A Guide to FERS Survivor Benefits for Federal Employees

When we talk about FERS survivor benefits, we're really talking about a financial safety net for the people you care about most. It’s not just a one-time payment; it's a way to ensure your family has long-term income and stability long after you’re gone.

Think of it as extending your federal service legacy, providing a shield for your loved ones through a combination of monthly payments, lump-sum options, and crucial connections to your other federal benefits.

Your Financial Legacy and Peace of Mind

Ensuring your family is secure is one of the most important parts of financial planning. Your FERS survivor benefits are a massive piece of that puzzle. This isn’t just about filling out forms; it’s about creating a reliable financial bedrock for your spouse and children during what will undoubtedly be a very tough time.

The Federal Employees Retirement System (FERS) gives you some powerful tools to make this happen, but they don't work on autopilot. They require you to make informed, proactive decisions. This guide is designed to cut through the jargon and lay out your options in plain English, empowering you to make the best choices for your family.

What This Guide Covers

To give you the full picture, we’re going to break down the different pieces of your survivor benefit package. These parts don’t exist in a vacuum—they work together to create a complete support system.

Here’s what you’ll learn:

- The Survivor Annuity: This is the big one—a lifelong monthly payment for your spouse that essentially functions as a continuation of your pension.

- Lump-Sum Death Benefits: We'll cover the situations where an immediate cash payment is available, which is especially relevant for employees who die while still on the job.

- Connecting the Dots: We’ll explore how your survivor benefits interact with your health insurance (FEHB), life insurance (FEGLI), and your Thrift Savings Plan (TSP).

- The Nuts and Bolts: We'll get into who qualifies for what and the specific steps you and your family need to take to elect or claim these benefits.

Understanding how these benefits fit together is what transforms a simple employee benefit into a real financial strategy. It's this shift from passive to active planning that provides genuine peace of mind.

To give you a quick reference, here’s a high-level look at the main options we'll be discussing in detail.

Key FERS Survivor Benefit Options at a Glance

| Benefit Type | What It Provides | Primary Recipient |

|---|---|---|

| Survivor Annuity | A recurring monthly payment, often a percentage of your FERS pension. | Surviving Spouse |

| Lump-Sum Death Benefit | A one-time payment of unpaid contributions plus interest. | Designated Beneficiary |

| TSP & FEGLI Payouts | Payouts from your retirement savings and life insurance policies. | Designated Beneficiary |

This table is just the starting point. Each of these benefits has its own set of rules, and understanding them is key to protecting your family's future.

Making sense of it all is the first step. For a broader look at how FERS benefits fit into your overall estate, you can check out our guide on navigating federal employee death benefits. Now, let's dive into the most critical decision you'll face: the survivor annuity.

When you're thinking about how to protect your family after you’re gone, FERS survivor benefits boil down to two very different paths. You can either provide a steady, lifelong income stream or a one-time, lump-sum payment. It's a classic financial dilemma: predictable monthly cash flow versus a significant amount of cash upfront.

The most common choice is the survivor annuity. This is essentially a continuation of your pension, paid out monthly to your surviving spouse. It’s built for the long haul, designed to provide a reliable source of income to cover living expenses for years, or even decades, after you pass away.

On the other hand, you have the lump-sum payment, officially called the Basic Employee Death Benefit (BEDB). This is a single, tax-free payout designed to offer immediate financial help. It’s most relevant if a federal employee dies while still working, giving the family a quick injection of cash to handle urgent needs.

