HCFSA vs HSA Which Is the Right Choice for Federal Employees

At its core, the difference between an HCFSA and an HSA comes down to a simple question: are you planning for this year's medical bills, or are you saving for healthcare costs for the rest of your life? Think of a Health Care Flexible Spending Account (HCFSA) as a short-term, use-it-or-lose-it tool designed for predictable expenses. In sharp contrast, a Health Savings Account (HSA) is a portable, long-term savings and investment tool that you own outright, but it requires you to be enrolled in a High Deductible Health Plan (HDHP).

Your choice really hinges on whether you're looking for immediate tax savings on costs you know are coming or if you're building a flexible healthcare fund for the long haul.

A Quick Guide to HCFSA vs HSA

Picking the right account means understanding how they fit into the bigger picture of your federal benefits. For federal employees, this decision is directly tied to your choice of a Federal Employees Health Benefits (FEHB) plan, since only certain plans unlock the ability to open an HSA.

An HCFSA is an account your employer sets up for you, allowing you to stash away pre-tax money for out-of-pocket medical expenses you expect to have during the year. It's a fantastic way to reduce your taxable income while paying for things like prescription co-pays, dental procedures, or new glasses. The catch? That notorious "use-it-or-lose-it" rule looms at the end of the year.

An HSA, on the other hand, is a personal savings account that is yours to keep and control. The money rolls over year after year, can be invested to grow tax-free, and stays with you even if you switch jobs or retire. You can dig deeper into our detailed explanation of Federal Employee Health Benefits to see how these accounts can be part of a smart benefits strategy.

HCFSA vs HSA At a Glance Key Differences

To make things even clearer, let's break down the fundamental differences between a Health Care FSA and a Health Savings Account side-by-side. This table gives you a quick snapshot of what sets them apart.

FeatureHealth Care FSA (HCFSA)Health Savings Account (HSA)EligibilityAvailable to most federal employees.Must be enrolled in an HSA-qualified High Deductible Health Plan (HDHP).Fund OwnershipOwned by the employer.Owned by the employee.Rollover RulesLimited carryover or grace period; "use-it-or-lose-it" applies.Funds roll over indefinitely each year.PortabilityFunds are forfeited upon leaving federal service.Fully portable; you keep the account for life.Investment OptionNo investment option available.Funds can be invested for tax-free growth.

As you can see, the differences in ownership, portability, and growth potential are significant. One is a yearly spending tool, while the other is a lifelong financial asset.

