Understanding the Key Changes to FERS Retirement

The biggest changes to FERS are hitting newer employees the hardest, requiring them to pay much higher contribution rates. At the same time, everyone under FERS now needs to lean more heavily on their Thrift Savings Plan (TSP) to build a secure retirement. These shifts place more of the financial burden directly on your shoulders, making smart, proactive TSP management absolutely critical.

The Evolving Landscape of Your FERS Benefits

Your Federal Employees Retirement System (FERS) benefits aren't static. Think of your retirement as a classic three-legged stool. For decades, this stool has stood on three sturdy legs: your FERS Basic Annuity (the pension), Social Security, and your personal savings in the Thrift Savings Plan (TSP). Together, they created a solid foundation for federal retirees.

But recent legislative tweaks have started to shorten the annuity and Social Security legs, shifting more of the weight onto that third leg—your TSP. My goal here is to walk you through these changes so you can see exactly how they affect your financial future.

Why Your Active Involvement Matters More Now

In this new FERS environment, your personal savings and investment choices are more important than ever. The old "set it and forget it" approach to retirement planning just doesn't cut it anymore. Today's federal employees have to be hands-on in building their own financial security. It's a bit like other complex federal systems, where understanding federal compliance regulations like FERPA is essential for those involved.

Here are the key changes you need to get a handle on:

Tiered Contribution Rates: If you were hired more recently, you're paying a significantly higher percentage of your salary toward your FERS pension than your more senior colleagues.

Modified COLAs: Cost-of-Living Adjustments for FERS retirees are often less generous than they used to be, which can slowly chip away at your buying power over a long retirement.

Enhanced TSP Features: The government has introduced new withdrawal options and investment funds, giving you more control but also demanding more careful planning on your part.

The bottom line is a major shift in responsibility. The government still provides a solid retirement framework, but the balance has tipped, making your TSP the real engine for a comfortable future.

Navigating the New FERS Reality

This doesn't mean your retirement is in jeopardy. It just means the game has changed. Instead of depending almost entirely on a guaranteed pension, you now have both the tools and the responsibility to build significant wealth through your TSP.

This guide will break down each of these changes piece by piece. We'll look at how the contribution tiers impact your paycheck, what the COLA modifications mean for your long-term plans, and how you can truly maximize the power of your TSP. By the time we're done, you'll have a solid grasp of the new rules and a clear action plan to master your FERS benefits for a financially secure retirement.

The Foundational Shift from CSRS to FERS

To really get a handle on the recent changes to FERS, we have to go back to the beginning. Before 1987, federal employees were under the Civil Service Retirement System (CSRS). It was a solid, generous pension plan, but it was also a massive financial weight on the government.

Think of CSRS as a single, powerful engine meant to carry a federal worker all the way through retirement. It was almost entirely funded by Uncle Sam, so employees didn't have to think much about it. But that old model just wasn't built to last. The government needed a system that was more flexible and shared the financial load between the employer and the employee.

The answer was the Federal Employees Retirement System (FERS). It wasn't just a tweak; it was a complete overhaul of how federal retirement was structured. FERS took that single CSRS engine and replaced it with a more modern, hybrid design. It blended three separate parts: a smaller government pension (the Basic Annuity), Social Security benefits, and the employee-controlled Thrift Savings Plan (TSP). This "three-legged stool" approach was a game-changer.

A New Philosophy of Shared Responsibility

At its heart, FERS was built on the idea of partnership. The government still provides a solid foundation with the pension and Social Security, but the real power to build a comfortable retirement now lies with you, the employee, through your TSP.

This completely changed the game for federal workers. Under the old CSRS system, your main job was just to show up and put in your time. But with FERS, you're in the driver's seat of your own financial future. The choices you make about how much to contribute to your TSP and how to invest it directly shape what your retirement will look like.

This wasn't just a policy update; it was a philosophical one. It shifted the entire model from a passive, government-guaranteed benefit to an active, shared-responsibility system where your personal savings are a huge part of the equation.