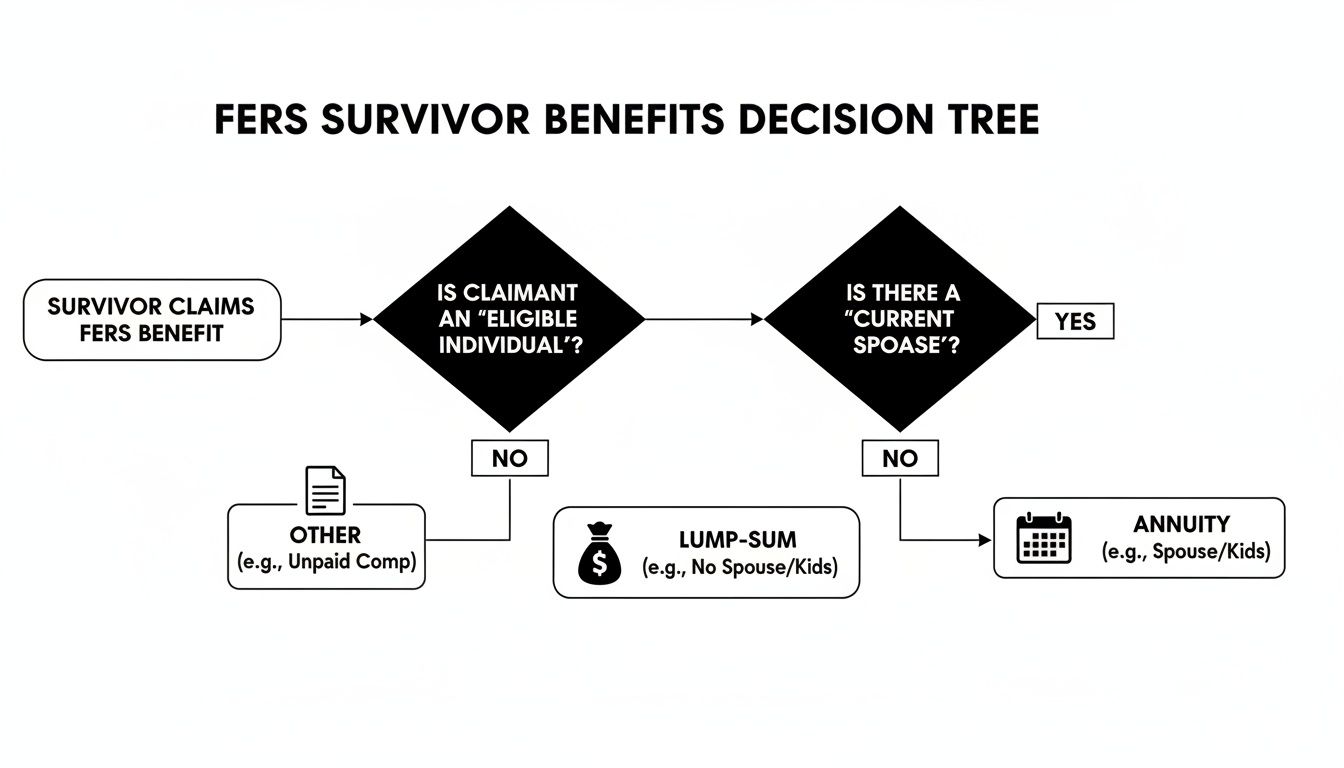

This decision tree helps visualize how the options diverge based on your life and work situation.

As you can see, the "right" choice really hinges on your survivor's financial situation and whether you pass away during your career or in retirement.

The Survivor Annuity Trade-Off

Choosing to provide a FERS survivor annuity isn't a freebie; it comes with a cost. To fund this future benefit for your spouse, you have to agree to a permanent reduction in your own pension check throughout your retirement. You're taking a little less now to make sure your loved one has a safety net later.

At retirement, you’ll be presented with two main options:

- A 50% Survivor Annuity: This gives your surviving spouse 50% of your full, unreduced pension amount. The price for this is a permanent 10% reduction in your own monthly pension.

- A 25% Survivor Annuity: This option gives your spouse 25% of your full pension. The cost is a smaller 5% permanent reduction to your monthly check.

It's a true balancing act. If you elect the 50% annuity, you're accepting a bigger hit to your own retirement income to secure a more substantial future for your spouse. This is a heavyweight decision, largely because it’s usually irrevocable once you’ve made your election and your retirement is finalized.

