Tsp Withdrawal Rules: A Practical Guide to In-Service and RMDs

Think of your Thrift Savings Plan (TSP) as a secure vault holding your retirement savings. While the money inside is definitely yours, you can't just open it whenever you want. There are specific keys and combinations required, and the right one depends entirely on where you are in your career.

The TSP has two completely different sets of rules: one for when you're still on the federal payroll and another for after you've separated from service. This isn't just bureaucratic red tape; it’s designed to protect your nest egg for its intended purpose—retirement.

When you're still working, the government makes it tough to pull money out. Access is limited to very specific situations, like a proven financial hardship or once you hit a certain age. But after you leave your job, the doors swing open. You get a whole menu of flexible options designed to turn that lump sum you've saved into a reliable income stream for the rest of your life.

Understanding Your Core Choices

Getting this right is a big deal. Making smart withdrawal decisions requires a good handle on essential money management skills to make sure your choices today don't jeopardize your financial security tomorrow.

Before we get into the nitty-gritty of each withdrawal type, it helps to see everything from a bird's-eye view. For a deep dive, you can check out our complete guide on Thrift Savings Plan withdrawal options.

The table below is a quick-glance summary. It lays out the main withdrawal types, when you can use them, and what they’re for. Think of it as your cheat sheet for figuring out which rules apply to you right now.

Key Takeaway: If you remember only one thing, make it this: your employment status is the single most important factor determining your TSP withdrawal options. The rules for active feds are strict and meant for true emergencies. The rules for retirees are all about flexibility and creating a long-term income plan.

TSP Withdrawal Options At a Glance

Here’s a simple breakdown of the main ways you can access your TSP funds, whether you’re still working or have already moved on from federal service.

Withdrawal TypeWhen It's AvailablePrimary PurposeKey Rules and PenaltiesFinancial HardshipWhile actively employedTo cover a documented, urgent financial need (e.g., medical bills, eviction).Subject to income tax and a potential 10% early withdrawal penalty.Age-Based In-ServiceWhile actively employed, age 59½+To access funds without penalty while still working; offers financial flexibility.Taxed as ordinary income, but avoids the 10% early withdrawal penalty.Partial Post-SeparationAfter leaving federal serviceTo withdraw a specific dollar amount for a one-time need like a home purchase.Can only be done once before you begin installment payments or an annuity.Full WithdrawalAfter leaving federal serviceTo receive your entire account balance via lump sum, installments, or an annuity.This is a final decision that structures your long-term retirement income.

This table should help you quickly pinpoint the options that might be a fit for your situation. Each one has its own set of detailed rules, so it's critical to understand the fine print before making a move.

Getting Into Your TSP While Still on the Job

Think of your TSP account as a locked treasure chest you're building for retirement. While you're still working for the federal government, the keys are kept under pretty tight security. The TSP withdrawal rules for active employees are deliberately strict—they're designed to protect your future self, not to fund a weekend getaway.

For the most part, there are only two ways you can take money out for good from your TSP while still on the payroll: you either have to prove you're facing a legitimate financial hardship, or you have to hit a certain age. Both paths have very different rules and serious consequences, so let's break them down.

When Times Get Tough: The Financial Hardship Withdrawal

A financial hardship withdrawal is exactly what it sounds like—it's an emergency button for dire financial situations. This isn't for wanting a new car or remodeling the kitchen. The TSP has a very specific list of what qualifies as a "hardship," and you'll need the paperwork to prove it.

Be warned: this is a one-way street. You can't put the money back later. It's also incredibly expensive. The money you take out is taxed as regular income, and if you're under age 59½, you'll almost certainly get slapped with a 10% early withdrawal penalty. It’s one of the costliest ways to get your hands on cash. For a full breakdown of the documentation you'll need and what to expect, take a look at our in-depth guide on TSP hardship withdrawal rules.