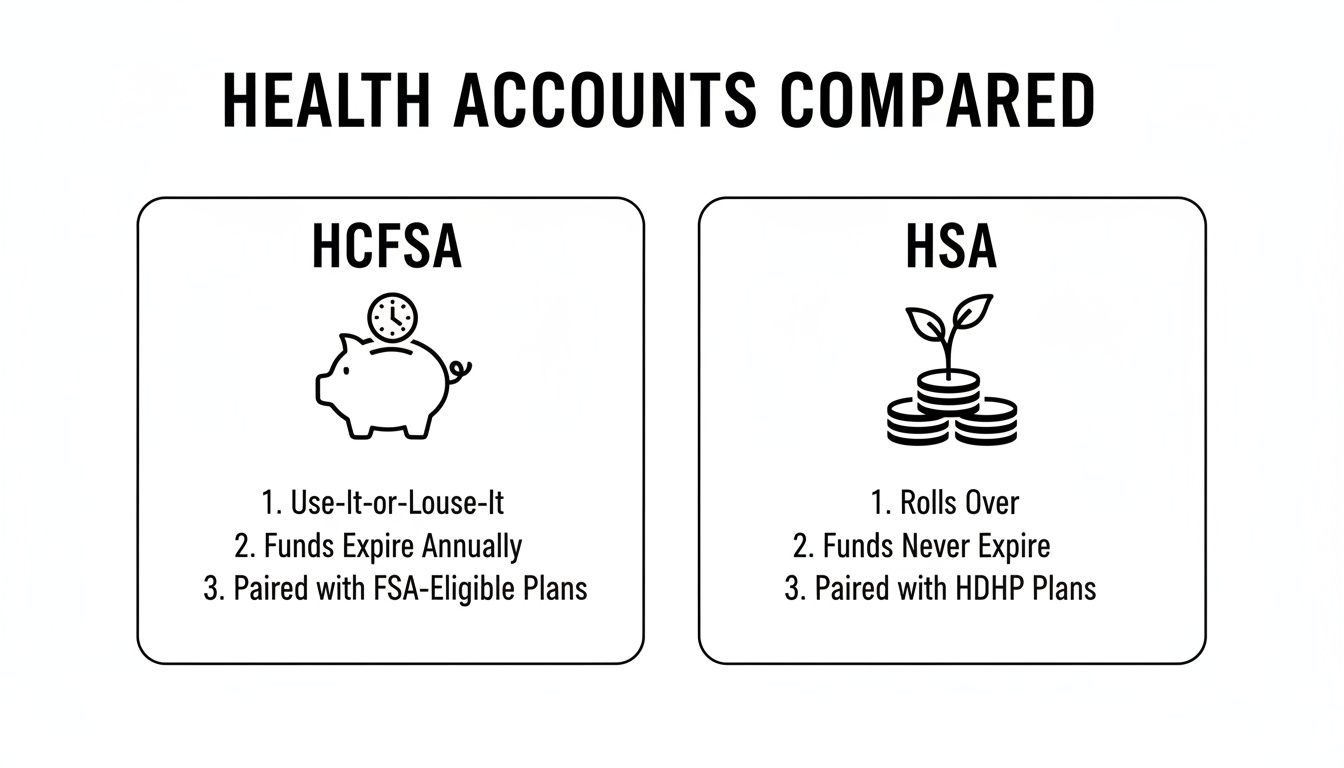

The infographic below really drives home this core distinction: an HCFSA is built for short-term savings, whereas an HSA is structured for long-term growth.

This visual contrast highlights the strategic decision you have to make. The most important differences boil down to how long your money lasts and who truly owns it over time. While FSAs are famously limited by the “use‑it‑or‑lose‑it” rule, HSAs function more like a 401(k) for healthcare, where your balance rolls over and grows with you indefinitely.

Can You Get an HSA, an HCFSA, or Both? Eligibility and Contribution Rules

When you're weighing an HCFSA against an HSA, the first question isn't which one is better—it's which one you can actually get. For federal employees, this all comes down to the health plan you pick during Open Season. That single choice is the gatekeeper.

The Health Care Flexible Spending Account (HCFSA) is pretty easy to access. If you're eligible for the Federal Employees Health Benefits (FEHB) program, you can almost certainly open an HCFSA. It doesn't matter what kind of plan you have, which makes it a go-to option for many feds.

The Health Savings Account (HSA), on the other hand, is a different story. It has a very strict, non-negotiable rule.

You must be enrolled in a High-Deductible Health Plan (HDHP) to open and contribute to an HSA. Not just any HDHP will do; it has to be an HSA-qualified plan offered through the FEHB program.

This is the most important distinction right out of the gate. If you're not in a qualifying HDHP, an HSA isn't even on the table for you. Your only choice for a tax-advantaged health account is the HCFSA. If you're curious, you can learn more about if an HDHP is the right move for you at https://federalbenefitssherpa.com/post/what-is-a-high-deductible-health-plan-and-is-it-right-for-you.

How Much Can You Contribute?

Once you know which account you’re eligible for, the next piece of the puzzle is figuring out how much money you can put into it. The IRS sets these limits, and they change annually.

The contribution rules are a key differentiator. With an HCFSA, there's one single contribution limit for every employee, no matter if you have a self-only or family health plan. HSAs work differently, offering higher limits for those with family coverage.

HCFSA: One contribution limit applies to everyone.

