah were to only look at her final three years, her High-3 average would be artificially low. Her actual High-3 period is the 36 consecutive months that ended right before she made that move, because that's when her basic pay was at its absolute peak. This is a perfect illustration of why you have to review your entire salary history, not just the recent past.

The High-3 is a rolling average, not a fixed snapshot of your final years. OPM will analyze your entire career's salary history to find the 36-month window that results in the highest possible average basic pay for your FERS calculation.

Common Missteps to Avoid

Calculating your High-3 can feel simple on the surface, but small mistakes can ripple out into a significant difference over a lifetime of pension payments. One of the most common errors I see is people miscalculating the start and end dates of their 36-month period, especially when it doesn't line up neatly with calendar years.

Another classic pitfall is incorrectly factoring in a big one-time bonus or a year with a lot of overtime. While those payments were a nice boost at the time, they won't do a thing for your FERS pension. Your best source of truth is always your Standard Form 50 (SF-50) documents, which clearly state your official basic pay.

Helping federal employees navigate these exact details is a core part of our mission at Federal Benefits Sherpa. Accurately pinpointing your High-3 is one of the key services we provide to ensure your retirement plans are built on a solid, reliable foundation.

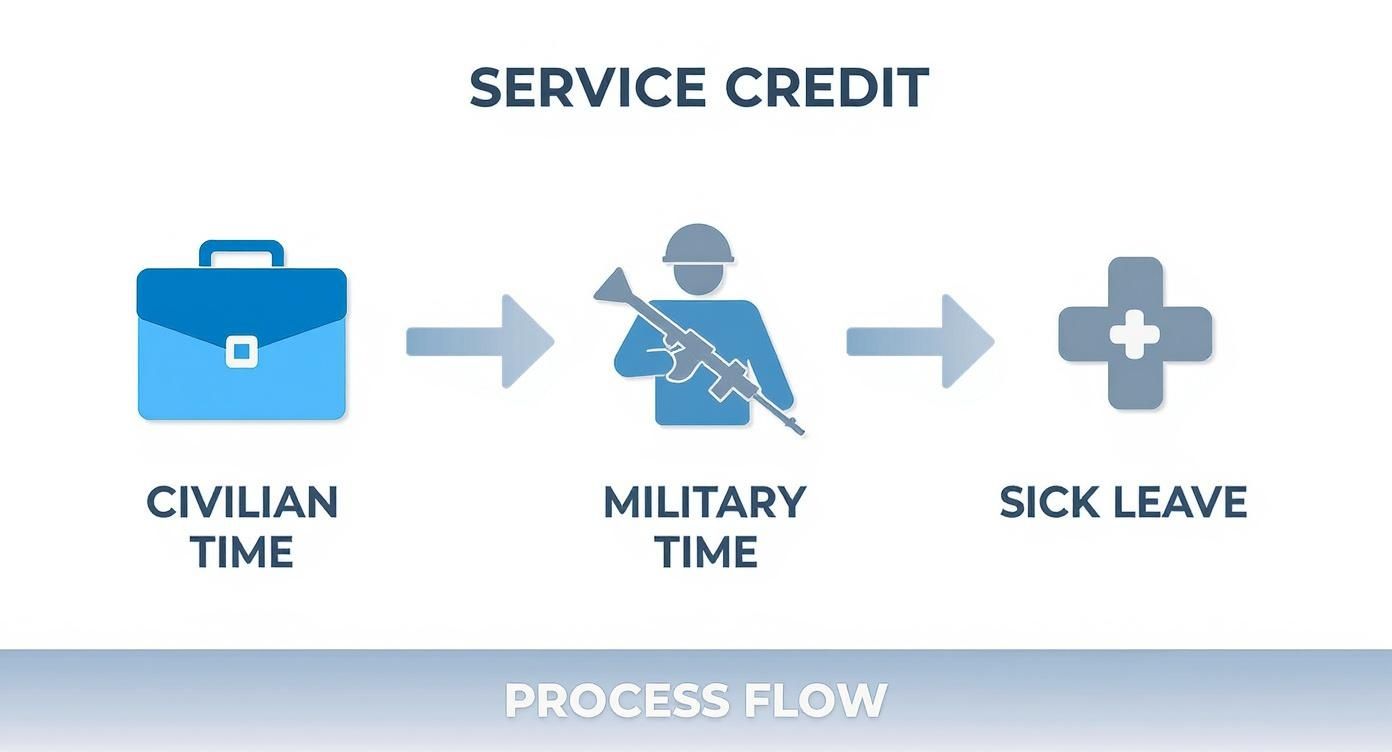

Once you've nailed down your High-3 salary, the next piece of the puzzle is your total creditable service. This isn't just the time you've spent at your desk in a federal job. It’s the total sum of all the time the government officially recognizes toward your pension, and every single month you can add to this number directly bumps up your final annuity payment.