While this option exists, it’s not taken lightly. In a recent year, only 3.9% of TSP participants took a hardship withdrawal, with the highest usage among those aged 40-49. Every dollar taken out is a dollar that's no longer invested and growing for your retirement. Unlike a TSP loan, it's a permanent hit to your nest egg.

Reaching a Milestone: The Age-Based Withdrawal

Once you turn 59½, the rules change in your favor. The TSP lets you take what’s called an "age-based" withdrawal. This is a one-time opportunity to take money out of your account without having to prove any kind of financial need.

The best part? No 10% early withdrawal penalty. That's a huge advantage. You will still have to pay regular income tax on the amount you withdraw, but it gives you a way to access a chunk of your savings for a big expense or to supplement your income without the red tape of a hardship claim.

Important Consideration: An age-based withdrawal is a one-shot deal while you're still working. Once you take it, you can't do it again until after you've separated from federal service.

The Smarter Alternative for Most People: A TSP Loan

Before you even think about permanently pulling money from your account, you absolutely have to consider a TSP loan. A withdrawal is like selling off a room in your future retirement house—it's gone forever. A loan is more like borrowing against its value and then paying yourself back.

A TSP loan isn't a distribution at all. You're simply borrowing your own money and paying it back into your own account, with interest. This comes with two massive advantages:

No Immediate Taxes: Because it isn't considered income, you don't pay income tax on the loan amount.

No Penalties: The 10% early withdrawal penalty doesn't apply, no matter how old you are.

Repayments are handled automatically through payroll deductions, so you’re consistently rebuilding what you borrowed. You can even have two loans at once—a general-purpose loan for any reason and a residential loan for buying your main home. For almost any temporary financial need, a loan keeps your retirement savings whole and working for you, making it the far superior choice.

Navigating Your Post-Separation Withdrawal Choices

Leaving federal service is a huge milestone, and it completely changes how you can use your Thrift Savings Plan. While you were working, your TSP was a savings account, plain and simple, with pretty strict rules about taking money out. Now that you've separated, it’s a whole new ballgame. Your TSP is ready to transform into an income source, offering you a menu of options to fund your retirement.

Think of it like this: for your entire career, you’ve been filling a reservoir with water. The post-separation withdrawal rules are the different faucets and spigots you can now install. Your choice determines whether you get a single powerful gush, a steady, predictable trickle, or something in between.

Making the right call here is critical because many of these decisions are one-way streets—you can't go back. Your choice needs to fit into your big picture, working alongside your FERS pension and Social Security to create a retirement income plan that actually works for you.