The Rapid Adoption of a New System

FERS wasn't just an option—it quickly became the new standard. The changes to FERS made it mandatory for all new federal hires, which led to a swift and dramatic shift across the entire federal workforce.

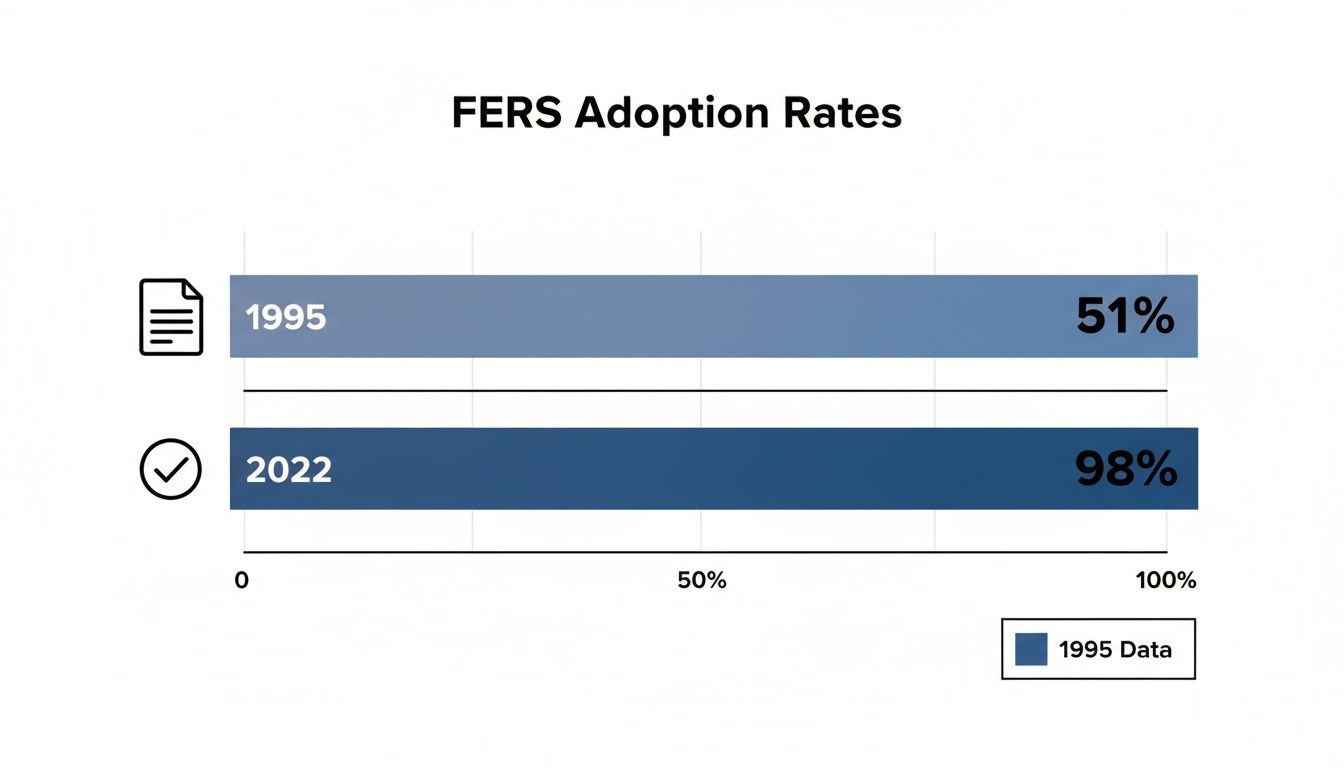

The growth was explosive. By fiscal year 1995, FERS had already hit a tipping point, with 51% of civilian federal employees enrolled. That momentum just kept growing. Fast forward to fiscal year 2022, and a staggering 98.4% of federal workers were covered by FERS as the last of the CSRS employees began to retire.

Why This History Matters for You Today

Understanding where FERS came from is key because it gives context to every change we see today. Things like higher contribution rates for newer employees or the ongoing focus on TSP options are all built on that original philosophy of shared responsibility. The system was designed from day one with the expectation that you would be an engaged saver and investor.