Calculating the Basic Employee Death Benefit

The Basic Employee Death Benefit (BEDB) offers a different kind of security through a one-time payment. This benefit is generally available if a FERS employee with at least 18 months of creditable civilian service dies while still on the job.

The BEDB formula is pretty straightforward and has two parts:

- 50% of Your Salary: The survivor gets half of your final annual basic pay (or your high-3 average salary, if that's higher).

- A Fixed Lump Sum: This is a specific dollar amount that gets an inflation adjustment each year. For deaths on or after December 1, 2024, this amount is $42,607.52.

Let's see how this works with an example:

Say a FERS employee passes away with a final salary of $90,000.

- 50% of Salary: $90,000 / 2 = $45,000

- Fixed Lump Sum (2025 rate): $42,607.52

- Total BEDB Payout: $45,000 + $42,607.52 = $87,607.52

This substantial, tax-free payment can be a huge relief for a grieving family, providing immediate funds for funeral costs, paying off debts, or just bridging the income gap while they figure things out.

Deciding between a lifelong annuity and a lump sum requires a hard look at your family's entire financial picture. You have to consider other assets, Social Security benefits, and whether your spouse is better equipped to manage a steady monthly check or a large, one-time payment. It's also wise to look beyond the FERS rules and understand the wider financial picture, including the tax considerations for beneficiaries and inheritance, to make a truly informed decision.

Who Is Eligible for FERS Survivor Benefits?

Before you can plan for your family’s future, you have to know who actually qualifies for FERS survivor benefits. Think of the eligibility rules as a clear-cut roadmap—they define who is entitled to support and under what circumstances. The rules aren't tricky, but they are very specific.

The primary people these benefits are designed for are surviving spouses and dependent children. For them, things like how long you were married, your years of federal service, and your child's age all come into play. Let's break down exactly what that means.

Surviving Spouse Eligibility

For your spouse to be eligible for a survivor annuity, the most important factor is often the length of your marriage. It’s a straightforward rule designed to create a clear line of eligibility.

Generally, your surviving spouse must have been married to you for at least nine months right before your passing. This is the main requirement for them to receive a monthly survivor annuity check.

But life isn't always that simple, and OPM has built-in a few critical exceptions to this nine-month rule:

- Accidental Death: If your death is the result of an accident, the nine-month marriage requirement is completely waived.

- Child of the Marriage: The rule is also waived if a child was born of your marriage. This is true even if the child is born after you pass away.

These exceptions provide a crucial safety net, ensuring that families dealing with a sudden, tragic loss aren't left without the financial support they were counting on.

Former Spouse and Children Eligibility

The circle of eligibility doesn't always end with your current spouse. A former spouse can also be entitled to survivor benefits, but only if a court order—like a divorce decree—explicitly grants them a portion. This isn't automatic; it has to be officially documented and on file with the Office of Personnel Management (OPM).

When it comes to your children, the rules are all about their age and dependency status.

- Age Limit: Your unmarried, dependent children are eligible to receive benefits until they turn 18. This support can be extended all the way to age 22 if they remain a full-time student.

- Disabled Children: For an unmarried child who can't support themselves due to a physical or mental disability that started before they were 18, the age limit doesn't apply. They can receive benefits indefinitely.

This framework is designed to make sure the support goes to the children who are still financially dependent.

Specific Service Requirements for Benefits

Your own service history is the final piece of the puzzle. The type and amount of benefits available are directly tied to how long you worked for the federal government. For example, to qualify for the Basic Employee Death Benefit (BEDB), you must have at least 18 months of creditable civilian service under your belt.

This specific benefit provides a one-time, lump-sum payment. It's calculated by taking 50% of your final salary and adding a set base amount that’s adjusted for inflation. For deaths occurring on or after December 1, 2025, that base amount is $43,800.53.

Let’s put that into perspective: if you had a final salary of $100,000, the BEDB would be around $93,800 ($50,000 + $43,800.53). That’s a significant amount of immediate financial relief for a grieving family. You can find more details on how OPM calculates survivor benefits on their official website.

