Planning for Healthcare Costs in Retirement A Practical Guide

When you picture retirement, you’re probably thinking about travel, hobbies, or spending more time with family. But there's a huge, often underestimated, line item in every retirement budget: healthcare. Getting a real handle on what you might actually spend is one of the most important things you can do to secure your financial future.

It’s not just a vague worry; it’s a real number you need to plan for.

The Real Cost of Healthcare in Retirement

The gap between retirement dreams and financial reality can often be traced back to unexpected medical bills. While no one has a crystal ball, we can look at expert projections to get a solid baseline for planning. These estimates help turn a fuzzy concept into a concrete goal.

A recent estimate from Fidelity Investments provides a sobering but necessary starting point. They project that a 65-year-old individual retiring in 2025 can expect to spend an average of $172,500 on healthcare and medical expenses throughout retirement. That number isn't just pulled out of thin air; it reflects a steady climb in costs over the past 20 years.

That $172,500 estimate covers things like premiums, deductibles, and out-of-pocket drug costs. But here’s the kicker: it doesn't include the potential for long-term care, which can be one of the biggest expenses of all.

Why You Can't Afford to Ignore This

Hoping for the best isn’t a strategy. Without a dedicated plan, healthcare expenses can quickly drain your retirement savings, forcing you to make tough decisions you never anticipated. The goal here is to take you from a place of uncertainty to one of control.

To get there, we'll walk you through a clear roadmap that covers:

- What Drives the Costs: We’ll break down exactly what makes up that big number, from Medicare premiums to prescription drugs.