This history also helps make sense of your own FERS retirement eligibility simplified and the rules that govern your benefits. The move from CSRS explains why your TSP isn't just a nice little bonus—it’s the absolute cornerstone of your financial plan. It’s the part you control, and it's where you have the greatest potential to grow your wealth and secure the retirement you've been working toward.

What Newer Employees Must Know About FERS Contributions

If you started your federal career sometime in the last decade or so, one of the biggest changes to FERS hits you directly in your bi-weekly paycheck. The old system, where everyone paid the same flat rate toward their pension, is long gone. Now, we have a tiered system where your start date dictates exactly how much you chip in.

This isn't just some minor accounting shift; it tangibly affects your take-home pay and how you need to approach your long-term financial strategy. Congress essentially passed legislation requiring newer employees to contribute more to keep the FERS system funded, which created distinct groups of employees based on when they first came on board.

The Three Tiers of FERS Contributions

The easiest way to think about it is that there are now three main "FERS categories," each with its own contribution rate. It's like paying a toll on the highway to retirement—everyone's going to the same place, but folks who got on the road more recently are paying a higher price for the journey.

FERS: The original group. If you were hired before 2013, you contribute 0.8% of your basic pay.

FERS-RAE (Revised Annuity Employee): Hired in 2013? Your contribution jumps to 3.1% of your basic pay.

FERS-FRAE (Further Revised Annuity Employee): If you were hired in 2014 or any time after, you’re in this group, contributing 4.4% of your basic pay.

The chart below shows just how widespread the FERS system has become, which helps explain why these funding adjustments were seen as necessary.

As you can see, the federal workforce is now almost entirely under the FERS umbrella, making system-wide changes like this impact nearly everyone hired today.

Crucial Takeaway: Here’s the key thing to remember: the formula used to calculate your actual FERS pension at retirement is exactly the same no matter which tier you're in. These changes only affect how much comes out of your pocket during your working years to fund that future benefit.

To make this crystal clear, here’s a table breaking down the different contribution rates.

Comparison of FERS Employee Contribution Rates by Hire Date

FERS CategoryHire Date WindowEmployee Contribution Rate (% of Basic Pay)FERSBefore January 1, 20130.8%FERS-RAEBetween January 1, 2013, and December 31, 20133.1%FERS-FRAEOn or after January 1, 20144.4%

This table neatly lays out the significant difference in the personal investment required from employees based solely on their start date.

A Tale of Two Paychecks

Let's put this into real-world numbers. Take two federal employees, both earning a salary of $80,000 a year. One started in 2010 (FERS), and the other started in 2020 (FERS-FRAE).

The 2010 Hire (FERS): Their annual contribution is $640 (0.8% of $80,000).

The 2020 Hire (FERS-FRAE): Their annual contribution is $3,520 (4.4% of $80,000).

That’s a difference of $2,880 a year in take-home pay. It's the same job, same salary, but a much different financial reality because of when they were hired. Over a 30-year career, that newer employee is making a substantially larger personal investment toward the same calculated pension.

What This Means for Your Financial Planning

Knowing you’re paying more right out of the gate has a direct impact on your budget. A higher mandatory deduction means you have less cash on hand, which makes being strategic about your other savings—especially your Thrift Savings Plan (TSP)—absolutely critical.

This reality check underscores the need to maximize every single dollar you can. First and foremost, you have to contribute at least 5% of your salary to your TSP to get the full government match. That matching money is the single most powerful tool you have to build wealth and offset the higher cost of your FERS pension. Your own savings are no longer just a nice-to-have; they are a core pillar of your financial future.

How COLAs Impact Your Long-Term Purchasing Power

Think of Cost-of-Living Adjustments, or COLAs, as your retirement plan's built-in defense against inflation. Their job is to make sure your FERS annuity grows over time, so your buying power doesn’t get eaten away year after year. But here’s a critical change that separates the modern FERS from the older Civil Service Retirement System (CSRS): the FERS COLA is often a lot less generous.

This isn't just a tiny detail in the fine print. It's a fundamental shift that can seriously compound over a 20 or 30-year retirement. For most FERS retirees, this results in a "COLA-lite," where your annuity increase just doesn't quite keep up with the real cost of living.