HSA: You can contribute more if you have family HDHP coverage versus self-only.

There’s another twist. HSAs have a great feature for those nearing retirement: if you’re 55 or older, you can make an extra "catch-up" contribution each year. This gives you a nice opportunity to pad your healthcare savings. HCFSAs don't offer a similar age-based perk. For a closer look at these core differences, you can check out this detailed comparison of HSA and FSA accounts.

The One-Account-a-Year Rule

Here’s a critical rule of thumb for federal employees: You generally can't contribute to both a standard HCFSA and an HSA in the same year. While there are some exceptions for specialized limited-purpose FSAs (which only cover dental and vision), you can't have a general-purpose HCFSA and an HSA at the same time. The government sees this as "double-dipping" on tax benefits for the same medical costs.

These accounts are becoming a massive part of financial planning across the country. The Consumer Financial Protection Bureau reported that in 2023, there were roughly 36 million HSAs holding over $116 billion in assets. As a federal employee, you have access to these powerful tools, but choosing the right one is what really counts.

Comparing the Tax Advantages of Each Account

When you’re weighing an HCFSA against an HSA, the tax benefits are a huge part of the conversation. This is where the two accounts really start to show their differences. While both give you an immediate tax break, the HSA is a much more powerful tool for building wealth over the long haul, thanks to what’s famously called the "triple tax advantage."

Both accounts let you put money in before taxes are taken out, which lowers your taxable income for the year. For every dollar you contribute, you sidestep federal, state, and FICA taxes. For an HCFSA, this upfront benefit is pretty much the whole tax story.

The problem is, the tax savings for an HCFSA stop right there. It’s a spending account, not a savings one, so your funds don't have a way to grow. An HSA, on the other hand, is just getting warmed up.

The Unmatched Power of the HSA Triple Tax Advantage

The HSA is truly in a league of its own as one of the most tax-efficient savings vehicles you can find—I'm talking even more so than a traditional 401(k) or your Thrift Savings Plan (TSP) when it comes to healthcare. Its power comes from three distinct layers that work together to create incredible compounding over time.

Tax-Deductible Contributions: Just like an HCFSA, every dollar you put into an HSA is pre-tax. This immediately shaves down your taxable income and cuts your annual tax bill.

Tax-Free Growth: Here’s where the HSA pulls way ahead. You can actually invest the money in your HSA, putting it into mutual funds, stocks, and other assets. All the earnings and growth from those investments are completely tax-free.

Tax-Free Withdrawals: As long as you pull the money out for qualified medical expenses, those withdrawals are also 100% tax-free. This completes the trifecta, making it possible for your money to never be taxed at any point if you use it for healthcare.

The HSA is unique because it lets you put money in tax-free, let it grow tax-free, and take it out tax-free for medical costs. No other retirement or savings account offers this powerful combination.

This structure completely changes the game, turning the HSA from a simple spending account into a strategic retirement savings vehicle for your future healthcare needs.

A Practical Example of Tax Savings

Let’s run the numbers to see how this plays out in the real world. Imagine a federal employee in the 22% federal tax bracket who decides to contribute $4,000 to their health account for the year.

With an HCFSA: That employee gets an immediate savings of $880 in federal income tax (22% of $4,000), plus they save on FICA taxes. But they have to spend that $4,000 by the end of the year. The tax benefit is a one-and-done deal for that year's contribution.

With an HSA: The employee gets the same immediate $880 tax savings. The big difference? They can invest that $4,000. If we assume a modest 6% annual return, that balance could grow to over $7,100 in 10 years or nearly $12,800 in 20 years—all without paying a dime in taxes on that growth.

Over a full career, that tax-free compounding potential is massive. The money grows on its own, building a dedicated healthcare nest egg that works right alongside your TSP. While an HCFSA is a great tool for getting an annual tax deduction on predictable costs, the HSA’s triple tax advantage offers a real path to building substantial, tax-free wealth specifically for medical expenses in retirement. This makes the HSA a true cornerstone of long-term financial planning for any eligible federal employee.