Connecting Survivor Benefits with Your Other Federal Plans

Your FERS survivor benefits are a critical piece of your financial legacy, but they don't work in a vacuum. It’s a mistake to look at them in isolation. A much better way is to see your federal benefits as an interconnected system, where each part—your health insurance, life insurance, and retirement savings—supports the others.

To build a truly bulletproof financial plan for your loved ones, you have to understand how these pieces fit together. Ignoring how they interact can leave dangerous gaps in your family’s safety net, especially when it comes to something as vital as healthcare.

The Critical Link Between FERS Survivor Annuity and FEHB

Pay close attention here, because this is one of the most important rules in all of federal benefits planning. For a surviving spouse to keep their Federal Employees Health Benefits (FEHB) coverage after you’re gone, they must be eligible for and receiving a FERS survivor annuity.

This connection is non-negotiable, and the financial consequences are massive.

If you choose to waive the survivor annuity, perhaps to get a slightly larger pension payment for yourself during retirement, your spouse will almost certainly lose their FEHB coverage when you pass away. They might get a temporary offer for COBRA-like coverage, but they'll be on the hook for the full premium without the government's contribution. For most people, that’s simply unaffordable.

By electing even the minimum 25% survivor annuity, you aren't just leaving behind a monthly check. You are handing your spouse the golden key to keeping affordable health insurance for the rest of their life. For many federal couples, this is the single most compelling reason to elect a survivor benefit.

FEGLI for Immediate Needs vs. Annuity for Long-Term Security

While the FERS survivor annuity provides a steady, lifelong income, it doesn't start the day after you pass away. It takes time for the Office of Personnel Management (OPM) to process the claim and get the payments flowing. This is where your Federal Employees' Group Life Insurance (FEGLI) steps in to play a completely different, but equally vital, role.

FEGLI delivers a tax-free, lump-sum cash payment that can bridge the financial gap right when your family needs it most.

Think of it this way:

- FEGLI is the emergency fund. It’s the quick cash meant to cover a funeral, pay off a car loan or mortgage, and handle immediate bills without adding financial stress to an already difficult time.

- The FERS survivor annuity is the long-term income replacement. It's the paycheck that shows up month after month, year after year, giving your spouse a predictable foundation for their new budget.

A smart plan uses both. To make sure your coverage is properly aligned with your family’s needs, take a look at our complete guide to federal life insurance FEGLI.

The Role of Your Thrift Savings Plan

Your Thrift Savings Plan (TSP) is the third major pillar of your survivor's financial security. Unlike the annuity, which is a defined benefit (a promise of future income), your TSP is a defined contribution plan. That balance is a tangible asset that passes directly to your designated beneficiaries.

When you pass away, the person you named as your TSP beneficiary gets control of the funds. A surviving spouse has the most options here; they can roll the entire balance into their own TSP Beneficiary Participant Account, move it to an IRA, or take a distribution. This flexibility allows the money to continue growing tax-deferred.

Non-spouse beneficiaries, like your children, have fewer options. They generally can't keep the money in the TSP and must either take a full distribution or move it to an Inherited IRA, which has its own specific set of withdrawal rules.

Building a Coordinated Financial Strategy

The most resilient survivor plans are built by layering these benefits together. Your survivor's financial well-being will be shaped by several overlapping programs, each with its own rules. That survivor annuity election, for instance, is the linchpin for keeping FEHB, which can save a surviving spouse thousands of dollars a year in health premiums.

At the same time, FEGLI and TSP balances can provide immediate liquidity, often in the tens or even hundreds of thousands of dollars for long-serving employees. And don’t forget Social Security—it provides its own survivor benefits. In November 2023, the program reported about 5.8 million survivor beneficiaries receiving an average monthly benefit of $1,576.20, a significant supplement to a FERS annuity.

Because of all these moving parts, a good financial planner will often model different scenarios. They might combine a 25% or 50% survivor annuity with projected FEGLI, TSP, and Social Security payments to ensure the income stream truly replaces what’s lost and provides lasting security for the surviving spouse.