The Tiered FERS COLA Formula

To understand why FERS often lags, you have to look at how the COLA is calculated. The system uses a tiered approach based on the annual increase in the Consumer Price Index (CPI-W), which is the government's official inflation yardstick.

Here’s the breakdown:

If inflation (CPI-W) is 2% or less: You get the full amount. Your COLA matches the inflation rate.

If inflation is between 2% and 3%: Your COLA is stuck at a flat 2%.

If inflation is over 3%: Your COLA is the inflation rate minus 1%.

This tiered system essentially creates a built-in brake. Whenever inflation really heats up, your FERS COLA is guaranteed to be less than the actual increase in your expenses. That’s a huge departure from the more direct formula CSRS retirees enjoy. If you want to get into the nitty-gritty, you can explore our complete guide to cost-of-living adjustments.

This was a deliberate policy choice, aimed at balancing inflation protection with the government's long-term budget. Let’s say the CPI-W rises by 2.8% between the third quarters of 2024 and 2025. In January 2026, CSRS retirees would get a full 2.8% raise. But because of that middle-tier cap, FERS retirees would only see a 2.0% adjustment. For more on the history behind these rules, you can find a ton of insights on federal retirement COLA policies and rates on FedWeek.

This "COLA-lite" is one of the most significant changes under FERS. It reinforces a central idea: your FERS annuity is the foundation, but your TSP is the primary tool you need to beat inflation and protect your lifestyle.

A Real-World Scenario

Let’s put this into perspective. Imagine a year where inflation spikes to 4.5%. A CSRS retiree would see their annuity go up by the full 4.5%. A FERS retiree? Their annuity would only increase by 3.5% (that's 4.5% minus 1%).

A 1% difference might not sound like much in a single year, but over decades, the compounding effect is enormous. That small gap in purchasing power gets wider and wider over time, leaving FERS retirees with less real-world money to cover rising costs for everything from healthcare to groceries.

This reality is exactly why building a substantial Thrift Savings Plan (TSP) balance is non-negotiable. Your TSP is your personal inflation buffer. It’s the part of your retirement you control, and its growth is what will supplement your annuity and make sure you don't fall behind financially. The FERS COLA rules make a healthy TSP not just a nice-to-have, but an absolute necessity.

Why Your Thrift Savings Plan Is More Important Than Ever

With some of the foundational changes to FERS—like higher employee contributions and less generous cost-of-living adjustments—your Thrift Savings Plan (TSP) has gone from a nice-to-have to an absolute necessity. It's no longer just a supplemental savings account. Today, it’s the cornerstone of your retirement security.

Think of it this way: your FERS annuity is the sturdy foundation of your retirement house, but your TSP is the engine that will actually power you through a comfortable future. It’s what you build.

This shift in importance means you have to be more hands-on. A much bigger piece of your retirement nest egg now rests squarely on your shoulders. The good news? Recent upgrades to the TSP give you more control and flexibility than ever before, putting you in the driver's seat.

The Power of the 5 Percent Match

If you do nothing else, do this: capture the full government match. It’s free money.

The government offers a dollar-for-dollar match on the first 3% of your basic pay that you put in. Then, they’ll kick in an extra 50 cents on the dollar for the next 2% you contribute. To get the whole bonus, you need to contribute at least 5% of your salary to receive the full 5% government match.

Not contributing at least 5% is like literally turning down a 100% return on your investment from day one. It's easily the single best financial deal you’ll get as a federal employee. This match is your secret weapon for building wealth fast.

More Control With the TSP Modernization Act

For years, getting money out of your TSP was a rigid, one-and-done affair. The TSP Modernization Act of 2017 blew up those old rules, giving you much more freedom over how and when you access your funds in retirement. It was a huge improvement that brought the TSP in line with what you’d find in a private-sector 401(k).

Here’s what that means for you:

Multiple Withdrawals: You’re no longer limited to just one partial withdrawal after you separate from service. You can take several as needed.