Think of it this way: your regular federal civilian time is the foundation of your retirement. But you might have other valuable building blocks, like military service or unused sick leave, that you can stack on top. The trick is knowing what you have and how to make it count.

What Goes Into Your Service Time?

For most federal employees, the bulk of their creditable service comes from their time under FERS. This part is usually pretty straightforward—it starts when you're hired and ends when you separate. But you need to make sure the official record is right, especially if you've had breaks in service, worked part-time, or taken leave without pay.

Periods of part-time work, for example, are prorated. If you worked half-time for ten years, that time counts fully toward your eligibility to retire, but it will be calculated differently for your annuity amount compared to ten years of full-time work.

Don't Forget About Redeposits! If you left federal service at some point and cashed out your retirement contributions, that period of work doesn't count toward your pension—unless you pay it back. Making a "redeposit" essentially buys back that service time, making it a powerful tool for boosting your total.

Adding Military Time to the Mix

Did you serve in the military before joining the federal civilian workforce? That time can be a huge asset, but it won't automatically be added to your FERS calculation. To get credit, you have to make a military service deposit. You're essentially "buying" that service time so it can be used to calculate your civilian pension.

The process involves paying a deposit based on your military basic pay from that period, plus interest. That interest can really add up, so the sooner you do this in your federal career, the less it will cost you. If you skip making the deposit, your military years won't add a dime to your FERS pension.

First, you'll need to get your estimated military earnings from the appropriate military finance center.

Then, you'll submit Form RI 20-97, Estimated Earnings During Military Service, to your HR office to get the ball rolling.

Let's see this in action. Imagine you have four years of active duty. By making that military deposit, you add four full years to your creditable service. If your High-3 salary is $90,000, those four years add an extra $3,600 to your pension every single year (using the standard 1% multiplier). Over a 25-year retirement, that one decision could be worth $90,000.

The Untapped Goldmine: Unused Sick Leave

One of the most overlooked—and valuable—assets in your FERS calculation is your unused sick leave. When you retire, your entire sick leave balance gets converted directly into more creditable service. This is a game-changer that can add months, or even years, to your service total.

It’s not a simple hour-for-hour conversion. The Office of Personnel Management (OPM) uses a specific chart based on a 2,087-hour work year to turn your leave into years, months, and days of service. For instance, saving up 2,087 hours of sick leave adds exactly one full year to your service time.

Here's a quick look at how it works:

Unused Sick Leave HoursApproximate Service Credit174 hoursRoughly 1 month522 hoursRoughly 3 months1,044 hoursRoughly 6 months2,087 hoursExactly 1 year

The best part? This conversion happens automatically at retirement. You don't have to fill out any forms or make any special requests. All you have to do is not use the sick leave. This gives you a powerful incentive to save it, as every hour you bank is a direct investment in your future pension. At Federal Benefits Sherpa, we often show clients that simply being mindful of their sick leave is one of the easiest ways they can boost their FERS retirement without having to work a single extra day.

Putting the FERS Calculation into Practice

Knowing the formula is one thing, but seeing how the numbers actually play out is where it all clicks. The FERS retirement calculation isn't just some abstract equation; it’s a living, breathing tool that shows exactly how your career decisions directly impact your financial future.

Let’s walk through a few different scenarios. By looking at three distinct federal employee profiles, you can see how things like your retirement age, years of service, and even your timing can lead to very different outcomes for your annual pension.

Scenario One: The MRA Plus 30 Retiree

Meet David. He started his federal career young and is now ready to retire at his Minimum Retirement Age (MRA) of 57. After 30 years of dedicated service, his High-3 average salary has reached a solid $95,000.

Because David is retiring before he turns 62, his pension will be calculated with the standard 1% multiplier.

Here’s how his calculation breaks down:

High-3 Salary: $95,000

Creditable Service: 30 years

Multiplier: 1% (0.01)

The math is pretty straightforward: $95,000 x 30 x 0.01 = $28,500 per year.

This means David can expect an annual gross pension of $28,500, which works out to about $2,375 per month before any deductions. He’s eligible for this immediate, unreduced pension because he met the crucial MRA+30 requirement.

David's situation is a classic example of a full-career federal employee. By starting early and putting in three decades, he secured a reliable pension right at his earliest eligibility date, setting himself up for a smooth transition into retirement.