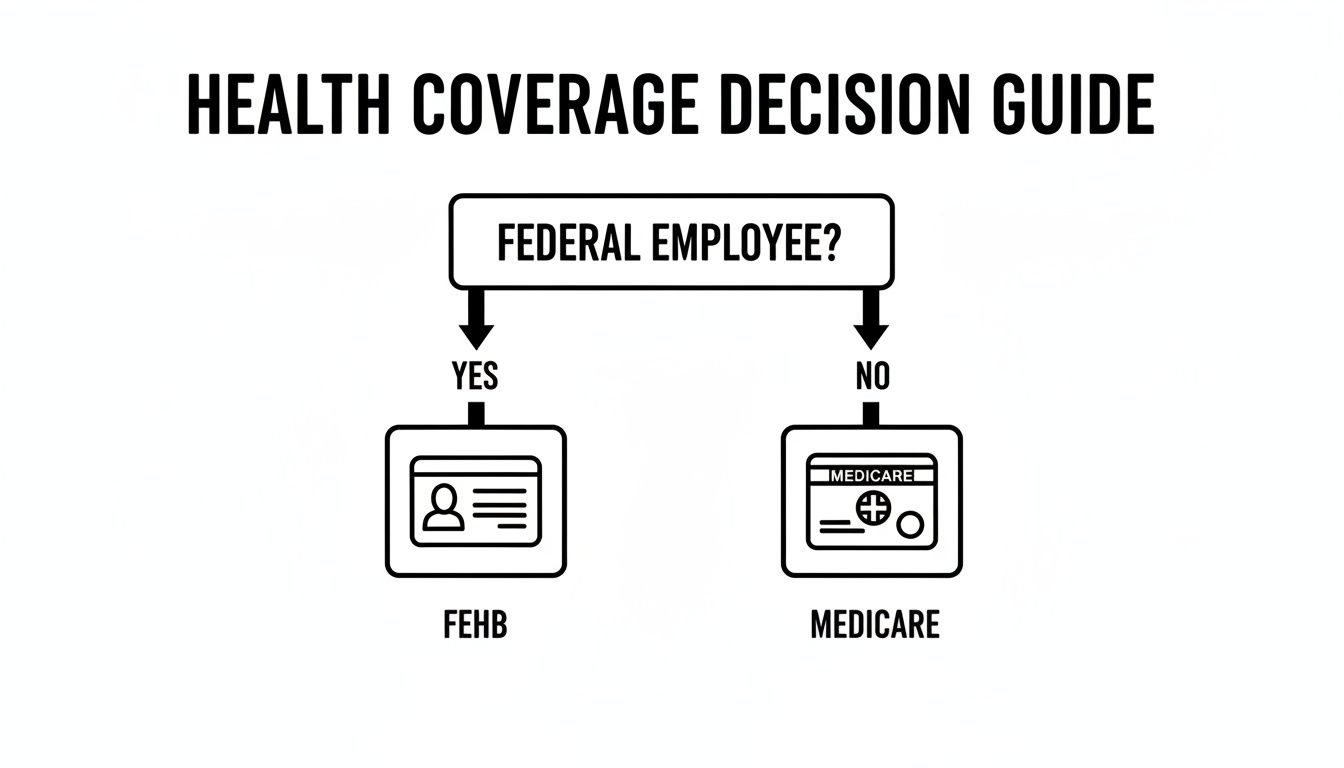

- Navigating Your Insurance: You’ll get a straightforward look at your options, including Medicare and the Federal Employees Health Benefits (FEHB) program.

- Real-World Savings Strategies: We'll dive into actionable steps you can take right now to prepare for these future costs and protect your nest egg.

By breaking down the components that contribute to your total healthcare bill in retirement, you can build a financial plan that's truly prepared for the road ahead. That way, you can spend your retirement years focused on what really matters.

What Really Drives Your Healthcare Spending

When you see those big six-figure estimates for retirement healthcare, it’s easy to feel a little sticker shock. But remember, that number represents a total spread out over many, many years. To really get a handle on planning, you have to break down the individual pieces that make up that total.

I like to think of retirement savings as a bucket of water you’ve spent a lifetime filling. Different healthcare costs are like small, persistent leaks. If you don't patch them or plan for them, they can drain your bucket faster than you think.

Some of these costs are predictable, like your monthly insurance premiums. Others are a complete surprise, like deductibles and copays that pop up when you least expect them. Getting to know both is the first step in building a solid financial defense for your future.

The Predictable Premiums

The most consistent cost you’ll face in retirement is your monthly insurance premium—it's the regular fee you pay just to keep your coverage active. For most federal retirees, this usually means a few parts of Medicare.

- Medicare Part B: This covers your doctor visits and outpatient services. There's a standard monthly premium, though it can be higher if you have a larger income in retirement.

- Medicare Part D: This is your prescription drug coverage. Premiums here can be all over the map, depending on the plan you pick and the specific medications you need.

- Supplemental Plans: Many retirees also add a Medigap policy or choose a Medicare Advantage plan to fill in the gaps. Each of these comes with its own monthly premium.

These premiums are your baseline. They're the fixed cost you can count on every single month. While they might seem small individually, they form the bedrock of your total healthcare costs in retirement.

The Variable Out-of-Pocket Costs

Beyond those steady premiums are the costs that only show up when you actually use your insurance. These are the trickier, variable "leaks" that are harder to pin down but can have a huge impact. This bucket includes things like deductibles, copayments, and coinsurance.

A deductible is what you pay out-of-pocket before your insurance kicks in. A copayment is a flat fee for a service (like a doctor's visit), and coinsurance is the percentage of a bill you’re responsible for after meeting your deductible.

So, if you have a hospital stay, you might have to pay a big deductible first, then a daily copay for a few days. A quick trip to a specialist could just be a flat copay, but a major surgery might leave you on the hook for 20% of the entire bill. You can see how these can add up fast, especially if you have a rough year health-wise.

Personal Factors That Shape Your Spending

Here’s the thing: no two people will have the exact same healthcare expenses. Your costs are deeply personal. The most obvious factor is your health—if you’re managing a chronic condition like diabetes or heart disease, you're naturally going to have more appointments, treatments, and prescriptions.

Your lifestyle choices make a huge difference, too. Things like eating well, staying active, and not smoking can dramatically lower your risk for some of the most expensive health problems down the line. Even where you live matters, as insurance plans and medical costs can vary wildly from one state to the next.