Flexible Timing: You can now change the amount and frequency of your installment payments to match your life's circumstances.

Age-Based Options: You can keep taking withdrawals even after you start taking required minimum distributions (RMDs), which currently kick in at age 73.

These updates make the TSP a far more flexible tool for managing your retirement income stream, letting you adapt your withdrawals to whatever life throws at you.

The TSP is not an afterthought; it is your most powerful financial tool. Recent changes to FERS have elevated its importance from a secondary benefit to the primary driver of your long-term financial independence.

Expanding Your Investment Horizons

Another game-changer has been the introduction of the mutual fund window. This feature lets you invest up to 25% of your total account balance into a massive selection of private-sector mutual funds, provided you have at least $40,000 in your TSP.

While the core C, S, I, F, and G funds are fantastic, low-cost options that work for most people, the mutual fund window opens up a world of possibilities. It’s perfect for those looking for more diversification or to implement specific investment strategies. This gives savvy investors more tools to build a truly customized portfolio. To learn more about navigating these choices, you can read our guide on how to use TSP for smart federal savings.

Actionable Strategies for Your TSP

Knowing all this is one thing, but taking action is what actually builds wealth. You need a simple, consistent plan for managing your TSP account.

Here are three non-negotiable actions to take right now:

Secure the Full Match: First and foremost, check your payroll deductions today and make sure you are contributing at least 5% of your salary. Don't leave free money on the table.

Choose Your Contribution Type: You have to decide between Traditional (pre-tax) and Roth (after-tax) contributions. A Traditional TSP lowers your taxable income today, but a Roth TSP gives you tax-free income in retirement. Each has its pros and cons.

Rebalance Periodically: At least once a year, take a look at your investments. If the market has caused your mix of C, S, and I funds to drift away from your original plan, rebalance your account to get back to your target risk level.

Taking these steps will help ensure your TSP grows into the financial engine you need it to be, giving you the cushion required to offset other FERS changes and secure the retirement you've worked so hard for.

Your Action Plan for Mastering the FERS System

Knowing the rules of the FERS system is one thing, but actually putting that knowledge to work is what really matters. Now it's time to build a practical roadmap for your career, whether you’re a brand-new hire or are already counting down the days to retirement.

This isn’t about becoming a Wall Street wizard overnight. It’s about taking smart, simple, and consistent steps throughout your federal service. Let's break it down by career stage.

For New Federal Employees (First 5 Years)

Welcome to federal service! The habits you build right now will have a massive impact down the road thanks to the power of compounding. Your main job is to get the fundamentals right from day one.

Grab Your Full TSP Match: This is non-negotiable. Contribute at least 5% of your salary to your Thrift Savings Plan (TSP). If you don't, you're literally turning down free money from the government—it’s the best return you'll ever see, guaranteed.

Pick Your Flavor: Roth or Traditional TSP? You have a choice to make. Do you want to pay taxes on your contributions now (Roth) and get tax-free withdrawals in retirement, or get a tax break now (Traditional) and pay taxes later? Think about your long-term goals and what makes sense for your financial picture.

Put Your Money to Work: Don't let your TSP contributions just sit in the default G Fund. That’s a common rookie mistake. A great starting point is a Lifecycle (L) Fund, which automatically adjusts its risk based on your target retirement date. Or, if you're comfortable, you can build your own mix of the C, S, and I funds.

For Mid-Career Employees (5-20 Years of Service)

You've got a solid foundation. Now is the time to check in, make adjustments, and really start accelerating your progress toward the finish line.

Do a Quick "Retirement Check-Up": Pull up your FERS annuity estimate, your latest Social Security statement, and your current TSP balance. Ask yourself a simple question: Will this be enough to live the life I want in retirement? If you see a gap, the simplest fix is to bump up your TSP contribution rate.

Revisit Your Risk Tolerance: Life happens. Your feelings about risk might have changed since you first started. It’s a good idea to rebalance your TSP at least once a year to make sure your investments still line up with your long-term plan.

Check Your Beneficiaries: Have you gotten married? Divorced? Had kids? Major life events mean you absolutely need to update your beneficiary forms for your FERS pension, TSP, and any federal life insurance (FEGLI). Don't leave this to chance.