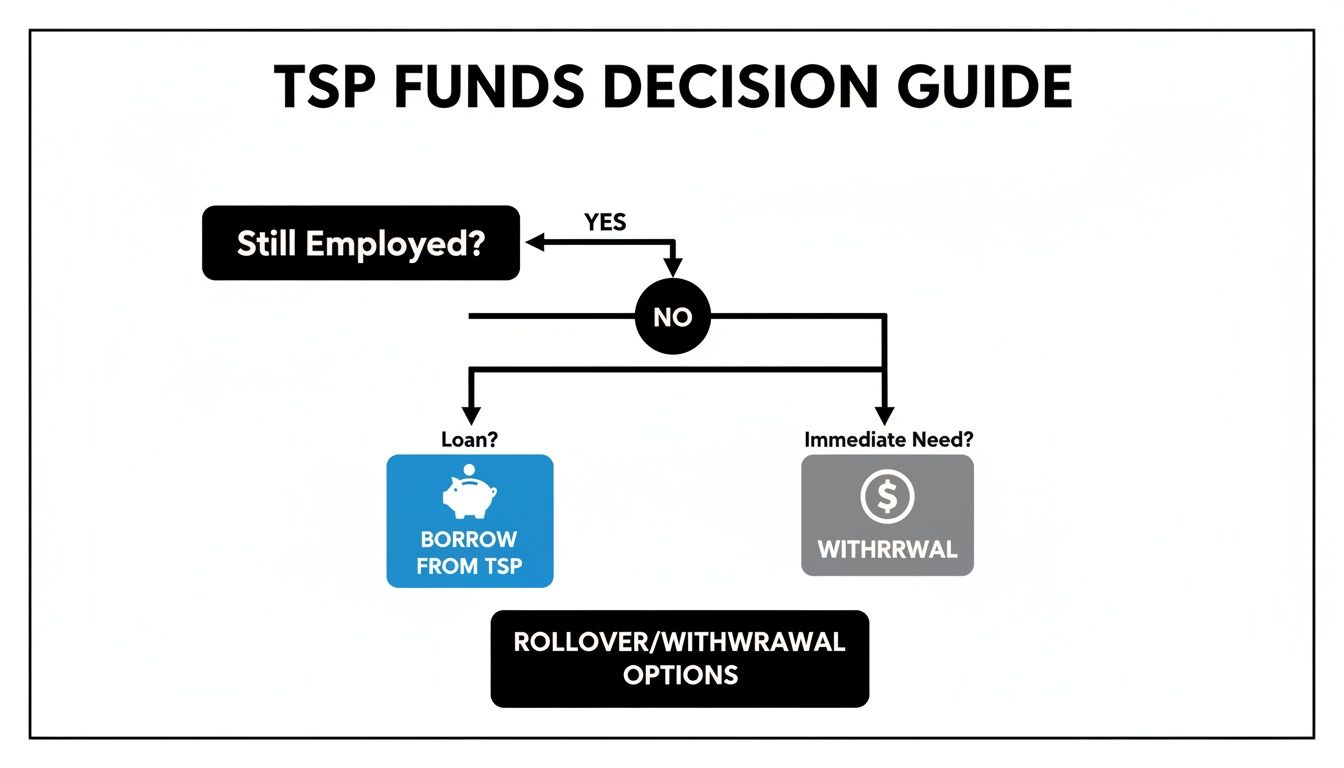

This decision tree lays out the basic paths you can take, showing how your options change once you leave federal service.

As you can see, once you're no longer a federal employee, your world of options opens up dramatically, moving from a few limited in-service choices to a full suite of ways to access your money.

The One-Time Partial Withdrawal

One of the most useful tools you gain after separating is the partial withdrawal. This lets you take a specific dollar amount from your account in a single payment. It’s perfect for a one-off expense, like finally paying off the mortgage, buying that retirement cabin, or helping a family member with a down payment.

But there’s a big string attached. You only get one shot at a partial withdrawal. Once you take it, your remaining choices are limited to the full withdrawal options. This makes it a highly strategic move—you'll want to save it for a planned, significant event.

The Full Withdrawal Decision

When you're ready to start generating regular income or need to access the rest of your funds, you have to make a full withdrawal election. This doesn't mean you have to cash out everything at once. Instead, it’s the formal process of choosing the final distribution method for your entire remaining TSP balance.

You've got three main paths to choose from:

Lump-Sum Payment: You can take your entire account balance in a single check. This gives you instant access to all your cash, but it almost always comes with a massive tax bill in the year you take it. It also means you're suddenly responsible for managing a large sum of money.

Installment Payments: You can set up a series of monthly, quarterly, or annual payments. This is a very popular choice for people who want to create a steady, predictable "paycheck" in retirement.

Life Annuity: You can use your TSP balance to purchase a life annuity through a TSP provider. This option gives you a guaranteed monthly payment for the rest of your life (and your spouse's, if you choose).

A Critical Decision Point: Heads up—electing a full withdrawal method is a permanent move. Once you start installment payments or buy an annuity, you can't change your mind and switch to a different full withdrawal option or go back for another partial withdrawal.

A Closer Look at Installment Payments

If you decide installment payments are the right fit, you get even more flexibility to fine-tune your income stream. This is where you can really tailor the payouts to your specific budget and how long you think you'll need the money to last.