How to Use and Manage Your Health Funds

So you've picked between an HCFSA and an HSA and the contributions are flowing. Now what? The next step is getting a handle on how to actually use and manage your money.

At first glance, both accounts look pretty similar. They both cover a huge list of qualified medical expenses—doctor's visits, prescriptions, dental work, vision care, you name it. For the most part, the list of eligible items is the same for both.

But the real story, and the core of the HCFSA vs. HSA debate, lies in the mechanics. How you get your hands on the money, what happens to it at the end of the year, and who truly owns it are the game-changers. One account puts you on a strict annual clock, while the other gives you a lifetime of flexibility.

Navigating the HCFSA Rules

A Health Care Flexible Spending Account runs on a simple, and sometimes stressful, principle: you have one year to spend the money you’ve put in. This is the infamous "use-it-or-lose-it" rule, and it's the single most important thing to know about managing an HCFSA. If you don't use the funds by the end of your plan year, they could be gone for good.

To take some of the pressure off, the federal HCFSA program has a carryover provision. It lets you roll over a small amount of unused money into the next year—the exact figure is set by the IRS and can change. Think of it as a small safety net, not a savings plan.

The whole point of an HCFSA is to get you to plan ahead for predictable healthcare costs within a 12-month period. It's built for expenses you know are coming, not for building a long-term nest egg.

Using your HCFSA usually means paying out-of-pocket and submitting receipts for reimbursement, or swiping a special debit card for qualified purchases. And because the account is tied to your job, your access to the funds stops the day you leave federal service.

The Freedom and Flexibility of an HSA

Managing a Health Savings Account is a totally different ballgame. The single most powerful feature of an HSA is that your money never expires. There is no "use-it-or-lose-it" deadline breathing down your neck. Your entire balance rolls over, year after year, transforming the account from a simple spending tool into a serious savings vehicle.

This one difference completely changes how people approach these accounts. Data on spending habits reveals that around 67% of FSA funds are spent on predictable costs like dental and vision care, showing a clear focus on short-term needs. In contrast, 62% of HSA dollars are used for medical services and procedures, which points to a mix of paying for current needs while saving for the future. You can discover more insights on these spending patterns and how an HSA can support a long-term strategy.

The flexibility of an HSA goes even further:

It's Yours to Keep: Your HSA is your personal bank account. If you change jobs, leave federal service, or retire, the account and every penny in it go with you. It’s not tied to your employer.

Tax-Free Growth: You can invest your HSA funds in stocks, bonds, and mutual funds, just like you would with your TSP. This allows your healthcare savings to grow completely tax-free.

Retirement Bonus: Once you hit age 65, you can pull money from your HSA for any reason at all without a penalty. If you use it for something other than medical care, you’ll just pay regular income tax on it, much like a traditional 401(k) or IRA.

Many feds who sign up for a qualifying HDHP, like the one from GEHA, make their HSA a central part of their financial plan. You can check out our guide to the GEHA Health Savings Account for a deeper dive into how that specific plan works. When it comes down to it, managing an HSA is about striking a balance between paying for today’s medical bills and building a tax-free health fund for the rest of your life.

Real-World Scenarios to Guide Your Decision

Sometimes, the best way to understand the HCFSA vs. HSA choice is to move past the feature lists and see how these accounts play out in real life. Your health, your family's needs, and where you are in your financial journey will ultimately point you to the right account. Let's look at a couple of common scenarios to see how this works in practice.

We'll walk through two different federal employee profiles. This isn't just about saving a few bucks on taxes; it's about making your benefits work for your life. When you're facing these kinds of financial forks in the road, it helps to have a solid framework for how to make better decisions.