Planning for retirement isn’t something you do once and forget about. It's an ongoing conversation with yourself. The federal workforce is always changing, and you need to be proactive to stay ahead of the curve.

For Employees Approaching Retirement (Final 5 Years)

The finish line is in sight! Your focus naturally shifts from growing your nest egg to figuring out how to protect it and turn it into a reliable income stream.

The decisions you make in these last few years are critical. It's no surprise that the average retirement age is creeping up. For FERS employees, it was 62.3 in fiscal year 2022, a notable increase from 57.6 back in 1998. Today, FERS retirees make up a whopping 83.7% of all new federal annuitants. You can dig into more of these trends in the retirement statistics from the Office of Personnel Management.

Here’s your final checklist to get you across the finish line smoothly:

Lock In Your High-3: Remember, your pension is calculated using your highest 36 consecutive months of pay. Be strategic in your last few years to maximize that number.

Plan Your TSP Exit Strategy: The TSP Modernization Act gave you a ton of flexibility. You need to decide how you'll take money out—installments, lump sums, or a mix. This plan will define your cash flow in retirement.

Coordinate All Your Benefits: Now is the time to sign up for a pre-retirement seminar. You'll learn exactly how your FEHB health insurance carries over and, just as importantly, how your FERS pension and Social Security benefits will work together.

Your Top Questions About FERS Changes, Answered

Let's face it, digging into the details of federal retirement can feel like untangling a knot, especially when rules have shifted over time. Here are some straightforward answers to the questions I hear most often from federal employees about their FERS benefits.

If I Was Hired After 2013, Is My FERS Annuity Smaller?

This is a huge point of confusion, and the short answer is no. Your actual pension check won't be smaller, but the journey to get there costs you more out of pocket.

While it’s true that your take-home pay is lower because you're contributing a much higher percentage of your salary, the formula used to calculate your basic FERS pension at retirement is exactly the same as it is for someone hired before 2013. The math is still 1% of your high-3 average salary for each year you worked (or 1.1% if you retire at age 62 or older with at least 20 years of service).

The real difference for FERS-RAE and FERS-FRAE employees is that you're making a bigger upfront investment in your own future pension. It doesn't shrink the benefit you've earned at the finish line.

The pension formula is consistent for all FERS employees. The major difference is the cost of participation during your career, not the size of the benefit at the end.

Can I Switch From FERS Back to CSRS?

Unfortunately, that ship has sailed. It’s not possible to switch from FERS back to the old Civil Service Retirement System (CSRS). Think of it as a one-way street; once you're on the FERS path, you can't turn back.

CSRS officially closed its doors to new employees at the end of 1983. There were a few very specific, rare instances where a long-time employee under CSRS had a break in service and got a one-time choice to elect FERS when they returned. But once that decision is made, it's final. Today, the federal workforce is almost entirely covered by the FERS framework.

How Do I Protect My Retirement Income From Inflation?

This is one of the most important questions you can ask. We all know that FERS Cost-of-Living Adjustments (COLAs) don't always keep up with the real cost of living, which can eat away at your pension's buying power over time. Your best defense against this is building a powerful Thrift Savings Plan (TSP) balance.

Your TSP account is your personal inflation-fighting tool. It gives you a second, more flexible stream of income that you control. To make it work for you, you need to be proactive.

Invest for Growth: Don't be afraid to put your money to work in funds with real growth potential, like the C, S, and I funds. The goal is to earn returns that beat inflation over the long run.

Contribute Consistently: At the absolute minimum, contribute enough to get the full 5% government match—that's free money you can't afford to leave on the table.

Stay Engaged: Your TSP isn't a "set it and forget it" account. Active management and consistent contributions are absolutely essential for protecting your purchasing power throughout a long retirement.

Ready to take control of your retirement plan? Federal Benefits Sherpa offers personalized gap analysis and benefit reviews to make sure you're on the right track. Secure your financial future by booking your free 15-minute consultation at https://www.federalbenefitssherpa.com today.