What Is a High Deductible Health Plan and Is It Right for You?

A high-deductible health plan (HDHP) is exactly what it sounds like: a type of health insurance that pairs lower monthly premiums with higher upfront out-of-pocket costs. It's a lot like choosing your car insurance—if you agree to a higher deductible, you can usually bring down your regular payments quite a bit. This trade-off makes HDHPs a really appealing choice for many people, especially when you factor in the powerful savings tool they unlock.

Understanding the High Deductible Health Plan

At its heart, an HDHP is built on a simple premise: you pay less for your insurance premium each month, but in return, you cover a larger chunk of your medical bills before the insurance company steps in. That initial amount you're on the hook for is called the deductible.

Once you've spent enough out-of-pocket to hit that deductible, your plan's cost-sharing features like copayments and coinsurance kick in. You'll continue to share costs with your insurer until you reach the out-of-pocket maximum—a critical number that represents the absolute most you'll have to pay for covered medical care in a single year.

The Official IRS Definition

Here's a key detail: not just any plan with a high deductible gets to be called an "HDHP" in the official sense. The Internal Revenue Service (IRS) has very specific rules that a plan must meet. Sticking to these rules is non-negotiable because only a qualifying HDHP lets you open and contribute to a Health Savings Account (HSA)—a financial game-changer we'll dive into later.

The IRS tweaks these financial thresholds every year to keep up with inflation. To qualify as an HDHP, a plan has to play by these government-mandated numbers.

For 2025, the IRS says a qualifying HDHP must have a minimum deductible of $1,650 for an individual and $3,300 for a family. At the same time, the plan has to cap your maximum out-of-pocket spending at $8,300 for individuals and $16,600 for families. Meeting these specific limits is what makes a plan HSA-eligible. You can dig into the detailed HDHP and HSA guidelines to see the official requirements for yourself.

The Core Concept: An HDHP shifts more of the initial financial risk to you in exchange for lower, predictable monthly premiums. The idea is to encourage you to be a more engaged and cost-conscious consumer of your own healthcare.

HDHP Key Features at a Glance

To make this crystal clear, let's put an HDHP side-by-side with a more traditional plan, like a PPO or HMO. Seeing the differences in black and white really helps illustrate the two distinct financial philosophies at play.

| Feature | High-Deductible Health Plan (HDHP) | Traditional Low-Deductible Plan (PPO/HMO) |

|---|---|---|

| Monthly Premiums | Typically lower, giving you immediate savings on your fixed monthly expenses. | Generally higher, reflecting the plan's lower upfront cost-sharing. |

| Deductible | Significantly higher; you pay for most services until this amount is met. | Lower; insurance begins paying for a larger share of costs much sooner. |

| Out-of-Pocket Maximum | A legally defined cap on your total annual spending for covered services. | Also has a maximum, but the path to reaching it involves smaller, more frequent payments. |

| HSA Eligibility | Yes, this is a key benefit, allowing for tax-advantaged savings for medical costs. | No, these plans are not eligible to be paired with a Health Savings Account. |

As you can see, the choice isn't just about how much you pay, but when and how you pay for your healthcare.

Unlock Your Financial Potential with a Health Savings Account

The lower monthly premium of an HDHP is just one piece of the puzzle. The real superpower you get with a qualifying high-deductible plan is access to a Health Savings Account (HSA). This isn't just another place to stash cash; it's one of the most effective financial tools you can find for handling healthcare costs while building serious long-term wealth.

Think of an HSA as a personal savings account dedicated to your health, but turbocharged with tax advantages you won't find in a regular bank account. It’s built to help you cover your deductible and other medical expenses, turning a simple insurance plan into a cornerstone of your financial strategy.

The Unbeatable Triple Tax Advantage

So, what makes an HSA such a big deal? It comes down to a coveted "triple tax advantage" that's practically unmatched anywhere else in the tax code. Grasping these three benefits is the key to seeing just how powerful the HDHP-HSA combo can be.

Here’s the breakdown:

- Contributions are tax-deductible. Any money you put into your HSA lowers your taxable income for the year. That’s an immediate tax break right off the top, just for saving for your own future.