This isn't just a local issue, either. Globally, medical costs are climbing fast. A recent survey is forecasting an average medical cost increase of 10.4% for 2025, pushed up by new technologies and expensive drugs. You can read the full 2025 Global Medical Trends Survey from WTW to see the data for yourself.

But the single biggest factor? Longevity. The longer you live, the more years you'll be paying premiums and the greater your odds of facing a major health event. Planning for a long, happy life means you also have to plan for the costs that come with it.

Understanding Your Health Coverage Options

Figuring out health insurance for retirement can feel like navigating a maze. The good news? Once you get a handle on the main players, the path forward becomes much clearer. For most Americans, including federal retirees, that journey starts with Medicare.

Think of Medicare as the foundation of your healthcare plan once you retire. It’s the federal health insurance program for people 65 or older. But it’s not just one plan; it’s broken down into different "parts," each covering specific medical services.

Getting these parts straight is the first, most important step. Each one plays a unique role in protecting both your health and your nest egg.

The Building Blocks of Medicare

Let’s start with what’s called "Original Medicare," which consists of Parts A and B. From there, you can add other pieces to fill in the gaps and build a more comprehensive safety net.

Medicare Part A (Hospital Insurance): This is your hospital coverage. It helps pay for inpatient care if you're admitted to a hospital or a skilled nursing facility, and it also covers hospice and some home health services. The best part? For most people who've paid Medicare taxes for at least 10 years, Part A is premium-free.

Medicare Part B (Medical Insurance): This covers your day-to-day medical needs—things like doctor visits, lab tests, outpatient care, and preventive screenings. Unlike Part A, Part B comes with a standard monthly premium. Keep in mind, this premium can be higher for retirees with a higher income.

Together, Parts A and B form the core of your coverage. But you’ll quickly notice they don't cover everything. The most obvious gap is one of the most significant and consistent expenses for nearly every retiree: prescription drugs.

That's where the next piece of the puzzle slots in.

Medicare Part D (Prescription Drug Coverage): This is optional coverage for your medications, which you purchase from a private insurance company that's been approved by Medicare. These plans help cover the cost of prescriptions, but the premiums and what you’ll pay out-of-pocket can vary quite a bit from one plan to the next.

So, Parts A, B, and D create a solid base. But for federal employees, there’s another critical layer that changes the entire game.

How FEHB Fits with Medicare

If you're a federal retiree, your Federal Employees Health Benefits (FEHB) plan is a huge asset. The real question isn't choosing between FEHB and Medicare—it's figuring out how to make them work together to save you the most money.

When you enroll in Medicare, your FEHB plan doesn't just go away. It simply shifts its role. For most feds who sign up for both Medicare Parts A and B, Medicare becomes the primary insurer. That means Medicare gets the bill first and pays its share.

Then, your FEHB plan steps in as the secondary payer. After Medicare pays, the remaining bill goes to your FEHB plan, which typically covers most of what's left, like your deductibles and coinsurance. This one-two punch can drastically lower what you actually spend out of pocket.

Getting this coordination right is absolutely critical. Some retirees think about suspending FEHB to save on the premiums, but that's a risky move with major long-term implications. Understanding how these two powerful programs can work in tandem is the key to keeping your healthcare costs under control and securing your financial future.

Choosing Between Original Medicare and Medicare Advantage

Once you get a handle on the basic parts of Medicare, you’ll find yourself at a major crossroads in your retirement planning. This isn’t just some box to check; it’s a foundational choice that will dictate your access to doctors, your monthly budget, and your financial risk for the rest of your life. The two main paths are Original Medicare and Medicare Advantage.

To put it simply, think of it like buying a car. Original Medicare is like buying a reliable base model. It gets you where you need to go, but for long road trips or extra safety, you’ll want to add on things like roadside assistance and an extended warranty. Medicare Advantage is more like leasing a fully loaded model—one monthly payment gets you the car, the maintenance plan, and all the bells and whistles, but you have to take it to the dealer's approved service centers.