Meet "The Planner" with Predictable Expenses

First up, let's consider a federal employee we'll call "The Planner." She’s got two kids, and she knows for a fact that her oldest needs braces this year—a big, predictable expense. On top of that, her family has routine prescription copays and yearly eye exams. She's happy with her traditional, low-deductible FEHB plan and has no desire to switch.

For The Planner, an HCFSA is a no-brainer. Here’s the thinking:

Immediate Tax Savings: She can sit down, add up the expected out-of-pocket costs for the year (orthodontia, meds, glasses), and contribute that amount to her HCFSA pre-tax. This instantly reduces her taxable income without forcing her to change a thing about her health plan.

No HDHP Required: This is key. She likes her current FEHB plan and doesn't want the risk of a high deductible. The HCFSA lets her keep that plan while still getting a nice tax break.

Low Risk of Forfeiture: The "use-it-or-lose-it" rule isn't scary for her because her expenses are known quantities. She is completely confident she'll spend every dollar in that account before the deadline.

In her situation, the HCFSA fits perfectly into her short-term financial plan. It’s a straightforward way to save money on expenses she already sees coming.

Meet "The Long-Term Saver" Focused on Retirement

Now, let's shift gears to "The Long-Term Saver." He's a younger fed, healthy, with no chronic conditions, and his doctor visits are pretty much limited to an annual physical. He's comfortable taking on a higher deductible if it means lower monthly premiums, and his main focus is building wealth for retirement, right alongside his Thrift Savings Plan (TSP).

For The Long-Term Saver, an HSA is the clear winner. His strategy is all about the future:

Building a Healthcare Nest Egg: He doesn't just see the HSA as a way to pay for a random doctor's visit. For him, it's a powerful investment account. He puts in the maximum allowed each year, pays for small medical costs out-of-pocket to preserve his balance, and invests the HSA funds for long-term, tax-free growth.

Comfort with an HDHP: He’s willing to enroll in an HSA-qualified High Deductible Health Plan. The money he saves on lower premiums helps fund his HSA contributions, and he has enough in savings to cover the deductible if a real medical need pops up.

Ultimate Flexibility: The fact that the HSA is his money, forever, is a huge plus. The balance rolls over year after year, he can take it with him if he leaves federal service, and it can even pull double-duty as a retirement account after age 65.

The core decision in the HCFSA vs. HSA comparison comes down to your primary goal. Are you looking for a tool to reduce taxes on this year's known expenses (HCFSA), or are you building a tax-free financial asset for a lifetime of healthcare costs (HSA)?

These two stories show that neither account is universally "better." The Planner uses her HCFSA as a tactical tool for immediate, yearly savings. The Long-Term Saver, on the other hand, is using his HSA as a strategic asset for decades of financial growth. The right choice for you depends entirely on which of these people sounds more like you.

A Practical Checklist for Making Your Choice

Alright, we've covered a lot of ground comparing the HCFSA and HSA. Now it's time to bring it all together and figure out which one makes sense for you. Instead of getting bogged down in the details, let's walk through a simple checklist.

Think of this as a decision-making guide. Answering these questions honestly will point you in the right direction, helping you match the right account to your real-life needs and future goals. This isn’t just about picking a health account; it’s about making a smart financial move.

Step 1: Start with Your Health and Finances Today

Your current situation is always the best place to start. Let's get a clear picture of your immediate healthcare needs and financial comfort zone.

Are you enrolled in an HSA-eligible High-Deductible Health Plan (HDHP)? This is the make-or-break question. If the answer is no and you’re not planning to switch during Open Season, the HCFSA is your only choice. It's that simple.

Can you map out your family's medical expenses for next year? If you have predictable costs on the horizon—think braces for the kids, a planned surgery, or regular prescription refills—the HCFSA is a fantastic way to budget for those specific expenses and get an immediate tax break.

How do you feel about a higher deductible? To open an HSA, you have to be in an HDHP. Are you financially prepared to cover a larger out-of-pocket expense if a medical emergency pops up? You'll need a solid emergency fund to feel secure.