Scenario Two: Securing the 1.1% Multiplier

Now, let's look at Maria. She’s 62 years old with 25 years of creditable service, and her High-3 average salary is $105,000. Maria made the strategic choice to work until at least age 62 specifically to get that enhanced pension multiplier.

Since she meets both key criteria—age 62 or older with at least 20 years of service—her multiplier gets a 10% boost, jumping from 1% to 1.1%.

Let's run her numbers:

High-3 Salary: $105,000

Creditable Service: 25 years

Multiplier: 1.1% (0.011)

Her FERS calculation looks like this: $105,000 x 25 x 0.011 = $28,875 per year.

Maria’s annual gross pension is $28,875, or $2,406 a month. Had she retired just before her 62nd birthday, her annuity would have been based on the 1% multiplier, giving her only $26,250 per year. A little patience and planning earned her an extra $2,625 annually for the rest of her life.

As this graphic shows, your total creditable service is more than just the time you spent in your civilian role. It’s a combination of that time, any military service you’ve bought back, and all of that unused sick leave you’ve accumulated.

Scenario Three: The Early Retirement Option

Finally, there’s James. He’s 58 with a High-3 of $88,000 and 15 years of service. He wants to leave federal service now but doesn't qualify for an immediate, unreduced pension. While he could opt for a deferred retirement, he's considering the MRA+10 option for an immediate—though reduced—annuity.

His MRA is 57, so he meets the age requirement. The catch? Because he’s retiring under age 62 with fewer than 20 years of service, his pension will be permanently reduced. The reduction is 5% for every year he is under 62.

James is four years younger than 62 (62 - 58 = 4), so here’s how we figure out his final pension.

Calculate the Base Annuity: First, we calculate his pension without any reductions.

$88,000 (High-3) x 15 (Years) x 0.01 (Multiplier) = $13,200 per year

Apply the Age Reduction: Next, we figure out the penalty for retiring early.

4 years under 62 x 5% reduction per year = 20% total reduction

$13,200 x 0.20 = $2,640 reduction

Determine the Final Annuity: Finally, just subtract the reduction from his base amount.

$13,200 - $2,640 = $10,560 per year

James's immediate annual pension would be $10,560. He does have the option to avoid this penalty by postponing his annuity application until he turns 62, but he wouldn't receive any payments during those four years.

FERS Retirement Calculation Comparison

These scenarios clearly show how your age, service time, and strategic decisions can dramatically alter your retirement income. Let’s put them side-by-side to see the full picture.

Retirement ScenarioAge/ServiceMultiplierHigh-3 SalaryAnnual AnnuityDavid (MRA+30)57 / 30 years1.0%$95,000$28,500Maria (1.1% Boost)62 / 25 years1.1%$105,000$28,875James (Early Out)58 / 15 years1.0% (Reduced)$88,000$10,560

As you can see, there's no single "best" path—the right choice depends entirely on your personal financial situation and retirement goals. At Federal Benefits Sherpa, we help employees model these exact outcomes to make truly informed decisions about their future.

What Gets Taken Out of Your FERS Annuity?

You've done the math, crunched the numbers, and finally arrived at your gross annual annuity. It’s a great feeling, but hold on—that big number isn't what will actually hit your bank account. Before you start planning your retirement budget, you need to understand the deductions that will come out of your pension first.

Failing to account for these adjustments is a common mistake that can throw your financial plans off track. Your gross annuity is just the starting line; it’s the net annuity—the cash you have left after deductions—that really matters. Let’s walk through the most common items that will reduce your monthly payment so you have a realistic picture of your income in retirement.

The Price of a Survivor Benefit

One of the biggest decisions you'll make when you retire is whether to elect a survivor benefit for your spouse. This is your way of ensuring your spouse continues to receive an income if you pass away first. It’s a powerful safety net, but it comes with a price tag.

If you choose the full survivor annuity, which gives your spouse 50% of your basic pension, it will reduce your own annuity by 10%. There's also a smaller option: a 25% survivor benefit costs you a 5% reduction.

This isn't a temporary thing; the reduction lasts for as long as you draw your pension. For most couples, the peace of mind this provides is well worth it, but you have to factor that 10% cut into your budget from day one.

Think of the survivor benefit as an insurance policy for your spouse's future. That 10% reduction is the premium you pay for their long-term financial security, a trade-off that should be weighed against your family’s overall financial strategy.