Each route has its own set of pros and cons. The best fit for you boils down to your personal health, your budget, and how much freedom you want when it comes to choosing your doctors.

Original Medicare: The A La Carte Approach

Original Medicare, made up of Parts A and B, is the traditional health plan run by the federal government. Its biggest selling point is freedom. You can go to any doctor or hospital anywhere in the country, as long as they accept Medicare. No networks, no referrals needed.

But that freedom comes with some pretty big gaps in coverage. That's why most retirees who go this route add two more private insurance policies to the mix:

- A Medigap Plan: This is also called Medicare Supplement Insurance. It’s designed to pick up the tab for out-of-pocket costs like deductibles and coinsurance that Original Medicare leaves behind.

- A Part D Plan: This is your prescription drug coverage, which you buy as a separate, standalone policy from a private insurer.

When you combine these three—Original Medicare + Medigap + Part D—you create a powerful, comprehensive safety net. You'll have three separate premiums to pay (for Part B, Medigap, and Part D), but your out-of-pocket costs for medical care become incredibly predictable and often very low.

Medicare Advantage: The All-in-One Bundle

Medicare Advantage, also known as Part C, is a totally different way to get your Medicare benefits. Instead of the government managing your care, private insurance companies approved by Medicare take over. They are required by law to cover everything Original Medicare does, but they bundle it all together.

The big difference is that these plans combine Parts A, B, and usually Part D into a single package. They often throw in extra perks you can't get with Original Medicare, like dental, vision, hearing aids, and even gym memberships. In exchange for those lower premiums and extra benefits, you have to play by their rules—which means staying within their network of doctors and hospitals.

That’s the critical trade-off. The bundled approach can definitely simplify your life and lower your monthly bills, but it limits your choice of providers and often requires referrals to see a specialist. For federal employees, this decision is even more layered because it has to work with your FEHB plan. We dig into that specific dynamic in our FEHB and Medicare guide for federal retirees.

This flowchart helps visualize that first big decision you'll face, showing how federal employees have an extra consideration with FEHB.

As you can see, while Medicare is the central piece of the puzzle for everyone, federal retirees have to figure out how FEHB fits into their long-term strategy.

Original Medicare vs. Medicare Advantage: A Head-to-Head Comparison

To help clarify the trade-offs, it’s useful to see these two paths laid out side-by-side. The right choice often becomes clearer when you can directly compare the features that matter most to you, from monthly costs to provider access.

| Feature | Original Medicare (with Medigap + Part D) | Medicare Advantage (Part C) |

|---|---|---|

| Monthly Premiums | Higher. You pay separate premiums for Part B, Medigap, and Part D. | Lower. Many plans have a $0 premium beyond your standard Part B premium. |

| Doctor Choice | Maximum freedom. Go to any doctor or hospital in the U.S. that accepts Medicare. | Limited. You must use providers within the plan's network (HMO or PPO). |

| Out-of-Pocket Costs | Predictable and often very low for medical services with a good Medigap plan. | Varies. You pay copays and coinsurance until you hit the plan's out-of-pocket maximum. |

| Prescription Drugs | Covered by a separate, standalone Part D plan. | Usually included in the plan (MAPD). |

| Extra Benefits | None. Does not cover dental, vision, or hearing. | Often included. Many plans offer dental, vision, hearing, and wellness programs. |

| Referrals | Not required to see specialists. | Often required, especially in HMO plans. |

| Best For | Retirees who prioritize provider choice and predictable costs, and can afford higher premiums. | Retirees who want lower monthly premiums, bundled benefits, and are comfortable with a network. |

This table highlights the fundamental give-and-take. Original Medicare costs more per month but buys you freedom and predictability. Medicare Advantage saves you on premiums but requires you to operate within a specific network and cost structure. There's no single "best" answer—only what's best for your situation.

Planning For What Your Insurance Will Not Cover

Even with the best combination of Medicare and FEHB, it's a huge mistake to think you're 100% covered. Think of your health insurance as a sturdy roof—it’s fantastic for protecting you from common storms like doctor's appointments and hospital stays. But some financial storms are more like a hurricane, and that roof was never designed to handle them. For most retirees, that hurricane is long-term care (LTC).