- Your money grows tax-free. Once inside the account, your funds can be invested. Any interest, dividends, or capital gains it earns are completely tax-free, letting your money compound much faster.

- Withdrawals are tax-free. When you pull money out for qualified medical expenses—from doctor’s visits and prescriptions to dental and vision care—you pay zero taxes on it.

This powerful trio means your healthcare dollars work much harder. You're effectively paying for medical care with money that hasn't been taxed on the way in, on the way up, or on the way out.

The Key Takeaway: An HSA lets you save for healthcare with pre-tax dollars, grow those savings tax-free, and spend them tax-free on medical costs. It’s a financial hat trick that can turn a necessary expense into a wealth-building opportunity.

Maximizing Your HSA Contributions

To keep things fair, the IRS sets annual limits on how much you can contribute to an HSA. For federal employees, some plans even give you a head start. The GEHA HDHP, for instance, provides a "premium pass-through" that automatically deposits a portion of your premium savings right into your account. You can learn more by checking out a complete guide to the GEHA Health Savings Account.

The IRS adjusts these contribution limits for inflation each year. For 2025, the maximums are:

- $4,300 for self-only coverage.

- $8,550 for family coverage.

This total can be a mix of contributions from you and your employer, but the combined amount can't go over the annual limit.

A Special Boost for Savers Over 55

The government knows that healthcare costs tend to rise as we get older. To help people prepare, the IRS allows for "catch-up" contributions. If you're age 55 or older, you can put an extra $1,000 into your HSA each year.

For example, a 55-year-old with a self-only plan could contribute up to $5,300 in 2025 ($4,300 base + $1,000 catch-up). This extra thousand dollars a year can seriously accelerate your savings as you head toward retirement.

Best of all, your HSA balance rolls over year after year—there's no "use it or lose it" deadline like you find with a Flexible Spending Account (FSA). This allows you to build a substantial nest egg over your career. After you turn 65, your HSA gains even more flexibility. You can still take money out tax-free for medical needs, but you can also withdraw it for any other reason. Those non-medical withdrawals are just subject to regular income tax, exactly like a 401(k) or TSP distribution, with no penalties.

Choosing Your Plan: HDHP vs. PPO and HMO

Picking a health plan can feel like standing at a crossroads. Do you go with a high-deductible health plan (HDHP) or stick with something more traditional, like a PPO or HMO? This decision is about more than just comparing monthly premiums to annual deductibles. It’s about finding a financial structure that clicks with your family's health needs, your budget, and how much financial risk you’re comfortable taking on.

The fundamental trade-off is pretty straightforward. HDHPs are built around low fixed costs—your monthly premiums. In exchange, you take on a larger share of the initial costs when you need care. On the flip side, PPOs and HMOs have higher premiums but offer the peace of mind that comes with smaller, predictable copayments right from the start.

Comparing Network Flexibility and Access to Care

One of the most practical differences you'll experience is how you actually get medical care. This is where the alphabet soup of plan types really matters.

HMOs (Health Maintenance Organizations) are the most structured. You typically choose a Primary Care Physician (PCP) who acts as your gatekeeper, and you need to stick to a specific network of doctors. Want to see a specialist? You’ll almost always need a referral from your PCP first.

PPOs (Preferred Provider Organizations) give you a lot more freedom. You can see just about any doctor you want, whether they're in-network or not, and you don't need a referral. The catch is that your costs will be much, much lower if you stay within the plan’s “preferred” network.

HDHPs aren't a network type themselves—they're a financial structure. This is a crucial detail people often miss. An HDHP can be set up as a PPO with a wide-open network or as an HMO with a more managed approach. So, when you're looking at an HDHP, you have to look past the deductible and see what kind of network rules come with it.

Debunking a Major HDHP Myth

There's a common misconception that with a high deductible, you’re on the hook for everything out-of-pocket until that deductible is met. That's simply not the case.

Thanks to the Affordable Care Act (ACA), every compliant health plan—including HDHPs—is required to cover a list of preventive care services at 100%, even before you’ve paid a dime toward your deductible.

This means your annual physical, routine shots, and key health screenings like mammograms and colonoscopies are usually covered for free. It’s designed to make sure cost isn't a barrier to catching health problems early.