How to Elect and Claim Survivor Benefits

Dealing with the paperwork for FERS survivor benefits can feel overwhelming, but it really comes down to two different situations: the employee planning for retirement, and the survivor handling things after a loved one has passed. Let’s walk through the steps for each, so you know exactly what to expect and what forms you’ll need.

This is all about getting the details right to make sure the process is as smooth as possible.

For a federal employee, the big moment is at retirement. This isn't some form you fill out years ahead of time; your survivor annuity election is a core part of your retirement application.

It's a huge decision. In nearly all cases, once your retirement is finalized by OPM, that choice is irrevocable. You are locking in a decision that will directly impact your own monthly pension and your spouse's financial well-being for the rest of their life.

Key Actions for Employees

Your job, both before and during retirement, is to make an informed election and keep all your paperwork up to date. A little proactivity now can prevent a world of headaches for your family down the road.

- Make Your Election at Retirement: On the retirement application, you’ll officially choose whether to provide a full (50%), partial (25%), or no survivor annuity for your current spouse.

- Update Beneficiary Forms: Life happens. Marriage, divorce, a new baby—these events mean you need to update your beneficiary designations right away. Use the SF 3102 (FERS) and TSP-3 (Thrift Savings Plan) forms to make sure your assets go exactly where you intend. The same goes for your FEGLI life insurance.

Think of your beneficiary forms for the TSP and FEGLI as legally binding instructions. They operate completely outside of your will and will always override it. Keeping them current is absolutely essential.

Making sure you have the right beneficiary named for your TSP is a critical step. For a deeper dive into what your beneficiaries need to know, check out our complete guide on Thrift Savings Plan withdrawal options.

Steps for Surviving Family Members

For a survivor, the journey begins after the federal employee or retiree passes away. Your main point of contact will be the Office of Personnel Management (OPM), the agency that oversees all FERS benefits.

The very first thing you need to do is report the death to OPM. You can do this with a phone call or through their online reporting tool. Notifying them quickly is important because it prevents them from overpaying the retiree's annuity, which you would eventually have to pay back.

After that, you'll need to gather some key documents to formally apply for your survivor benefits.

- Get the Death Certificate: You'll need an original, certified copy of the death certificate.

- Fill Out the Application: OPM will mail you an application packet. For a surviving spouse, the main form is the SF 3104, Application for Death Benefits.

- Gather Supporting Documents: You’ll likely also need to provide your marriage certificate, your own birth certificate, and the Social Security numbers for yourself and any eligible children.

Once OPM has your completed application and all the necessary paperwork, they'll start processing your claim. The timeline can vary, but it often takes several weeks or even a few months before the first survivor annuity payment arrives. It’s a difficult time, but staying organized and patient will help you navigate the process.

Common Mistakes to Avoid in Your Planning

When it comes to FERS survivor benefits, knowing the rules is only half the battle. The other half is avoiding the common, and often costly, mistakes I see federal employees make all the time. These aren't just minor slip-ups; they're errors that can seriously jeopardize your family's financial security down the road.

Let's walk through some of the biggest pitfalls so you can steer clear of them.

Forgetting the Health Insurance Connection

One of the most frequent and damaging mistakes is failing to connect the dots between the survivor annuity and federal health insurance (FEHB). Some folks waive the annuity to get a slightly bigger pension check for themselves, not realizing this single decision can boot their spouse off the FEHB plan for good.

This can be a devastating blow, leaving a surviving spouse to suddenly face thousands of dollars in annual healthcare costs with no affordable options. It's a classic case of winning the battle but losing the war.

Letting Your Paperwork Go Stale

Another critical error? Stale beneficiary forms. Life happens—divorce, remarriage, new kids—and your paperwork needs to keep up. Your TSP, FEGLI, and FERS designation forms are legally binding documents that override whatever your will says.

I can't tell you how many heartbreaking stories I've heard where benefits ended up with an ex-spouse because someone forgot to update a form from 20 years ago. Don't let that be you.