Keeping Your Insurance in Retirement

Another significant chunk will likely go toward keeping your federal insurance plans. If you're eligible to carry your Federal Employees Health Benefits (FEHB) and Federal Employees' Group Life Insurance (FEGLI) into retirement, the premiums are taken directly out of your annuity payment.

It works pretty much the same way it did while you were working. The government continues to pay its share of the premiums, but the total cost will almost certainly change over the years.

FEHB Premiums: This is often the single largest deduction for retirees. Health insurance costs tend to go up every year, so you absolutely need to build that inflation into your long-term budget.

FEGLI Premiums: If you retire after age 65, the cost for Basic FEGLI is covered. However, the premiums for any optional coverage you keep can get very expensive as you age.

It's reassuring to know that the pension systems supporting these benefits are on solid ground. In fact, a recent analysis projects the national average funded ratio for U.S. pensions will climb from 78.1% in 2024 to 83.1% in 2025. This growing stability, which you can read more about in this report on the state of U.S. pensions, helps ensure the system can continue to meet its obligations to retirees like you.

Got FERS Questions? Let's Get Them Answered

As you start running the numbers on your FERS retirement, you'll find that the big picture is made up of a lot of small, crucial details. It's totally normal for specific questions to bubble up, and finding the right answers can have a huge impact on your final pension and overall financial plan.

Let’s walk through some of the most common questions I hear from federal employees when they get serious about planning their exit strategy. These aren't just minor details; they often represent major decision points that can influence when you retire and how comfortably you'll live.

The FERS Annuity Supplement: Who Actually Gets It?

You’ve probably heard of the FERS Annuity Supplement, sometimes called the Special Retirement Supplement. Think of it as a financial bridge. It's designed to fill the gap until you can claim your actual Social Security benefits at age 62, approximating the Social Security pension you earned during your years of FERS service.

But not everyone gets it. To qualify, you have to hit a few key milestones:

You need at least one full calendar year of FERS service under your belt.

Your retirement must be an immediate, unreduced annuity.

You have to retire at your Minimum Retirement Age (MRA) with 30 years of service, or at age 60 with at least 20 years of service.

One big thing to remember is that this supplement is subject to an earnings test, just like regular Social Security. If you hang up your federal hat and jump into a new job, earning over a certain amount can reduce or even completely wipe out your supplement for that year.

What Happens if I Leave Federal Service Before I Can Retire?

Life is unpredictable, and sometimes a career path changes before you reach retirement eligibility. If you find yourself in this boat, don't worry—you don't lose the benefits you've worked for, but your options will look a little different.

If you have at least five years of creditable civilian service, you can opt for a deferred retirement. This means you leave your contributions with FERS and file for your pension once you hit the required age, which is typically age 62. The calculation will be based on your High-3 salary and service time when you left. The trade-off, however, is you generally can't carry your FEHB or FEGLI coverage into retirement this way.

Here's the critical thing to understand about deferred retirement: your annuity is essentially frozen. It won't get any cost-of-living adjustments between when you leave service and when you start drawing it. Years of inflation can seriously erode its real value.

How Do I Get an Official FERS Retirement Estimate?

While back-of-the-napkin math is great for early planning, nothing beats an official estimate from your agency. Your agency’s HR office is your go-to source for this.

Most agencies now have online benefits portals where you can run your own retirement scenarios. These tools use your actual service history and salary data, so the projections are far more accurate than anything you could do on your own. I always advise clients to request a certified retirement estimate about one to two years before they plan to retire. This gives you plenty of time to make sure all your service is accounted for correctly and gives you a solid number to build your budget around. Your agency's HR is responsible for this, not the Office of Personnel Management (OPM).

What Are the Biggest Timing Mistakes to Avoid?

I see this all the time—retiring on the very last day of the month. It feels clean, right? But it can be a small but needless financial mistake.

Your FERS annuity always begins on the first day of the following month. If you retire on December 31st, your pension starts January 1st. But if you retire on December 30th, you still get paid for that final workday, and your pension still starts on January 1st. It’s a small win, but why leave money on the table?

A much more costly error is fumbling the 1.1% multiplier. If you have over 20 years of service but retire just one month shy of your 62nd birthday, you'll get the 1.0% multiplier for life. That tenth of a percent might seem tiny, but over a 20- or 30-year retirement, it can add up to tens of thousands of dollars lost. These little details in your FERS retirement calculation have massive consequences down the road.

Navigating these questions is what we do best. At Federal Benefits Sherpa, we help federal employees understand every facet of their benefits to create a clear and confident path to retirement. If you’re ready to move from questions to answers, let's start with a personalized review of your situation at https://www.federalbenefitssherpa.com.