This built-in benefit makes HDHPs far more practical than they might seem at first glance, as it takes the financial sting out of staying on top of your routine wellness visits.

Running the Numbers: Real-World Scenarios

To see how this all plays out financially, let's look at how the total annual costs might stack up for a PPO versus an HDHP paired with an HSA.

The following table paints a picture of two very different situations, showing how the total out-of-pocket costs can shift dramatically based on your healthcare usage.

HDHP vs Traditional Plan Cost Scenarios

| Cost Component | Healthy Individual Scenario (HDHP) | Healthy Individual Scenario (PPO) | Family with Chronic Condition (HDHP) | Family with Chronic Condition (PPO) |

|---|---|---|---|---|

| Annual Premiums | ~$2,000 (Low) | ~$4,000 (High) | ~$5,000 (Low) | ~$9,000 (High) |

| HSA Contribution (Tax-Free) | $4,150 (Max) | $0 | $8,300 (Max) | $0 |

| Preventive Care | $0 | $0 | $0 | $0 |

| Medical Expenses | $300 (1 Sick Visit) | $50 (Copay) | $8,000 (Hits Deductible) | $3,500 (Copays & Coinsurance) |

| Net Out-of-Pocket Cost | $2,300 (Premiums + Medical) | $4,050 (Premiums + Medical) | $13,000 (Premiums + Medical) | $12,500 (Premiums + Medical) |

| HSA Balance End of Year | $3,850 | N/A | $300 | N/A |

As you can see, the "best" plan is highly dependent on the user. The healthy individual saves a significant amount with the HDHP and builds their HSA balance, while the family with ongoing medical needs might find the PPO's predictability more financially manageable, even with higher premiums.

HDHPs are becoming a mainstream option. Their availability for private industry workers grew from about 38% in 2015 to around 50% by 2024. The median annual deductible for these plans hit $2,750 in 2024, but they can range anywhere from $2,000 to $5,000, highlighting just how much the financial risk can vary. You can explore more data on how HDHPs are changing the benefits landscape on BLS.gov.

Ultimately, this is a personal financial decision. To really get into the weeds, especially if you're a federal employee navigating FEHB, take a look at our comprehensive guide to federal health insurance options.

Is an HDHP the Right Financial Move for You?

Deciding if a high-deductible health plan is the right fit is a deeply personal calculation. There’s no magic formula here; the best choice really hinges on your health, your finances, and frankly, your tolerance for risk.

An HDHP can be a brilliant financial tool for some. For others, a more traditional plan provides much-needed security. To figure out which camp you’re in, you have to take an honest look at your own situation. Think about your typical medical needs, your family's health, and whether you have the savings to handle a big, unexpected medical bill without breaking a sweat.

Who Typically Wins with an HDHP

Some people are almost perfectly suited for the HDHP model. They're the ones who can really capitalize on the lower premiums and the powerful HSA benefits, often coming out way ahead financially.

You might be a great candidate for an HDHP if you are:

- Young, Healthy, and Rarely See a Doctor: If your medical life is pretty much just an annual check-up, paying high monthly premiums for a low-deductible plan can feel like throwing money away. An HDHP lets you slash those fixed costs and funnel the savings into an HSA.

- A High-Income Earner Focused on Investment: For anyone in a higher tax bracket, the HSA's triple-tax advantage is a massive perk. You can max out your contributions, shrink your taxable income, and essentially use the HSA as another tax-free investment account, right alongside your 401(k) or TSP.

- Financially Prepared with a Healthy Emergency Fund: If you already have a solid emergency fund, a deductible of $3,000 or $5,000 isn’t going to cause a panic. You have the cash ready to go, which means you can enjoy the lower premiums without the financial anxiety.