Overlooking the Bigger Financial Picture

It's easy to fall into the trap of just defaulting to the maximum survivor annuity without looking at the complete financial picture. Sure, the 50% annuity gives your spouse the largest possible monthly payment, but it also takes the biggest bite out of your own pension. It’s crucial to weigh this against the other resources your spouse will have.

For instance, a smaller 25% annuity might be the smarter play if your spouse has other assets to lean on, like:

- A substantial TSP balance of their own to draw from.

- A hefty FEGLI life insurance payout coming their way.

- Their own pension or robust Social Security benefits.

This kind of strategic thinking balances your retirement income with your spouse's future needs, ensuring everyone is secure without needlessly shrinking your pension.

The most effective planning treats FERS survivor benefits not as an isolated decision but as one component of a comprehensive financial strategy. The goal is to create a secure future, and that often means using all available tools in concert.

Finally, a huge oversight is simply neglecting your broader estate plan. Life is unpredictable, and incapacity can make it impossible for you to manage your own affairs. To head off potential problems, take proactive steps like appointing someone you trust to establish a Durable Power of Attorney.

This ensures that critical financial decisions can still be made on your behalf if you're unable. Ignoring these details can create a legal and financial nightmare for your family right when they're at their most vulnerable.

Your Top Questions About FERS Survivor Benefits Answered

When you dig into the details of FERS survivor benefits, a lot of specific "what if" questions pop up. It's only natural. Let's walk through some of the most common ones we hear from federal employees so you can get the clear, straightforward answers you need.

Think of this as your go-to guide for those tricky situations, from remarriage to cost-of-living adjustments.

What Happens to the Survivor Annuity if My Spouse Remarries?

This is a big one, and the answer hinges on a specific age. If your surviving spouse remarries before they turn 55, the FERS survivor annuity payments will stop.

It's not always a permanent stop, though. Should that new marriage end through death, divorce, or annulment, the annuity can often be reinstated. On the other hand, if your surviving spouse remarries after age 55, the annuity continues, uninterrupted, for the rest of their life.

Can I Leave the Survivor Annuity to Someone Besides My Spouse?

The FERS spousal survivor annuity is specifically designed for a current spouse or, in certain divorce situations, a former spouse under a court order. You can't simply name your child, a sibling, or a close friend to receive this monthly pension benefit.

There is a very specific, and much less common, exception called an "insurable interest" election. This allows you to provide an annuity for someone who is financially dependent on you, like an aging parent. Choosing this route, however, means you'll have to pass a physical to prove you're in good health, and it comes with a significantly larger reduction to your own pension.

Remember, this rule is only for the survivor annuity. Your other benefits, like the Thrift Savings Plan (TSP) and Federal Employees' Group Life Insurance (FEGLI), are a different story. You have total freedom to name anyone you want as a beneficiary for those.

Are Survivors Eligible for Benefits if I Leave Federal Service Before Retiring?

It all comes down to your service time. If you leave your federal job before you're eligible for an immediate retirement but you have at least 10 years of creditable service, you're what's known as a "deferred retirement" case.

If this is your situation, your surviving spouse could still be eligible for a survivor annuity. The key difference is that the payments won't start right away. They would only begin at the point when you would have been eligible to start drawing your own pension, which could be many years down the road. Also, keep in mind the Basic Employee Death Benefit is off the table unless you die while still an active employee.

Does the FERS Survivor Annuity Keep Up With Inflation?

Yes, it does, which is a huge relief for long-term planning. FERS survivor annuities get the same Cost-of-Living Adjustments (COLAs) that federal retirees receive on their own pensions.

These COLAs are calculated based on the Consumer Price Index (CPI) and are typically applied once a year. This is a powerful feature because it helps the benefit hold its value over time, protecting your survivor's income from being chipped away by inflation.

Planning for your family's future is one of the most important things you can do. Federal Benefits Sherpa is here to help you make sense of these complex decisions and create a retirement plan that provides true peace of mind. Get started with a free benefits review and ensure your loved ones are protected. Learn more at Federal Benefits Sherpa.