Step 2: Look Ahead to Your Long-Term Goals

Now, let's shift focus from the next 12 months to the next 10, 20, or even 30 years. These accounts play very different roles in your long-term financial picture.

Is saving for healthcare in retirement a top priority? If you're serious about building a dedicated medical nest egg for your golden years, the HSA is built for exactly that. Its triple-tax advantage and investment options are unmatched.

Do you want to own your account outright? An HSA is yours. It belongs to you, not your employer. You take it with you when you change jobs or leave federal service. An HCFSA, on the other hand, is tied to your employer, and you typically lose any unused funds if you leave.

What's your comfort level with investing? The HSA's real power comes from investing your contributions for growth. That, of course, comes with market risk. If you’d rather have a simple, no-fuss spending account, the HCFSA is the more straightforward option.

The real difference comes down to your timeline. An HCFSA is a short-term tool for managing next year's budget. An HSA is a long-term asset you can build for the rest of your life.

Step 3: Make Your Decision and Take Action

You've done the thinking, so now you can make a choice with confidence. The right account is the one that best fits your answers to the questions we just walked through.

Check your FEHB plan options during Open Season. If an HSA is calling your name, your first move is to find and enroll in a qualifying HDHP.

Do the math. Run some quick calculations to see what the tax savings look like for both options. See how it impacts your take-home pay now and your potential savings down the road.

Enroll and set your contributions. Once you've made your call, it's time to sign up for the HCFSA or open that HSA and get your payroll deductions started.

By following these steps, you’re not just guessing. You're making an informed decision that will serve you and your family well, both for the year ahead and for many more to come.

Still Have Questions? Let's Clear Things Up.

Even with all the details laid out, a few specific questions always seem to pop up. Let's tackle some of the most common ones we hear from federal employees to help you iron out the final details.

Can I Have Both an HCFSA and an HSA?

For the most part, the answer is no. The IRS doesn't allow you to contribute to a standard Health Care FSA (HCFSA) and a Health Savings Account (HSA) in the same year. It's considered double-dipping on tax breaks for medical costs.

But there is one important exception. If you're enrolled in an HSA-qualified High Deductible Health Plan (HDHP), you might be eligible for a Limited Expense Health Care FSA (LEX HCFSA). This special account is designed to work alongside your HSA, but it can only be used for qualified dental and vision care. This frees up your HSA funds for other medical needs or for long-term, tax-free growth.

What Happens to My HSA If I Leave Federal Service or Retire?

This is where the HSA really shines. It's your account, period. When you leave your federal job or retire, the HSA and every dollar in it goes with you. It’s completely portable.

Think of it like any other personal savings or investment account. The money is yours to use tax-free on qualified medical expenses for the rest of your life, regardless of where you work. Your HSA is never tied to your federal employment.

Unlike an HCFSA, which you lose when you leave your job, your HSA is a lifelong financial asset. It follows you into retirement or to a new employer, acting as a permanent, tax-advantaged healthcare fund.

What Kind of Investment Options Do HSAs Offer?

A huge advantage of the HSA is its ability to grow your money tax-free, similar to your Thrift Savings Plan (TSP). Once you have a certain amount of cash in the account (often around $1,000), you can start investing the rest.

The investment choices are usually what you'd expect to see in a retirement account and can include:

Mutual Funds: A simple way to get a diversified mix of stocks and bonds.

Exchange-Traded Funds (ETFs): Low-cost funds that track different market indexes.

Stocks and Bonds: Some HSA providers even let you invest in individual securities.

This feature turns your HSA from a simple healthcare spending account into a powerful retirement savings tool, giving your healthcare nest egg a chance to grow significantly over the years. The specific options will vary depending on which financial institution manages your HSA.

Navigating federal benefits can be a lot to handle, but you don't have to figure it all out on your own. Federal Benefits Sherpa provides one-on-one guidance to help you build a confident plan for your future. You can schedule your free 15-minute benefit review today.