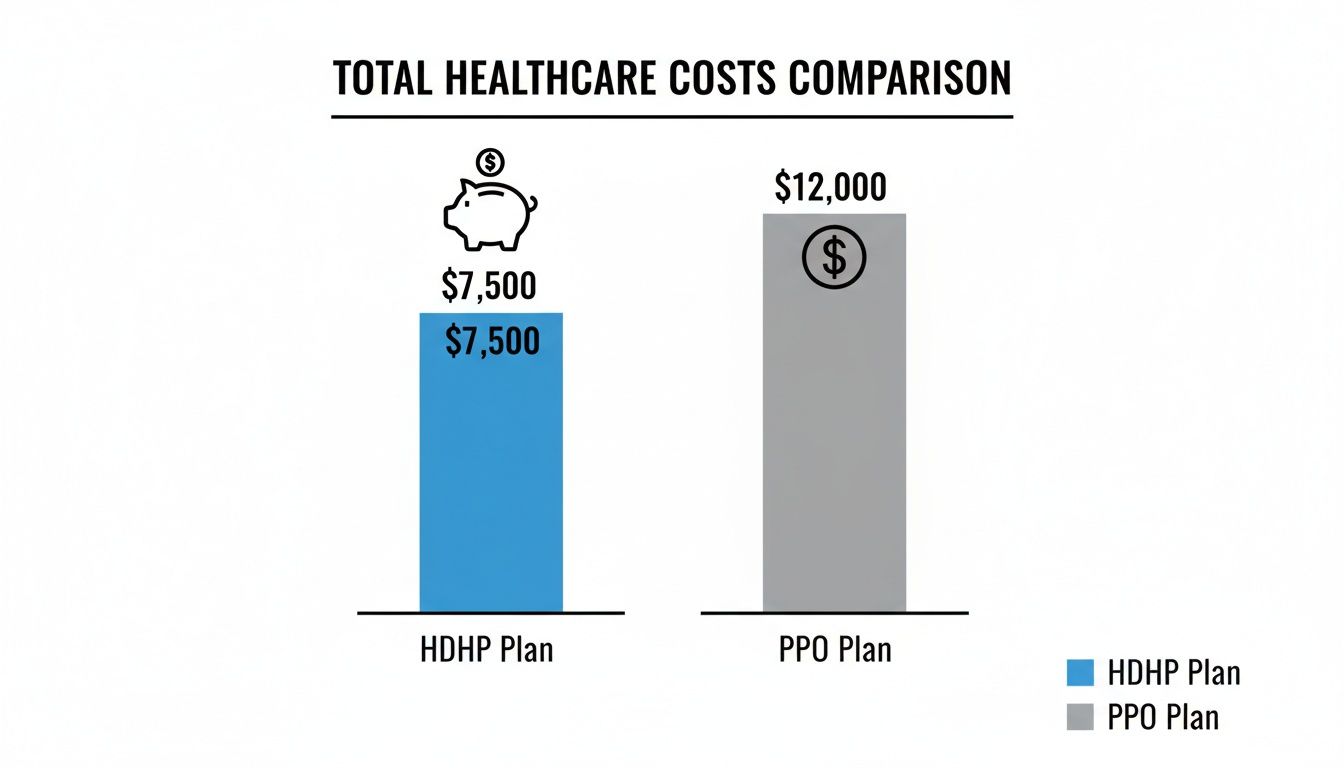

This chart gives you a visual on how total yearly healthcare spending can shake out between an HDHP and a traditional PPO plan in a best-case scenario.

As you can see, for people with low medical expenses, the HDHP's lower premiums can lead to big overall savings, even after you factor in some out-of-pocket costs.

Who Should Approach an HDHP with Caution

On the flip side, an HDHP can be a source of serious financial strain for some folks. The risk of those high upfront costs is very real, and it’s critical to be honest with yourself if this model just isn't a good fit.

You should think twice before jumping into an HDHP if you:

- Manage a Chronic Health Condition: If you have a condition like diabetes or asthma that involves regular doctor visits, specialists, and multiple prescriptions, you're going to burn through that high deductible fast. In your case, the predictable copays of a traditional plan will likely add up to less money spent over the year.

- Have a Young Family or Are Planning a Pregnancy: Little kids mean frequent and often unpredictable trips to the pediatrician. Planning for a baby means a whole series of appointments and a major hospital bill. In these situations, you’re almost guaranteed to meet your deductible, and a PPO might offer far better financial predictability.

- Lack a Substantial Emergency Fund: If a surprise $4,000 medical bill would throw your finances into a tailspin, an HDHP is a gamble. The low premium is tempting, but it’s not worth it if you can't comfortably cover the deductible when it matters most.