This is a critical gap in your financial armor. Medicare simply does not pay for the ongoing, non-medical assistance that defines long-term care. This includes help with the fundamental "activities of daily living" we all take for granted—things like bathing, dressing, eating, or just getting around safely.

Whether this care happens at home with an aide or in a dedicated facility, these services can quickly become one of the most staggering healthcare costs in retirement. Left unplanned, they can drain a lifetime of savings in just a few short years.

The Reality of Long-Term Care

This isn't some rare, fringe expense we're talking about; it's a very common chapter in the lives of many older Americans. The numbers don't lie: someone turning 65 today has a nearly 70% chance of needing some form of long-term care services before they pass away. Sometimes the need arises suddenly after an accident or illness, and other times it creeps up gradually.

Because the odds are so high and the costs can be so devastating, you need a specific, dedicated strategy to deal with it. Crossing your fingers and hoping your standard health insurance will cover it is not a plan. You have to consciously decide how you'll fund these potential costs, and there are really three main paths to consider.

Funding Your Long-Term Care Needs

Each approach comes with its own set of pros and cons, balancing cost, flexibility, and risk. Getting familiar with these options is the first step toward building a financial plan that won't shatter when faced with a major health crisis.

- Traditional Long-Term Care Insurance: This is exactly what it sounds like—a standalone insurance policy designed specifically to cover LTC expenses. You pay premiums, and if you need care, the policy pays a benefit up to a set limit. The upside is dedicated coverage, but the downside is that premiums can be pricey and might even go up over time.

- Hybrid Life/LTC Policies: These products are a two-for-one deal, combining a life insurance benefit with an LTC rider. If you need long-term care, you can tap into the death benefit while you're still alive. If you never need the care, your heirs get the full payout. People like that it isn't a "use it or lose it" proposition, but they often cost more upfront than a traditional LTC policy.

- Self-Funding: This strategy is pretty straightforward: you earmark a large chunk of your own retirement savings to pay for any potential LTC costs. This gives you total control and flexibility, but it also means your entire nest egg is on the line if you face a catastrophic, multi-year care event.

Deciding which path is right for you requires a hard look at your health, your family's history, and your overall financial picture. The most important thing is to make a conscious choice now, rather than letting a health crisis force your hand later.

As a federal employee, you have unique factors to weigh when looking at these insurance products. To get into the nitty-gritty, you can explore our complete federal employee long-term care insurance guide for a much more detailed breakdown. Ignoring this piece of the retirement puzzle leaves your financial future exposed to one of its biggest threats.

Building Your Retirement Healthcare Savings Plan

Knowing the numbers is one thing, but building a solid plan to cover those costs is how you actually prepare for a secure retirement. This is where we turn those big, scary estimates into a real, actionable savings strategy.

The idea isn't just to save a pile of money, but to save it smartly. You want your money working for you, not just sitting there. Thankfully, there are some fantastic tools out there designed for this exact purpose, helping your savings grow while minimizing the tax bite. With the right approach, even a $315,000 healthcare estimate can become a manageable part of your financial future.

Use the Best Tool for the Job: The Health Savings Account

When it comes to saving for future medical bills, the Health Savings Account (HSA) is in a league of its own. If you're eligible for one, it's hands-down one of the most powerful savings accounts available. Think of it as a retirement account specifically for your health, but with a unique triple-tax advantage you won't find anywhere else.

- Tax-Deductible Contributions: The money you contribute is tax-deductible, which lowers your taxable income for the year. It's an immediate tax break.

- Tax-Free Growth: You can invest the funds in your HSA, and all the earnings grow completely tax-free.

- Tax-Free Withdrawals: When you pull money out for qualified medical expenses—anything from dental work to prescriptions—it comes out 100% tax-free.