The TSP gives you two different ways to calculate your payments:

Fixed Dollar Amount: You tell them exactly how much you want each month, quarter, or year (for example, $2,000 per month). The payments keep coming until your account runs dry. You can change the amount once a year or stop the payments, but once stopped, you can't restart them.

Life Expectancy Calculation: This is a bit more hands-off. The TSP uses the IRS Uniform Lifetime Table to calculate a payment amount for you each year based on your age and account balance. The goal is to make your funds last for your projected lifespan, and the payment will be automatically recalculated every year.

So, which one is better? It all depends on your goals. A fixed amount gives you predictability for budgeting. A life-expectancy-based payment, on the other hand, is a structured way to manage the risk of outliving your money.

Understanding Required Minimum Distributions

You've spent decades diligently growing your Traditional TSP funds, and the government has let that money compound tax-deferred. But that tax-free ride doesn't last forever. Eventually, Uncle Sam wants his share, and that's where one of the most critical TSP withdrawal rules comes into play: Required Minimum Distributions, or RMDs.

Think of RMDs as the government's way of saying, "It's time to start paying taxes on all that money you've saved up." The IRS requires you to start taking a specific, calculated amount from your tax-deferred retirement accounts each year once you hit a certain age. This rule applies squarely to your Traditional TSP, making sure those savings don't avoid taxation indefinitely.

When Do RMDs Begin and Who Is Affected?

For most retired federal employees, the starting line for RMDs is crystal clear. If you've separated from federal service, you must start taking RMDs from your TSP in the year you turn age 73. This isn't a suggestion; it's a hard deadline with serious consequences if you miss it.

The TSP actually tries to help by automatically calculating and sending you your RMD if you haven't withdrawn at least that much on your own by the deadline. While convenient, this automation can be a double-edged sword, sometimes forcing a distribution you weren't quite ready for.

The Penalty is Severe: Failing to take your full RMD triggers one of the steepest penalties in the tax code. The IRS will hit you with a 25% excise tax on the amount you should have withdrawn but didn't. It's an incredibly costly mistake you absolutely want to avoid.

How Your RMD Is Calculated

The TSP doesn't just pull a number out of a hat. The calculation is based on a simple formula that uses two key pieces of information:

Your Prior Year-End Account Balance: They look at your total Traditional TSP balance on December 31st of the previous year.

Your Age and the IRS Uniform Lifetime Table: The IRS publishes a table with a "life expectancy factor" for every age, which dictates the percentage of your account you have to withdraw.

The process is straightforward: your account balance is divided by the factor for your age. For example, using the IRS table, a $500,000 balance at age 73 would require a withdrawal of about $18,867. Fast forward to age 90, and that same $500,000 balance would demand a withdrawal of nearly $45,045. For a deep dive into how these mandatory withdrawals are processed, you can review this official TSP audit report.

The Escalating Impact on Your Retirement Plan

Here’s the crucial detail that catches many retirees by surprise: as you get older, the life expectancy factor in the IRS table gets smaller. This means the percentage of your account you're forced to withdraw gets larger every single year.

What starts as a small, manageable withdrawal at age 73 can balloon into a substantial, tax-heavy distribution by the time you're in your 80s or 90s. This forced escalation can throw a wrench in a carefully crafted retirement income plan. The bigger distributions could easily push you into a higher tax bracket, potentially make more of your Social Security benefits taxable, and even increase your Medicare premiums.

This is why proactive planning is so important. Strategies like a TSP to IRA rollover can give you more control over your distributions, which may help mitigate some of these tax consequences. Before locking in a decision, it’s smart to explore all your options. You can learn more about how to rollover a TSP to an IRA in our guide and see if it's the right move for your situation. Understanding these rules today is the best way to avoid costly surprises down the road.