The Bottom Line: Your choice should come down to a realistic projection of your healthcare needs for the coming year. An HDHP is a strategic financial decision, not just a shortcut to a lower monthly premium. It requires you to be prepared for the real possibility of paying that full deductible.

At the end of the day, an HDHP is a trade-off. For the right person, it’s a smart combination of low fixed costs and a powerful, tax-advantaged investment tool. For the wrong person, it can become a barrier to getting needed care and a source of major financial stress. By carefully weighing your personal health and financial situation, you can make a choice that truly works for you.

How an HDHP Fits Into Your Federal Benefits

As a federal employee, choosing health insurance isn't the same as it is in the private sector. You're operating within the guide to the Federal Employees Health Benefits program, a unique system with its own set of rules and opportunities. This is especially true when it comes to High-Deductible Health Plans (HDHPs).

An HDHP in the FEHB system is more than just a health plan; it's a financial tool that plugs directly into your other federal benefits, like your FERS pension and Thrift Savings Plan (TSP). Think of it as another lever you can pull to build a more secure financial future.

The "Premium Pass-Through" — A Unique Federal Perk

One of the biggest game-changers for federal employees is something called the "premium pass-through." This is a feature you'll only find in certain FEHB-sponsored HDHPs. The insurance carrier takes a portion of the premium savings you generate by choosing a high-deductible plan and deposits it directly into your Health Savings Account (HSA).

Let's be clear: this isn't an employer match. It's a direct, automatic contribution from the insurance plan itself. The plan is essentially sharing its savings with you, giving your HSA a massive head start each year before you've contributed a single dollar.

Key Insight: The premium pass-through is like getting a built-in bonus just for enrolling in the plan. It pre-loads your HSA, giving you a fund to cover your deductible right from the start.

This feature makes the whole idea of a high deductible feel much less scary. You begin the year with a funded account, ready to tackle out-of-pocket costs from day one.

Weaving Your HDHP into Your Federal Retirement Plan

Building a secure federal retirement is the end goal, and an HDHP with an HSA plays a surprisingly powerful role. Your retirement security traditionally rests on three pillars: your FERS pension, Social Security, and your Thrift Savings Plan (TSP). An HSA effectively becomes a fourth pillar—one dedicated solely to healthcare.

Here’s how you can think about them working together:

- Your TSP Funds Your Lifestyle: You contribute consistently to your TSP to pay for the retirement you want—travel, hobbies, and day-to-day living expenses.

- Your HSA Funds Your Health: You use the HSA to build a separate, tax-free war chest to cover medical costs in retirement, like Medicare premiums, long-term care, or unexpected bills.

This strategy is brilliant because it protects your primary retirement savings. By keeping medical costs separate, you don't have to raid your TSP every time a health issue pops up. Your HSA acts as a financial firewall, shielding your TSP from the unpredictable and often high costs of healthcare in your later years.

A Long-Term Financial Play

When you combine the annual premium pass-through with your own maximum HSA contributions, the numbers really start to add up. Over a 20- or 30-year federal career, you can easily build a six-figure account. The money grows tax-free and can be invested, compounding over time.

This shifts the HDHP from being a simple insurance decision into a serious wealth-building strategy. It's a tax-advantaged vehicle for tackling one of the biggest expenses you'll face in retirement. For a savvy fed, an HDHP isn't just health coverage; it's a strategic move that strengthens your financial security for decades.

Addressing the Risks and Common Myths of HDHPs

When you choose a high-deductible health plan, you're making a calculated trade-off. You accept more upfront financial risk in exchange for lower monthly premiums and the chance to save for the future with an HSA. This trade-off is the core reality of an HDHP, and it brings us to the single biggest danger of these plans: care avoidance.

It’s completely understandable. When you know a doctor's visit or a prescription will cost you hundreds of dollars out-of-pocket, the temptation to "wait and see" can be powerful. Putting off care might save a little money now, but it can lead to devastating health and financial consequences if a small problem snowballs into a major one.