This triple-play makes the HSA a powerhouse for long-term growth. The money is always yours; it never expires and rolls over every single year, giving your investments decades to compound. To see how this works with a popular federal plan, take a look at our complete guide to the GEHA Health Savings Account.

After you turn 65, your HSA gets even better. You can still pull money out tax-free for medical costs, but it also starts acting like a traditional IRA. You can withdraw funds for any reason—a vacation, a home repair, anything—and you'll just pay ordinary income tax on it, with no penalties.

Weave Healthcare Savings Into Your Broader Plan

Your strategy for healthcare costs shouldn't be an afterthought. It needs to be a core part of your overall retirement plan, sitting right alongside your TSP and any other investments you have.

Take the cost estimates we talked about and treat them as a specific savings goal. From there, you can work backward from your planned retirement date. How much do you need to put into your HSA or another dedicated account each month to hit that number? Breaking down a large, intimidating figure into small, consistent steps makes it feel much more achievable.

Get a Second Opinion and Review Your Plan Yearly

You don't have to go it alone. Navigating federal benefits and retirement planning can get complicated, and a financial advisor who truly understands the federal system can make all the difference. They can help you project your costs, see how your plan holds up under different scenarios, and make sure everything is working together.

Finally, get into the habit of reviewing your plan at least once a year. Life happens. Your health changes, your insurance options might change, and your financial picture can shift. An annual check-in is your chance to adjust your savings rate or investment mix to stay on course. It’s that consistent, proactive attention that will ultimately give you confidence and peace of mind.

Your Questions, Answered

Planning for retirement always brings up a lot of questions, especially around healthcare. Let's tackle some of the most common ones we hear from federal employees to help clear things up.

Can I Get a Tax Deduction for My Retirement Healthcare Premiums?

Good news—in many situations, you can. The IRS lets you deduct the portion of your unreimbursed medical expenses that goes above 7.5% of your adjusted gross income (AGI), as long as you itemize. This includes your premiums for Medicare Part B, Part D, Medicare Advantage, and even Medigap plans.

For instance, if your AGI is $60,000, the first $4,500 of medical costs is on you. But you can start deducting any qualified expenses after you hit that mark. This is why keeping detailed records of every premium, co-pay, and prescription is so important—it could lead to a valuable tax break.

What’s the Biggest Surprise Healthcare Cost Most Retirees Face?

While a major surgery or sudden illness is always a concern, the one expense that can truly derail a retirement plan is long-term care (LTC). This isn't about hospital stays; it's about needing help with everyday activities like eating, dressing, or bathing over a long period.

Here's the critical part: Standard health insurance, including Medicare, simply does not cover these costs. Whether it’s an in-home aide, an assisted living facility, or a nursing home, the expense of long-term care can drain your savings faster than anything else if you haven't prepared for it.

How Much Should I Aim to Have in My HSA for Retirement?

There’s no one-size-fits-all answer here, since it depends on your health, how long you expect to live, and the kind of care you want. A great benchmark to aim for comes from Fidelity, which estimates an individual might need around $172,500 just for healthcare in retirement.

How can you get there?

- Contribute Aggressively: If you can, max out your HSA contributions each year you're working.

- Put Your Money to Work: An HSA isn't just a savings account; it's an investment vehicle. Investing your balance allows it to grow tax-free, which makes a huge difference over a couple of decades.

- Check In Yearly: Review your savings goal annually. As healthcare cost estimates change, you can adjust your strategy accordingly.

Will My FEHB Premiums Go Up After I Retire?

Yes, you should absolutely plan on your Federal Employees Health Benefits (FEHB) premiums rising over time. It's the same pattern you saw during your career—costs go up each year to keep pace with medical inflation and new treatments.

Factoring these expected increases into your retirement budget is crucial. It’s a key part of realistically planning for your healthcare costs in retirement and avoiding financial stress down the road.

Navigating your federal benefits is complex, but you don't have to do it alone. Federal Benefits Sherpa specializes in helping federal employees build clear, confident retirement plans. Schedule your free 15-minute benefits review today to ensure you're on the right path.