How Taxes and Penalties Impact Your TSP Withdrawals

Taking money out of your Thrift Savings Plan isn't quite like pulling cash from a checking account. You have to think about taxes and potential penalties, because nearly every dollar you withdraw has some strings attached. If you're not careful, they can take a serious bite out of your hard-earned savings.

I like to think of a Traditional TSP as a tax-sheltered greenhouse for your money. Inside, everything grows without the tax man touching it. But the moment you take a withdrawal, you're "harvesting" that money and bringing it out into the real world, where it's finally time to pay taxes.

The basic rule is straightforward: any money you pull from your Traditional TSP balance is taxed as ordinary income. That means it gets added to your other income for the year and taxed at your regular federal and (usually) state rates.

Your Roth TSP is a different story. Since you already paid taxes on the money you put in, qualified withdrawals—that's both your contributions and all the earnings—are 100% tax-free.

The Mandatory Tax Withholding Rules

When you request a withdrawal, the TSP doesn't just hand over the full amount and wish you luck with the IRS. They're legally required to withhold a portion for federal taxes right off the top. The exact percentage depends on how you take the money.

Mandatory 20% Withholding: For most lump-sum withdrawals (both partial and full), the TSP must withhold a flat 20% for federal taxes. You don't have a choice in this.

Standard 10% Withholding: For installment payments, the default withholding is 10%. You can often ask them to withhold more or less, but 10% is the starting point.

It's absolutely critical to remember that this withholding is just an estimate of your tax bill. Depending on your total income for the year, that 20% might be too much or, more commonly, not nearly enough. You could still owe a hefty sum when you file your taxes.

Dodging the 10% Early Withdrawal Penalty

On top of ordinary income taxes, there's another potential hurdle: the 10% early withdrawal penalty. The IRS slaps this on top of your regular taxes if you take money from a retirement account before you turn age 59½. It's their way of making sure you use retirement funds for, well, retirement.

But here’s where being a federal employee pays off. The TSP withdrawal rules have a fantastic exception built right in.

Key Takeaway: If you separate from federal service in or after the year you turn 55, the 10% early withdrawal penalty does not apply to your TSP distributions. This is a massive advantage for federal retirees.

This special "age 55 rule" gives federal employees incredible flexibility if they decide to retire before the traditional 59½ milestone. It gets even better for public safety officers, like law enforcement or firefighters, who get the same break starting in the year they turn 50.

When planning your exit, you'll want to get a handle on all the financial implications, including understanding your rights and protections if the IRS targets your 401k or other retirement accounts. Strategically timing your separation date around these key age milestones can save you a significant amount of money.

Comparing the 4 Percent Rule to TSP RMDs

Many retirees swear by a popular guideline called the “4 percent rule.” The idea is simple: you withdraw 4% of your portfolio in your first year of retirement, then just give that dollar amount a little bump each year to keep up with inflation. It's a straightforward way to manage your own money and create a predictable income stream that can last for decades.

But this trusty rule often smacks right into one of the most powerful TSP withdrawal rules out there: Required Minimum Distributions, or RMDs. While the 4 percent rule is a flexible strategy you control, RMDs are a non-negotiable mandate from the IRS. This creates a major planning headache, especially as you get deeper into retirement.

The conflict comes down to control. RMDs force you to pull out a specific, and always increasing, percentage of your TSP balance each year. It doesn't matter what you actually need to spend or what the stock market is doing. This government-mandated withdrawal rate often grows far larger than the gentle 4% you originally planned for.

The Inevitable Clash of Strategies

Think of the 4 percent rule as setting a comfortable, sustainable cruising speed for a long road trip. RMDs, on the other hand, are like a mandatory accelerator that the government starts pressing for you at age 73, pushing you to go faster and faster every single year.