This isn't just a hypothetical concern. A study looking at over 343,000 adults with chronic conditions found that switching to an HDHP led to a noticeable decline in getting necessary care. Specifically, they saw a 3.1 percentage point drop in clinic visits and a 9.0 percentage point drop in prescription fills. You can dig into the full research findings on HDHP care patterns yourself, but the takeaway is clear: the risk of skipping care is real.

Debunking Common HDHP Misconceptions

Beyond the legitimate risks, a lot of myths and misunderstandings surround HDHPs. Believing them can lead to some nasty surprise bills. Let's clear the air on two of the biggest ones.

Myth 1: You Pay 100% for Everything Until You Hit Your Deductible

This is probably the most common—and most wrong—assumption about these plans. By law, all ACA-compliant health plans, including HDHPs, must cover a specific list of preventive care services at 100%, even before you’ve paid a dime toward your deductible. This means your annual physical, routine immunizations, and important screenings are typically covered from day one at no cost to you.

Myth 2: Any Check-Up Is 'Preventive' Care

Here’s where things get tricky. A "preventive" visit is a routine wellness check when you don't have any specific complaints. The moment you ask your doctor to examine a sore back or a weird rash during that same visit, it can change from a preventive check-up to a diagnostic one. Once the conversation shifts to a specific health problem, the costs for that part of the visit will start counting toward your deductible.

Plan for Success: The secret to thriving with an HDHP is being prepared. You have to acknowledge the risk of high upfront costs and actively plan for them. By setting up a dedicated "deductible fund" in your budget or, even better, in your HSA, you'll have the money ready when you need it and won't have to think twice about getting care.

Strategies for Mitigating HDHP Risks

Knowing the risks is half the battle; the other half is actively managing them. With the right strategy, an HDHP can be a powerful financial tool instead of a source of stress.

Here are a few practical steps you can take:

- Front-Load Your HSA. If your budget allows, make a significant contribution to your Health Savings Account at the start of the year. This builds an immediate financial cushion for any medical expenses that pop up.

- Get to Know Your Plan. Don't just glance at the deductible amount. Dive into your plan’s documents to learn exactly what’s covered as preventive care. It's also critical to understand your coinsurance and copayments for after you've met the deductible.

- Become a Savvy Healthcare Consumer. Your insurer likely offers price transparency tools that let you compare costs for different procedures and prescriptions. When it’s your money on the line, shopping around for non-emergency care can save you a bundle.

Got Questions About HDHPs and HSAs? We've Got Answers.

When you're digging into the specifics of a high-deductible plan, a lot of "what if" scenarios pop up. Let's clear up some of the most common questions that people ask.

Can I Use My HSA for Something Other Than Medical Bills?

You can, but you really need to be careful. If you take money out for non-medical expenses before you turn 65, you'll get hit with a double whammy: the withdrawal is taxed as regular income, plus you'll face a stiff 20% penalty.

Once you hit age 65, things get much more flexible. The 20% penalty goes away completely. At that point, you can withdraw from your HSA for any reason at all, and you'll just pay ordinary income tax on the amount—much like you would with a traditional 401(k) or IRA.

What Happens to My HSA Money if I Switch to a Different Health Plan?

That money is yours, period. It doesn't matter if you leave your job or switch to a traditional PPO next year—the funds in your HSA belong to you forever. You can keep using that balance for qualified medical expenses, completely tax-free.

The only thing that changes is your ability to contribute. You can only put new money into an HSA while you're actively covered by a qualifying HDHP. But the money already in there? It's your personal health savings fund for life.

Is All Preventive Care Really Free with an HDHP?

For the most part, yes. Thanks to the Affordable Care Act (ACA), all compliant health plans, including HDHPs, have to cover a specific list of preventive services without you paying a dime. This covers things like your annual check-up, standard immunizations, and many routine screenings.

Here's the catch: a visit that starts as preventive can quickly become diagnostic. If you bring up a new health problem or a specific symptom during your annual physical, the doctor's investigation into that issue likely won't be considered preventive. Those services can then be billed and applied toward your deductible.

At Federal Benefits Sherpa, we specialize in helping federal employees understand how health plans like HDHPs fit into their overall financial picture. Get a free benefits review to ensure you're making the right choices for your retirement. Learn more at federalbenefitssherpa.com.