The 4% rule might suggest a $20,000 first-year withdrawal on a $500,000 TSP balance is sustainable. But the IRS RMDs demand much more over time, eventually forcing you to take out over 4.9% by age 83 ($28,248 on that same $500,000) and a staggering 9.9% by age 93 ($49,505). These required withdrawals can completely derail a carefully crafted 4% plan. You can discover more insights about how TSP savings rates and rules interact at Govexec.com.

Being forced to pull out more money than you need has real consequences. It means a bigger tax bill each year, which shrinks your net income and could even bump you into a higher tax bracket.

A Head-to-Head Comparison

To really see the difference, let’s run the numbers. Imagine a retiree with a $500,000 TSP balance. Using the 4 percent rule, their first-year withdrawal is $20,000. If we assume a 2% annual inflation adjustment, their withdrawals would rise slowly and predictably.

Now, let's see what the IRS would demand at different ages. The table below shows just how jarring the difference becomes over time.

Key Insight: The 4 percent rule is designed to preserve your portfolio. RMDs are designed for tax collection. The IRS simply wants to make sure you eventually pay taxes on all that tax-deferred growth—their goal isn't to help your money last longer.

The following comparison shows how quickly RMDs can overtake a sustainable withdrawal strategy, forcing you to cash out far more of your TSP than you might want or need.

4 Percent Rule vs RMD Withdrawals on a $500,000 TSP Balance

A direct comparison showing how RMDs force escalating withdrawals in later retirement, often exceeding the sustainable 4% rule.

Retiree AgeAnnual Withdrawal (4% Rule with 2% Inflation)Annual Withdrawal (Required Minimum Distribution)Difference73$20,808$18,868-$1,94080$23,892$24,752+$86090$29,088$45,045+$15,957

As the numbers show, RMDs might actually be lower than your 4% withdrawal when they first kick in. But the tables turn quickly. By age 90, the government is forcing a withdrawal that's over 55% larger than what the 4 percent rule would suggest. This is exactly why your TSP withdrawal plan has to account for the ever-increasing demands of RMDs from day one.

TSP Withdrawal Questions We Hear All the Time

Even after you've got the basics down, real-life situations always bring up new questions about the Thrift Savings Plan. Let's tackle some of the most common ones we get asked, clearing up the confusion so you can move forward with confidence.

Can I Take Back a TSP Withdrawal Once It's Done?

Think of a TSP withdrawal as a one-way street. Once you request a lump-sum payment (either partial or full) and the transaction is processed, it's final. There’s no undo button.

You do have a bit more wiggle room with recurring installment payments. While you can't put back the money you've already taken out, you can stop future payments or change the amount. This is why it's so important to think through your decision before you hit submit on any withdrawal forms.

What Happens to My TSP Loan If I Leave My Federal Job?

If you leave federal service with a TSP loan still on the books, you have a big decision to make, and it comes with serious tax consequences. Here’s what you can do:

Pay it all back. You can repay the entire loan balance by the deadline to avoid any tax headaches.

Keep making payments. You can arrange to continue making monthly payments until it's paid off, just like a regular loan.

Let it go. If you don't repay it, the TSP will declare a "taxable distribution." This means the outstanding balance is treated as income, and you'll owe ordinary income tax on it. If you're under age 59½, you'll likely get hit with the 10% early withdrawal penalty, too.

Do I Need My Spouse's Permission to Take Money Out of My TSP?

Yes, this is a big one. The TSP has specific rules to protect spousal rights because your account is generally considered a marital asset. The exact requirement depends on your retirement system.

If you're a FERS employee, your spouse must give their written, notarized consent for most withdrawals and any loans you take. For CSRS employees, the rules are a little different; your spouse must be notified of your withdrawal, but their formal consent isn't always required.

Getting these rules right is critical, but you don't have to figure it all out on your own. Federal Benefits Sherpa provides personalized retirement planning to help you make smart choices with your hard-earned benefits. Secure your financial future by scheduling your free benefits review today at https://www.federalbenefitssherpa.com.